Student loans •

Public Service Loan Forgiveness 101

The Public Service Loan Forgiveness (PSLF) program can provide welcome relief for certain borrowers, but the rules can be complex. Read on to learn more.

Student debt is on a steady upward trend, with the average recent graduate owing $29,000 in 2020. The average among all borrowers is even higher, at around $37,000 per person.

And for many borrowers, it’s tough just to keep up with interest payments—sometimes, the loan continues to grow post-graduation!

Fortunately, there are programs in place to help certain people tackle their student debt. In this article, we’re talking about Public Service Loan Forgiveness (PSLF).

There’s been a lot of confusion and controversy surrounding PSLF, but we’re here to set the record straight. Here’s everything you need to know about public service student loan forgiveness!

What is Public Service Loan Forgiveness (PSLF)?

Public Service Loan Forgiveness is a federal program that aims to forgive student debt balances for people who work full-time for 10 years in public service jobs. This can include a wide variety of public servants, including teachers, police officers, government workers, and nonprofit employees.

Basically, it applies to student loan borrowers who work full-time for the government—and this includes federal, state, local, and tribal governments. Full-time workers at nonprofit organizations also qualify.

The program only kicks in after 10 years, though.

Borrowers will be required to make on-time payments for 10 years. After you make 120 qualifying on-time payments and are enrolled in PSLF, you can have the remaining balance forgiven by the federal government!

The PSLF program’s rules are in place to reward those who choose to go into public service roles and work full-time for 10 years or more. While loan payments are required during this 10-year period, many applicants won’t be required to make large payments.

This is because PSLF applicants must be on qualifying income-driven repayment plans. This means that lower-income applicants may only be required to make very small payments towards their loans, while higher earners will need to pay more.

Keep in mind that the program is only available to those who have federal direct student loans—private loans don’t qualify.

To enroll in the program, applicants must submit the Public Service Loan Forgiveness form along with proof of employment in a qualifying position. Applicants are asked to submit this form each year to verify employment and ensure payments are on track.

Who qualifies for public service student loan forgiveness (PSLF)?

Generally speaking, people who work full-time in “public service” jobs and have federal student loans can qualify for PSLF.

This means teachers, city workers, government agency workers, and nonprofit employees could all potentially qualify.

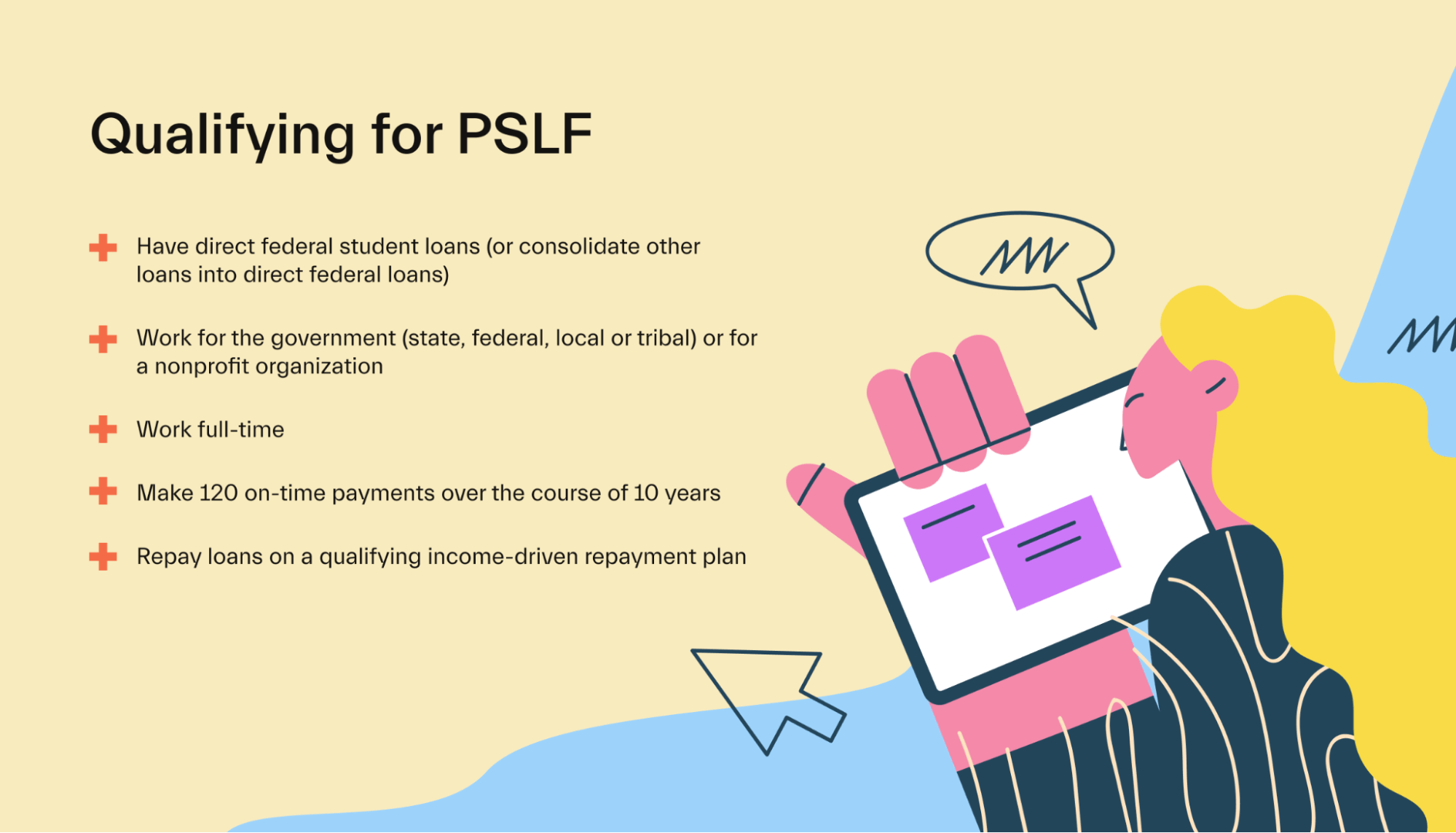

The details matter, though. To qualify for PSLF, you must:

Have direct federal student loans (or consolidate other loans into direct federal loans)

Work for the government (state, federal, local, or tribal) or for a nonprofit organization

Work full-time

Make 120 on-time monthly payments over the course of at least 10 years

Repay loans on a qualifying income-driven repayment plan (this requirement is waived until October 31, 2022—more on this below in “eligible payment requirements”)

To confirm that you qualify and to formally enroll in the program, applicants need to complete the Public Service Loan Forgiveness application online. We’ll cover this in more detail in the “how to apply” section below.

Examples of qualifying jobs

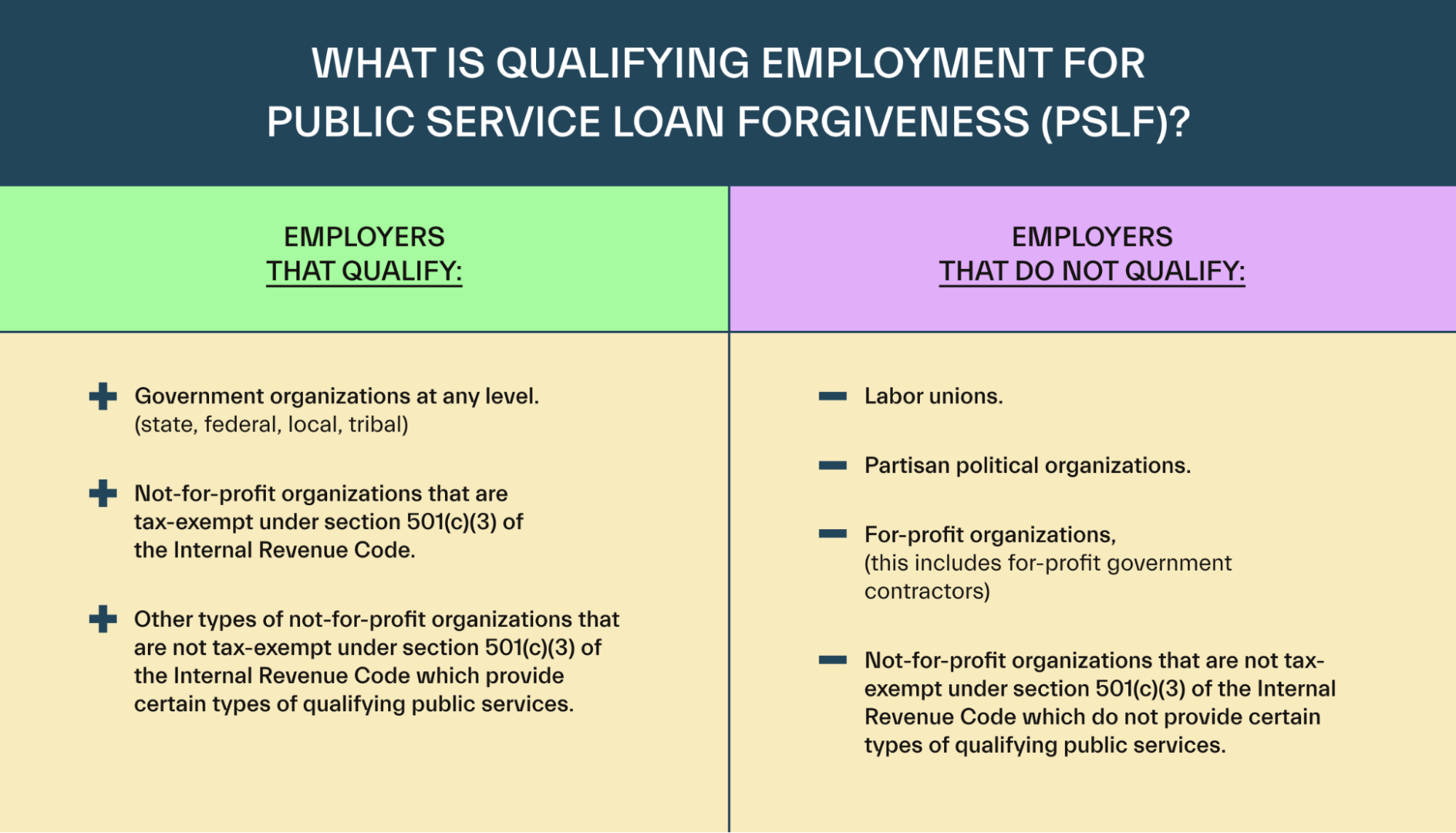

Many individuals who work for the government or for nonprofits may qualify for PSLF.

Qualification is based on the employer rather than the specific job type. For instance, all employees working for a school district should qualify—whether they’re teachers, school nurses, or janitors.

Here are some examples of positions that may qualify for PSLF:

Federal government workers of any type (IRS employees, federal law enforcement agencies, federal administrative workers, etc.)

Military members of any type (active duty, reserve, administrative workers, etc.)

State government workers of any type (health department workers, parks department workers, etc.)

Local city/county government workers (police officers, librarians, city admin workers, etc.)

School district employees (teachers, tutors, librarians, administrators, etc.)

Tribal government employees of any type

Employees of 501(c)(3) nonprofit organizations

Other nonprofit organizations that aren’t necessarily 501(c)(3) certified may still qualify. For instance, many private schools that operate as not-for-profits may qualify.

Any organization that’s not for profit and provides “public service” should qualify, but you’ll need to confirm this with the education department.

Employers that don’t qualify for PSLF include any for-profit employer, partisan political organizations, and labor unions.

Generally speaking, contractors don’t qualify for PSLF—even if they’re contracting for an otherwise qualifying government agency or nonprofit. To be eligible, you typically must work full-time for a qualifying employer.

Likewise, employees of for-profit contractors don’t qualify, even if their employer is contracting for a government agency.

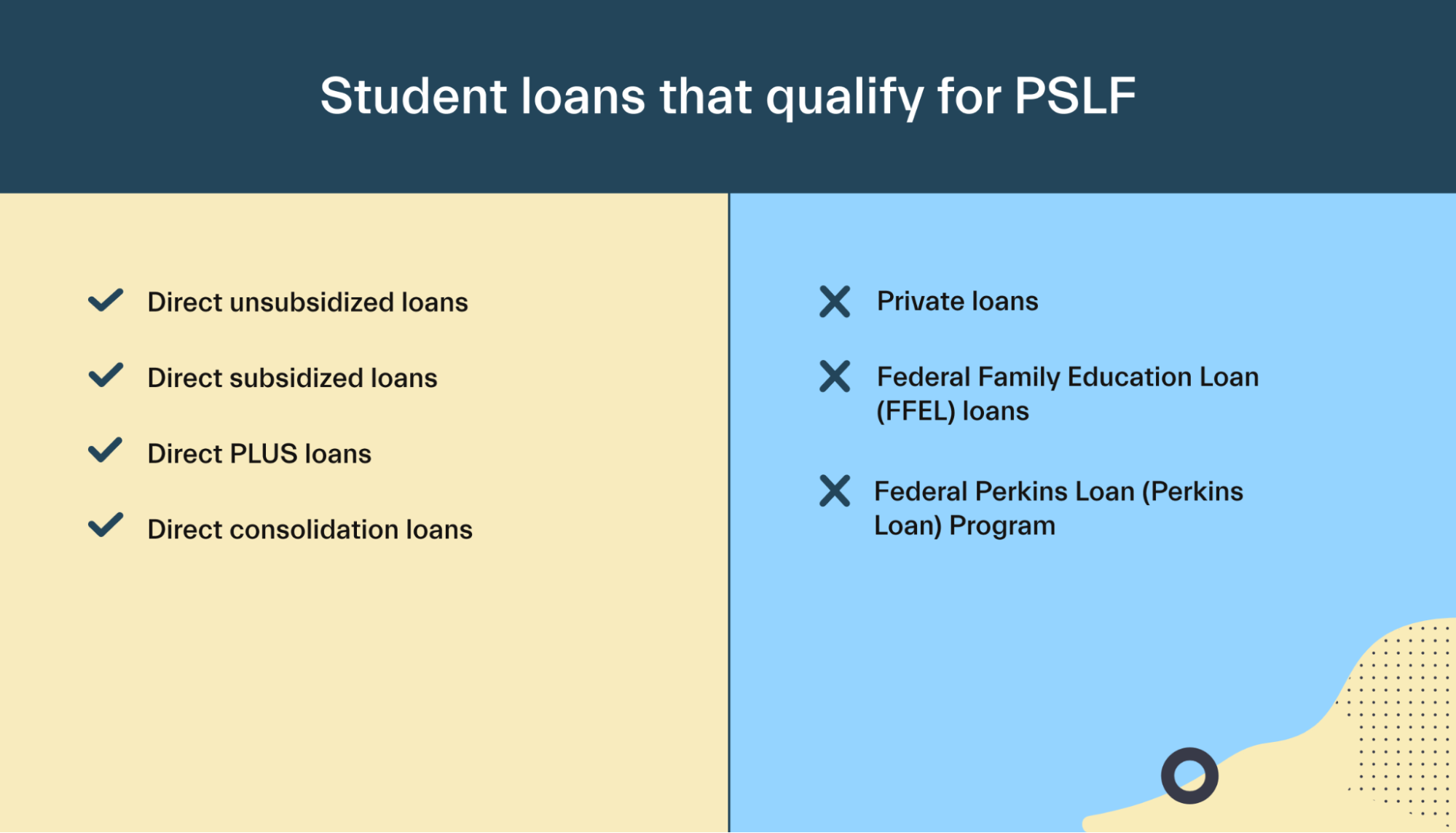

Which student loan types qualify?

In addition to requiring a qualifying employer, PSLF also requires a qualifying loan type. This means that not all types of student loans qualify for the program.

Only direct loans qualify for this program. Learn more about the different types of student loans here.

“Direct loan” is the shorthand for loans issued through the William D. Ford Federal Direct Loan (Direct Loan) Program (what a mouthful!)

There are several subtypes of direct loans, all of which can qualify for PSLF:

Direct unsubsidized loans

Direct subsidized loans

Direct PLUS loans

Direct consolidation loans

These loans are governed by federal loan programs, but they may be managed or administered by third parties. You can check with your student loan administrator/servicer to confirm which type(s) of loans you have.

If you have any of these qualifying loan types, your loans should automatically qualify for PSLF (you’ll need to meet the other eligibility criteria, of course).

If you have other types of federal loans that don’t qualify (such as FFEL or Perkins loans), you can consolidate them into a direct consolidation loan in order to qualify.

Finally, keep in mind that each loan qualifies separately. Many borrowers have multiple student loans, and some even have a mix of federal and private loans.

Because of this, some applicants may find that only some of their loans qualify for the program, while some don’t.

Likewise, certain applicants may find that one loan hits the 120-payment threshold before another qualifying loan does.

Loan types that don’t qualify for PSLF

Certain loans won’t qualify for the public service loan forgiveness program. These include:

Federal Family Education Loan (FFEL) Program loans

Federal Perkins Loan (Perkins Loan) Program loans

All private student loans

If you have a Perkins loan or FFEL loan, you may be able to consolidate these loans into a Federal Direct Consolidation Loan. Because these consolidation loans are eligible for PSLF, you’ll likely then be able to qualify for the program (as long as you meet all the other requirements).

Private loans cannot be consolidated into federal loans. If you have private loans, there’s currently no way to qualify them for PSLF, unfortunately.

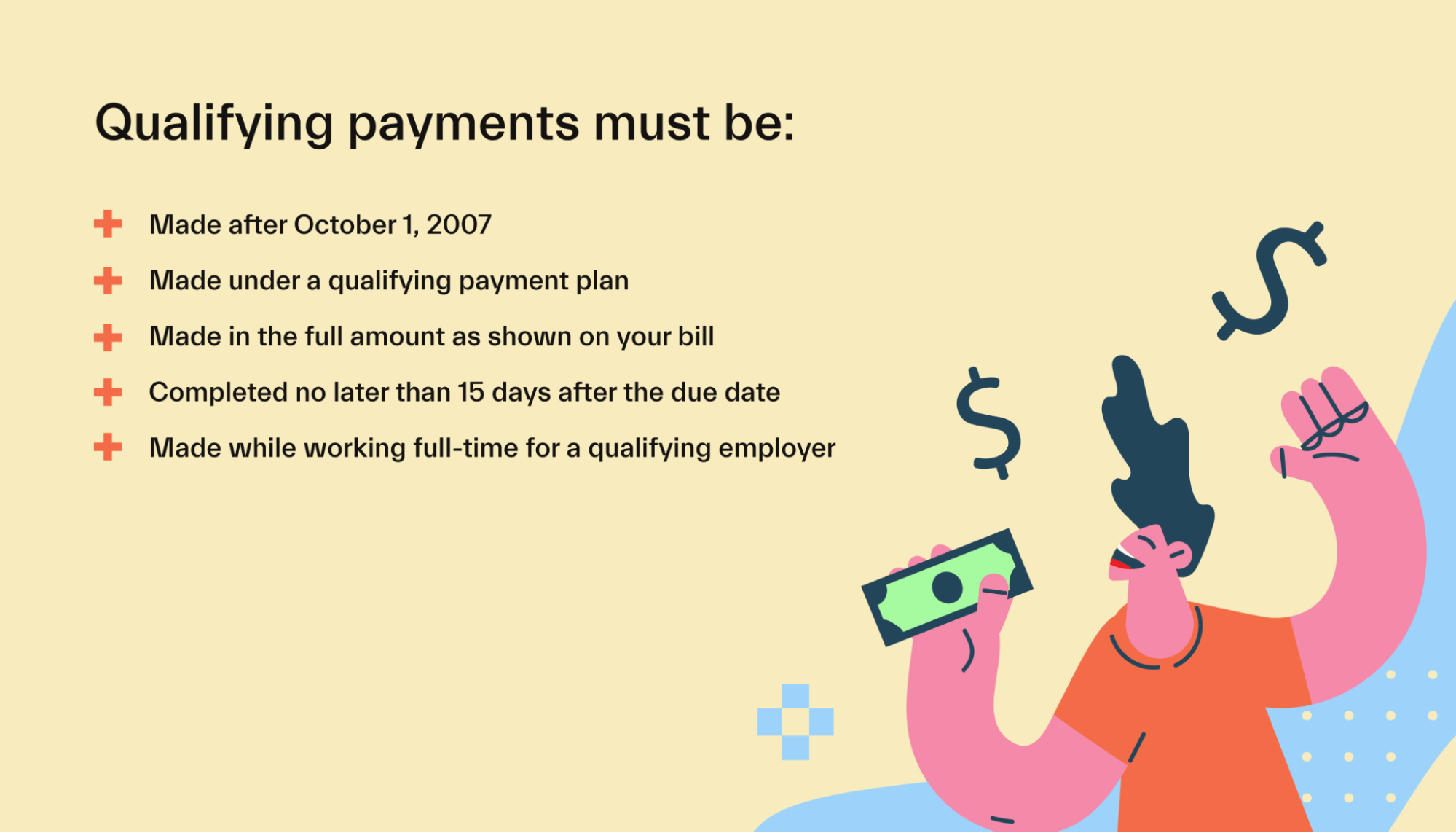

Eligible payment requirements

To have a loan forgiven through the public service student loan forgiveness program, you must make 120 on-time qualifying payments toward the loan. Additionally, you must be on an income-driven repayment plan.

In other words, you must make monthly payments for 10 years or more. At the end of the 10-year period, the remaining balance will be forgiven (as long as the loan qualifies and you’ve done everything correctly).

Payments don’t necessarily need to be consecutive, however.

For example, you could work for 5 years and make 60 qualifying payments. If you then switch jobs to a non-qualifying employer, future payments will not qualify—but you’ll retain credit for those 60 qualifying payments. If you later return to employment in a qualifying role, you’ll only need to make 60 additional payments.

Importantly, these must be “qualifying payments.” So what’s a qualifying payment, exactly?

Qualifying payments must be:

Made after October 1, 2007 (when PSLF was first established)

Made under a qualifying payment plan (income-driven repayment plans)

Made in the full amount as shown on your bill

Completed no later than 15 days after the due date

Made while working full-time for a qualifying employer

Keep in mind that you’ll need to make qualifying payments on each of your qualifying loans.

Each loan qualifies for PSLF separately—you’ll need to diligently track payments on each of your loans to ensure everything stays on track.

Additionally, qualifying payments can only be made when you’re required to make a payment. So you cannot earn credit for payments made while you are still in school, in the grace period, in student loan deferment, or in forbearance.

To illustrate this, let’s look at an example.

A student graduated college with a federal direct loan balance. He has no private loans.

He did not make any payments while in school or while in his grace period.

After the grace period ended, he established an income-driven repayment plan.

He had a part-time job at a grocery store while he looked for a permanent job as a teacher.

While working part-time, he made 5 monthly payments toward his loans based on his income-driven repayment plan.

Because he wasn’t working for a qualifying employer, these 5 loan payments don’t qualify towards his 120 payment requirement.

He finds work as a teacher at a local elementary school.

Each of his monthly payments from now on will qualify.

Once he reaches 120 qualifying payments, the remaining balance of his student loans will be forgiven!

PSLF limited waiver (through October 2022)

There’s currently a waiver in place that makes it easier to get credit for payments. This waiver is only valid through October 31, 2022. It was introduced as part of COVID-19 relief efforts from the Biden administration.

The PSLF Limited Waiver expands the eligibility requirements for what gets credit as a “qualifying payment.”

Basically, this waiver expands “qualifying payment” to any previous payment. Payments previously made for less than the full amount due, payments made late, and payments made while not on a qualifying repayment plan will all count under this temporary waiver.

A few aspects of the original requirements are still in place, however. The payment must have been made after October 1, 2007, and it must have been made while working full-time for a qualifying employer.

To take advantage of this temporary rule change, applicants must take action before the October 31, 2022 deadline. See this explainer on the Temporary Expanded Public Service Loan Forgiveness (TEPSLF) and this page on studentaid.gov for the next steps.

While some aspects of the Biden administration’s student loan efforts have fallen flat, this PSLF waiver is a welcome change for applicants to this program.

How to apply for Public Service Loan Forgiveness

The first step is to thoroughly read through the eligibility requirements (see above) to determine if you’re eligible. If you believe you are, the next step is to fill out the Public Service Loan Forgiveness (PSLF) & Temporary Expanded PSLF (TEPSLF) Certification & Application.

This can be done using this online tool. You’ll need around 30 minutes to complete the application, and you cannot save your progress (so you’ll need to complete everything in one session).

You’ll need your current W2 tax form or your employer’s federal employer identification number (EIN). You can get this from your workplace’s human resources (HR) department. This information is used to verify that your employer qualifies for the PSLF program.

The PSLF help tool will help you confirm eligibility and will then walk you through the steps you need to complete. Studentaid.gov has an in-depth guide on how to navigate this tool.

The Department of Education recommends that you complete this step annually to confirm that your eligibility remains the same and to keep track of how many qualifying payments you have made. This is not a strict requirement, however.

Likewise, you should file again if you switch employers. This will help you double-check that your new employer is eligible for PSLF.

Here's the link for the Public Service Loan Forgiveness online help tool.

Is it worth applying?

In most cases, if you qualify for the public service student loan forgiveness program, it’s well worth applying!

However, there are some considerations to keep in mind.

The first is that many applicants have found the program to be stressful. There hasn’t been any guarantee that the program will remain in place, and the program’s fate may rest in a future administration’s hands. This has led to a lot of controversy surrounding PSLF (see below).

Second, the program requires you to make income-driven repayments. For low-income borrowers, this can sometimes result in payments that don’t even cover the interest that’s building up.

This causes the loan balance to actually grow over time—which means that if the borrower is for some reason unable to continue qualifying for PSLF, they may end up stuck with a larger balance than they would have if they had made larger payments over time.

And third, the benefit is much less substantial for borrowers who have a relatively small loan balance. For instance, if you graduate with only $10,000 of student debt (the average is $37,693) and make payments for 10 years, your remaining forgivable loan balance may be quite small by the time PSLF kicks in.

Finally, if there’s a possibility that you won’t work in public service for 10 years, you may wish to avoid this program and pay off your loans quicker on your own.

Controversy surrounding PSLF

While it’s a great program in theory, the Public Service Loan Forgiveness program has stirred up a lot of confusion and controversy.

The main issue has been an overly complex qualification scheme that has caused thousands of applicants to be rejected from student loan relief.

The first few cohorts of applicants (who began becoming eligible in 2018, around 10 years after the program officially started in late 2007) were mostly disqualified due to technicalities: they hadn’t submitted the right form, or a few of their payments didn’t qualify. In fact, 99% of the applicants in the first round were rejected!

Particularly in the early days of the program, there was a lot of confusion around who would and wouldn’t qualify. The Department of Education didn’t provide very clear guidance and instead relied on private loan servicers to answer questions.

The situation is improving, thankfully. Around 30,000 people were notified that their debts had been forgiven in late 2021, marking one of the first major “waves” of people to receive debt relief through the program.

Plus, temporary programs like the PSLF waiver (discussed above) have made it simpler for some applicants to get credit for past payments.

In short, much of the confusion has been cleared up as of 2021. If you qualify for the program, it’s well worth participating—just be sure to cross your t’s and dot your i’s.

Step-by-step instructions for determining if you qualify for PSLF

If you’re still unsure whether your student loans qualify for public services loan forgiveness, the following instructions will help you get the answers you’re looking for:

Step 1: Determine if you have eligible federal student loans

Only federal student loans, such as direct loans, are eligible for Public Service Loan Forgiveness. If you have private student loans, you won’t qualify for PSLF. Additionally, some federal loans, such as Perkins Loans and FFEL Loans, are not eligible for PSLF but may become eligible if you consolidate them into a Direct Consolidation Loan.

You can check what types of loans you have by logging into the National Student Loan Data System (NSLDS) at nslds.ed.gov.

Step 2: Check if you’re enrolled in a qualifying repayment plan

To be eligible for PSLF, you must make payments while enrolled in a qualifying repayment plan.

The most common of these plans is the income-driven repayment (IDR) plan.

Other qualifying plans include:

The 10-Year Standard Repayment Plan

The Graduated Repayment Plan

The Extended Repayment Plan

You can check which repayment plan you are on by logging into your loan servicer’s website.

Step 3: Verify that you work for a qualifying employer

To qualify for PSLF, you must work full-time for a qualifying employer in public service. This includes a government organization at any level (federal, state, local, or tribal), a not-for-profit organization that is tax-exempt under section 501(c)(3) of the Internal Revenue Code, and other not-for-profit organizations that provide qualifying public services.

You can verify whether your employer qualifies for PSLF by submitting the Employment Certification Form (ECF) to FedLoan Servicing, the PSLF servicer.

Step 4: Ask a professional

The rules, restrictions, and guidance around the PSLF program are convoluted, to say the least. And you have a lot of money at stake. So it might be worth speaking with a professional to verify whether you qualify for PSLF and to get support in the forgiveness application process.

Mos, a money app for college students, is a great place to start. Mos has personal advisors (actual human beings, not chatbots!) who’ll give you 1:1 support throughout the PSLF process. The Mos app even includes a free debit card so students can keep their money all in one place!

And even if you don’t qualify for forgiveness, Mos can still help you figure out how to make your monthly payments more manageable.

Conclusion

Public Service Loan Forgiveness is an excellent program in theory, but it’s certainly had its share of controversy.

Fortunately, rules have recently been clarified, making it easier for borrowers to ensure that they are eligible.

Overall, if you qualify for this program, absolutely apply to have your loans forgiven!

And whether you qualify or need help figuring that out, a Mos financial aid advisor today can help you minimize your student loan debt.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you