Budgeting •

October 28, 2022

6 tips for creating a budget for college

Your college student budget can help you keep your spending under control, save money, and prepare for the financial future. Learn how to get started.

6 tips for creating a budget for college

Heading off to college is a big deal. It's a huge life change and the start of many new experiences and opportunities.

And, for many students, it often means managing your own money for the first time—which can be exciting, but also pretty stressful.

One of the best ways to manage your finances during college is to create a budget for yourself.

Budgeting can help you stay on track with your spending habits, get the most of your financial aid money, and prepare yourself for the future.

Preparing—and sticking to—a college budget can make a significant difference in your finances today and in the future.

In this article, we’ll show you why budgeting as a college student is worth the effort, and how to create your college student budget.

The importance of budgeting for college students

When you head off to college, it may be the first time you’ve ever been responsible for your own finances.

Getting the hang of managing a monthly budget can be challenging. You have to make sure you spend wisely so that you have enough to make it to the end of the month.

You also have to manage your due dates. After all, one late payment on something like rent or your phone bill can have a significant impact on your finances.

Unfortunately, the risks of not having a budget can be pretty severe. You risk overspending and then not having enough money left over for important expenses.

The last thing you want is to spend all your money on eating out during your first semester, and not have enough money to buy your books for the second semester.

But failing to budget can also have long-term implications.

A missed payment can stay on your credit report for years, and a poor payment history can drastically reduce your credit score.

A low credit score will make it more difficult to rent an apartment, finance a car, and even get a job—making your post-grad life pretty rough.

The benefits of budgeting

We’re not trying to be all doom and gloom here. Budgeting doesn’t just help you avoid the negatives, it also helps you capture lots of positives!

Budgeting is an important part of living on your own and has many benefits. Some of the most significant benefits of budgeting include:

Budgeting helps you to make your money last longer. It’s easy to overspend on shopping, eating out, traveling, and more. With a budget, you’re less likely to spend money you don’t really have.

Budgeting creates peace of mind. You’ll always know you have enough money to pay your monthly bills and cover your spending, so you can focus on your studies instead of stressing about your bank account.

Budgeting helps you to avoid debt. Without a budget, you risk going into credit card debt to cover your living expenses––and that’s something you want to steer clear of.

Budgeting helps you to save for your post-grad years. The more money you can save before graduation, the better set you are to start your new life after college! Your future self will thank you.

Budgeting can help reduce student loans. If you can cover some of your tuition costs and living expenses out-of-pocket, you can rely less on a student loan to pay for them. Again, the less debt, the better.

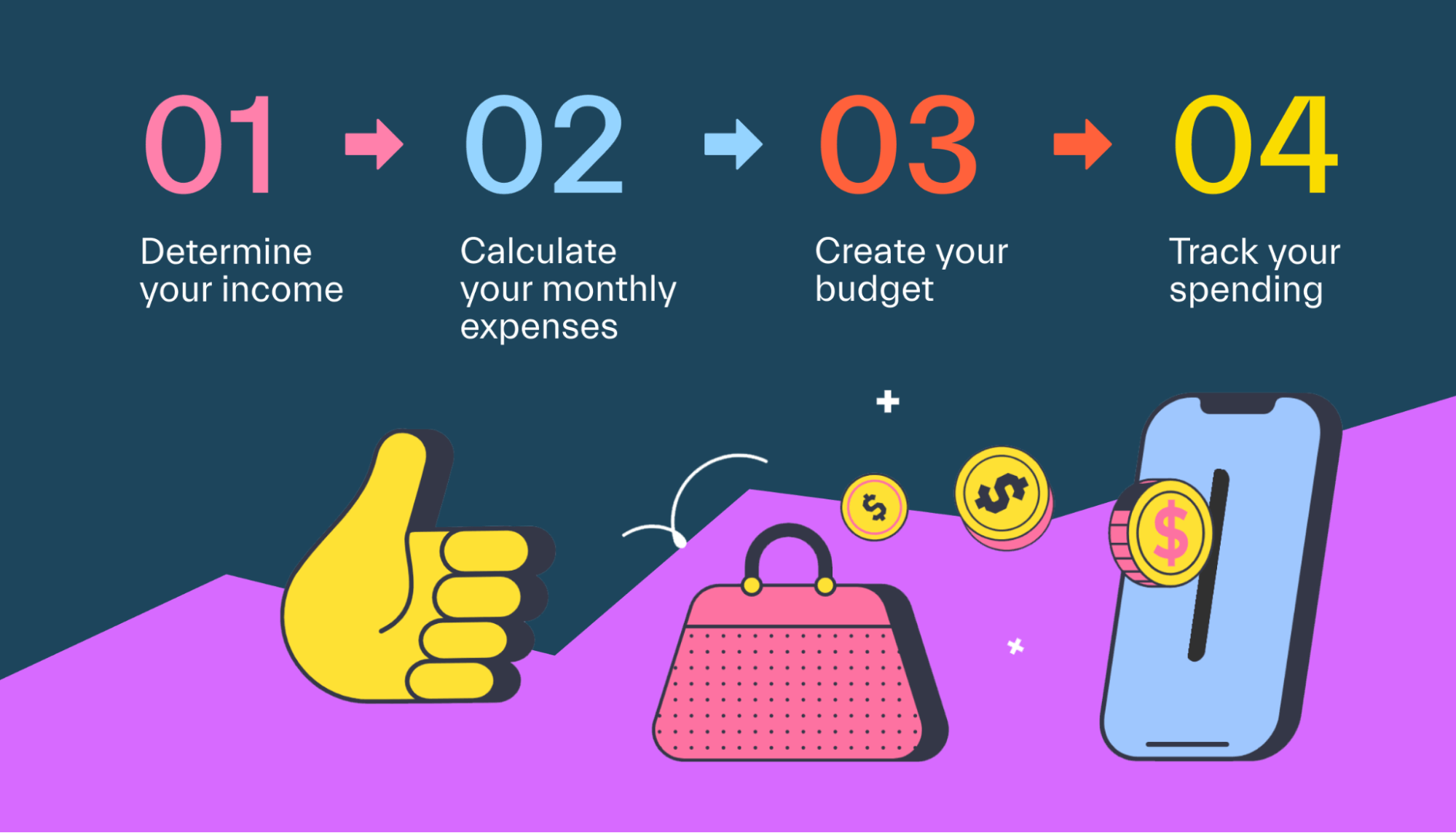

How to create a college student budget

Creating a budget can be daunting. Let’s go over 4 steps you can use to create a college student budget.

Step 1: Determine your income

In order to create a monthly budget for your money, the first step is figuring out just how much money you have to work with.

After college, you’ll likely budget with the income you earn at your job. But during college, income can come from a variety of sources.

First, many students either qualify for work-study with their financial aid package or pick up a part-time job while they’re in school. The income from these jobs may make up some or all of your monthly income.

If your family’s financial situation warrants it, your parents may also send you money to cover monthly expenses so that you can focus on your studies rather than working.

But unless they’ve guaranteed you a set amount each month, you might not want to bank on mom and dad for income.

Finally, many students rely on student loans to help cover living expenses during college. When you borrow more money than is necessary for tuition and fees, your school will typically give you the rest to cover living expenses.

In this case, budgeting is even more critical since you probably only get a check once each semester or year rather than every month.

Once you know all of your income sources, add up the total. That’s how much you have to budget.

Step 2: Calculate your monthly expenses

The next step is to add up all of your monthly expenses. These are likely greater than they were when you were in high school, so it’s important to be thorough.

First, add up your fixed expenses (the amounts that are the same every month). These may include your phone bill, car insurance, a parking permit, and rent and utilities if you’re living off-campus.

Next, add up your variable expenses. These are likely to include groceries, gas, eating out, entertainment, personal care items, clothing, and more.

Ideally, your list of expenses will add up to be less than your monthly income.

If that’s not the case, you’ll need to make a change. Either you’ll have to find a way to earn more money to cover your expenses, or you’ll have to reduce your expenses to fit within your current budget.

Step 3: Create your budget

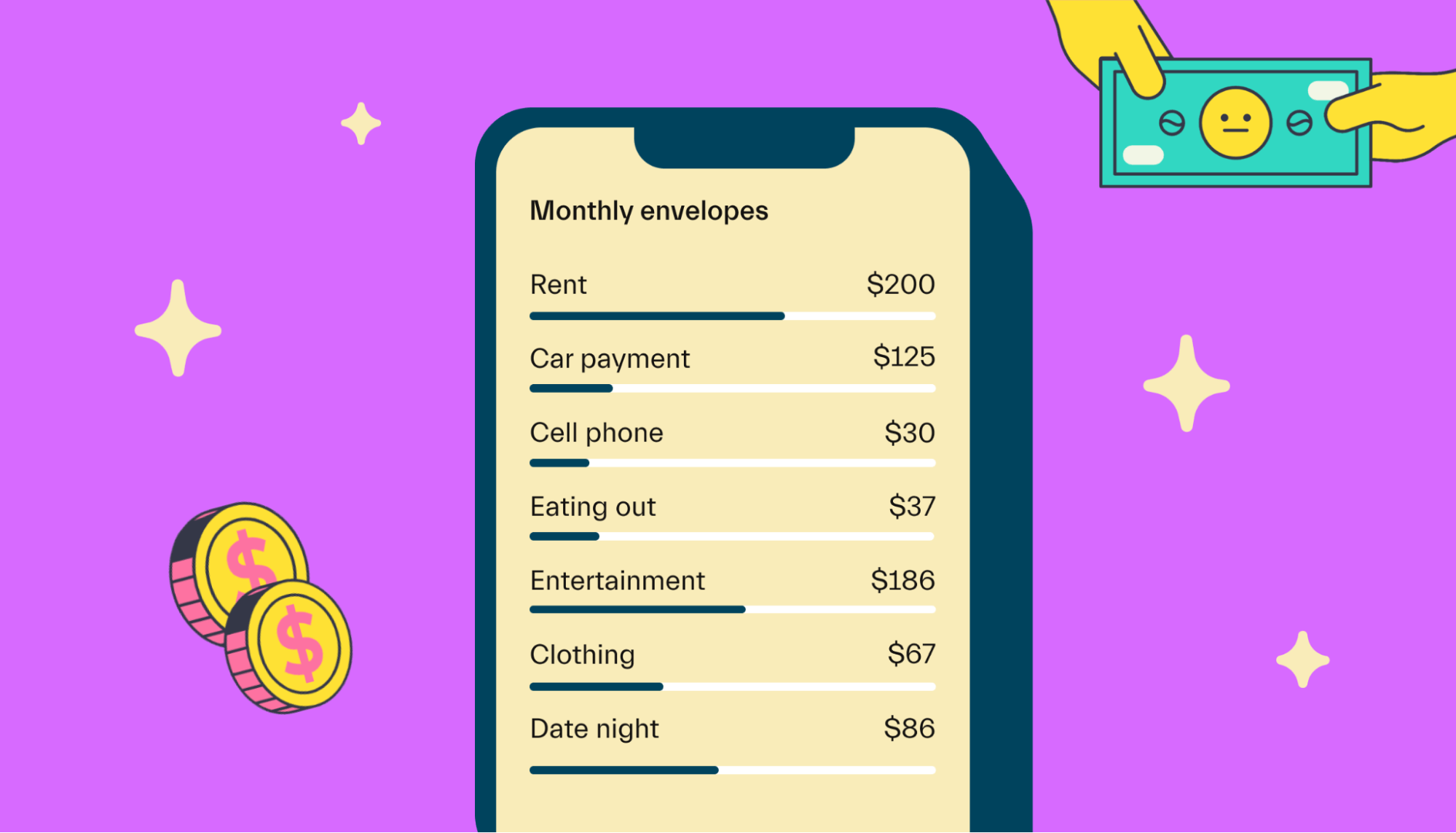

Once you’ve added up your income and expenses, it’s time to actually create your budget. There are plenty of digital tools available to help you do this, including a spreadsheet, or a budgeting app like Mint or You Need a Budget (YNAB).

Having your target budget laid out is important because it serves as a benchmark each month to make sure you’re sticking to your spending goals.

Step 4: Track your spending

Finally, be sure to track your spending each month and compare your actual spending to the spending goals you set in your budget.

After all, a budget isn’t really effective if you aren’t paying attention to whether you’re sticking with it.

One of the easiest ways to track your spending is by signing up for a budgeting app that automatically adds your expenses. Apps like Mint or YNAB import each expense and then automatically categorize them in your budget.

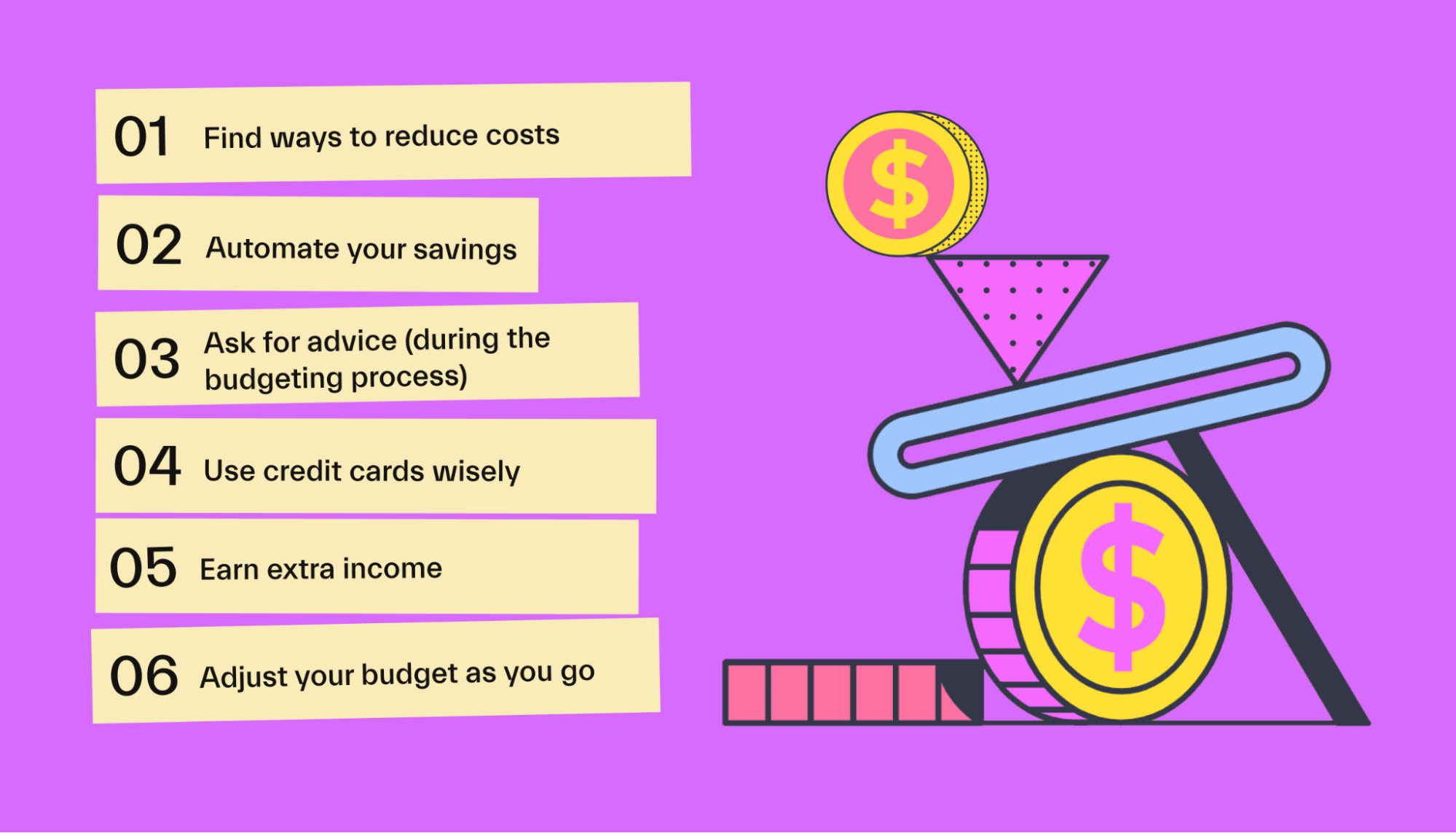

Budgeting tips for college students

Sticking to a budget can feel impossible. But it doesn’t have to be. Let’s take a look at 6 tips you can use to successfully fit your spending within your budget:

1. Find ways to reduce costs

College is probably the first time you’re managing your own budget, and the costs can definitely add up. One of the best ways to make the process a bit easier is to look for ways to reduce your expenses.

First, consider how you can spend less on items you’re buying.

Whether you’re moving into a dorm room or an apartment, you’ll probably have to buy some new items. But if you can buy used instead of new, you can save yourself a lot of money.

Next, find ways to save money around your college campus.

Universities often have free entertainment and events that students can take advantage of, and there’s almost always an event or meeting where you can snag a free meal.

You can also take advantage of businesses that offer a student discount to save money off-campus.

Finally, look for creative ways to save money on food.

Food is a significant part of most people’s budgets, meaning it’s one of the best places to cut back.

You might have a meal plan, meaning you aren’t responsible for cooking for yourself or buying all your own groceries.

If you have the option of paying for your meal plan upfront as a part of your college costs, you might want to do so. That way, you never risk a situation where you don’t have enough money for dinner.

You can also look for other ways to save on food. Even with a school meal plan, you’ll probably find yourself spending on some groceries, snacks, meals out, and cups of coffee.

Shopping at the grocery store and keeping food on hand can help you avoid unexpected meals out and trips to the convenience store. And with a coffee maker in your room, you’ll be less tempted to stop at the coffee shop on your way to class.

2. Automate your savings

There’s no doubt that saving money while you’re in college is tricky. But having some savings for unexpected expenses will help you stick to your monthly budget.

Automating your savings is an easy way to make sure you have that safety net in place and don’t have to stress about an emergency blowing up your budget.

First, if you have a monthly income, you can set up an automatic transfer from your checking account to a savings account each month. That way, you never have to think about it, and you don't have the chance to spend that money on something else.

You can further automate by setting up your debit card to round up each transaction, moving the spare change into your savings account.

Not sure how much to save? A general rule of thumb is that you should have at least 3 to 6 months of expenses set aside for emergencies. But if this isn’t obtainable, whatever you can afford to save is better than nothing.

3. Ask for advice during the budgeting process

It’s natural to feel overwhelmed by the budgeting process when you head off to college. But you don’t have to do it alone.

Consider asking your parents, teacher, guidance counselor, or another trusted adult for budgeting advice. They’ll probably be happy to offer some insight.

In fact, they’ll probably be excited that you’re taking your finances seriously and will be eager to help.

You could also talk to any old siblings or friends who have done this before you. They might have some advice that’s more actionable and relatable since they’ve probably been through your situation more recently.

4. Use credit cards wisely

When you arrive on campus, you’ll almost certainly see offers for student credit cards. And while it’s not necessarily a bad idea to sign up, you should only do so if you can use those credit cards wisely.

The first rule of credit cards is that you should pay off your entire balance each month by the due date. If you don’t, you’ll be stuck paying interest on your purchases.

Next, make sure to pay attention to your credit limit.

The last thing you want is to max out your card without you noticing. And while using credit cards can be an effective way of boosting your credit score, it can actually have a negative effect if your credit utilization (or the percentage of your credit limit that you’re using) is too high.

5. Earn extra income

Any time there’s a shortfall in your budget, you’ve got 2 options: reduce your expenses or increase your income.

Unfortunately, there’s only so much you can cut from your budget. Often, it’s easier to try and earn more money.

These days, it can be pretty easy to find income opportunities.

All the traditional options still apply, such as picking up a part-time job near campus. Serving and bartending jobs can be lucrative, thanks to tips. You can also consider a retail job.

But with today’s technology, there are even more options available.

If you have an inconsistent schedule and want to be able to work on your own time, you can join the gig economy with apps like Instacart, Rover, and DoorDash. You can also look for opportunities online as a virtual assistant, transcriber, and more.

6. Adjust your budget as you go

Your budget is likely to evolve as you make your way through school. The budget you set for yourself freshman year isn’t likely to cut it by the time you’re a senior.

And when you’re just getting started, you might find that you’ve underestimated or overestimated your income or spending.

Flexibility is key. Rather than getting upset with yourself if you go over budget, figure out what you can change to make sure you do better the next month.

Conclusion

Creating a college student budget can make a significant difference in your life.

For the many students who live paycheck to paycheck in college, budgeting can help ensure you stay on top of your monthly expenses.

Budgeting can also help you save money, avoid going into debt, and set yourself up for a successful financial future after you graduate.

As you make your way through school, you can continue to take advantage of federal student aid opportunities such as grants, scholarships, and loans to help you lessen the financial burden.

Not sure where to start? With the largest scholarship pool in America and personal advisors who can help you get free money for school (and life!), Mos can guide you as you get your financial sh*t together.

So what are you waiting for? Explore Mos memberships today.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you