Financial aid •

How does financial aid work?

Financial aid is available from many sources and helps you to afford to pay for your college degree. Find out how it works and how to apply.

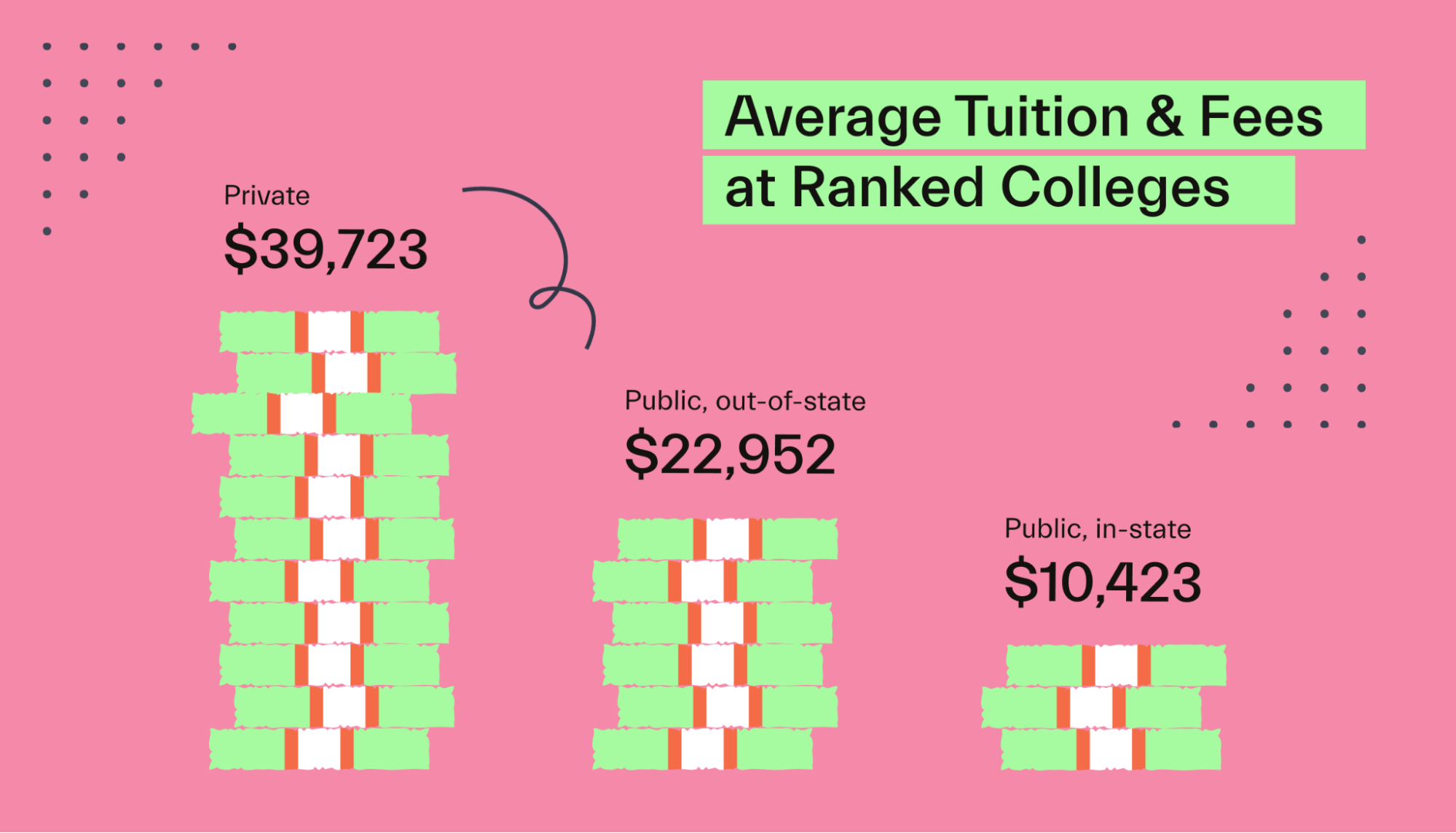

College can be expensive. The average annual cost for a college degree is over $30,000.

This is why figuring out how you’ll pay for college is one of the most important steps to take as you think about getting a college education.

If you think that a student loan is the only way to cover your educational expenses, we’ve got great news for you: the Department of Education (DOE) has over $120 billion (that’s $120,000,000,000!) in financial aid available for students.

And, other institutions have money to offer too.

You could be eligible for some of that money, giving your college budget a much-needed boost.

This guide will walk you through what financial aid is, types of financial aid, how financial aid works, and how to apply for financial aid.

What is financial aid?

Financial aid (also called student aid) is money that a third party gives you to help you pay for college expenses. An example of this aid is the $120 billion the Department of Education offers for eligible students.

While the DOE is the biggest source of financial aid, other institutions like state agencies, schools, and nonprofits also offer financial aid to eligible students.

Contact your state agency to learn about participating institutions for your program.

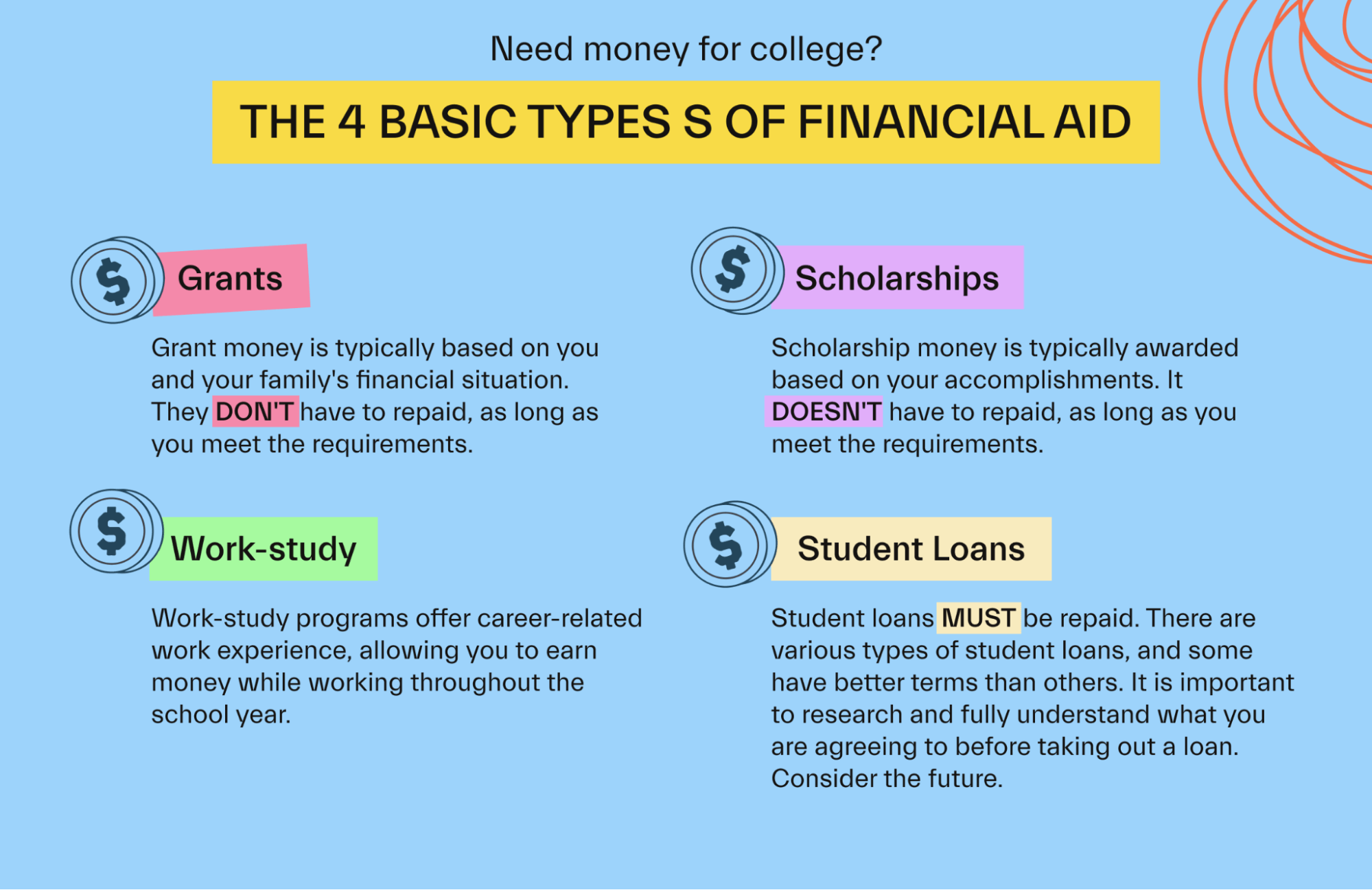

What are the types of financial aid?

There are two main types of student financial aid: free money and self-help funds (money that you have to earn or pay back).

Free money

Financial aid, like scholarships and grants, is a gift that you won’t have to pay back under most circumstances.

This type of financial aid helps cover the cost of your education. To receive financial aid that qualifies as free money, you’ll typically have to demonstrate financial need or meet academic requirements (such as a minimum GPA or enrollment in a specific program).

If you meet the requirements of the organization giving you the free money (such as continuing your studies or attending college at least part-time), you won’t have to pay this financial aid back.

Self-help

‘Self-help’ financial aid is a type of financial aid that you have to earn through work or pay back. You’ll have to do something for that money. Examples of self-help financial aid are work-study programs, federal TEACH and military grants, and student loans.

In the Federal Work-Study program, you’ll have to work an eligible job to earn financial aid provided by the government.

In a student loan scenario, you’ll usually have to pay the money back plus applicable interest.

The two main types of student loans are federal student loans (loans issued by the DOE) and private student loans (loans issued by an institution other than the DOE).

Do I have to pay back financial aid?

It depends on the type of financial situation that you receive.

If you receive free money (like a grant or a scholarship), you don’t have to pay it back as long as you meet the requirements. A common requirement is to be in school at least half-time.

If you receive self-help funds (such as through a work-study program or a student loan), you’ll receive the financial aid as long as you meet the requirements.

A work-study program requires you to find, apply, and secure a job that meets the program’s requirements so you can receive the financial aid. In the case of a student loan, you’ll have to pay back the financial aid based on the terms of the loan.

How does financial aid work?

Financial aid is cash that you receive from the government, a state agency, a school, or a private organization. Whether or not you have to pay that money back depends on the type of financial aid you received (free money vs. self-help).

In some cases, the money is disbursed directly to you (such as through a direct deposit to your bank account), and in other scenarios, it’s paid directly to the college or university you’ll be attending, and the school applies the funds to your tuition.

Where can I find financial aid?

The biggest source of student financial aid is the Department of Education. The money provided by the DOE is also called federal financial aid, federal aid, or federal student aid.

You have to complete a Free Application for Federal Student Aid (FAFSA®) to find out what federal financial aid is available to you.

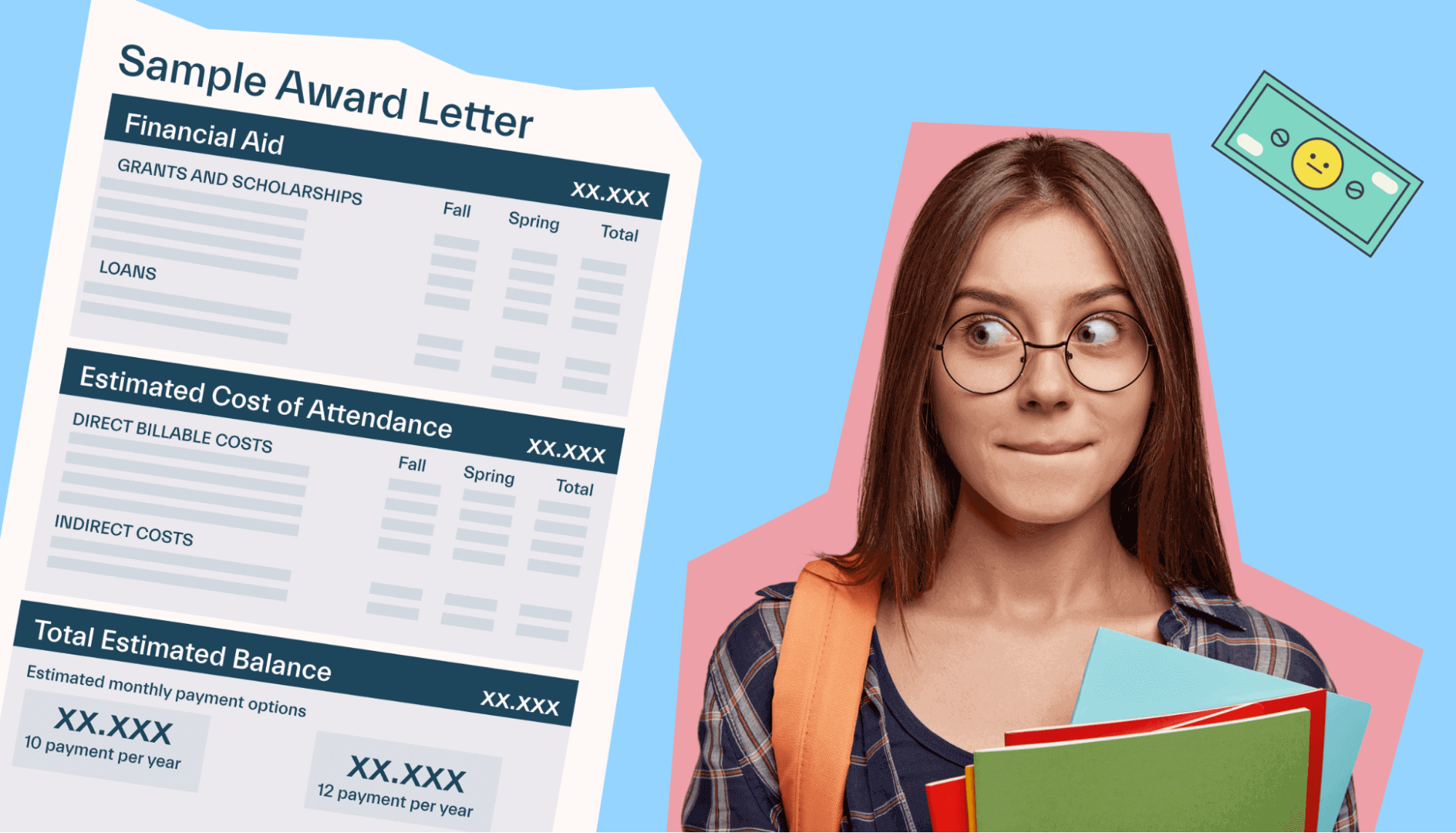

Once your school has processed your FAFSA, you’ll receive a financial aid award letter breaking down your:

Financial aid: grants, scholarships, work-study programs

Cost of attendance: Tuition, fees, living expenses

Student loan options to finance the difference between the financial aid and cost of attendance (if applicable)

But FAFSA is not the only way to get financial aid—it’s just your starting point.

There are plenty of niche scholarships, grants, and other forms of financial aid you can apply for directly.

For financial aid from other sources, you’ll need to follow the guidelines from the organization offering you those funds.

With Mos, you can gain access to every single state and federal aid program you’re eligible for. This can be the difference between $13,000 and $42,000––$29,000 more per year than what you’d receive if all you did was complete the FAFSA.

Want help filing the FAFSA and getting the most financial aid possible? Connect with a financial aid expert today to get started.

Are student loans the only type of financial aid available?

No, there's plenty of financial aid besides student loans out there to help you pay for college.

The government offers free money, such as scholarships and grants, that students will likely not have to pay back.

One big step to unlocking financial aid is to fill out the FAFSA. But it should never be your only step.

Still, only 71% of families filled out the FAFSA form in the 2019-20 academic year—a big drop from 83% of families 2 years ago.

If you need help completing the FAFSA or extra help finding scholarships and grants, sign up for Mos. We can help you find the right scholarships for you and save time applying by focusing on the right opportunities.

What are examples of financial aid?

Financial aid can come in many forms.

While the Department of Education is the main source, it’s important to explore all options. Your options include your state government, target schools, private sources recommended by your schools, and niche scholarships.

Gift and ‘self-help’ are broad categories that include many types of financial aid. Let’s review in more detail the financial aid options available for you.

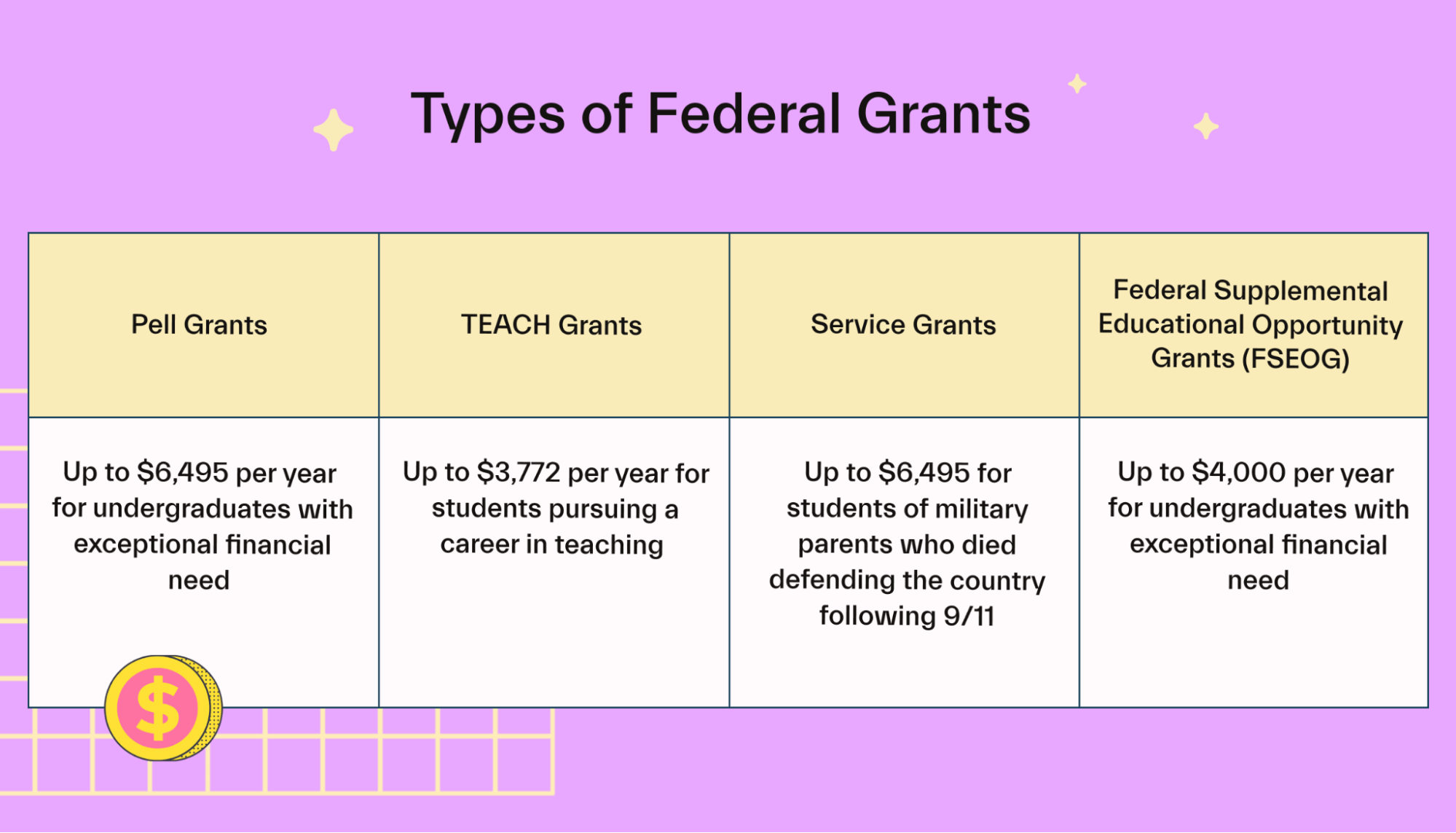

Grants

A grant is merit-based or need-based financial aid and requires you to submit supporting evidence. When you’re eligible for a grant, you won’t have to pay it back. Typically, as long as you stay in school and meet the necessary requirements, a grant stays as free money.

One example of a need-based grant is the Federal Pell Grant, which is a federal grant usually available to undergraduate students with great financial need.

Some types of need-based financial aid may require you to pursue a specific career. An example is the Teacher Education Assistance for College and Higher Education Grant, or TEACH Grant for short.

This grant requires you to complete four years of qualifying teaching to keep your free money. Otherwise, it’ll turn into a student loan that you’ll have to pay back in full.

Scholarships

Just like grants, scholarships are a type of financial aid that you won’t have to pay back under most circumstances.

Like grants, scholarships may be need-based (dependent on financial need) or merit-based.

Most of the time, you’ll need to have a minimum GPA, demonstrate a skill, have membership in a specific group, or choose a specific major for a merit-based scholarship.

Examples of scholarships include:

Scholarships for minority groups

Athletic scholarships

Arts and music scholarships

First-generation scholarships

Religious and community group scholarships

Mos can also help you with scholarships. Mos members gain access to the largest scholarship pool in America (over $160 billion worth)! Explore membership today to see why thousands of students trust Mos to maximize their financial aid dollars.

Work-study programs

A work-study job program allows you to earn cash to cover the cost of tuition and other eligible expenses.

In most situations, you’ll earn at least the minimum wage. Most undergrads receive an hourly wage, while some graduate students may be eligible for a salary.

Typically, your pay can’t exceed your total financial need. For this reason, your work hours may be limited.

Depending on the terms of your work-study program, your employer may pay you directly or make the payments to your college for eligible education expenses (tuition, fees, and room and board).

The Federal Work-Study program from the Department of Education is the most popular work-study program.

Many states offer work-study programs separate from the federal program. Consult with your state’s department of education.

Student loans

A student loan is a fixed amount of money that you borrow and pay back according to a schedule (typically monthly). Key elements of a student loan include:

Principal: The original amount that you borrow.

Interest rate: The cost of the money that you borrow, usually expressed as a percentage.

Repayment term: The life of the loan: how long it takes you to pay it all back.

Monthly payment: The amount that you send to your lender every month. This payment depends on the interest rate and repayment term of the loan.

When you borrow from the Department of Education, you take out a federal student loan. When the lender is an organization other than the DOE or a state organization, then you’re typically taking a private student loan.

A federal subsidized loan covers your interest payment while you're in school and defers your payment up to 6 months after graduation.

If you have to take out a loan, you should first seek a federal subsidized loan and only then consider a federal unsubsidized loan.

The next options to consider are state student loans. A private student loan should be your last option when evaluating student loans since they tend to have less favorable terms and higher interest rates.

How do you apply for financial aid?

Applying for financial aid is essential—you usually won’t get a dime unless you ask.

In the 2019-20 period, 43% of students that didn’t fill out the FAFSA said that they believed that they wouldn’t qualify for any aid.

The reality is that the Department of Education has to allocate about $120 billion in financial aid every year. Often, some of those funds go unused.

A key step in applying for financial aid is completing your FAFSA. If you’re struggling to fill out your application, Mos advisors can help.

Is the FAFSA the only way to apply for financial aid?

No. Don’t stop with just filling out the FAFSA, or you’ll be leaving money on the table.

There are plenty of other potential sources of financial aid besides the FAFSA.

Financial aid and assistance can also come from your state’s department of education or other education agency. Contact your state agency for more details because they vary from state to state.

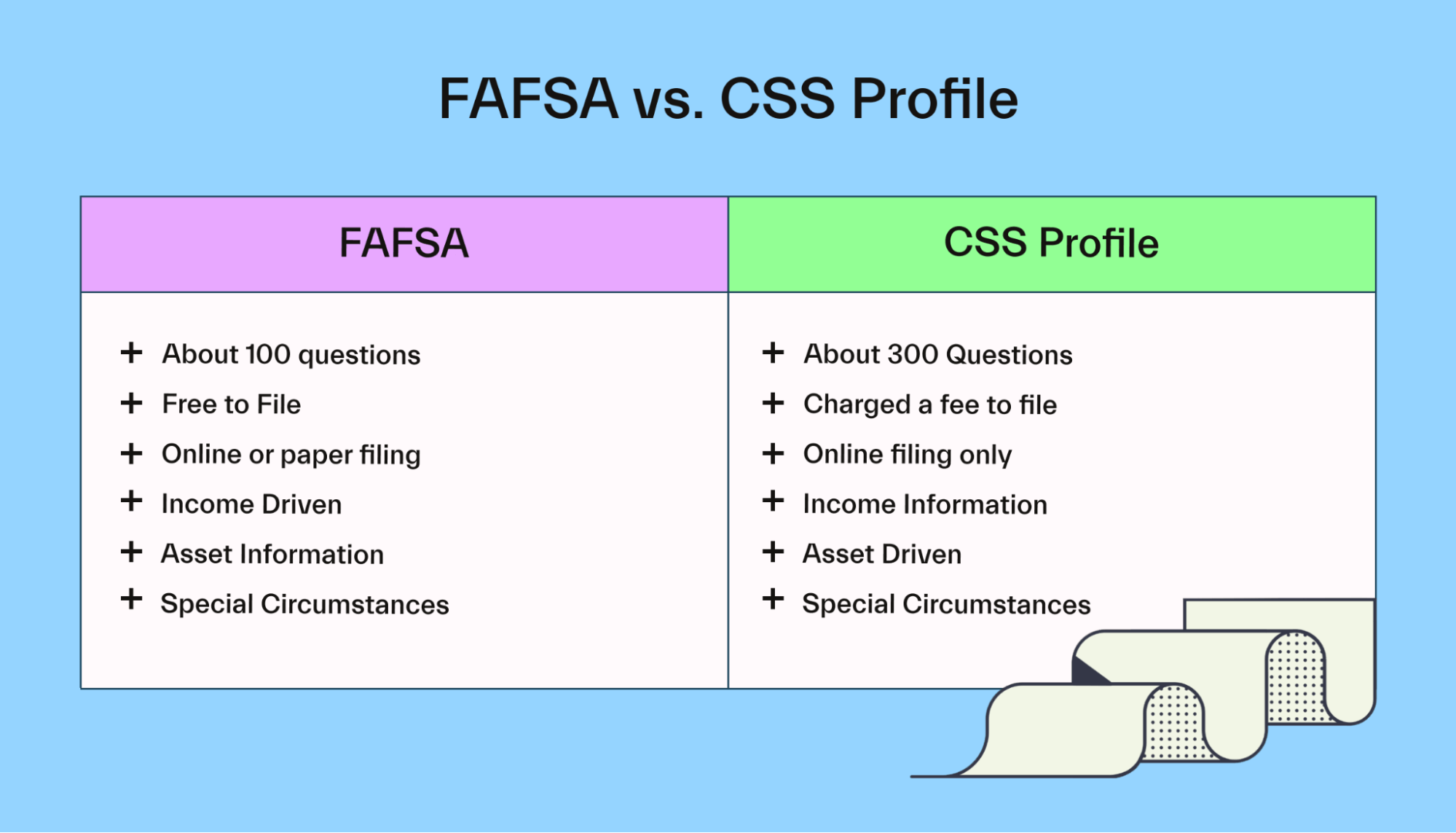

Your college’s financial aid office is another great resource for finding financial aid. Some schools may require you to complete a College Scholarship Service (CSS) profile to apply for additional sources of financial aid.

About 200 schools require a CSS profile. Here’s that list of schools.

There are some differences between the FAFSA and the CSS:

Cost: The College Board administers the CSS profile and charges $25 for the first school and $16 for every school for which you complete a CSS profile thereafter. Students with low income or financial need may qualify for a fee waiver.

Details of your financial situation: The CSS profile requires you to show your and your family’s finances in much more detail and requires considerably more time than the FAFSA.

Length: The CSS profile involves 300 questions—3 times that of the FAFSA.

Are there deadlines to apply for financial aid?

Yes, the FAFSA has a federal deadline set by the Department of Education.

The federal deadline is June 30 of every year. So the federal deadline for the 2022–2023 academic year is June 30, 2023. The FAFSA opens on October 1 of every year, so you have 9 months to fill out this form.

But leaving it to the last minute is a mistake as you may lose out on money that’s awarded on a ‘first come, first served’ basis. Plus, schools often set their own deadlines, which are typically earlier. Each college has its own deadline. And this deadline may or may not be the same one as the federal deadline for the FAFSA.

So make sure you’re aware of your school’s deadline and don’t miss it. Contact your state agency and school financial aid for the deadline to keep top of mind.

Can you negotiate a financial aid package?

Yes, you can negotiate your financial aid package with your school.

This is another reason to be in constant contact with the financial aid office of your school. If your financial, academic, or life situation has changed, you can submit an appeal for your financial aid package.

This is an opportunity to provide more details about your case.

For example, a major change in your family’s finances could affect a college student’s expected family contribution (student’s EFC). Schools use a student’s EFC to calculate your financial aid award.

Your school will provide you more details on the necessary steps to appeal to your financial aid package. It’s important to meet those steps and back up your statements with documentation as much as possible.

Some best practices with your school’s financial aid office when negotiating a financial aid package include:

Show your math: If you're requesting an extra amount, break down that amount as much as you can.

Include latest grades and achievements: If there are grades or academic achievements that didn’t make it to the deadline, check if you can include them with your appeal.

Bring up another financial award letter: An award letter from another school may provide you some leverage to negotiate a higher amount.

Document financial need: Be transparent about what you can afford and reveal your financial situation in more detail. If you have experienced major life events, such as a family emergency or divorce, you may be able to use them as support for financial need.

Conclusion

College can be expensive. But that doesn’t mean you should think that taking out student loans is your only option.

There are many financial aid opportunities out there. Some of them are free money that you don’t have to pay back (in most cases).

From scholarships to grants to work-study programs, there are plenty of options that can help you reduce how much you pay out-of-pocket.

Want to get the most financial aid possible? Consider joining Mos today.

Mos is a money app that includes a debit card so students can keep all their money in one place. On average, Mos members who work with a financial aid advisor save $3,500 per year. Find the best plan for you to get started.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you