Financial aid •

October 28, 2022

What's a Student Aid Report?

Once you submit your FAFSA, you’ll get a document called a Student Aid Report. Here’s everything you need to know about it.

So you finally knocked out your FAFSA form. Step one on your way to getting federal financial aid is done!

After a few days, a document called a Student Aid Report, or SAR, should arrive either electronically or by mail for you.

Don’t worry—this isn’t another document to fill out.

However, it’s important to hold on to and understand it.

So in this article, we’re going to explain what the SAR is, what’s on it, and why you might need it. Toward the end, we’ll also answer some frequently asked questions regarding the SAR and its contents.

What is a Student Aid Report?

The Student Aid Report, or SAR, is a document you receive after submitting your Free Application for Federal Student Aid (FAFSA). It contains a bunch of important information relevant to your FAFSA and federal aid eligibility.

Once you submit your FAFSA, the government processes it, then sends a SAR to you and to your chosen schools. Schools use the information on it to put together your aid package.

Below, we’ll break down the sections you need to know about:

Data release number

Your data release number, or DRN, is a 4-digit number the Department of Education (ED) assigns to your FAFSA.

Once you finish and submit the FAFSA, your DRN shows up on your FAFSA confirmation page.

It will also appear in the upper-right-hand corner of your SAR.

Your DRN is important to know if you ever need to make changes to your FAFSA. You should keep it private and only share it with your school’s financial aid office or FAFSA customer service representatives.

Sharing it with these people authorizes them to access your FAFSA information so they can fix things.

Expected family contribution

Your expected family contribution (EFC) is a number the government calculates based on yours’ and your family’s financial information that you put on the FAFSA.

It estimates your financial need by looking at what they think your family could contribute (regardless of how much they actually pay for your college).

If you’re considered an independent student by the ED, it may use your finances instead of your parents’.

The schools you choose on your FAFSA use the EFC to calculate and put together your total financial aid award. Each school subtracts your EFC from its cost of attendance to figure your total financial needs.

Something to keep in mind: the FAFSA Simplification Act will cause the EFC to change to the Student Aid Index, or SAI, starting in July 2023.

The change is mostly in name only. That said, the SAI will be able to go below $0 to as low as -$1,500. This is supposed to help more accurately reflect your financial need.

FAFSA information

The SAR contains all of your FAFSA information for record-keeping purposes and so that schools are more aware of your financial situation.

You can also use the SAR to double-check your answers and correct any errors if necessary.

Pell Grant eligibility

Pell Grants are federal grants designed for low-income students and are awarded by the ED. Your SAR will show you if you’re eligible for a Pell Grant and, if so, how much.

For the aid year 2020–2021, the maximum Pell Grant you can earn is $6,495.

Outstanding federal loans

If you’re taken out federal student loans in the past, your SAR will list each loan you still have to pay.

That way, you can remain aware of how much debt you already have to pay back—which is important for making decisions about taking out more student aid this year.

Verification selection

There’s a chance the ED selects your FAFSA for verification. This means they want you to provide additional documentation to prove certain information on your FAFSA is correct.

If you’re chosen, your SAR will have an asterisk next to your EFC number.

Don’t worry: being selected for verification doesn’t necessarily mean you’re in trouble, so don’t assume they’re accusing you of lying.

Still, you should take action as soon as possible. Cooperating and providing what they need quickly shows you’re acting in good faith and helps you resolve the FAFSA stress faster!

When and how do I get my SAR?

If you submitted your FAFSA online and provided a valid email address, you should receive an email with instructions on viewing your SAR online at fafsa.gov.

If you did it online but didn’t provide an email address, you’ll get a form called a SAR Acknowledgement in the mail.

If you filed a paper FAFSA, you should receive a paper SAR in the mail within 3–4 weeks.

Regardless of the method, you’ll eventually be able to view an online copy of your SAR by logging into the FAFSA with your FSA ID and selecting “View or Print your Student Aid Report (SAR)" near the middle of the “My FAFSA" page.

Additionally, you can request to receive a paper copy in the mail by contacting the Federal Student Aid Information Center at 1-800-4-FED-AID (1-800-433-3243; TTY for the deaf or hard of hearing 1-800-730-8913).

What do I need my SAR for?

Your SAR has a few main uses. They are:

Updating or correcting FAFSA information

Editing your list of schools or trying to add more than 10

Reporting incorrect SAR information

Even if you don’t need to do these, hold onto SAR for your records. You never know when you might need it on hand.

Anyways, let’s look at each of these uses in more detail to see how the SAR comes into play.

Making FAFSA corrections or updates

If you made some errors, forgot to include information, or your situation changes after submitting your FAFSA, you have a chance to make corrections.

You’ll need your DRN to make those changes, which is on your SAR at the top right corner above your EFC.

With that in hand, you can contact FAFSA customer service to make corrections. You’ll provide the representative with your DRN to make certain corrections, such as fixing your email and mailing addresses, phone number, and housing plan.

Adding more than 10 schools to the FAFSA

You can only add 10 schools to the FAFSA when you’re first filling it out.

Later, however, you can update your FAFSA and add more than 10 schools or simply update your existing list.

To do so, you’ll need your DRN from your SAR.

The process of adding or removing schools is the same as making FAFSA corrections or updates—you’ll just need to also provide the school codes for schools you’re adding.

Reporting incorrect SAR information

Once you get your SAR, you should check it against your FAFSA numbers to see if anything doesn’t look right. There’s always a small chance some information you recorded on the FAFSA ends up different on your SAR.

By making sure your info is correct, you’ll be able to get the most money that you’re eligible for!

FAFSA SAR FAQs

Do you have more questions about the SAR and why you need it? Check out some frequently asked questions about the FAFSA SAR below.

What do I need my SAR for?

Your SAR contains a lot of helpful information. For instance, it has your DRN and FAFSA answers, which can help you make corrections if necessary.

It also has your EFC, federal Pell Grant eligibility, and outstanding loan information. You can use this to help you plan out how much you’ll pay and what sources of aid you’ll rely on.

The SAR also tells you if the ED selected your FAFSA for verification. If you’re selected, you need to provide whatever extra documentation the ED asks for.

How do I access my SAR?

If you have an FSA ID, you can view an online copy of your SAR regardless of how you filled out your FAFSA.

Reach out to the ED as soon as possible if you haven’t received your SAR after 3–4 weeks.

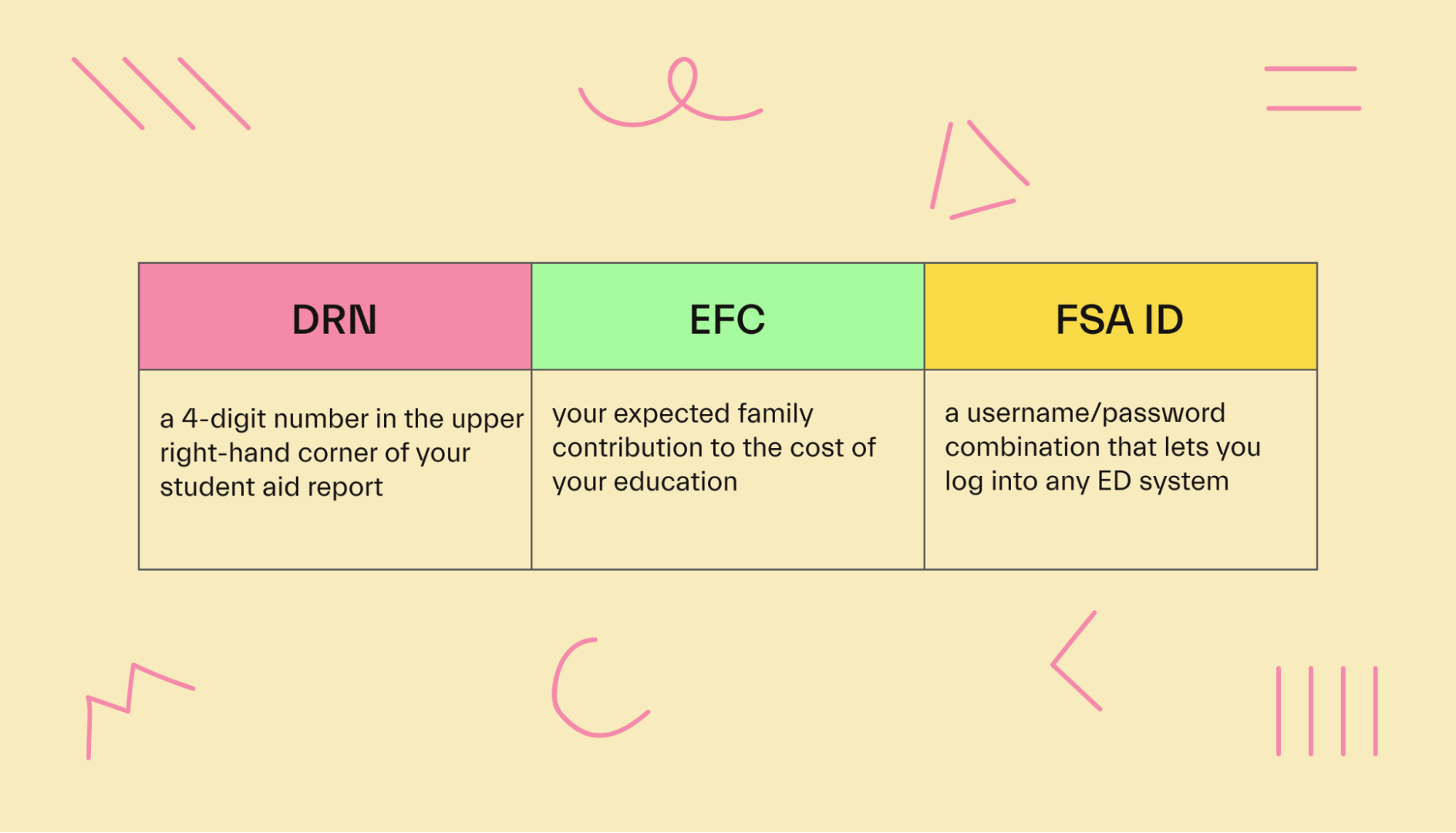

What’s the difference between my DRN, EFC, and FSA ID?

The FAFSA has a lot of acronyms. 3 of the most important are your DRN, EFC (soon to be SAI), and FSA ID.

Your DRN is a 4-digit number that appears at the upper right-hand corner of your student aid report—right above your EFC. You need your DRN if you ever have to make corrections to your FAFSA. When you contact FAFSA customer service, giving them your DRN lets them get into the system and make those fixes.

Your EFC is right below your DRN on your SAR, and it helps the government determine your estimated financial need. The SAI will replace it in 2023—mostly a name change, except the SAI can be a negative number.

Your FSA ID is a username/password combination that lets you log into any ED system, including the FAFSA. According to the ED, your FSA ID is your legal signature, so only you should use it.

You can learn more about FSA IDs from the ED’s Federal Student Aid office.

What is the deadline for the FAFSA application?

In general, the federal deadline for FAFSA applications is June 30 of the academic year you actually attend. For instance, if you’re filing for the academic year 2022–2023, you can file as late as June 30, 2023.

That said, you shouldn’t wait this long.

For one, some forms of aid are first-come, first-serve. You can miss out on some aid if you wait too long.

Additionally, states may have earlier deadlines for state-based aid programs. Individual schools may have their own earlier deadlines as well.

When in doubt, applying as early as possible is often best. You can always make corrections later if something changes unexpectedly.

What is the deadline for FAFSA corrections?

The deadline for FAFSA corrections is generally 2.5–3 months after the regular deadline. For instance, the corrections deadline for the 2022–2023 academic year is September 10, 2023.

Once you receive your SAR, you should double-check everything and make any corrections right away. It’s easy to put off and forget about, and, as we mentioned, some forms of aid can run out.

Conclusion

Your SAR is the key document for determining your federal aid eligibility, and you also need it to correct errors or add schools after you submit your FAFSA.

Make sure you hold onto it once you get it, even if you don’t need to do any of these things.

And remember: keep your SAR private. Don’t show it to anyone except for financial aid employees, ED customer service representatives, and maybe your parents. Information like your DRN can be used by the wrong person to access your sensitive financial aid information.

For more answers to your financial aid questions, check out these 8 facts about financial aid in 2021.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you