Budgeting •

A guide to personal finance for college students

Learn about the importance of student personal finance and explore 10 pillars of personal finance for college students that’ll shape your financial future.

College is expensive—and we're not just talking about tuition costs. Living expenses, textbooks, and other college-related costs add up quickly. That's why it's important to have a handle on your finances from the get-go.

But student personal finance isn’t just about learning how to budget and juggle expenses. It’s also about embracing adulthood, building sound financial habits, and making tough, responsible decisions with your money.

In this guide, we’ll do a deep dive into personal finance for college students. Along the way, you’ll learn why personal finance is so important and also explore the 10 pillars of personal finance that'll help shape your financial future.

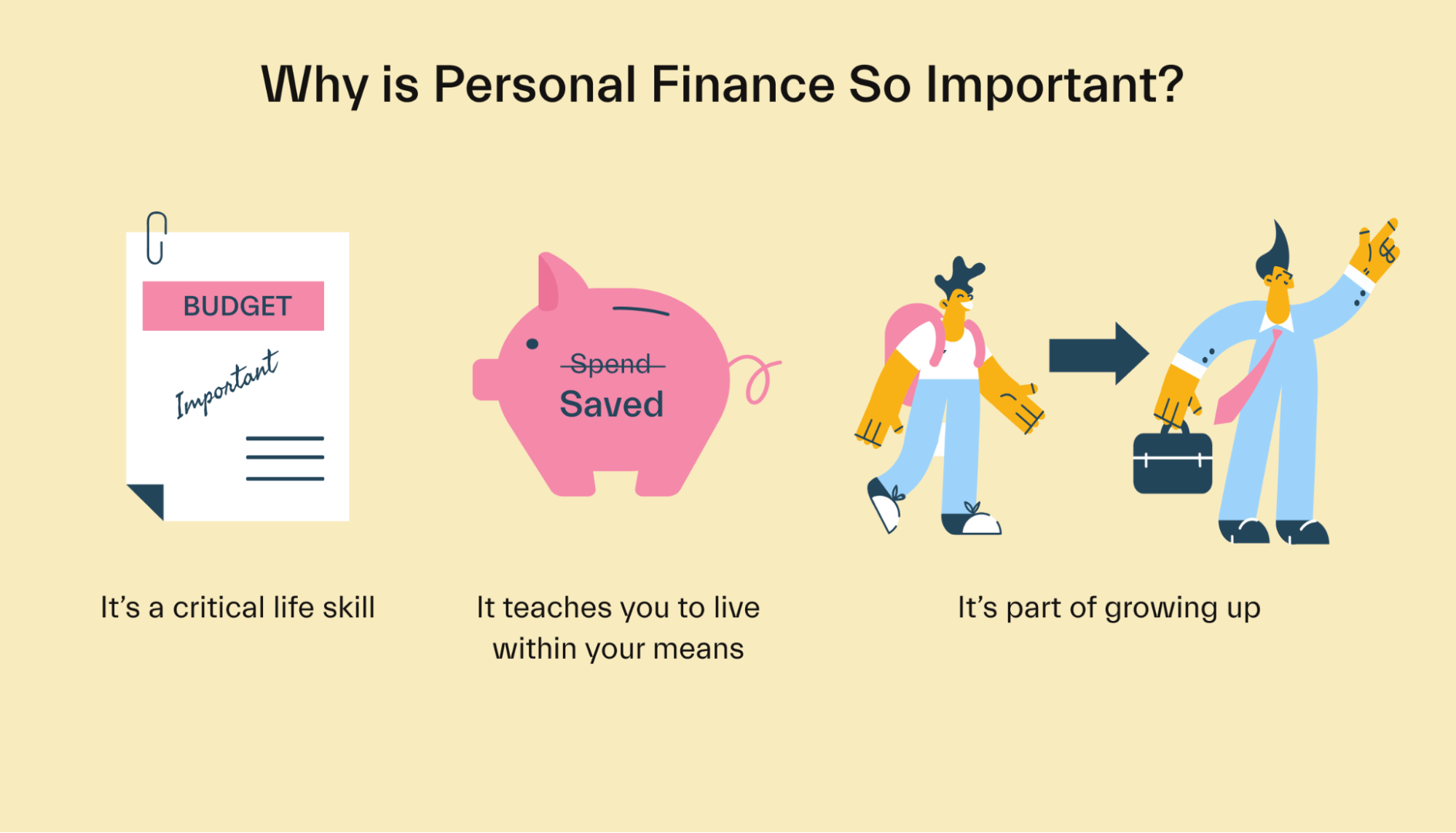

Why is personal finance so important for college students?

Let's pop the top off personal finance and review a few of the reasons college students should care about it.

Personal finance is a critical life skill that extends beyond college

Strengthening your personal finance skills in college can help you live a healthier, wealthier life after you graduate. After all, personal finance is a lifelong journey.

Think about it this way—the decisions you make about your money in college will influence how you approach fiscal responsibility after you've left campus. So, it's never too early to start learning about personal finance and how to make smarter financial decisions.

You'll learn to live within (or below) your means

As a college student, you'll probably live on a shoestring budget—and that's not an entirely bad thing. Living on a tight budget will teach you to be more mindful about your spending and how to live within your means.

Both of these skills will come in handy when you're out of college and have to juggle rent, transportation, utilities, student loan payments, and other adult expenses.

Living within your means isn’t about skimping out on all the fun stuff—after all, college is a time for self-discovery—it simply means prioritizing needs over wants and spending a modest amount of money on things like partying and pizza.

It's part of growing up

Whether you like it or not, you'll need to take ownership of your finances at some point. And while it might seem like a daunting task, honing your personal finance skills in college can give you the confidence and independence to embrace adulthood—financial responsibilities and all.

The 10 pillars of personal finance for college students

Now that we've talked about why personal finance is important for college students, let's get into the nitty-gritty. Here, we'll cover the 10 foundational personal finance strategies for college students.

1. Get real about your needs and wants

Sure, a big part of college is having a good time. But many college students conveniently forget that those “good times” may cost a lot of money, leaving less cash for important, essential needs.

Put more bluntly; if you're spending your rent money on nights out and pricey new clothes, you're earning yourself a big fat "F" in personal finance.

To avoid this, start by jotting down a list of your needs and wants. This helps you prioritize your spending and avoid making unnecessary impulse purchases.

Not sure about the difference between a need and a want? Here's how it works:

Without needs, you'll die.

Without wants, you'll feel bored.

More specifically:

Needs are things you need to stay alive, like food, water, and shelter.

Wants are non-essential items that can increase your quality of life but aren’t necessary for survival, like a Phineas and Ferb tattoo across your chest or a brand new iPhone.

2. You don’t need an MBA to budget money

Budgeting isn’t an ancient secret guarded by an elite squad of MBA graduates. In fact, it’s quite simple.

Here's what budgeting boils down to:

You track your income and expenses over a certain period—usually a month. This gives you a clear picture of where your money is going and helps you make informed decisions about your spending.

If you want to get more technical, there are different types of college student budgets, like the 50/30/20 budget or the envelope budget. But for our purposes, we'll just stick to the basics.

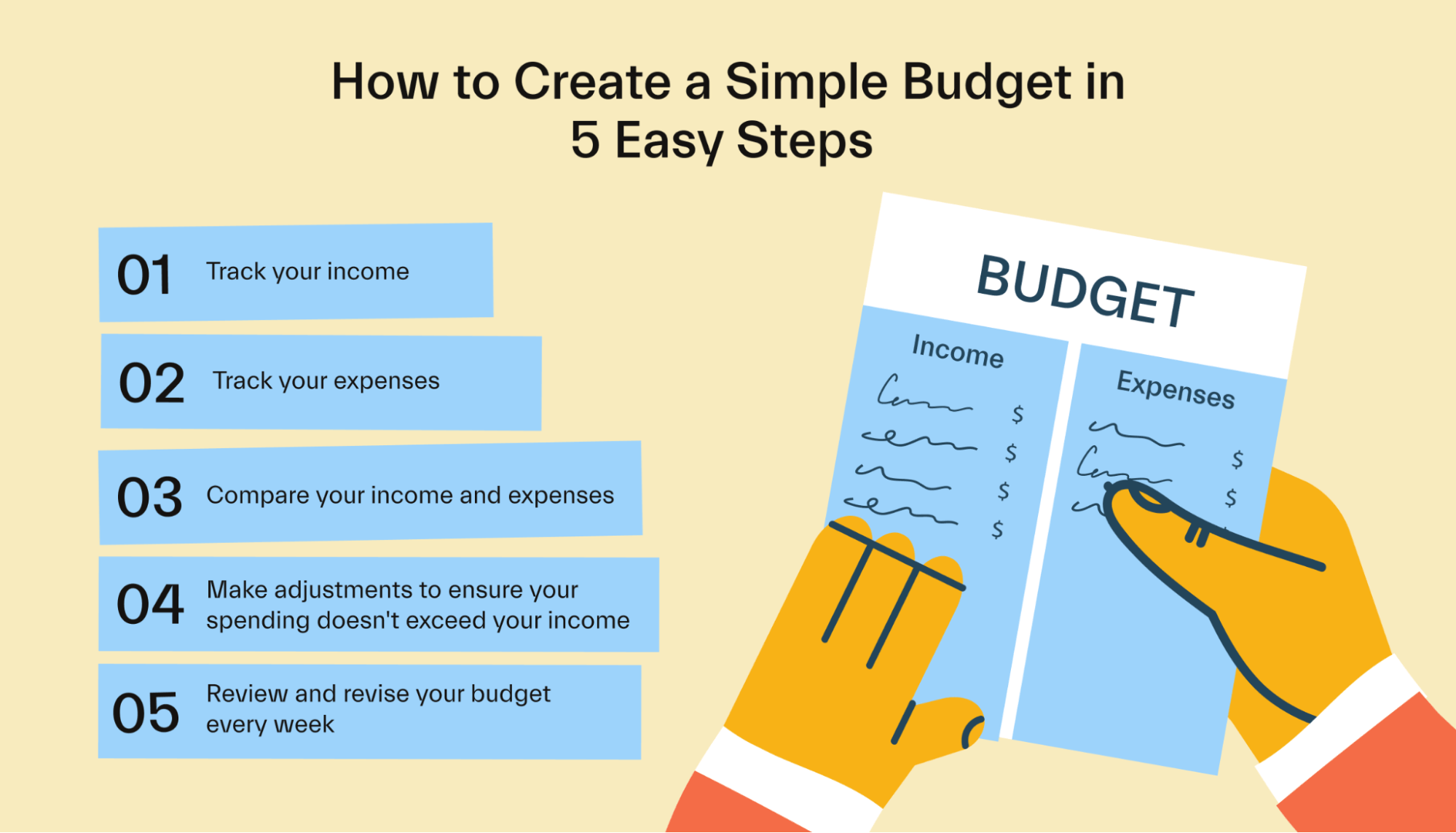

Here's how to create a budget in 5 simple steps:

Track your income.

Track your recurring and everyday expenses.

Compare your income and expenses.

Make adjustments to ensure your spending doesn't exceed your income.

Review and revise your budget every week.

That's it.

Now, you may not have a "monthly income" because you receive your financial aid in a lump sum at the start of each semester. In which case, you can still use the budgeting tips outlined above. Simply track your expenses over a semester, and keep a running total of how much of your financial aid money you have in the bank as you plan your budget each month.

3. Emergency funds aren’t a reset button for bad decisions

Emergency funds are there for emergencies—like if you have an unexpected bill or your car needs a sudden repair.

What emergency funds are not for is bailing you out after a string of bad financial decisions, like going on a Spring Break vacation you clearly can't afford or buying a new wardrobe every semester.

We get it; it's tempting to use your emergency fund as a personal piggy bank. But if you do that, you'll put yourself in a tough spot the next time you have an actual emergency and no money to cover it.

Now, if you don't think an emergency fund is necessary, consider this:

37% of Americans don't have $400 in savings to cover an emergency.

So if you can start building your emergency fund while you're in college, or at least getting into the habit of setting aside money for emergencies, we recommend you do it.

But how much should you set aside in your emergency fund?

While you're in college: A good rule of thumb is to have at least $1,000 dollars you can immediately access in case of an emergency.

After you graduate: You'll want to save a least 3 months of living expenses in case you lose your job or have another financial setback.

4. Student credit cards are dangerous in greedy hands (but useful tools in smart ones)

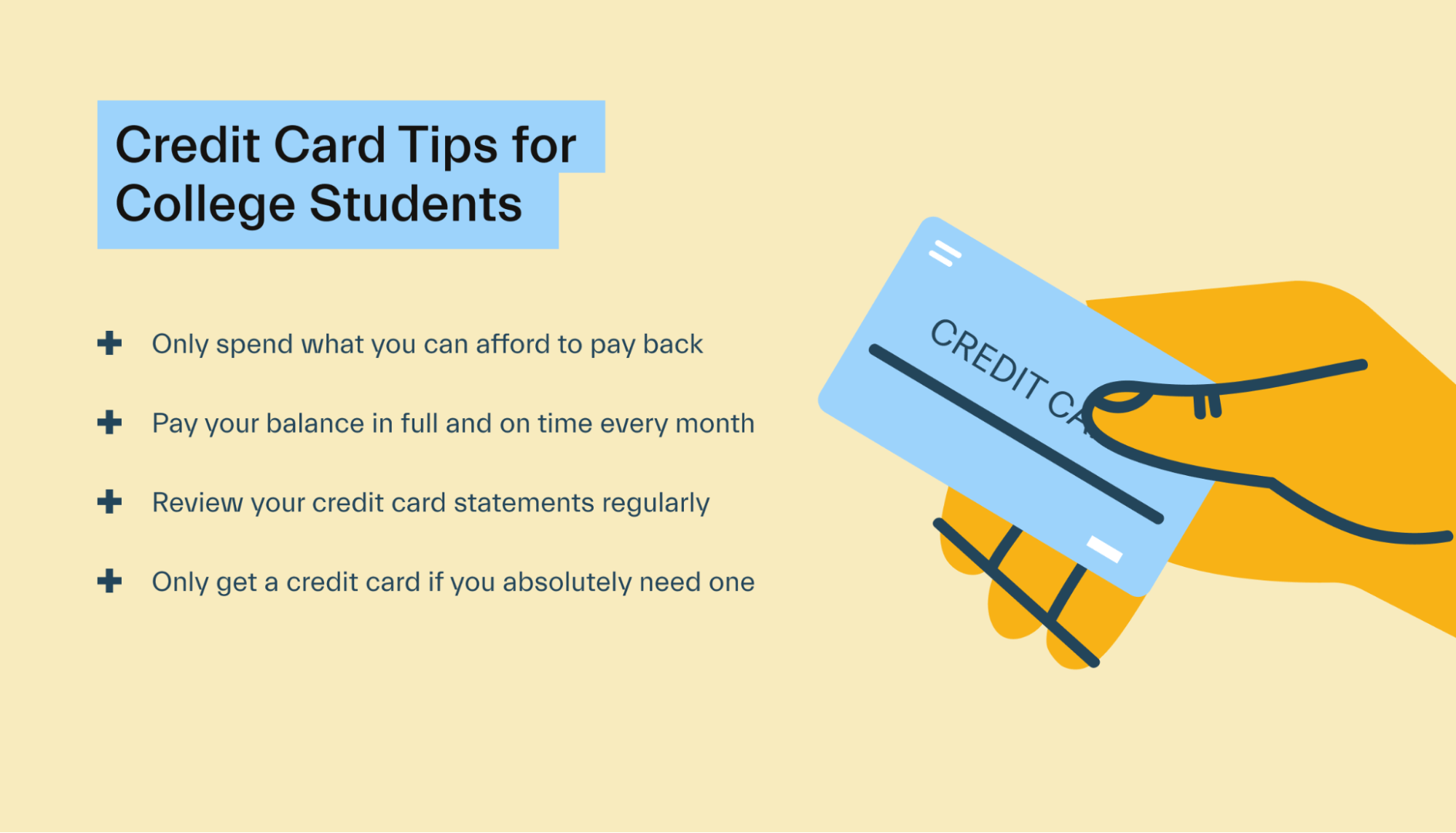

When used responsibly, credit cards can help you build your credit score, which can lead to better interest rates on things like personal loans and mortgages. But when used recklessly, credit cards can ruin your credit score and leave you in debt for years.

Here are a few tips to help you use credit cards responsibly:

Credit card debt is a difficult burden to carry, especially when you have student loan debt. So if you’re not sure you can handle the responsibility of a credit card, don’t get one.

5. Your student loan isn’t free money

Like credit cards, your student loan isn't free money to spend on whatever you want, so treating it like a "fun money" ATM isn't a great idea.

For example, let's say you're strolling through Target, and you see they've got PS5s in stock for $500. And having just received your financial aid, you decide to “treat yourself” and buy it.

End of story, right? Not quite. You forgot about that pesky little thing called interest.

Now, the fortunate part about federal loans (and most private loans, too) is that they use simple daily interest. This means you're only charged interest on the principal balance, not your initial balance plus any accrued interest, as you are with compound interest.

Simple interest on federal student loans is calculated using this formula:

Interest Amount = (Outstanding Principal Balance x Interest Rate Factor) x Number of Days Since Your Last Monthly Payment (typically 30 days)

Note: Interest Rate Factor is your loan's annual percentage rate (APR) divided by the number of days in a year. As of 2022, the average interest rate among all student loan borrowers is 5.8%, or an interest rate factor of 0.01589% (0.0001589 as a decimal required for calculations).

Getting back to our PS5 example, until you pay off that $500, it collects $2.38 in interest every month:

($500 x 0.0001589) x 30 = $2.38

And if it takes you 10 years to pay your balance, the $500 you spent on a PS5 will collect $285.60 in interest charges. In other words, your PS5 actually cost you $785.60, or about 57% more than what you originally spent.

Think twice before spending money you don’t have on things you don’t need that end up costing you a lot more when the bill is due.

6. Saving & investing pay off (literally)

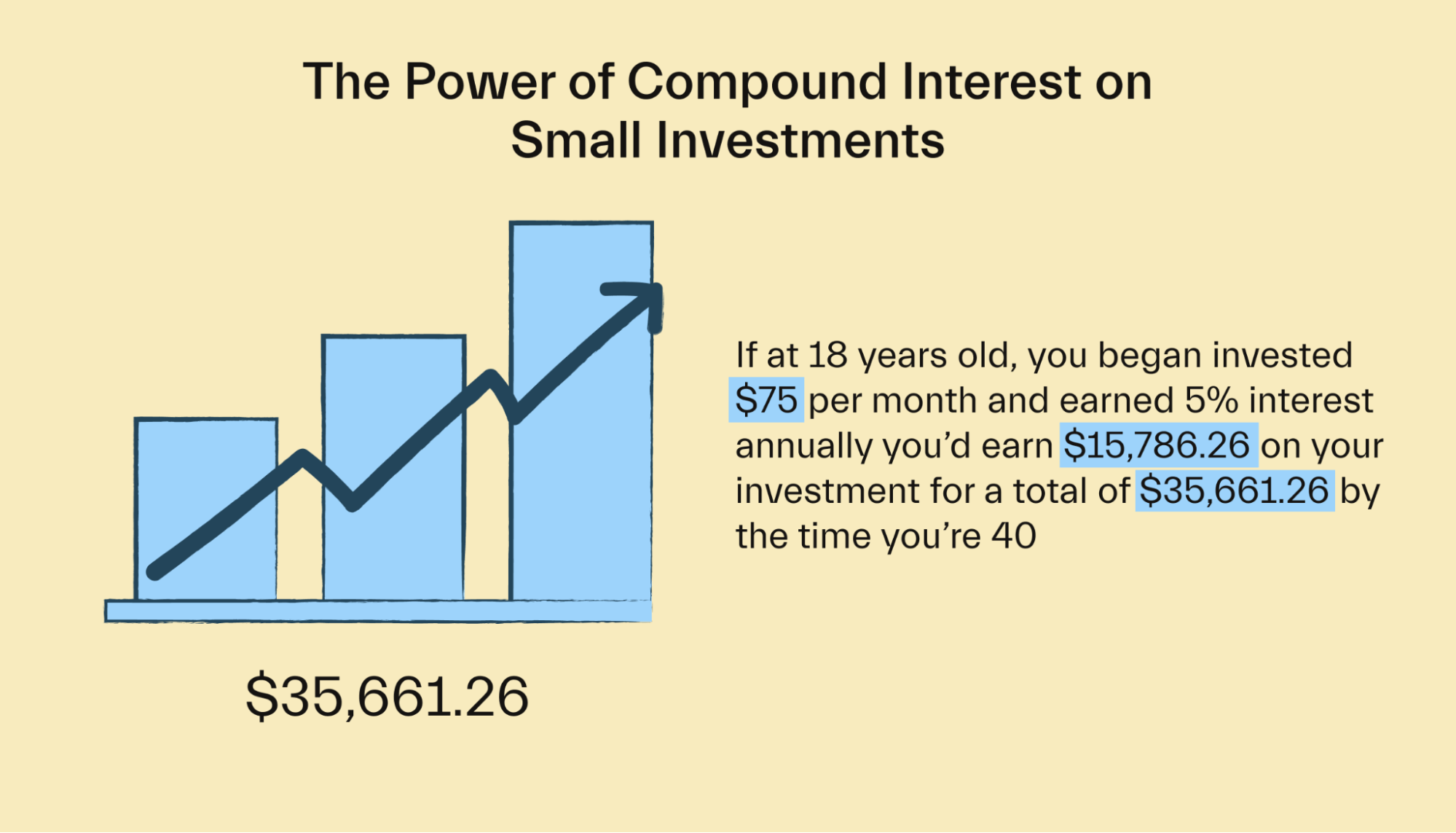

You may not think you have much cash to save or invest while you're in college, but even small amounts can add up over time—especially if you start early.

For example, say you turn 18 and decide to invest $75 every month. If your investment earns a compounding return of 5% every year, you'll gain $15,786.26 in compound interest, and your total investment would be worth $35,661.26 when you turn 40.

Not bad for 75 bucks every month, right?

If you're interested in learning more about investing, here are a few things to remember:

Speak with a financial planner: investments can be risky if you're a newbie and have no idea what you're doing, so talk with a pro before you invest.

Avoid meme stocks: better yet, avoid WallStreetBets and SuperStonks on Reddit entirely—these subreddits do more harm than good for novice investors.

Opt for low-risk investments: investing in a Roth IRA or in exchange-traded funds (ETFs) like the S&P 500 ETF are low-risk investments with consistent returns over time. They're simple investment strategies but will teach you the ropes of investing before you move on to advanced strategies.

The bottom line is learning how to save and invest with small amounts of money in college can cement the skills you need to build an impressive investment portfolio when you start making better money after college.

7. Choose a bank that treats you like a best friend

The best bank for college students is one that won't nickel and dime you with unnecessary fees—and also has checking and savings accounts specifically for students.

When choosing a student bank account, look for one that offers:

No monthly maintenance fees

A low or no minimum balance requirement

A mobile app for easy banking on the go

Access to a large fee-free ATM network

Rewards

FDIC Insurance

No-hassle customer service

8. Don’t pay full price for anything

Embrace student discounts, secondhand shopping, and buying things on sale. Seriously, paying full price for goods on a student budget is like setting money on fire.

Here are some of the best ways to score student discounts:

Flash your student ID: you'll find student discounts on everything from clothing to food. And if you're not sure whether a store offers a student discount, it never hurts to ask.

Look for student discounts online: plenty of companies offer student discounts when you verify your student status on their website (usually by signing up with your “.edu” email address).

Download the Unidays app: Unidays gives you instant access to discounts for over 800+ brands, both online and in-store. And the best part? It's free!

You can also save money by shopping second-hand. Browse through your local thrift store for clothing or hit up Craigslist for some furniture or household goodies.

Of course, you can also save money by simply waiting for sales. You’ll need a bit of patience, but it's totally worth it when you finally score something you’ve been eyeing for a fraction of the original price.

9. Insurance: protect your stuff and your health

As a college student, you'll want renter's insurance to protect your belongings in case of theft, fire, flooding, or some other disaster.

Renter's insurance is pretty affordable, with the average policy costing about $15 per month. However, coverage limits vary, so shop around for a fair policy.

And lest we forget about health insurance.

If you're still on your parents' health insurance plan, great! But if you're not on their plan or your school is outside of your parents' healthcare network, you'll need to find a different healthcare insurer. Thankfully, most schools offer affordable student health insurance plans.

10. Plan for your post-college finances

After you graduate college and enter the workforce, you'll have more expenses—including that big, bad student loan repayment.

If you've honed your personal finance skills throughout college, managing these "grown-up" expenses will feel less demanding.

Still, it's important to have a solid plan for your post-college finances, which should include:

Tackling student loan debt: create a budget and timeline for paying off your federal and private loans. If you're struggling with your monthly payment, you may want to refinance your loan to get a lower interest rate.

Saving for retirement: If your employer offers a 401k, sign up and start contributing as much as you can. If not, continue contributing to the IRA and/or other investments you started in college.

Building a proper emergency fund: if COVID has taught us anything, it's that you never know when a layoff will hit. Now that you're on your own, you'll need a proper emergency fund that covers at least 3 months of living expenses.

And that’s a wrap on personal finance for college students

Personal finance can be a tricky subject. But like anything, the more you work at it, the better you'll be at money management.

Use this guide as a resource to help you navigate personal finance during your college years and beyond.

We believe all students deserve their dream degree—without the debt. Mos helps students save on tuition, match with scholarships, and earn extra cash—all in one app. Explore memberships today.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you