Financial aid •

Stanford financial aid: a complete guide

Read all about financial aid at Stanford University, including scholarships, loans, and grants.

One of the world’s top research universities, Stanford University is a well-known school located in the San Francisco Bay Area. The school was founded in 1891 and has since grown to become one of the most prestigious schools in the United States.

If you’re a high school student who is interested in applying to Stanford but needs to figure out how you can afford attending, here’s what you need to know.

A snapshot look at Stanford

Stanford is a private research university located in Stanford, California. It has a strong reputation for academics and research, often ranking in the top 10 universities in the US and having academic rivalries with Ivy League universities. In its own words, Stanford aims to be a place of discovery, creativity, and innovation.

With its campus located in the San Francisco Bay area—near both San Francisco and San Jose—students have access to a highly innovative and vibrant part of the country. Thanks in part to this innovative atmosphere, Stanford is regularly ranked as one of the top schools for attracting start-up funding.

Undergraduate students at Stanford can choose from 40 academic departments and more than 69 majors. For graduate students, Stanford offers more than 200 fields of study. The school boasts more than 80 Nobel laureates among its faculty, staff, and alumni network.

Outside of classes, off-campus students can participate in campus life along with the 13,000+ on-campus students. Stanford has more than 625 organized student groups and clubs. Those interested in athletics can participate in 36 varsity and 33 club sports as either players or spectators.

Ranking: 6th in national universities

Size: 16,937 students

Demographics: 50% male, 50% female

Acceptance rate: 4%

Average GPA of accepted students: 3.95

Key dates and deadlines (2022):

Application deadline: January 5th

Financial aid deadline: February 15th

A look at scholarships offered by Stanford

Everyone knows that college is expensive. Some families spend years or even decades trying to save for their children’s college education but find themselves unable to save enough to pay for the full cost of tuition.

If you need some help paying for college, the best thing that you can do is apply for scholarships.

What makes scholarships so great as sources of funding for college is that they’re like free money that you can use to pay for school. You can apply the funds to tuition and other educational expenses without having to worry about paying the money back.

There are lots of ways that you can earn scholarships. Commonly, these are awarded based on financial need but you can also get awards based on academic or athletic merit.

Stanford offers many scholarship opportunities to its students. Best of all, there is no need to submit additional applications to apply. You’re automatically considered for these awards based on the information in your application, FAFSA, and CSS profile.

Stanford, specifically, notes that all university scholarship aid is awarded on the basis of financial need rather than academic or another merit.

One unique financial aid program Stanford offers is the Knight-Hennessy Scholars program. This program offers a fellowship covering up to 3 years of tuition for graduate students. It “cultivates and supports a multidisciplinary and multicultural community of graduate students from across Stanford University, and delivers engaging experiences that prepare graduates to be visionary, courageous, and collaborative leaders who address complex challenges facing the world.”

If you’re a student from California, you can also benefit from the Cal Grant Program. This program works like a scholarship, giving you funds that you don’t have to pay back.

Don’t forget, there are plenty of opportunities outside of the scholarships offered by Stanford. You should take the time to apply for the scholarships offered by local businesses, charity groups, and other organizations. Even if you only get a few hundred dollars from these programs, every little bit helps.

If you look carefully, you can find scholarships for almost anything. If you’re having trouble finding opportunities for students like you, Mos can help. Our financial aid tips and tricks page is a great resource for students who need advice on getting the most aid possible.

Student loans

Savings and scholarships are two of the best ways to pay for college, but if you find that those aren’t enough to cover your bills, you have other options. Many people choose to borrow money to pay for school, investing in themselves by furthering their education.

The obvious drawback of student loans compared to scholarships is that they’re loans. You’ll have to pay them back, plus the interest they’ve accumulated, over time.

Stanford’s financial aid office has a webpage that outlines the different loan programs available to its students.

For most students, the best source of loan funding is the federal government. You can get Federal Direct Loans in two different forms: subsidized and unsubsidized loans.

Subsidized loans are the better of the two. With these loans, the federal government pays the interest that accrues while you’re in school. This makes them cheaper than unsubsidized loans. With unsubsidized loans, interest starts to build up on them right away.

One major benefit of federal loans is that there are multiple aid programs built into them. For example, once you leave school, you can sign up for income-based repayment, which can make your monthly payments more affordable.

Some students can even qualify for loan forgiveness over time, reducing the total amount they have to pay.

Once you’ve maxed out your federal loans, the next place to look is private student lenders. These are banks, credit unions, and specialized companies that offer loans to students who need help paying for college.

However, private loans are usually more expensive than federal loans. They also lack protections and perks like loan forgiveness and income-based repayment. These should be your last resort after exhausting your federal loans.

Student loans can be complicated, so if you want a more detailed breakdown, you can read our article on how student loans work.

FAFSA

The most important thing for every student who needs help paying for college to do is to fill out the Free Application for Federal Student Aid (FAFSA). The FAFSA is a universal aid application used by the federal government, schools, and state governments. The information in your FAFSA can make you eligible for scholarships, grants, and loans.

When you fill out the FAFSA, you’ll have to provide some information about your family’s finances, such as how much you make each year and how much you have saved for college.

Based on the information you provide, the government and schools will calculate your expected family contribution to the cost of your education. They will then compare that number to your school’s cost of attendance to determine your total financial need.

The greater your financial need, the better your chances of getting need-based aid, such as federal loans and grants or scholarships from your school. Keep in mind that most schools don’t guarantee that they’ll meet 100% of your financial need, so you’ll have to come up with the remaining money another way.

The FAFSA opens on October 1st for aid awarded in the next academic year. The deadline for the application is June, but it’s usually a good idea to fill it out as soon as possible. California has a March 2nd deadline for many state programs, and some aid programs award money on a first-come, first-served basis.

Filling out the FAFSA can take some time, so prepare yourself by learning more about how long it takes to complete the FAFSA.

Stanford financial aid FAQs

Let’s answer a few questions you may have about financial aid at Stanford.

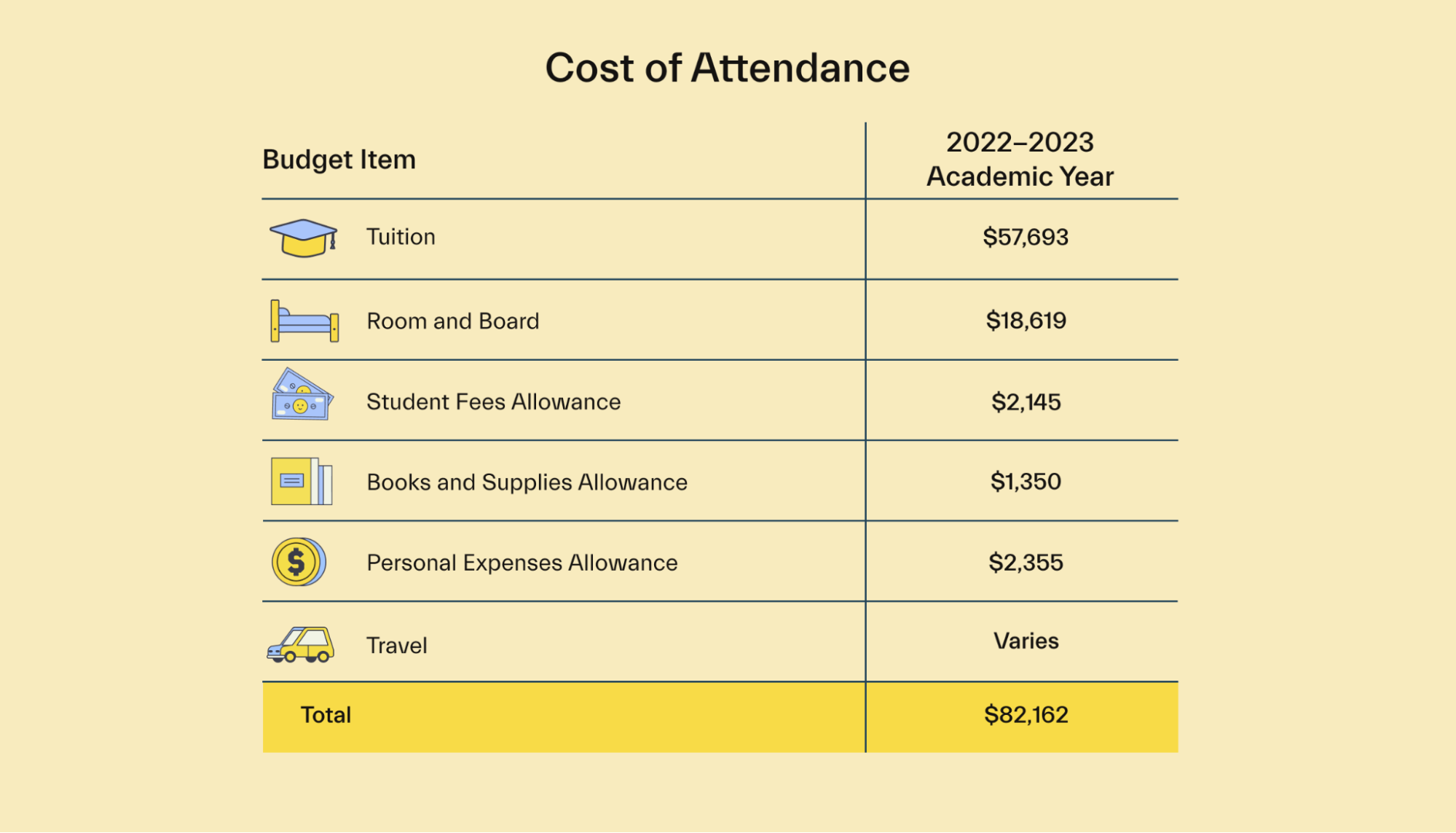

What is Stanford’s cost of attendance?

Stanford’s cost of attendance is $82,162 per year. Of that amount, $57,693 is tuition, and $18,619 is room and board. Students may be able to secure a lower cost if they live off campus or with family.

Can out-of-state students receive financial aid?

Yes, Stanford offers financial aid to students from outside of California. However, non-resident students may not qualify for state aid programs like Cal Grants.

Can non-citizens or permanent residents receive aid?

Yes, Stanford offers scholarships and other aid to international students, non-citizens, and non-permanent residents. This includes undocumented students regardless of their DACA status. Immigration status is not a condition of admission.

How many students pay no tuition at Stanford?

Stanford does not publish information on how many students pay no tuition. However, in 2019, 54% of first-year students received need-based financial aid, and the average need-based award totaled $55,000.

When do incoming students and prospective students receive their financial aid information?

Incoming students who apply for Stanford using restrictive early action receive their award notification on December 15th. Students who apply regular decision will receive their award info in April.

When do transfer students receive their financial aid information?

If a transfer student applies by March 15th, they’ll receive their financial aid package by May 15th.

Does Stanford offer student employment?

Yes, Stanford offers student employment as part of federal work-study programs. You can use the school’s career services platform, Handshake, to apply for on-campus jobs or seek a job off campus.

What family income qualifies for financial aid?

Stanford considers many factors when determining financial aid, such as family income and family size. Almost 100% of students with a family income under $150,000 receive financial aid.

Universities like Stanford that you might be interested in

Stanford is one of the top universities in the United States, but there are many other options for academically-inclined students. If you’re interested in Stanford, consider these alternatives.

Harvard University

Located on the opposite side of the United States in Cambridge, Massachusetts, Harvard is one of the oldest universities in the United States. A member of the well-known Ivy League, Harvard is known for its rigorous academics.

The school has more than 23,000 students and a powerful alumni network that includes multiple presidents, Supreme Court justices, and senators.

Massachusetts Institute of Technology

The Massachusetts Institute of Technology (MIT) is another top university located on the opposite coast from Stanford.

Like Stanford, MIT is known for its academic rigor and focus on research and innovation. Many start-ups and technological innovations have come out of MIT, and its location in the heart of the Boston metro area gives students access to a city known for its academic institutions.

MIT is also known for its vibrant pranking culture, with students having executed stunts such as placing a police car on the school’s Great Dome or replacing the John Harvard statue at Harvard University with a statue of the video game character Master Chief.

University of California, Berkeley

For students who would rather remain in California, the University of California, Berkeley may be an appealing option.

Like Stanford, UC Berkeley has a strong academic record, with nine Nobel laureates on its current faculty. One thing that sets it apart, however, is the fact that it is a public university. This means that tuition for in-state students is much lower than Stanford’s, at just $14,254. If you’re looking for a good college education at a low price and are a California resident, UC Berkeley might be the place for you.

Conclusion

Stanford is one of the highest-ranked, best-known, and most selective universities in the United States. If you can get in, you’ll be sure to receive an excellent education and join a large alumni network that you can leverage throughout your career.

If you’re looking for the best way to pay for higher education, Mos can help.

Connect with a Mos private advisor today to find every dollar you qualify for. From scholarships to grants to loans, we’ll fight to lower your tuition. When you join, you’ll also earn extra cash with Mos’s cash back debit card, referral bonuses, and gigs.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you