FAFSA •

Is FAFSA first come, first served?

Does FAFSA run out of money? Sort of, but it’s not that simple. Learn the details about federal aid availability in this article.

Tons of college students rely on federal financial aid to cover large chunks of their college expenses.

The FAFSA (Free Application for Federal Student Aid) application alone leads to over $120 billion in aid funds to applicants each year.

That’s a lot of money, but obviously not enough for every student. So that begs the question, is the FAFSA first come, first served? Can the FAFSA run out of funds if you wait too long to apply?

In this post, we’ll explain why the answer is both “yes” and “no.” We’ll also cover FAFSA deadlines at the federal and state levels, show you some tips for getting the FAFSA done faster, and answer some FAQs.

When is the FAFSA due?

The regular FAFSA deadline is June 30 for the previous academic year.

If you’re submitting the FAFSA for the academic year 2022-2023, your FAFSA will be due by June 30, 2023. If you want any financial aid at all, that’s the final deadline.

Keep in mind that your tuition bill will still be due before classes. If you need the aid to pay tuition up front, get started on your FAFSA ASAP.

But as with most things college-related, things aren’t really that simple. Deadlines and rules differ from state to state; more on this later.

Is federal aid given out on a first come, first served basis?

The answer is yes, and no. It depends on the type of aid. The most helpful types of financial aid tend to run dry the quickest—just like the best candy in a movie theater.

Here’s a quick explanation of each aid type and how quickly they run out:

Grants: Grants are based on financial need, so they tend to run out first. The Pell Grant, a notable federal grant, is the only exception—it will always be available.

Scholarships: Scholarships are generally based on merit, unlike grants, and may involve writing scholarship essays. But, like grants, scholarship funds can run dry as well.

Work-study: Federal work-study jobs are a form of federal aid that lets you work a part-time job to cover some tuition costs. The longer you wait, the more of these jobs are taken by others. As a result, you may have fewer options to choose from.

Student loans are the only form of aid that doesn’t run out. Of course, they also put you in (often crushing) debt, so they aren’t ideal.

The moral of the story? Make sure you apply as early as possible.

The FAFSA opens on October 1 preceding the academic year—for the 2022-2023 academic year, that’s October 1, 2021. So set an alert in your phone or calendar if you want to max out your potential non-debt aid.

All that said, you can look for external grants and scholarships if needed.

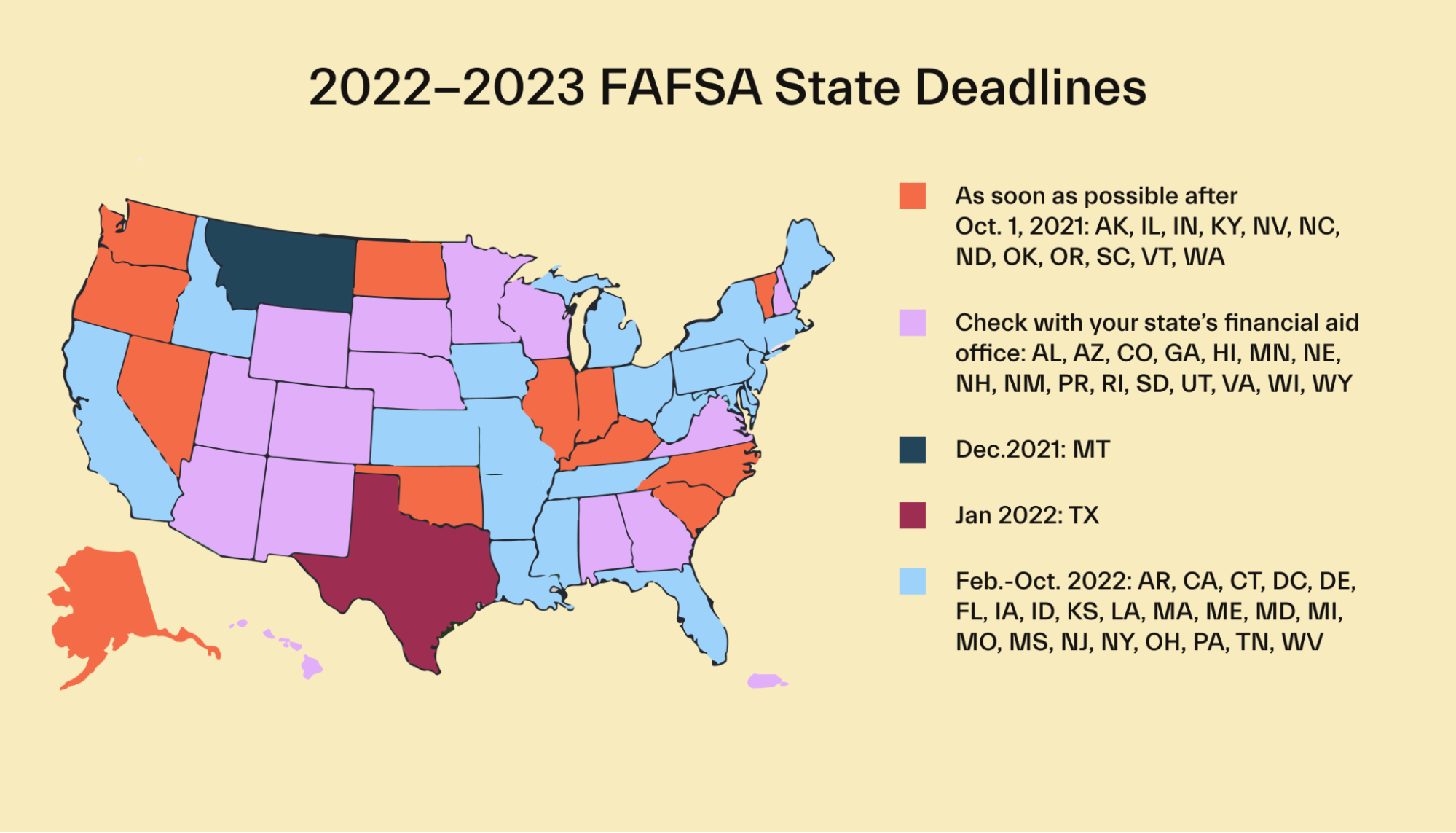

States with earlier FAFSA deadlines

Some states have earlier deadlines for the FAFSA for certain types of financial aid programs.

Here’s a map of each state’s deadlines for FAFSA purposes:

Many schools have earlier aid deadlines for their own financial aid purposes, but they usually line up with the statewide application deadlines. Still, make sure you check the policies of every school you apply to.

You might be getting tired of hearing it, but applying early really increases your potential financial aid.

How has COVID-19 affected student aid availability?

The COVID-19 pandemic put a lot of financial strain on students and their families, meaning more people might be applying earlier in hopes of getting extra aid. Again, that’s one more reason to apply as early as possible.

You and your family’s financial situation may have changed, too—and that can impact your Expected Family Contribution (EFC) and, therefore, your aid eligibility.

The Federal Student Aid website offers more details on how the pandemic may have impacted your aid.

Tips to get the FAFSA done faster

Since the best forms of aid run out the quickest, you want to get your FAFSA in as soon as you possibly can—and hopefully without errors.

Studentaid.gov claims it takes most people less than an hour to fill out the FAFSA, but with a bit of preparation, you could knock it out even faster.

So below, we’ve put together a couple of tips to fill out and submit your FAFSA a little bit faster.

Make a folder for all FAFSA info

It’s simple—if you have all your information ahead of time, you won’t have to dig it all up when the FAFSA is available to fill out.

You’ll also be more likely to avoid mistakes. And if you do make errors, fixing them will be more manageable.

Make yourself a physical folder for any paper documents you’ll need and a folder on your computer for anything digital. Creating a list of any documents you need could also help, in case it’s sensitive, like your Social Security card.

Then, put each document you’ll need—such as your parents’ tax returns—into the folder when you get them.

Create your Federal Student Aid ID as early as possible

Your FSA ID is the login information you can use to log in to US Department of Education online systems, including the FAFSA, much faster.

It’s not mandatory to fill out your FAFSA, but it makes signing it easier and helps the federal government process it faster.

That said, you may have to wait a few days after creating your FSA ID before it’s usable. Set yours up as early as possible for a more seamless FAFSA experience.

Know all relevant deadlines

Make a note of all relevant FAFSA deadlines, including federal, state, and school-specific deadlines.

Set alerts in your phone or some calendar software to go off a week before the deadline, too. It’s all too easy to forget, especially in the hectic days leading up to your first semester.

If you have to wait for any documents to complete your FAFSA, the deadlines give you a timeline for getting ready.

Know your schools beforehand

One of the most critical FAFSA sections is choosing your schools. The government sends your SAR (student aid report) to each one after they process your student aid application. These schools use that info to put together your financial aid package.

The FAFSA lets you list 10 schools—make sure you figure out your top 10 list and find their federal school codes ahead of time. Doing so will make this part of the FAFSA a breeze.

If you’d like to add more than 10 schools to the FAFSA, you have to wait for your SAR to be processed first.

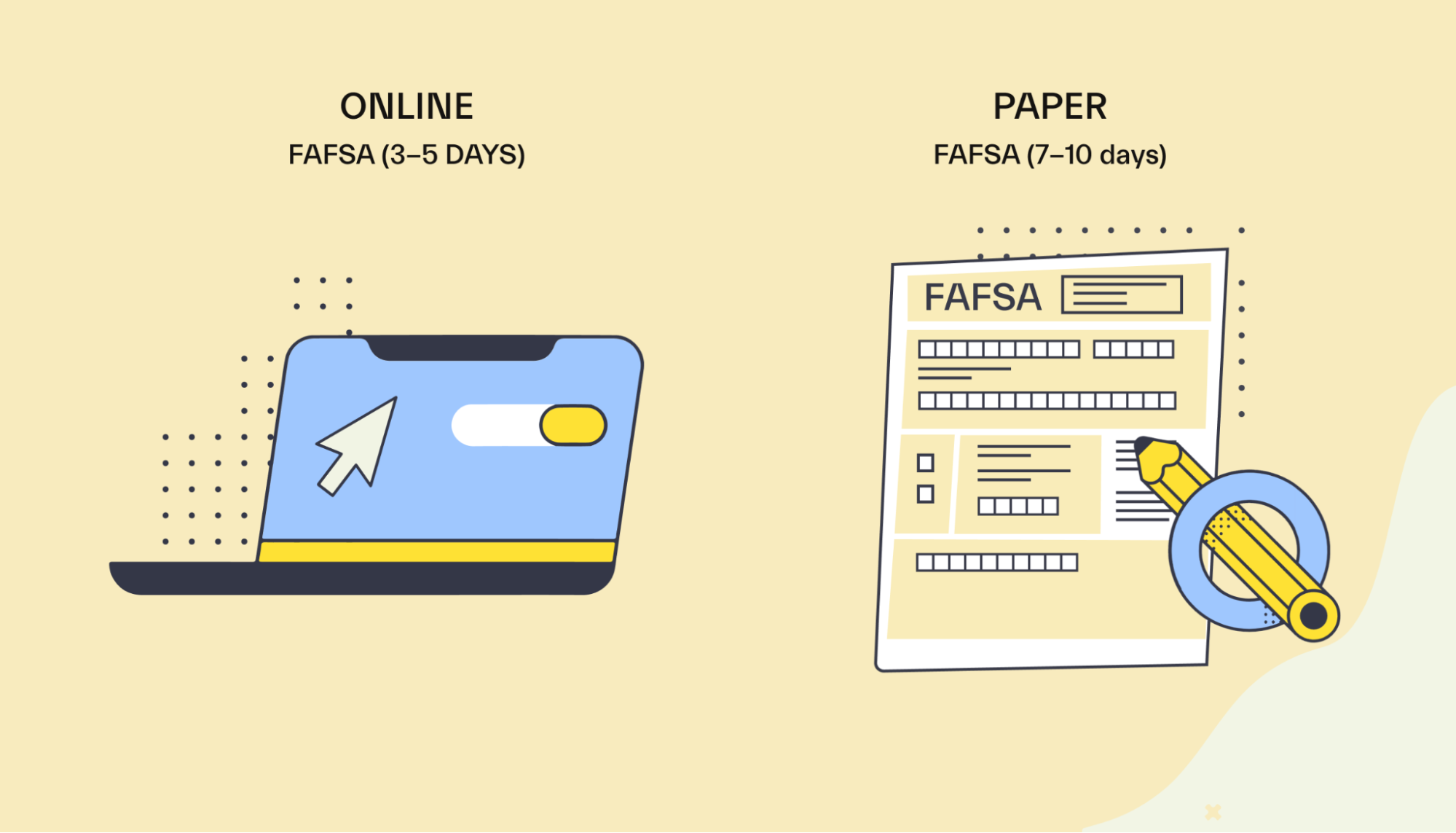

Do it online if possible

Don’t want to spend the time and effort of filling out a physical FAFSA form and mailing it to the government? Submit it online.

It’s faster and easier — really a no-brainer. Online FAFSA applications are even processed than paper applications.

Knock it out in one go

When it comes to things like the FAFSA, it’s best to do it all in one sitting. You don’t want to start procrastinating and then forget about it.

Set aside a few hours on a weekend to plow through the application and send it off. You’ll feel a lot better with it out of the way.

Back to our earlier tip: having all your information lined up makes finishing the FAFSA a breeze.

Triple-check before submitting

Before you submit your FAFSA, you should triple-check to make sure there are no errors. You might even want to “sleep on it” for a day before scanning it again for mistakes with fresh eyes.

That’ll reduce the chances of having to make corrections later.

FAFSA-related FAQs

Have more questions about FAFSA financial aid availability? Check out our FAQs below.

When can I submit the FAFSA?

The FAFSA becomes available on October 1 before the school year—October 1, 2021, for the 2022-2023 school year.

You can complete the entire thing and submit it on October 1 or any time afterward, up to June 30 of the following calendar year—in this case, June 30, 2023.

Do FAFSA corrections impact my aid?

FAFSA corrections may or may not affect your aid, depending on what the error is.

For instance, if you made a typo in your name or Social Security number, that likely won’t harm your aid eligibility if you catch it.

Try to make these changes early, as some forms of aid can run out.

But edits that change your EFC—like changes to your parents’ income or the number of household members—can often change your potential aid amount.

Are there other ways to supplement my federal student aid?

If you don’t get enough federal financial aid, you have plenty of options outside the FAFSA.

Your best options are external scholarships and grants. You don’t have to pay them back—it’s “free” money.

You can find plenty of scholarships and grants from private organizations through your school’s financial aid office or online searches.

After that comes private student loans from banks, personal lenders, and other financial institutions.

Be careful with these, though. Their interest rates are usually higher than federal loan rates. Plus, they don’t often offer deferment, forbearance, or income-driven repayment plans like federal loans.

You may even have to start paying back private loans while still in school, unlike federal loans.

With that in mind, exhaust all scholarships, and grants, and federal student loans, before relying on private loans.

Are there any downsides to filing early?

There are no real downsides to filing the FAFSA early. It’s completely free, and you won’t get penalized for sending it on the day it opens.

The bottom line is filing early increases the amount of potential aid you’ll get.

You’ll even get your Student Aid Report sooner, making it easier to plan out how you’ll finance your education.

Additionally, you can correct any mistakes you made a lot sooner to make sure you don’t lose out on aid.

Also, there’s something to be said about getting this part of the financial aid process done, out of sight and out of mind. Knowing you’ve ticked this crucial task off the list can be quite a relief.

Is there any reason not to fill out the FAFSA?

The FAFSA isn’t the most fun thing in the world, but there’s no reason to skip it. It’s completely free and doesn’t take that long—especially if you prepare for it.

Even if you’re 100% certain you don’t need aid, situations can change. Having the FAFSA in your back pocket in case something goes wrong financially can give you a chance to still go to college.

Are there income limits on FAFSA?

There aren’t hard income limits on the FAFSA. Instead, schools limit your aid by financial need.

The government calculates your financial need using a metric called your Expected Family Contribute, or EFC.

Your EFC estimates how much your family can contribute to your education. It often isn’t entirely accurate, but it’s the government’s best tool for fairly distributing aid among FAFSA applicants.

That said, as part of the FAFSA Simplification Act in 2021, the Student Aid Index, or SAI, will replace EFC in the 2023-2024 academic year.

It’s mostly a name change, but unlike EFC, SAI can also go negative to reflect financial needs more accurately.

Conclusion

At the end of the day, FAFSA hasn’t run out of federal aid even if you apply late in the process.

But the more desirable forms of aid, like grants and scholarships, tend to go first. If you wait too long, you may be forced to rely on loans and hunt for external aid.

So that’s another reason to knock out your FAFSA early—peace of mind and potentially less debt.

If you’re confused by this whole process and want some guidance, check out the Mos app. You can ask real, human experts on financial aid and get their help to submit your application to over 500 student aid programs.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you