Student loans •

October 28, 2022

What's a Stafford loan?

A Stafford loan is a type of federal student loan. Find out everything you need to know about Stafford loans.

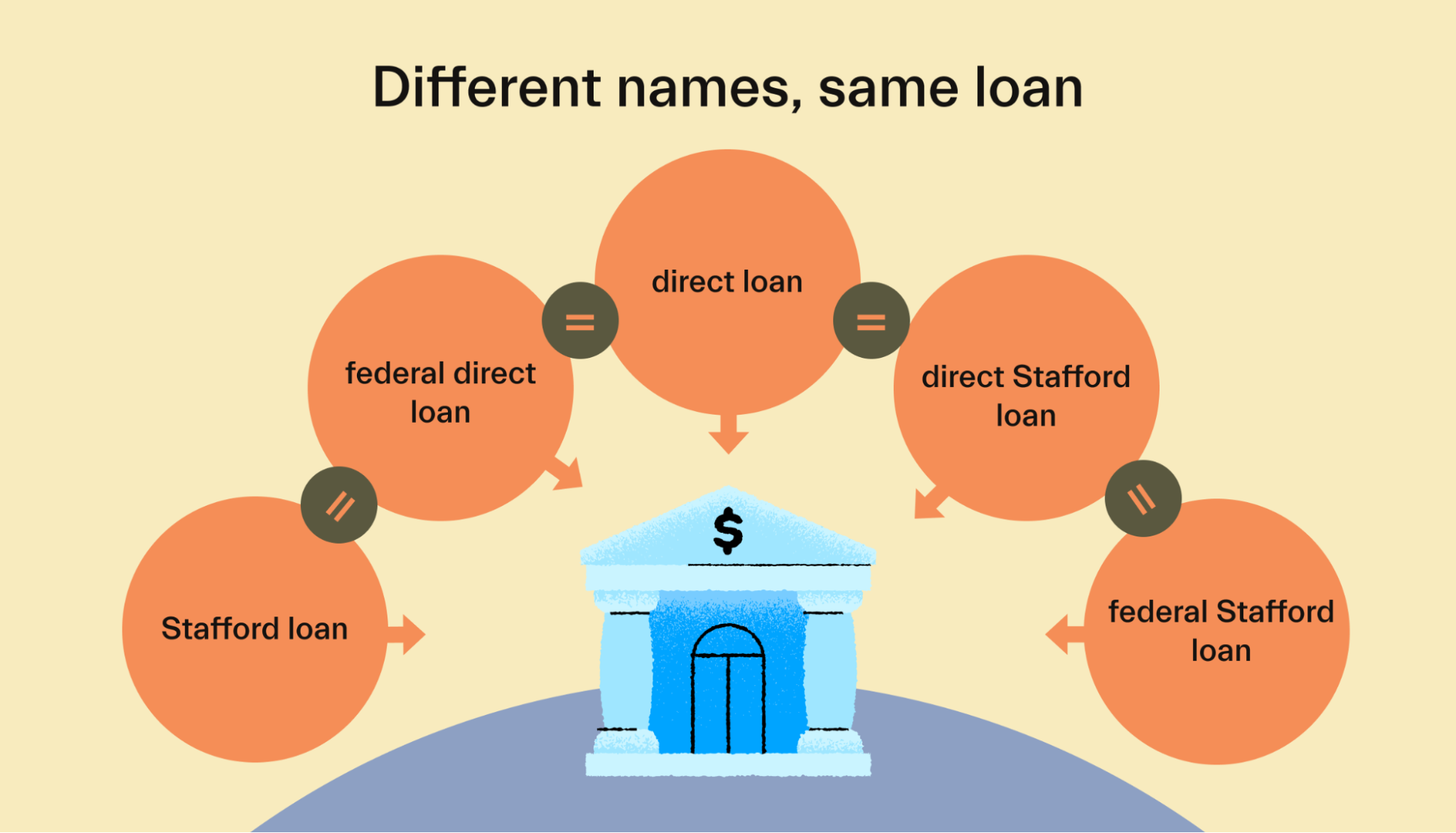

One of the many names for federal direct student loans is federal Stafford loans (or Stafford loans for short).

Depending on where you are in the US., who you’re talking to, or what year it is, you’ll probably hear lots of different terms for the same thing.

It’s like calling a carbonated drink soda, pop, Coke, or soft drink.

Something similar happens when it comes to federal direct student loans. Over the years, these types of loans have gone through many name changes and adopted a few nicknames.

Understanding what is—and isn’t—a Stafford loan will help you determine if it might be a good fit to help pay for your college education.

Let’s review what a Stafford loan is, how a Stafford loan works, what the different types of Stafford loans are, and how you can apply for a Stafford loan.

Find scholarships and grants, and fight to lower your tuition. Learn More

What is a Stafford loan?

A federal Stafford loan is another name for a federal direct student loan: money that the Department of Education (DOE) lends directly to you at a low rate to pay for college.

Federal direct loan, direct loan, Stafford loan, and direct Stafford loan are terms that typically refer to the same type of loan.

There are direct Stafford loans available to undergraduate and graduate students.

Why is this type of student loan called a Stafford loan?

The name Stafford loan comes from Senator Robert Stafford, a Vermont congressman who in 1988 passed legislation that changed the Higher Education Act of 1965.

Senator Stafford’s contributions to higher education were so remarkable that the government renamed federal direct loans as federal Stafford loans in his honor in 1988.

In 2010, US legislators discontinued the name Stafford loan program and renamed it the William D. Ford Federal Direct Loan Program—which is a mouthful.

So, in practice, we call it a direct loan or Stafford loan—they both refer to the same type of federal student loan.

What are the types of Stafford loans?

The two main types of Stafford loans are subsidized Stafford loans and unsubsidized Stafford loans.

Let’s break them down.

Subsidized Stafford loan

A subsidized Stafford loan means that the federal government covers part of the cost of your loan. They do this by not charging you interest while you’re in school and up to 6 months after graduation.

You can use a subsidized Stafford loan to pay for the expenses of an undergraduate degree. To qualify for this loan, you typically have to show financial need and attend school at least half-time.

The interest (a cost that the lender charges you for lending you the money) of a subsidized loan won’t start accumulating until 6 months after you graduate.

The federal government also offers you a grace period of up to 6 months after graduation. A grace period means that you won’t have to start paying the loan back until 6 months after you graduate, which is the same time that it will begin accumulating interest.

Unsubsidized Stafford loan

Unlike a subsidized Stafford loan, an unsubsidized Stafford loan starts charging you interest on your loan from the day that you get the money.

This means that interest charges start adding to the amount that you borrow, and interest will apply to the growing balance.

Unsubsidized Stafford loans are available to undergrad and grad students. While you’ll still need to attend college at least half-time, you won’t need to demonstrate financial need.

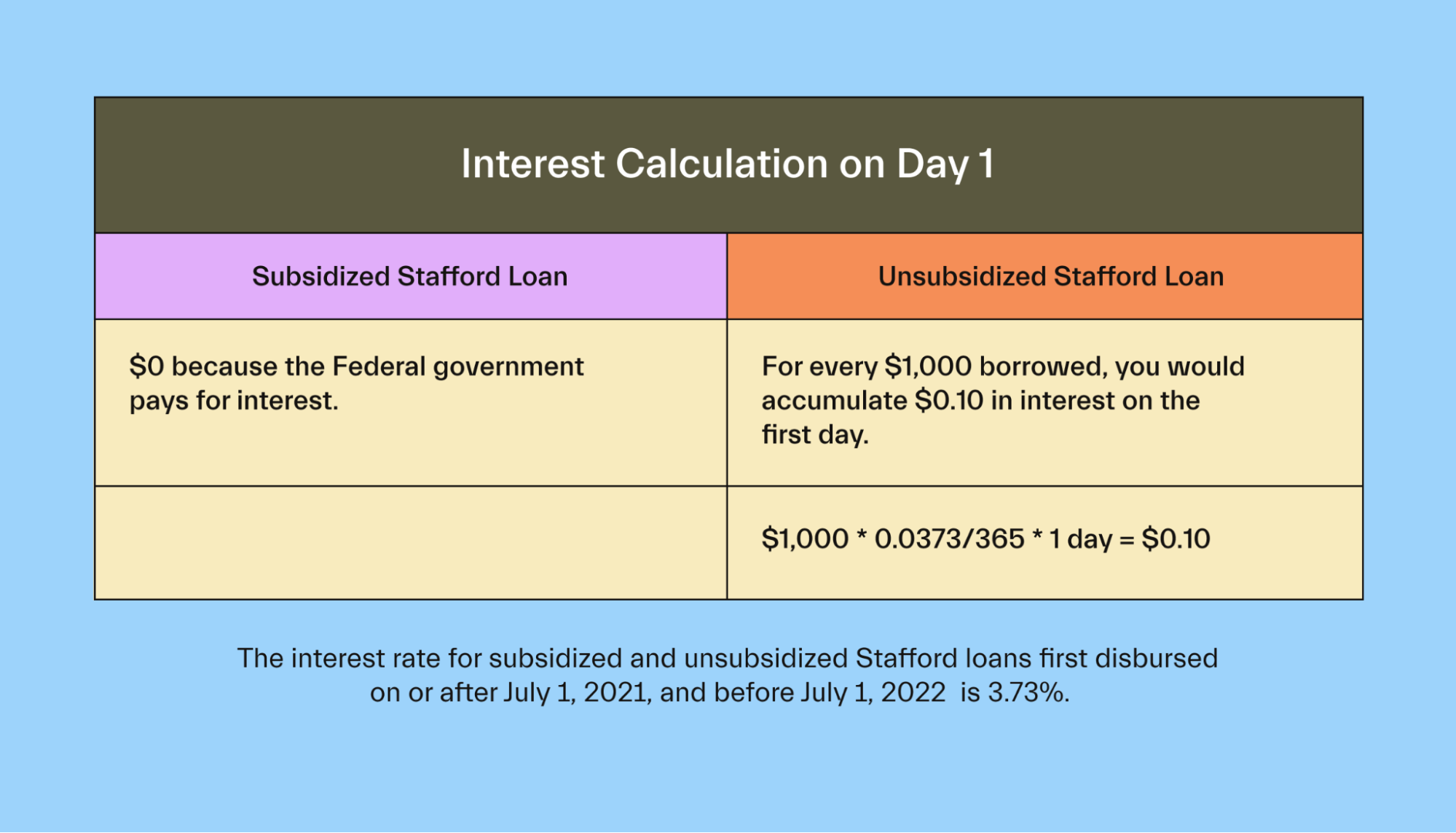

Comparison of interest calculation between a subsidized and unsubsidized Stafford loan

The interest rate of a student loan is calculated daily.

The interest rate for subsidized and unsubsidized Stafford loans first disbursed on or after July 1, 2021, and before July 1, 2022, is 3.73%.

A subsidized Stafford loan wouldn't charge you any interest on the first day of the loan. But an unsubsidized Stafford loan would accumulate $0.10 for every $1,000 that you borrow beginning on the first day.

You can see how an unsubsidized loan can rapidly become more expensive.

PLUS Stafford loan

A PLUS Stafford loan is an unsubsidized federal student loan that is only available to eligible graduate or professional students or parents of graduate students.

When you take out a PLUS Stafford loan on your own, the loan is a grad PLUS loan.

When your parents apply for the PLUS Stafford loan, then the loan is a parent PLUS loan.

To qualify for a grad PLUS loan, you’ll need to attend the graduate program of a qualifying school and not have a poor credit history (a history of owing large debts and paying debts late or not at all).

A parent can use a parent PLUS loan to cover the undergraduate college expenses not covered by the student’s financial aid package.

Unlike other student loans, a parent PLUS loan has no grace period, and parents usually need to start repaying back the loan once the student graduates.

How does a Stafford loan work?

A Stafford loan is cash that you borrow from the Department of Education to cover your college expenses. The amount you can borrow, interest rate, period when interest accumulates, repayment, and fees can all vary depending on your specific situation.

Let’s review each one of these details and how they may change depending on your type of Stafford loan (subsidized, unsubsidized, or PLUS).

Loan amount

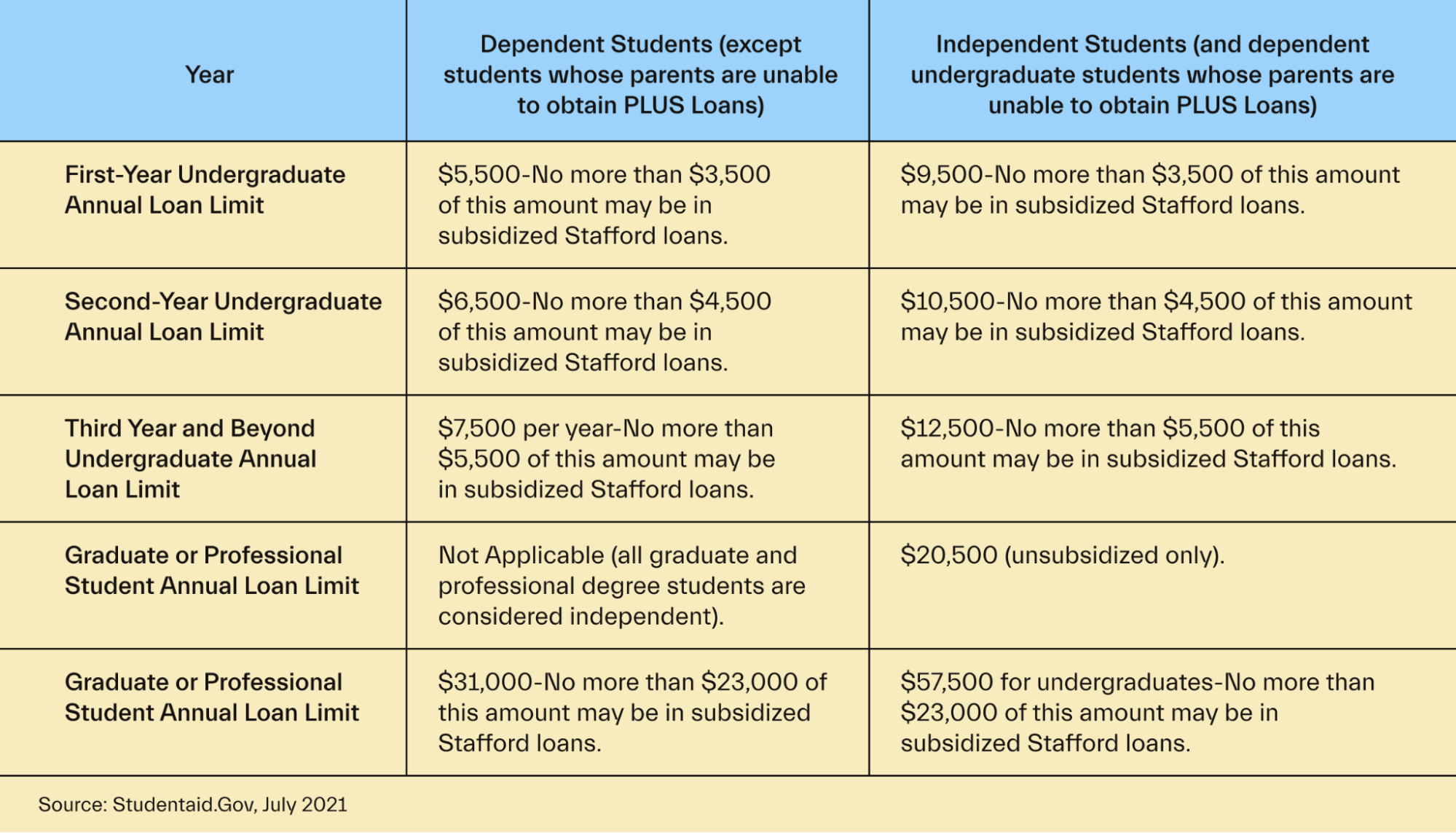

The Department of Education sets the maximum amount that you can borrow using several factors. These could be your year in school, the type of degree you’re pursuing, your dependency status, the type of Stafford loan, and total amount you’ve borrowed so far.

For example, in June 2021, a freshman dependent student pursuing an undergraduate degree could borrow up to $3,500 in a subsidized Stafford loan.

Here is the complete breakdown of maximum loan amounts for Stafford loans:

Interest rate

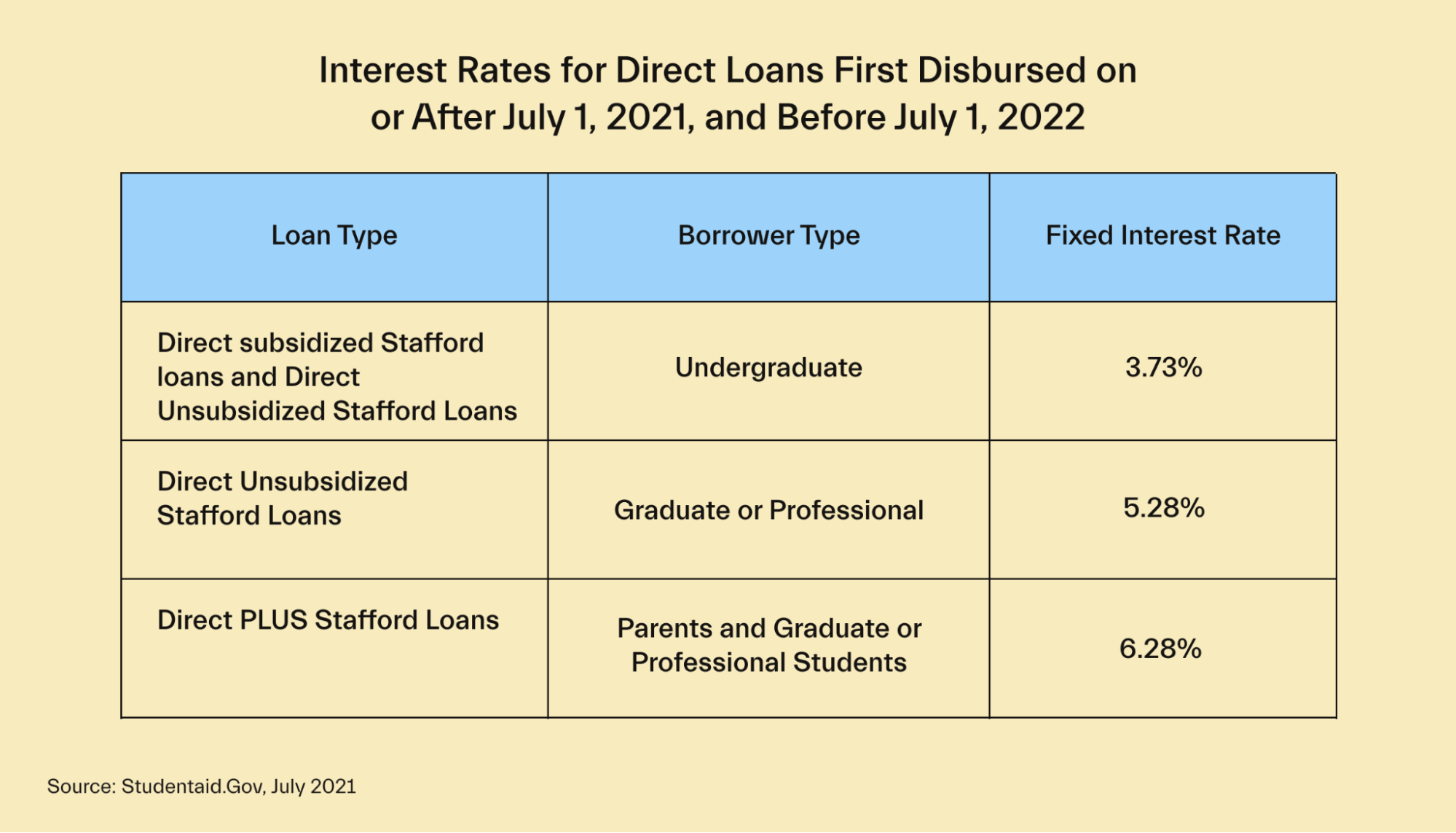

The federal government sets the interest rate of Stafford loans every year, and it changes on July 1 of every year. Once set, the interest rate is fixed for the life of the student loan.

Here are the interest rates for Stafford loans issued between July 1, 2021, and July 1, 2022:

Period when interest accumulates

With subsidized Stafford loans and grad PLUS loans, the government pays for your interest while you’re attending college at least half-time.

With unsubsidized Stafford loans and parent PLUS loans, the interest applies starting day 1 of the loan.

Life of loan

The life of your Stafford loan can be up to 30 years, depending on how much you borrow and what payment plan you choose.

The life of the loan may vary if you switch between payment plans, but it typically doesn’t go beyond 30 years.

Get more money for college life! Learn More

Repayment

Depending on your payment plan, your Stafford loan payments will be monthly or quarterly.

Unsubsidized Stafford loans require you to make payments from the start of the loan.

Subsidized loans require you to begin making payments after the post-graduation 6-month grace period or when you attend school less than half-time.

Fees

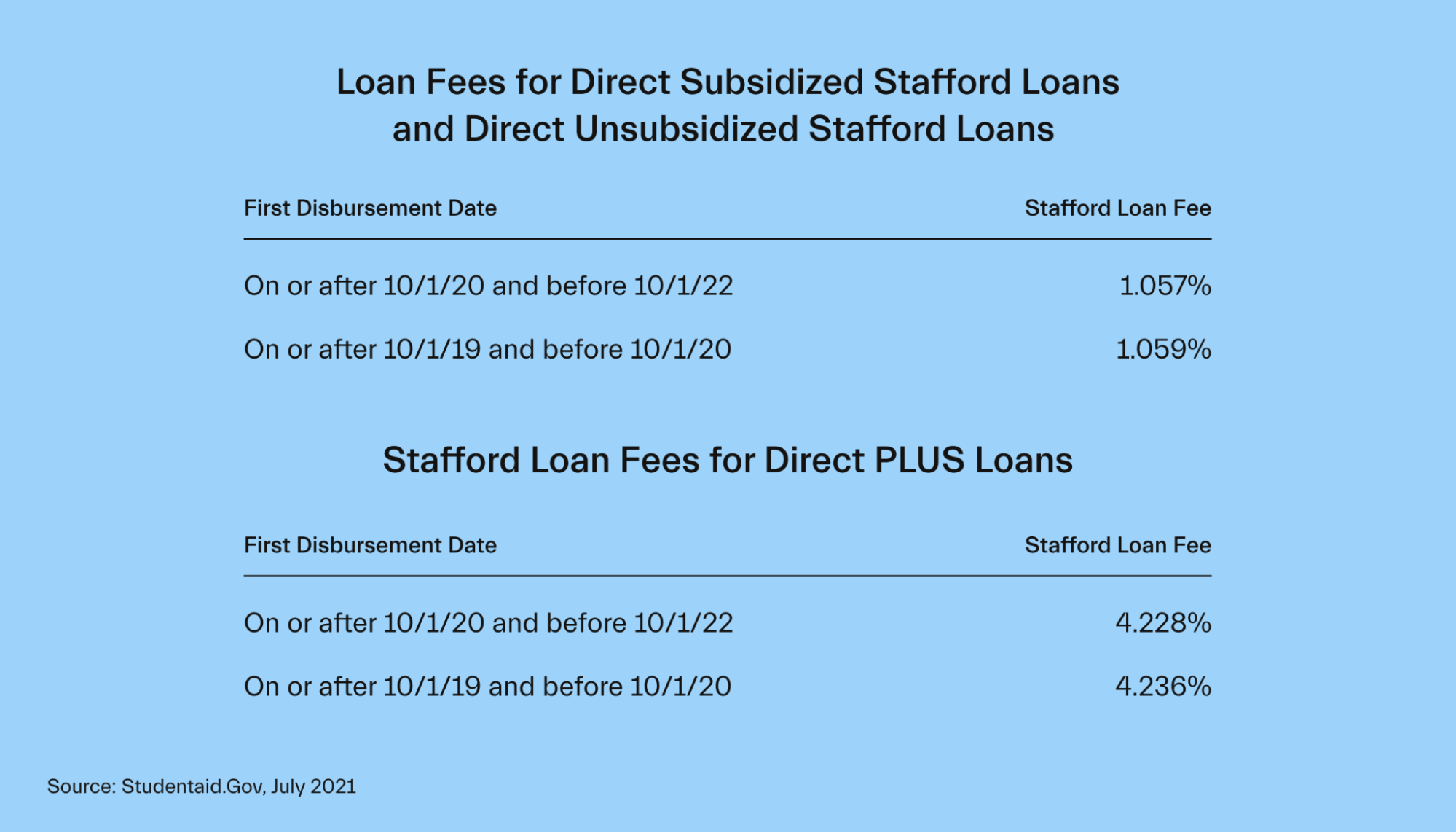

In addition to the interest rate, most Stafford loans have a loan fee called the origination fee. Expressed as a percentage, an origination fee applies at the beginning (origin) of the loan.

The loan fees for Stafford loans issued after October 1, 2019, range from 1.057% to 4.236%.

The origination loan fee reduces the actual amount of money that you get.

For example, a subsidized Stafford loan has an origination fee of 1.057%. If you were to borrow a $1,000 subsidized Stafford loan, you’d receive about $989.43.

$1,000 - ($1,000 * 0.01057) = $989.43

What are the benefits of Stafford loans?

Grants and scholarships are the best sources of funding to pay for college because they’re free money!

Let’s say you explore all of your options for grants and scholarships, and you still need more money to pay for your college expenses.

In this case, Stafford loans are preferable to other types of loans.

Here’s why:

Lower interest rate: Stafford loans often offer a lower interest rate than private student loans do.

Cost savings: A subsidized Stafford loan means that the federal government covers your interest payments while you attend school at least half-time. Because of this, you’ll end up paying less money overall.

Grace period: Most Stafford loans give you the opportunity to delay the start of payments up to 6 months after graduation.

Smaller initial payments: Once the federal government requires you to start making payments, your initial monthly payments typically are only to cover the interest. The initial minimum monthly payment can be as little as $25.

Flexibility on repayment plans: The federal government allows you to renegotiate your repayment plan if you can show that your financial situation has changed significantly. There are also repayment plans based on your income once you find a job after graduation.

Do I have to pay back a Stafford loan?

Yes, under most circumstances, you have to pay back a Stafford loan.

You will complete the FAFSA when you apply for a Stafford loan. As part of the FAFSA process, you have to sign a master promissory note (MPN) to receive your loan funds. By signing a FAFSA MPN, you’re making a promise to pay back the loan in full.

Even if you find that your degree doesn’t help you land a higher-paying job or a job at all, you’ll almost always have to pay the loan back plus interest and fees.

You could negotiate a repayment plan based on a reduced income, but you’ll still have to pay your student loan. This applies to both a subsidized loan or an unsubsidized loan.

In some instances, you won’t have to pay back a Stafford loan:

Specific industries or sectors: If you work in an eligible profession, such as nursing, teaching, or public service, your Stafford loan may qualify for loan forgiveness.

Bankruptcy: If you declare bankruptcy (a legal proceeding when you’re unable to pay back your debts), then your loan can be discharged.

School fraud: If your school commits fraudulent activities, you may qualify for loan forgiveness. Examples of fraudulent activities include inaccurate claims about your employment opportunities, college expenses, or the school’s professional accreditations.

Who can apply for a Stafford loan?

You need to meet a few conditions before you can submit your FAFSA to apply for a Stafford loan.

The general eligibility requirements for a direct Stafford loan include:

Current US citizenship or qualifying noncitizen status (e.g., green card holder)

Valid Social Security number (SSN)

High school diploma, GED, or other eligible certificate equivalent to a high school diploma

Registration in a qualifying degree or certificate program that participates in the direct loan program

School enrollment must be at least half-time

For male students age 18+ only: registration with theSelect Service System (the nation’s registry of potential military personnel)

How do you apply for a Stafford loan?

You apply to Stafford loans by completing the FAFSA.

The FAFSA is available for free online at https://studentaid.ed.gov/sa/fafsa. If you prefer to fill it out by paper, your local high school or library may provide you a physical copy.

You need to fill out a FAFSA every year.

While the federal deadline is June 30, your state or school may have an earlier deadline. This second deadline is the one that matters the most, so contact your school’s financial aid office for the right date.

Conclusion

If you do have to take out a student loan, a Stafford loan may be a good option for you.

But, when looking to pay for college, you should always go after any free money you can get before accepting loans you have to pay back.

The first step to unlocking your financial aid is to complete the FAFSA and apply for other scholarships and grants that you qualify for.

Quit leaving money behind. Work 1:1 with a Mos advisor to find every dollar you qualify for.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you