Saving •

Passive income for college students

Passive income lets you earn money without much active time invested. Here are passive income ideas for college students.

Most college students could certainly use some extra spending money. Most are also short on time and won’t be able to juggle a traditional part-time job and school.

What are students to do? Passive income for college students may be an option. Passive income is money you can earn without additional effort. Think of it as a way to make money while you do other stuff, like study or sleep.

Of course, some ventures are often labeled as passive income but, in reality, require quite a bit of active effort. It’s important to have realistic expectations about passive income opportunities and recognize that, in some cases, simply getting a part-time job may be more effective.

Nonetheless, it’s well worth exploring the various passive income ideas for college students. Here’s what to consider.

What is passive income?

While it may sound to good to be true, passive income is definitely a thing. As we said above, passive income is a great option for busy students because you can snag extra bucks without additional effort.

For example, earning dividends from stock market investing could be considered passive income, as could income from a rental property. Unfortunately, these methods are often out of reach on a college student’s budget!

Income from a job is not passive income, as it requires active effort to earn.

Of course, the line between passive and active income is a bit blurry at times. Almost everything requires at least some level of effort. And plenty of “passive” opportunities actually require quite a bit of upfront effort.

For instance, writing a book would require a ton of work—but once it’s published, the income from book sales could be considered “passive” income. As you can see, the definition of this phrase can be different depending on who you ask.

This can also create a bit of a trap for those pursuing passive income opportunities. You might start a blog hoping to earn passive income—but you may need to spend 100s of hours on it before you earn any significant amount of money.

For these reasons, it’s important to weigh passive income opportunities carefully. Are they worth the time and effort? And perhaps more importantly, are they enjoyable?

Passive income for college students

Many of the traditional passive income opportunities require huge upfront investments of time, money, or both. Real estate investments are a common example of how people generate passive income. But unfortunately, these are often out of reach for students.

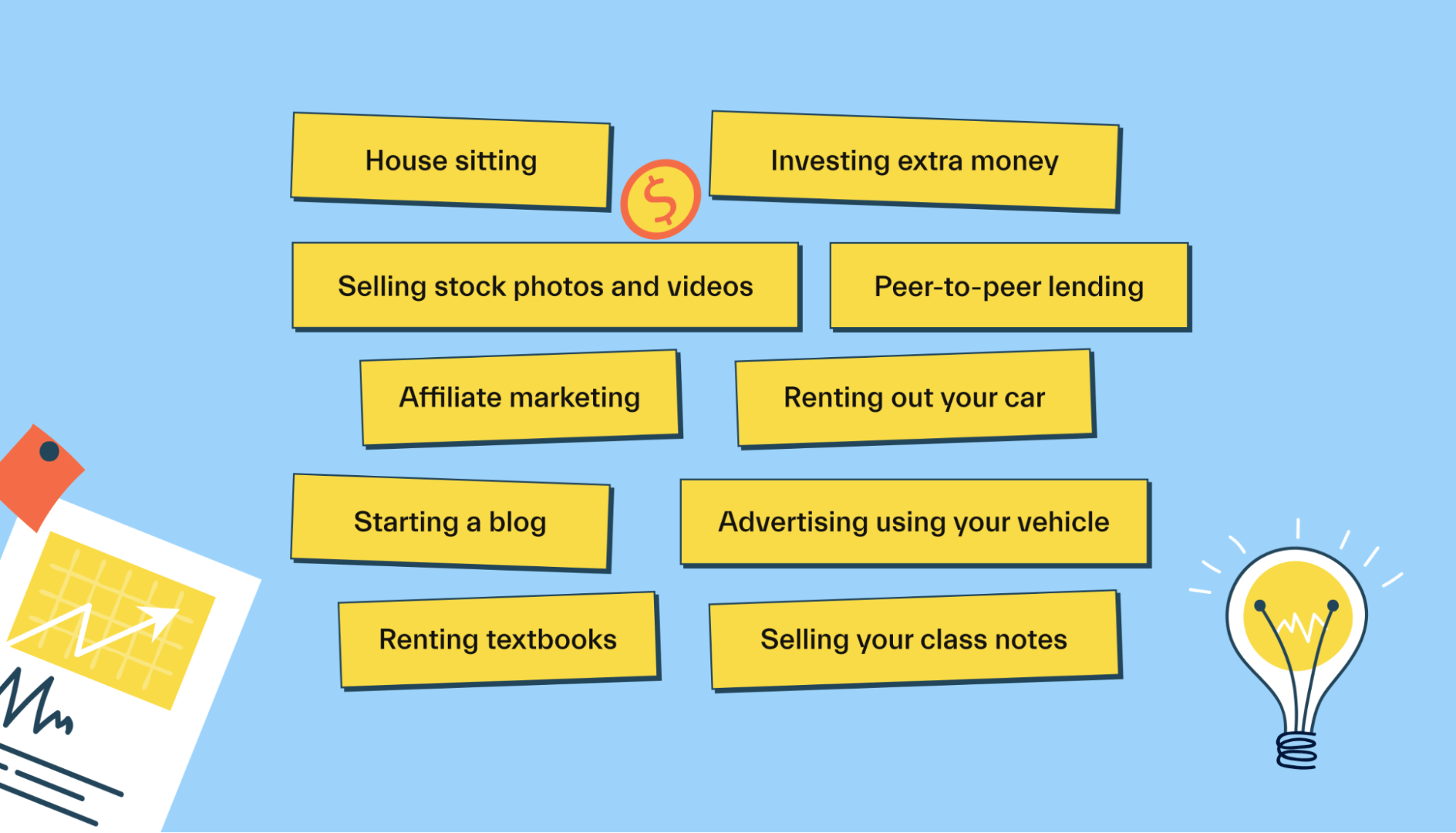

The best passive income for college students may lie in lesser-known opportunities. Some of these opportunities—like renting textbooks—exist specifically because of college, while others are simply more approachable for students' budgets and time constraints.

Below, find some top passive income ideas for college students to drum up some extra money. To earn more, you may consider developing multiple passive income streams.

House sitting

House sitting can be a great passive income source for college students. Depending on the situation, it could require very little work or a bit more if pets are involved.

House sitters can typically charge between $25 and $50 per night, and perhaps even more if there are pets. That can quickly add up, with a 1-week house sit racking up between $175 and $350 at those rates.

Finding house-sitting gigs is mostly about word-of-mouth. You could also choose to advertise on local message boards, Facebook groups, or websites like Housesitter.com.

The downside of this is that you may need reliable transportation to get back and forth from campus to the house, depending on where it’s located. It’s wise to estimate the amount of time you’ll need to spend on the gig before accepting it and weigh that time against the amount of money you’ll earn.

Selling stock photos and videos

If you’re interested in photography or videography, you could opt to sell stock assets online. This involves producing imagery, organizing and tagging each asset, and uploading it to a popular stock photo website.

Websites like iStockPhoto, Shutterstock, and Dreamstime all allow you to sell photos and videos directly to customers. And there are actually dozens of websites where you can list your digital assets.

This is an opportunity that requires a good amount of upfront effort. It’s best for those who have a genuine interest in these hobbies (and the equipment handy already) and for those who already have a library of images built up.

A big chunk of the upfront effort is uploading, labeling, and tagging all your images. Once this is done, very little ongoing effort is required (although you may want to keep adding more images as you take them).

Don’t expect to earn a fortune from selling stock photos—but if you’re interested in photography, this is a viable opportunity for earning passive income as a college student.

Affiliate marketing

Affiliate marketing involves promoting various products, services, and courses. You earn a commission when someone buys something or signs up for a free trial.

To make money in affiliate marketing, you need an audience. This could be from your blog, YouTube channel, email newsletter, or even paid advertising.

For example, you could start a YouTube channel about hiking. In the video description box, you could include affiliate links to hiking gear on Amazon, and you’d earn a small commission if someone clicks on your link and buys something.

The upfront effort involved in affiliate marketing can be immense. You will likely need a substantial audience in order to make any sort of real money.

For this reason, this is mostly recommended if your dream job is in an industry where the skills are transferable. If you want to work in travel and hospitality, starting a travel YouTube channel may be enjoyable—and could actually earn you a few bucks on the side, while also looking good on a resume.

Starting a blog

Starting a blog is one way to grow an audience, which you can monetize via advertising or affiliate marketing.

For example, you could blog about rock climbing (or whatever you’re passionate about!) In each post, you could include an advertisement from Google Adsense, which pays you a small amount each time someone clicks on an ad. Or, you could include affiliate links to relevant products (see above).

Blogging can be rewarding, but building an audience takes a long time. You shouldn’t expect to have any sort of significant traffic—let alone profit—in at least the first 6 months.

There are also typically costs involved, like website hosting, a domain name, etc. You can get by on a basic setup with minimal upfront investment (around $50 per year, for example), but it’s still important to be aware of costs before getting started.

Because of the huge upfront effort involved, this is an opportunity that is best reserved for those who are truly passionate about a topic and have a genuine desire to blog about it.

Renting (or flipping) textbooks

Buying and renting out textbooks can be a way to drum up some semi-passive income. There are 2 ways to do this:

Renting directly to students on your campus

Renting online

To rent directly, you’ll need to find renters by spreading the word in your classes or posting advertisements on campus. You may wish to buy multiple copies of each textbook in order to improve your profits.

To rent online, you can use a platform like Valore to list items. When someone rents it, you’ll ship it directly to them, and they will return it after the designated time period.

Buying and reselling textbooks for a profit could be another angle to consider. For instance, you could speak to fellow students in your class on one of the final days of class to see if they would sell you their textbooks.

Flipping textbooks is simply a matter of buying low and selling high. Start by researching how much used textbooks are going for, either on Amazon or on other third-party marketplaces. Then, subtract the fees you would have to pay for selling on that platform (it’s 15% on Amazon). This will determine your net selling price — now, all you have to do is determine how much profit you wish to make on each book.

For example, let’s say a used chemistry textbook is selling for $90 on Amazon. If you list yours at $89 (to be the cheapest option), you’ll pay $13.35 in fees, plus around $5 to ship it. That will leave you with a net income of around $70.65. By offering $50 to students in your class, you can turn a profit of around $20.65 per textbook.

Just be sure to be aware of the risks of this approach. You could struggle to sell the books and wind up having to store them for a while. Or a new edition could come out, resulting in the prices of your textbooks plummeting.

Investing extra money

Investing is a great way to develop an extra source of income. You can earn dividends (like interest) from stocks, interest from savings products, or interest from something like peer-to-peer loans.

In general, you need a lot of cash to invest to earn any significant amount of passive income. However, it’s true passive income, as it really doesn’t require much effort.

If you invest $1,000 in an S&P 500 index fund, you might earn around 1.5% in dividends. This means that after a year, you’ll have earned $15 in dividends. Plus, your investment will typically grow over time (although this fluctuates with stock market movements).

Though it won’t necessarily produce a huge amount of passive income, investing is a fantastic idea in general. The earlier you get started, the more your money can grow.

If you kept that same $1,000 invested for a total of 45 years (until retirement age) and earned 7% returns, you would have over $21,000 in your account—and that’s without making any additional investments!

For more info, read through our guide on how to invest as a college student.

Live streaming

Various platforms exist where you can live stream and make money in college. While this isn’t necessarily “passive” income, in some cases, it can reward you for doing activities that you would already be doing.

For instance, you might choose to live stream yourself playing your favorite video game. Platforms like Twitch allow viewers to leave tips and donations; you can even sell premium subscriptions to loyal viewers.

This strategy requires building up an audience, but getting started is usually low-cost or no-cost, although you probably need to buy a better microphone and camera than those in your laptop if you want to start earning serious money.

Renting out your car

If you own a vehicle, you can make semi-passive income by renting it out on a platform like Turo. Turo is like Airbnb for vehicles, and it allows owners to rent directly to renters.

This strategy will work best if you live in a decent-sized town that has strong rental demand. Bonus points if there is an airport nearby!

Advertising using your vehicle

Another way to make passive income using your vehicle is to sell ad space on your car. This is known as “wrapping,” allowing you to make money by driving around.

A few different companies will pay you to wrap your vehicle. Just be sure to check the fine print—some may require that you drive a certain amount of miles per month, for example.

Selling your class notes

Here’s a creative strategy: You can actually sell class notes for cash. Since you’re taking these notes anyway, the income from this source could be considered passive.

Various online platforms enable you to sell notes for cash. Examples include Nexus Notes and Stuvia. Stuvia reports that the average seller earns over $100 per month selling notes on the platform.

Retail arbitrage

Retail arbitrage involves buying discounted items from retailers and reselling them online. This is not truly “passive” income, but it can still be worth considering as the time requirement is flexible.

Arbitrage is all about looking for opportunities to buy low and sell high. You might see a video game on sale for $25 at a local store, where it goes for $45 on eBay or Amazon. After fees and shipping, you could likely net around $10 to $15 from flipping this item.

This strategy can require a fair amount of time spent researching, listing, and shipping items—it’s only recommended if you enjoy these kinds of entrepreneurial pursuits.

Wrapping up

Passive income is a great way to supplement your funds during college. Some passive income ideas require a lot of upfront investment—whether of time, money, or both—while others are simpler to get into.

Regardless of which way you choose to earn passive income, it’s wise to track your progress and see how much time you’re actually spending. In some cases, you may find that your “passive” income source isn’t so passive after all! Be sure to re-evaluate if the activity is worth the extra money it provides or if you’d be better off getting a part-time job or being a rideshare driver.

Looking for other ways to save and earn in college? We’ve got you. Mos is a banking solution specifically designed for students. You can use Mos to earn cash back, manage your funds, apply for scholarships, and much more.

Plus, if you’re looking for active income, try Mos gigs. Earn extra cash on a schedule that suits you, with vetted opportunities sourced just for students.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you