Student loans •

Do student loans affect my credit score?

Find out how student loans can affect your credit score, what happens if you miss a payment, and how you can manage your loans to improve your score.

Roughly 42 million people currently have student loans. And it’s safe to say they didn’t take them out just for the fun of it.

The reality is, a lot of people would never have the opportunity to go to college if they couldn’t get a student loan.

But, just like any other tool, a student loan requires careful use. Think of a hammer: great for hanging up pictures — also a potential way to bust up your fingers.

A credit score is a rating that helps lenders evaluate your ability to pay them back. When it comes to your credit score, student loans have the potential to affect it for the good, or for the bad.

And, since your credit score will impact your ability to get approved for a credit card, car loan, or mortgage, it’s important to understand the effects of student loans before you take one out.

This guide explains how student loans work and the ways that student loans affect credit scores. We’ll also cover the pitfalls to avoid with student loans to keep a healthy credit score, and what some best practices are for managing student loans.

How do student loans work?

There are many types of debt, and each one of them affects your credit score differently. By taking a look into the mechanics of a student loan, you’ll get a better understanding of its potential impact on your credit score.

A student loan is cash that you borrow to pay for college expenses.

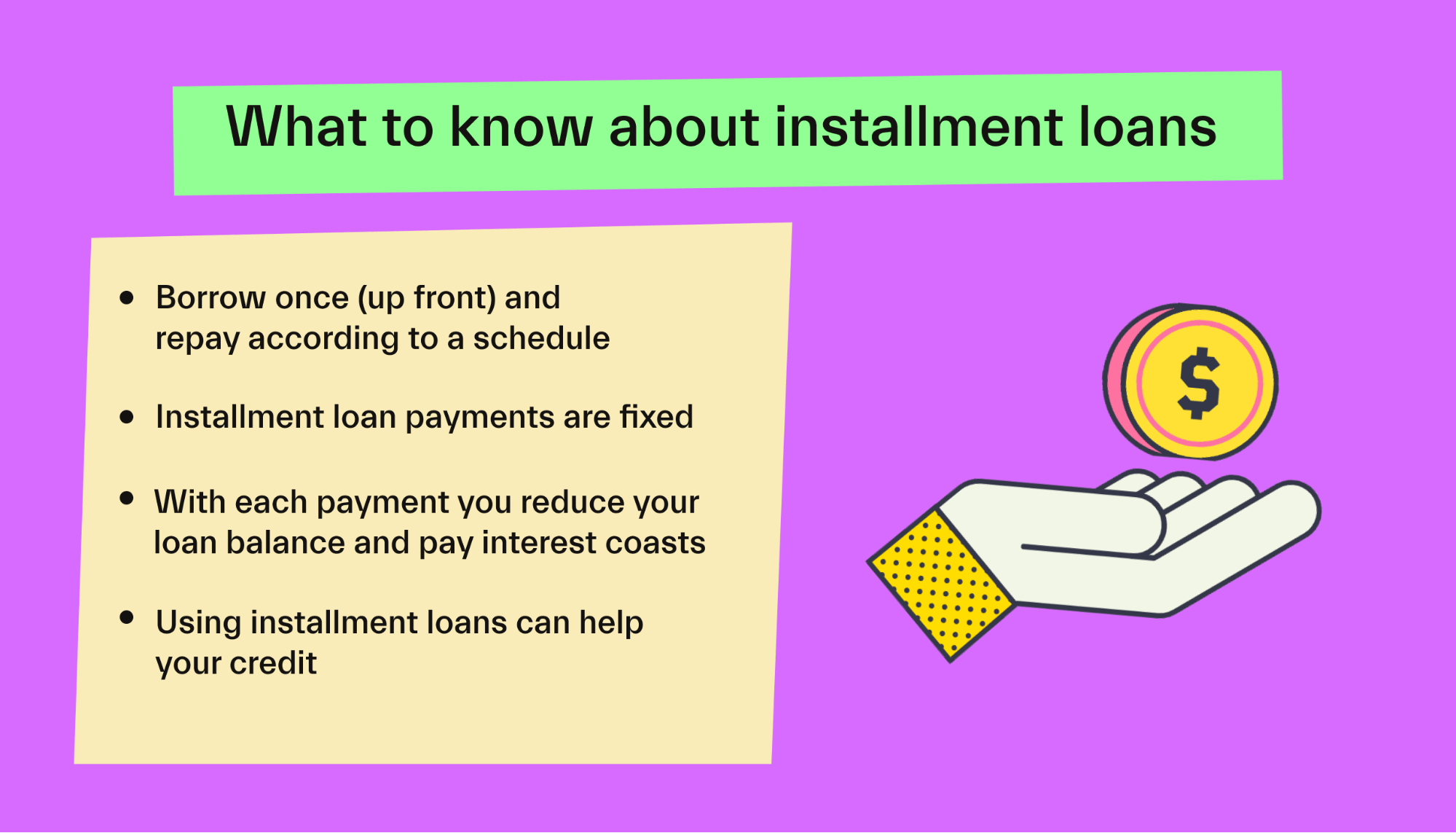

Student loans are installment loans — a fixed amount of borrowed money that you pay back in a set number of scheduled payments.

A student loan follows the terms and conditions set in a contract that you sign with a lender. The contract includes key details such as the interest rate, monthly payment amount, and repayment period.

Each of your student loan payments covers a portion of the principal plus the applicable interest.

Typically, you’ll make your payments for the life of the student loan until you pay back the loan’s balance in full.

For an in-depth walkthrough of how student loans work, check out our complete guide.

What are examples of installment loans?

Two common examples of installment loans are car loans and mortgages.

Credit cards are not installment loans, for two main reasons.

First, credit cards allow you to borrow again as you pay them down. If you pay $100 on a credit card, you can borrow $100 again. With an installment loan — such as a student loan — you’d need to apply for a new loan to borrow again.

Second, credit cards don’t have a set schedule in which you have to pay them down in full.

What are the types of student loans?

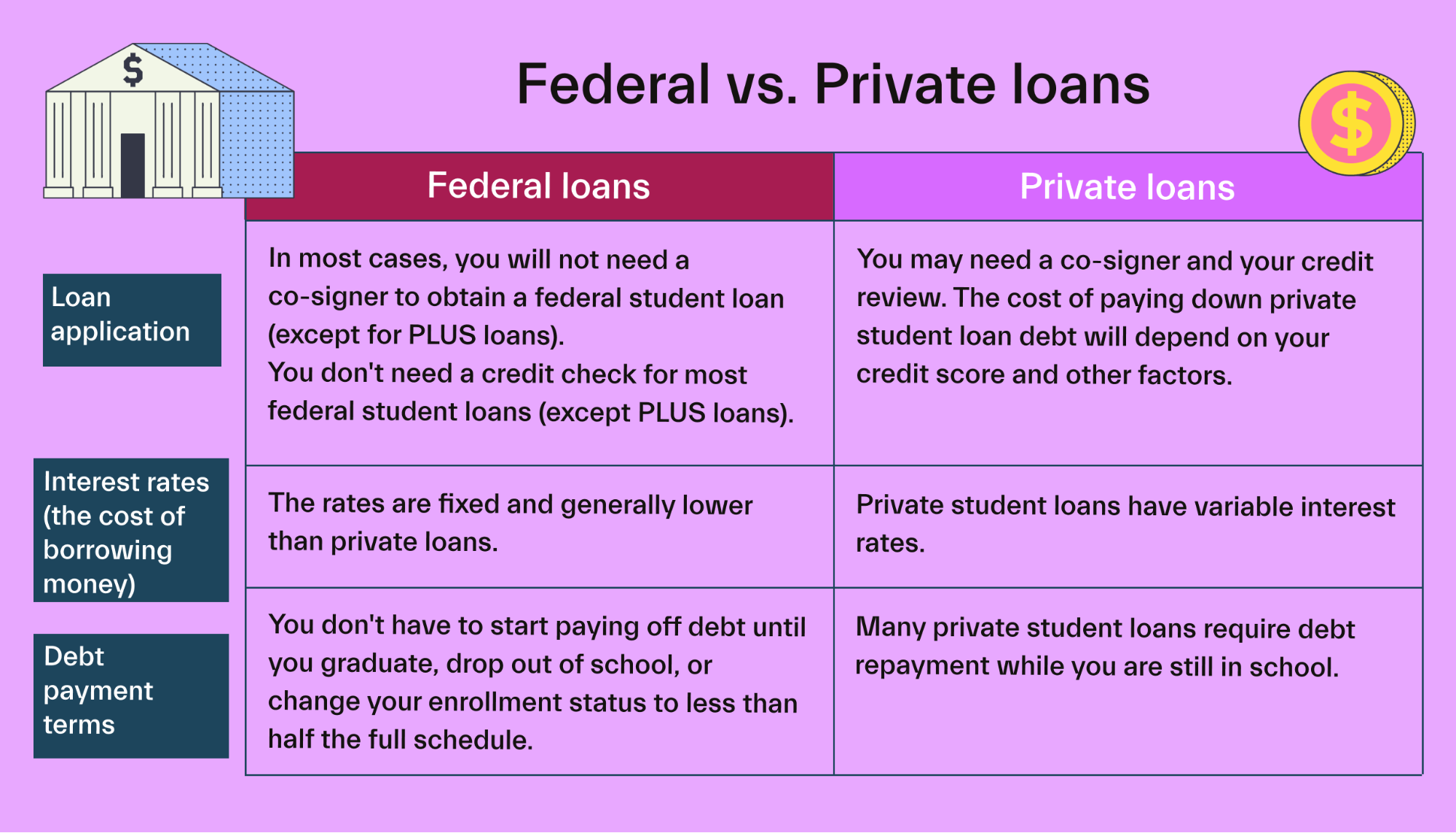

There are two types of student loans: federal student loans and private student loans.

Most student loans come from the federal government (federal state loans), but other lenders can also offer student loans (private student loans).

Lenders offering a private student loan include banks, credit unions, state agencies, or schools.

Federal student loans

To apply for a federal loan, you file a Free Application for Federal Student Aid (FAFSA®) form.

With most federal student loans, you won’t need a co-signer and can apply on your own. The exception is the PLUS federal student loan, for which you have the option to co-sign with a parent. Or your parent can take out their own parent PLUS loan to pay for your college expenses.

Since the federal government funds these types of loans, the interest rate of a federal student loan is typically lower than that of a private student loan.

One key difference between federal student loans and their private counterparts is that some federal student loans can be subsidized loans — a loan in which the federal government covers the interest payments while you’re attending school.

Eligible recipients of a subsidized loan are undergraduate students with financial needs and who are attending school at least half of the time.

When researching a federal loan, you’ll notice that it’s often referred to as a direct loan.

For example, a financial advisor may refer to a PLUS loan as a direct PLUS loan. The reason is that William D. Ford Federal Direct Loan Program is the name of the U.S. Department of Education’s federal student loan program.

Private student loans

When it comes to private student loans, you’ll need to contact the state government or financial institution to learn about the application process.

A common feature of a private student loan is that it is an unsubsidized loan — you’re required to make a loan payment while you’re still in school.

Another common feature of private loans is that private lenders use your credit score and financial situation to determine the interest rate. This is why a private loan often has a higher interest rate than a federal loan.

Some private student loans also have a penalty fee for early prepayments — unlike federal loans.

Federal student loans vs. private student loans

Here’s a quick summary of the differences between federal student loans and private student loans.

Now that you have the answer to how do student loans work, and know the features and types of student loans, let’s see how student loans affect your credit score.

How do student loans affect credit score?

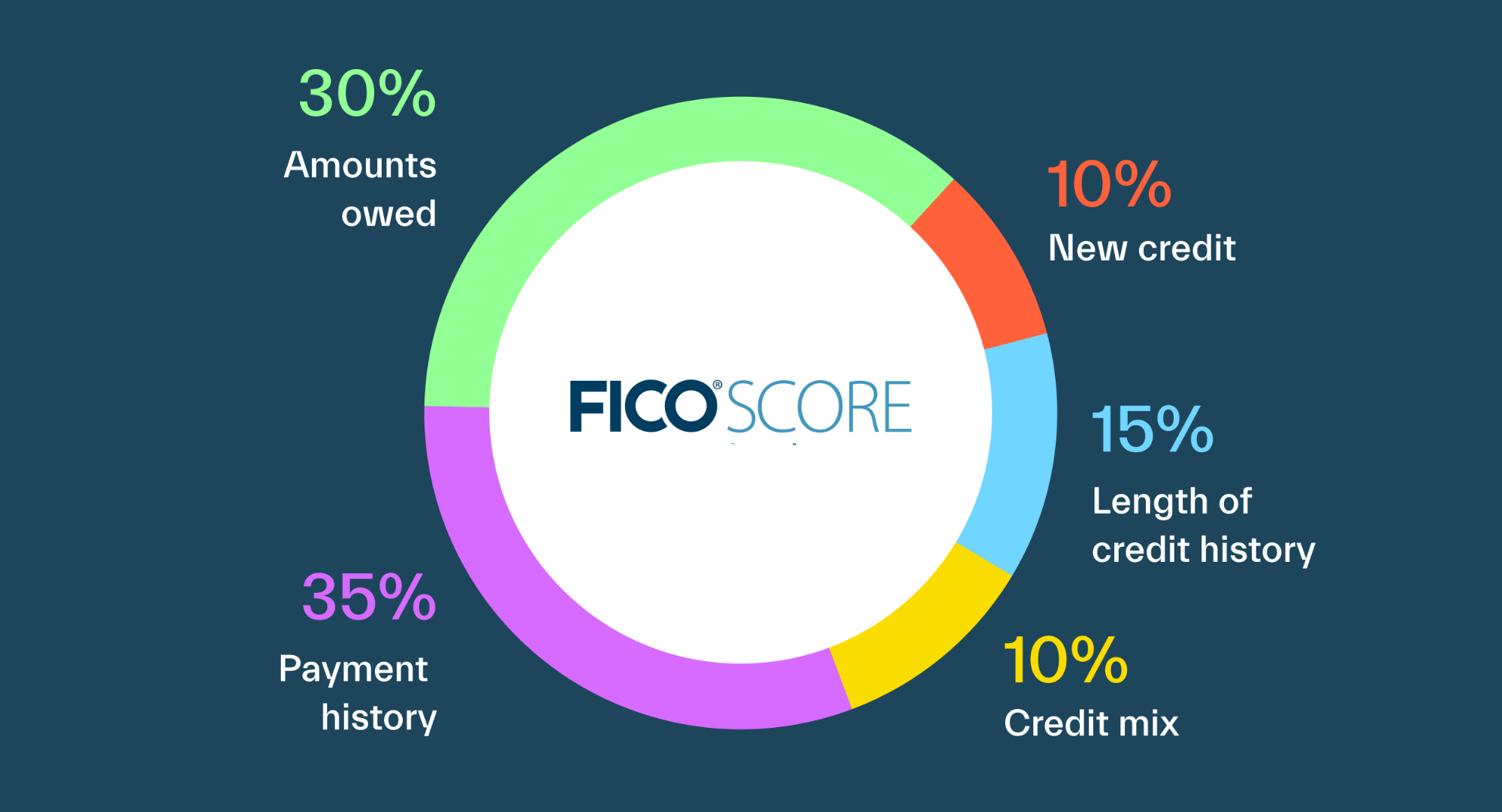

The most common credit score is the Fair Isaac Corporation credit score, better known as the FICO score.

This score weighs five factors as follows:

Payment history (35%)

Amounts owed (30%)

Length of credit history (15%)

New credit (10%)

Credit mix (10%)

Other credit score models, such as Transunion and Experian, may consider additional factors or slightly modify the weightings. But, most financial experts agree that these five areas are the ones to focus on.

The main reason is that these five factors involve your credit history — a detailed report of all of your debts compiled by the credit reporting bureaus. While your credit score may vary, your credit history is always the same.

Let’s review the five different ways that a student loan affects your credit score. This will empower you to make more informed decisions about your monthly budget and to have a plan to build up — and maintain — a good credit score.

Payment history

Keeping up with your student loan’s scheduled payments is very important because it’s the biggest contribution to your credit score.

If you make timely payments, your credit score goes up. If you miss payments, your credit score decreases.

We’ll cover missed payments more in-depth in a minute. First, let’s walk through the other four factors.

Amounts owed

Taking on the full amount that you’re approved for a student loan can bite back.

Most credit rating agencies give you a lower credit score if you’re maxed out on your approved amount of debt — this is known as credit utilization.

Many financial experts suggest a credit utilization ratio under 30%, meaning that if you’re approved to borrow $100, you’d only take out a loan for $30 at the most.

There’s a direct relationship between your credit score and amounts owed: the lower your credit utilization, the higher your credit score.

Length of credit history

Typically, the longer your credit history, the higher your credit score.

However, when your student loan is your first debt, the good news is that you can offset your shorter credit history by paying on time and consistently reducing your amount owed.

Credit mix

There are two main types of debt: installment debt (a.k.a. installment loans like a student loan or car loan) and revolving debt (e.g., credit card, retail store card).

Creditors want to see that you’re able to manage both types of debt. If you only had revolving debt in the past, getting a student loan — and managing it property — will positively affect your credit score.

New credit

The more debt that you take within a short amount of time, the more risk that you’re taking on.

Avoid taking on additional debt like a car loan or credit card right before or after accepting a student loan. Your credit score will thank you.

What happens when I miss student loan payments?

Since payment history is the biggest contributing factor from a student loan to your credit score, pay close attention to it.

Remember that a student loan is a financial contract enforceable by law. In the case of a federal student loan, your lender is the federal government. Just missing a single student loan repayment can have a negative effect on your credit score.

According to data from FICO, missing a monthly payment for 30 days may decrease:

17 to 37 points in a fair credit score

63 to 83 points in an excellent credit score

Miss several payments (90 days or more) or let your student loan go into default, and your credit score will take an even bigger drop.

When your student loan is eligible for repayment options like forbearance or deferment, you’re not required to continue making payments, and your credit score shouldn’t be affected.

But, make sure to follow the requirements and necessary steps from your student loan’s issuer.

If the credit bureau doesn’t get the right paperwork proving the forbearance or deferment, your credit score could still suffer until the error is resolved.

How do you manage student loans to improve your credit score?

Good credit scores don’t happen by accident. Develop a plan and take actions that benefit your credit score.

This will increase your chances of keeping your student debt in check and paying back your debt without a hitch. Plus, it’ll boost your score, so in the future, you’re eligible for other debts — like a mortgage — with more attractive rates.

Here are some strategies to manage your student loans in a way that’ll help boost your credit score.

Make every payment on time and in full

Remember that payment history is the single biggest contributing factor to your credit score.

The easiest way to tackle this is to set up an automatic payment plan with your federal or private lender and have the monthly payment automatically withdrawn from a bank account.

Take out a student loan to only cover education expenses

Resist the idea of including expenses not directly related to college in the total amount of your student loan.

Explore additional options, such as grants and financial aid, to fund your college budget prior to taking on additional student loans.

Fill out your FAFSA every year

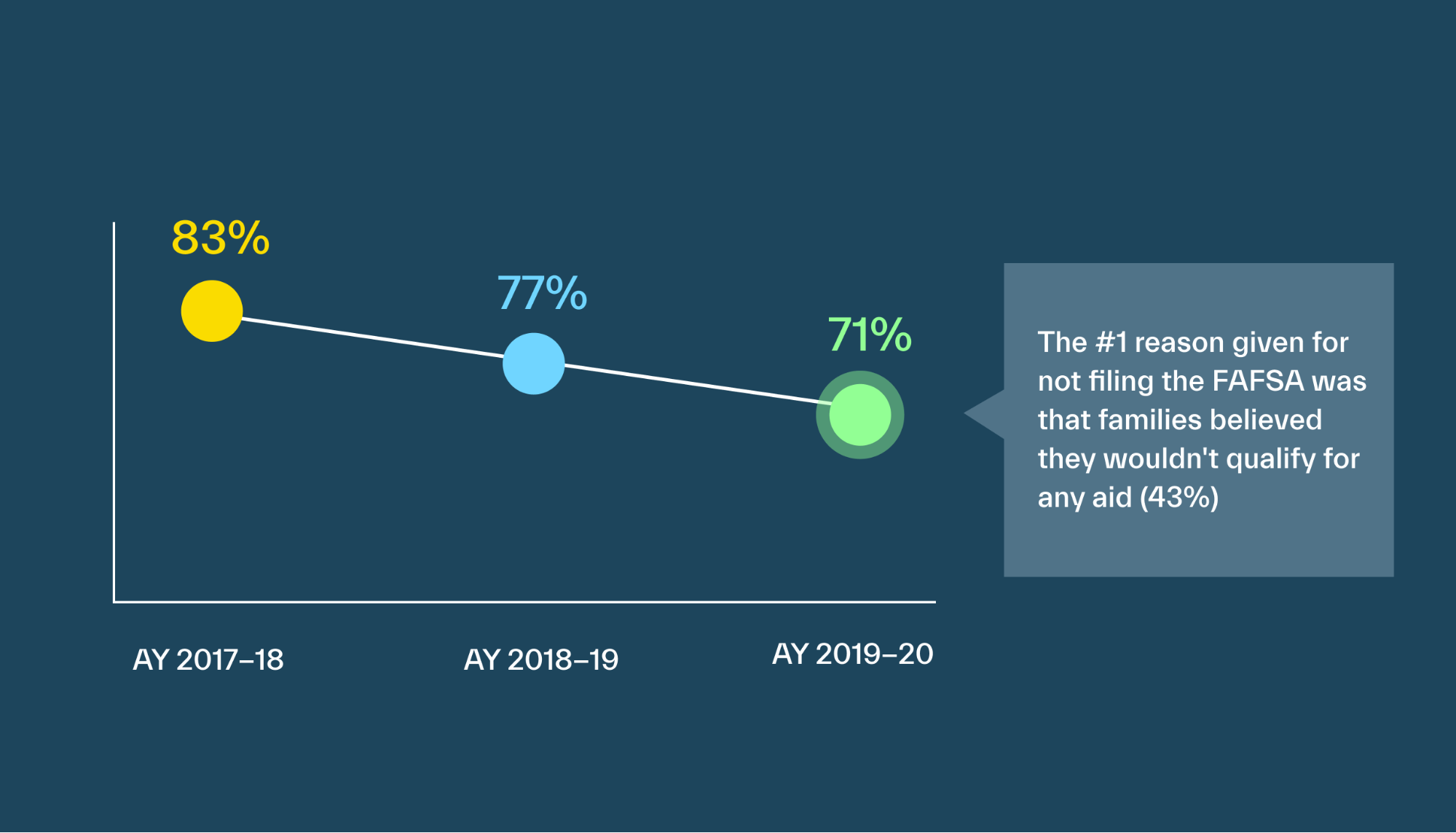

Only 71% of eligible applicants filed the FAFSA in the 2019-2020 academic year. This is an 83% decrease from two years prior.

Remember that the FAFSA only applies to the year that it is completed. Don’t leave potential financial aid on the table.

Space out new loans

Avoid signing up for new credit cards, retail store cards, or car loans within 1-3 months before and after taking on a student loan.

Have an early repayment plan

The terms of your loan will tell you if you can add a bit extra to your monthly payment. Topping off your student loan payment will allow you to pay off your student debt faster.

A federal loan is more likely to allow early repayment without a penalty or fee. However, it’s always worthwhile checking with a private lender if you can pay early.

Once you have an early repayment plan, make sure you stick to it and don’t miss any payments. (Yes, we keep repeating this, because it is the largest factor impacting your credit.)

Inform your lender about financial challenges

Stuff happens. Maybe you lose your job or have an unexpected medical expense eat away all your extra cash.

You don’t have to suffer in silence and wreck your credit score in the process. Explore refinancing, deferment, forbearance, and other types of repayment options with your lender.

When you have a federal loan, you often have many options. But the key is to speak as early as possible.

In some instances, you may qualify for student loan forgiveness.

Some professions, such as teachers and nurses, are eligible for loan forgiveness. Check the terms of your contract and contact your loan servicer for more details.

Conclusion

Student loan debt affects your credit score. But, it can have a positive effect on it when managed efficiently.

Your payment history, amounts owed, length of credit history, and credit mix are some of the ways that your student loan affects your credit score.

By far, making payments on time has the greatest effect on your credit score. That’s why you need to never miss a payment.

There are clear steps that you can take to manage your student loan and build up and maintain a good credit story. But there are also scenarios in which you may need to work with your lender and explore other options such as deferment or forbearance.

That’s why you need a financial advisor that can break down the fine print of your offer of financial aid or your existing student loan. If you need help with your student loan, connect with a Mos financial aid advisor today.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you