Financial aid •

December 18, 2021

Things to watch out for when you sign your financial aid award letter

Your scholarship award letter tells you all about your education financing. Here’s what to watch out for when signing it.

One of the most important aspects of preparing to head to college is lining up your finances.

This process includes learning the price tag of your education and finding out what financial aid you might be eligible for.

Much of this information will come in the form of a financial aid award letter, also known as a scholarship award letter, which you’ll receive after you get your acceptance letter from a college or university.

Unfortunately, these letters can be difficult to understand, and you might find yourself wondering what it is you’re looking at, and what your next steps are supposed to be.

In this article, we’ll help you understand your scholarship award letter. We’ll also show you how to use the information to choose the right school for you.

What is a financial aid award letter?

A financial aid award letter is a document you’ll receive from a school you’ve been accepted to, detailing your financial aid offer.

In most cases, the term ‘scholarship award letter’ refers to the financial aid award letter you’ll receive from a university. Most people use these terms interchangeably and to refer to the same document.

This award letter will contain important information about your financial aid, including any scholarships and grants you’ve been awarded, loans you’re eligible for, and how much you’ll need to pay out-of-pocket.

When will you receive your financial aid award letter?

Usually, schools send out their award letters around the time they send acceptance letters.

It’s important to note that your financial aid offer is dependent on the information you provide in your Free Application for Federal Student Aid (FAFSA).

To receive an accurate award letter, you must fill out your FAFSA. Otherwise, you’ll be ineligible for most financial aid. The one exception to the FAFSA requirement is students ineligible to complete it due to their citizenship—they’ll have to complete a special state or school financial application to receive any aid.

For certain types of aid, schools only have a finite amount to give out. Once the money has been awarded, there’s none left for the rest of the students.

As a result, you may increase your aid award by applying to schools and filling out your FAFSA as early as possible.

What is typically included in a financial aid award letter?

Each school issues its own financial aid award letter, and there’s no standardized format.

The letters you receive from each school you applied to might look slightly different from one another, but they’ll all include the same basic information.

Let’s look at the information you can expect to see in your financial aid award letter.

Expected family contribution

Your expected family contribution (EFC) is one of the most important factors that influence how much financial aid you can receive.

Your EFC is how much the US Department of Education believes you and your family can contribute to your college costs. This dollar amount doesn’t change based on the school you attend.

Your EFC is based on your and your parents’ income and assets. In general, the government expects students and their families to contribute a certain percentage of income and assets to education costs.

Your EFC also depends on a few other factors, such as the size of your family and the number of children in your family currently attending college.

The larger your family and the more students in college, the less the government expects your family to contribute to each student.

Cost of attendance

The cost of attendance (COA) in your financial aid award letter is the cost of attending that particular school for a single year.

Schools are required to disclose their official COA, which is the cost of attendance for a single academic year from fall to spring.

Your COA includes your tuition costs, but it covers much more than that. It also includes the cost of room and board, books, supplies, transportation, loan fees, miscellaneous expenses, and more.

Schools will have different COAs depending on whether you’re living on-campus or off-campus, paying in-state or out-of-state tuition, attending part-time or full-time, and more.

It’s important to look at the COA in your financial aid offer letter rather than relying on the information on the school’s website or other sources.

Keep in mind, the COA you receive isn’t what you’ll pay––it’s the total cost, which includes your share of the expenses, as well as any financial aid you’re eligible for.

Financial need

Your financial need is the difference between your EFC and your COA. It’s also the number that determines how much need-based financial aid you’re eligible for.

Suppose your COA at your dream school is $20,000, and your EFC is $12,000. Your financial need—and the maximum need-based aid you’re eligible for—is $8,000.

Estimated financial aid offer

The final important section of your award letter will be the financial aid you’re eligible for. This aid will come from the federal government, your state government, and the school.

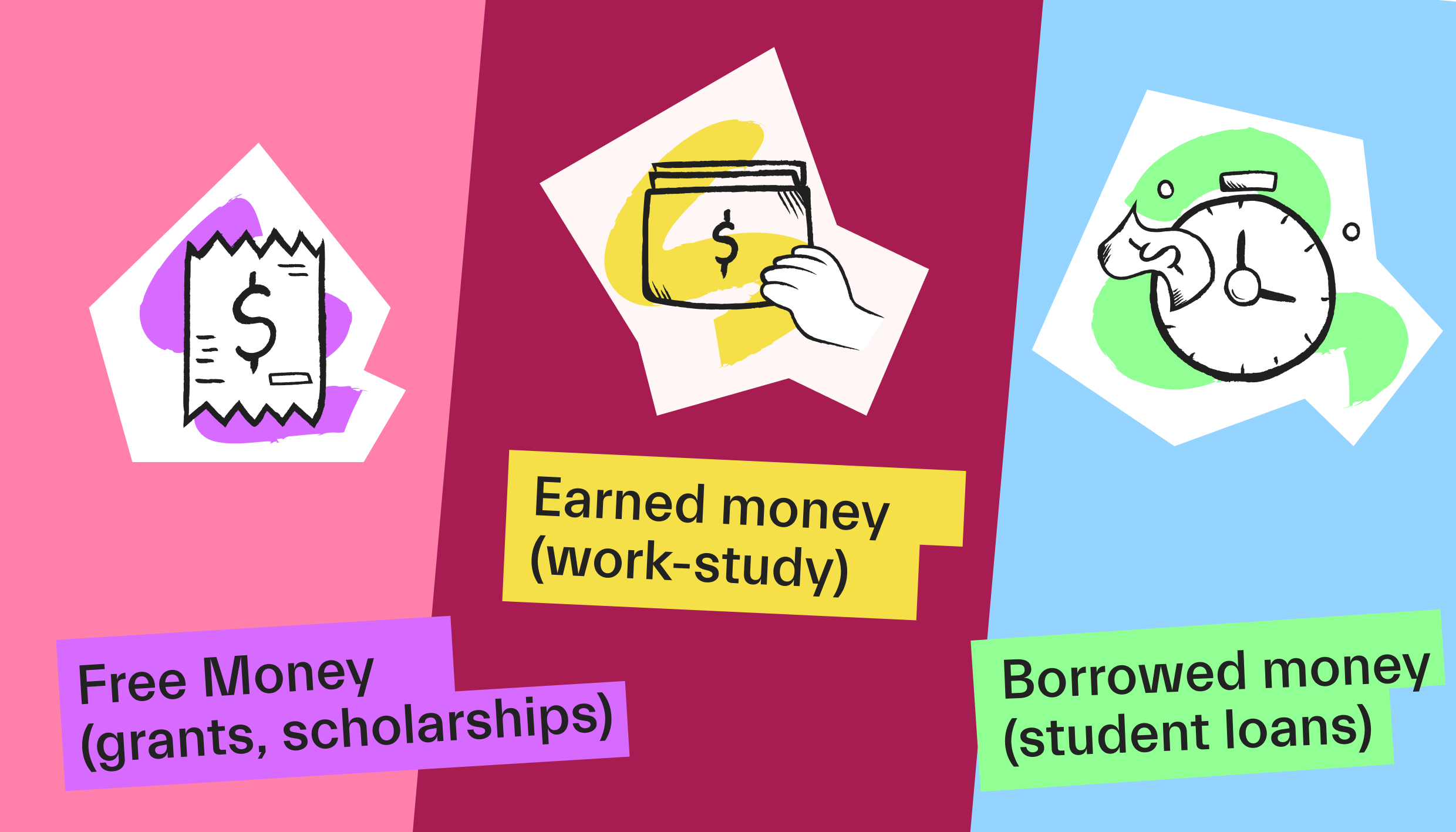

Aid comes in 4 primary forms:

Grants: A grant is a form of financial aid that you don’t have to repay after you graduate. Grants are usually need-based, meaning they’re awarded to families with low to moderate incomes who may not be able to cover much of the cost of college. The most common grant awarded is the federal Pell Grant, which offers up to $6,345 per year.

Scholarships: Like grants, scholarships are a form of aid you don’t have to repay. Unlike grants, scholarships are usually based on merit rather than need. The schools you apply to may include merit scholarships in your financial aid award letter as a way to get you to attend their school over another.

Work-Study: This federal program allows students with financial needs to earn a certain amount of income through on-campus or off-campus jobs. You can usually either receive a paycheck for your work hours or have the money applied directly to your tuition.

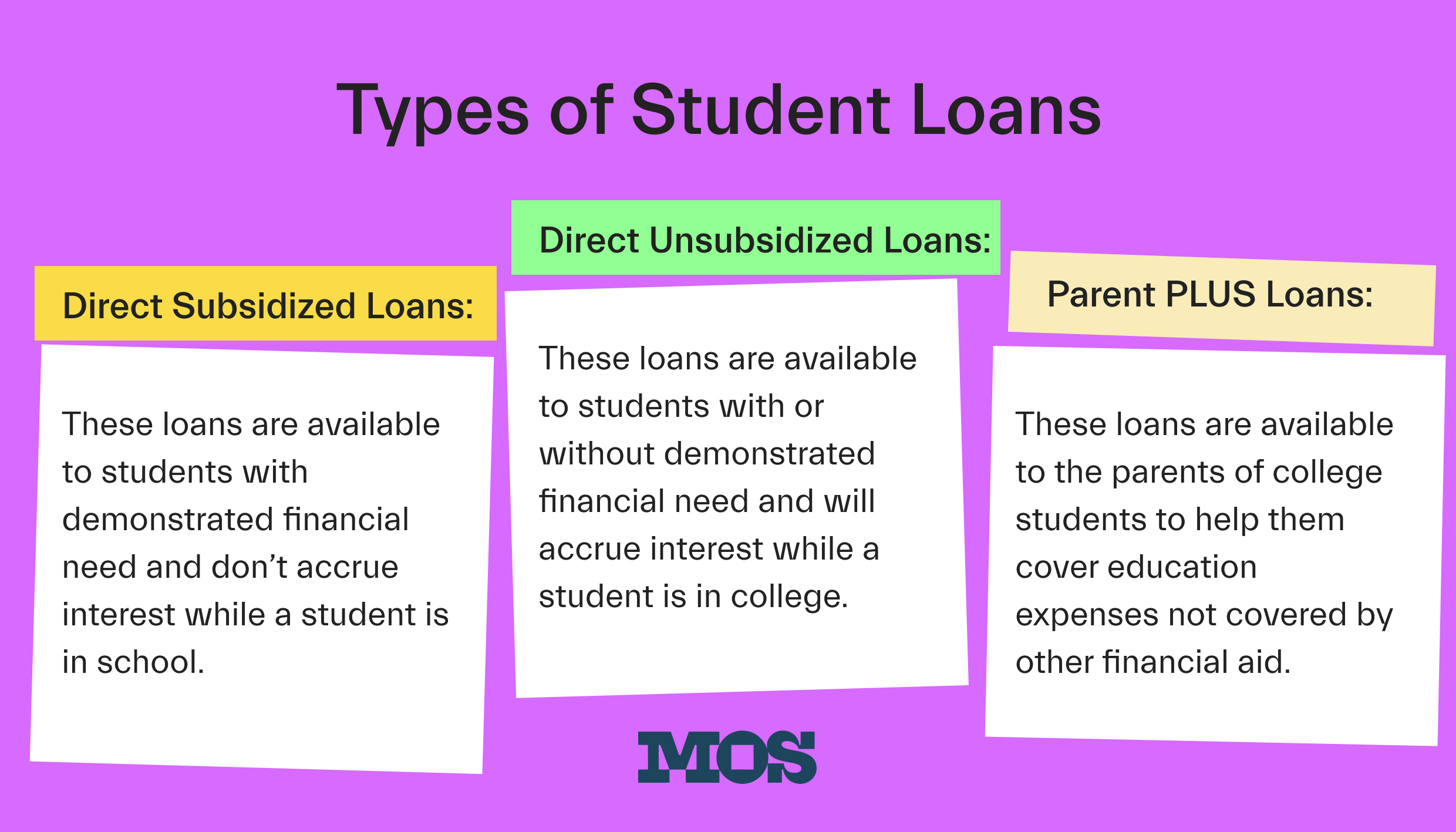

Loans: Student loans are a form of federal aid that you’ll have to repay after you graduate. The federal government offers several types of loans that come with low interest rates and flexible repayment terms.

A subsidized loan is one available to students with financial needs. These loans don’t accrue interest while you’re in school.

On the other hand, an unsubsidized loan does accrue interest while you’re in school, but you don’t have to demonstrate as much financial need to be eligible.

Finally, a Parent PLUS loan is available to the parents of college students to help them cover the cost of college.

5 things to watch out for in your scholarship award letter

Once you’ve received your award letter, the next step is to figure out exactly what to do with it. These letters can help you compare offers from different schools and decide the best fit.

Let’s take a look at 5 things you should watch out for in your scholarship award letter:

1. Determine your total out-of-pocket cost

Your award letter is going to include a lot of information and many different dollar amounts, and that can be confusing to navigate.

The first step is identifying exactly what your estimated out-of-pocket cost is going to be.

But more than just checking your EFC, it’s important to compare the different types of aid you’re offered. After all, not all financial aid is created equally.

Some forms of financial aid are free money. Scholarships and grants don’t typically have to be repaid when you graduate, so they can be a great source for funding your education.

Next, look at the aid you’re eligible to earn (in other words, work-study). This aid isn’t exactly free money since you have to work for it. But unlike student loans, you won’t have to pay your work-study income back.

That being said, many work-study jobs pay minimum wage, and you may be able to earn more by seeking out a different part-time job.

Finally, look at the aid you’ll have to pay back when you graduate. Student loans are the most widely available form of financial aid, but they also come with the most strings attached.

Not only do you have to pay this money back, but you’ll also pay interest.

And depending on whether you get subsidized or unsubsidized loans, interest may accumulate the entire time you’re in school.

2. Compare financial aid award letters

If you’ve applied to multiple schools, you should receive a separate financial aid award letter from each school. The EFC on each letter will be the same, since you submit one FAFSA for all schools, but the rest of the information is likely to be different.

Your financial need, and thus the amount of aid you’re eligible for, is based on both your expected family contribution and the cost of attendance. If a school has a higher cost of attendance, you may be eligible for more financial aid.

When you’re comparing your award letters, look specifically at the amount of free money each school is willing to offer. A school with a higher cost of attendance might still be more affordable if the school offers more aid.

For example, some schools offer free tuition and fees to students who fall under a certain income level.

While that school might normally have a higher price tag, a low-income student would likely save money by attending that school over another.

3. Look at the big picture

Remember that the award letter you receive represents just 1 year of your college education.

If you’re on a normal 4-year schedule, it’s just 25% of the total aid you’re likely to be eligible for—but also just 25% of the total out-of-pocket cost.

Having your award letter in hand might help you plan your financial strategy for the next 4 years. This can help you decide how much you should rely on student loans vs. your own savings and other sources of income.

4. Negotiate your aid package

If your financial aid offer is lower than you expected, don’t worry, you may be able to negotiate!

To negotiate your aid offer, you’ll have to write an appeal letter to the school’s financial aid office explaining why you think you should get a higher amount.

When negotiating your aid package, you’ll generally want to provide either a need-based or merit-based reason for your appeal.

A need-based reason could be that your family’s financial situation has changed since you completed your FAFSA form.

Merit-based reasons could include an improvement in your academic record or competing aid offers from other schools.

For help negotiating, sign up for Mos. An advisor can help!

5. Prepare the rest of your financing

There’s a good chance the aid you receive won’t be enough to cover your entire college costs.

You and your family have to figure out how to cover your EFC, and if you don’t have the funds to do so, you might have to arrange other forms of financing.

One way you might get the rest of your financing is through private student loans, which are available through many lenders.

You can also apply for private scholarships to help supplement your aid.

It’s also important to remember that you don’t have to accept your entire financial aid amount.

If you’d rather reduce your student loan burden, you can apply for additional scholarships or work to start saving for tuition expenses.

How do you accept your financial aid award?

Once you’ve compared your financial aid offers and made your decisions, it’s time to accept your offer.

First, read the award letter for the school you’re attending. Chances are, it includes instructions on how to accept your aid offer. Follow those instructions to contact the school and formally accept.

Pay close attention to any deadlines included in the letter. If you don’t formally accept by the deadline, you may lose out on some of the aid you’ve been promised or even lose your spot at the school altogether.

Once you’ve accepted the aid offer from the school you’re attending, be sure to contact the other schools to decline their offers.

Finally, complete any paperwork necessary to receive each type of aid. Aid from the school may be automatically applied to your tuition bill. But in the case of student loans, you’ll have to complete certain forms or loan applications.

Conclusion

When it comes to planning for college and choosing the right school for you, one of the most important considerations is cost.

An important part of that process is receiving and understanding your financial aid award letter, which outlines your financial aid package and your out-of-pocket cost to attend school.

Navigating this information isn’t fun, but financial aid can help to ease the financial burden of attending college.

Quit leaving money behind. Work 1:1 with your Mos advisor to find every dollar you qualify for.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you