Financial aid •

December 20, 2021

Types of financial aid, explained

Need help figuring out your options for affording school? Get the low-down on all major types of financial aid in this guide.

A college education is expensive these days. Few students can make enough money during the summer—let alone throughout an entire year—to pay the tuition bills.

Luckily, there are plenty of financial aid options out there. The problem is understanding the nuances of each form of aid.

That takes time—time sifting through tab after tab of information on aid types, their eligibility requirements, and so on.

We wanted to make that process easier for you, so we created this guide covering the types of financial aid available. Read on to learn more about your options and what might be best for you.

Scholarships

Scholarships are an excellent form of aid because you usually don’t have to pay it back. Yep, they’re free money, helping you to reduce or avoid student debt!

There are tons of these available, making it hard to know where to start. Lucky for you, tools like the Mos app can help you sift through the tens of thousands of opportunities out there.

That said, we can break these down into a few broad categories.

Academic scholarships

It pays to do well in high school and college. If you have exceptional grades and test scores, you can win academic scholarships, also called merit scholarships.

Many schools automatically award you a standard amount if your numbers hit a certain threshold. Others may offer more money if you have higher grades and scores.

You may not have to do anything else, such as write an essay, to earn these.

Athletic scholarships

If you’ve got athletic talent, you can translate that into cash by winning an athletic scholarship to your chosen school.

You’ve likely heard of the elusive full-ride scholarship. These are rare, but winning one gets your entire school paid for—as long as you fulfill your end of the agreement.

Beyond that, there are partial athletic scholarships. They may not cover everything, but they can be a big help when combined with other aid.

Community service scholarships

Not a top student or star athlete? No worries—if you love to help give back to your community, you can win some money through community service scholarships.

Many private and public organizations give away money to students who show a passion and dedication to giving back. They may require you to write an essay, create a video, or complete another task to apply, but the money will be worth it!

Employer scholarships

It’s always a good idea to check with your or your parents’ employers. They might offer scholarships to college-aged children of employees.

Now, these aren’t the same thing as tuition reimbursement. That’s a separate benefit and generally only available to the person that works for the company. We’ll talk more about that later.

Hobby/extracurricular scholarships

If you’re active in particular hobbies or extracurriculars, there are scholarship opportunities out there to help you afford college.

For example, say you like to play an instrument in your free time, but it’s not part of your major. There are scholarships relevant to musicians available.

Or maybe you’re a big fan of debate and participate in a Debate Club. You’ll be able to find scholarship contests related to debating or giving speeches.

Identity-based scholarships

The government and private organizations have created plenty of scholarships to help traditionally underrepresented students pay for a college education.

Some may only consider identity, but others may be specific to a major or general area of study, like STEM.

Regardless, scholarship search sites usually let you specify your race, gender, ethnicity, or other parts of your identity to match you to these opportunities.

Grants

A grant is a source of aid you don’t have to pay back, like scholarships.

However, grants are generally based on financial need. This is different from most scholarships, which are usually based on merit in some form or another.

Here’s something interesting: about $2 billion in grants goes unclaimed every year. Some of your money might be in that pile, even if you don’t think you “need” it.

There are 4 main types of federal grants. Beyond those, there are often state-based and private grants that you might qualify for.

Learn more about each type of grant below.

Federal Pell Grants

The Federal Pell Grant program is one of the most well-known. It offers federal financial aid to students in need that have not yet earned a bachelor’s, graduate, or professional degree.

For the 2021–2022 award year, the maximum amount of Pell Grant aid you can win is $6,495.

That said, the amount you could win depends on a few things:

Institution cost of attendance

Level of financial need (based on expected family contribution)

Enrollment status

Academic year length

Federal Supplemental Educational Opportunity Grants (FSEOG)

FSEOG grants award between $100–$4,000 per year in aid to in-need students at eligible schools.

Not all schools participate in the FSEOG program. Keep this in mind if you’re still applying to schools and might need extra aid.

Plus, each school sets deadlines for applying, and aid for this type of grant can run out, unlike Pell Grants. Apply for aid as early as possible if you’re at a participating school.

Iraq and Afghanistan Service Grants

The federal government gives out Iraq and Afghanistan Service Grants to students whose parents or guardians died during military service in Iraq and Afghanistan after 9/11.

Students must also be ineligible for Pell Grants based on the EFC requirement (but nothing else) and have been under 24 years old or enrolled at least part-time in college when their parent or guardian passed.

Teacher Education Assistance for College and Higher Education (TEACH) Grants

Want to become a teacher? The federal government might offer you a TEACH Grant of up to $4,000 per year.

These are a bit more complicated and have several requirements—aside from going into a teaching profession—so check out the Federal Student Aid website for more information.

State-based grants

Beyond the above 4 types of federal grants are state-based grant programs. You’ll have to check with your state’s government, nonprofits, or financial aid websites to see what kinds of opportunities are available in your state.

Private grants

Many private institutions give out grants, too. In many cases, it’ll be along the lines of specific factors (besides need) like identity, location, major, and so on.

There are tons of these out there, so it’s worth looking into them, even if you’re unsure what you’ll qualify for.

Loans

Student loans are one of the most heavily used forms of aid. Around 70% of students take out loans to at least partially fund higher education.

Unlike scholarships or grants, you must pay back loans over time. In many cases, you can wait until after graduation before starting your payments.

The silver lining to taking on this debt is that paying loans on time helps you build your credit score. Down the road, a higher score can help you with all sorts of financial goals.

Here are the 2 broad categories of loan aid available.

Federal

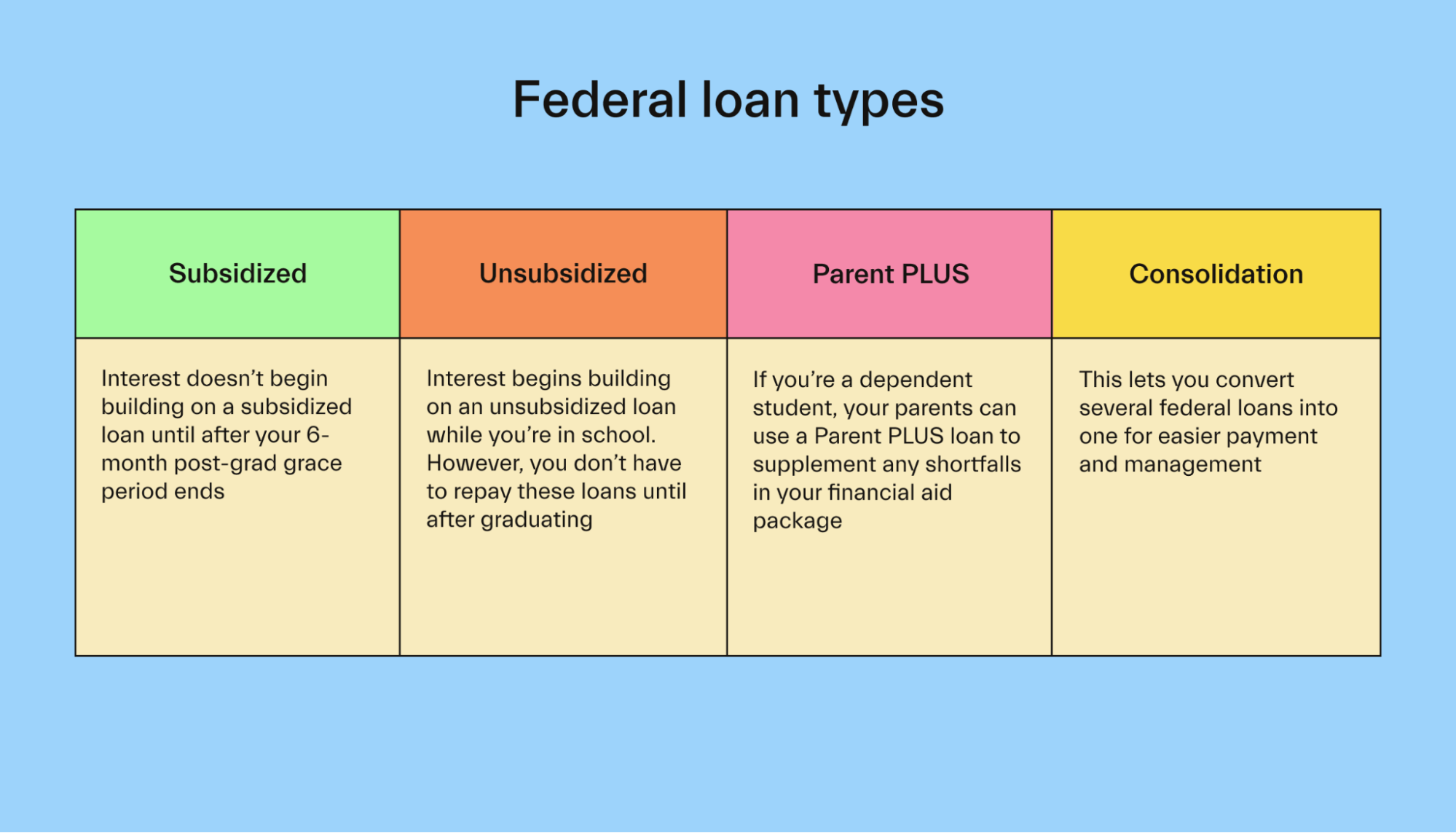

The William D. Ford Federal Direct Loan program, known simply as direct loans, is a student loan program offered by the US Department of Education. This is the largest federal loan program, and there are 4 types:

Subsidized: Interest doesn’t begin building on a subsidized loan until after your 6-month post-grad grace period ends.

Unsubsidized: Interest begins building on an unsubsidized loan while you’re in school. However, you don’t have to repay these loans until after graduating.

Parent PLUS: If you’re a dependent student, your parents can use a Parent PLUS loan to supplement any shortfalls in your financial aid package.

Consolidation: This lets you convert several federal loans into one for easier payment and management.

The government sets interest rates on these loans, so they tend to be pretty low.

This federal student loan program offers some extra benefits, like:

Deferment: Lets you temporarily reduce or pause loan payments during financial hardship without interest building up.

Forbearance: Lets you temporarily reduce or pause loan payments during financial hardship, but interest continues to build up.

Payment plans: Income-driven repayment plans can alter your payment amount and schedule to make it more affordable.

Loan forgiveness: Some borrowers might be able to have their loans erased. President Biden is looking to.

Private

Many banks, lenders, and other financial institutions offer private student loans. However, these should be your last resort for a few reasons.

First of all, interest rates are often higher than on federal loans. They can be variable, too, meaning they change with broad interest rates.

Private lenders don’t usually have those nifty programs like deferment, forbearance, and repayment plans (though more of them did offer that in 2020 due to the pandemic).

The worst part is some private lenders might make you repay while in school. That’s not doable on most student budgets.

Finally, you might need a cosigner, such as a parent, to get a private loan. A cosigner basically agrees to be responsible for your debt if you can’t pay it.

See why it might be hard to find a cosigner?

With all this in mind:

You’re not stuck with high interest rates forever. At the very least, you can refinance your private loans down the road for a lower rate when your credit score improves.

Work-study

Work-study is a form of federal aid that lets you work at certain approved jobs to help pay for school. Jobs can be on-campus or off, but will either be relevant to your major or in public service.

These usually don’t pay as much or offer the same hours as other part-time jobs.

However, the advantage here is flexibility. Work-study tends to be more lenient about scheduling your hours around classes. That way, you can afford school without giving up good grades.

Also, most work-study jobs look good on a resume as you apply to internships or jobs, since they’re usually major-relevant.

Employer aid

Many companies now offer some financial help to students employed by the firm.

This usually takes the form of tuition reimbursement—the company will pay you back some of your tuition costs upon completing a semester or year.

That said, companies may have some rules to be eligible. Check with your employer’s HR department and employee handbook to get details on the type of aid, eligibility, caps on aid, and more.

Military aid

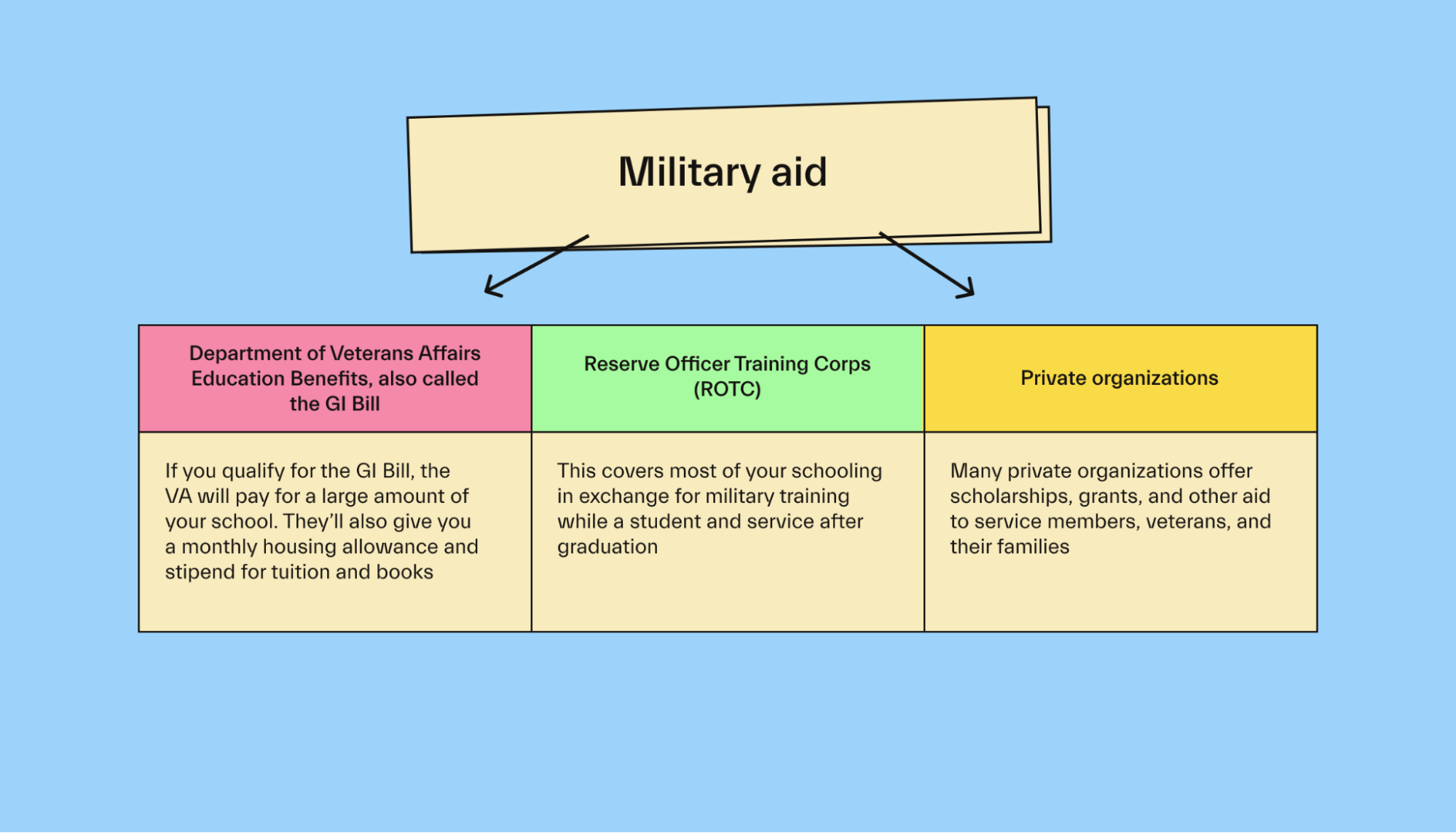

Service members, veterans, and their families have access to military financial aid to thank them for their service.

The most well-known military aid is the Department of Veterans Affairs Education Benefits, also called the GI Bill.

If you qualify for the GI Bill, the VA will pay for a large amount of your school. They’ll also give you a monthly housing allowance and stipend for tuition and books.

Another popular form of military aid is scholarships offered through the Reserve Officer Training Corps (ROTC). This covers most of your schooling in exchange for military training while a student and service after graduation.

Beyond that, many private organizations offer scholarships, grants, and other aid to service members, veterans, and their families.

Afford college with these forms of aid

Few students ever rely solely on one form of financial aid. Chances are you’ll stitch together funds from several sources to afford your higher education.

With that in mind—make sure you exhaust any forms of aid you don’t have to pay back first to lower your debt. Grants, scholarships, work-study, whatever it might be.

If you have any education expenses after using those forms of aid and other sources of funds, like 529 plans, only then do loans become a good idea.

Got more questions about financial aid? Check out our financial aid FAQs.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you