FAFSA •

November 9, 2022

Does the FAFSA have an age limit?

Nontraditional students often need financial aid. They can apply for FAFSA aid but with certain limits. Learn more about these limits here.

Students traditionally go to college from age 18 to 22 before heading off into the “real world.” But not everyone follows that path. In fact, the number of nontraditional students is rising.

Regardless of why you’re going to school beyond the conventional age range, you have to pay. Given tuition trends, you’re probably looking at the FAFSA to qualify for aid.

The good news for you is there’s no hard age limit for the FAFSA. But your age and student status will impact how you’ll fill out the FAFSA and what aid you’ll qualify for.

In this article, we’ll explain how age and student status influence the FAFSA process and what kinds of aid you could receive.

Does the FAFSA have an age limit for applying?

People go to school outside of the typical 18-22 age range for all sorts of reasons. They might be:

In longer or more rigorous undergrad programs

Returning to class to enhance their skills and advance their career

Returning to class to change careers

Military veterans seeking education after serving

Regardless of your situation, there’s no age limit on applying for the FAFSA or on certain forms of financial aid you can receive from the federal government.

You can apply for the FAFSA once a year for as many years as you’re enrolled in college. You’ll qualify for other aid as long as you meet the following requirements:

You’re a US citizen or eligible noncitizen with US national status or a green card, an Arrival/Departure Record (I-94), battered immigrant-qualified alien status, a T visa, or a parent with a T-1 visa.

You have a high school diploma or recognized equivalency, such as a GED, or have completed a state-approved home-school high school education.

You have a valid Social Security number

You’re enrolled or accepted for enrollment in an eligible degree or certificate program

You’ve maintained satisfactory academic progress in college if already enrolled (though this standard varies by school)

Dependency status

Although there’s no FAFSA age limit, your age influences your aid package by impacting your dependency status.

Dependency status determines whether you use your parents’ or your own financial info on the FAFSA:

Dependent students use their parents’ financial information on the FAFSA

Independent students use their own info—and their spouse’s if they’re married

Students aged 24 or older by January 1 of the school year in which they’re applying for aid are automatically considered independent.

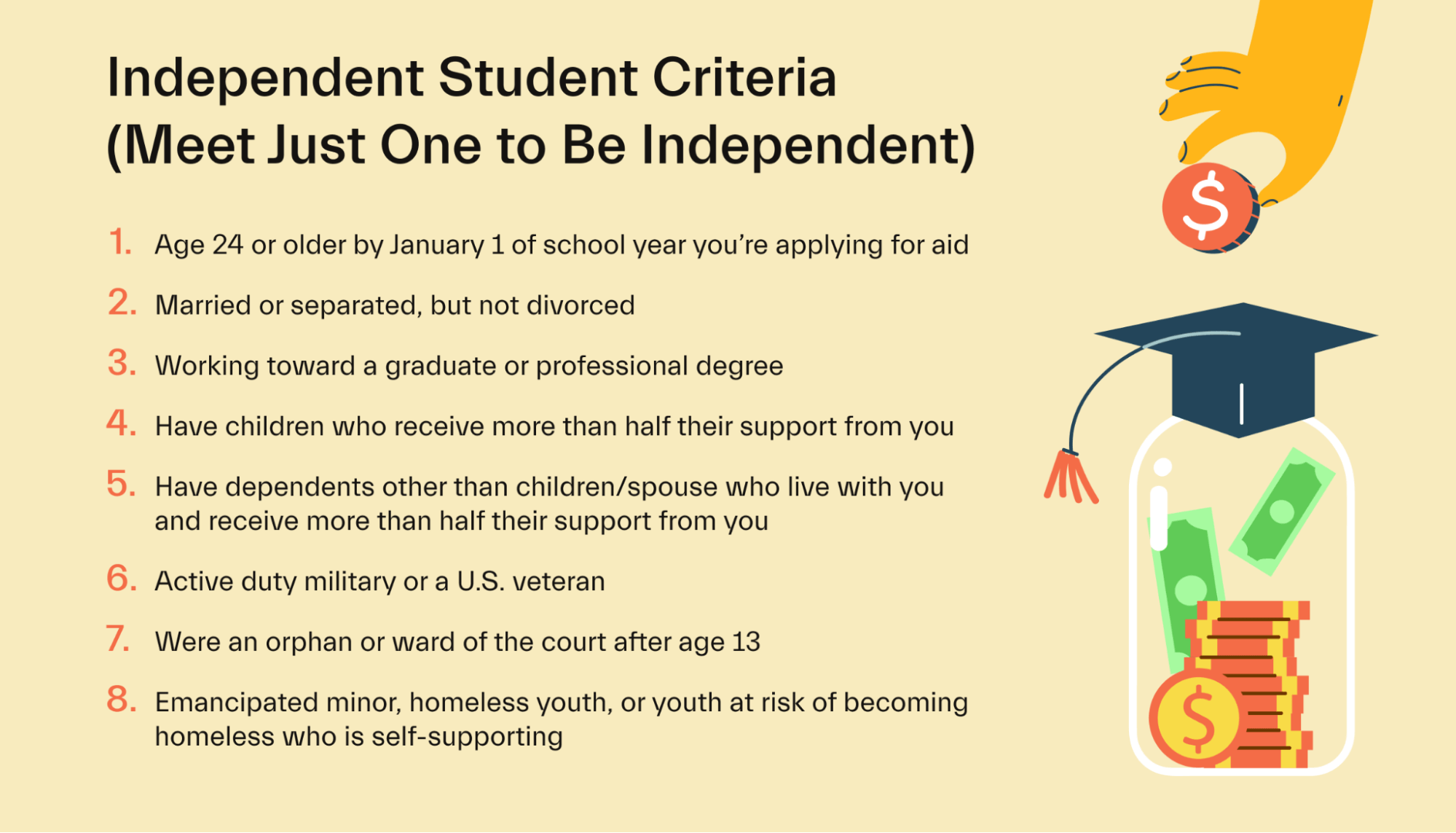

However, if any of the following describes you, you could be considered an independent student before you turn 24:

You’re married or separated but not divorced

You’re working toward a graduate or professional degree

You have children who receive more than half of their support from you

You have dependents other than children or a spouse who live with you and receive more than half of their support from you

You’re active duty military or a US veteran

You were an orphan or ward of the court after age 13

You’re an emancipated minor, homeless youth, or youth at risk of becoming homeless who is self-supporting

Independent students usually receive much more aid than dependent students since they tend to earn less and have a lower EFC than their parents.

Plus, if they qualify, they get to take advantage of education tax credits and deductions instead of their parents. This gives them more savings on college costs.

Reward limits for financial aid types

Some aid, like certain student loans and work-study, don’t limit the number of times you can be awarded.

Others cap how many times you can win—usually because they’re funds you don’t have to repay.

Here are some aid types with other limits.

Direct subsidized loans

Direct subsidized loans are need-based federal student loans. They don’t require repayment until 6 months after graduating, leaving school, or dropping below half-time enrollment—this is called a grace period.

Interest doesn’t start accruing until the end of the grace period, either.

Due to their financial benefits, direct subsidized loans are only available to undergrads. Even if you’re an undergraduate student, you can only borrow so much each year and over your lifetime, depending on your dependency status.

Federal grants

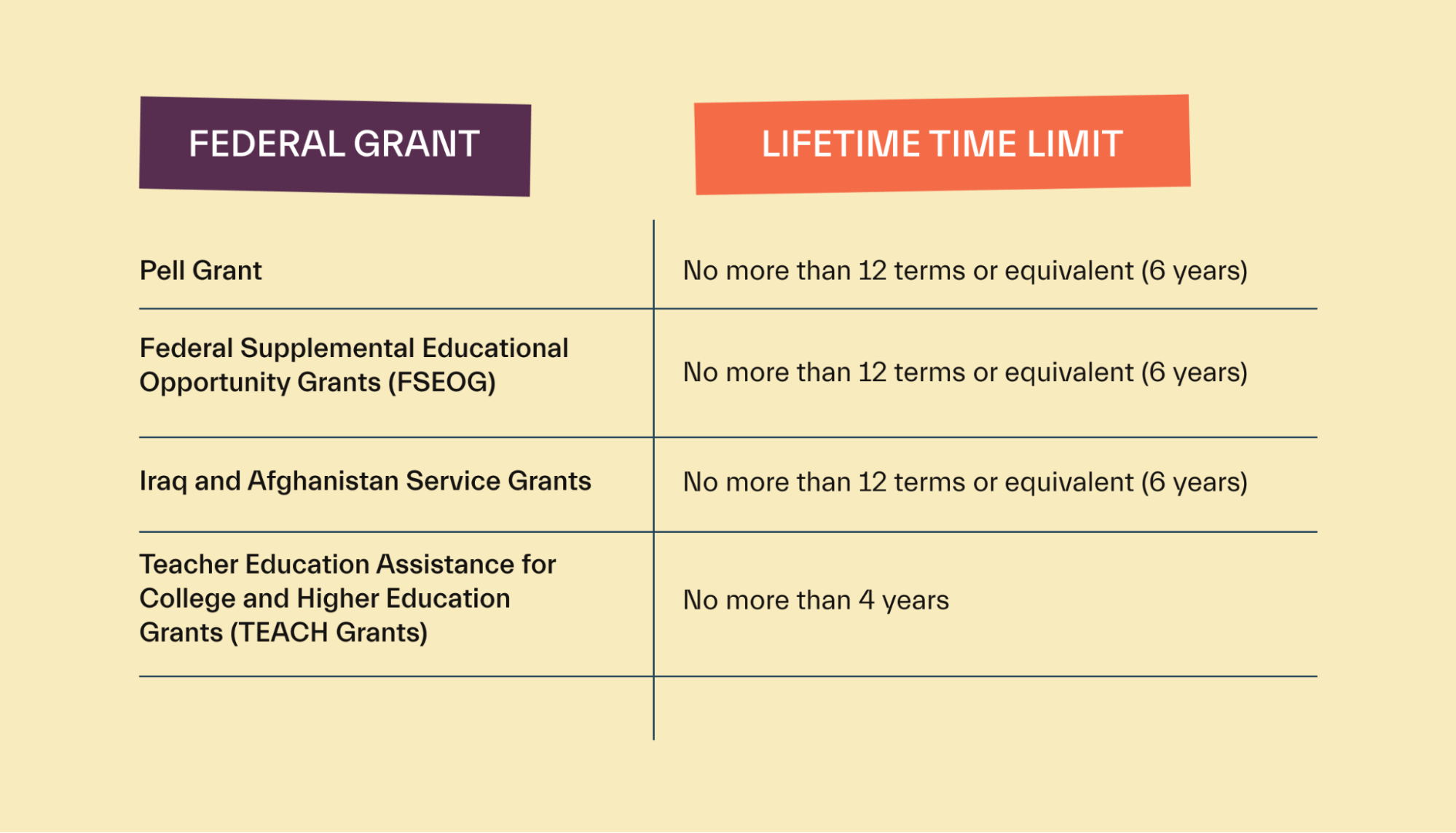

Federal grants are need-based and don’t require repayment. Naturally, the government imposes limits on these as well:

Pell Grant: The Pell Grant is only available to first-time undergrads. You can receive aid for a maximum of 12 terms or 6 years. This is called the Federal Pell Grant Lifetime Eligibility Used, or LEU.

Federal Supplemental Educational Opportunity Grants: FSEOG Grants are only available to first-time undergrads. They are subject to the same LEU limits as the Pell Grant.

Iraq and Afghanistan Service Grants: These grants are available to students who were 24 years old or enrolled in college at least part-time when one of their parents or guardians died while serving in Iraq or Afghanistan. Students must also meet Pell Grant requirements to qualify. These Iraq and Afghanistan Service Grants are subject to the same LEU time limits as the Pell Grant.

Teacher Education Assistance for College and Higher Education Grants: You can receive Teach Grants for no more than 4 years of schooling.

State and private grants

State-based and private grants may or may not have lifetime limits. This will vary widely by which state or organization you’re going for.

For instance, there is no age limit to qualify for New York State’s Tuition Assistance Program. However, as with the regular FAFSA, your dependency status can change with age.

Scholarships

Like state and private grants, scholarships can vary in their minimum and maximum age limits—or they may have no age limits at all.

For instance, a more niche scholarship might be designed for students returning to school to upskill or switch careers. The school might set a minimum age limit as part of its criteria for this scholarship.

On the other hand, a scholarship may be unavailable beyond a certain age. For example, enrollment in the College Bound scholarship program is only available to 7th and 8th graders. You won’t be older than 13 or 14 if you’re in 8th grade.

FAFSA age limit FAQs

Have more questions about federal aid age limits and other eligibility matters? Check out the following FAFSA age limit FAQs:

Do I have to put my parents’ information on the FAFSA?

The FAFSA asks for information about income, taxes, and some assets—but whose income, taxes, and assets depend on dependency status.

Dependent students must use their parents’ information on the FAFSA.

Independent students do not. Instead, they put their information and their spouse’s if they’re married.

Can I apply as an independent student before age 24?

If you're under 24, you may be considered an independent student if you meet one of the following requirements:

You’re married or separated

You’re pursuing a graduate or professional degree

You have children who receive at least half of their financial support from you

You have dependents (not your children or spouse) who receive more than half of their support from you

You’re an active duty member of the armed forces or a US veteran

You were an orphan or ward of the court since turning 13

You’re an emancipated minor, homeless youth, or youth at risk of becoming homeless who is self-supporting

Does the FAFSA have any income limits?

The FAFSA does not have a hard income limit. Your expected family contribution, or EFC, determines how much aid you could receive.

EFC is the government’s way of estimating how much money your family could contribute to your college costs—whether they actually do or not.

If you’re independent, EFC measures how much you could contribute. Usually, that’s a lower number—which often qualifies independent students for more aid.

EFC is changing to the Student Aid Index, or SAI, starting no later than July 1, 2024. The main change is that the SAI can go as low as -$1,500 to account for costs not included in a school’s cost of attendance, whereas the EFC can go no lower than $0.

Can you get federal student aid with low or no credit?

FAFSA aid—even federal student loans—has no credit requirements. At the same time, federal student loans can impact your credit score once you start repayment.

So although loans mean college debt, student loans can be the start of your credit-building journey—setting you up for success later.

Paying for college as a nontraditional or independent student

Whether you’re pursuing your first degree later in life, headed to grad school, or returning to class to change careers, you can apply for the FAFSA.

However, the information you provide on the FAFSA and the aid types you’re eligible for might be different than your average 18–22-year-old undergrad.

So now that you know you can use the FAFSA, it’s time to prepare. Check out our guide to the FAFSA to learn what info you need, how to apply, how long it takes, and much more.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you