Student loans •

November 16, 2021

What's the Stafford Loan interest rate?

Read this guide from Mos.com to find out the current Stafford Loan interest rate.

Going to college can be really expensive—and unfortunately, it’s not always clear how expensive college is going to be until after you’ve already started.

Sometimes new expenses come up, or it becomes obvious pretty quickly that the funding or scholarships you already have aren’t going to cover the entire cost of your tuition and college fees.

Fortunately, the federal government offers a support loan for students that have already started their degree and need a helping hand with funding.

This loan is called the Direct Stafford Loan—but you may also hear people refer to it as a “Stafford Loan” or a “Direct Loan”. Don’t worry, because they all mean the same thing.

The amount you can borrow for a Stafford Loan depends on the level you’re studying at, what year of college you’re in, whether you’re a dependent, and more.

But before you take on any loan, you need to know about the interest rates you’re getting locked into.

This guide will explain what the Direct Stafford Loan is, the current Stafford Loan interest rate, and what happens if you fail to pay the interest back.

What is a Stafford Loan?

Before we speed right into what the Stafford Loan interest rates are, let’s pump the brakes and talk about what Stafford Loans are.

Simply put, a Stafford Loan is a federal student loan that the US government offers to students who are still in school and need a hand paying for college tuition and other related expenses.

You’ll commonly hear Stafford Loans being called a “Direct Stafford Loan”. Both these terms refer to the same federal student loan product.

Unlike some other government financial aid programs, Direct Stafford Loans are available for both undergraduate and graduate students—assuming they meet a fairly inclusive set of eligibility requirements. But we’ll cover those in just a minute.

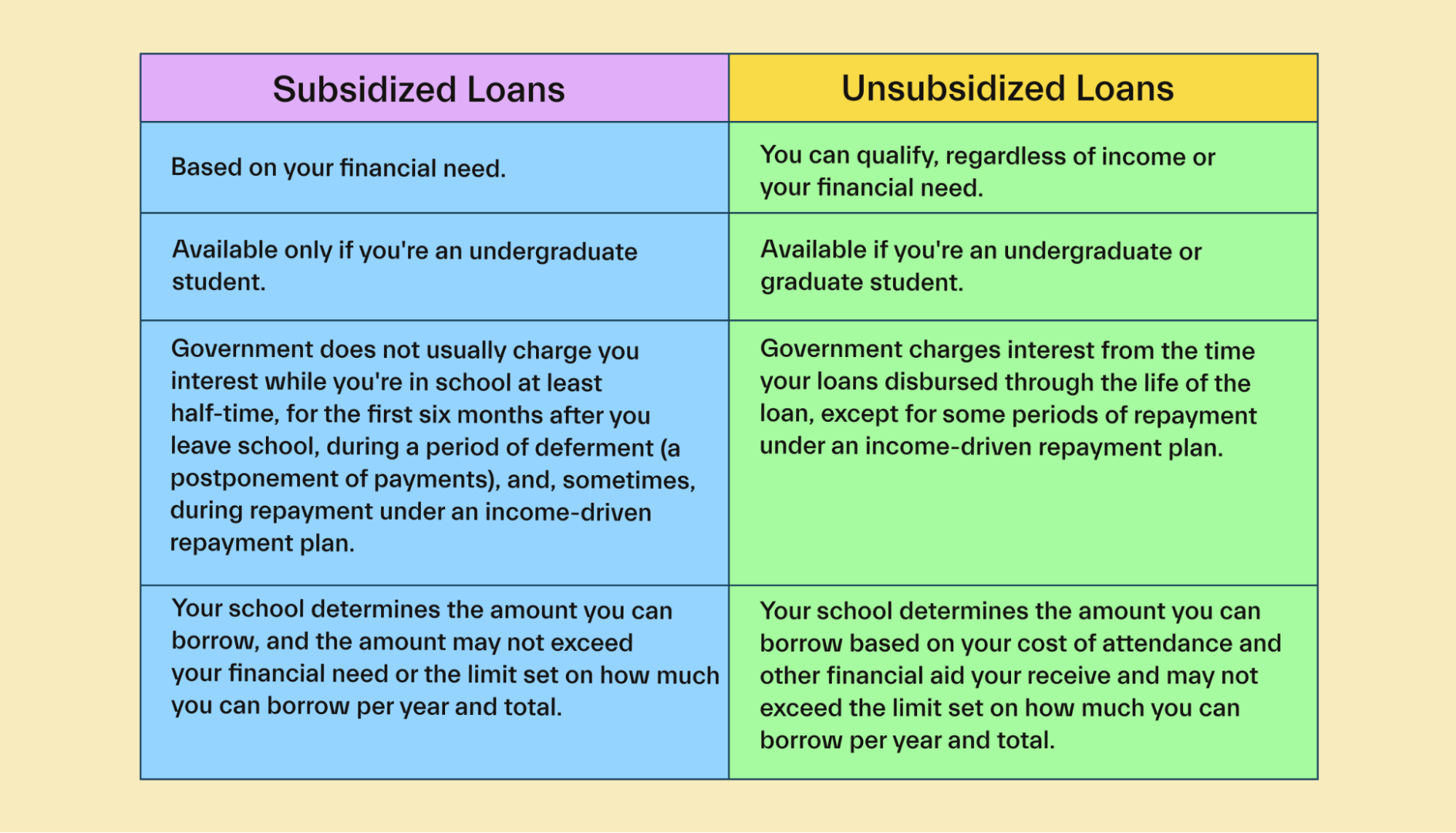

There are two types of Stafford Loans you’ll come across: a subsidized Stafford Loan and an unsubsidized Stafford Loan.

Subsidized Stafford Loans are federal student loans backed by the US Department of Education.

With a subsidized loan, the government agrees to pay off the interest on your student loan while you’re still studying in school. The government also covers your interest during grace periods or any deferment periods you might need.

For example, most federal student loans have a 6-month grace period after you graduate, in which you aren’t expected to make any student loan repayments.

Loan deferment is the process in which your loan servicer agrees to postpone your loan repayments for an agreed period of time—usually 12 months.

Next, you've got unsubsidized Stafford Loans.

An unsubsidized Stafford Loan is a federal student loan product in which you as the student borrower are responsible for paying all of the interest that builds up on your loan.

That means as soon as the US government has paid out your loan money, you immediately start to build up interest and need to start paying it back right away.

Which Stafford Loan is right for you? To be honest, it depends on what you’re looking for in a loan product.

Either type of Stafford Loan is a great funding option because they’re available to both undergraduate and graduate students.

There's also no requirement to prove that you have a financial need for the loan—even though you have to apply for a Direct Stafford Loan using the Free Application for Federal Student Aid (FAFSA).

With a subsidized loan, you’re going to benefit from a little bit of extra help from the US government paying off some of your interest. This makes it the better option for a lot of college students.

But it’s also important to note that students are able to borrow more tuition money with an unsubsidized loan.

What is the current Stafford Loan interest rate?

So we’ve explained what the Direct Stafford Loan is. Now let’s talk about the current Stafford Loan interest rate.

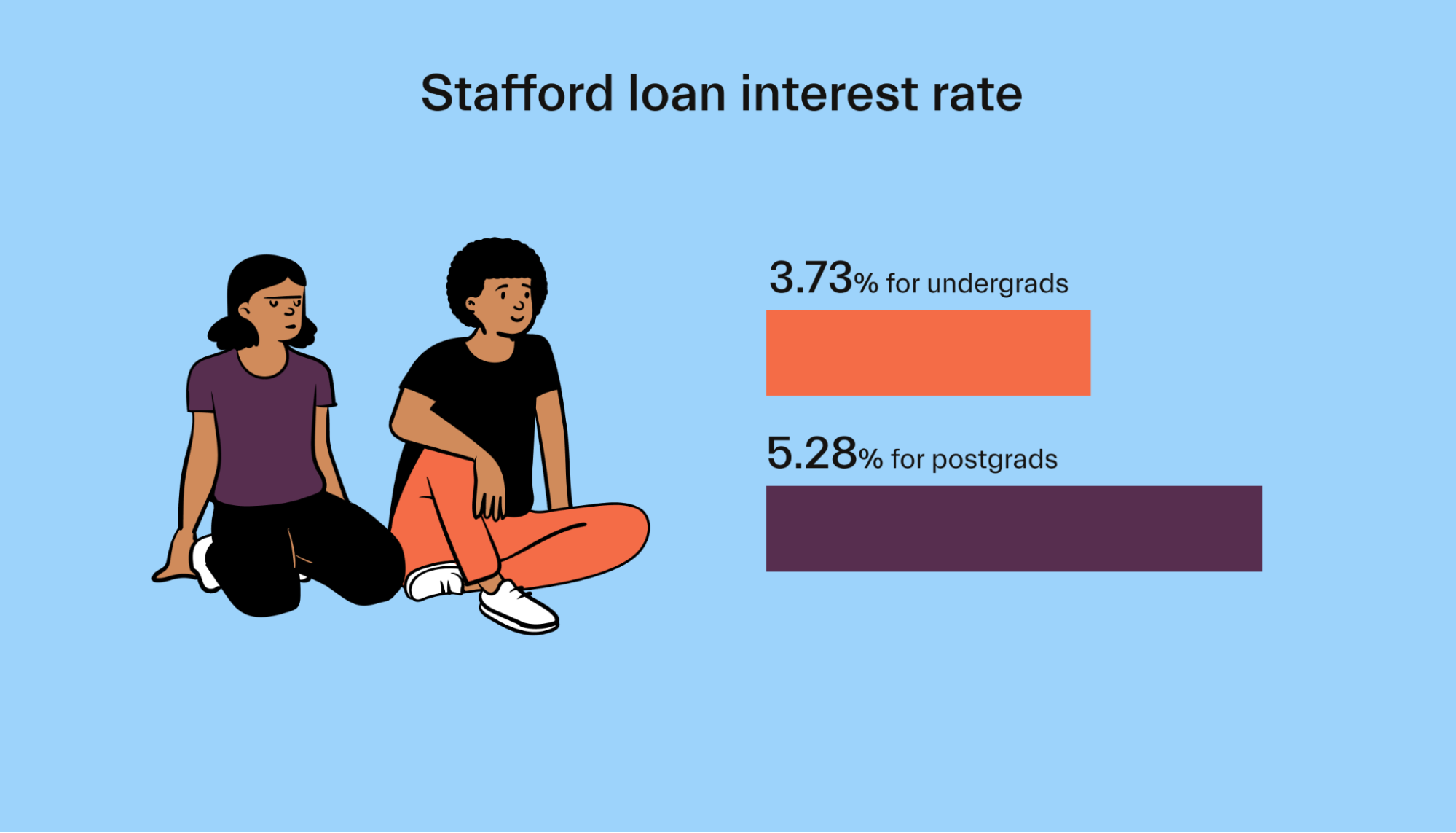

The current interest rate for any federal Direct Subsidized Loan or Subsidized Federal Stafford Loan is 3.73% of the total loan amount for undergraduate borrowers.

This rate tends to go up or down on a yearly basis, but it’s important to note that all Stafford Loan interest rates are fixed for the lifetime of your loan.

That means if you take out a $20,000 Subsidized Federal Stafford Loan in the 2021–22 academic year, you’ll be paying an interest rate of 3.73%. If the government decides to hike that interest rate up 2 percentage points in 2026, it won’t affect you or your loan repayments. You’re going to be locked into that rate of 3.73% until your loan is paid off in full.

Why do you have to pay interest on your Stafford Loans?

Interest is paid to your lender as a cost of borrowing money. Just think of it as a sort of rental fee for getting to use somebody else’s cash to pay for your college tuition.

The interest on your student loans is calculated as a percentage of the unpaid principal amount. Your principal amount is the original amount of money that you borrowed.

Unlike other loan payments you might find yourself paying like mortgages, direct loans from the US government are daily interest loans. This means that the interest on your account builds up on a daily basis.

It’s important to know that the current rate applies to loans that were first disbursed on or after July 1, 2021, and before July 1, 2022. If you plan to take out a Stafford Loan after July 2022, you may need to pay a different rate.

If you’re applying for a Stafford Loan as a current graduate student, you’ll have a slightly higher interest rate. For the 2021–22 academic year, the current Stafford Loan interest rate for grad school students is 5.28%.

Just like undergraduate interest rates, graduate interest rates are locked for the duration of your loan term. That means if you take out a loan with a 5.28% rate, it doesn’t matter if the government hikes its rates up further down the loan. You’ll continue to pay an interest rate of 5.28%.

Who is eligible for the Direct Stafford Loan?

Some of the federal student loans that are available from the Federal Student Aid office have certain requirements you must meet to be eligible. But Stafford Loans tend to be a lot easier for current college students to apply for.

First, if you want to apply for a Direct Stafford Loan, you need to be either a US citizen, a US national, or a permanent US resident.

You don’t need to be a full-time college student to qualify for a Stafford Loan, but you do need to be enrolled at least part-time in an accredited higher education institution. “Part-time” means you’re fulfilling at least 50% of the requirements a full-time student would be putting into their degree.

You also need to be in good academic standing.

Those are all of the education requirements you need to fulfill to qualify for a Stafford Loan. But there are a couple of financial requirements you’ll need, too.

First off, you can’t be someone who has ever defaulted on a previous student loan or another method of financial aid. You also can’t owe a refund to any student loan servicer.

You may need to show a financial need—but only if you want to apply for a subsidized student loan. Unsubsidized Direct Stafford Loans aren’t linked to financial need, and so you won’t need to prove that you need financial aid to qualify for these.

Whether or not you choose to apply for a subsidized or unsubsidized Stafford Loan, you’ll need to apply using the FAFSA.

Why is knowing all of this stuff important? By doing your homework and understanding the eligibility requirements beforehand, you’ll be able to start preparing your funding mix to make sure your college education gets fully funded.

How is the Stafford Loan interest rate calculated?

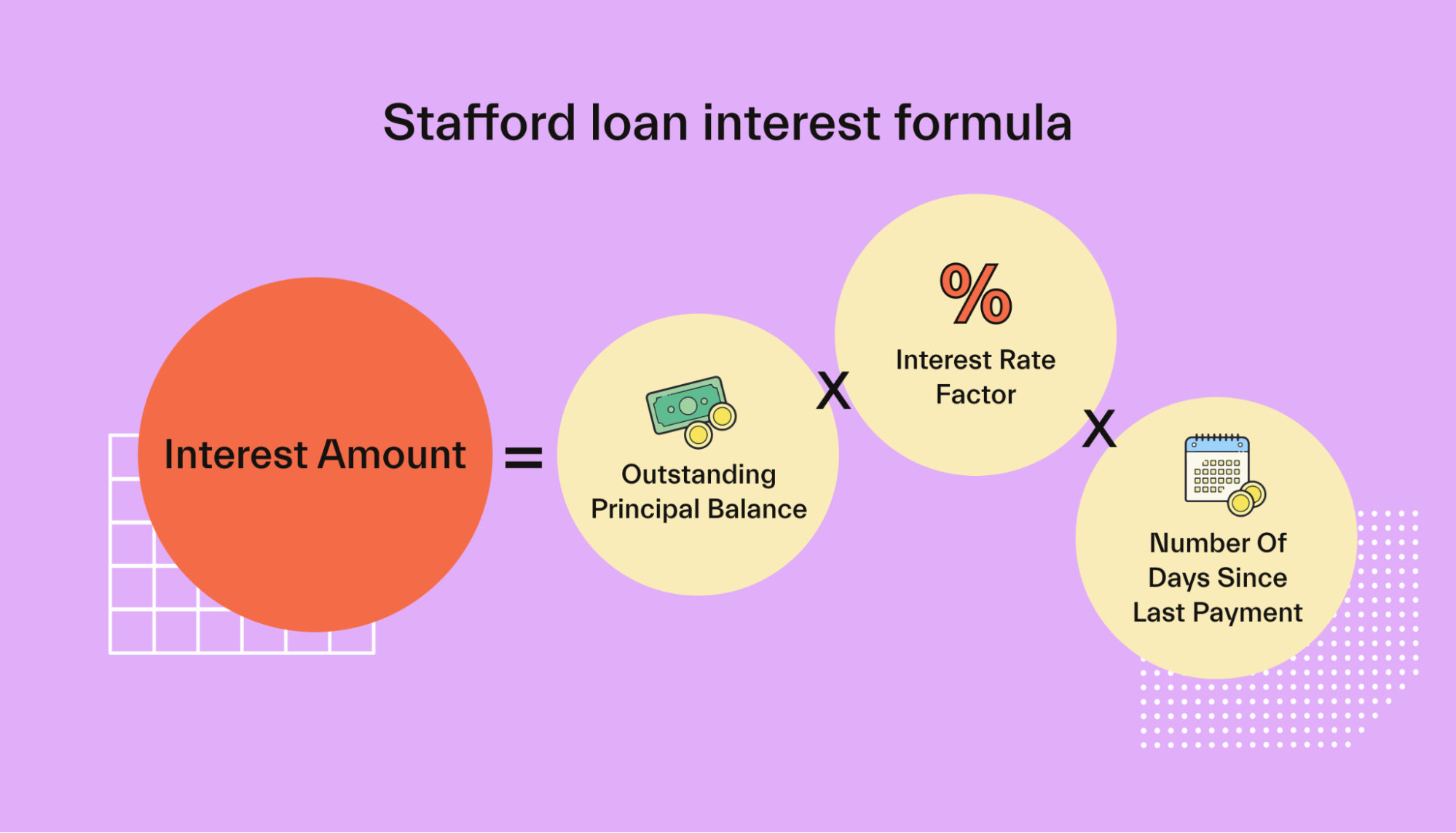

The interest rate on a Stafford Loan is calculated using a daily interest formula.

A daily interest formula is a simple equation a loan servicer uses to figure out the amount of interest that has built up (or “accrued”) on your loan in between the monthly payments that you’ve been making.

The daily interest rate formula is pretty straightforward. All you have to do is multiply your outstanding principal balance by the interest rate factor. Then, you multiply that resulting figure by the number of days it’s been since you’ve made your most recent payment.

Never heard of an interest rate factor? Don’t worry because it’s just a bit of financial jargon.

Your loan’s interest rate factor is a number that loan servicers use to calculate accrued interest on your loan. You can find your own loan’s interest rate factor by taking your loan interest rate and then dividing it by the number of days that are in the year.

This stuff might sound a little bit complicated at first glance, but it’s really important that you understand it. After all, you should take in all the information you can about how interest works and how it’s calculated before taking on debt.

What happens if you don’t pay your Stafford Loan interest?

When you take on a federal student loan, it’s super important that you stay up-to-date on all of your interest repayments.

You may find yourself in a situation where you decide you don’t want to pay the interest that’s built up on your loan (or you can’t make repayments).

For example, you might choose to defer your loan for a period of 12 months. But if you’ve signed on to take out an unsubsidized Stafford Loan, you’re still responsible for the interest on your deferment period.

Any time you're responsible for interest payments on a Stafford Loan but fail to pay, your unpaid interest is usually going to be capitalized.

What is loan interest capitalization?

Capitalization is the process in which a lender or loan servicer adds more unpaid interest to the principal balance of your loan. Translation: if you fail to pay off your loan interest, your loan provider will keep adding more interest onto your outstanding balance.

Generally speaking, your monthly loan payments should cover all of the built-up interest on your loan between monthly payments. That means you shouldn’t have any unpaid interest to worry about.

That being said, there are a few different scenarios in which your unpaid interest can start to build up and cause problems.

For example, if you defer your student loan, you aren’t going to be required to make monthly payments during that deferment period. Unfortunately, the same can’t be said of your interest if you have an unsubsidized Stafford Loan.

When you have an unsubsidized loan, interest will continue to build on your account even though your repayments have been deferred. Even though you aren’t making monthly repayments on your principal balance, you have to keep paying your interest.

This same rule doesn’t apply to subsidized Stafford Loans. If you take out a subsidized loan, the government will foot the bill for your interest payments during a deferment period.

You might also end up accruing unpaid interest if you’re repaying your federal student loan under an income-driven repayment plan. On many income-based repayment plans, your monthly loan payment will end up being less than the amount of interest that builds up in between payments.

If this happens, your account will build up unpaid interest that will get capitalized.

At the end of the day, it’s pretty important that you understand interest capitalization. Because capitalization increases the outstanding principal amount you must pay back, interest will then get charged on that higher principal balance.

In short: capitalization increases the overall cost of your federal student loan. Depending on what type of repayment plan you’ve agreed to with your loan servicer, capitalization could even push up your monthly payments.

That means you should do your best to avoid loan capitalization.

Conclusion

If you’re a current student that needs help covering the cost of your tuition, a Direct Stafford Loan is a pretty great option. It’s available to both undergrad and grad school borrowers, and you don’t always need to demonstrate financial need to qualify for a Stafford Loan.

But it’s important to remember that you will need to pay back your Stafford Loan—and until you pay off your loan in full, interest will keep on building.

Remember: the current Subsidized Federal Stafford loan interest rate is 3.73% for undergraduates and 5.28% for graduates. This rate may go up in the future, but it’ll be fixed for the duration of your loan.

Want to learn more about Stafford Loans and get matched with new funding opportunities? Join Mos now.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you