Budgeting •

December 15, 2022

What's discretionary income?

Discretionary income refers to the amount of money you have left over after paying for essentials, like rent and food. Here’s what students need to know.

We’re all familiar with the idea of income—it’s simply the amount of money you earn. Income could come from a job, business, or even from certain types of financial aid.

But what is discretionary income? This term is relevant for everyone, but it’s particularly important for students to understand because discretionary income levels can affect student loan repayment plans.

This comprehensive guide will cover what discretionary income is, why it matters, and how to calculate your discretionary income.

What is discretionary income?

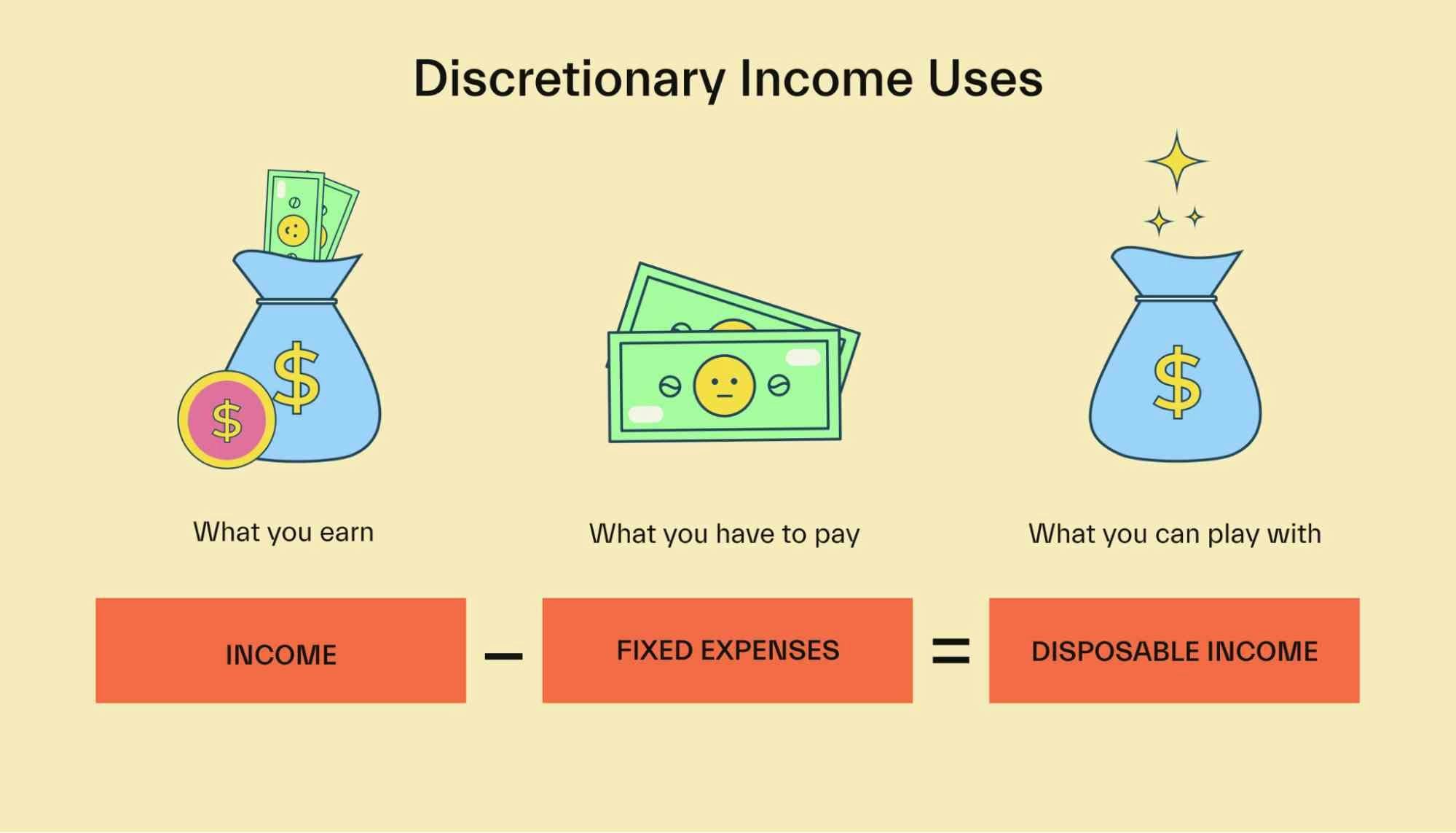

The simple definition of discretionary income is money left over after you pay for necessary expenses.

Discretionary means “available for use at the discretion of the user.” Essentially, discretionary means that you have a choice in the matter.

Required expenses are things like rent, utilities, and other bills. Basically, any necessary living expenses. You can’t choose to simply not pay rent—you’ll get evicted!

Discretionary expenses are optional or flexible expenses, like dining out, activities, and shopping.

Discretionary income refers to the gap between your income and your fixed, required expenses. Let’s look at an example of a college student budget to illustrate.

Income: $2,600 ($1,000 from part-time work, $500 from parents, $1,100 from financial aid/scholarships)

Mandatory expenses: $2,300 (rent, tuition, fees, meal plan, groceries, books, etc.)

Discretionary income: $300 ($2,600 - $2,300) this money is left over for optional spending.

In this example, the student has a monthly income of $2,600 (including financial aid) and mandatory monthly expenses of around $2,300. This leaves the student with around $300 to spend as they please. This $300 is the student’s discretionary income.

Discretionary income vs. disposable income

Discretionary and disposable are sometimes used interchangeably, but they have different meanings.

Disposable income is the amount of money you have left after paying income taxes. In other words, it’s your take-home pay after you pay federal and state taxes.

Discretionary income is discussed more in this article—it’s the amount of money left over after taxes and after any required expenses, like rent and groceries.

Discretionary income vs. personal income

Personal income is another term used to describe all the income people receive from sources such as wages, salaries, Social Security, businesses they own, and government benefits.

Discretionary income is a subset of your personal income that describes what is left after paying for essentials like health insurance, rent, and food.

Why does discretionary income matter?

Discretionary income is important because it shows you how much you have left over after paying for essential expenses, savings goals, and more. In other words, it measures how much income you have for discretionary spending. Knowing discretionary income levels can help you keep your budget on track and avoid overspending.

The figure has another important role for students: It can influence how your student loan repayment plan is structured and how much you’ll have to pay each month. This can have a substantial impact on your finances.

For general budgeting

For people without student loans, discretionary income is relevant for determining how much “pocket money” you have.

It’s very useful to know this number ahead of time—or at least have a rough idea. Otherwise, you can end up overspending.

For example, let’s say you earn $4,000 per month. That’s a lot of money, right? While $4,000 in your bank account may seem like a lot of dough, wait until you pay your rent, utilities, and phone bill, buy groceries, and save a bit for a rainy day. You may find that you’re not left with much at all!

If you don’t use any sort of budgeting structure, you may simply not know where your money is going. Small expenses can really add up.

If you don’t prioritize the most important expenses (as well as your savings goals), you can end up living paycheck-to-paycheck for a very long time. Or worse, you can end up with an increasing level of debt.

By knowing your discretionary income upfront, you can be aware of what you’re spending on optional items—and if that aligns with your discretionary income. You don’t necessarily need to track every purchase or budget every dime—just knowing your rough estimate will be very helpful.

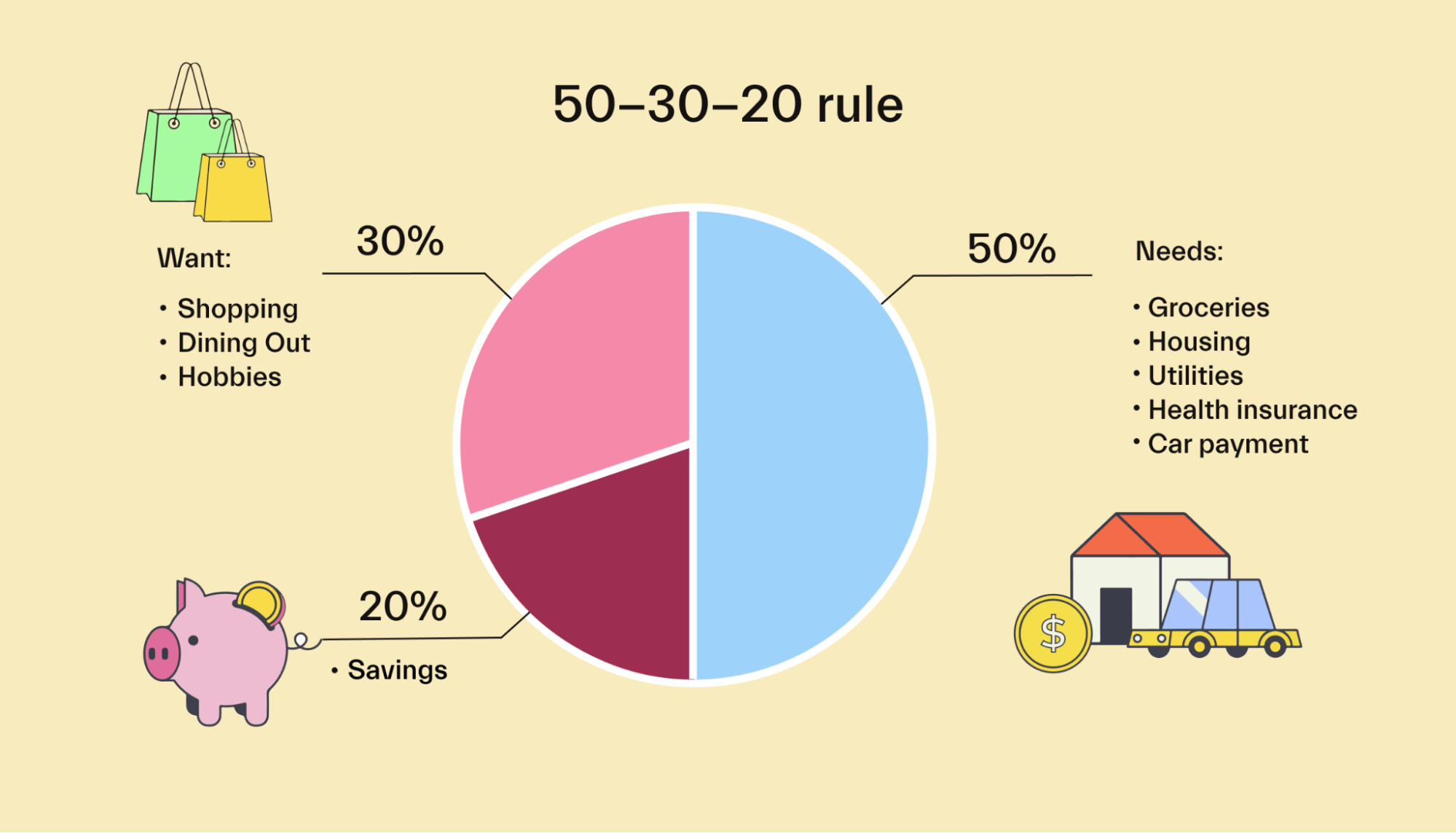

Some people adopt certain budgeting styles, as well. For example, the 50/30/20 budget states that you should aim to spend around 50% of your income on needs, 30% on wants (discretionary), and 20% on savings or paying down debt.

For student loan repayment plans

For students and graduates with student loan debt, discretionary income is even more important to be aware of. This is because it affects the amount you’ll need to pay on income-based student loan repayment plans.

The higher your discretionary income, the more you’ll need to pay toward monthly student loan payments.

Basically, the federal government (which backs most student loans) allows you to pay a portion of your discretionary income toward your student loans instead of paying a fixed amount. This is helpful for new graduates and low-income people because it means you won’t need to pay as much when you earn less.

For most plans, the amount is 10% of your discretionary income. So if the government formula determines that you have $700 in discretionary income, your student loan payment may only be $70 per month.

However, “discretionary income” in this case is defined in a very specific way. It doesn’t look at your actual spending—it uses baseline poverty-level information to estimate how much discretionary income you might have. See below for an explanation of how to calculate your discretionary income.

Keep in mind that this only applies to income-based repayment plans. There are a few different versions of these plans, including:

Revised Pay As You Earn Repayment Plan (REPAYE Plan)

Pay As You Earn Repayment Plan (PAYE Plan)

Income-Based Repayment Plan (IBR Plan)

Income-Contingent Repayment Plan (ICR Plan)

Each plan is set up a bit differently. In terms of discretionary income, here’s how they work:

REPAYE plan, PAYE plan, and IBR plan: Generally require payments of 10% of your discretionary income

ICR plan: One of either:

10 percent of your discretionary income, OR

What you would pay on a repayment plan with a fixed payment over 12 years, adjusted according to your income

The rules vary, so be sure to check with your loan issuer for details. There are also different requirements to apply for these plans—see this overview for more information.

For student loan forgiveness

With President Biden’s announcement of student loan forgiveness, many students and graduates have wondered whether they are eligible and can save money.

Under Biden’s plan, students who have federal loans and incomes under $125,000 can receive forgiveness of up to $10,000. Some low-income borrowers can receive double the relief, with forgiveness of up to $20,000.

Income eligibility is based on adjusted gross income rather than discretionary income. However, that doesn’t mean your discretionary income doesn’t matter. If you still have a balance after the loan forgiveness, your discretionary income can impact your loan repayment if you stay on an income-based repayment plan.

You can apply for loan forgiveness through the official application page on StudentAid.gov.

Keep in mind that this forgiveness only applies to federal student loans. It’s much harder to get a private loan balance forgiven. Usually, this can only happen if you become permanently disabled or die. If you have private student debt, consider alternatives like deferment or forbearance.

Are forgiven loans treated as income?

Previously, you would have to pay income tax on your forgiven loans because the forgiven debt was viewed as a type of personal income. However, under current federal rules, you don’t have to include forgiven debt on your tax return or pay income tax on it, making the $10,000 loan forgiveness tax-free. Some states may still tax the forgiven amount.

How to calculate your discretionary income

To calculate discretionary income in general, simply take your monthly income and subtract your mandatory monthly expenses.

If you earn $3,000 and spend $2,200 on required expenses, your discretionary income is $800.

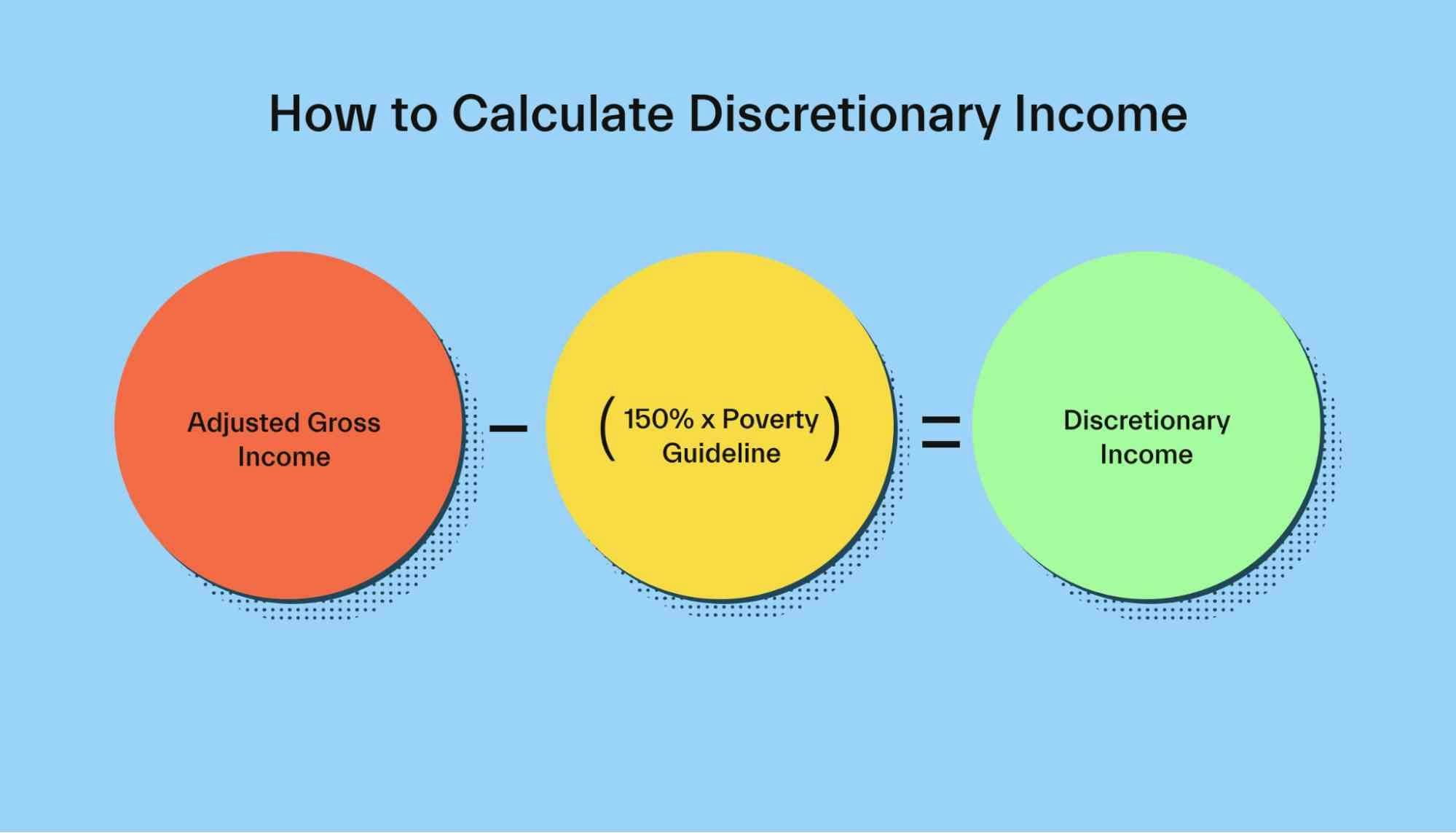

To calculate discretionary income for student loan repayments, the math is different. It doesn’t look at your actual expenses but uses an estimate based on the federal poverty levels.

For most repayment plans, your discretionary income is calculated as the difference between your annual adjusted gross income (AGI) and 150% of the federal poverty guidelines for your family size.

If your household size is one (and you aren’t a dependent for tax purposes), the federal poverty line is $13,590. You can multiply this by 1.5x (150%) to find the government’s estimate of your annual expenses. In this case, that figure is $20,385.

From here, take your annual AGI and subtract the figure you just calculated. If you earn $30,000 per year, you would subtract $20,385, leaving you with $9,615. This figure of $9,615 would then be what the government estimates your annual discretionary income to be.

Finally, divide that figure by 12 to get the monthly amount. In this case, that’s $801.25.

In this example, your monthly discretionary income estimate is $801.25. For most repayment plans, this means that you’d pay $80.12 per month (10% of your monthly discretionary income) toward your student loans.

To sum up, here’s how to calculate discretionary income for student loan repayment plans:

Look up the federal poverty level for your household size

Multiply this number by 1.5

Take your annual income and subtract the figure calculated in step #2

Divide by 12 to find your monthly discretionary income

Want an easier option? Simply use a discretionary income calculator to find out.

Federal poverty guidelines adjust each year. Typically, the poverty-level income rises due to the impacts of inflation. For example, in 2010, the poverty guideline for a single person was $10,830. By 2020, it had reached $12,670. This means that your discretionary income will likely change from year to year, even if your actual income doesn’t change.

Another thing to note is that Alaska and Hawaii have higher poverty guideline incomes due to the high cost of living in those states. In 2022, the poverty guideline in Alaska is $16,990 for a single person plus $5,900 for each additional person. In Hawaii, it is $15,630 plus $5,430 for each additional person.

Discretionary income for students: Impact on student loans

The government uses estimates of discretionary income to determine how much a borrower can reasonably pay each month toward their loans.

Instead of looking at actual expenses, the government uses a standardized system to estimate a borrower’s discretionary income.

Generally, the higher your income, the more you will be required to pay toward student loans. Again, this is only relevant if you’re on an income-driven repayment plan. Other plans have fixed payments. Private loans will also have fixed payments, which is only for federal student loans.

This system is designed to help keep monthly payments affordable for student loan borrowers. It also provides a way for people to pay more as they earn more.

For example, a fresh graduate might not have a job or much income—so their monthly payments would be very low (or even $0). As that person gets their first job, their discretionary income and monthly payments will increase. And if they land their dream job with high pay, they’ll have a much higher monthly payment.

How often does discretionary income change?

For student loan purposes, you are required to update your income level each year. This is done through your student loan issuer via a process known as recertification.

So each year, you will submit an updated application with details on your income level and household size. The loan issuer will then re-calculate your monthly payment requirements.

Your payment amount may change slightly, even if your income does not substantially change. This is due to changes in the federal poverty levels used to calculate discretionary income.

The federal poverty level also adjusts every year. Because discretionary income is determined based on a percentage of the poverty level, your discretionary income could change even if the amount of money you earn doesn’t. Generally, what is considered a poverty-level income increases based on the effects of inflation.

Because the poverty level adjusts based on household size, you may also see your discretionary income shrink if your family size increases.

In addition, you should submit an updated application any time you have a substantial change in income.

For example, if you lose your job, you should submit an updated application with your new income level. This will help reduce the amount of your payments for the rest of the year.

Likewise, if you get a new job with higher pay, you should update your application with your loan servicer.

How does discretionary income affect student loan repayments?

Discretionary income affects student loan repayments for borrowers of federal student loans who are on income-driven repayment plans. Other loan types (like private loans) and other repayment plans are not affected by discretionary income level.

In short, the lower your discretionary income, the lower your monthly payments will be. As your income increases, so will the required monthly payments toward your student loans.

Conclusion

Discretionary income is simply the amount of money you have left over in your budget after paying for essentials. It’s an important number for everyone to be aware of, as it defines what optional purchases you can make.

For students, the discretionary income also affects student loan repayment amounts.

Financially savvy students should check out Mos, the money app built for college students! Mos helps students save on tuition, match with top scholarships, and earn extra cash in college. Learn more today.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you