Financial aid •

November 11, 2022

University of Maryland financial aid: a complete guide

Learn about the financial aid at the University of Maryland, including information about scholarships, loans, and grants.

The University of Maryland, founded in 1856 as the Maryland Agricultural College, is one of the first land-grant schools in the United States.

UMD has made a name for itself as one of the top public research universities in the United States, with faculty members including Pulitzer Prize winners and Nobel laureates. At UMD, you can get an excellent education at an excellent price.

If you’re considering applying to UMD, but are worried about how you can pay for your education, here’s what you need to know.

A snapshot look at the University of Maryland

Located in College Park, an area between Washington D.C. and Baltimore, Maryland, the University of Maryland is a public school that offers a high-quality, low-cost education to students in Maryland.

Founded in 1865 as the Maryland Agricultural College, the University of Maryland is one of the first land-grant schools in the US. Since its founding, UMD has expanded to include 12 colleges offering 90 different degree programs.

The school boasts a low student-to-faculty ratio of 18 to 1 and has many notable alumni, including Sergey Brin, one of the founders of Google, and Jim Henson, creator of The Muppets.

Outside of their classes, UMD students can join one of UMD’s more than 800 student organizations and on-campus clubs. The school also has 20 NCAA Division 1 teams that students can play on or enjoy as spectators.

The application process for UMD is competitive, with 50,000 applicants resulting in a class of 4,600. Most applicants to the school average As and Bs.

Ranking: 59 in National Universities

Size: 30,875

Demographics: 53% male, 47% female

Tuition: $9,000

Acceptance rate: 47%

Average GPA of accepted student: 4

Key dates and deadlines (2021):

Application: January 20th

Financial aid deadlines: January 1st

A look at scholarships offered by the University of Maryland

If you’re looking to pay for the cost of college, one of the best ways to get funding is through scholarships. Scholarships—unlike student loans—are free money that you can use for tuition and other fees. There’s no obligation to repay them.

UMD’s financial aid office maintains a list of the many scholarship opportunities available to students.

The school has multiple scholarship programs, including the President’s Scholarship, which offers up to $12,500 per year, and the Banneker/Key Scholarship, which can cover the full cost of tuition at the school.

Several departments at UMD also have their own scholarship programs, so there may be more opportunities available to you based on your course of study.

In order to be eligible for a merit-based scholarship, you need to have submitted your undergraduate admission application by the early action deadline of November 1. There are also the following eligibility criteria:

Only available to US citizens and US permanent residents

Not available to students admitted for the spring semester

Financial award may be dependent on successful completion of an interview

Outside of the scholarship programs offered by UMD, you can look for scholarships offered by other groups—there are lots of scholarship opportunities out there if you know where to look.

Many community groups, charitable organizations, and local businesses operate scholarship programs for their communities. If you keep an eye out, you can earn several small, local scholarships that add up quickly. There are scholarships for almost everything you can think of.

For more on which scholarships you can apply for and how Mos can help, check out our financial aid tips and tricks.

Student loans

Scholarships are one of the best ways to pay for college, but few people can afford to pay for school with the money they’ve saved and the scholarships they receive. If you’re among that group, getting a student loan is another option for paying for your education.

Borrowing money to pay for school is a way to invest in yourself. Just be ready to pay back the money that you borrow, plus interest.

UMD’s financial aid office offers information about student loans and the loan programs at the school.

One of the best ways to borrow money for school is the Federal Direct Loan program. Federal Direct Loans are a form of federal financial aid. These loans can be either subsidized or unsubsidized.

If you get a subsidized loan, interest won’t start to build up on the loan until after you leave school. By contrast, unsubsidized loans start accruing interest immediately.

Both types of loans are eligible for other types of federal aid programs, such as public service loan forgiveness and income-based repayment.

If you don’t receive enough funding from scholarship providers and government lenders, your next step may be to look to private lenders. There are many banks and other lenders that also offer private student loans.

Keep in mind that private student loans are generally more expensive than loans from the government. They aren’t subsidized, and you can’t take advantage of income-based repayment or loan forgiveness programs.

It’s usually a good idea to max out government loans before turning to private student loans.

If you’re looking to get more money for college life, explore Mos memberships. Quit leaving money behind. Work 1-on-1 with a Mos advisor to find every dollar you qualify for. Learn more here.

FAFSA

One of the most important things for every student to do is fill out the Free Application for Federal Student Aid (FAFSA). The FAFSA is a single, universal financial aid application that you submit to the government and colleges. The FAFSA can make you eligible for grants, federal loans, scholarships, and work-study programs.

When you fill out the FAFSA, it will ask for financial information from you and your family. For example, you’ll have to provide information on your college savings and your family income.

Based on the information you provide, the government will determine your expected family contribution (EFC) to the cost of your education.

The government and many schools use the information in your FAFSA and your EFC to decide how much need-based aid you’ll receive. For example, if you have a low EFC, you may be eligible for more loans or programs like the Pell Grant.

Schools usually don’t look at the information in the FAFSA when making admissions decisions, so it won’t hurt your chance of getting into school.

The FAFSA process starts on October 1st for financial aid awarded during the next academic year. You have until the end of June to fill out the form. However, UMD asks that students submit it by January 1st.

Keep in mind that some programs award money on a first-come, first-served basis, so you should fill out the form as soon as you can.

For more on applying for FAFSA, including important dates and how to make sure your application is successful, join Mos today and connect with a financial aid advisor.

University of Maryland financial aid FAQs

These are some of the most frequently asked questions about financial aid at UMD:

What is the University of Maryland’s cost of attendance?

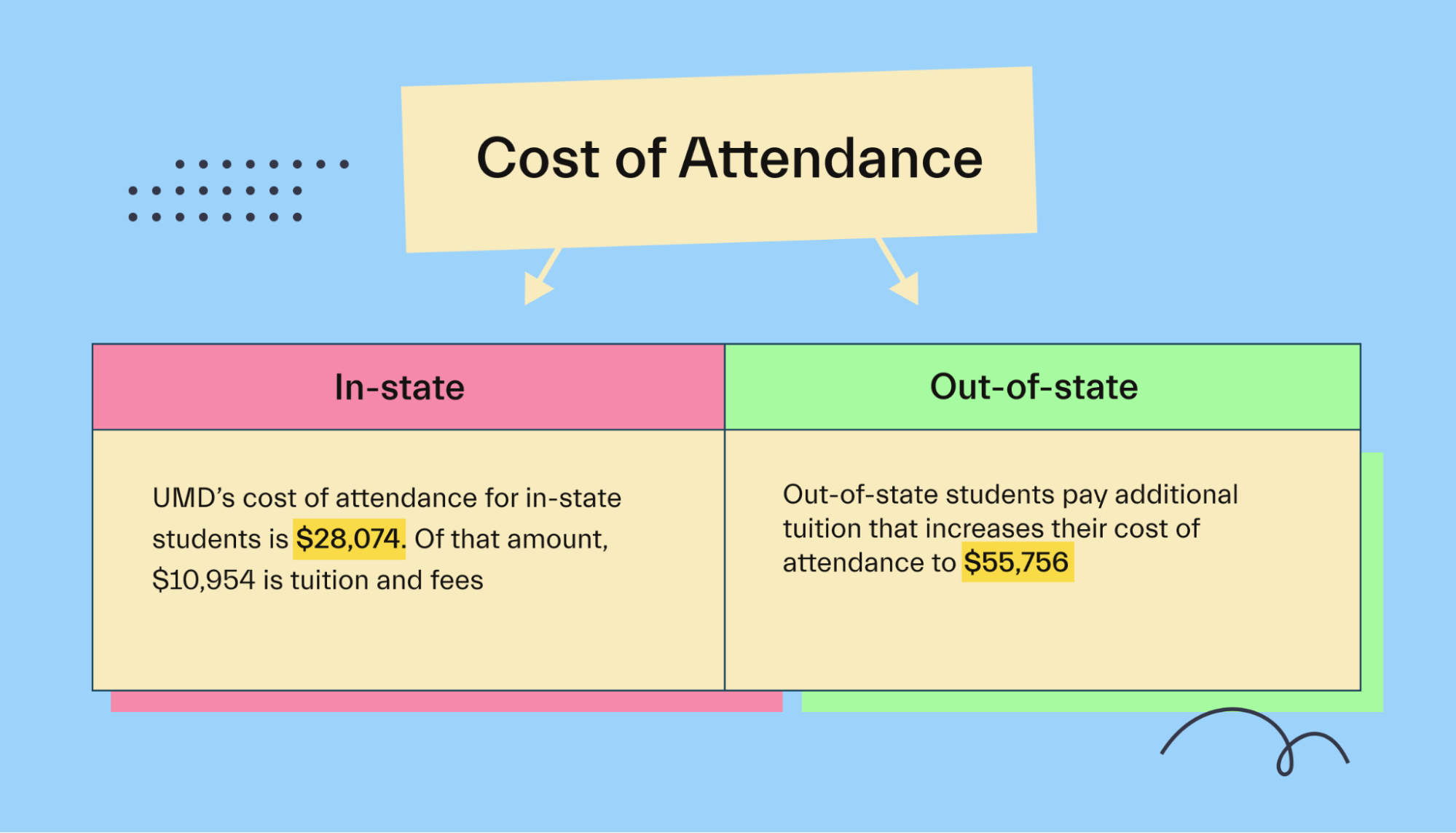

UMD’s cost of attendance for in-state students is $28,074. Of that amount, $10,954 is tuition and fees. Out-of-state students pay additional tuition that increases their cost of attendance to $55,756.

How many students pay no tuition at UMD?

UMD does not provide information on how many students pay no tuition at the school. But, we do know that the school provides aid to 72% of students, and those students receive an average of more than $9,000 in aid.

Can out-of-state students receive financial aid?

Yes, out-of-state students are eligible to receive financial aid at UMD. But, some programs may be restricted to Maryland residents.

Does UMD offer student employment?

Yes, UMD offers multiple opportunities for student employment. Students who receive federal work-study as part of their financial aid package can apply for jobs on campus. Other students can use the Careers4Terps portal, which contains a database of both on- and off-campus jobs that students can work to help make their education affordable.

Does UMD offer merit-based financial aid programs?

Yes, there are merit-based financial aid programs available at UMD. For example, the most prestigious is the Banneker/Key scholarship which awards the full cost of tuition, fees, room and board, and books. Recipients of the scholarship also receive admittance to UMD’s honors college.

What is the financial aid priority deadline?

UMD gives earlier applicants priority when it comes to awarding student aid. The priority deadline for students who are submitting the FAFSA is January 1st.

Can international students receive financial aid?

UMD does not offer financial aid to international students. However, it does offer resources to students who are able to find a US citizen or resident to serve as a co-signer on a student loan.

When are financial aid decisions released?

Eligible students will receive notification of their financial aid at different times.

Incoming freshman students who applied by the early action deadline receive their offer by March 1st. Continuing freshmen and sophomores get their offer by June 5th. Transfer students and current students entering their junior and senior years receive their aid offers by May 1st.

What are the financial aid application requirements?

UMD relies on the FAFSA to make financial aid decisions, so you must be eligible to submit the FAFSA to receive aid from the school. That means that only US citizens, permanent residents, and select groups of eligible non-citizens can apply.

Universities like the University of Maryland that you might be interested in

If you’re not sure whether the University of Maryland is right for you, these alternatives might fit the bill.

Morgan State University

Morgan State University is one of Maryland's top research universities.

The school was founded in 1867 and now offers more than 140 academic programs. Located north of Baltimore, Morgan offers students a large campus with easy access to the city.

If you have an interest in research, Morgan State University might be an option for you.

University of Baltimore

Located in Baltimore, Maryland, the University of Baltimore offers more than 70 degree programs across its Colleges of Public Affairs, Business, Law, and Arts and Sciences.

The school is relatively small, enrolling just over 1,600 undergraduate students. It boasts a low student-to-faculty ratio of 13 to 1.

If you’re looking for a smaller school than UMD, the University of Baltimore might fit the bill.

Bowie State University

Founded in 1865, Bowie State University is Maryland’s oldest Historically Black College and 1 of the 10 oldest in the United States. The school offers 23 undergraduate programs with a focus on science, technology, business, and education.

The school is located near Washington D.C. giving students easy access to the city.

If you’re interested in the program Bowie State offers and want to attend a Historically Black College, it is one of the best options in Maryland.

Conclusion

The University of Maryland is one of the top public universities in the state of Maryland. It offers an affordable, world-class education.

With some scholarship and grant aid, you should be able to make the cost of attendance affordable, especially if you’re an in-state student.

If you’re looking for the best way to pay for school, Mos can help you negotiate for more financial aid, apply for scholarships and grants, and write scholarship essays to help you earn extra money to pay for school.

Why not get started with a Mos financial aid advisor today? Students who work with a Mos advisor save an additional $3,500 per year on average.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you