Financial aid •

March 2, 2022

Financial aid award letter: what you need to know

The financial aid award letter details your financial aid package, but it can be confusing to understand. Here’s what you need to know.

Once you’ve filed the Free Application for Federal Student Aid (FAFSA) and applied for college, you’ll eventually receive financial aid award letters from any schools you were accepted into.

These letters are designed to tell you what kind of financial aid you’ve qualified for and to help you estimate how much you’ll need to pay out-of-pocket.

But these letters can be confusing—especially if you receive multiple letters from different schools.

Each school uses a different format for financial aid award letters, so comparing them can make your head spin!

But don’t worry—with a little guidance, you can make sense of your financial aid award letter.

Here’s what you need to know.

What is a financial aid award letter?

A financial aid award letter is a document you’ll receive from the college(s) you’re accepted into.

Once you file the Free Application for Federal Student Aid (FAFSA), the government sends your information to the schools that you included on the FAFSA. From there, individual schools process your information and determine the amount of aid available to you.

The results of your financial aid package are documented in the financial aid award letter.

Financial aid letters explain the total aid package that you’re eligible to receive, should you attend that school.

This can include all the different types of financial aid, such as:

Federal grants

Work-study

Student loans

Certain scholarships

If you apply for multiple schools and submit the FAFSA, you should receive a financial aid award letter from each school. The types and amounts of aid available will differ at each school.

These letters will generally arrive around April, although this too can vary by school. Students can contact the college financial aid office to find specific timing information. You won’t receive an award letter if you’re not accepted to attend a school.

In some cases, you may need to contact the school in order to request a financial aid package. Not all colleges prepare financial aid offers for every student that lists the college on their FAFSA. Because of this, additional steps may be required.

How to read a financial aid award letter

There’s no standardized format for financial aid award letters. This means that if you receive letters from multiple schools, they may look very different.

In order to understand your options, it’s important to be able to make sense of these letters.

There are 3 key components to understand on a financial aid award letter:

Cost of attendance: The total estimated cost of one year of attending the school.

Expected family contribution: The estimated value that your family can contribute towards education costs, calculated based on the information on your FAFSA.

Award details: The specific dollar amounts and the specific types of financial aid you’re eligible for.

We’ll explain these terms in more detail below.

Key terms to understand

You may come across the terms below on your financial aid award letter:

Cost of attendance (COA): This is the estimated total cost of attending a school for one academic year. This figure includes tuition, fees, books, transportation, and estimates for room and board. This is a rough estimate, but it’s helpful for students to use in calculating their out-of-pocket costs.

Expected family contribution (EFC): The EFC is an index number used to decide a student’s eligibility for financial aid. It’s calculated using information from your FAFSA, including your parents’ income, assets, and other financial information. Aid is calculated based on this amount, regardless of how much your family will actually contribute toward your education.

Financial need: Financial need is an estimate of the gap between what it costs to attend school and the amount you’re expected to be able to pay. It’s calculated by subtracting your EFC from your COA.

Types of financial aid on your award letter

You’ll likely see these terms on your financial aid award letter. They refer to the different types of financial aid.

Work-study: Work-study is a program that lets students work part-time, on or near campus, for more financial aid. Work-study programs are operated by schools but are funded by the federal government.

Scholarships: Scholarships are free money for college that you don’t need to pay back! Students must apply for most scholarships separately (in addition to filing the FAFSA), but schools may award certain scholarships directly via the financial aid award letter.

Grants: Grants are another form of “gift-aid” that you don’t need to pay back. Most grants are government-funded and are primarily available to students with significant financial needs.

Student loans: Student loans are loans available to students to help pay for college. They must be paid back—although most students won’t need to start making payments until after they graduate.

Keep in mind that you won’t necessarily qualify for all of these types of aid. Student loans are available for almost all students—but other forms of aid are harder to qualify for. You may or may not see these financial aid awards on your own award letter.

How to compare award letters

If you’ve applied to multiple schools, you should receive a letter from each school you’re accepted into.

Because there’s no standardized format or content for these letters, it can be a bit confusing to compare multiple financial aid offers. Here’s a simple step-by-step approach.

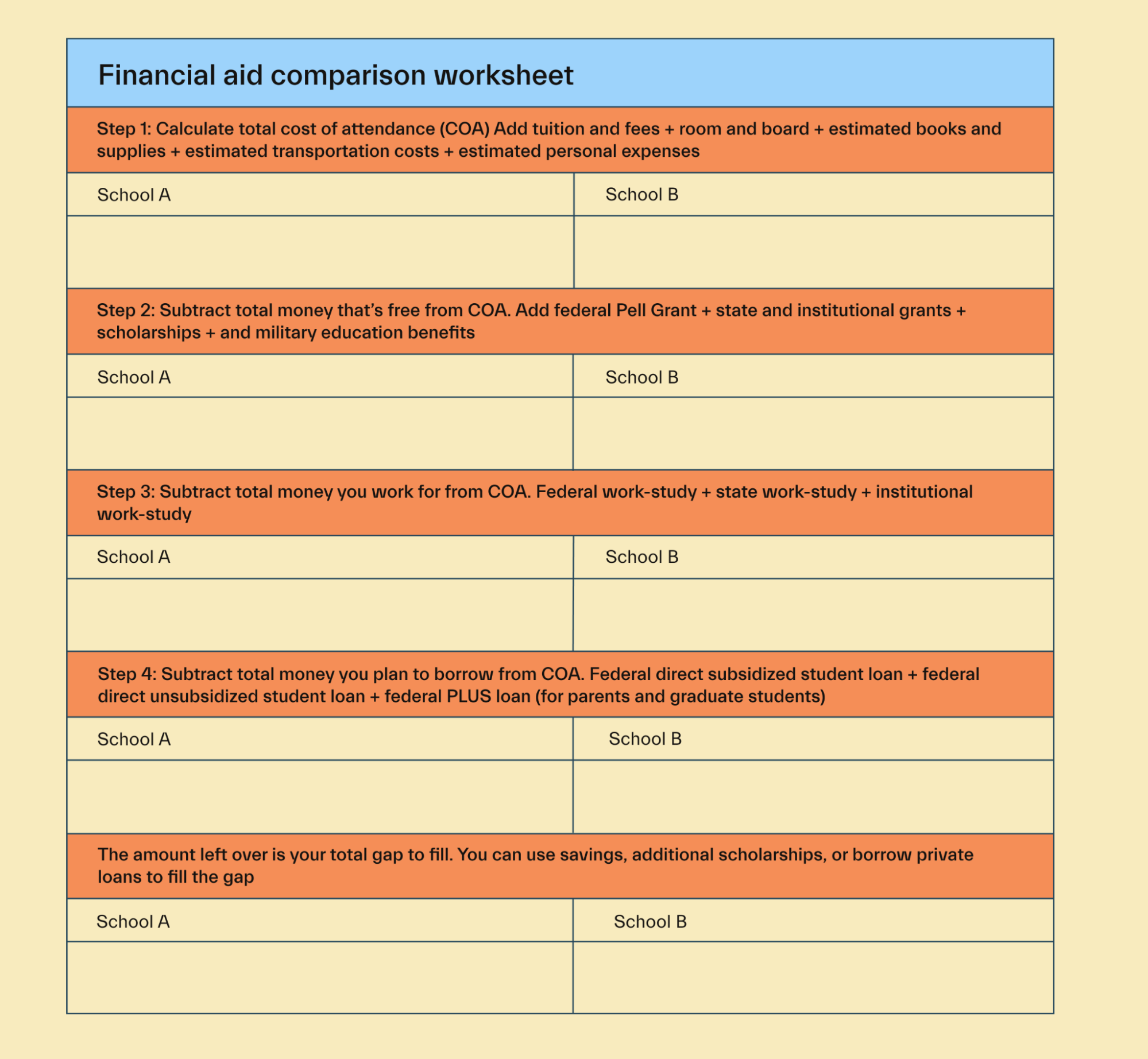

Prepare a comparison chart with a column for each school. You can use a piece of paper, a spreadsheet, or an online comparison tool.

Calculate the total cost of attendance (COA) for each school. Some schools include detailed COA figures in their award letters. For other schools, you may need to look online for estimates. If only tuition and fees are included, be sure to factor in housing, food, and other expenses.

Subtract the total gift-aid amount for each school. This includes federal grants, scholarships, state and school grants, and military aid (but it doesn’t include student loans).

Subtract the total work-study aid for each school (if applicable). The amounts you have now are the total expected costs of attending each school. This doesn’t yet account for student loans.

Factor in any loans you plan to take out. Federal student loans will be listed on your award letter, and additional loans may be available from private lenders. The remaining amount will be the expected out-of-pocket costs to attend that university.

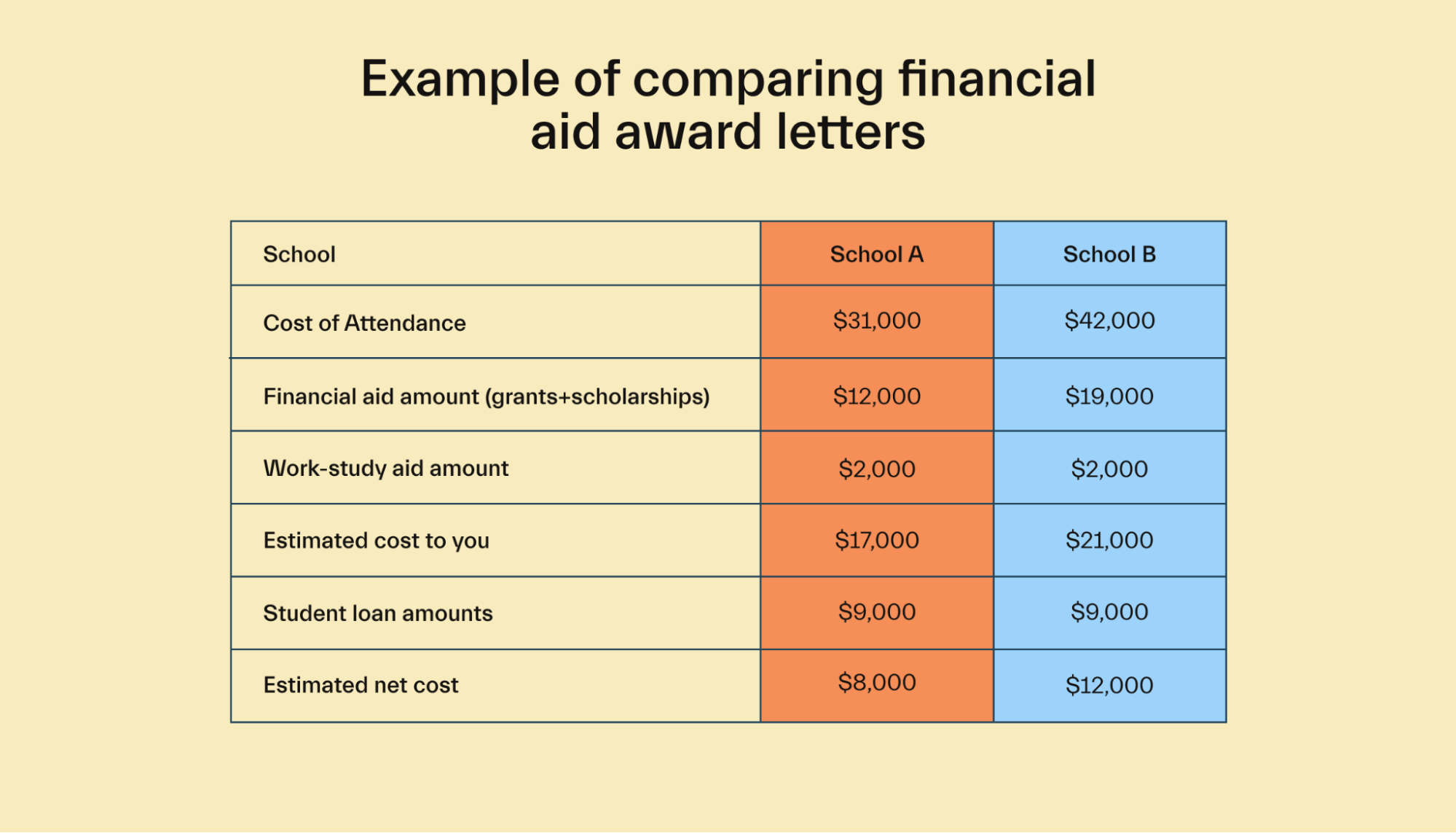

To illustrate the process above, let’s look at an example.

In this case, the “net cost” would be $8,000 for school A and $12,000 for school B. This assumes you take out $9,000 in student loans for either school.

One common point of confusion for students is that federal student loans are considered financial aid and are therefore included in your award letter.

However, you must pay student loans back eventually—so it’s important to think of them in a different category than gift-aid, such as grants and scholarships.

Another important point is that you don’t need to accept all forms of financial aid, even if you attend the school.

For example, you could decline work-study if you feel you won’t have time for a job. Or you could decline student loans if you or your family have the savings to pay for college in cash.

There’s usually no reason to decline grants or scholarships unless you get a better offer from another school.

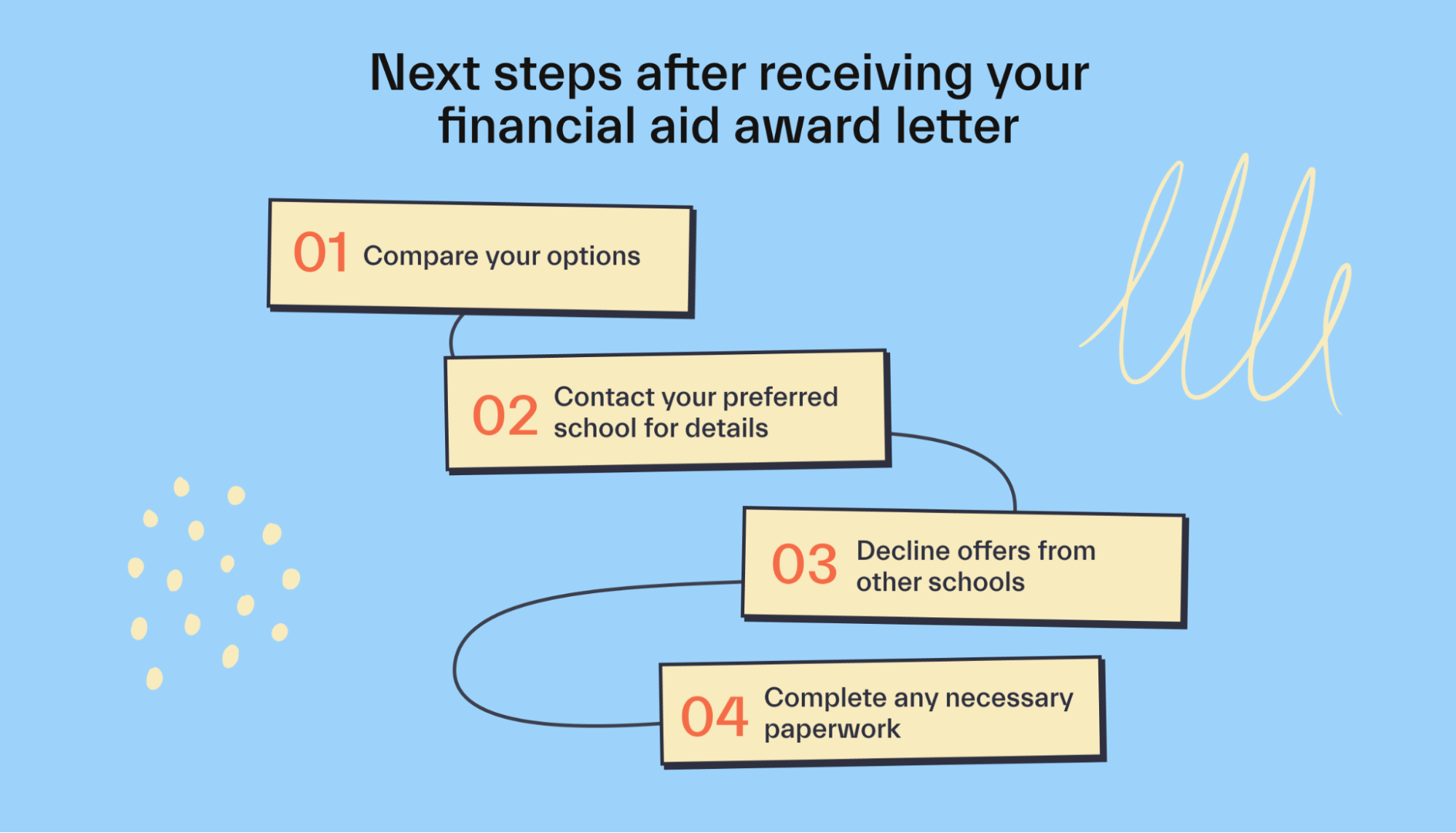

What to do after receiving your financial aid award letter

First, compare your options using the tips in the section above. But consider factors beyond the raw numbers. If your dream school costs more than your second choice, it may still be worthwhile to attend.

Next, call the school(s) if you have any questions about your award letter. Speak to the financial aid department.

When you’ve decided which school you wish to attend, you should formally accept the financial aid package. Each school has a different procedure for this. And remember, you can decline certain parts of an aid package if you want.

Filling the funding gap

Finally, it’s time to figure out how you’ll pay for the portion of costs that won’t be covered by financial aid.

The best place to start is external scholarships—meaning scholarships that are applied for outside of the FAFSA.

Mos is one of the best ways to find and apply for scholarships. Mos members get access to the largest scholarship pool in America.

FAQs

Do you still have questions about financial aid letters? Here are some commonly asked questions.

How do I get my financial aid award letter?

Students must apply for financial aid by completing the Free Application for Federal Student Aid (FAFSA) and adding specific schools to the FAFSA. Some colleges have additional requirements necessary to receive a financial aid offer—check with each school’s financial aid office to learn more.

When will I receive my financial aid award letter?

Most schools send out financial aid award letters shortly after acceptance/admission letters. In most cases, this means mid-March to late April. You can contact the school(s) directly for details.

Keep in mind that you won’t get a financial aid award letter from a school unless you’ve included that school on your FAFSA.

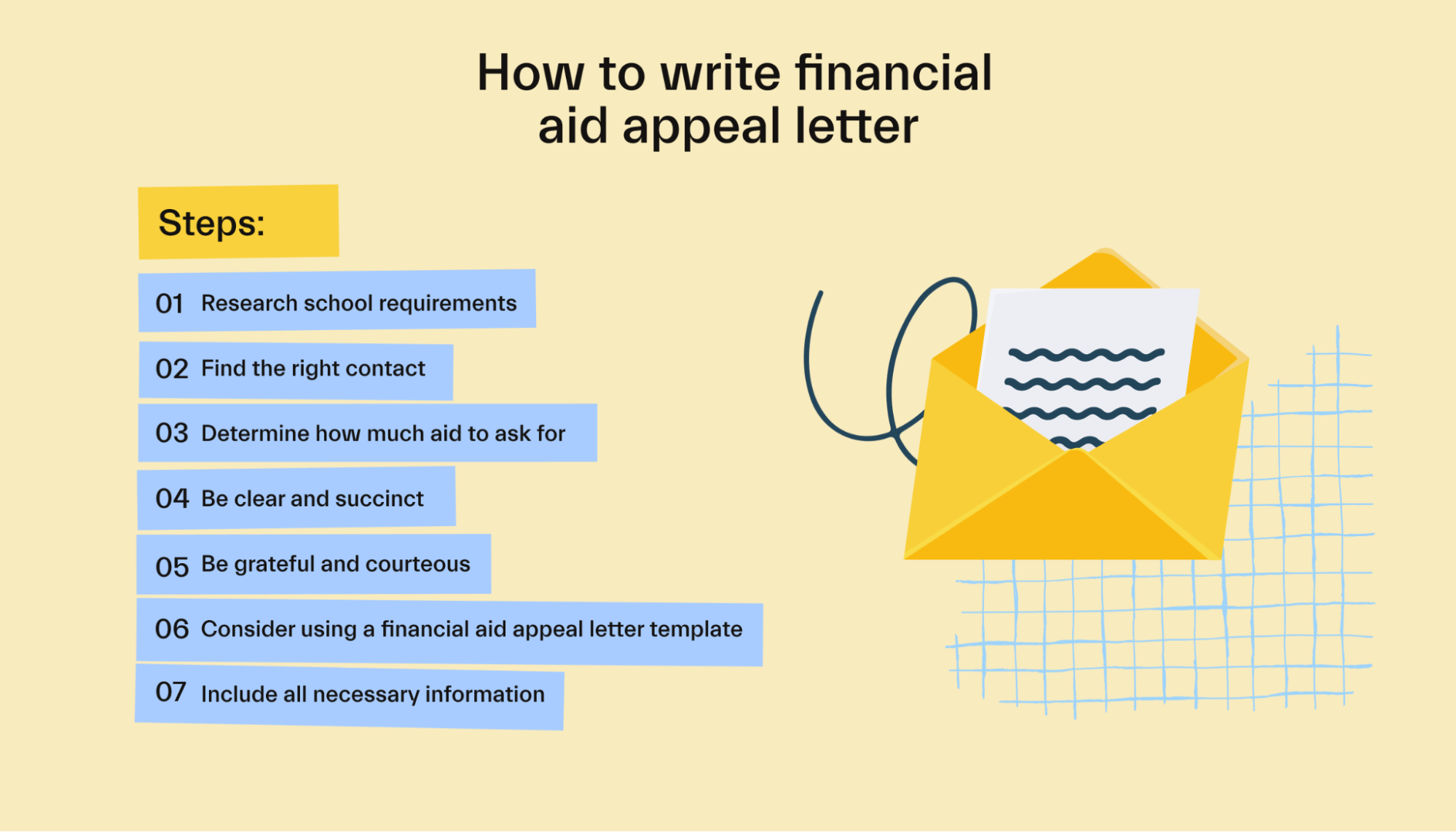

Can I appeal a financial aid decision?

Yes, you can! You can write a financial aid appeal letter to the college in order to appeal the decision.

It often makes sense to appeal a financial aid decision if you have:

Had a loss of income

Had significant unexpected expenses

Had a major life event

Noticed incorrect information on your FAFSA

Keep in mind that most schools have limited funds, so you won’t necessarily be successful in your appeal.

Do I have to repay financial aid?

Some types of financial aid must be repaid, while other types don’t.

Student loans usually must be repaid. Grants and scholarships are considered “gift-aid” and generally don’t need to be repaid. However, if a student drops out of school, some grants and scholarships may need to be repaid.

To learn more about financial aid, check out our article on financial aid FAQs.

Conclusion

Comparing financial aid award letters from different schools can help you understand your options and the financial implications of attending each school.

However, be sure to consider factors beyond the costs—school location, campus life, sports programs, etc. are all important things to keep in mind.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you