Financial aid •

March 28, 2023

What's work-study?

Work-study is a form of federal financial aid that enables students to work part-time on-campus or nearby. But how does the program work, exactly?

College costs are higher than ever and rise steadily each year. These days, most students need to utilize multiple sources of funding in order to pay for their education.

While student loans, grants, and scholarships can all help, there’s one opportunity that’s less commonly discussed: Work-study.

Work-study is a federal program that helps students with financial need get part-time jobs while in school.

This comprehensive guide will explain how work-study works, what types of jobs are available, and how you can apply for work-study.

What is work-study?

Work-study is a type of federal financial aid. Students who qualify for work-study can get part-time jobs (up to 20 hours/week) while working on their studies.

Most work-study jobs are on-campus jobs where students can work directly for their college. Other jobs may be off-campus for local nonprofits, public agencies, or small businesses.

Students may be awarded work-study aid when they receive their financial aid award letter. If you qualify for work-study, you can go out and find a work-study job to help you earn money for school or other expenses.

Work-study is awarded as part of the financial aid application process, which you complete by filing the Free Application for Federal Student Aid (FAFSA).

Work-study is a large program:

Around 3,400 schools offer work-study programs!

Around 16% of students utilized federal work-study in 2021.

Work-study is funded by the federal government but managed by individual schools. It also requires cooperation from employers, including organizations and private businesses.

It’s important to understand that work-study isn’t “free money.” If you’re approved for work-study, you still have to apply for a job, get hired, and perform your work responsibilities in order to earn a paycheck.

A work-study job could be something general, like working in a coffee shop, or it could be specific to the student’s field of study like a research assistant.

What is the point of work-study?

If work-study still requires students to work to earn the aid money, what’s the point? What’s the difference between work-study and a standard job?

First off, work-study aims to make it easier for students to find part-time work.

Federal funding subsidizes up to 75% of the student’s wages, while the school picks up the rest. This makes it more attractive for employers to hire students for part-time roles, as they don’t have to pay as much for labor. And for this reason, colleges themselves often participate in work-study programs by hiring many students.

Secondly, work-study earnings don't count when calculating FAFSA income eligibility. This means that money you earn from a work-study job won’t affect your ability to qualify for other types of aid—while a standard part-time job could.

And finally, work-study earnings are paid directly to the student, in the form of a paycheck. Students are free to use these funds for anything they want! Many other types of financial aid are applied directly to tuition costs, but work-study goes straight to students.

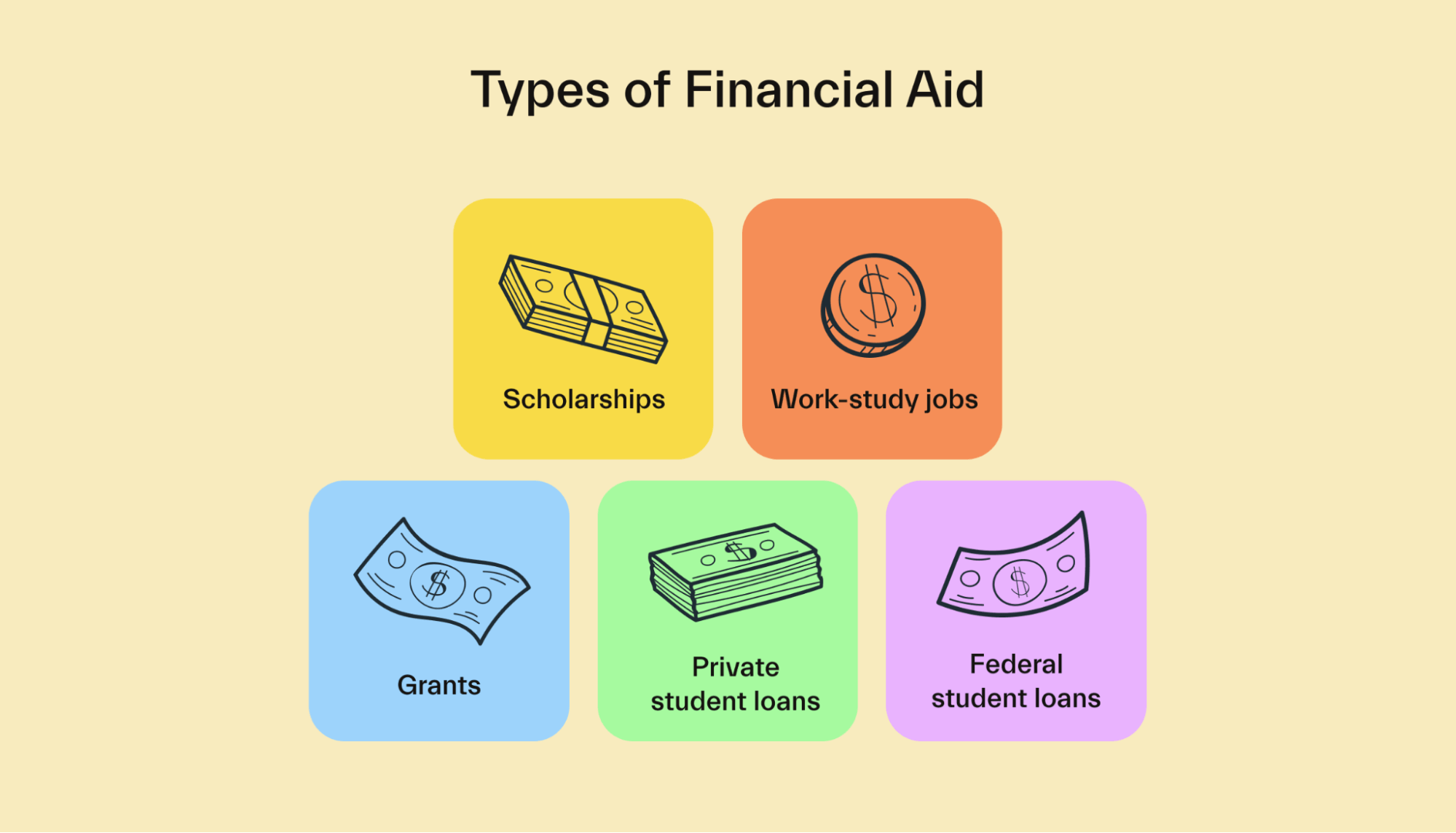

Overview of the types of financial aid

As mentioned, work-study is a type of financial aid. Here’s an overview of all the different types of aid that may be available to students:

Student loans: Student loans provide a way for students to borrow money to pay for school. You’ll have to pay them back over time, and you must pay interest on the loans.

Federal student loans are still considered a form of financial aid because they’re partially subsidized by the government. Private student loans are available from private banks and aren’t typically considered financial aid.

Grants: Grants are essentially free money for college! You don’t have to pay grants back, unlike student loans. Most grants are awarded based on financial need, which means that a student from a low-income household is more likely to receive a grant compared to a high-income student.

Scholarships: Scholarships are another form of gift aid that you don’t usually have to pay back. Scholarships are funded by governments, schools, businesses, and individuals. Most scholarships are awarded based on merit—academic excellence, athletic achievement, etc.

Work-study: This is the one we’re focusing on in this article. But just a recap—work-study helps students earn money for school through part-time work. Work-study funds are paid directly to the student in a paycheck (unlike other forms of financial aid, which are usually applied to tuition/fees directly).

Confused about financial aid? See these frequently asked questions about financial aid to learn more.

How does the federal work-study program work?

Here are the basics you need to know about work-study programs:

The Department of Education provides funding to schools that participate in the work-study program. Nationwide, around 3,400 schools participate.

Individual schools determine which students will receive work-study offers as part of their broader financial aid calculations.

Students who are awarded work-study will be told the maximum amount they can earn through the program.

Students can decline work-study and still receive other types of financial aid. Work-study isn’t mandatory, and many students do decline it if they feel they won’t have time to work.

If a student accepts work-study, they must then find a participating job either on-campus or in the community.

If a student is hired for a work-study job, they begin working at the job part-time. Students earn an hourly wage that varies based on the job. They can earn up to the maximum amount that was approved as part of their financial aid package.

The way each school handles work-study is a bit different. Most schools will maintain a list of available positions for work-study applicants. And many schools directly hire students to fill on-campus roles, as well.

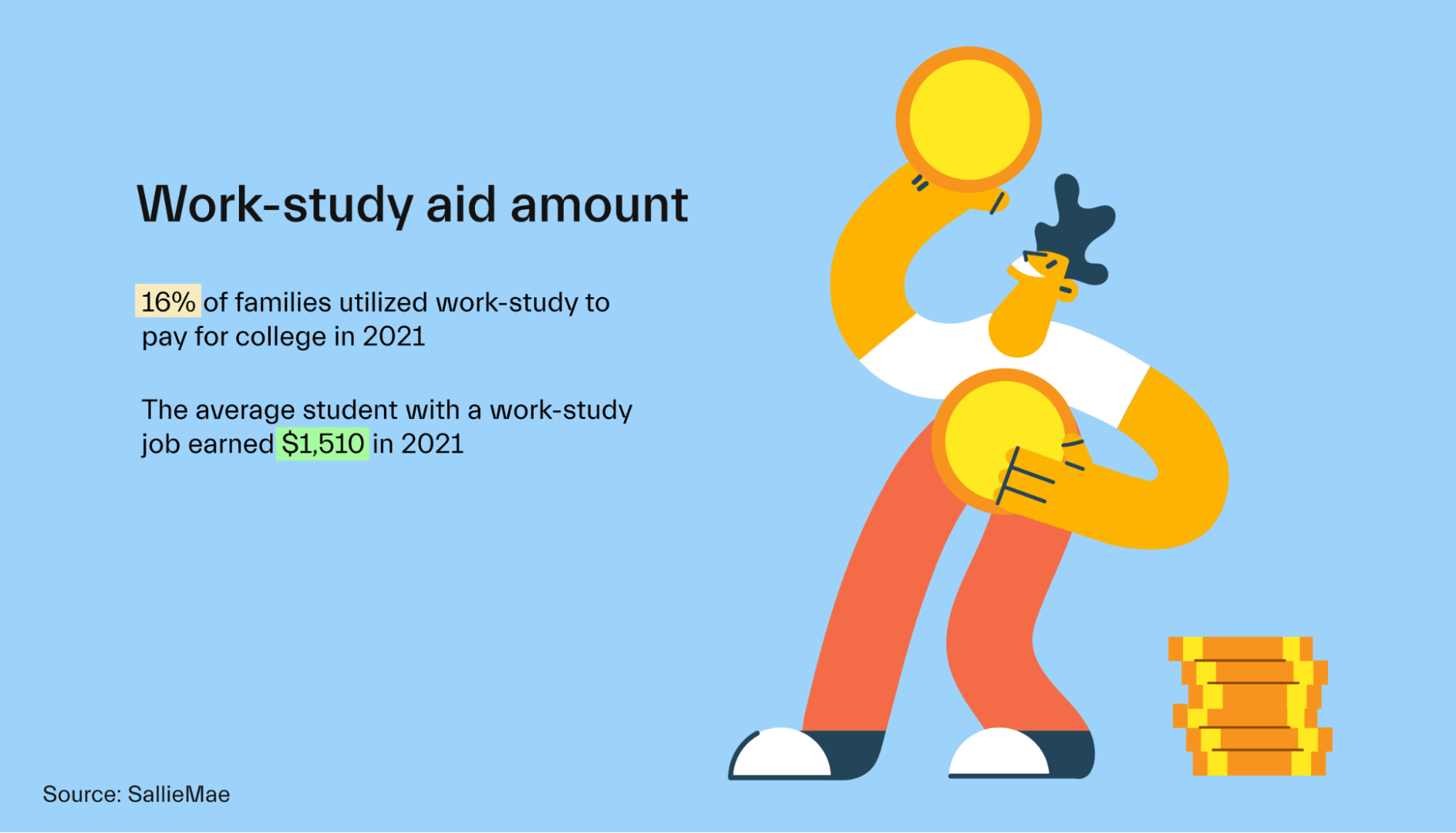

Work-study aid amounts

The amount of work-study aid that you’ll be awarded depends on many factors. Schools are responsible for calculating aid amounts, including all the different types of federal aid.

If you’re awarded work-study, you’ll see a maximum amount on your financial aid award letter.

This figure is the most you can earn through a federal work-study job. If you’re “awarded” $2,000 in work-study, that doesn’t mean you’ll receive $2,000—it just means that you can go find a part-time job and earn up to $2,000 at that job.

Aid amounts vary significantly, but we can look at averages to get a better idea. In 2021, the average student in a work-study job earned $1,510 through the program. In 2020, that figure was $1,847.

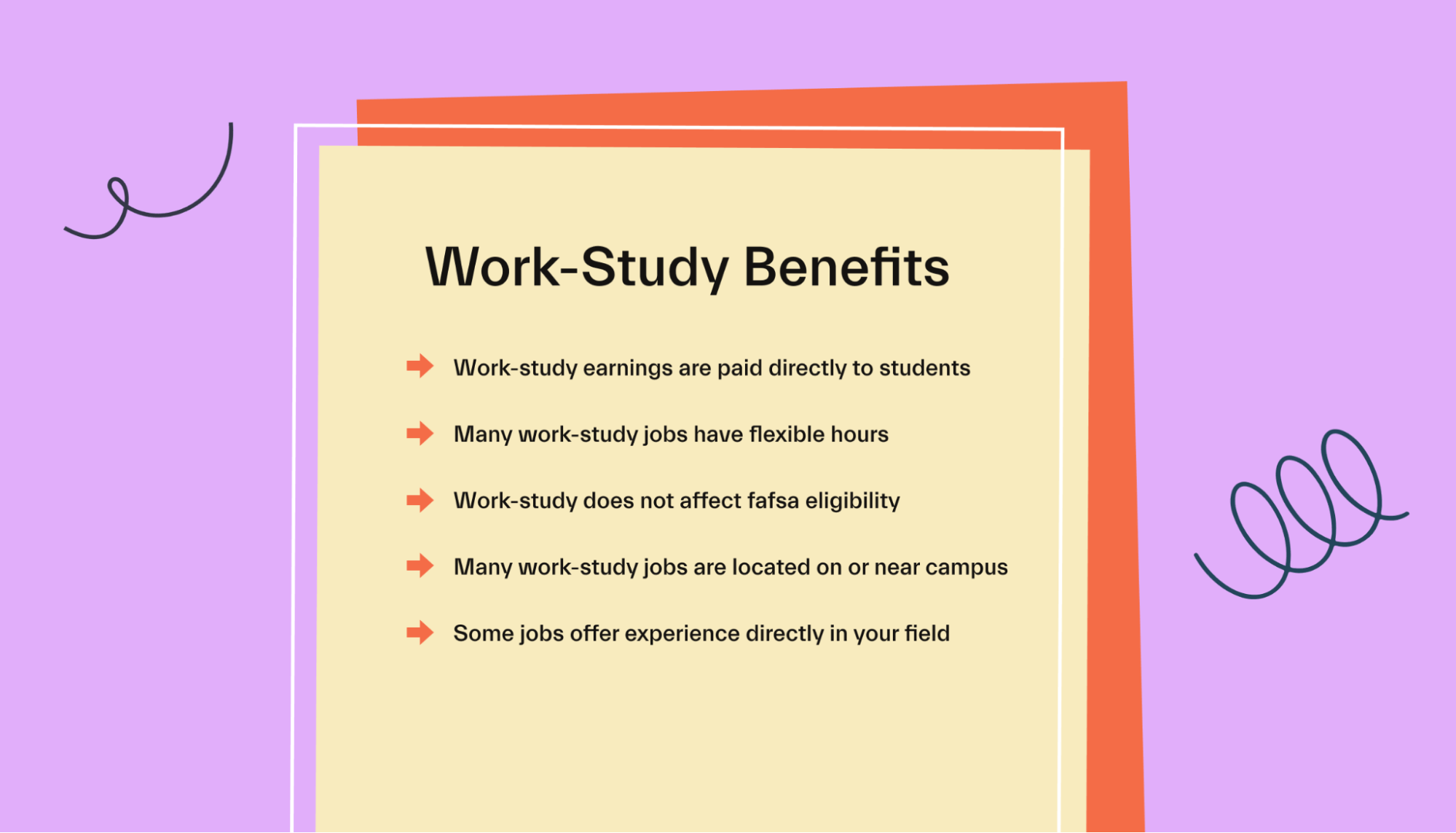

Benefits of work-study

There are many work-study benefits, including:

Direct pay. Students receive paychecks from their jobs and can use the money for any purpose.

Flexible hours. Work-study employers are familiar with employing students, and they’re usually willing to work around your class schedule. Plus, work-study jobs can only ask students to work a maximum of 20 hours per week (on average), so students should have enough time for their studies.

Often on-campus (or near campus). Many work-study jobs are on-campus or located nearby. In fact, colleges themselves are often some of the largest employers of work-study students. This is convenient, particularly for students who don’t have a car.

Doesn’t affect FAFSA eligibility: If a student gets a normal job and earns money, this income could affect their eligibility for other types of financial aid. But work-study earnings don’t count against you regarding FAFSA eligibility.

Work experience. Work-study provides hands-on professional experience. In some cases, students can even find positions that are relevant to their area of study.

How do you apply for work-study?

Utilizing work-study involves 2 applications:

Applying for federal financial aid through the FAFSA.

Applying for actual work-study jobs once you’re awarded work-study via the FAFSA.

To start, students must submit the FAFSA by June 30 at the end of the current academic year. For the 2022/2023 academic year, that means students must submit the FAFSA by June 30, 2023.

Then, students must wait for their financial aid award letter. This letter will explain what types of aid the student can get. If work-study is listed as an aid type, the student can then move on to looking for a work-study job.

Do I have to accept work-study aid?

No. Students are free to accept or decline work-study. Some schools also allow you to defer aid to the following academic period.

Does a work-study award automatically get you a job?

No. Work-study doesn’t guarantee you a job. Instead, it makes you eligible to apply for work-study jobs.

With that said, being approved for work-study can often make it easier to find work, particularly for on-campus jobs. Many colleges offer on-campus jobs and often prefer to hire work-study students for those roles.

Do I have to apply for work-study every year?

Yes. Students must submit the FAFSA each academic year to maintain financial aid eligibility. Federal work-study amounts aren’t guaranteed from year to year—you may receive different grant awards even if your financial situation hasn’t changed.

Students will also need to apply for new work-study jobs each academic year. If you’re already working at a job you enjoy, you can talk to your supervisor—they may be able to save the job for you.

How to get a work-study job

Once you’ve been approved for work-study, it’s time to actually find a work-study position!

Students must apply for jobs that are participating in the work-study program. Most schools will maintain a list of work-study positions that are open to applicants.

Students can contact the financial aid office at their schools to gain access to the job listings. Many colleges list these jobs publicly on their websites.

It’s important to choose a position that’s a good fit for you. Here’s what you should consider:

How does the job align with your skills, interests, and field of study?

Where is the job located, and will it be convenient to get to in between classes?

How do the pay and hours per week fit in with your maximum work-study amount?

This last question is quite important. For example, if you’re awarded a work-study amount of $1,500, you’d likely want to look for a job that’s only a few hours per week. But if you’re awarded a higher amount, you may wish to seek out a job with more hours in order to maximize your earnings!

From there, you simply need to apply for the jobs directly. The requirements for this will vary depending on the position and employer.

Types of work-study jobs

Work-study jobs can be almost anything.

However, many work-study jobs are on-campus jobs, and most of these are offered by schools themselves. These positions could include:

Resident advisor (RA)

Teaching assistant

Campus ambassador

Library assistant

Coffee shop barista

Cafeteria worker

Tutor

Other work-study jobs may be off-campus. The federal work-study guidelines encourage schools to partner with nonprofit organizations and public agencies whenever possible. Private businesses do also partner with schools to hire students, but this isn’t as common.

The requirements for individual work-study jobs vary significantly. Just because you’re approved for work-study doesn’t mean that you’ll be qualified for any particular position.

Some work-study jobs are entry-level, while others require specific experience. Check the list of job opportunities maintained by your school’s financial aid office to browse available positions.

How much does work-study pay per hour?

There’s no set hourly wage for work-study positions. It will vary with each job listing. Students must be paid at least the federal minimum wage, which is currently $7.25 per hour.

Additionally, work-study jobs must comply with all state and local labor laws. This means that state-level minimum wage rules will also apply. A list of state minimum wage laws can be found here.

Are work-study earnings subject to income taxes?

Yes. Money earned through federal work-study is treated as earned income and must be reported on a student’s personal income tax return.

Earnings will be subject to both federal and state income taxes. However, earnings may be exempt from FICA taxes if the student is enrolled in classes full-time.

Fortunately, most students work only part-time and won’t end up owing much tax at all. Concern over having to pay taxes on your earnings shouldn’t keep you from pursuing a work-study position!

Work-study vs. standard part-time jobs

There are many ways to make money in college. Work-study is just one.

How does work-study compare to picking up a standard part-time job? There are a few factors to consider here:

Competition. Work-study jobs often have fewer applicants than jobs posted publicly for anyone to apply to. Therefore, there’s often less competition, making it easier for you to land a job!

Flexibility. Work-study employers have specifically signed on to partnerships with the managing school, and their goal is to help students balance their studies with the jobs. Work-study is part-time (20 hours/week, maximum), and most employers are flexible enough to accommodate changing class schedules.

FAFSA eligibility. When you work a normal job, your income will affect your eligibility for financial aid. The more you earn, the more risk you run of not qualifying for grants and other forms of aid. Work-study jobs, on the other hand, don’t affect FAFSA income calculations—so you can earn money through work-study without worrying about it affecting your FAFSA eligibility.

Ask for help

If you’re interested in work-study but need help figuring out how to get started, there are a few resources available to you. Taking advantage of them can increase your chances of finding a job that will help you financially and will provide valuable work experience.

One option is to check with your school’s financial aid office to see if you’re eligible for the program. Many schools also have a job board or employment center where students can search for available work-study positions.

Another way to get help navigating work-study is to work with a personal advisor.

Mos is a money app that helps students lower their tuition, match with top scholarships, and earn extra cash in college. It has personal advisors (actual human beings, not chatbots!) who’ll give you 1:1 support.

Conclusion

Work-study can be a great option to supplement other types of financial aid while also gaining some job experience.

With the average work-study earnings being just $1,510 per year, most students won’t be able to count on work-study as a significant funding source. But it can certainly provide some extra spending money!

Need more money for school? Check out our full guide on how to pay for college.

And before you head off for your first semester, be sure to sign up for Mos. Mos is a powerful money solution for students that also happens to be the best way to apply for scholarships!

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you