Student loans •

October 28, 2022

Biden’s student loan forgiveness

Biden’s new student loan forgiveness program is set to forgive up to $20,000 in debt per borrower. Here’s what you need to know.

Student loan debt is a major problem—not that we need to tell you that!

The amount of the average federal student loan borrowed for the 2017-2018 academic year was a whopping $6,700 per student. That number is likely to keep going up with rising inflation and the growing cost of higher education.

Fortunately, some relief is on the horizon for millions of Americans, thanks to Biden’s student loan forgiveness program. Announced in August 2022, this new program aims to forgive up to $20,000 in federal student loan debt per borrower.

But how does this program work, and how can you take advantage of it? Here’s everything you need to know about the Biden administration’s student debt relief program.

What is Biden’s student loan forgiveness program?

The Biden administration announced a new federal program in August 2022 that aims to provide student loan borrowers with substantial debt relief.

The biggest announcement from the program is forgiveness of federal student loan balances for millions of borrowers.

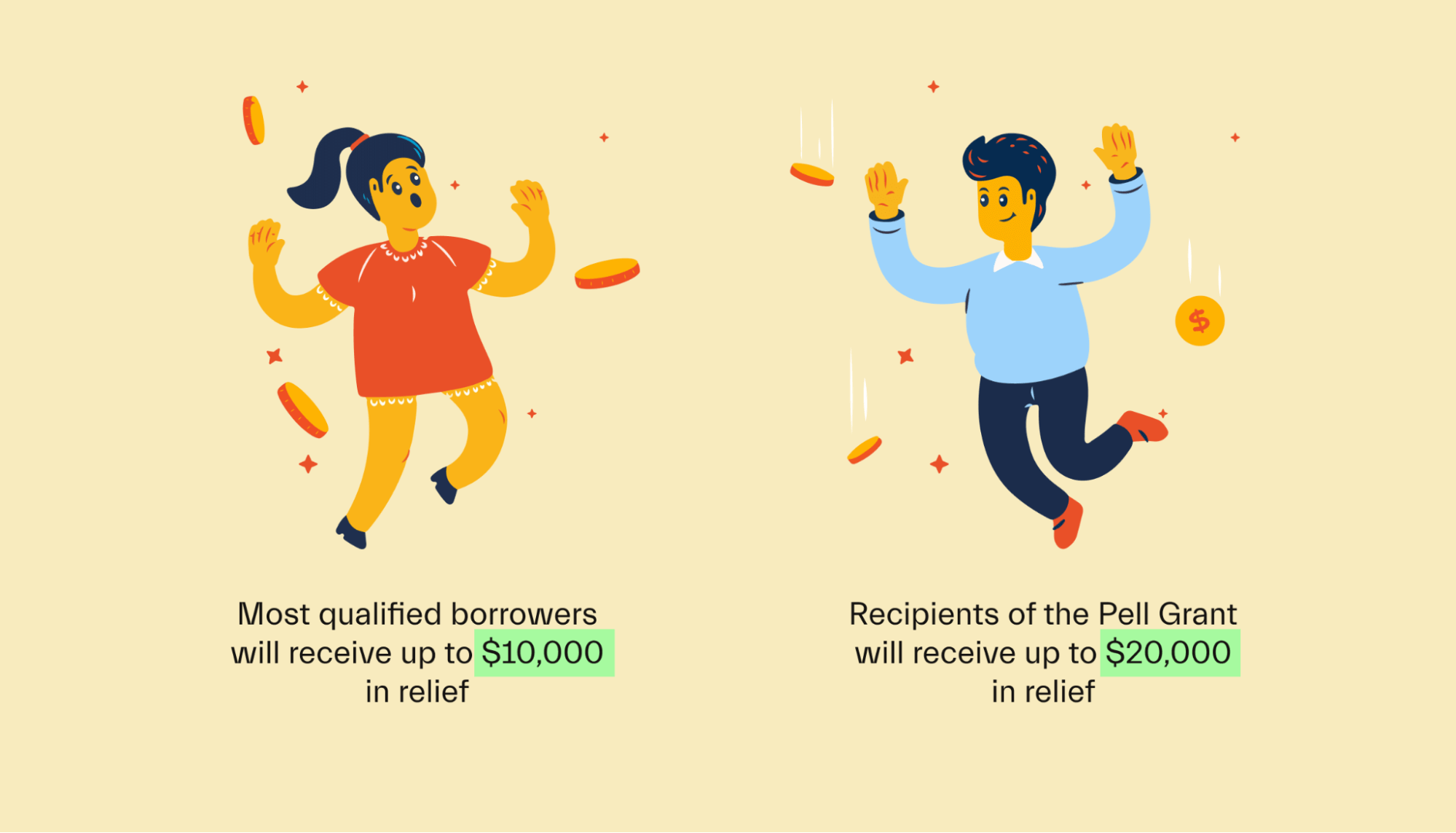

Essentially, anyone who currently has federal student loans and makes less than $125,000 per year can qualify for up to $10,000 in loan forgiveness. Some low-income borrowers will even qualify for up to $20,000.

What is loan forgiveness? Well, it means that the government will essentially “erase” the loan balance—meaning you won’t have to pay!

The federal government technically owns federal student loan debt. They have the power to forgive—or erase—this debt.

For borrowers, this means your balance will simply be reduced. If you owe $15,000 and qualify for $10,000 of debt relief, your new balance will be only $5,000 after the program takes effect.

Who qualifies for debt relief?

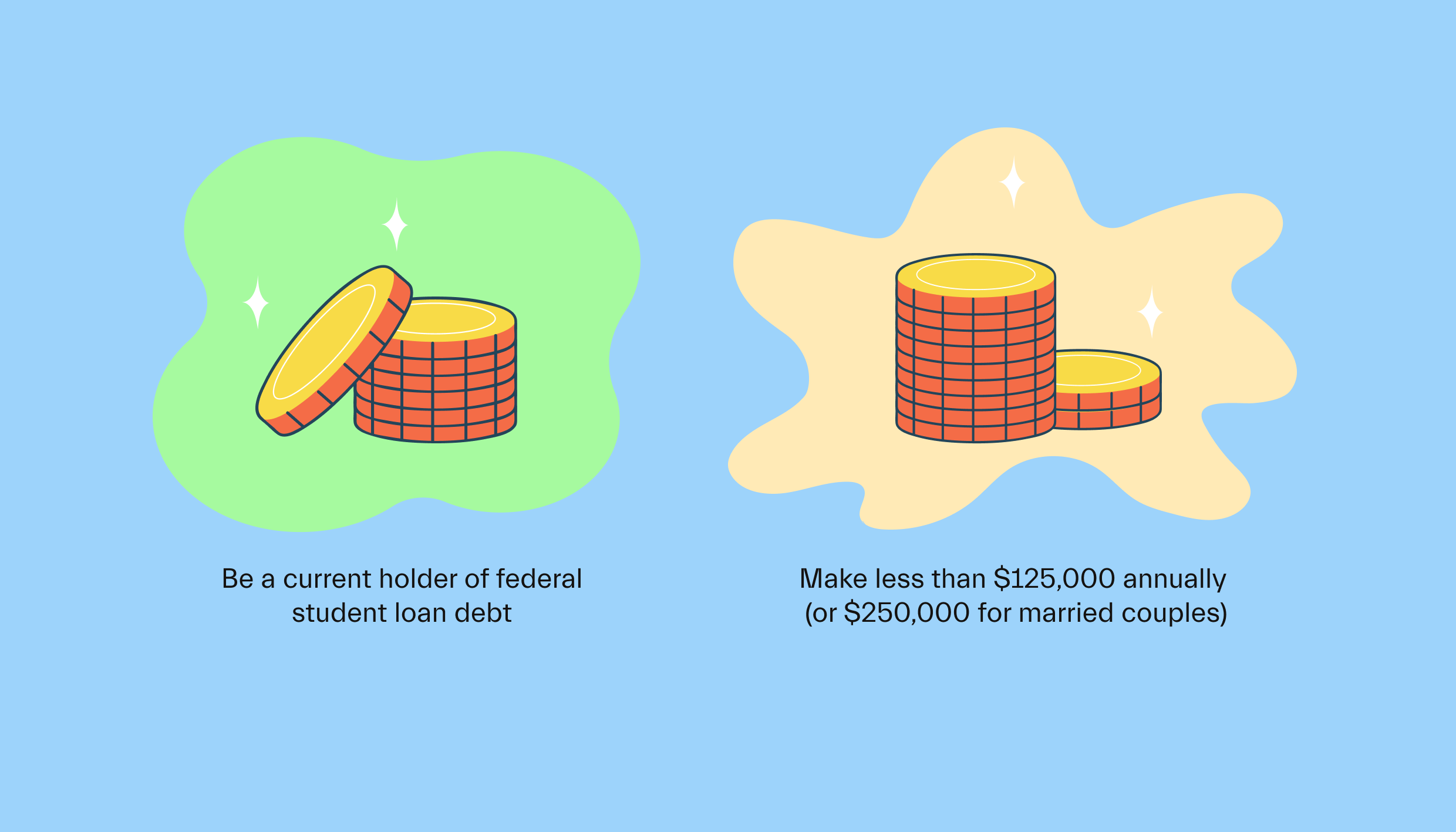

The debt relief program has fairly broad eligibility requirements. To qualify for up to $10,000 in relief, borrowers must:

Be a current holder of federal student loan debt (private student loans do not qualify)

Make less than $125,000 annually (or $250,000 annually for married couples)

This means that both current and former students will qualify—so long as they currently have federal student loans.

In addition, borrowers who received the Pell Grant while in college will qualify for up to $20,000 in debt relief—double the $10,000 amount for other borrowers.

Let’s break these eligibility requirements down to get into the details.

Current holder of federal student loan debt. This means that you need to currently have 1 or more federal student loans with a current balance. If you’ve already paid off loans in the past, you won’t qualify. Additionally, private student loans will not qualify.

Not sure which kind of loan you have? Federal loans are applied for via the FAFSA, while private loans are applied for via a bank. Most student loans are federal student loans.

Make less than $125,000 annually. This requirement is based on either of the previous 2 years’ tax returns. If you apply in 2022, you’ll use your 2021 or 2020 tax return to gauge your income level. This income threshold doubles to $250,000 for married couples. Income is based on adjusted gross income (AGI), which is typically lower than your gross income. You can find your AGI on Line 11 of your 1040 tax return form.

This requirement is designed to ensure that more funds go to low-income and moderate-income households rather than higher-income borrowers (who are more likely to be able to pay off their loans to begin with!).

Borrowers don’t need to submit tax returns, however. The application will only require a simple online form. The Education Department may request proof of income from select filers to ensure compliance with the income limits.

What types of loans qualify for debt relief?

Most federal student loans qualify for this program. Unfortunately, private loans do not qualify.

The following federal student loan types disbursed on or before June 30, 2022, are eligible:

Direct loans/William D. Ford Federal Direct Loans

Subsidized Stafford and Unsubsidized Stafford federal student loans

Parent PLUS Loans

Graduate PLUS loans

Federal Family Education Loan (FFEL) loans, if held by the Education Department

Federal Perkins Loans, if held by the Education Department or in default

Defaulted federal loans, if held by the Education Department

There’s 1 other sticking point: The loans must be held by the Education Department for the individual to qualify for relief. The vast majority of federal student loans are, so no worries there—however, borrowers participating in a few specific loan programs might run into some trouble.

Older Federal Family Education Loan (FFEL) holders and certain Perkins Loan holders might be out of luck, unfortunately. These loans are not held by the Education Department but by private lenders. The Education Department is working on a solution to get these loans included in debt relief programs, but currently, these loan types are not eligible.

How much of my debt can be forgiven?

For most borrowers, up to $10,000 in debt can be forgiven. The amount of forgiveness you receive will be based on your current debt balance.

If you owe $12,000 and make less than $125,000, your balance will decrease to $2,000 under the program.

If you owe $8,000 and make less than $125,000, your balance will decrease to $0 (but you won’t get a refund for the difference).

But wait, there’s more!

If you qualified for the federal Pell Grant while you were in school, you might qualify for up to $20,000 in debt relief.

The Pell Grant is a type of federal financial aid available for students from low-income families. The vast majority of Pell Grant recipients come from families with an annual income of under $60,000.

If you received a Pell Grant while in school, your maximum debt forgiveness can double to up to $20,000.

What happens if this forgives all my debt?

Biden’s student loan forgiveness program can relieve up to your total current debt, but no more.

So, if you owe less than $10,000 and you qualify, your entire debt will be forgiven. However, you won’t get anything back in a check (unfortunately).

For example, say you owe $7,000 in federal student loans and are under the income limit. In this case, you’ll qualify for up to $10,000 in relief. Once the program goes through, your entire $7,000 balance will be forgiven—but don’t expect a $3,000 check in the mail!

Can I get a refund for the amount I’ve already paid?

In most cases, no. The relief program is for folks with current federal student loan debt. There’s 1 exception, although the rules aren’t yet crystal clear.

If you’ve made monthly payments on your loans since March 13, 2020 (when the original payment pause went into effect due to COVID-19), you may be able to request a refund for them.

When will my loans be forgiven?

We don’t yet have confirmed information for how long it will take to process the student loan forgiveness applications and disburse relief. However, Education Secretary Miguel Cardona has indicated that relief should be disbursed within 4 to 6 weeks after a student submits their application.

There may be delays initially, as the Education Department manages a flood of applications. Nonetheless, it’s a good idea to apply ASAP!

When your loans are forgiven, you will receive a notice from the loan servicer who manages your loan. This notice will include how much debt was relieved, your new balance, and any payment requirements moving forward.

How do I apply for forgiveness?

To apply for debt forgiveness, you can head to the official application page on StudentAid.gov. From there, all you have to do is fill out a simple one-page form.

On the application, borrowers will need to provide their:

Full name

Social Security number (SSN)

Date of birth

Phone number

Email address

No proof of income is required, and you won’t need to submit any documents. However, by submitting the application, you agree that you make less than the maximum income requirement and that you are otherwise eligible for the program. You’ll need to digitally “sign” the application by entering your name again.

The Education Department can contact you to verify eligibility or income information, so be sure to double-check that you qualify before applying. Lying on this form can result in criminal penalties, including large fines and potential jail time.

Application deadlines

Borrowers will have until December 31, 2023, to submit the application.

However, the faster you apply, the faster you’ll have your loans forgiven! Experts are urging borrowers to apply for relief ASAP to get in the processing queue.

What about the payment pause?

Payments on federal student loans have been paused since early 2020 due to the COVID-19 pandemic. Monthly payments have not been required, and interest rates have been temporarily set to 0%.

This pause is set to continue while the Supreme Court considers the debt relief plan. Payments will resume 60 days after they make a ruling (or 60 days after June 30, 2023, if they still haven’t made a decision).

The Education Department will notify borrowers about this directly—so make sure they have your information on file, and that you have an updated payment method on file with your loan servicer!

Recent changes to income-driven repayment plans

This latest round of announcements from the government also proposed some changes to income-driven repayment plans—which many student loan borrowers participate in.

Income-driven repayment plans allow borrowers to pay a percentage of their discretionary income toward their student loans, which often results in a lower minimum payment.

Most of these plans require borrowers to pay 10% of their monthly discretionary income toward their loans. So, if their discretionary income is $1,500 per month, they may be required to pay $150 per month toward their loans.

The new plan would lower this amount to 5% of discretionary income—essentially halving payments for many borrowers.

However, the program hasn’t yet been launched—stay tuned to the Education Department’s announcements if you are on an income-driven repayment plan!

Bottom line

Millions of Americans will receive relief under the Biden administration’s student loan forgiveness plans. The majority of applicants will receive up to $10,000 of forgiveness, while recipients of Pell Grants will qualify for up to $20,000.

If you qualify, it’s a good idea to apply ASAP to get in the processing queue. Applications will remain open until the end of 2023.

Looking for other ways to optimize your financial life? Check out Mos, the all-in-one money app designed specifically for students. Mos offers a fee-free debit card, help finding scholarships and side hustles, cash back rewards, and much more! Learn more about Mos today.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you