FAFSA •

The FAFSA for married students: What you need to know

Your marital status could affect your financial aid, but it depends on several factors. Here’s what students need to know about marriage and the FAFSA.

Getting married is undoubtedly something to celebrate. But, as you and your spouse merge into a committed union, you also merge many aspects of your personal lives.

Including your finances.

If one or both spouses are in school (or plan to be soon), how does marriage affect their financial aid situation? This is a tricky question but an important one to answer.

Here’s everything you need to know about the FAFSA when married, including how marriage could affect your eligibility for financial aid.

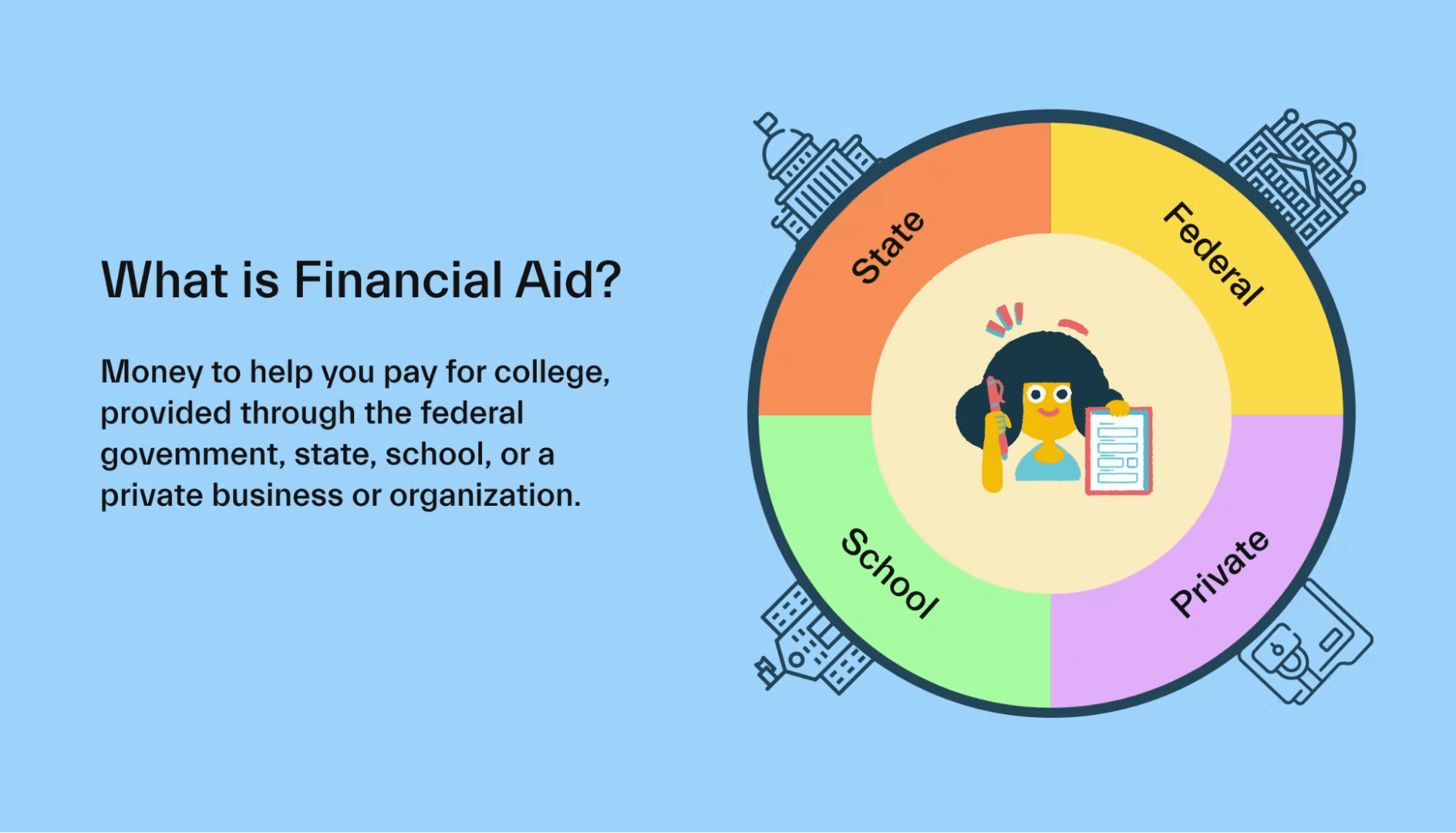

Financial aid basics

Financial aid is money students can get to help them pay for school. It can come from the federal government, state governments, local nonprofits, and businesses. That said, most financial aid comes from the federal government.

There are various types of financial aid that students may be able to utilize, including:

Student loans: These are loans that have to be paid back over time (with interest). Most student loans are federally backed and applied for via the FAFSA. Private student loans are also available.

Grants: Grants are free money for school that doesn't need to be paid back. The Pell Grant is a common example. Most grants are available from governments (federal and state) and are need-based.

Work-study: Work-study is a federal program that makes it easier for students to find part-time work on or near campus. It’s a federal program applied for via the FAFSA.

Scholarships: Scholarships are free money for school that doesn’t need to be paid back. They can be need-based or merit-based (like scholarships for star athletes or excellent academic performers). Note that most merit-based scholarships won’t be affected by your marital status.

Eligibility based on the Student Aid Index

Many forms of financial aid are applied for via a single form: the Free Application for Federal Student Aid (FAFSA). This application gathers information about the student to calculate how much aid might be available to them.

Many forms of student aid are need-based, meaning that lower-income students will typically qualify for more aid. Because of this, the FAFSA gathers a lot of financial information, including the student’s income, assets, and family income.

This data is used to calculate the Student Aid Index (formerly known as Expected Family Contribution). This is essentially a measure of how much the government thinks your family will be able to help you pay for college (no matter whether they’ll actually be helping).

The Student Aid Index calculation can change if you’re married. It also depends on whether you’re considered dependent or independent (more on this later).

Financial aid for married students

Marriage can affect a student’s eligibility for need-based financial aid, like grants. It won’t have much of an impact on federal student loans, though.

Marriage has 2 main effects on financial aid eligibility:

Dependency status: Marriage can affect younger students’ (under age 24) dependency status (more on this below). Dependency status is key to calculating financial aid award eligibility.

Income level: Married students need to report their spouse’s income and their own. Income is important for need-based financial aid, no matter whether the student is dependent or independent.

We’ll dive into each of these in more detail below, starting with FAFSA dependency status.

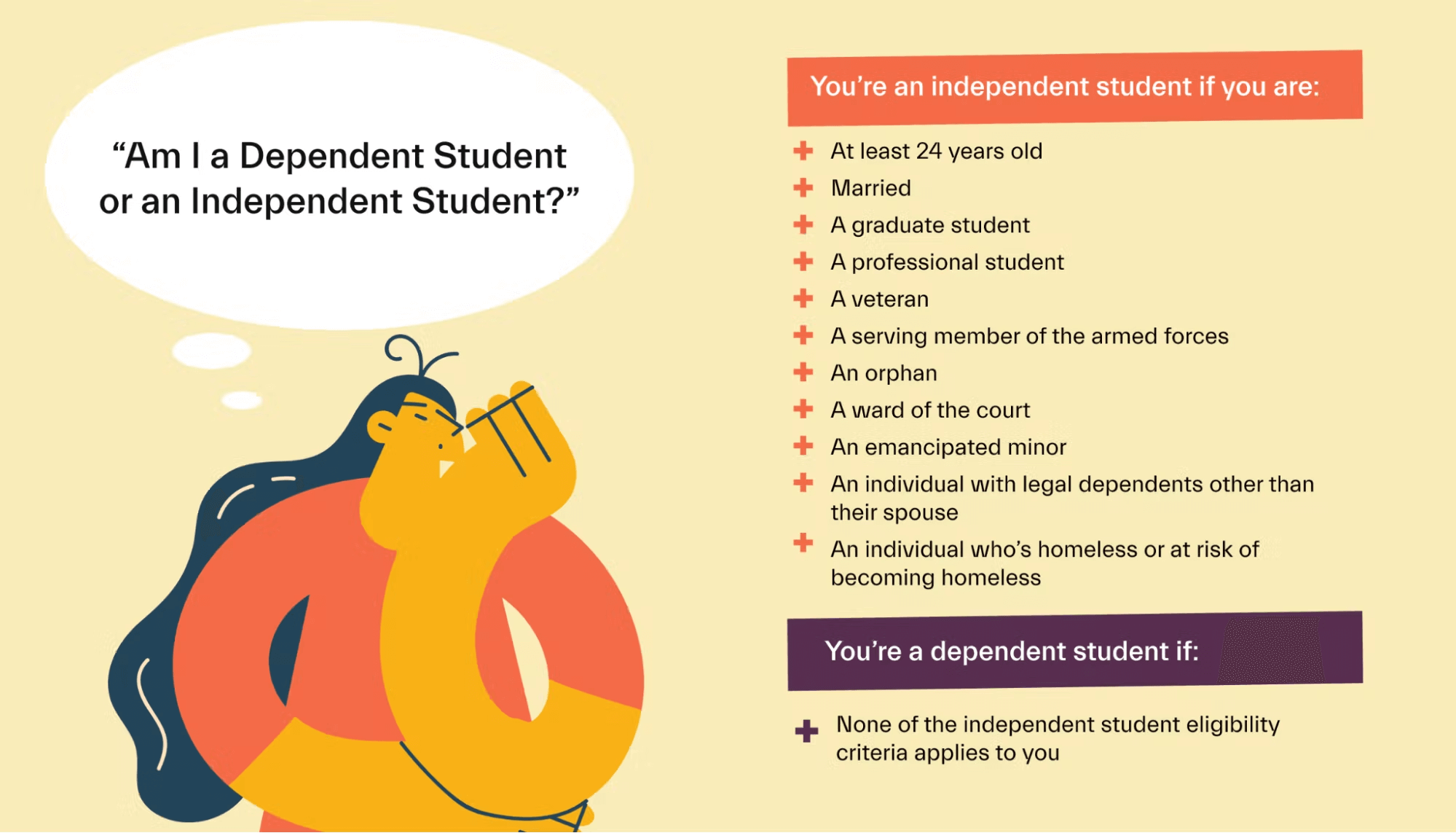

Dependency status explained

The FAFSA asks whether the student is dependent or independent. A dependent student is expected to receive financial support from their family. An independent student isn’t expected to have financial support from their family. (In this case, “family” refers to your birth family.)

Dependent students will need to enter financial information from their parents when filing the FAFSA. Independent students only enter their own information (and their spouse’s, if applicable).

FAFSA dependency status is determined by several factors. If you meet any of the criteria listed in the image above, you’re considered independent.

For example, anyone who is 24 years or older is automatically independent. Anyone married is also considered independent.

Because getting married makes you an independent student, it can change the FAFSA details if you’re under 24. For instance, a 20-year-old student would typically be considered dependent. But if they get married, they’d then be regarded as independent.

Remember, independent students don’t need to report parental financial information when filing the FAFSA.

How does the FAFSA work if you’re married?

The government will ask for information about your spouse’s finances and your own if you're legally married. But you won’t have to enter your parent’s information.

When you file the FAFSA, you’ll submit information about your own financial situation and assets, and you’ll also submit information about your partner’s finances.

It doesn’t matter if you share finances with your spouse, keep them separate, or even file your taxes separately. In any case, you’ll need to submit both your own and your spouse’s financial information.

This will affect your financial aid eligibility. We’ll dive into potential scenarios below.

Will getting married hurt (or help) my financial aid situation?

Getting married doesn’t necessarily hurt or help your financial aid eligibility—it can really go either way. In some cases, married students could get more aid than they would if they were single. In other cases, it’s just the opposite!

This is due to the complex nature of financial aid award eligibility. Remember that marriage has two key impacts on your financial aid eligibility:

Marriage affects dependency status. If you’re under 24, you’re likely considered dependent and have to enter your parents’ financial information. But if you’re married, you’re considered independent and don’t need parental information.

Marriage affects income level. Married students are required to report their income and their spouse’s. This directly affects eligibility for need-based financial aid.

When it helps

Marriage can potentially help your financial aid situation if:

You’re under 24 years of age. In this case, you won’t have to report your parent’s financial information, which could increase your award eligibility. However, if your spouse’s income is high, this effect could cancel out.

Your spouse has a low-to-moderate income level. The FAFSA considers household income when a married student applies for aid. If your spouse’s income isn’t high, this could boost your award eligibility.

When it hurts

Marriage can potentially negatively impact your financial aid situation if:

You’re under 24 and have low-income parents. If you’re under 24 and unmarried, you are considered dependent and will use parental financial information on your FAFSA. Being dependent could increase your award amount if your parents are low-income and/or don’t have many assets. But remember, getting married automatically makes you an independent student.

Your spouse’s income is high. Married students report combined household income. If your spouse makes a lot of money (and/or has many assets), you likely won’t qualify for as much aid.

Remember: Marriage only affects need-based financial aid

Your marital status can affect your eligibility for need-based financial aid. This includes grants and certain scholarships.

But in general, getting married won’t affect other forms of aid.

For instance, federal student loan eligibility won’t be affected because it’s not considered need-based aid. You can still take out federal student loans if you get married (although you’ll still need to submit your partner’s information on your FAFSA).

Many scholarships also won’t be affected by your marital status. For instance, an academic or athletic scholarship isn’t considered need-based, so your marital status wouldn’t affect them.

Unique financial aid opportunities for spouses

We’ve discussed the FAFSA when married and how marriage can affect your standard financial aid eligibility. But are there other ways that marriage can affect financial aid?

There are, indeed! While eligibility for these programs varies, you must consider all your options.

Employer benefits

In some cases, you may be able to take advantage of benefits offered by your spouse’s employer.

For instance, some employers offer tuition assistance, specialized scholarships, or other financial perks. Speak with the human resources department at your spouse’s workplace for details.

Military benefits

You may qualify for various government assistance or scholarship programs if your spouse is in the military (or a veteran). In addition, some of these programs are available for family members of military members.

Scholarships

Scholarships are available from various organizations, government agencies, private businesses, and even individuals. While there aren’t scholarships specifically for married couples, being married could help you meet eligibility requirements in some cases.

For instance, some scholarships require that the applicant be a member of a specific group or club, an employee of a particular company, or even a customer of a certain bank. And in some cases, these scholarships are also available to spouses.

Other things to know about marriage and student finances

Marriage can change your financial life in several ways. For students, here are some specific things to keep in mind:

Combined income can be used on loan applications. This is a big one. If you end up applying for private student loans, you can use household income on your application. If your spouse works, this will likely make it easier for you to get approved for loans—and potentially increase the size of the loan offered.

Marriage affects your taxes. Many married couples choose to file taxes jointly, which can affect your tax situation. If you’re a student, this could influence your eligibility for college tax credits and the student loan interest tax deduction. Taxes are complex, though, so check with your accountant for details.

Financial aid considers assets as well as income. This is important to remember. The FAFSA asks for information about income (for both you and your spouse), as well as asset information. If your spouse has significant assets (investments, real estate, savings, etc.), that could lower your financial aid award amounts. Your spouse’s information will always be reported, even if you have separate finances—and even if you and your spouse signed a prenuptial agreement before your wedding.

Marital status is based on the day you file the FAFSA. The FAFSA is due every year at the end of June. However, your marital status is determined on the day you file the FAFSA for the year. So if you submit it on November 5th, your marital status will be based on that date.

The FAFSA can be updated if your situation changes. The FAFSA is submitted each academic year. It can also be updated or corrected if your situation changes mid-year. For instance, if you get married (or divorced) after you submit your FAFSA, your application might require an update.

Conclusion

Getting married can affect your FAFSA dependency status, particularly if you’re a young adult. It can also affect the income amount reported on your FAFSA, which in turn affects aid eligibility. It all depends on the details of your situation.

We believe all students deserve their dream degree—without the debt. Mos helps students save on tuition, match with scholarships, and earn extra cash—all in one app. Explore memberships today.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you