Saving •

How to save for college

What’s the best way to save for college? This guide covers savings strategies both for parents and for students themselves.

Put simply, college is expensive—and it’s only getting more expensive by the day.

The average cost to attend college now exceeds $35,000 per year, and the average college cost is growing by approximately 6.8% each year.

In figuring out how to pay for college, students (and parents of future students) are smart to plan ahead. By saving for college early on, you can ease the burden of tuition and other expenses.

This guide will show you how to save for college efficiently.

Whether you’re a future student yourself or you’re saving for a loved one’s education, this article will answer all your questions.

We have tailored the article with both student-focused and parent-focused sections—feel free to jump around to the sections that are most relevant to you.

How to pay for college: at a glance

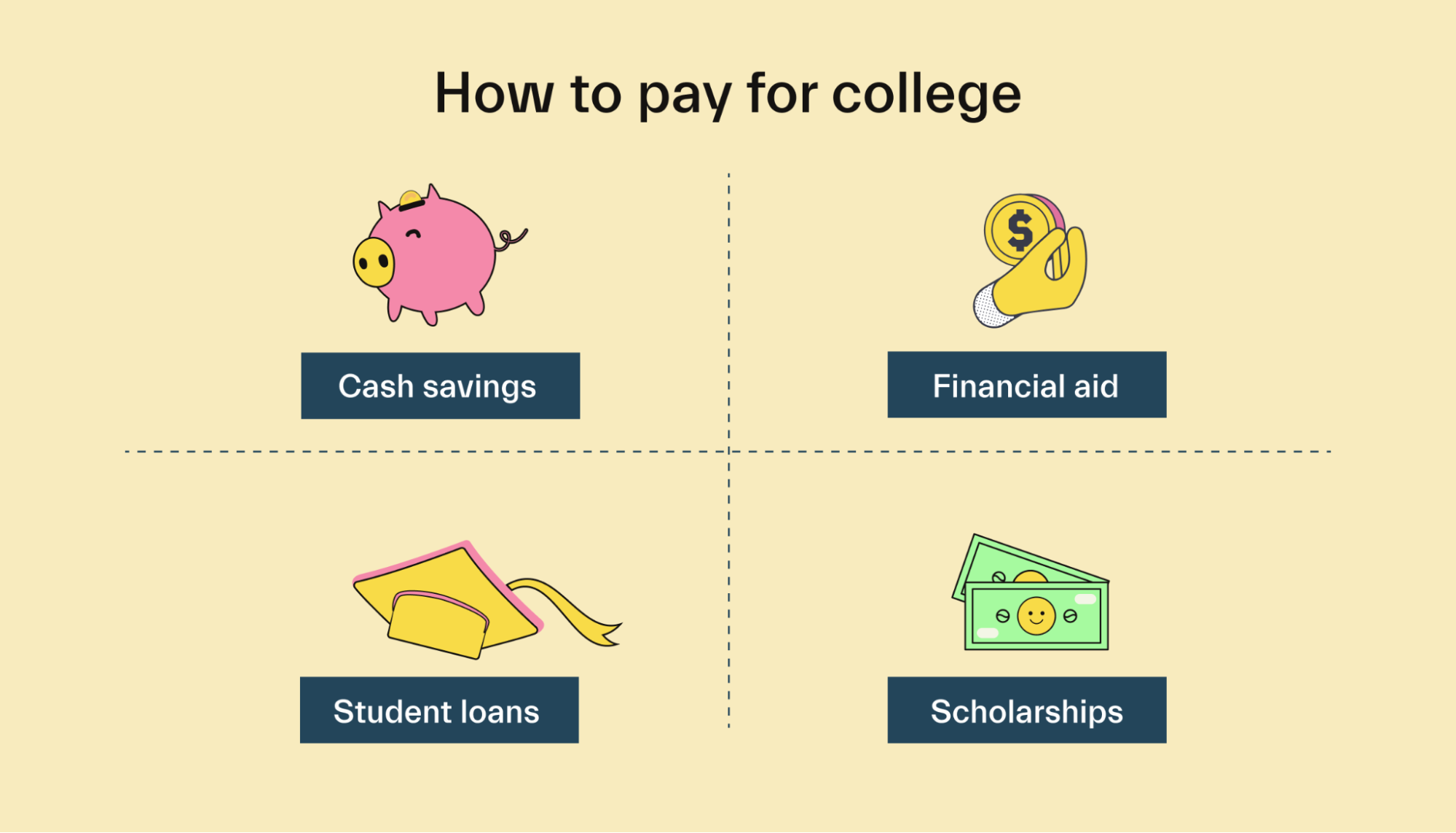

Most students pay for college using a mix of funding sources.

Typically, college costs are covered through a combination of:

Student’s own cash savings, either in a bank account, invested in a brokerage account, or in a college fund account like a 529 (more on this later).

Federal financial aid, which comes in the form of grants, work-study, and federal student loans. Federal grants are available to many lower-income families and don't usually need to be paid back.

Student loans, which are available from the government and private banks. A student loan will charge interest (currently 5.8%, on average) and must be paid back over time.

Scholarships, which are available from many sources and provide free money for higher education that doesn’t usually need to be paid back. Students must apply and compete with other applicants to win scholarships.

See our full how to pay for college guide for more information.

Now, let’s get into the nitty-gritty of saving for college—starting with what future students should be doing to prepare financially.

How to save for college as a future student

If you plan to pay for your own college expenses, this section is for you!

Even if your family has set aside some money for your education, it’s likely that you’ll need to come up with some coin yourself. Here’s how.

1. Consider opening a 529 plan account

The government wants you to set money aside for college—and they kick in some juicy tax perks to encourage you to do so!

The not-so-creatively-named 529 account is a type of college savings account that offers generous tax benefits.

Although these accounts are mostly marketed toward parents, anyone over 18 can open a 529 account.

If you’re still under 18, your parents will need to set up an account with you as the beneficiary.

Here’s how it works:

You or your parents can open a 529 account with you as the beneficiary.

Any money contributed to the account can be invested in the stock market or other assets.

Invested money can grow over time, and earnings are tax-free while they’re kept in the account.

Withdrawals can be made at any time, and:

If the funds are used to pay for qualified education expenses, no federal income tax will be due (and in most cases, there will be no state income tax either!).

If the funds are used for any other purpose, federal and state income tax may be due—and a 10% penalty may apply.

Putting money in a 529 makes a ton of sense for parents saving for their children’s education (more on this below), but it may also make sense for students themselves.

For example, say you’re 18, working a full-time job, still living at home. You plan to go to college eventually, but you’re not sure when. In this case, you could contribute some of your wages to a 529 account, and the funds could be invested. When you do decide to enroll in school, you can withdraw the funds—paying no income tax on the investment profits.

The tax benefit won’t be massive for students (mostly because of the relatively short time frame for investments to grow), but there are other perks.

For one, 529 accounts encourage diligent saving and also make it a bit painful to use the funds for anything except college. If you take out money for something besides college expenses, you may have to pay a 10% penalty (plus income tax on the profits).

While this can sound like a bad thing, it can be helpful to inspire some financial discipline—and prevent you from spending money that you may regret later.

2. Save money while your expenses are low

Newsflash: being an adult is expensive.

In 2020, the average American household had expenses of over $60k a year.

If you’re still living with your parents or crashing with 6 roommates in a 2-bedroom apartment (#collegelife), your expenses are probably way less than 60 grand. Now is the time to try to save some money.

Why? Well, because it’s gonna be a whole lot harder to save money when you have more bills to pay.

Use this time to maximize your savings. Your future self will thank you!

At this point, just saving money should be the focus. Where and how you save is a secondary concern but still important to think about. You could:

Save in a 529 account (see above)

Invest money in a normal taxable investment account (known as a brokerage account)

Save in a regular ‘ole bank account

The point here is to start saving while it’s (relatively) easy to do so.

Whether you choose to invest these funds or just keep them in savings depends on your timeline. If you plan to go to school within the next few years, it’s probably best not to invest all of your savings. If you have a longer timeline, investing typically makes sense.

3. Automate your college saving strategy

Do you find spending money infinitely more satisfying than saving money? Yeah, we get it.

If this is you, consider automating your savings. This could mean:

Setting up an automatic transfer from checking to savings on the 1st of the month

Setting up automatic investments for 20% of your paycheck each week

Using apps like Acorns that round up each of your purchases and transfer the remainder to savings (a purchase of $4.30 would round up to $5.00, with the $0.70 transferred to savings or invested)

Basically, you want to do whatever you can to automate and remove the “friction” from saving money.

4. Take advantage of AP classes in high school

Still in high school? You can earn college credit—for (almost) free. And you earn high school credit at the same time!

Many high schools offer Advanced Placement (AP) classes, which are college-level courses in a high school setting. Importantly, AP classes can earn students real college credit.

So, instead of yawning through high school history classes, you could upgrade to an AP history class and earn college credit.

There may be a small fee to take an AP exam and earn the formal college credits, but it’ll be far less than what you’d pay to take the college course.

Recent data suggests that, on average, a college credit costs around $312, or $935 per course. Meanwhile, the typical AP exam fee is less than $100, and you can earn numerous credits from it.

Some school districts also offer “running start” programs in partnership with local community colleges. These programs allow high schoolers to attend real college courses at the college.

If you’re still in high school, speak to a guidance counselor or advisor for details on your school’s programs.

5. Take full advantage of scholarships and financial aid

Looking at college tuition prices can give you sticker-shock. College costs how much, now?

Fortunately, most students won’t need to directly cover 100% of the cost of college. This is due to financial aid and scholarships programs that many students are eligible for. We talked about these briefly before, but let’s cover them in more detail now.

Financial aid is a federal government program that provides grants (free money), work-study opportunities (jobs for students), and student loans to qualifying students.

Financial aid is mostly need-based, meaning more aid is available for students from lower-income households. Students must submit the Free Application for Federal Student Aid (FAFSA) each year to qualify. See our financial aid FAQs for all the details.

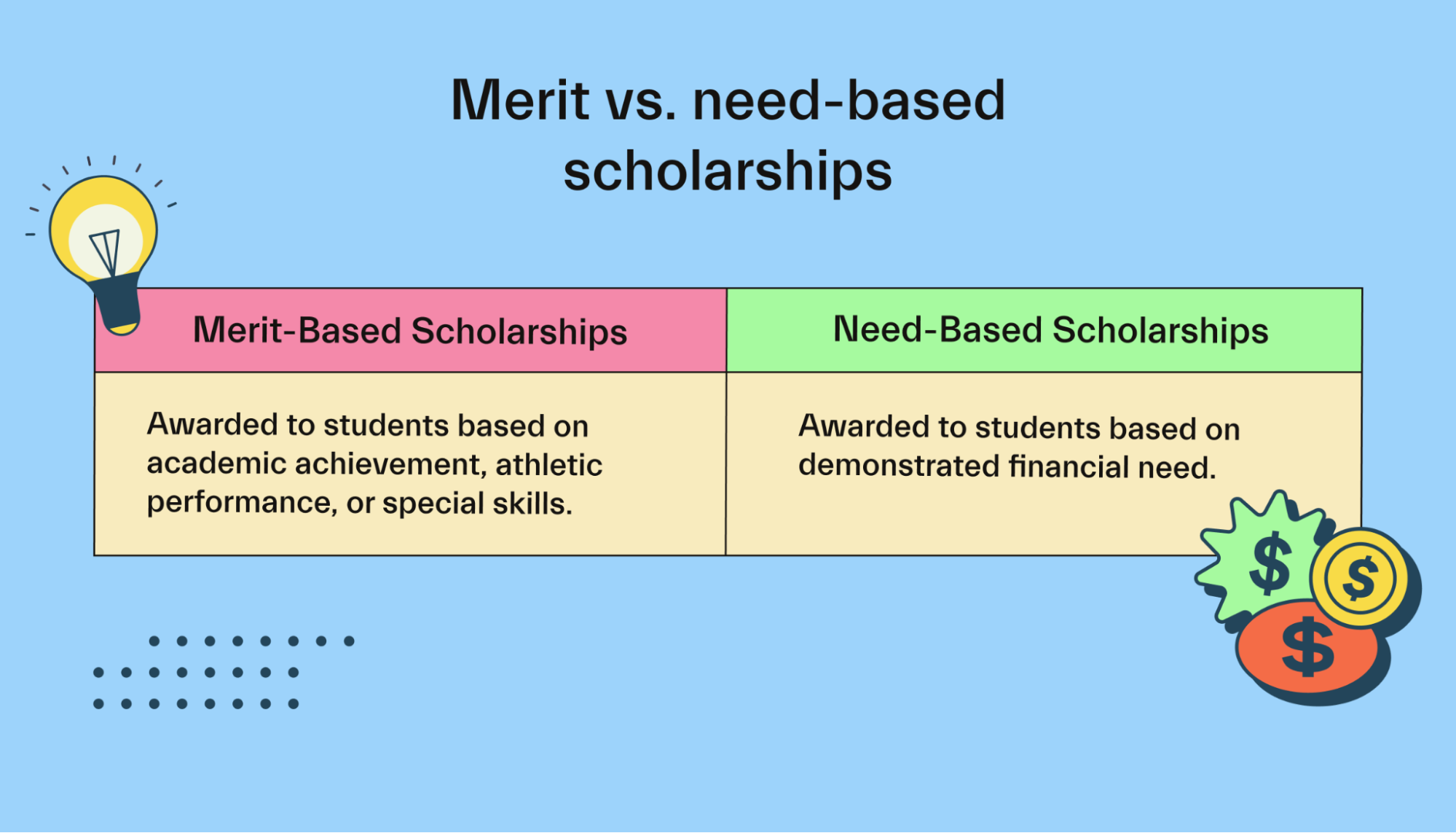

Scholarships are free money for college offered by governments, businesses, schools, and even individuals. Scholarships can be income-based, merit-based (e.g., for star athletes or outstanding academics), or niche-based (e.g., for LGBTQ+ students or students from a specific geographic area).

Students must apply for scholarships most directly and may need to write an essay or answer questions. You can find scholarship opportunities online or ask your school counselor or financial aid department.

Meet Mos, the “express lane” to financial aid and scholarships

Mos is on a mission to help students pay for college.

Mos guides students through the financial aid and scholarship application process. You can get help submitting the FAFSA, finding qualifying scholarships, and submitting applications—all from the Mos app.

Read our FAQ to learn more about how Mos can help you pay for college!

How to save for your children’s future education

Parents, grandparents, and other loved ones of future students, this section is for you!

How does the strategy change when you’re saving for someone else?

Well, you likely have time on your side—which means that investing your college savings can be far more impactful. Here’s what you need to know.

1. Open a 529 account

A 529 account is a tax-advantaged savings account that is designed to save for future education expenses. The account is set up with a beneficiary (the student you’re saving for) who will eventually be able to use the funds for educational purposes.

529 accounts can be opened through most brokers, such as Fidelity, Charles Schwab, and Vanguard. Funds in a 529 can be invested in a wide range of stocks, bonds, ETFs, and more! Plans are sponsored by states, and the specifics do vary a bit from state to state.

For tax purposes, a 529 functions somewhat similarly to a Roth IRA. The money you contribute isn’t a tax deduction upfront. However, any earnings from investments will be tax-free when withdrawn (as long as the funds are used for qualified education expenses).

This basically means that you don’t necessarily get any tax perks from contributing to a 529 for someone else. But the account recipient will be able to utilize all your contributions, plus the earnings from the account, to pay for college—and they won’t pay anything in federal or state income tax.

529 example

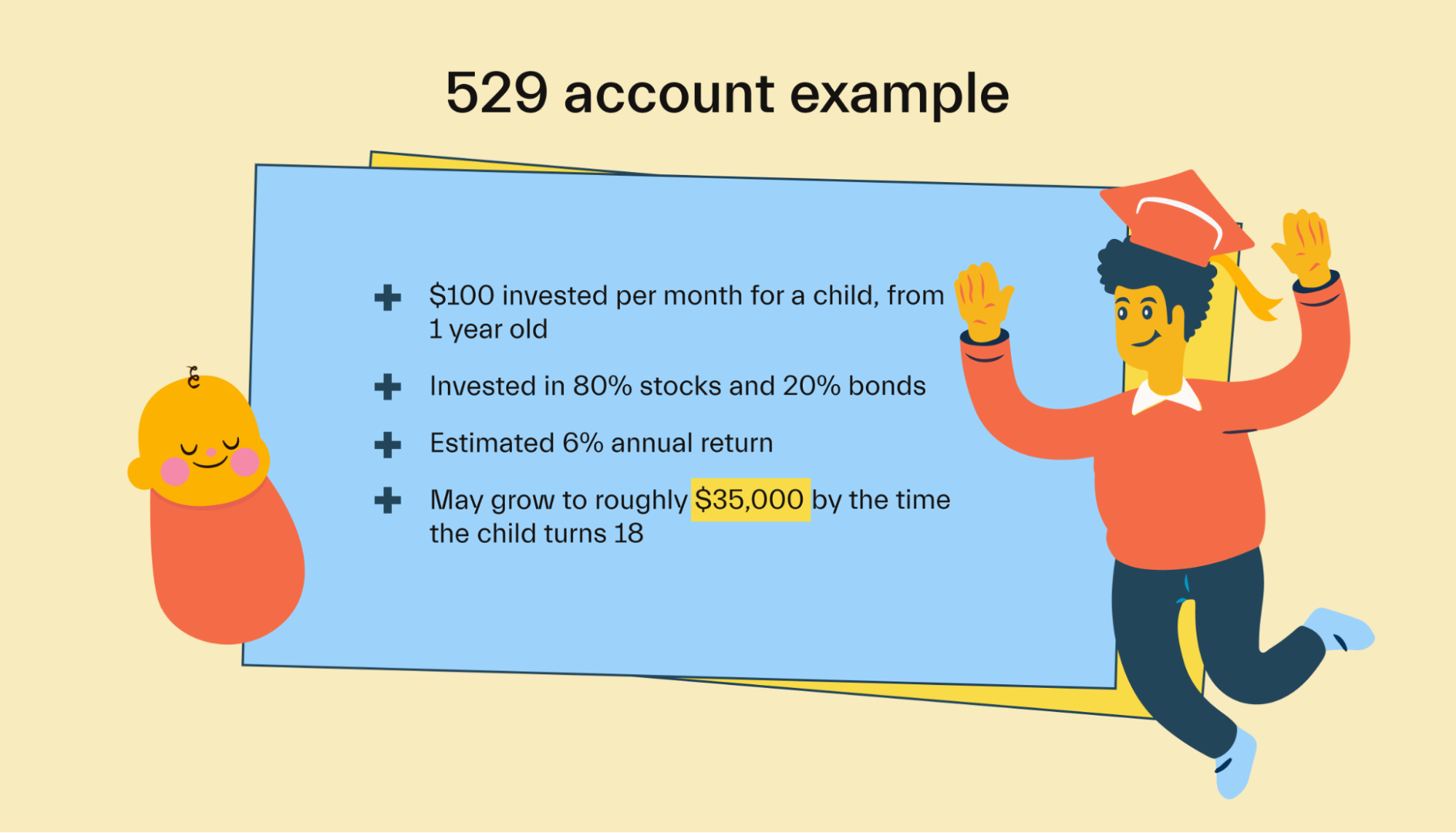

Let’s say your first child was born a year ago, and you’ve finally just got your first full night of sleep. You decide to seize the opportunity of a rested brain to set up a 529 account for your little one.

You then set up an automatic transfer of $100 per month into the account and continue making contributions regularly. You choose a moderately aggressive asset allocation with 80% stocks and 20% bonds.

By the time your child turns 18, you could expect to have around $35,000 in the 529 account, assuming average returns of around 6%. You can play around with an investment calculator to see how your money might grow.

Plus, around $14,000 of that would be dividends, interest, and profits earned on the investments—all of which would be tax-free once the beneficiary withdraws the funds to use for school!

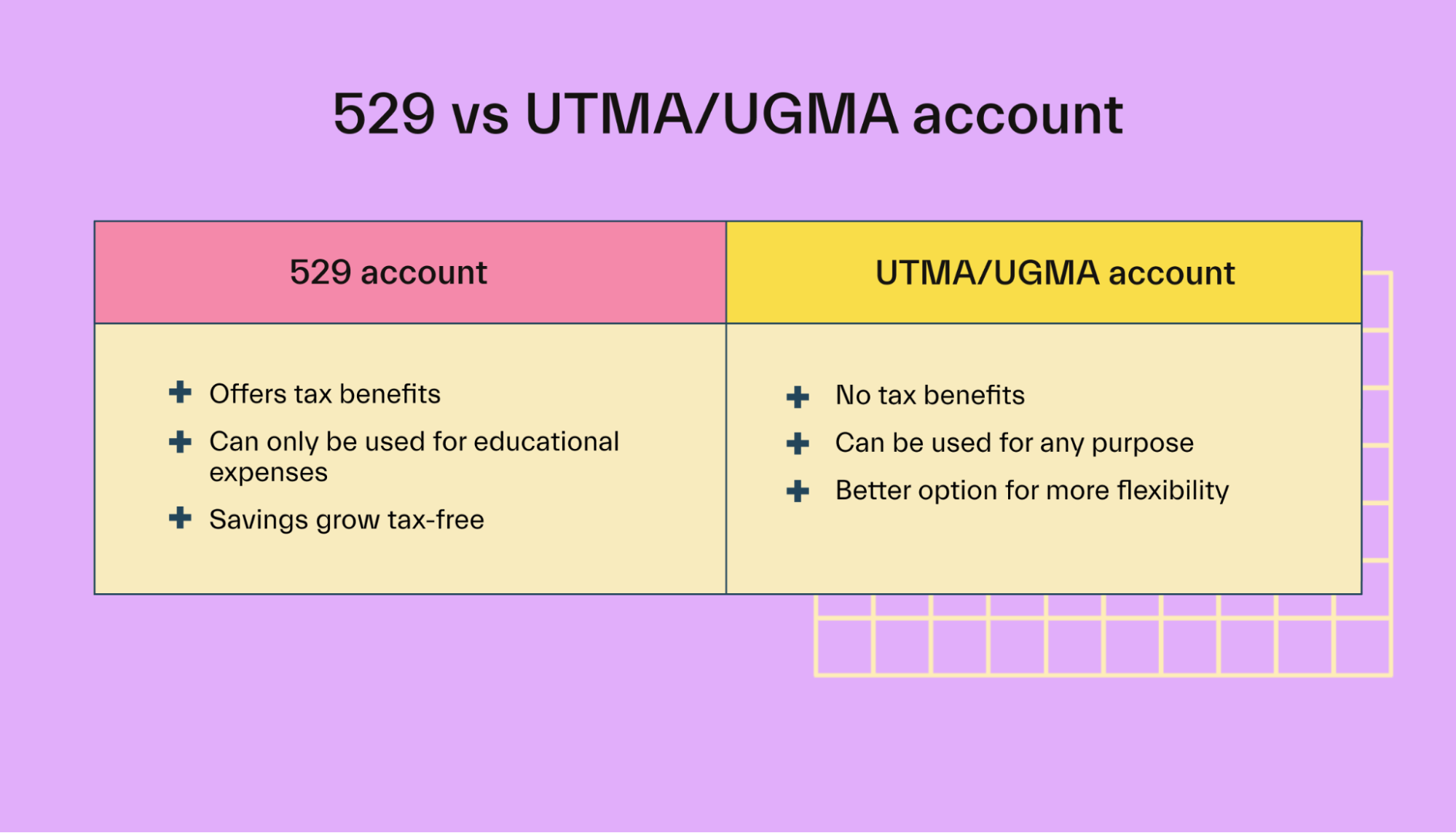

2. Consider a UTMA/UGMA account for more flexibility

What if you’re not 100% sure that the child will want to go to college? You can’t exactly ask a 1-year-old what major they’ll be studying!

529 accounts, discussed above, have penalties if the funds aren’t used for qualified expenses. UTMA and UGMA accounts do not have this penalty.

Some alternatives to the 529 account are Uniform Transfers to Minors Act (UTMA) accounts and Uniform Gifts to Minors Act (UGMA) accounts. These are also known as custodial accounts.

Basically, an adult can set up one of these accounts with the child as the beneficiary. They can then contribute money, which can be invested.

When the child becomes a legal adult, they’re given full control of the account. They can use the money for school, a business venture, or any other purpose—there are no restrictions.

UTMA/UGMA accounts don’t provide any of the tax perks of a 529 account, but they are far more flexible.

For more info, check out this guide to custodial investment accounts for children and this explainer on the difference between UTMA and UGMA accounts.

3. Invest savings in the stock market

Regardless of what type of account you use, investing the funds should be your top priority. This is particularly true if you’re saving for young kids who have a decade or more before they’ll be college age.

Historically, the US stock market has returned an average of around 10% per year for the last 100 years.

But, and it’s a big “but,” the year-to-year fluctuations are much more variable. The market could grow 20% in one year, only to lose 25% in another year.

Because of this, the longer the time frame, the more investing makes sense.

Investing your college savings is important, as is how you invest. Choosing an appropriate asset allocation is vital.

If you’re saving for a 1-year-old, you may choose a relatively riskier investment strategy—perhaps 75% stocks and 25% bonds. This has a higher potential for returns, but it also has more risk.

But if you’re saving for a 12-year-old, you may wish to be more conservative, as the child will need the funds sooner. In this case, an asset allocation of closer to 50% stocks, 50% bonds may make more sense.

And remember, asset allocation doesn’t have to be set in stone—it can change as the child gets older. So you may start with 100% stocks and slowly reduce risk by adding bonds as the child ages.

For more information, see this guide to asset allocation, or speak to your financial advisor.

4. Consider your own finances as well

Saving for your loved ones’ futures is a noble pursuit—but you shouldn’t ignore your own finances in the process.

In most cases, you should make sure that your retirement plans are on track before you start contributing to a child’s college savings plan.

Likewise, you should pay down any high-interest debt that you have.

It doesn’t make sense to keep credit card debt at 20% interest while saving for your child’s future. Pay off the debt first, and then you’ll have more room in your budget to set money aside for the kiddos.

Like so many things in life, this is all about finding a balance. You could also choose to work toward all your goals at once, allocating smaller amounts of money each month toward all of your savings goals and debts.

Tips for saving for college

There are a few more things that anyone saving for college—students and parents alike—should know.

Savings can affect financial aid eligibility in some cases

Eligibility for federal financial aid can, in some cases, be affected by college savings plans like a 529 account. Read this guide for more info, or talk it through with your accountant.

Invest early, and invest often

The earlier you get started saving for college, the better off you’ll be. Through the magic of compounding interest, savings that are invested can start to snowball. Relatively small investments made regularly can add up to a huge chunk of change.

Don’t underestimate the value of financial aid and scholarships

Saving for college is important, but many students will be eligible for financial aid and/or scholarships. This can reduce the financial burden on the student and their family.

Mos can help students navigate the financial aid and scholarship process from one simple platform.

Conclusion

A university education is pricey, but saving for college ahead of time can help ease the financial burden.

In fact, some students may even be able to graduate without taking out a student loan—particularly if they maximize financial aid and scholarship opportunities!

When it comes time to navigate the FAFSA and scholarship applications, Mos can be a huge help. Mos helps you find as much free money for school as possible. Learn more about Mos here.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you