Financial aid •

Financial aid FAQs

Wondering how to apply for financial aid? Or maybe how to figure out how much aid you’re eligible for? We’re answering all of your financial aid FAQs.

Planning for college is an exciting time in your life. Planning for how to pay for college? Not so much.

Whether you're a graduate or undergraduate student, college can be expensive.

Luckily, you don’t have to go it alone. Roughly 86% of college students use financial aid to pay for college! But even navigating the financial aid system can be hard.

We’re answering some of your biggest financial aid questions to make sure you’re ready to tackle all of your college financing needs.

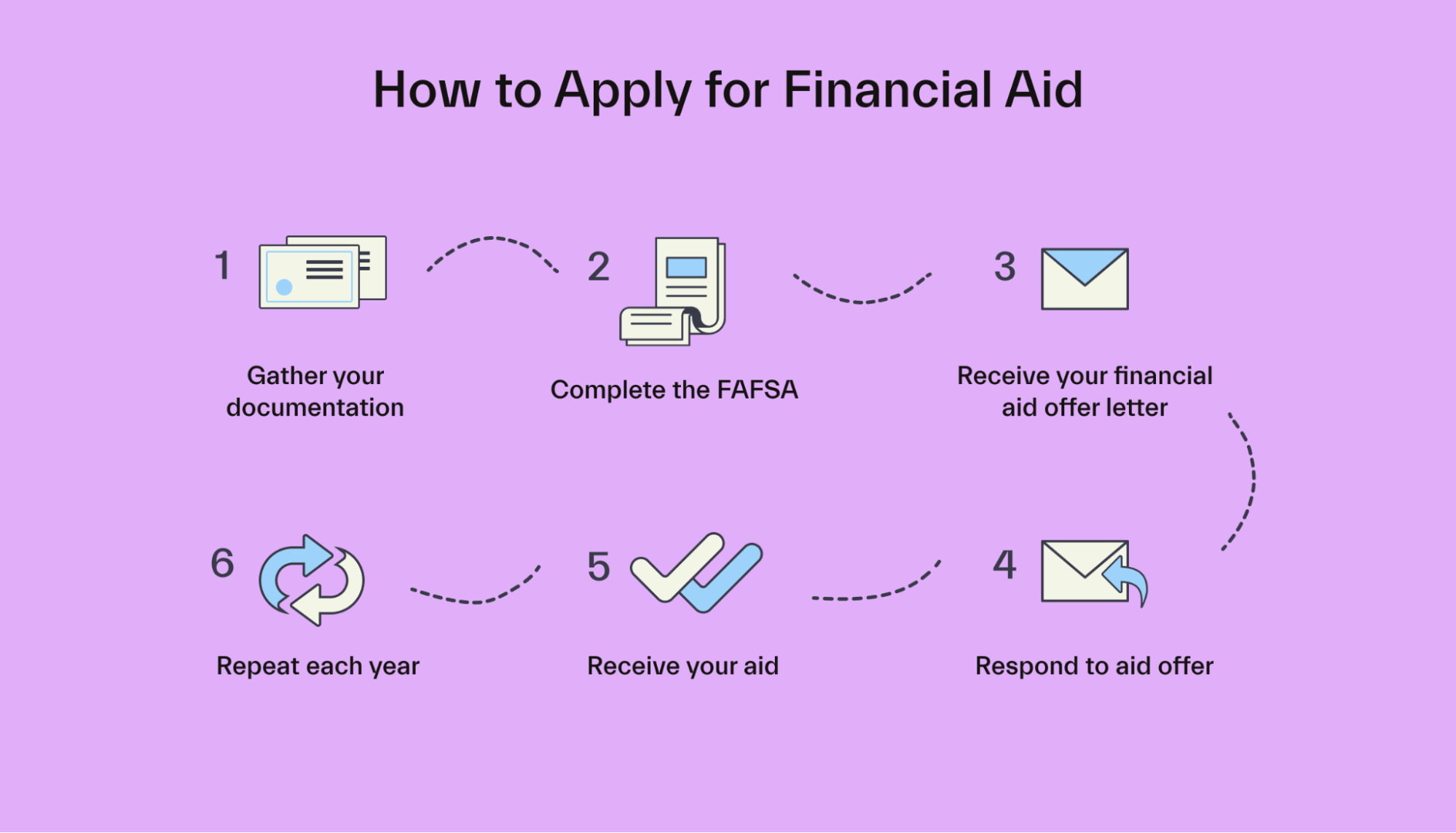

How do I apply for federal financial aid?

Federal financial aid can be really helpful in helping you pay for college.

Here’s how to apply:

1. Gather your documentation. You’ll have to share information such as your and your parents’ Social Security numbers, records of taxed and untaxed income, and information about other financial assets.

2. Complete the Free Application for Federal Student Aid (FAFSA). The FAFSA is the form that the federal government and schools use to determine what aid you’re eligible for. If you don’t complete the FAFSA, you can’t get federal aid.

3. Receive your financial aid offer letter. After you receive your school acceptance letter, you’ll also receive a financial aid offer letter that lets you know what type of financial aid—and how much—you’ve been awarded.

4. Respond to the aid offer. Once you’ve decided which school to attend, follow the instructions in your award letter to accept your aid.

5. Receive your aid. At the start of the new semester, your financial aid money can help cover your tuition, fees, room, board, and other school expenses.

6. Repeat each year. You must complete the FAFSA each year that you plan to attend school.

What happens if I don’t use all my financial aid money?

When you’re awarded grants or student loans, they’re usually sent directly to your school and applied to your tuition, fees, room and board, and any other school expenses.

If there’s still some money left after covering your school expenses, then your school may pay the rest directly to you. You’ll be able to use this money for other education-related expenses such as textbooks, computers, housing, and more.

If you took out student loans and the school sends you the remainder of the student loan money, you can decide you don’t want to keep it.

After all, any money you borrow today is money you’ll eventually have to pay back with interest.

If you decide to return your extra federal student loan money, you can cancel a loan—or even just part of one—within 120 days of receiving it. You won’t pay any interest or fees on the part of the loan you cancel.

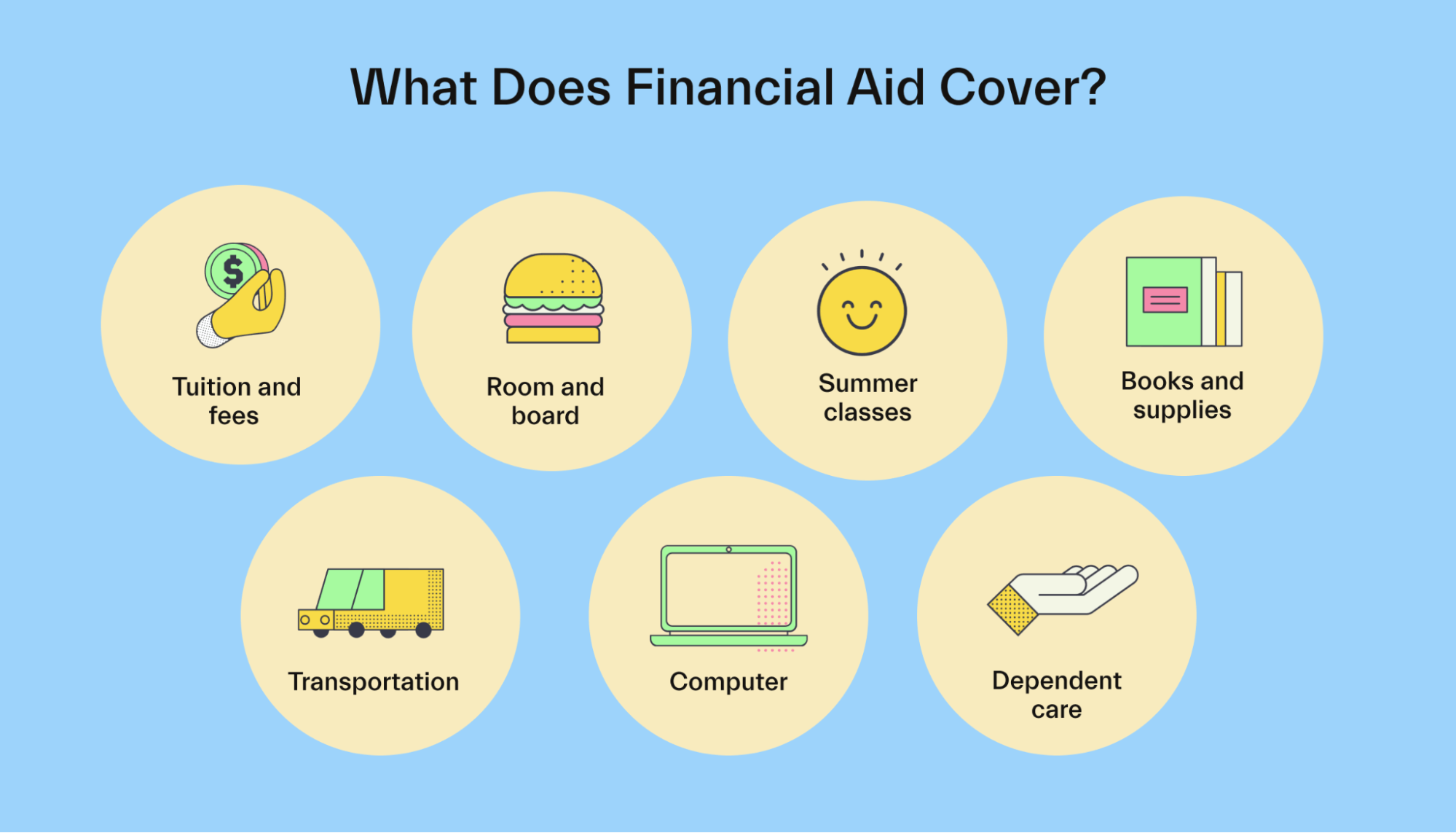

Does financial aid cover summer classes?

Financial aid is there to help cover the costs of tuition, fees, room and board, books, supplies, transportation, and more. Financial aid can cover your costs regardless of whether you’re attending classes during the regular semester or the summer.

But when applying for financial aid for summer semester classes, there’s one small catch.

When you complete the FAFSA, you’re applying for federal aid for a particular school year. Some schools include summer classes in the previous school year, while others include them in the upcoming school year.

If you’re planning to take a summer course, contact your school and ask them what school year your summer school will fall into. That way, you’ll know if you’ve completed FAFSA for the right year.

You can talk to your school's financial aid office to learn more about summer financial aid eligibility requirements.

Does financial aid count as income?

Certain types of financial aid count as income. It’s important to understand which do and don’t count as income since it can affect how much you'll owe in taxes for the year.

First, grants and scholarships aren’t considered taxable income as long as you’re attending a school with a regular faculty, curriculum, and body of students, and you’re using your grant and scholarship money to pay for education expenses.

For these purposes, education expenses include tuition, fees, books, supplies, and equipment.

Next, student loans don’t count as taxable income no matter what you spend them on because you’ll have to pay that money back.

One type of federal financial aid that does count as taxable income is money you earn at a work-study job. The income from this job is just like the income you’d earn at any other job, meaning you’ll pay federal and state taxes on it.

Other financial assistance may count as income, depending on the situation. For example, if you receive employer assistance to help pay for school, the first $5,250 you receive won’t count as income. But any amount beyond that will count as taxable income.

It’s worth noting that, in some cases, you may be able to count your financial aid as income to help qualify for a loan.

According to Experian, extra financial aid money that’s returned to you after paying for school expenses may count as income for loan and credit card applications.

I lost my financial aid. How do I pay for school?

If you’ve lost your financial aid because you’re no longer eligible, you may worry about how you’ll pay for your education. Luckily, there are still plenty of strategies you can try at this point:

1. Contact your school. Before taking any other steps, contact your school’s financial aid office to see if it’s possible to get your financial aid back. Depending on why you lost your eligibility, there may be a fix that could once again make you eligible for financial aid.

2. Apply for scholarships. Plenty of businesses and nonprofit organizations offer scholarships, and eligibility isn’t tied to your financial aid eligibility. Scholarships are free money, meaning you usually don’t have to pay them back! As a result, applying for scholarships is a good first step when looking for money to pay for school.

3. Seek out private grants. While most grant money comes from the federal government, there may be private grants available to help you pay for school. Like scholarships, grants are free money, and you don’t have to pay them back.

4. Work your way through college. While it might be difficult to fit a job into your schedule while in college, it’s certainly possible. Working through school can help you finance your education. You may even consider working full-time and going to school part-time. It’ll take longer to earn your degree, but it will be easier to pay for out of pocket.

5. Choose a more affordable school. Many don’t even think about the price tag of college when financial aid and federal loan money is covering it. But a simple way to make college more affordable is to simply choose a more affordable school, such as a community college, state school, or technical college.

6. Apply for private student loans. Plenty of lenders let you apply for a private loan to help you pay for college. While they don’t come with all of the same perks as federal student loans, they can still help you pay for college.

How much financial aid do I have left?

There’s a limit on how much of certain types of financial aid one student can get in their lifetime.

In the case of the federal Pell Grant, you can receive the equivalent of 6 years of Pell Grant funding or 600% of your Pell Grant eligibility.

To find out how much of your lifetime eligibility remains, you can log into your account dashboard with the Department of Education (DOE) Federal Student Aid office. There, you’ll see what percentage of your eligibility remains.

It’s possible that you won’t use all of your eligibility each year, which means you may actually stretch your 6 years of funding to more than 6 years.

For example, your Pell Grant eligibility for one year covers both the spring semester and fall semester. If you attend only one semester, you’ll only get 50% of your eligible funding.

On the other hand, if you attend the fall, spring, and summer semesters in a single academic year, then you’ll receive 150% of your eligible funding, meaning you’ll use your lifetime eligibility up more quickly.

There’s also a lifetime limit on the amount of subsidized and unsubsidized loan money you can borrow.

The limit is currently $57,500 for undergraduate students (no more than $23,000 can be subsidized loans) and $138,500 for graduate or professional students (no more than $65,500 can be subsidized loans).

To calculate how much eligible loan money you can still borrow, simply log into your financial aid account to see how much you’ve already borrowed.

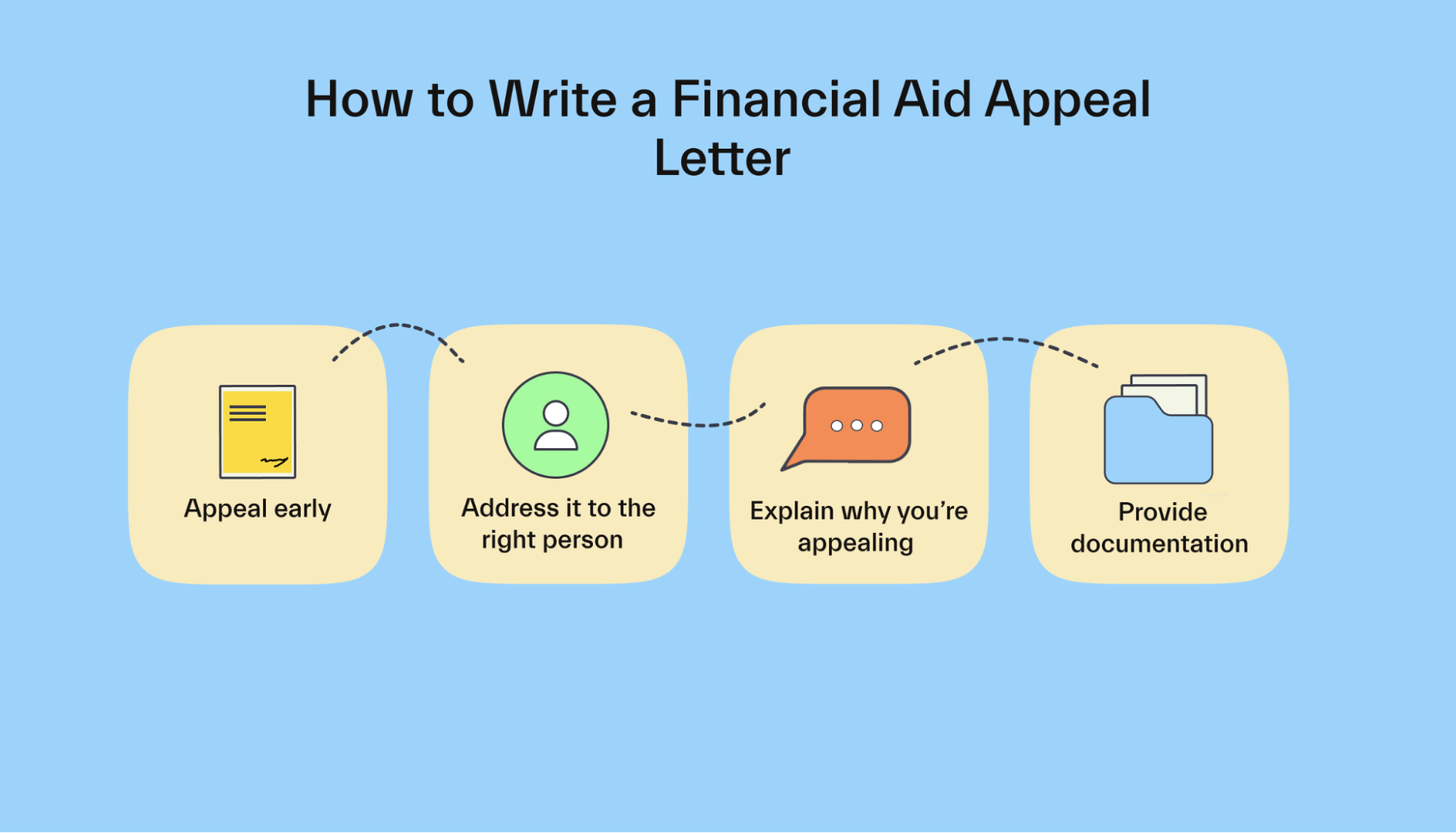

How to write a financial aid appeal letter

If your household income earner lost their job, one of your parents died, another significant life event occurred, or you made an error on your original FAFSA, then your financial aid award won’t accurately reflect your financial needs.

In that case, you can write a financial aid appeal letter to your school and ask them to reconsider your financial aid package.

Here are the steps to follow to write your letter:

1. Address it to your school’s financial aid office. If possible, find out the name of who in the office you should address it to.

2. Explain why you’re appealing. If you made a mistake on your FAFSA or your household lost income, explain that in your letter.

3. Provide documentation. Anything you can include to prove your case can help.

4. Appeal early. For certain types of financial aid, schools only have so much to go around. The earlier you appeal, the better your chances are of getting the aid you need.

What is the maximum income to qualify for financial aid?

There’s not necessarily an income limit for qualifying for financial aid. Instead, your financial aid eligibility depends on your expected family contribution (EFC) and the cost of attendance (COA) at your school.

First, the more expensive the school, the higher your family’s income would have to be for you to not qualify for any aid.

Additionally, other factors besides income can affect your EFC. For example, if there are lots of children in your family, then your EFC will be lower.

In general, no matter what your family’s income, it’s worth completing the FAFSA to make sure you’re awarded any financial aid you might be eligible for.

How much financial aid can I get?

How much financial aid you can get is based on your expected family contribution (EFC), your school’s cost of attendance (COA), your academic progress, and your enrollment status.

In general, your school’s financial aid office will take your COA and subtract your EFC. The difference is your financial need, and that’s how much money you might be eligible for.

Need-based aid includes the Pell Grant, Federal Supplemental Educational Opportunity Grant (FSEOG), subsidized student loans, and federal work-study.

Your financial need, which is based on your EFC and COA, is the maximum amount of need-based aid you can get. For example, if your EFC is $10,000 and your COA is $20,000, the most need-based financial aid you’ll qualify for is $10,000.

You may also be eligible for non-need-based aid.

To determine how much non-need-based aid you’re eligible for, your school’s financial aid office will subtract the amount of financial aid you’ve been awarded so far from your COA.

This type of aid includes unsubsidized student loans, PLUS loans (including the Parent PLUS loan), and Teacher Education Access for College and Higher Education (TEACH) grants.

So in the above example, where your COA is $20,000 and you’re awarded $10,000 of need-based financial aid, you may still be eligible for $10,000 of non-need-based aid.

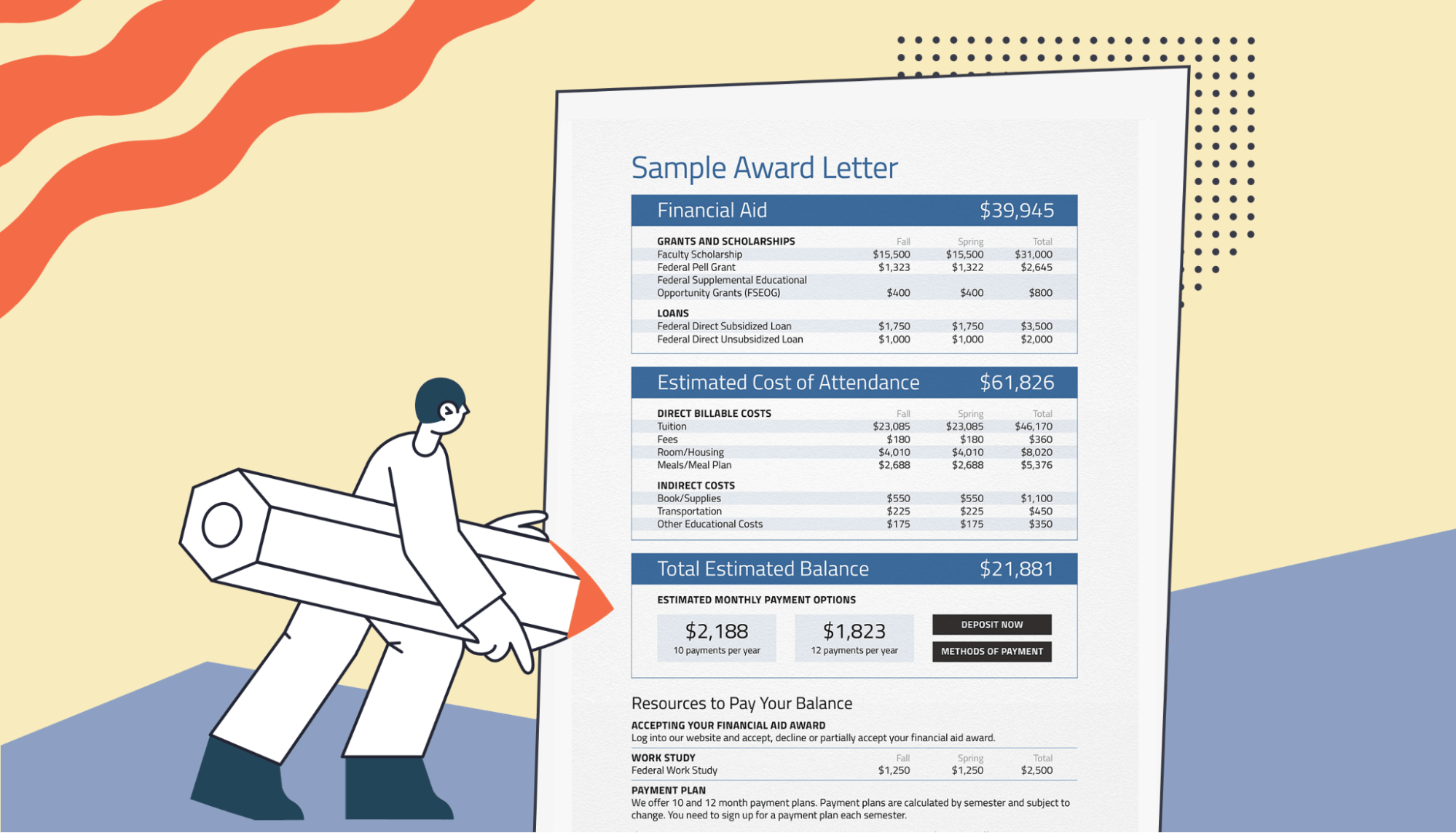

How will I be notified about what financial aid is available to me?

When you get your acceptance letter to a college or university, you’ll also get an award letter that lets you know what financial aid you’ve been awarded.

It’ll include federal aid, such as student loans, grants, and work-study, as well as any state or school aid available to you.

This letter helps you determine how much aid you’ll get and how much you should expect to pay out of pocket for school. Once you’ve decided which school to attend, you can accept your aid award following the instructions in your aid letter.

What are the different types of financial aid?

There are four common types of financial aid you might get to help you pay for college:

Grants are a form of free money often awarded by the federal government. Grants are usually need-based. The most common grant is the Pell Grant, which is available through the federal government.

Scholarships are another form of free money. But unlike grants, they come from private sources and are often merit-based rather than need-based. You may be eligible for scholarships based on your grade point average (GPA), athletic achievement, leadership experience, community service experience, and more.

Work-study is a student employment program through the federal government and some state governments. If you qualify, you can get an on-campus job (and some select off-campus jobs) to help you earn money to pay for school and living expenses.

Student loans are a type of borrowed money that you take out to pay for school and then pay back after graduation. The federal government is the largest student loan lender, but many private lenders also offer loans to pay for college.

How do I know if I’m considered a dependent or independent student for financial aid?

When you complete your FAFSA, you’ll apply as either a dependent or independent student.

Your dependency status can impact the amount of aid you’re eligible for since it affects whose income and assets the government looks at when calculating your EFC.

You’re an independent student if any of the following apply to you:

You’ll be 24 years old by January 1 of the school year for which you’re applying for aid.

You’re married or separated (but not divorced).

You’re working toward a master’s degree or doctorate.

You have children who receive more than 50% of their support from you.

You have dependents who live with you and receive more than 50% of their support from you.

You’re serving on active duty in the armed forces.

You’re a veteran of the armed forces.

Since the age of 13, both of your parents were deceased, you were in foster care, or you were a ward or dependent of the court.

You’re an emancipated minor or are in a legal guardianship.

You’re an unaccompanied youth who’s either homeless or self-supporting and at risk of homelessness.

If none of the above circumstances applies to you, then you’re considered a dependent student, and you’ll need to include your parents’ financial information on your FAFSA

Conclusion

Financial aid can be tricky to navigate, but we’ve broken down the answers to some of your biggest financial aid questions.

Want more help with financial aid? Sign up for Mos for help completing your FAFSA, negotiating your financial aid package, applying for scholarships, and more.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you