Financial aid •

November 2, 2022

Duke financial aid: a complete guide

Read all about financial aid at Duke University, including scholarships, loans, and grants.

Originally founded in 1838 as a preparatory school for young men, Duke is a well-known university located in Durham, North Carolina. The school offers a variety of academic programs, including 53 majors, 52 minors, and 23 certificates, letting students choose from 437,989 different academic combinations.

If you’re considering applying to Duke but think you’ll need help covering tuition, we’ll break down what you need to know.

A snapshot look at Duke

Duke is a moderately-sized school, home to 6,789 undergraduate students and nearly 10,000 graduate and professional students. Since its founding, the school has sought to “provide real leadership in the educational world’ by choosing individuals of outstanding character, ability, and vision.”

Duke aims to provide its students with a liberal arts education that helps prepare them not only for their future careers but for their futures as participants and leaders in their communities, open to constant learning and intellectual growth. Students who are dedicated to keeping an open mind can excel at the school.

That open-mindedness is shown in the fact that students can create more than 400,000 academic specializations from the school’s degree program options. Students can be assured of a strong education at the school.

Outside of class, students can join one of the university’s hundreds of student organizations or participate in NCAA Division I sports.

Ranking: 9th in National Universities

Size: 6,789

Demographics: 50% male 50% female

Acceptance rate: 9%

Average GPA of accepted student: 3.94

Key dates and deadlines (2022):

Application: January 3rd

Financial aid deadlines: February 1st

A look at scholarships offered by Duke

For many people, a college education is one of the most expensive things they’ll ever pay for outside of a house. Paying for college is tricky, so you’ll need all the help you can get. Some families save to help pay for their kids to go to school, but it’s difficult to save enough to pay for all 4 years of college.

If your family’s savings aren’t enough to pay for school, the best way to fund your education is through scholarships. Scholarships are like free money you can put toward tuition, fees, and other costs. Best of all, you don’t have to pay them back like you would if you got a student loan.

There’s a huge variety of scholarships out there. Some are available based on athletic skills. Others are awarded for good grades or specific achievements. You can even win some based on the luck of the draw.

Duke University’s financial aid office has a webpage outlining the scholarship programs available. All students are automatically considered for these scholarships. However, the prestigious Robertson and Nakayama Scholarships have individual applications that students must fill out.

Some of these scholarships can award a full ride, so it’s worth trying your hardest to earn a scholarship.

If you’re looking for other opportunities to get college funds, don’t forget to check in your community. Many businesses and community organizations have scholarship programs that you can apply to. These programs can award hundreds or thousands of dollars and focus on all sorts of things. With enough effort, you can find scholarships for almost everything.

Scholarships are the best way to pay for college, so do your best to max out the awards you earn. Read our financial aid tips and tricks for more resources on earning scholarships and other college funds.

Student loans

Scholarships are the best way to pay for school, but it’s hard to earn enough scholarships to be able to pay for an entire degree. If you need more funding, the next best thing to do is apply for a student loan.

Student loans let you invest in your education, but they have an obvious drawback: they’re loans. You have to pay the money back, plus interest, once you finish school.

Duke’s financial aid office has a web page describing the different loan programs that students can take advantage of.

Of the loans available to most students, the best program is the Federal Direct Loan Program. These loans come from the United States government in two different forms: subsidized and unsubsidized.

If you get a subsidized loan, you don’t have to worry about interest building up while you’re still in school. The government covers the interest while you’re still studying. With unsubsidized loans, interest accrues right away.

That means that subsidized loans are the better of the two.

If your federal student loans don’t get you the rest of the way to paying your tuition, you can also consider applying for private student loans. These loans come from banks, credit unions, and specialized lenders who want to help students fund their education.

There are, however, significant drawbacks to private loans. They tend to have higher rates than federal loans, making them more expensive. They also lack benefits such as income-based repayment and loan forgiveness.

Ultimately, it’s best to max out your federal loans before you start applying for private student loans.

Borrowing money to pay for college is common, but it’s important to understand what you’re getting into. You can read our article on student loans, where we break it down.

FAFSA

Because college is so expensive, every last dollar of aid that you can earn is important. The number one thing you can do to get more financial aid is complete the Free Application for Federal Student Aid (FAFSA) each year you plan to attend college.

The FAFSA is a financial aid application that the federal government and most colleges around the US use to decide how much need-based aid you’ll receive.

To fill out the FAFSA, you’ll have to sit down with your family and answer some questions about your financial situation. That can include things like your family's income and how much money you have saved to pay for college.

Based on the information you provide on the FAFSA, the government calculates your expected family contribution (EFC) to the cost of your education. When you choose which college to attend, you can calculate your financial need by subtracting your EFC from the cost of attendance. The greater your financial need, the larger your financial aid package should be. You’ll receive more need-based aid, such as scholarships, grants, and subsidized loans.

While you usually have to keep in mind that most colleges do not guarantee that they will meet 100% of their students’ financial needs, Duke breaks the mold. Duke’s financial aid office meets 100% of demonstrated need for undergraduates, awarding more than $130 million in grants each year.

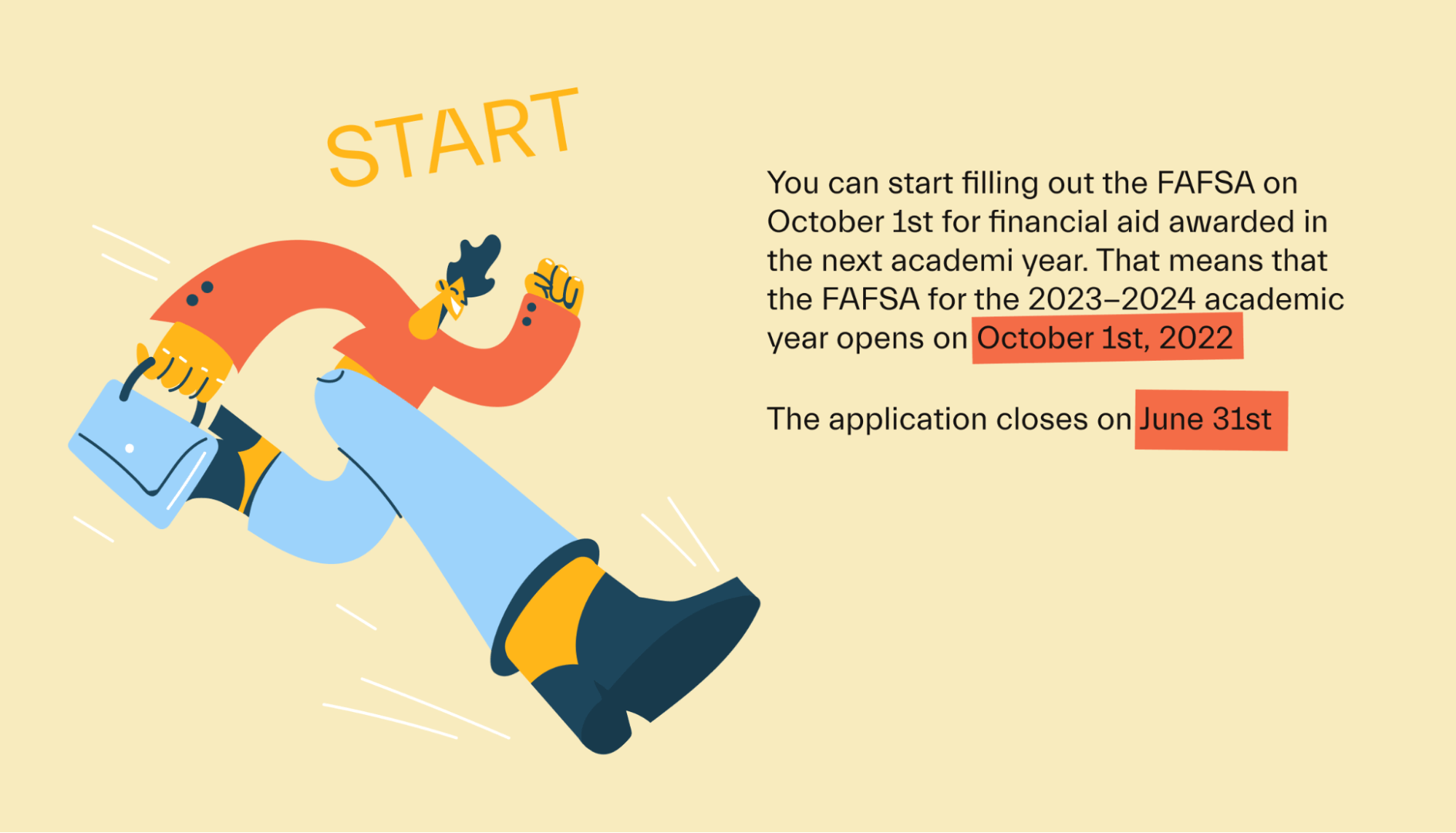

You can start filling out the FAFSA on October 1st for financial aid awarded in the next academic year. That means that the FAFSA for the 2023-2024 academic year opens on October 1st, 2022.

The application closes on June 31st. However, North Carolina has some state-based programs that award money on a first-come, first-served basis until the funds run out. That means that filling out the form as soon as possible can help you earn additional aid.

The FAFSA can be a bit complicated if you’ve never filled it out before, so prepare yourself by learning more about how long it takes to complete the FAFSA.

Duke financial aid FAQs

We’ll answer a few more questions you may have about getting financial aid at Duke.

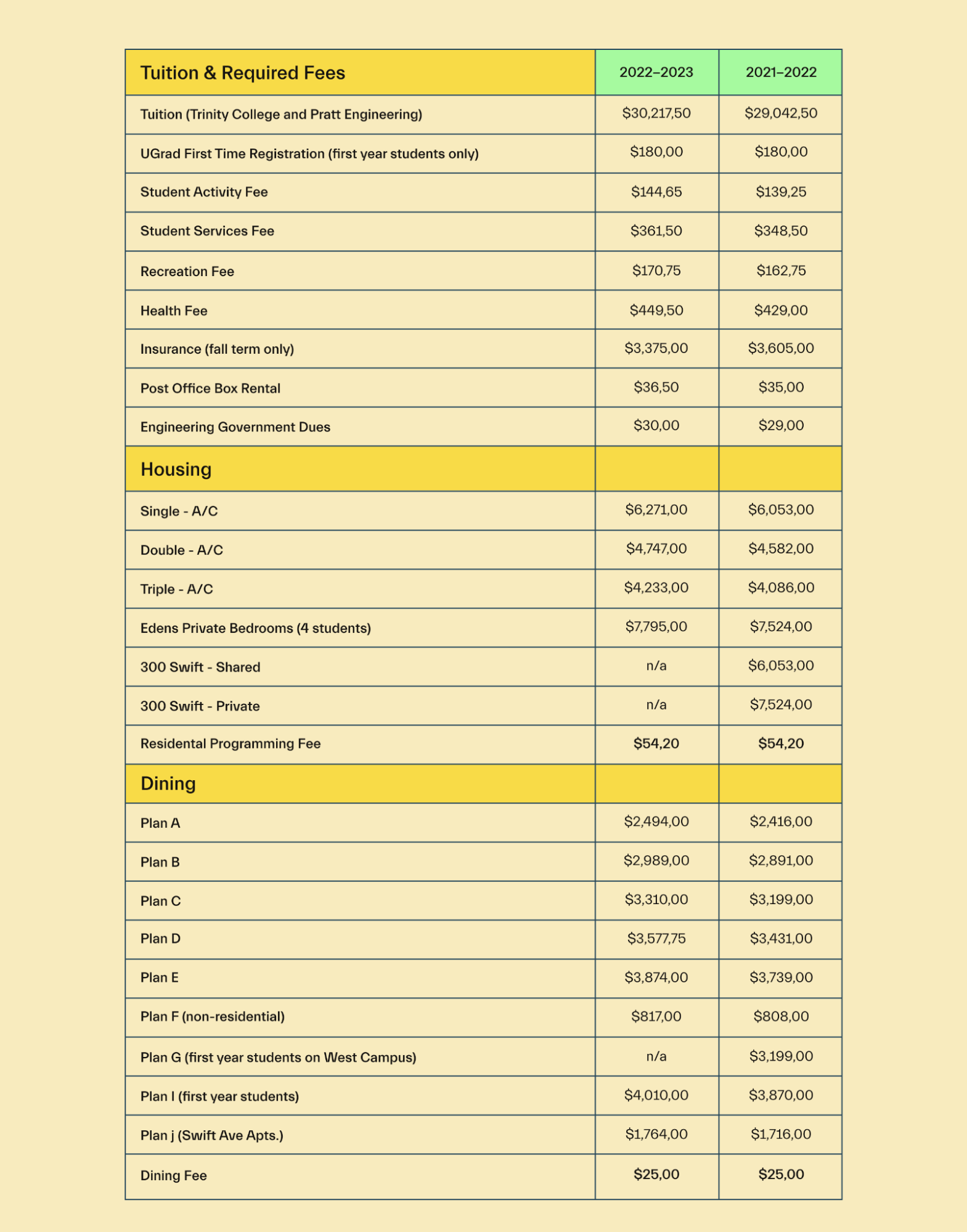

What is Duke’s cost of attendance?

Duke is a private university, which means it can be a bit more expensive than public colleges. Its cost of attendance is $79,469, $60,489 of which is tuition.

Can out-of-state students receive financial aid?

Yes, out-of-state students at Duke are eligible to receive financial aid. The school isn’t a state school, which means out-of-state students pay the same tuition and fees as residents.

How many students get a full ride?

Duke does not publish the number of students that receive a full ride at the school. However, it has published the fact that 43% of incoming students received need-based aid in 2019 and that the average need-based aid was $51,332.

When will I receive my financial aid award?

Duke will apply your financial aid award to your student account a few business days before each semester begins. Before you receive your aid, you must have completed all required applications and provided the required documentation and information.

Can a graduate student receive financial aid?

Yes, you can receive financial aid if you are a graduate student at Duke University. There are scholarships, loans, and stipends available, as well as the opportunity to work as teaching assistants or in a fellowship to help pay for school.

How can my financial aid counselor help me?

Each student will have a financial aid counselor who is available to meet online or in person. Your counselor can help outline your options for paying for school and answer any questions about different loans and scholarships you’ve received.

Can international students receive financial aid?

Yes, international students at Duke can receive financial aid. This can include merit-based scholarships as well as need-based financial aid. You do not need to be a citizen or permanent resident to be eligible.

However, international students may face some restrictions. For example, international students who do not have a work authorization in the United States cannot receive work-study aid.

Universities like Duke that you might be interested in

If you’re interested in Duke University but don’t know whether it’s right for you, consider these alternatives.

University of North Carolina, Chapel Hill

If you like the idea of going to school in North Carolina but find that Duke is too expensive, you might be interested in UNC-Chapel Hill.

As a state school, UNC Chapel Hill keeps tuition low for residents of North Carolina. Tuition for residents is just $7,020, and the total cost of attendance for those who live on campus is $25,258, less than half of what is charged at Duke.

However, that lower price doesn’t mean a sub-par education. UNC-Chapel Hill is rated number 28 nationally by US News & World Report, and the school is well-known for its research programs and status as a “public ivy.”

Wake Forest University

Wake Forest is another North Carolina-based private university. Like Duke, the school is known for its academic excellence. It also has strong research programs for students to participate in. Athletes may be interested in Wake Forest due to the NCAA Division I sports programs.

As a private school, Wake Forest also has a relatively high cost of attendance. Tuition is $62,128, and the overall cost of attendance is just over $83,000 per year.

Yale University

High-achieving students who want a top-notch education may be interested in Yale University, located in New Haven, Connecticut. A member of the prestigious Ivy League and the third-oldest university in the United States, Yale will provide students with a world-class education and access to a powerful alumni network.

On top of the great academics, students at Yale get to participate in a vibrant student life that includes hundreds of student organizations and sports teams.

Conclusion

Duke is a school with a strong reputation and a large campus that is home to vibrant student life. If you’re looking for a school that provides a high-quality education while letting you enjoy things like Division I sports and a variety of educational tracks, Duke might be the school for you.

Paying for college can be hard, but Mos is here to help.

With Mos, you can get assistance negotiating for more financial aid, applying for hundreds of scholarships and grants, and writing scholarship essays to help you earn extra money to pay for tuition. Why not get started today?

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you