Student loans •

January 21, 2022

What happens if you don't pay student loans?

Read this guide from Mos to find out what happens if you don't pay student loans.

Taking out student loans is the only way that many people can pay for college.

Once you graduate from school, you’ll need to start paying the money back shortly afterward. It’s important to remember that you can’t put off paying your loans forever.

The problem is that you might not have the money to start paying your loans back right away—and even if you do land a job with steady income, it might not pay enough to make sure you’re making all your student loan payments on time.

So, what happens if you don’t pay your student debt?

This article will explain the short-term and long-term consequences of not paying your student loans. You’ll also learn what to do if you’re in a situation where you can’t afford your student loans.

What happens if you never pay your student loans?

Unfortunately, life can get pretty expensive! Both during and after college, your bank account is going to get pulled in a lot of different directions. After all, there are all sorts of bills to pay—and sometimes, you might find yourself in a situation where you’re coming up short.

But even if you’re having a hard time financially, you should always do your best to stay up-to-date on your student loan repayments.

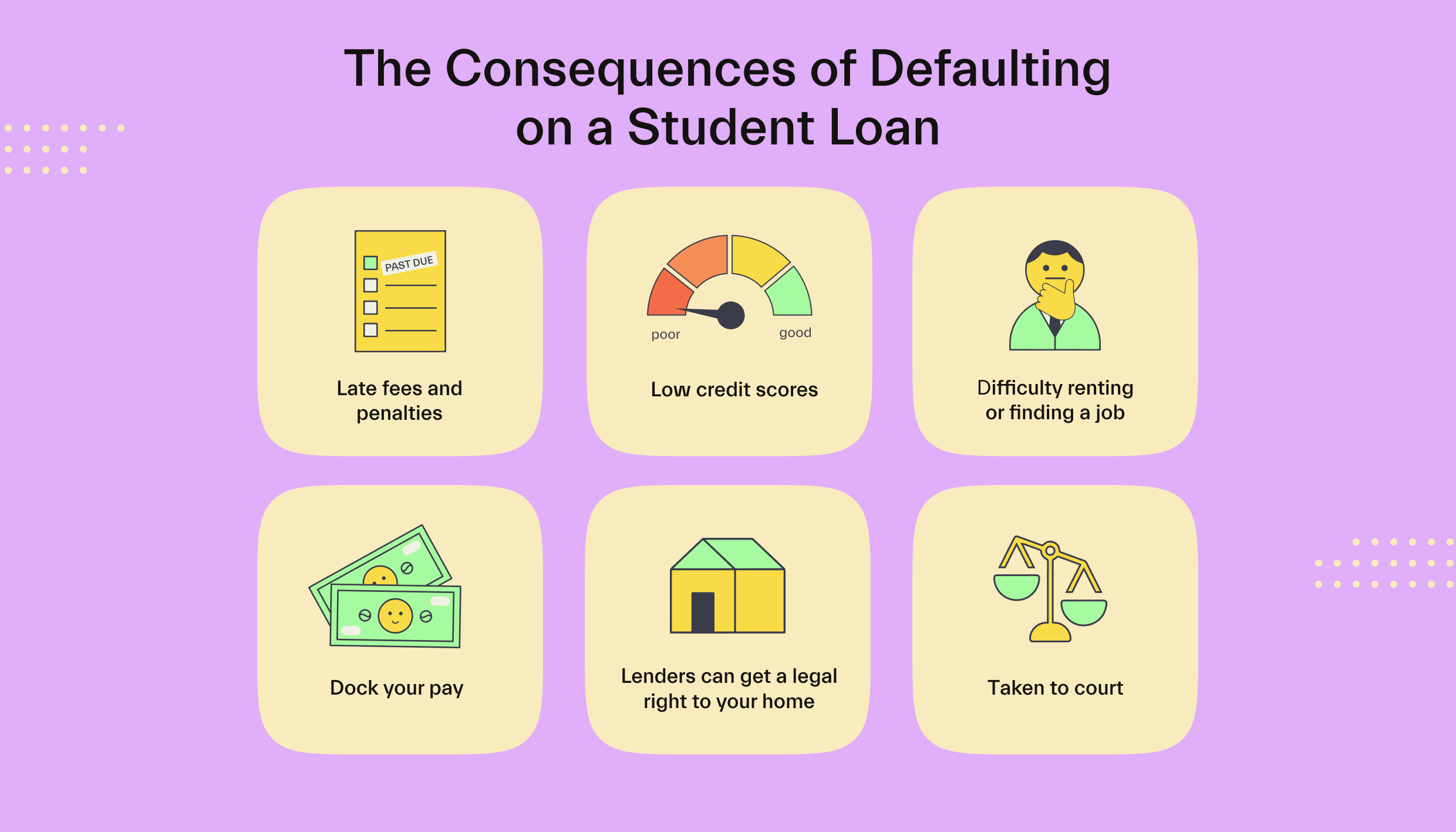

If you miss enough payments, it’ll start to have a big impact on your credit rating, the amount of money you owe to lenders, and even your personal life.

The first thing that happens if you don’t pay student loans is that your credit will take a big hit.

After 90 days of missed student loan payments, the debt is classified as “delinquent.” When this happens, your loan provider will then turn around and report your delinquent loan to the 3 big credit bureaus in the US: Equifax, Experian, and TransUnion.

Whenever you want to finance a car, apply for another loan, get a mortgage, or even finance new gadgets, companies will pull your credit score from one of these agencies. And if you have a delinquent loan on your credit history, your score will suffer.

Translation: you’re either going to get denied by a lot of lenders and utility service providers, or they’ll offer you packages with higher interest rates and ask for bigger deposits.

If you have a cosigner on your loan, this is bad news for them too. Their credit rating will take the same hit as yours. Then, they’ll have to start making payments on your delinquent loan.

After your student loan is delinquent for 270 days, the loan officially enters into “default.”

If your student loan account goes into default, it means the entire balance of your loan (plus interest) is now due immediately. This is called the "acceleration” process—and if you can’t pay back your outstanding balance right then, your lender will then refer your account to a collection agency.

The agency will then likely hassle you to try and get you to pay some of the money you owe.

It’s also important to note that, after you’ve gone into default, you’ll no longer be eligible for forbearances or deferments on federal student loans.

Loan deferment is when you agree with a lender to pause making payments on interest or principal on a loan.

Meanwhile, loan forbearance is when your lender agrees to let you temporarily pause making principal payments or reduce your monthly payment amount for up to 12 months. This is usually only permitted if you don't otherwise qualify for a deferment.

That means if you’ve got any other loans that are in good standing, you can’t request to pause or defer payments for any reason.

But the consequences of going into default aren’t just financial.

Some states will even suspend your driver’s license if you default on a federal student loan or a state loan. States where you might be at risk of losing your license include Iowa, Alaska, Texas, Kentucky, Georgia, Massachusetts, Hawaii, and Tennessee.

In certain situations, state authorities could even choose to take away your professional license if you go into default on a loan. This can affect nurses, teachers, electricians, accountants, or even lawyers—and there are 18 US states in which this can happen.

The difference between not paying federal or private loans

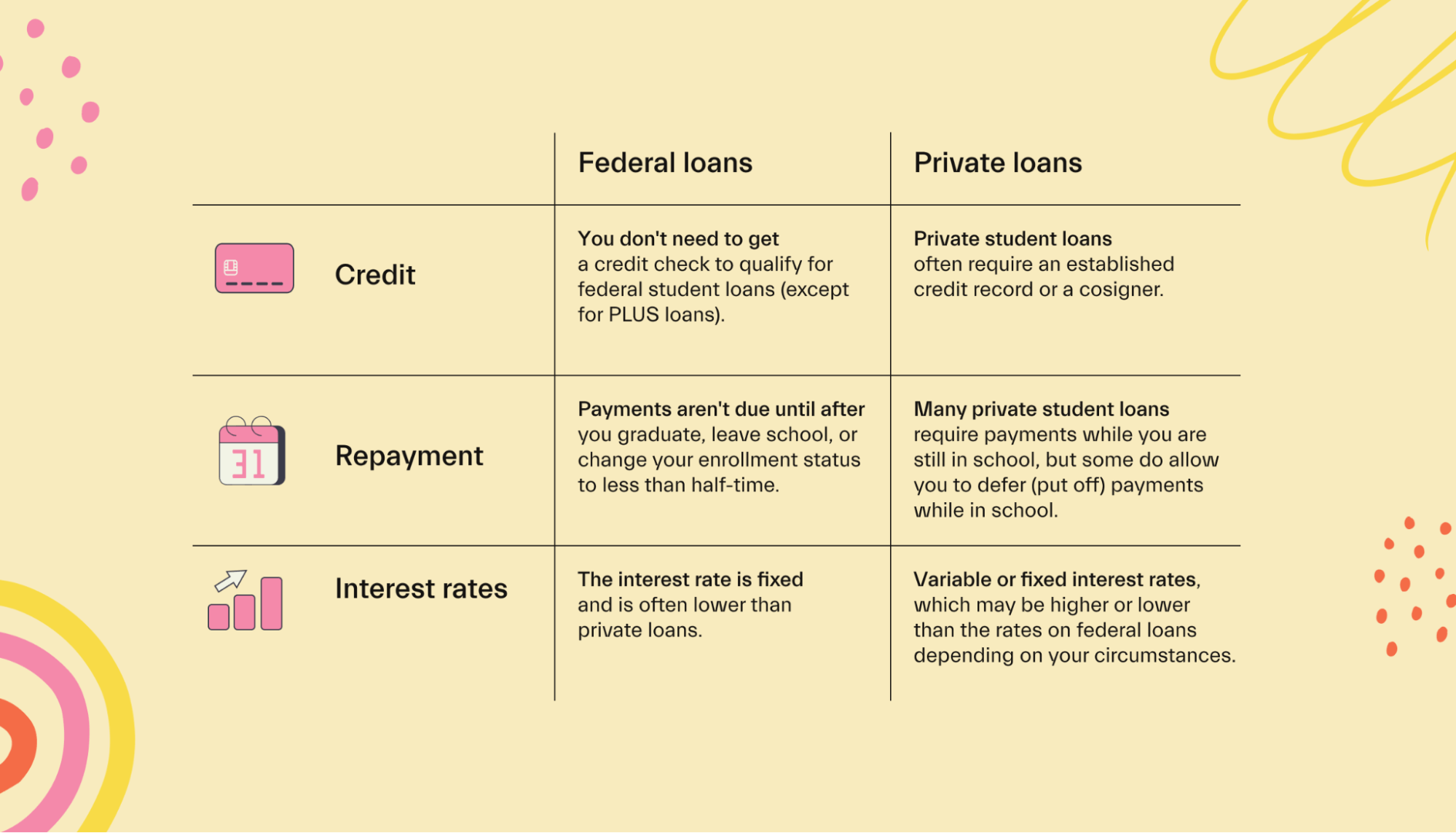

The consequences for not paying your student loans can be slightly different depending on whether you have a delinquent federal student loan or a private student loan.

Federal student loans are education-based funds you can borrow that are subsidized by the US government. Because the terms and conditions of federal student loans are set by law, these loans normally include a few added protections for consumers.

First, with a federal loan, your repayment schedule should be a lot easier to keep up with. That’s because federally subsidized loans benefit from a fixed interest rate. This means that the amount of interest charged on your loan won’t change for the entire lifetime of your loan.

Federal student loans also offer income-driven repayment plans. That means if you’re unable to pay a federal student loan with your existing income, you can get in touch with your loan servicer to request a new repayment plan that’s linked to how much money you’re making.

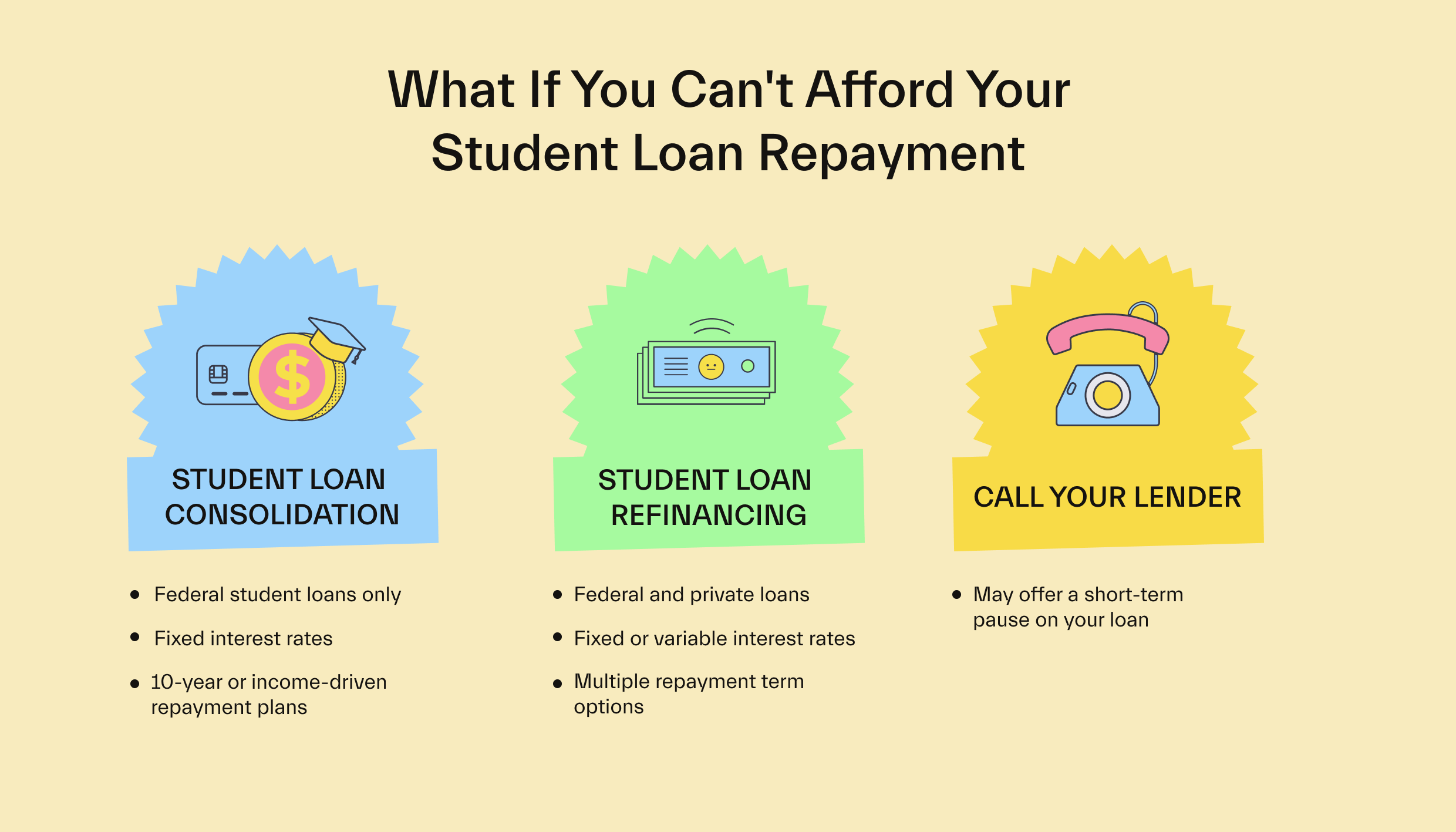

You can also request a loan consolidation plan.

With loan consolidation, you’re able to combine multiple loans you might have into one big loan. This allows you to make one monthly payment rather than having to make several payments each month.

That being said, the top benefit you’re going to get with a federal student loan is student loan forgiveness.

Under many federal student loan programs, you can have part or all of your loan forgiven—which means you no longer have to pay any of the money back.

If you’ve opted for a private student loan, you’re not going to benefit from all of these repayment programs. Private loans are a lot less flexible than federal student loans, and they don’t offer loan forgiveness.

Private lenders are also more likely to send default loans to a collections agency. They may also decide to take you to court as part of a lawsuit.

But it’s important to note that it’s in the best interest of both the private lender and yourself to make sure you continue to make loan payments.

As a result, you should always get in touch with your lender if you’re unable to make payments. They may be able to offer you a new repayment plan before taking legal action.

Can you go to jail for not paying student loans?

If you genuinely can’t afford to pay student loans, there’s one bit of good news: you’re not going to go to jail over missing student loan payments.

Under current law, you can't be arrested or sentenced to time behind bars for not paying your student loan debt. This is because student loans are considered "civil" debts.

Civil debt is a type of debt that includes things like credit card bills or medical bills—and so although failing to pay student loans can negatively impact your life in a lot of ways, you won’t get arrested or go to jail because of them.

There’s one caveat here that you need to remember, though. If you end up getting sued by a private lender as part of a civil case, you need to show up to any court dates attached to the case. If you fail to show up to a court date, it can ultimately result in you getting arrested.

Can student loan providers take your house?

Unfortunately, the short answer is: yes. Both private lenders and the US government have been known to take a student loan borrower to court—and this can ultimately result in your house being repossessed.

The US Department of Justice has reported that more than 3,300 student loan borrowers have been sued for defaulting in recent years. Worst yet, in almost every case, the borrower loses.

When the lender wins a case against a borrower, they can place a court-mandated lien on your home. A lien is a rule that allows a creditor to get a financial stake in your property to help them recover some of the debt you owe them.

If you ever sell your home, the companies you owe money to will be paid first before you’re allowed to get any of the money from the sale.

For example, let’s say you sell your home for $250,000 — but there’s a lien on your house because you owe a loan company $50,000. That means after you sell your house, the loan company automatically gets its $50,000 before you see a single dime of the sale money.

In other cases, the lien on a property can even give your student loan provider the right to force the sale of your property to get paid.

This would mean not only are you forced to sell your property, but your lender would receive funds owed to them before you get any money from the sale.

What other actions can the government take if I don’t pay my federal student loans?

If your loan goes into default and a collection agency can’t get you to repay your loan, the federal government is then allowed to intervene directly.

The government then has a couple of options.

First, the government can opt to keep any of your future tax refunds and apply those funds directly to your debts. They can also dock any disability benefits you’re receiving.

The government has also been known to get in touch with employers and arrange for part of your salary to get sent straight to the government. These salary deductions will then be used to put a dent in the amount of your loan balance that you still need to pay.

Can student loans go away without paying them off in full?

Generally speaking, the amount of money you owe is only going to increase after graduating, thanks to interest.

Because of this, many borrowers find it harder to make payments as the years go on—which is why so many graduates are always hunting for loan forgiveness programs or legal ways to get out of their existing loan agreements.

To help give you an idea of what happens to student loans as time goes on, we’ll quickly break down how some of the rules work.

Do student loans go away after 7 years?

Unfortunately, student loans don't go away after 7 years. There’s no program for loan forgiveness or loan cancellation after 7 years.

But if it's been more than 7-and-a-half years since you made a student loan payment on your student loan debt and you default, the debt and the missed payments can be removed from your credit report.

However, there’s no statute of limitations for federal student loans. You can be sued at any point if you don't pay your loans (as long as you’re alive).

There is a statute of limitations for private student loans, which is set by individual states and generally ranges from 3–10 years. But this limit just means the lender can’t sue you. It doesn’t mean the private loan goes away or that they'll stop trying to collect what you owe.

Are student loans removed when you retire?

Believe it or not, nothing happens to student loans when you retire. You’ll still owe your federal student loans.

Federal student loan borrowers do get to make monthly payments based on a number of factors. These include your income, the number of people living with you that you support, and your student loan balance—and these factors are very likely to change as you get older and retire.

Do student loans go away upon death?

If the person who took out a loan dies, the lender then typically discharges the cosigner's responsibility to repay the loan.

That being said, the primary borrower usually is still responsible for repaying the loan if the cosigner passes away.

What should I do if I can’t afford my student loans?

If you can’t afford your student loan payments, the first step you’ll always need to take is to contact your loan servicer immediately.

In most cases, your loan servicer will be able to help you change your repayment plan or lower your monthly payments to make sure you can get back on top of your loan debt.

Depending on the type of loan you’ve received, you may be able to gain a short-term pause on your loan payments or even the ability to refinance your student loan.

By refinancing, you effectively move your outstanding loan balance to another loan type or lender—hopefully gaining better interest rates or repayments along the way.

Finally, you may want to consider loan consolidation. However, if you try to refinance or consolidate federal student loans, you can lose valuable federal protections on those loans. So, make sure you understand your options before you make any changes.

Conclusion

At the end of the day, we all know life costs a lot of money—and student loan debts can really hinder your ability to pay for the other important things in your life.

But no matter how much you’re struggling financially, you should really try to stay on top of your student loan debts. If you miss payments, it can start to affect your credit, job, and personal life.

Want to learn more about paying back your student loans and college finance in general? Visit our learning hub to find out more.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you