FAFSA •

December 6, 2022

What's the FAFSA and when is it due?

Find out when the FAFSA is due, how to submit the application, and what to do if you miss the deadline.

Preparing to head off to college is exciting––how much it costs is not.

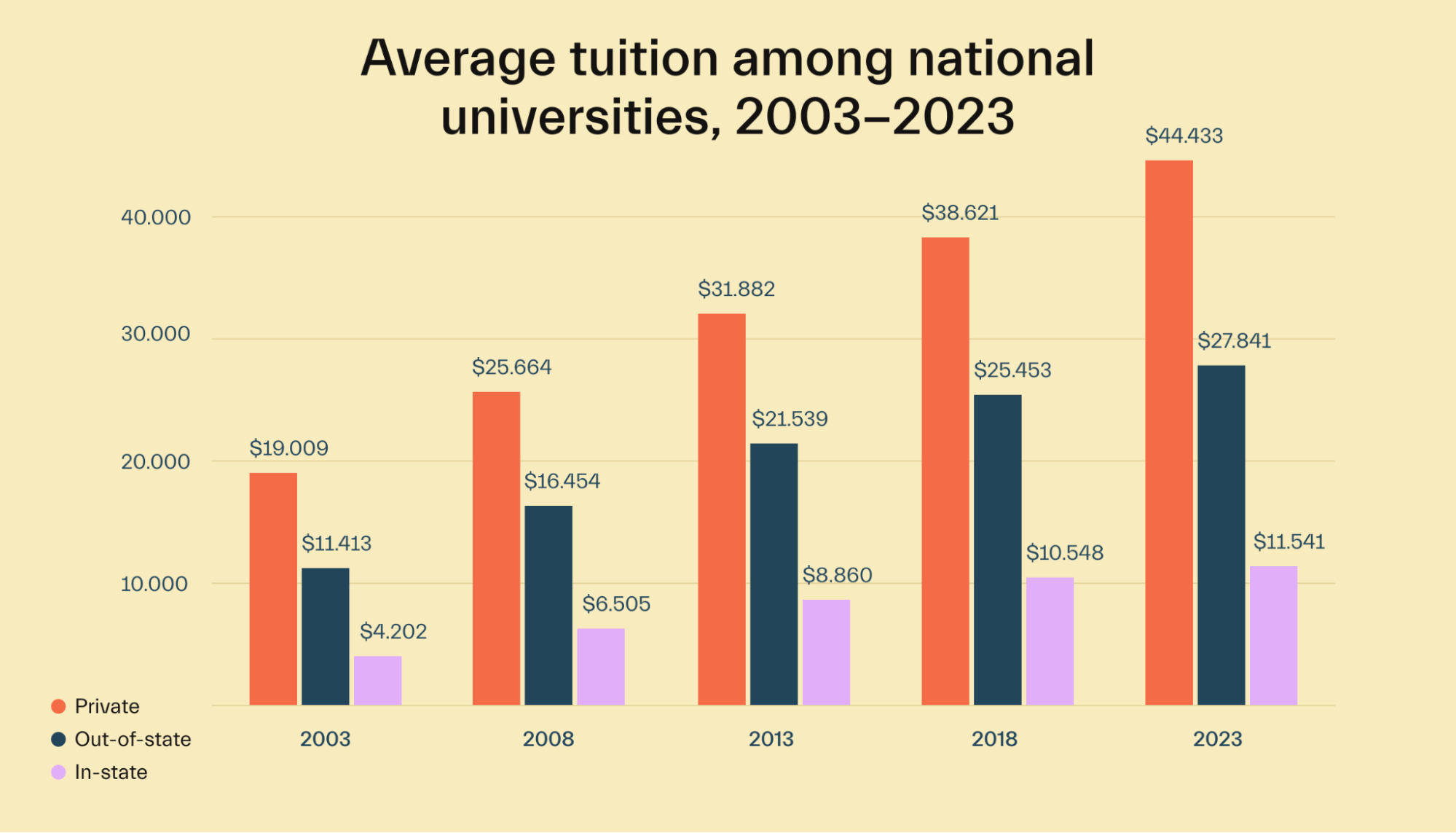

The latest data shows that the average cost of attending a 4-year public university in the US is about $25,864 per year. That’s over $100,000 to get an undergraduate degree! And unfortunately, that’s more than most families can afford.

That’s where the FAFSA comes in. The FAFSA is a federal form you can submit to qualify for financial aid in the form of grants, student loans, work-study, and scholarships.

But to qualify for that aid, it’s critical that you submit your FAFSA by the deadline.

In this article, you’ll learn what the FAFSA is, how and when you should submit it, and what you should do if you miss the deadline.

What's the FAFSA?

The Free Application for Federal Student Aid (FAFSA) is a form you fill out that colleges use to decide how much financial aid you’re eligible for. It’s one of the most important parts of the financial aid process.

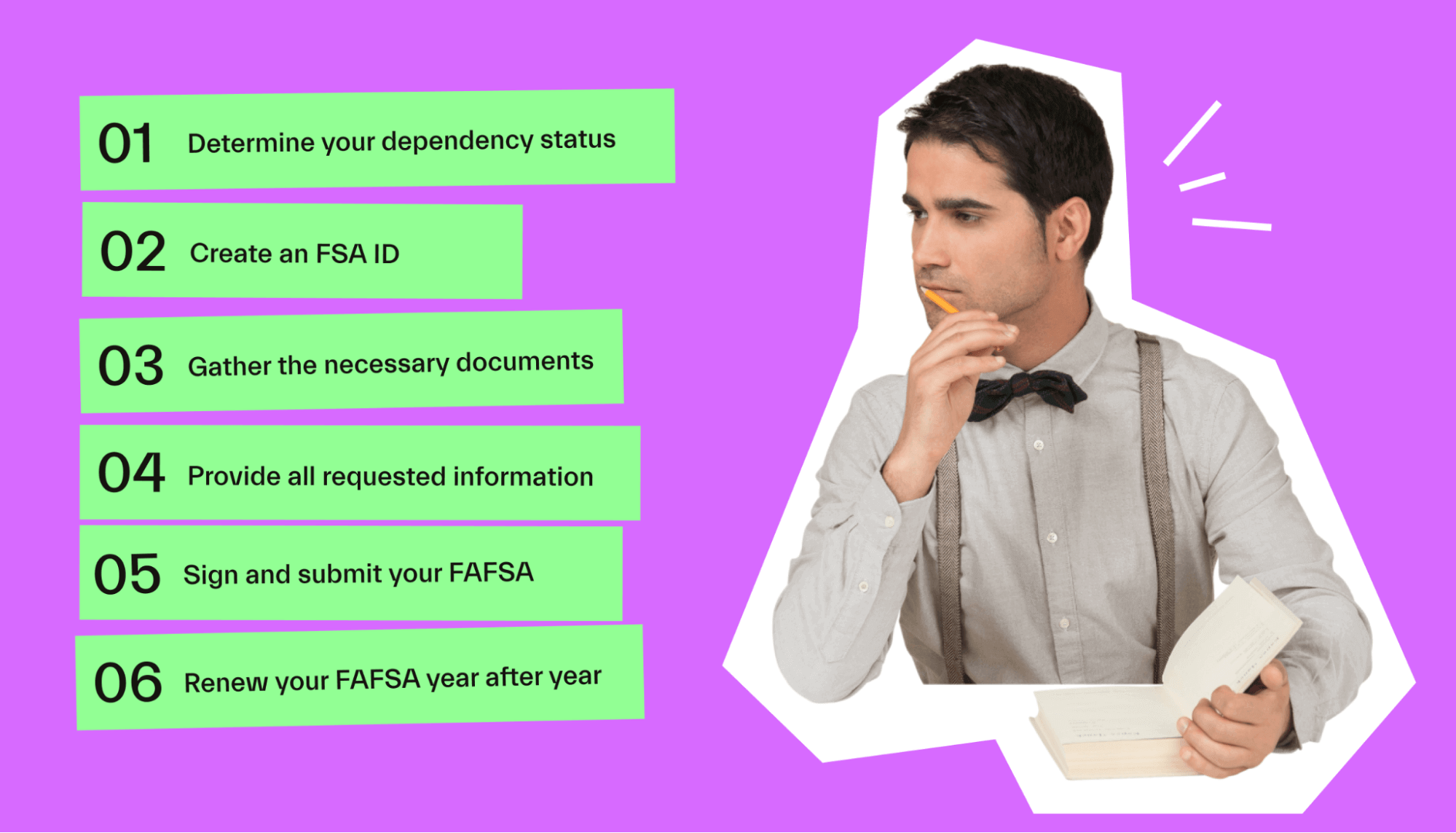

Here’s what filling out your FAFSA entails:

Step 1: Determine your dependency status

Most students are considered dependent. As a dependent student, you have to report your parents’ financial information on your FAFSA.

You could be considered an independent student if you’re older than 24, you’re married, you have children, you’re a military veteran, you’re a graduate student or a Ph.D. student. If none of these apply to you, you're a dependent.

Step 2: Create an FSA ID

Before you fill out your FAFSA, you’ll have to create an FSA ID, which is a username and password combination that allows you to complete and sign your FAFSA electronically.

You’ll use this same FSA ID year after year to complete your FAFSA, sign loan contracts, and access other federal aid information.

If you’re a dependent student, your parents will also need to create their own FSA IDs.

Step 3: Gather the necessary documents

There are many documents you’ll need to complete your FAFSA. These include:

Your Social Security number (SSN) (or your alien registration number if you’re not a US citizen)

Federal tax returns and other income-related documents, such as your latest W-2

Records of any untaxed income

Information about assets such as cash, bank account balances, and investments

If you’re applying as a dependent, you’ll also need most of this information for your parents. For instance, you’ll need their Social Security numbers, copies of their tax returns, and information about their assets.

Step 4: Provide all requested information

Once you’ve gathered all the necessary information, it’s time to actually fill out the form.

Simply answer each question in the application. It shouldn’t take more than 1 hour to complete. Take your time and make sure you don’t miss anything. An incomplete form could cause you to lose out on financial aid.

Step 5: Sign and submit your FAFSA

Once you’ve entered all your information into your FAFSA, it’s time to sign and submit.

To electronically sign your form, you’ll need your FSA ID, which you created in step 1. If you’re a dependent student, you and your parents will both have to sign.

Step 6: Renew your FAFSA year after year

You don’t have to start from scratch every year.

Once you’ve completed the form, you can return in future years and choose the “FAFSA Renewal” option. The form will be pre-filled with your non-financial personal information, so you don’t have to enter it again.

Do you have to fill out the FAFSA?

The information you provide on your FAFSA determines whether you’re eligible for financial aid from the federal government and the school you’re attending. That means that filling it out is important, but it's not strictly mandatory if you have lots of money and don’t want to try to get aid. Of course, not filling out the FAFSA means turning down free money in the form of federal grants and other aid, so 99% of students should definitely fill it out.

Most financial assistance is need-based, meaning it’s awarded to students whose parents don’t have the financial resources to fund their college education.

But, you may also have to fill out the FAFSA to qualify for merit-based scholarships and grants, depending on your school.

Who should fill out the FAFSA

The FAFSA is the first necessary step in receiving federal financial aid. As a result, anyone who can’t fully fund their college education out-of-pocket should fill out the FAFSA. After all, the money's there. You lose nothing whatsoever by filling out and submitting a FAFSA, and you could benefit massively.

Based on your family’s income and assets, the government will determine your expected family contribution (EFC) or the amount your family can afford to put toward your education for the upcoming year.

Then, the school will subtract your expected contribution from the total cost of attendance (COA) to calculate your financial need.

Based on your financial need, you’ll be awarded some or all of the following financial aid opportunities:

Grants, which are a free—often need-based—form of financial aid

Scholarships, which are a free form of financial aid that can be need- or merit-based

Work-study, which is an opportunity to earn money at on- or off-campus jobs

Student loans, which you’ll typically be required to repay once you graduate

Who doesn’t need to fill out the FAFSA?

If your parents have enough savings to fully fund your college education, you may not need financial aid and may decide that completing the FAFSA isn’t worth your time.

However, while there’s nothing wrong with passing on the FAFSA if your college costs are fully funded, it might still be worth filling it out.

Even if you don’t qualify for need-based funding from the federal government, many schools still offer scholarships to entice students to attend their school over their competitors. And if a school is willing to provide free money, it’s worth taking. Remember that your financial aid package could include merit-based scholarships that you can qualify for even if your family has no financial need.

It also means that some of the money that you or your parents have saved over the years could go toward other financial goals.

While you might feel there’s no way you’ll qualify for aid, you might be surprised!

The government only expects families to allocate a certain percentage of their income and assets toward college. And, with the rising cost of college—up 25% in the past 10 years—your family might still show a financial need by the government’s standards.

There’s really no downside to filling out the FAFSA. The worst that can happen is you spend 1 hour completing it, and it turns out you aren’t eligible for aid.

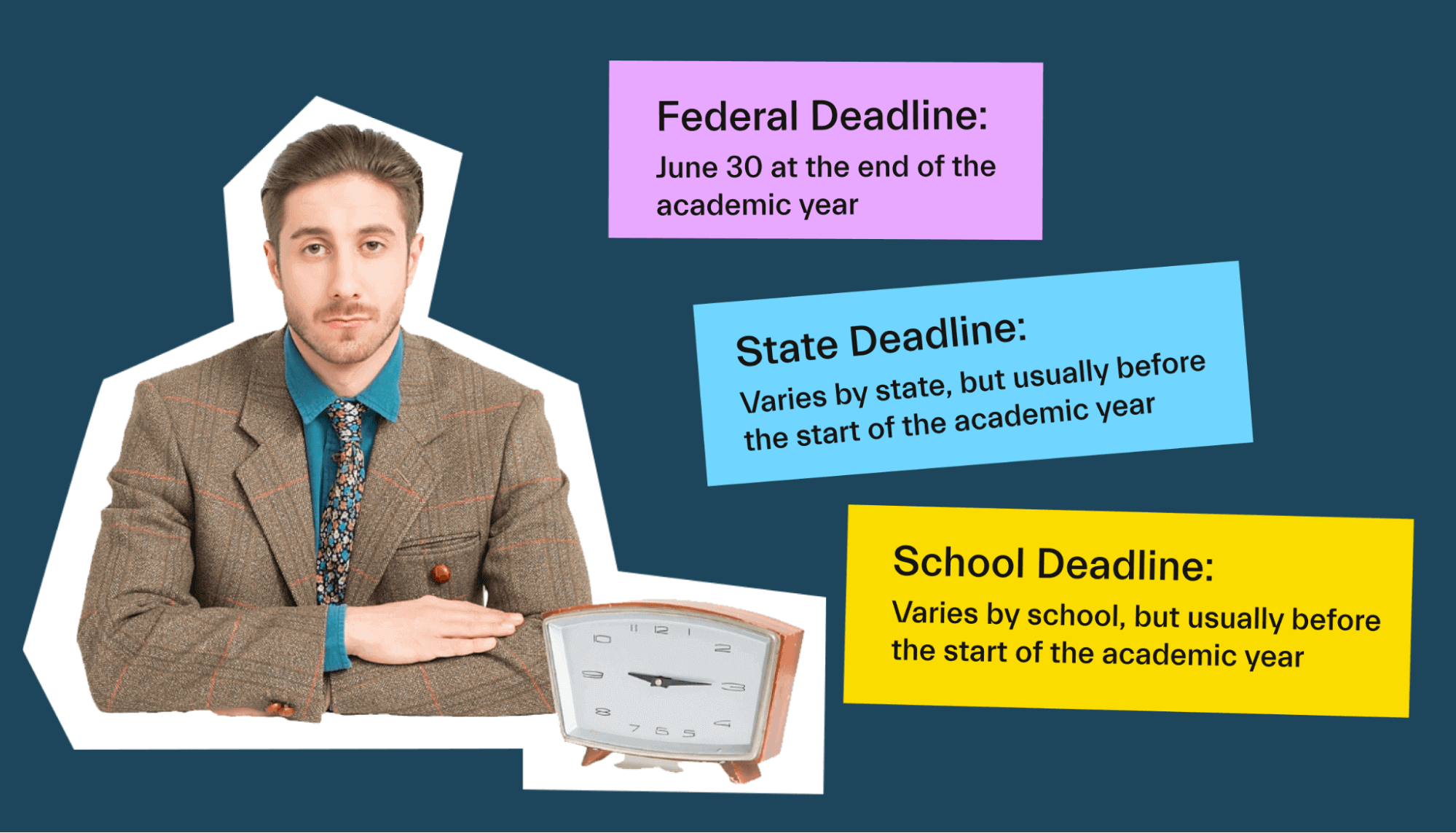

When is the deadline to submit your FAFSA?

The deadline to complete your FAFSA is June 30 for the previous academic year. For example, you must complete your FAFSA by June 30, 2023 to receive aid for the 22-23 school year.

You can fill out the FAFSA up until the end of the school year you should keep in mind that your tuition bill will be due at the beginning of each semester. If you really need the money to cover your college costs, you’ll have to submit your FAFSA application much earlier than the deadline.

The FAFSA opens on October 1 for the following academic year. So for the 23-24 year, you can complete your 2023-2024 FAFSA as early as October 2022.

State and school deadlines

In addition to the federal deadline, you must also pay attention to the deadlines for your state and the school you’re attending.

Unlike the federal deadline, your school’s deadline will generally be before the school year begins.

Schools also only have a finite amount of money to give away. Filing at the last minute will likely mean missing out on aid you would have otherwise gotten.

Many schools rely on the FAFSA to determine your aid amount, but some may have a separate form to fill out to be eligible for aid directly from the school.

As far as the state deadline, it varies from state to state. Some states require that your FAFSA be completed by a certain date, and it’s often before the school year starts.

For example, California requires that you submit your FAFSA a full 6 months before the school year to be eligible for state financial aid programs.

Some states may not have hard deadlines, but they do have a limited amount of money to give away. That means there may be a priority deadline where you have a better chance of getting aid if you file early. So if you wait until the last minute to file, you might not receive any state aid.

What happens if you miss the FAFSA deadline?

The years before and during college are a busy time in your life, and it’s natural for things to fall through the cracks occasionally. Unfortunately, failing to complete your FAFSA by the deadline comes with serious consequences.

If you don’t complete your FAFSA by the federal deadline of June 30, you take yourself out of the running for all federal financial aid opportunities, such as federal student loans, that year.

And while you might still be eligible for some aid through your state government or the school you’re attending, it probably won’t be enough to fund your educational costs for the year fully.

If you’ve missed your deadline, contact the financial aid administrator for your state and the school you’re attending. They might have some remaining aid for latecomers. Unfortunately, you won't be able to submit your federal form to receive federal loans and grants after the deadline.

If you’ve missed the FAFSA deadlines, you might need to get more creative with your school financing.

First, apply for as many scholarships as you can.

There are hundreds of thousands of private scholarships available, and you should apply for as many as possible. When you sign up for Mos, you get matched with a list of scholarships that you actually qualify for. So you can get started applying straight away.

Second, check out our resources. We’ve got lots of ideas for helping you make money in college. And don’t forget to speak to your family about how they might be able to help support you. Perhaps they can loan you enough to help you cover your first-year costs.

As a last resort, you might consider applying for a private student loan to cover some of your expenses until you can complete the FAFSA and receive your aid for the following academic year.

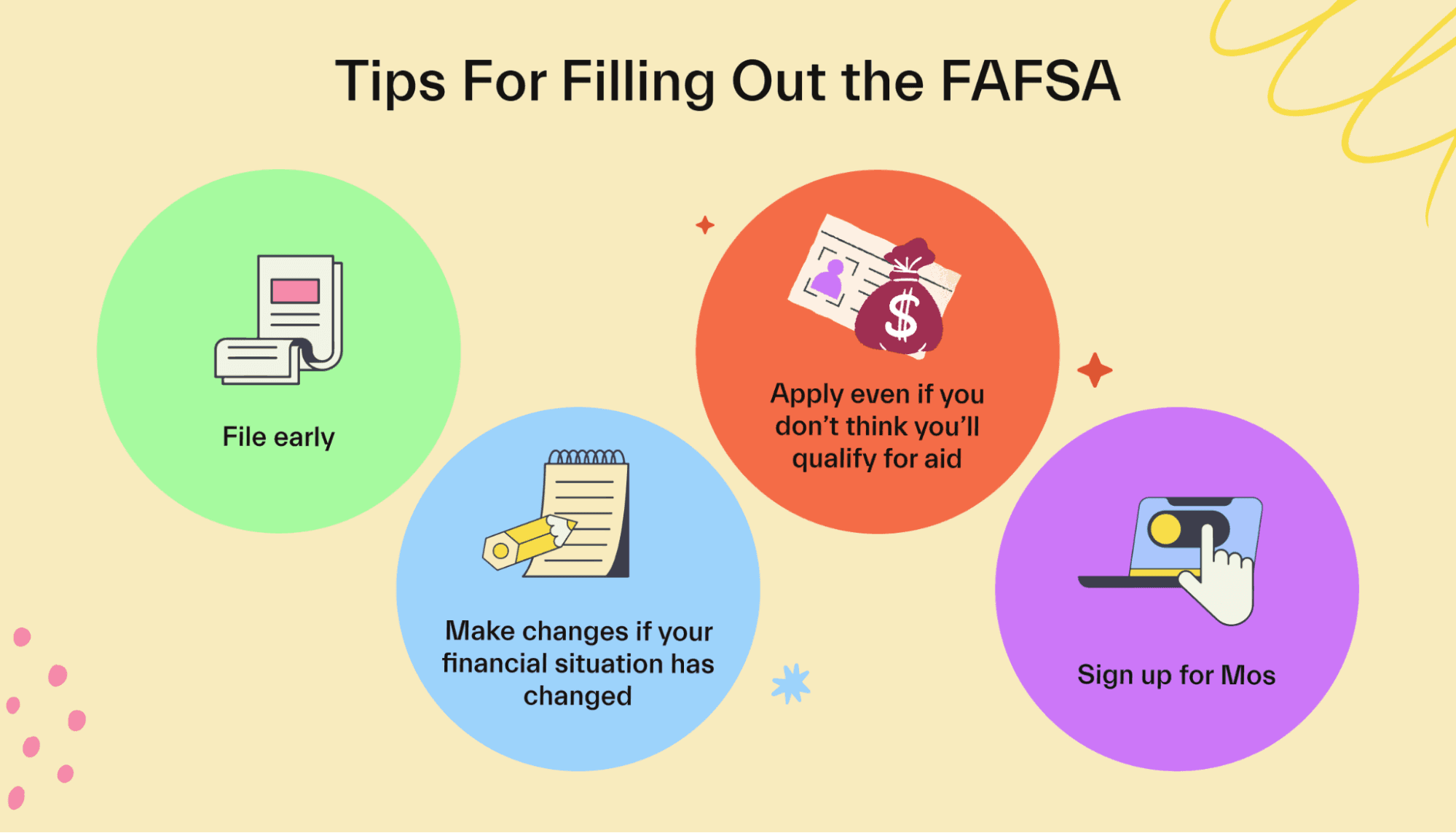

Tips for filling out the FAFSA

Filling out the FAFSA might feel overwhelming when you’re doing it for the first time, but it doesn’t have to be. Here are a few tips to help make the process a bit easier for you:

1. File early

We’ve said this already, but it really can’t be said enough. Though the FAFSA deadline may not be until June 30 after the school year in question, you should file much earlier than that. Hitting the priority filing deadline for your school or state can help you get much more aid.

Many schools and states require that you file before the school year begins to be eligible for any aid they offer.

Plus, because there’s only a finite amount of aid to go around, filing late will reduce your chances of getting enough to pay for your education.

Finally, even though the deadline might be after the school year ends, your tuition bill and any other college costs will still be due at the start of the semester. If you haven’t completed your FAFSA, you may not have the funds necessary to pay your bill.

2. Make changes if your financial situation has changed

Your financial aid award letter is based on the information you provide in your FAFSA, but your financial situation could change after you file.

If your family’s income or assets decrease after you file your FAFSA, contact your school’s financial aid office to appeal your aid offer.

3. Apply even if you don’t think you’ll qualify for aid

Regardless of whether you think you’ll be eligible for aid, it’s worth applying. Some forms of financial aid are literally free money, and you might be surprised by what you qualify for.

Remember, the worst that can happen is that you spend 1 hour completing the FAFSA and don’t get any financial aid.

But the best that can happen is you’re pleasantly surprised by what the government and your school are willing to offer.

4. Sign up for Mos

The college financing process can feel overwhelming, even for those who have done it before.

Mos is a resource available to help maximize your financial aid and make college more affordable and accessible.

When you sign up for Mos, you can get help completing your FAFSA, as well as assistance qualifying for other forms of financial aid.

Conclusion

Without help in the form of loans, grants, and scholarships, the cost of college would be too high for many students.

The student financial aid available through the federal and state governments and universities can make the difference of tens of thousands of dollars, helping to make a college degree more accessible and affordable.

Even if you aren’t sure you’ll qualify for aid, it’s worth filling out the FAFSA. There’s a variety of aid programs available, and you might be surprised by what you qualify for.

Visit Mos for help filling out the FAFSA and qualifying for other types of financial aid.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you