Financial aid •

November 9, 2022

Massachusetts Institute of Technology financial aid: a complete guide

Read all about financial aid at the Massachusetts Institute of Technology, including scholarships, loans, and grants.

The Massachusetts Institute of Technology (MIT), located in Cambridge, Massachusetts, is one of the best-known universities in the US. It’s known for its innovation and for providing a rigorous academic experience to top students in the fields of science and technology. The school boasts many honors, including nearly 100 Nobel laureates among its faculty, staff, and alumni.

If you’re thinking about attending MIT but don’t know how you’ll pay for tuition, we’ll cover what you need to know in this article.

A snapshot look at the Massachusetts Institute of Technology

MIT is filled with students and faculty driven to be on the cutting edge of technology and research. If you’re looking for one of the most rigorous academic experiences available for students in technological fields, MIT will fit the bill.

Of course, this also means that MIT is highly selective. With an acceptance rate of just over 4%, you’ll need to be well-qualified to gain admission.

Though MIT is known for its rigorous academics, there’s more to do at the school than study. MIT offers lots of extracurriculars, including more than 500 student organizations, almost 40 Greek letter and independent living groups, and NCAA sports.

You can also get involved in the long-running MIT tradition of “hacking”—MIT’s term for pranks and practical jokes. Some famous hacks include flying an MIT weather balloon at the annual Harvard/Yale football game, placing a campus police car on the roof of MIT’s Great Dome, or turning a nearby building into a giant screen for a game of Tetris.

Thanks to MIT’s location in Cambridge, when you’re not on campus, you can explore Cambridge, Boston, and the surrounding area, which is full of museums, sporting events, parks, and cultural institutions.

Ranking: 2 of national universities

Size: 4,602

Demographics: 54% male, 46% female

Acceptance rate: 4.1%

Average GPA of accepted student: 4.17

Key dates and deadlines (2022)

Application: January 5, 2022

Financial aid deadline: February 15, 2022

A look at scholarships offered by the Massachusetts Institute of Technology

College is expensive.

Even if you and your family have saved for years to pay for college, you might find yourself coming up short and unable to pay for 4 years of education. If that happens, you’ll need another source of funding.

The first place to look for extra college funds is scholarships.

Scholarships are the best way for students to pay for school for a simple reason: You don’t have to pay them back. They’re simply free money that you can use for college costs, such as tuition, fees, room and board, or books.

There are plenty of different ways to earn scholarships. Some are awarded based on your financial need. Others focus on your academic merit or athletic achievements. Others are simply based on luck. Finding scholarship opportunities and applying for them is the best way to earn college funds.

MIT’s financial aid office has information about the scholarships and grants that are available. The most common is the MIT Scholarship, which roughly 57% of undergraduates receive each year. In 2021-2022, the average MIT Scholarship totaled $53,997.

You can also get scholarships from outside organizations. Many businesses and community groups operate scholarship programs of their own. If you search thoroughly, you can find a scholarship for almost anything you can think of.

Maximizing your financial aid can make going to college relatively cheap. For help on earning scholarships and other college funds, check out our financial aid tips and tricks page.

Student loans

Scholarships might be the best way to pay for college, but it’s difficult to earn enough money for that elusive full ride. If, after you’ve used your savings and applied for scholarships, you still need help paying for college, your next best bet is a student loan.

The obvious drawback to student loans is that you’ll need to eventually pay them back—plus interest. However, earning a degree can be a valuable investment in your future, so the loan may be worth the cost.

MIT’s financial aid website has information about loans students can use to pay for school.

For most students, the best loan program available is the Federal Direct Loan Program. As the name implies, these loans go to students from the US government. There are 2 types of Federal Direct loans: subsidized and unsubsidized.

Subsidized loans are the better option. With these loans, the government pays interest for you until you leave school. With unsubsidized loans, however, interest builds up on the loan as soon as you receive the funds, which makes them more expensive overall.

Federal loans have other benefits, such as the option to sign up for income-driven repayment plans or to get your loans forgiven if you meet certain requirements.

If you’re an international student, MIT also offers a special loan program: the MIT Technology Loan. This offers up to $3,400 in funding—and an additional $2,000 if you have a creditworthy cosigner. Interest is subsidized, and the loan must be repaid in 10 years.

A private student lender is the next stop after federal student loans. Private loans come from regular banks and other lending companies. However, they tend to have higher interest rates and lack the protections of federal loans, so you should only get one if you’ve exhausted your federal loan limits.

Borrowing money for college can be scary, but you should look at it as an investment in your future. To find out whether student loans would be the right move for you, it’s important to understand how they work.

Check out our article on student loans, where we break them down in more detail.

FAFSA

If you need financial aid for college, the best thing that you can do is fill out the Free Application for Federal Student Aid (FAFSA).

The FAFSA is a single application used by the federal government and thousands of universities across the US. The information you provide in it helps these schools and the government make decisions about scholarships, grants, and loans that you might receive.

To fill out the FAFSA, you’ll have to work with your parents or guardians. You’ll answer some financial questions, such as how much your family makes each year and how much they’ve saved for college.

Based on your answers, the FAFSA will produce your Expected Family Contribution (EFC) to the cost of your college education. When you choose a school, you can subtract your EFC from the cost of attendance to determine your level of financial need. This will help determine the amount of need-based financial assistance you’ll get.

Most schools don’t commit to meeting 100% of their students’ financial needs, but MIT is different. The Institute commits to both 100% need-blind admissions and providing 100% of students’ financial needs in the form of scholarships and other aid.

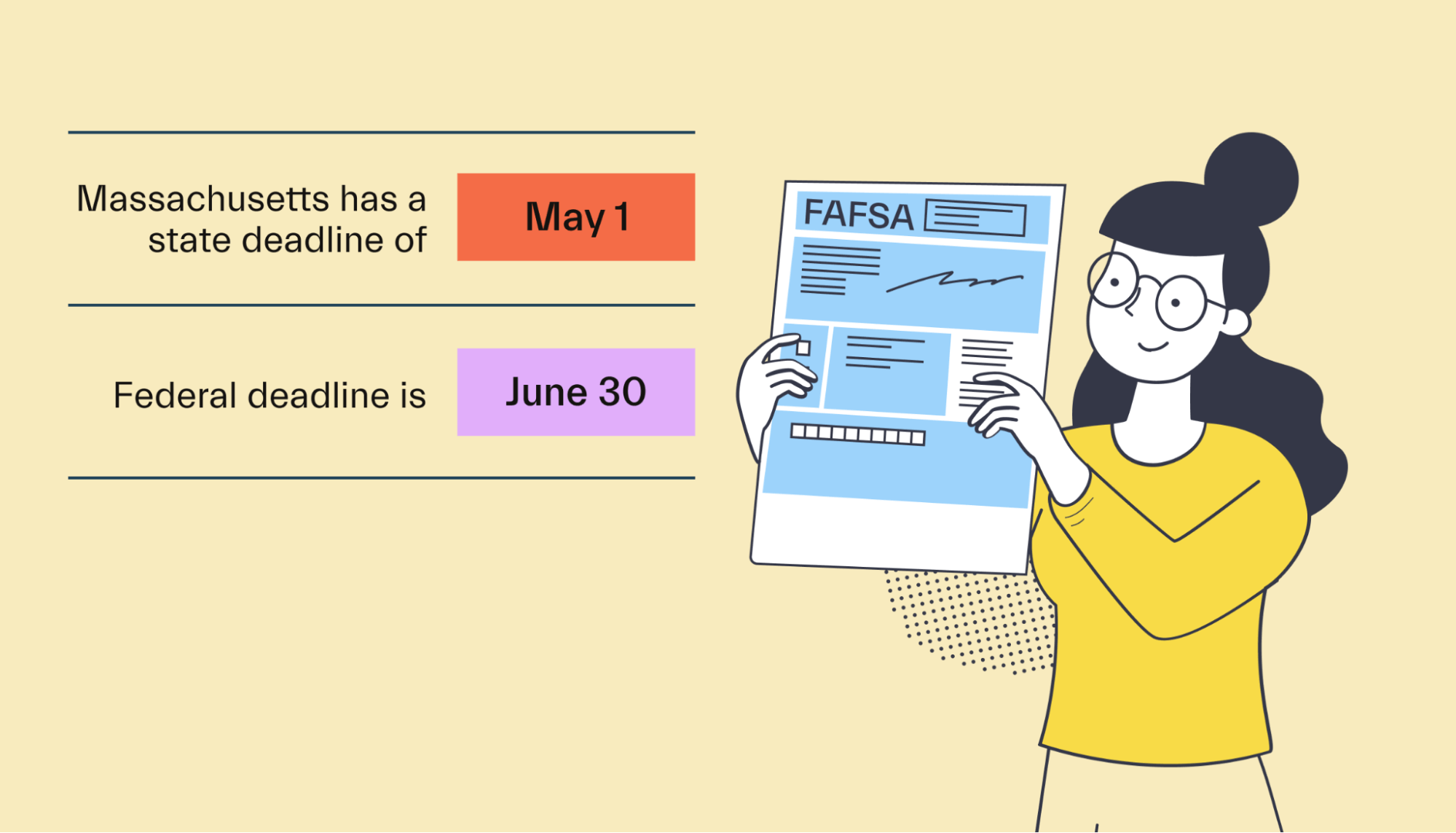

The FAFSA process begins on October 1 for financial aid awarded in the next academic year. That means applying starting in October 2022 will make you eligible for aid in the fall of 2023. You can apply anytime through the end of June before the academic year starts. Massachusetts has a state deadline of May 1, so it’s best to apply before that date.

The FAFSA is complicated and might take some time to fill out. Read our article on how long it takes to complete the FAFSA.

Massachusetts Institute of Technology financial aid FAQs

Here we’ll answer a few more questions you may have about getting financial aid at MIT.

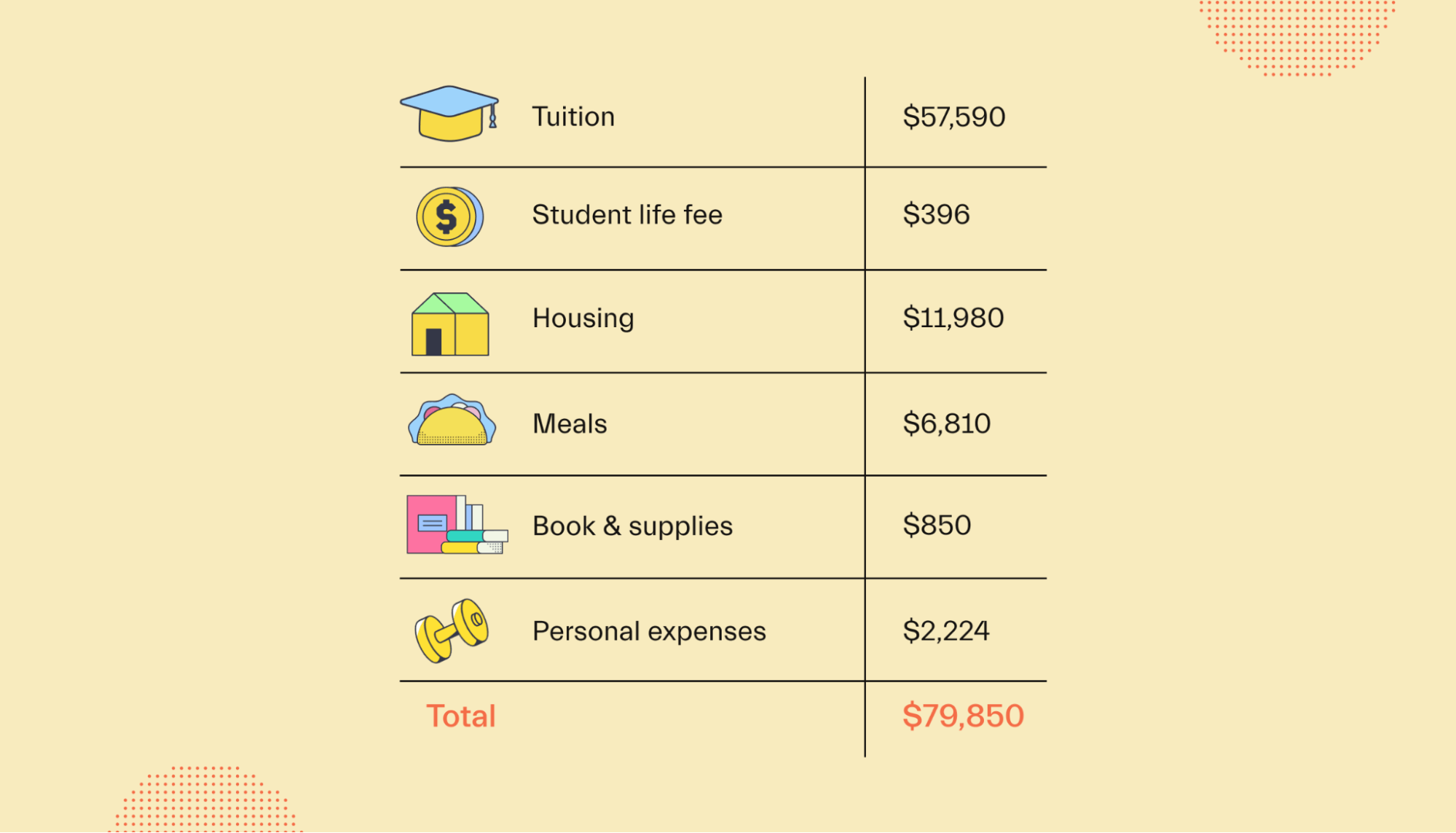

What is the Massachusetts Institute of Technology’s cost of attendance?

The annual cost of attendance at MIT is relatively high, at $79,850. Of that amount, $57,950 is for tuition, and $11,980 is for housing. The remaining amount covers food, books, and other expenses.

Keep in mind that more than half of students receive the MIT Scholarship, which has an average award of just under $54,000. This can go a long way toward paying for the cost of school.

How many students get a full ride?

MIT claims that 33% of undergraduates receive scholarships or grants equal to or greater than the tuition amount. It also notes that 57% of undergraduates receive the MIT Scholarship. MIT meets 100% of its students’ financial needs and claims that most students with family incomes under $140,000 pay no tuition.

What types of aid can I get from MIT?

MIT offers many forms of aid to students, including scholarships, grants, and loans.

Are there any ways to reduce student costs?

MIT is a private university, so it doesn’t offer things like state resident tuition rates. To reduce your costs, you can find ways to save money on things like food and housing.

For example, you might consider finding an off-campus apartment that is less expensive than the school’s dorms. However, that would mean passing on experiencing the school’s unique dorm culture.

What is the MIT Undergraduate Research Opportunities Program?

The MIT Undergraduate Research Opportunities Program (MIT UROP) allows students to participate in paid faculty research. Many students use this program to help pay for the cost of their education. In fact, MIT claims that 93% of its students participate in it before graduating.

How many students graduate debt-free?

More than 8 in 10 MIT graduates leave the school with no student loan debt—much more than the national average of 4 in 10.

MIT students who do borrow tend to graduate with less debt than the national average. For instance, the Class of 2022’s average debt was $25,080 compared to the national average of $28,400.

When does MIT release admissions decisions?

Applicants to MIT will hear back in mid-December if they applied for Early Action and mid-March if they applied for Regular Action.

Universities like the Massachusetts Institute of Technology that you might be interested in

If you’re looking for a rigorous academic environment but don’t know if MIT is right for you, there are other alternatives.

Here are other universities like MIT that are worth exploring.

Harvard University

Also located in Cambridge, MA, Harvard is one of the oldest universities in the United States and a member of the well-known Ivy League. This school has more than 23,000 students and an incredibly powerful alumni network that boasts presidents, Supreme Court Justices, and senators among its members.

Stanford University

Stanford University, located in the San Francisco Bay Area, is another of the country’s top research universities. Students interested in computer technology may appreciate the school’s proximity to the nation’s tech hub and reputation for entrepreneurship and innovation.

Yale University

Another historic member of the Ivy League, New Haven, Connecticut’s Yale is a relatively small school with roughly 4,700 undergraduates. If you’re looking for an Ivy League education but want to stick to a smaller community with small class sizes, Yale might appeal to you.

Conclusion

MIT has a strong reputation for academics and innovation. Students at MIT can expect to work hard but also get to enjoy the school’s unique culture. Its location in the heart of the Boston metro area also means students can enjoy the amenities the city has to offer.

When you go to college, you’ll need access to essential financial tools. Mos is here to help. Mos is a money app that helps students lower their tuition, match with top scholarships, and earn extra cash in college. Join Mos today to get started.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you