FAFSA •

April 7, 2023

FAFSA MPN: what is it and how do you fill one out?

Learn about the FAFSA master promissory note and how to complete it.

When planning how to pay for college, you’ll encounter different types of financial aid.

After exhausting options like scholarships and grants, you may need to consider taking out a student loan to cover any remaining expenses.

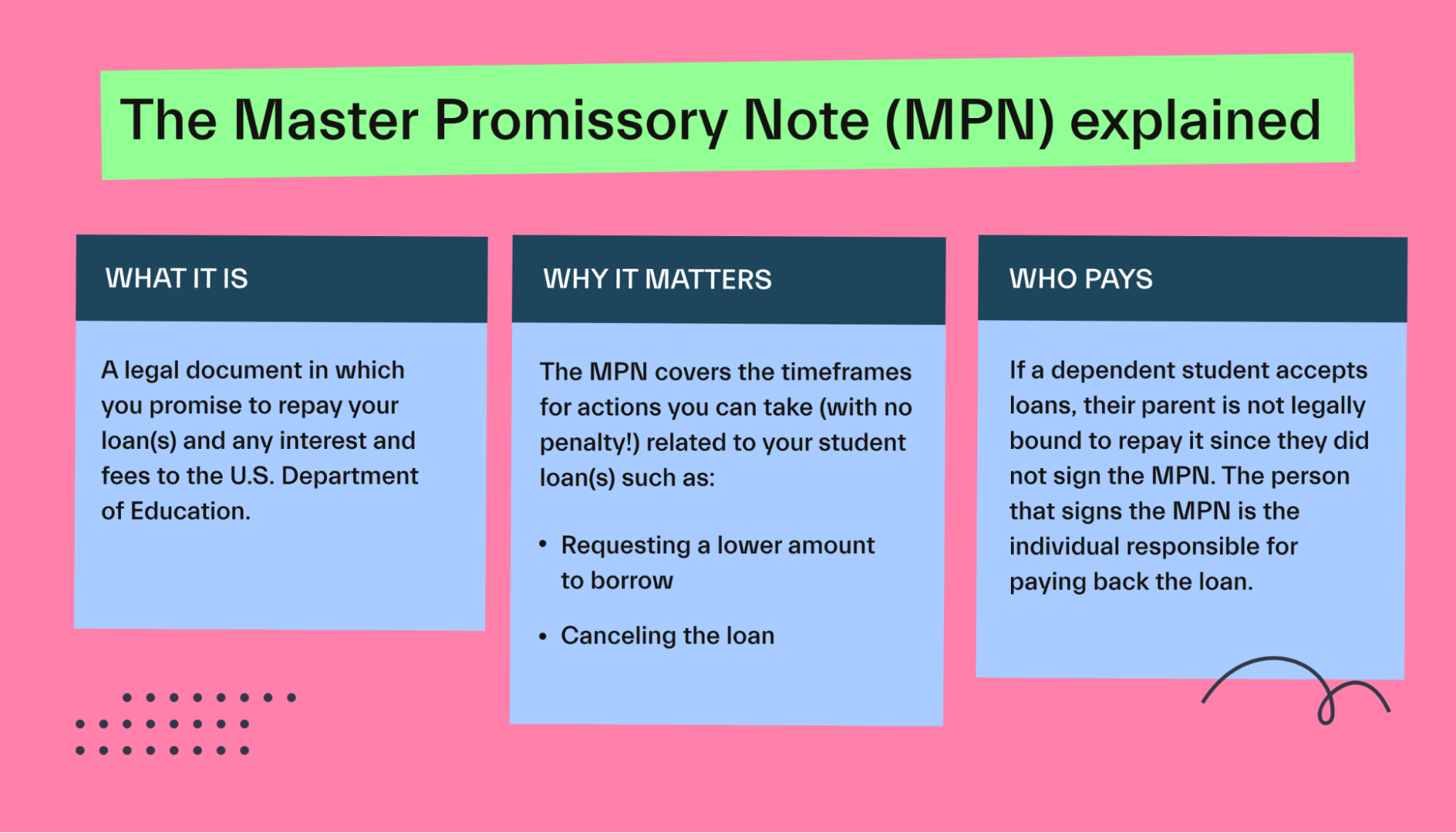

Some student loans have you sign a master promissory note (MPN). This is a legal document you sign promising to pay back that loan.

To accept a student loan from your completed FAFSA, you’ll often have to sign a FAFSA MPN.

To help you understand a FAFSA MPN, we’ll break down how it works. We'll also cover the parts of a FAFSA MPN and when you have to sign it.

What is a FAFSA MPN?

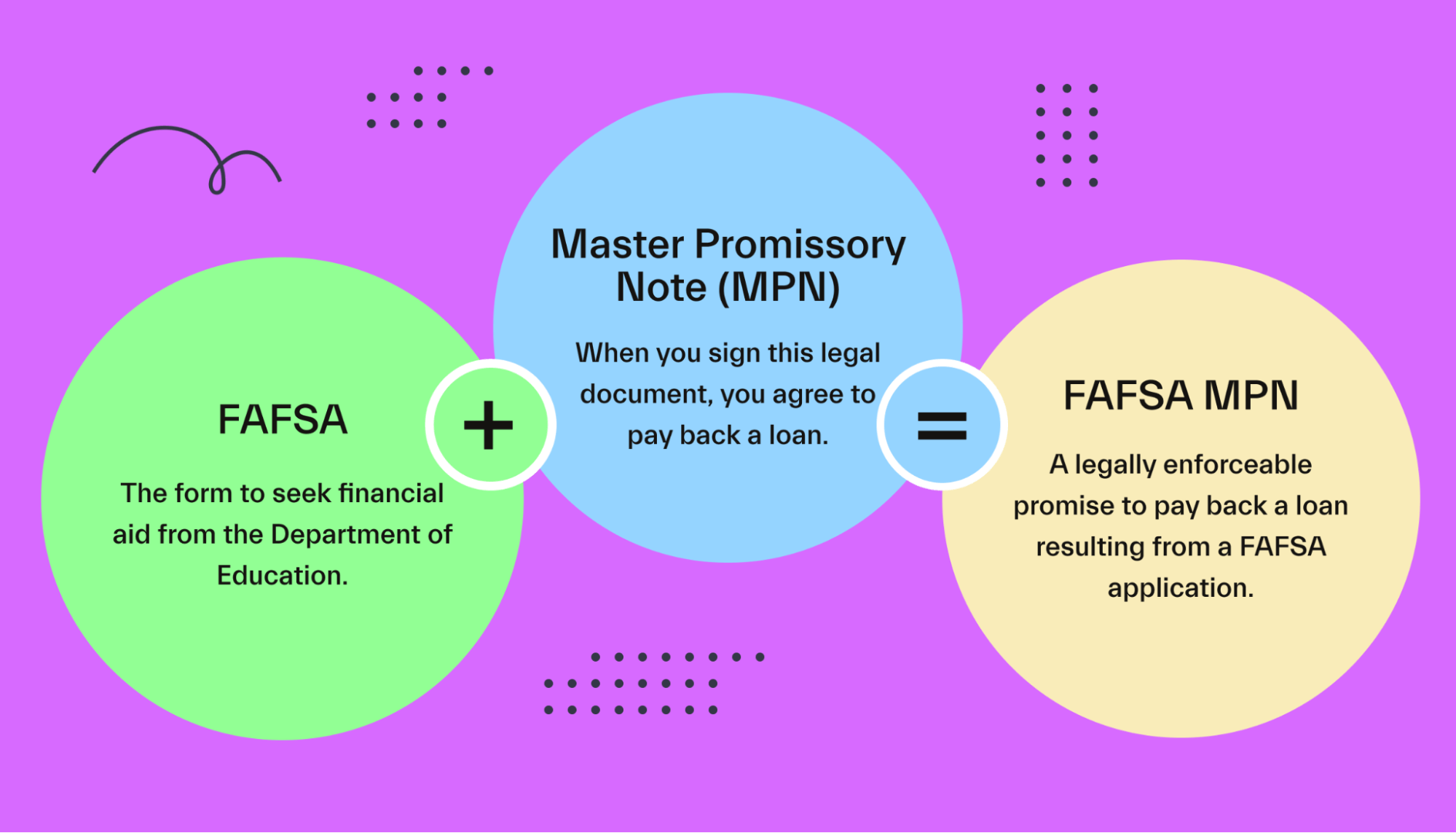

The term FAFSA master promissory note (MPN) has 2 components: FAFSA and MPN.

FAFSA: TheFree Application for Federal Student Aid (FAFSA) is a form you fill out when seeking financial aid from the Department of Education (DOE).

MPN: An MPN is a document you sign agreeing to pay back a loan. When you sign an MPN, you’re agreeing to the terms of the loan and promising that you'll pay it back plus interest and fees.

By putting the 2 terms together, a FAFSA MPN is a legal promise to pay back a loan that you got through the FAFSA.

When you sign a FAFSA MPN, you’re promising that you’ll pay back the loan no matter what.

Even if your degree doesn’t help you land a job or you quit school before earning your degree, you’ll have to pay the loan back plus interest and fees (most of the time).

There may be few exceptions, such as when you declare bankruptcy (a legal process in which you declare you can’t pay back your debts) or your school commits fraudulent activities (such as claiming false school accreditations or promises of employment).

What is the difference between a master promissory note and a promissory note?

A promissory note covers just one loan.

A master promissory note covers the first loan and any others you take out after the first one. Since you have to complete a FAFSA every year to apply for financial aid, using a FAFSA MPN makes the process easier by covering multiple loans. Instead of signing a new MPN every year, the first FAFSA MPN you sign usually covers every new FAFSA loan that you take out.

Some schools ask you to fill out a FAFSA MPN every year as an extra step before funding your loans. Contact the financial aid office of your school for details.

What are the types of FAFSA MPNs?

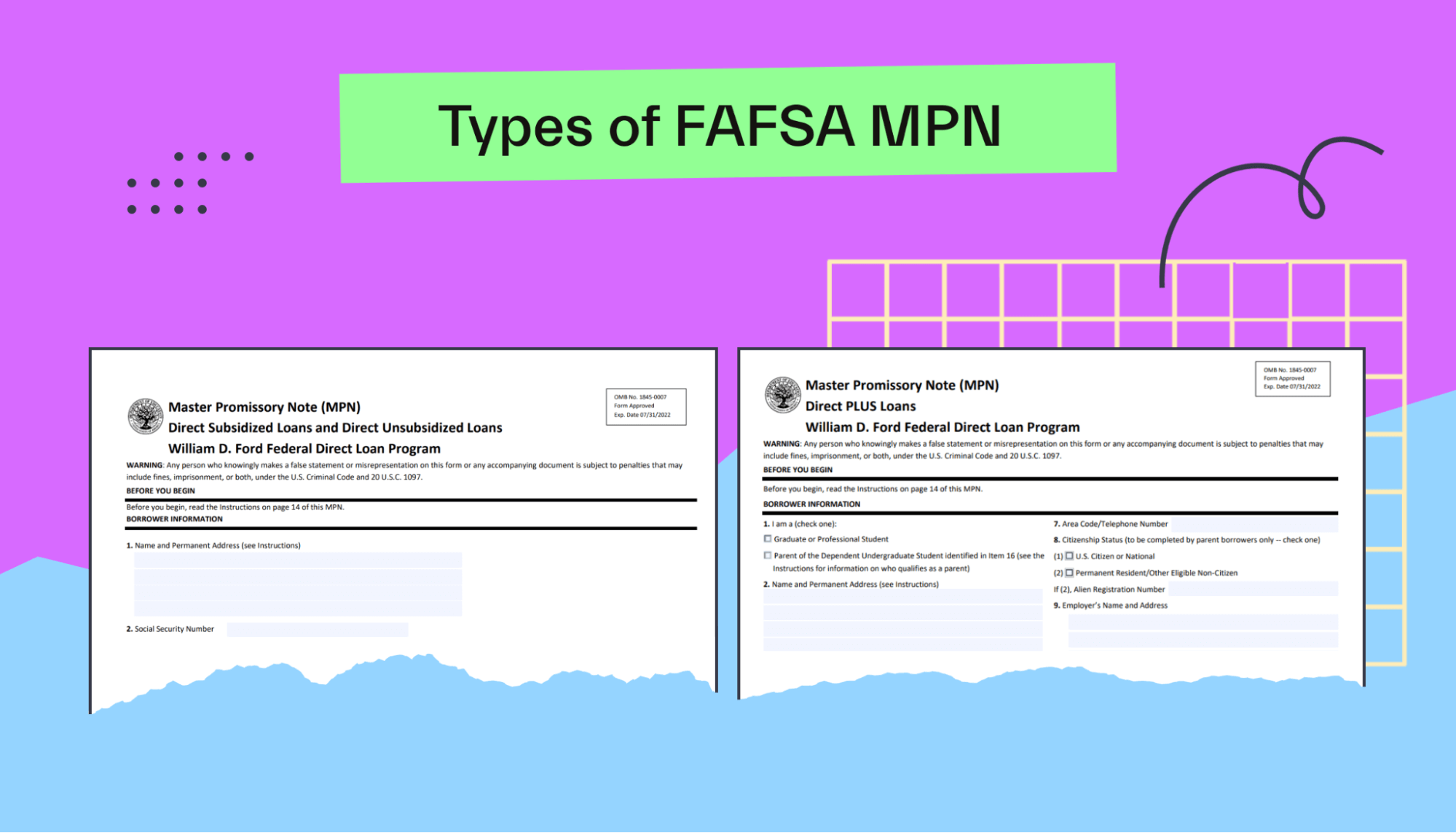

The 2 types of FAFSA MPNs are the FAFSA MPN and the PLUS MPN.

FAFSA MPN

The FAFSA MPN is for undergraduate students seeking a direct subsidized or unsubsidized loan.

A direct subsidized loan is a loan you borrow directly from the DOE, and it covers your interest payments for you while you’re in college.

A direct unsubsidized loan is also a direct loan from the DOE, but it doesn’t cover interest payments. The interest on an unsubsidized loan starts growing from day 1.

Graduate or professional students seeking a direct subsidized or unsubsidized loan also use a FAFSA MPN. These are students earning degrees beyond an undergrad degree, like a Master’s or Doctorate degree.

FAFSA PLUS MPN

The FAFSA PLUS MPN is for grad students or parents of students seeking a Direct PLUS loan. Offered by the DOE, a Direct PLUS loan pays for college expenses not covered by your available financial aid.

The term grad PLUS loan means that the loan is for a graduate or professional student, while the term parent PLUS loan means that the loan is for a parent. They both sign a FAFSA PLUS MPN to get their loan.

Do you have to sign more than one type of FAFSA MPN?

Most of the time, you only need to sign one FAFSA MPN. You’ll sign it as a first-time federal student loan borrower.

Sometimes, however, you’ll need to sign 2.

For example, a grad student taking out both a direct subsidized loan and a Direct PLUS loan needs to sign an MPN for the first loan and a PLUS MPN for the second loan.

What are the parts of a FAFSA MPN?

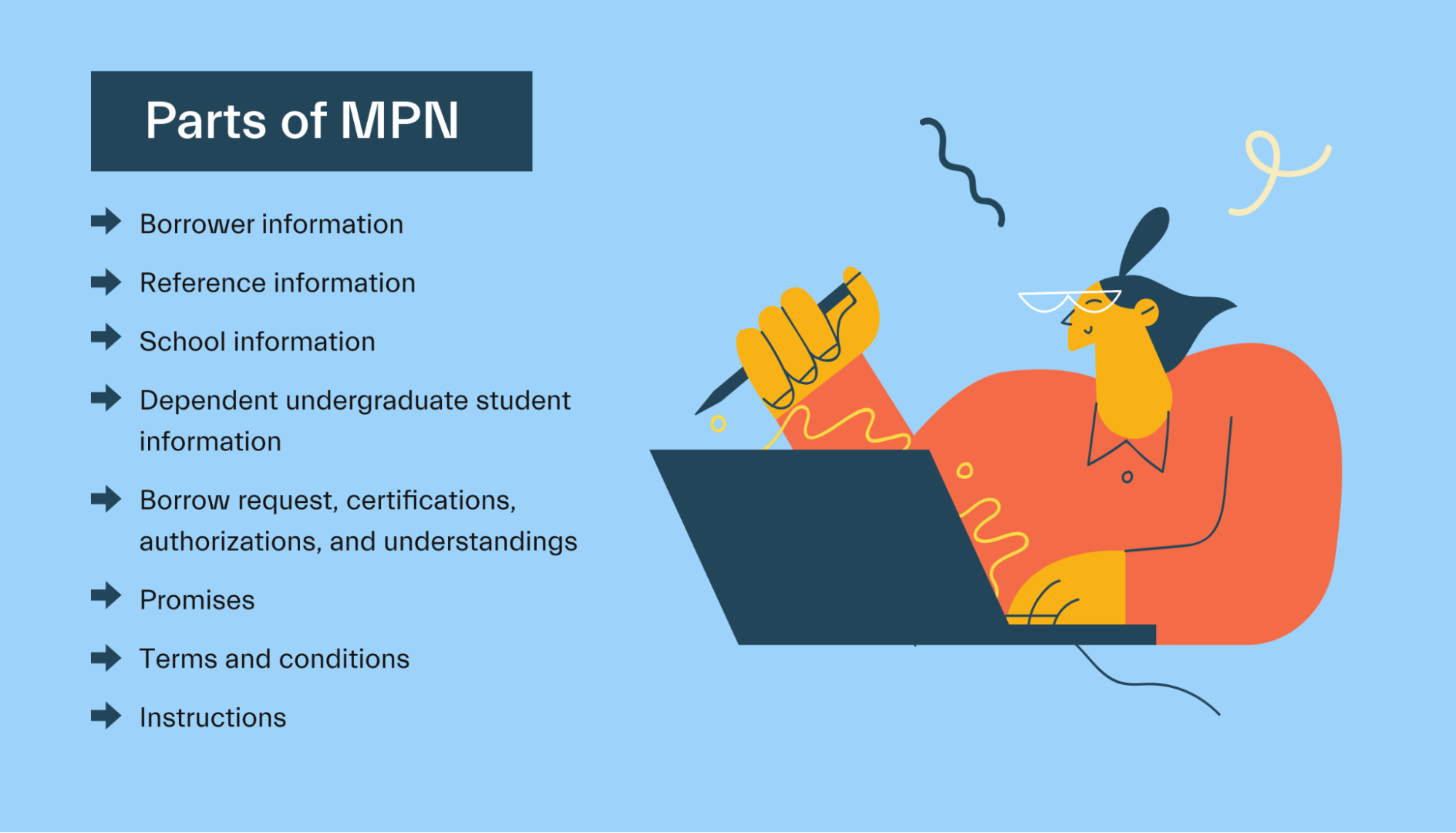

A FAFSA master promissory note (MPN) has 8 sections. Let’s walk through each of them:

1. Borrower information

Here, you include information that identifies you, including your name, date of birth, driver’s license number (If you do not have a driver’s license, enter N/A), and Social Security number (SSN).

You’ll also include your contact information, such as your address, email, and phone number.

2. Reference information

The federal government requires you to provide information about 2 people living in the US who have known you for at least 3 years. They’ll be your references.

One of the 2 references must be a parent or legal guardian. The other needs to have a different address than you.

When picking a reference, make sure to ask that person before including them in your FAFSA MPN. The federal government may contact them for different reasons, including to verify some of your information or if you were to stop paying your student loans.

3. School information

You’ll select a school to notify about your loan by providing its name, address, school code, and identification number.

4. Dependent undergraduate student information

This section only appears on the FAFSA PLUS MPN. It applies to a parent taking out a PLUS loan.

Since the parent of an undergrad student provides their own information in the ‘borrower information’ section, this section is for gathering information about their student.

5. Borrower request, certifications, authorizations, and understandings

This section doesn’t have anything for you to complete. Instead, it includes important information about the MPN for you to read.

This section makes it clear that when taking out a loan, you:

Request a total loan amount not above what you’re eligible to borrow.

Certify that you’re providing accurate information, planning to use the loan to pay for college expenses, informing your references about your loan, and allowing your school, the DOE, and acting agents to contact you about your loan.

Understand that your school can use the loan to credit your school’s account up to the full loan amount, use the MPN for more than one loan, and help you cancel or modify a loan amount.

6. Promises

A key feature of an MPN is that by signing it, you’re promising that you’ll pay back the loan.

This section includes a statement that you understand you must repay all loans that you receive under this FAFSA MPN. You’ll sign and date right under that statement.

7. Terms and conditions

The section ‘Borrower request, certifications, authorizations, and understandings’ mentions an MPN’s terms and conditions, which you’ll find written out in this section.

This disclosure statement includes a breakdown of each one of the terms and conditions of your MPN, including the laws that apply to the MPN and details about different parts of the loan, such as the amount that you can borrow and the interest rate.

We’ll review the terms and conditions from the FAFSA MPN in more detail in a later section.

8. Instructions

This short guide provides general instructions about items in your MPN.

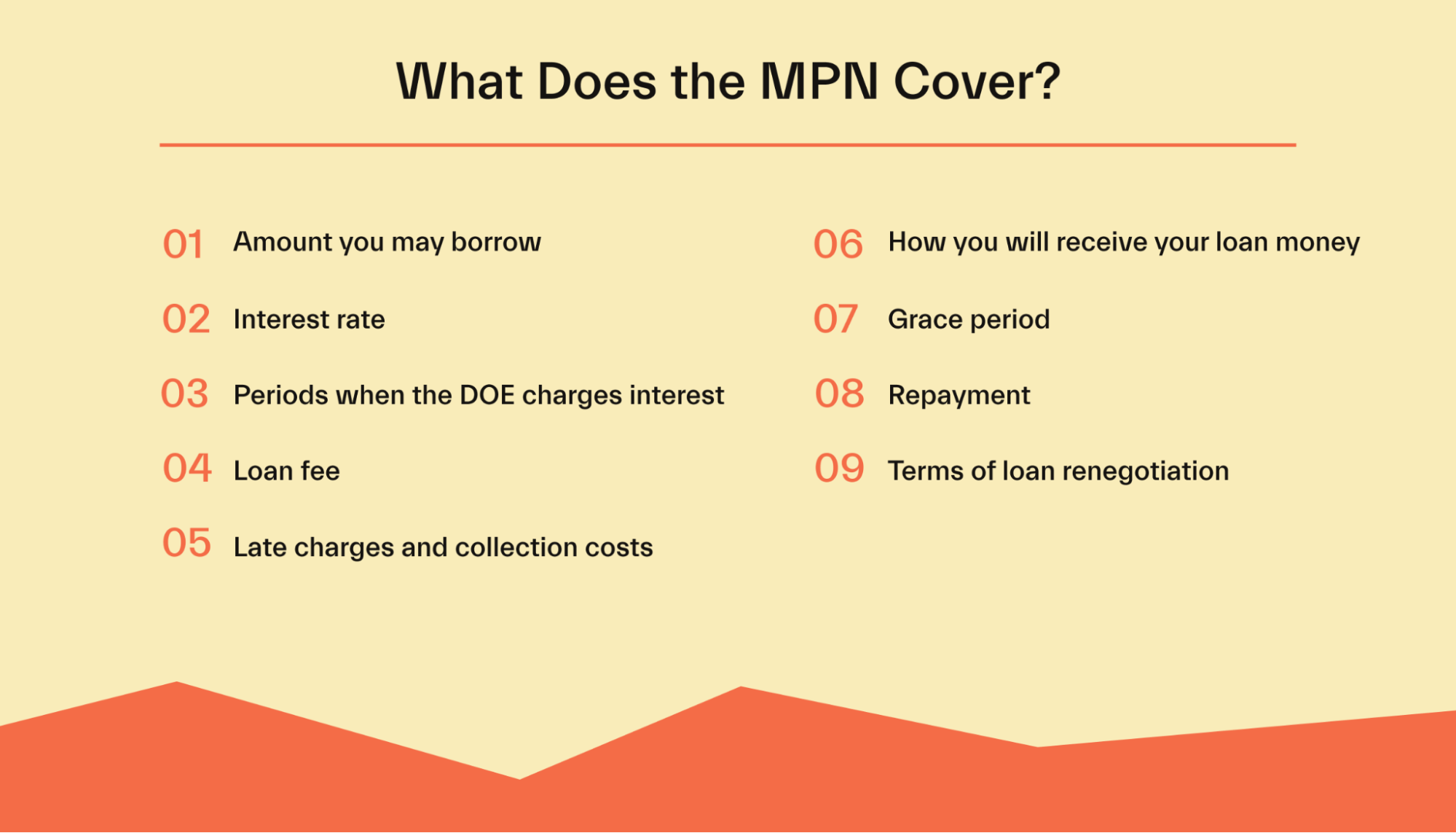

What does a FAFSA MPN cover?

A FAFSA MPN is a legal document covering the terms and conditions of your loan.

The terms of a FAFSA MPN include:

1. Amount you may borrow

Also called principal, the amount that you first borrow must be the same as or less than your total loan limit.

2. Interest rate

The interest rate tells you the amount of money you’ll have to pay the DOE for lending you the money. It is based on a percentage.

The highest interest rate for a direct subsidized loan or unsubsidized loan is 8.25% for undergraduate students and 9.5% for graduate students.

3. Periods when the DOE charges interest

The DOE doesn’t charge interest on subsidized loans while you’re attending school at least part-time and up to 6 months after graduation.

The DOE charges interest on unsubsidized loans from the day the loan is disbursed.

4. Loan fee

The DOE charges a fee for every loan that it issues to you. The fee reduces the actual amount of your loan rather than adding to your loan balance.

A 1% loan fee would reduce a $1,000 loan to $990:

$1,000 - ($1,000 * 0.01) = $1,000 - $10 = $990

5. Late charges and collection costs

The DOE charges you a late fee of up to $.06 per dollar of every late payment.

The DOE also charges more costs to recover unpaid debts (collection costs), including attorney fees and court costs.

6. How you will receive your loan money

You’ll typically receive your loan in a series of payments according to a schedule from your school.

Most of the time, your school receives the loan funds and applies them to your account to pay for college costs.

If your account balance is greater than your total cost, you may choose to keep the extra cash as credit in your account or give it back to the federal government. This way, you won’t have to pay as much money back after you graduate.

7. Grace period

You have a grace period of up to 6 months after graduation to start repaying your federal direct loan.

While the grace period applies to both a subsidized and unsubsidized loan, an unsubsidized loan will still accumulate interest during this time.

8. Repayment

After your grace period, you’ll begin making monthly payments for any loans you took out.

9. Terms of loan renegotiation

A perk of borrowing from the federal government instead of a private lender is that you have more flexibility in repaying your loan and options for negotiating your loan.

You’ll have several repayment options, including making monthly payments based on your income and making initial payments that cover only the interest.

FAFSA MPN frequently asked questions (FAQs)

Let’s take a look at 3 FAQs about a FAFSA MPN.

What happens when I sign a FAFSA MPN?

When you sign a FAFSA MPN, you promise to pay the DOE the full amount of all loans under the MPN according to the terms of the MPN.

By signing a FAFSA MPN, you acknowledge that you have read, understand, and agree to its terms and conditions. Typically, the MPN is valid for up to 10 years of continuous education.

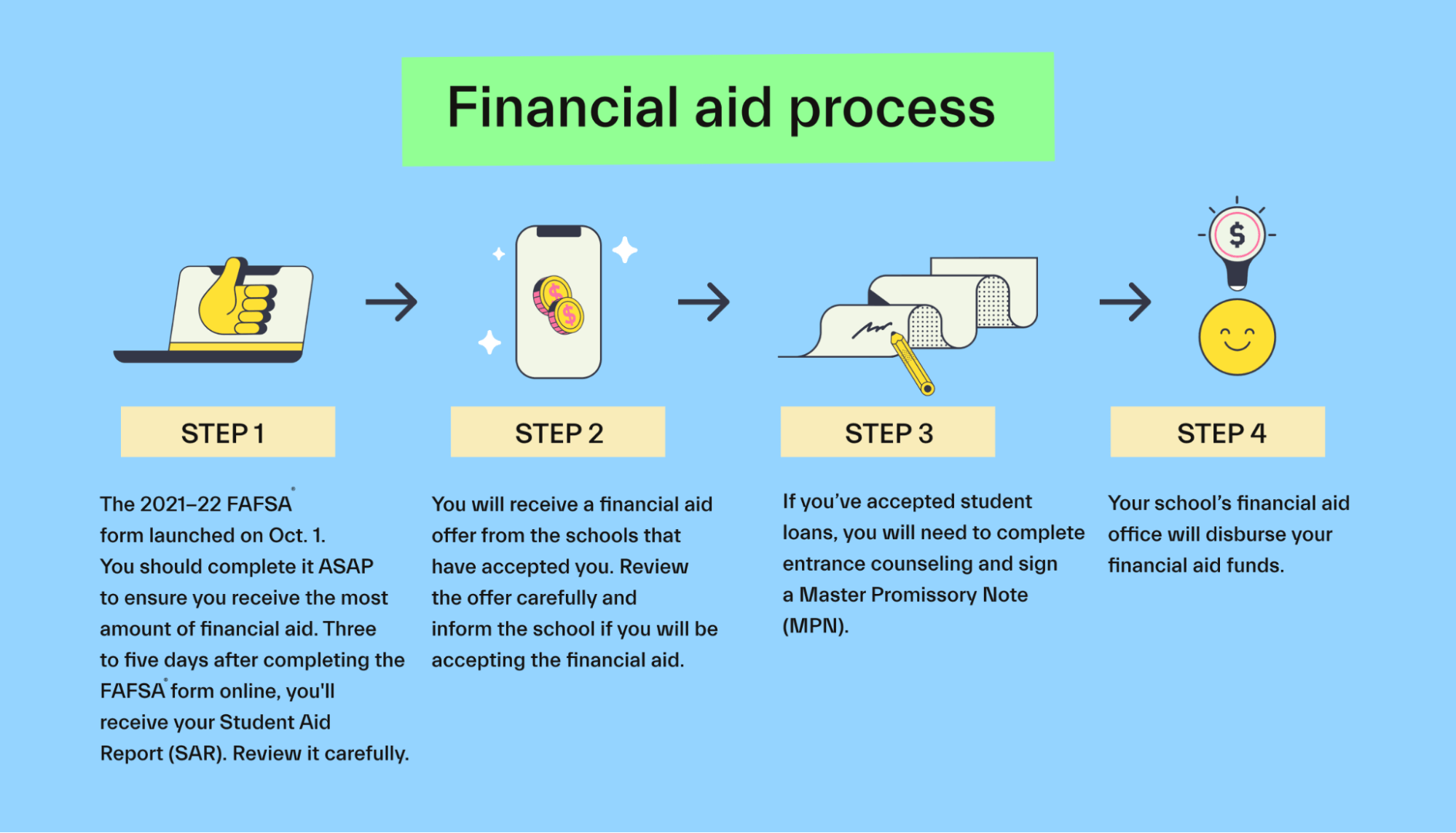

Signing an MPN is one of the last steps before your school gives you your financial aid funds. An additional step may be to do entrance counseling to learn more about your rights and responsibilities related to your student loan.

When do I have to sign a FAFSA MPN?

Here are times when you’ll sign a FAFSA MPN:

If you are borrowing a loan for the first time

If your school asks you to sign a new MPN every year

If you signed an MPN over 1 year ago but never received a loan

If you haven’t signed an MPN in the last 10 years and are receiving a loan

How do I complete a FAFSA MPN?

The FAFSA MPN is available online here. To log in, you’ll need your Federal Student Aid (FSA) ID.

Undergraduate and graduate students complete the FAFSA MPN. Graduate students and parents receiving PLUS loans complete the FAFSA PLUS MPN. Parents use their own FSA ID.

You can also fill out a FAFSA MPN by hand, but the federal government recommends the online version to speed up the process.

Does a parent borrower complete a FAFSA MPN?

If a parent is a first-time borrower in the Federal Direct PLUS loan program, they must complete an electronic Master Promissory Note of their own. The Direct PLUS Loan MPN includes the same information as the MPN for other federal student loans.

Note that Federal Direct PLUS loans can be denied due to adverse credit history, such as a defaulted loan, so you’ll only be able to sign the MPN after you’re approved.

Conclusion

There are many types of financial aid available to help you pay for college. Some types of financial aid you don’t have to pay back, and others, like student loans, you do.

After reading your school’s financial aid offer letter, you may find that you have some student loan options from the DOE.

Read through the MPN carefully, as this document tells you all the information you need to know about the loan you’re being offered. This information will help you determine if the loan makes financial sense for you.

Before taking out a loan, make sure you look for scholarships and grants that you qualify for. Don’t leave free money on the table.

If you want to get the most financial aid available to you, check out Mos today. We’re here to help.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you