Financial aid •

March 24, 2023

Your guide to financial aid for trade school

Financial aid is available for students of accredited trade schools. Here’s everything students need to know about the FAFSA for trade schools.

Attending school is a great way to boost your career prospects—but it can be costly. Fortunately, financial aid is available for students to help pay for school.

But what about trade school? Can you still get financial aid for that?

You can, but it depends on the school.

Here’s everything you need to know about financial aid, the FAFSA, and trade schools.

What are trade schools?

Trade schools, also called vocational schools, career colleges, or technical schools, are specialized institutions that train students for careers in specific industries. For instance, a student might attend a trade school to become an electrician, mechanic, or dental hygienist.

Instead of focusing on general education, like history and math, trade schools focus on hands-on skills, like repairing vehicles or performing dental procedures. Most coursework is directly related to the industry or career that the student is pursuing.

Some are dedicated trade schools, meaning they only offer hands-on training in trade programs. Other schools, including many standard community colleges, offer a hybrid approach: they have both traditional and trade college programs.

Trade schools offer many potential benefits. For instance:

Their programs provide real-world skills for pursuing specific careers

Their programs are generally shorter than 4-year degree programs

They can provide a direct path to job placement

Many trade school programs are available with classes in the evenings, on weekends, or online

They often have simple admissions requirements and processes

They often have smaller class sizes

Most importantly, trade school graduates are more likely to find full-time work than general education graduates. Data from the National Center for Education Statistics shows that 86% of trade school graduates are employed full-time, compared to 79% of academic degree graduates.

How much does trade school cost?

The cost of attending trade school can vary significantly depending on the program and school.

According to the College Affordability and Transparency Center data, average tuition costs for trade schools range from around $3,600 to $15,000. You can research average costs for the program you’re interested in here.

Remember that trade school programs can vary in length—from as little as a few months to 2 years or more. Shorter trade school programs are usually much cheaper than longer ones.

Does the FAFSA cover trade schools?

Trade school can be expensive, so how do students pay for it? Fortunately, financial aid may be available for trade school students.

Financial aid is a broad term that encompasses student loans, grants, and scholarships (more on the types of aid below!). Aid can be available from the federal government, state government, schools, or private organizations.

Students can primarily access financial aid by filing the Free Application for Federal Student Aid (FAFSA) each year. The FAFSA is how students can access all federal financial aid forms, including loans, grants, and work-study opportunities.

So does financial aid cover trade schools? Of course, it does—but only if the school’s accredited and the program lasts at least 15 weeks. Students attending qualifying trade schools can file the FAFSA each year to see what aid is available to them.

Keep in mind that the FAFSA asks the student a bunch of questions to determine what types of aid are available to them. It also asks them to list the school(s) they attend or may attend. However, to actually get aid, the student must enroll in a qualifying, accredited school.

In other words, the FAFSA usually approves students for aid based on their income and family information. But to actually receive student aid, the student must go to a qualifying school.

Confirming that the school(s) you are considering are accredited and compatible with federal financial aid rules is essential.

Accredited trade schools

Accredited schools are educational institutions that have met specific academic standards set by an independent agency. Regarding trade schools, accreditation helps to ensure that the school’s curriculum meets employer standards in the specified field or industry.

You can confirm if a trade school is accredited here.

Not all trade schools are accredited. Students who attend a non-accredited school will most likely not be able to receive federal financial aid—they’ll have to pay out-of-pocket or take out private loans instead.

The Department of Education warns students to avoid so-called diploma mills, which are non-accredited schools that often have low-quality educational programs.

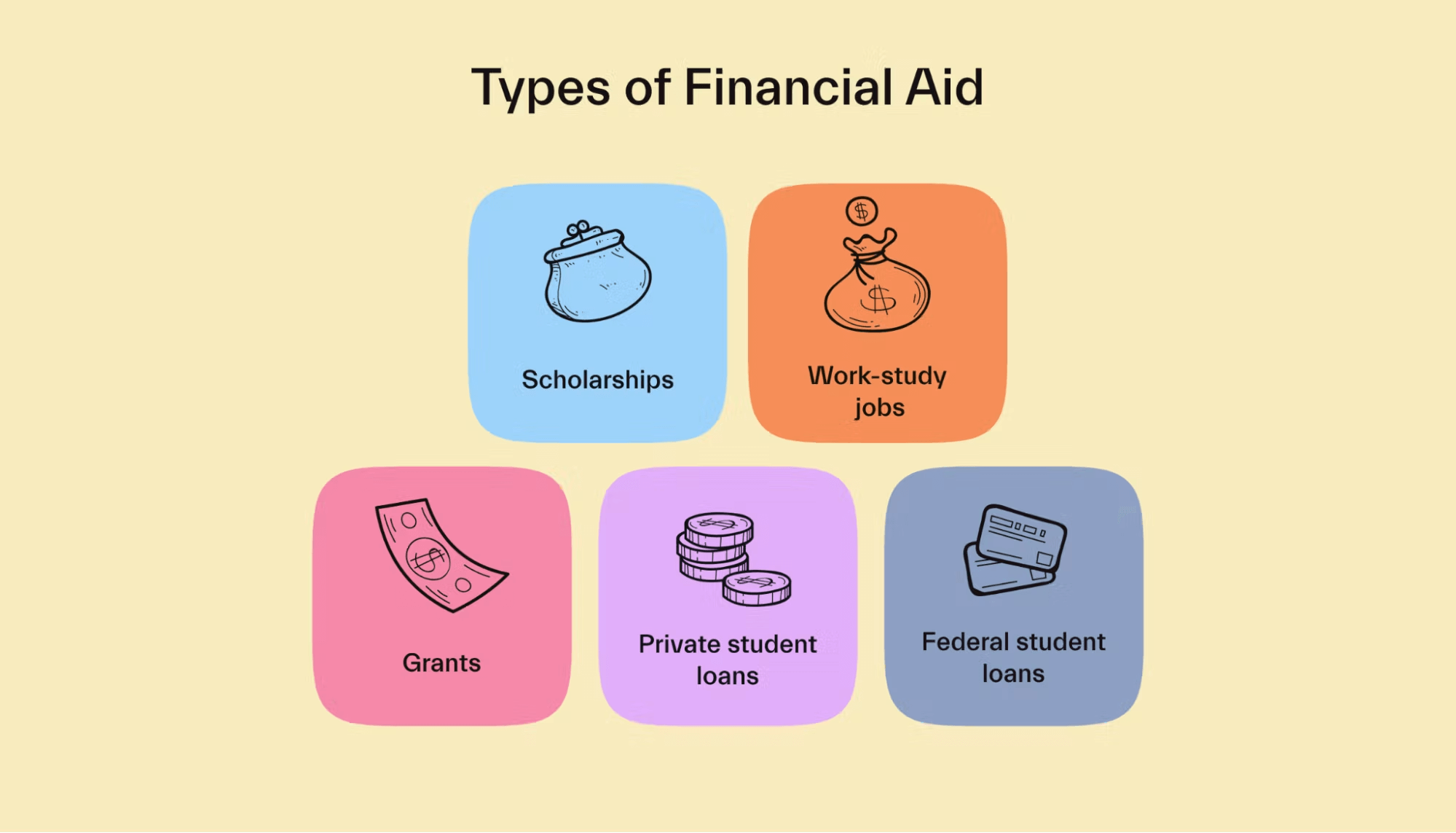

Types of financial aid for trade schools

Students should be aware of a few types of financial aid. Most of them are available to vocational school students (again, as long as the school’s accredited!).

In addition to these programs, the schools may offer their own forms of financial aid. Again, check with the school you plan to go to for details.

Federal and state grants

Grants are free money for school funded by federal and state governments. The most common grant is the federal Pell Grant. Federal grants are applied for via the FAFSA, while state grants may require separate applications.

Grants are a form of need-based financial aid. They are primarily available to students who demonstrate a financial need—so lower-income students will typically have a better chance of qualifying for grants.

Many grants are available to trade school students, but you’ll want to double-check each grant’s requirements.

Federal student loans

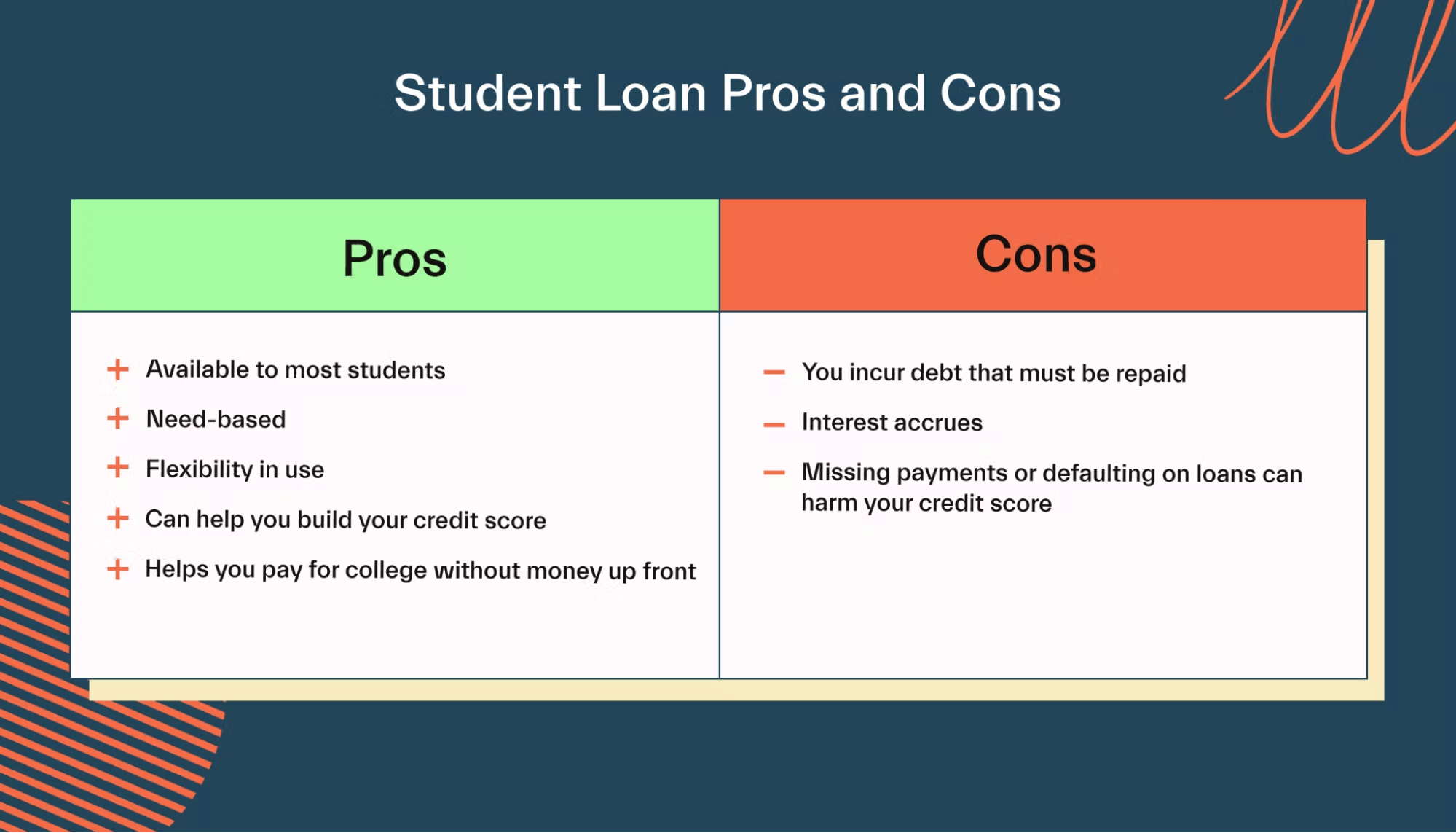

Federal student loans are loans that are backed by the federal government. Because they’re loans, they must be repaid eventually—with interest.

Although student loans need to be paid back, they offer relatively low-interest rates because they’re subsidized by the federal government. Plus, students don’t need to start making repayments until after they graduate. And student loans are easy to get approved for, even if the student doesn’t have an income or much of a credit history.

For these reasons, most students take out student loans to help them pay for school.

Federal student loans are applied for via the FAFSA. Therefore, they are available to students attending trade schools as long as the trade school is accredited.

Although student loans are applied for via the FAFSA, students can choose how much they wish to borrow. The FAFSA will determine the maximum loan amount available, and then the student will work with their school’s financial aid department to determine how much is needed. Most students pay for school using a mix of loans, scholarships, and their own/family money.

Private student loans

Private student loans are loans available from banks, credit unions, and other private lenders. They are NOT subsidized by the government and must be applied directly from banks. The FAFSA isn’t involved with them, either.

Private student loans are substantially more challenging to get approved for than federal loans. This is because applicants must generally have good credit and a solid income to qualify. In addition, the interest rates on private loans can vary significantly depending on the borrower’s creditworthiness.

Depending on the lender and school, private loans can typically be used for vocational schools. Each lender sets their own rules and restrictions on what the loans can be used for—so if you choose to go this route, ask your lender if the loans can be used for trade school.

Work-study jobs

Work-study is a unique form of financial aid that helps students find part-time employment while in school. Students can apply for work-study on the FAFSA. They can find a part-time job with a qualifying employer on or near campus if approved.

With work-study, students still need to work to earn money. The idea of the program is to make it simpler for students to find work and more attractive for employers to hire students.

If you’re approved for work-study via the FAFSA, you aren’t required to utilize it. But if you are interested, you can check with your school’s financial aid office for details on how to apply for qualifying jobs.

Scholarships

Scholarships are another form of free money for school. Unlike student loans, though, scholarships don’t need to be paid back.

Schools, government agencies, businesses, and even generous individuals can offer scholarships. They can be awarded based on merit (academic performance or athletic ability, for instance), identity (first-generation students, for example), or financial need.

Some scholarships are available for trade schools, but many are reserved for undergraduate students at traditional colleges. Therefore, you’ll want to check the fine print of any scholarship opportunities you plan to apply for.

In most cases, the student must apply for the scholarship directly with the organization offering it. You can search online to find opportunities you might qualify for and submit your application.

How to pay for trade school

Paying for vocational training can be expensive. Most students end up using many funding methods to make ends meet. Here are just some of the ways you can pay for trade school:

Student loans (federal or private)

Grants (federal or state)

Scholarships

Work-study programs

Self-pay

School payment plans

Tax credits

We’ve discussed most of these options in detail already, but there are 2 aspects of paying for school that we haven’t yet talked about: payment plans and tax credits.

School payment plans at trade schools

Payment plans are a unique option that some schools offer. The details vary by school, but the basic concept is to allow students to pay for tuition in monthly installments instead of all at once.

For instance, a school may offer a payment plan that allows a student to pay $700 per month instead of $4,200 upfront for a 6-month program.

These plans can make paying for school easier if you don’t qualify for traditional financial aid. Plus, some non-accredited schools (which don’t qualify for federal financial aid) also offer these payment plans.

Because the details of these programs vary, it’s essential to check with your school to see if they offer payment programs—and to get clear on how exactly they work.

Tax credits

Tax credits are available to qualifying students with qualifying educational expenses. They lower the amount of money you have to pay in taxes—and can, in some cases, even help you get a bigger tax refund!

Tax credits won’t directly help you pay for school when your tuition is due, but they can help reimburse you for some expenses when you file your tax return.

A common tax credit is the American Opportunity Tax Credit (AOTC). This credit can be worth up to $2,500 per year. If you have qualifying tuition costs and meet the other requirements, you can use the AOTC when filing your taxes to help offset your tuition expenses.

Conclusion

Financial aid is generally available for trade schools as long as the school is accredited and the program is at least 15 weeks long. But you’ll want to check with your target school directly to confirm that you can use financial aid if you go there.

Want more help navigating how to pay for school? Mos is a money app for students with 1-on-1 financial aid help, a $160 billion scholarship pool, and much more. Explore student memberships today.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you