FAFSA •

January 4, 2023

Special circumstances and FAFSA: What you need to know

Some students are unable to complete the FAFSA’s parent section. Learn how to request special circumstances consideration and what qualifies.

The FAFSA is your key to federal financial aid. But if you’re a dependent student, you can’t submit your FAFSA without your parents’ financial information.

That said, some dependent students can’t fill out the parent section for various reasons. If that’s you, don’t worry. Your school might give you a “special circumstance” status and let you bypass it.

This article will explain a few special circumstances that could allow students to bypass parts of the FAFSA. Then, we’ll explain how to request special circumstances consideration and look at a few other ways students in unique situations can help pay for school.

What are FAFSA special circumstances?

The FAFSA almost always requires students to fill out the financial information for each parent—unless the student is considered an independent student.

However, “special circumstances” not specifically addressed during the FAFSA process can let students skip the parental portion entirely and still send their applications off.

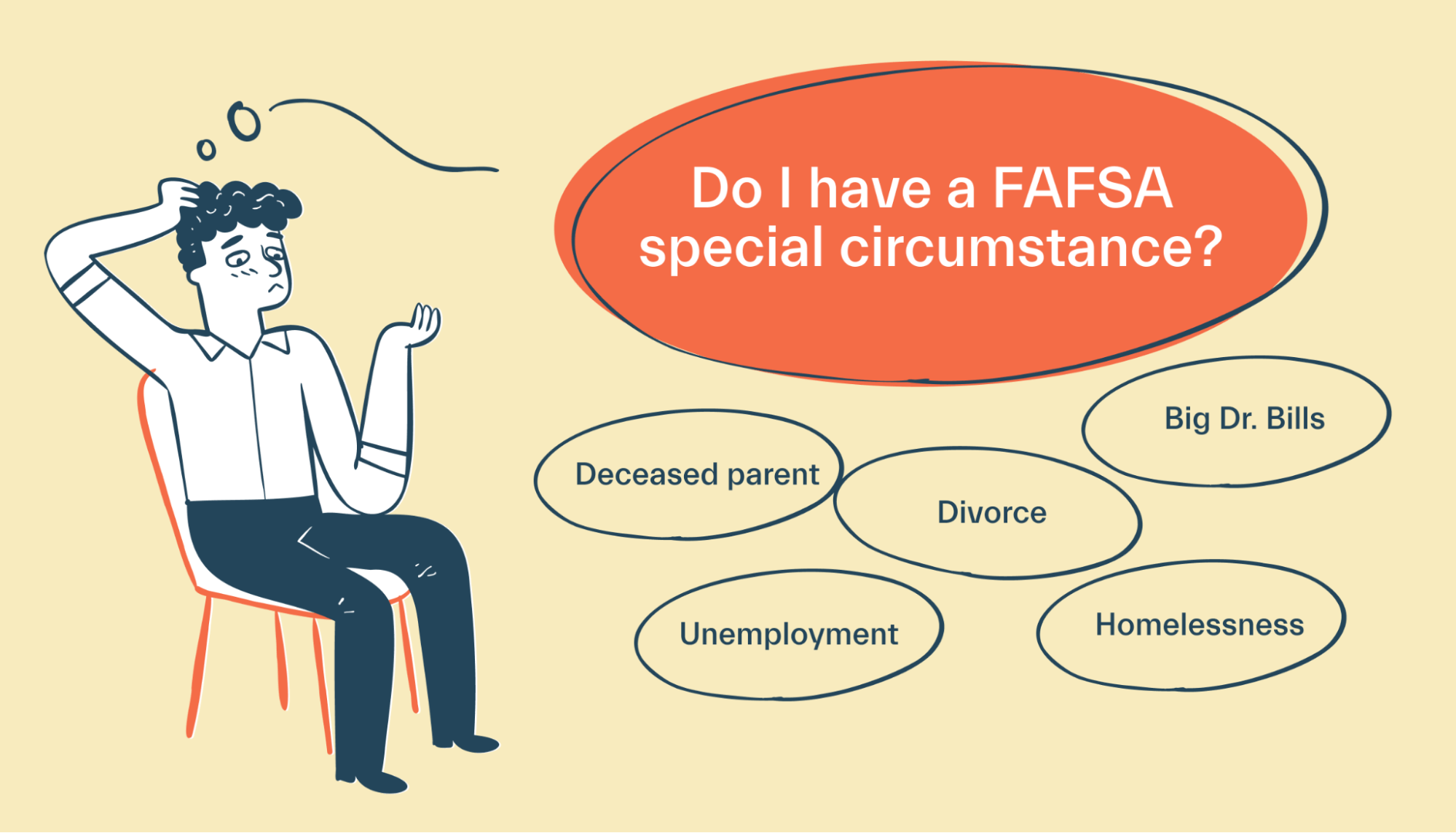

Here are a few examples of special circumstances:

The student or parents receive a loss or reduction in employment, wages, assets, or unemployment compensation

The student or parents see a one-time income reduction, like a Roth IRA conversion. Converting from a traditional IRA to a Roth IRA can trigger taxes on income the taxpayer doesn’t actually receive. Therefore, the taxpayer’s income is reported as larger than the income they can access.

The student or parents have exceptional medical/dental expenses

The student’s parents get divorced or separated after filing taxes

Either of the student’s parents passes away

The student is homeless or at risk of becoming homeless

The student is seeking only unsubsidized loans

The student is unable to provide parental information for any other reason

If a special circumstance is approved, the student can fill out the FAFSA without parental information to potentially receive federal financial aid.

Only a school’s financial aid administrator (FAA) has the authority to approve your special circumstance. They use what Federal Student Aid calls professional judgment.

In plain English, the FAA uses the information you provide and their own discretion to evaluate your case.

Dependency overrides

A dependency override involves the FAA changing a student’s dependency status if certain information about the student’s situation effectively makes them financially independent.

In general, the FAA can only override from dependents to independents, not vice versa.

However, independent students receiving significant support from others may have their cost of attendance or certain FAFSA data items, like untaxed income, adjusted.

Because the FAA uses professional judgment to make override decisions on a case-by-case basis, there’s no hard-and-fast way to tell whether you’ll qualify.

However, we do know that the following situations—singly or in combination—do not qualify as circumstances meriting an override:

The student’s parents refuse to contribute to the student’s education costs

The student’s parents will not provide information for the FAFSA or verification

The student’s parents don’t claim the student as a dependent on their income tax returns

The student demonstrates total self-sufficiency

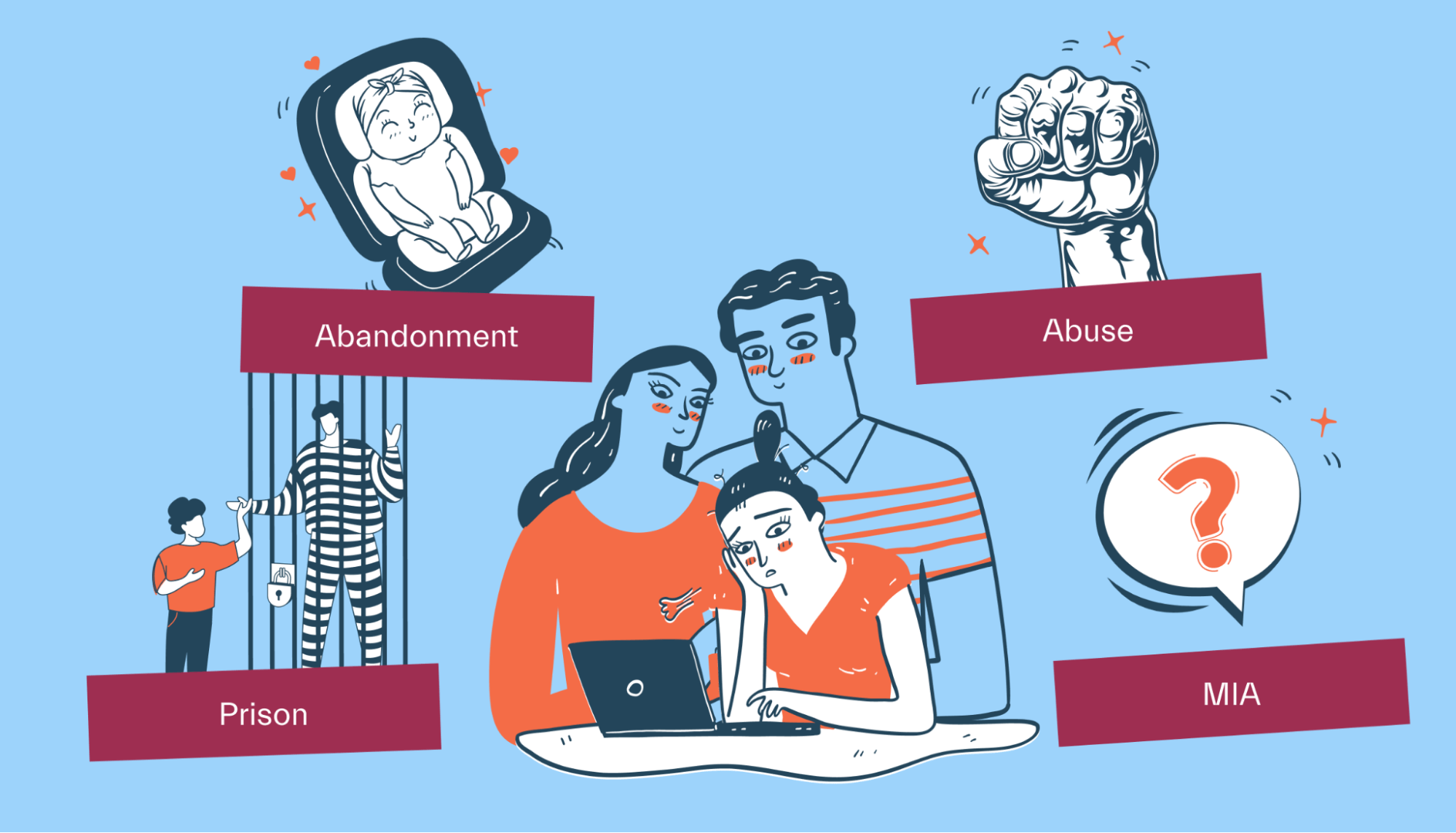

On the other hand, the following situations may cause the FAA to override a student’s dependency status:

The student is in an abusive family environment

The student has been abandoned by or is estranged from their parents

Both of the student’s parents are incarcerated or institutionalized

Neither of the student’s parents can be located

Homeless youth determination

According to the FSA Handbook, Students are considered unaccompanied homeless youth if they were independent at any time on or after July 1, 2020—even if they aren’t homeless or at risk of becoming so.

This determination can be made by the following authorities:

A school district homeless liaison

The director or designee of a US HUD-funded emergency shelter or transitional housing program

The director or designee of a runaway or homeless youth basic center or transitional living program

If a student can’t get documentation from any of these sources, the FAA uses its professional judgment to make a homeless youth determination.

Here are some potential criteria the FAA may use to make this determination:

Living with other people temporarily because the student has nowhere else to go

Living in substandard housing—if the building doesn’t meet local building codes or utilities are turned off, it’s generally considered inadequate

Living in an emergency or transitional shelter, such as a trailer provided by the Federal Emergency Management Agency after a natural disaster

Living in a motel, campground, car, park, abandoned building, bus or train station, or any public or private place not designed for humans to live in

Living in a school dorm if the student would otherwise be homeless

How to tell the FAFSA you have special circumstances

Start by filling out as much of the FAFSA as possible. This means all the sections that need your information and any questions relevant to you.

Leave the parent section blank for now. You can’t submit the FAFSA without your parental information if you aren’t an independent student.

Instead, prepare as much documentation detailing your special circumstances as possible. Here are some examples the FSA provides:

Court/law enforcement documents

Letters from a school counselor, social worker, or clergy member

Letter from TRIO/Gaining Early Awareness and Readiness for an Undergraduate (GEAR UP) grant director/designee

Next, contact your school’s FAA and let them know you have special circumstances. Each school may have forms you need to fill out. Complete those forms and email or mail them with your documentation to the school’s FAA.

Keep in contact with the FAA, and respond promptly with any other information needed. As you’ve seen, the FAA will need to spend time making sure you qualify for special circumstances consideration.

Eventually, your FAA will decide if you still need parental information or if you can skip over it for FAFSA purposes.

How long does it take to process special circumstances requests?

FAAs follow some of the same guidance on special circumstances we explained earlier. However, each school differs in how they handle these cases. Some have forms to fill out, and others may not.

All that said, the process can take at least a few weeks. Keep in contact with the FAA—monitor your email inbox and mail for correspondence from your FAA to keep the process moving.

Other ways to pay if you have special circumstances

If special circumstances prevent you from getting the aid you need or if you need more aid after getting approved for special circumstances, there are several ways outside the FAFSA to pay for college.

Here are a few options:

Private scholarships and grants

Grants and scholarships don’t require repayment. They’re basically free money. The best part? You don’t have to fill out the FAFSA.

Scholarships are generally awarded on merit, using criteria like grades, essays, and extracurriculars to decide on the winners. Easier scholarships offer smaller amounts but don’t take much time to apply for, whereas more competitive ones may offer more but ask you to write essays or make videos.

Many scholarships are often targeted toward specific niches, too. For example, the Ron Brown Scholarship is designed for high-achieving Black students.

On the other hand, grants are given based on need. Instead of competing by grades or essays—you’ll provide information about your financial situation. If you meet the criteria for financial need (and other factors), there’s a good chance you’ll win.

If you have special circumstances stopping you from completing the FAFSA, there’s a good chance you could win private grant money. Afterall, you may have more financial need than students who can fill out the FAFSA’s parent section.

On-campus jobs

The FAFSA is required to get work-study aid. If you can’t get this aid due to lacking a qualifying circumstance, you can try to get a job on campus to earn money for school.

On-campus jobs offer a few other benefits besides a paycheck.

For one, schools are pretty flexible about scheduling on-campus work around your classes making it easier to balance work and classwork.

What’s more, on-campus jobs could score you discounts on certain things you need for school.

For example, the job at the campus bookstore might give you discounts on textbooks. Or, working in the dining hall could score you some free meals.

Working in college just looks good on your resume. Graduating with work experience —especially internships—doesn’t hurt when it comes to looking for that first “real” job.

College tax breaks

Did you know that students with special circumstances (ones that warrant a dependency override) can possibly knock down their tax burden through college tax credits and deductions?

Tax credits like the American Opportunity Credit and the Lifetime Learning Credit can directly refund taxes you’ve paid on qualifying educational expenses during the tax year. These can be lucrative since they pay you money or reduce your taxes owed directly.

Meanwhile, deductions reduce the income the IRS looks at when taxing you.

The student loan interest deduction lets you write off interest paid on qualifying federal and private student loans. Students can also potentially deduct money they pay for tuition and fees.

Tuition reimbursement

Nontraditional students, those working full-time who’ve returned to campus to advance their careers, should look at their employee benefits package—tuition reimbursement or assistance might be hiding in there.

If your employer offers these benefits, they’ll cover some or all of the costs of your returning to school.

Employers usually require you to hit and maintain a certain GPA, and they may only reimburse you for courses in certain subject matter. But some money is better than no money.

Employers offer this to upskill their employees. And, once your coursework is done, you’ll mostly get a raise. In summary, they’ll help you pay for your education and give you a raise once you finish. It’s a win all the way around.

Private student loans

Private student loans are available through banks, credit unions, and online lenders. They can cover any gaps in your aid package, but you should only fall back on them as a last resort.

Here are some reasons why:

They have higher interest rates than federal student loans

Interest starts accruing immediately

The lender demands repayment immediately—there are no grace periods like with federal students loans

They require good credit or a cosigner if you lack credit. This can be a challenge if your parents are unable to cosign your private student loans

There are no official deferment or forbearance programs

Private loans offer virtually no forgiveness options

Go after grants, scholarships, work, and other sources before looking into private student loans.

Get the financial aid you need

Many schools are willing to overlook the parental financial aid section if you can’t fill it out for whatever reason. Just make sure you document the reason for your special circumstances and stay in contact with your school’s FAA.

You don’t have to figure this out by yourself, though. Mos students get the help they need by requesting special circumstances treatment and finding other sources of aid to help pay their way through college.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you