Financial aid •

California State University, Northridge financial aid: a complete guide

Read all about financial aid at California State University, Northridge University, including scholarships, loans, and grants.

California State University, Northridge, is a public university located in the San Fernando Valley in California. With a student body of more than 38,000, it has a large, vibrant campus that gives students easy access to one of California’s largest cities, Los Angeles.

If you’re a high school student and are thinking about applying to CSUN, you might be wondering how you can afford tuition. We’ll break down what you need to know.

A snapshot look at California State University, Northridge

California State University, Northridge is one of the 23 campuses in the California State University (CSU) system. Founded in 1958, the university has served students from Los Angeles and across California. The school has grown from using portable classrooms on former agricultural land to graduating more than 11,000 students a year and boasting an alumni network of more than 370,000.

Students at Cal State Northridge can expect strong academic programs at a reasonable cost, thanks to the school’s status as a public university. Undergraduate students can choose from 68 degree programs, while graduates can choose from 58. The school also offers 2 professional doctorate degrees and 14 teaching credential programs.

Outside of class, students can explore the San Fernando Valley or nearby Los Angeles. There are also plenty of clubs and sports for students to get involved in, such as the student radio station, 88.5 FM, the Daily Sundial student paper, and 270 student clubs, fraternities, sororities, and other organizations.

Ranking: 39 in Regional Universities West

Size: 38,310

Demographics: 46% male, 54% female

Acceptance rate: 51%

Average GPA of accepted student: 3.35

Key dates and deadlines (2022)

Application: November 30

Financial aid deadlines: March 2

A look at scholarships offered by California State University, Northridge

It’s no secret that it can be hard to pay for college. Tuition is expensive, and you also need to find a way to pay for your living expenses while in school. Many families spend years trying to save for their kids’ educations and find themselves with less than they need.

If you find yourself needing more funds to pay for school, the best thing you can do is try to earn a scholarship.

The reason scholarships are the best way to pay for school is that they’re like free money. You get funds from the scholarship organizer, and you don’t have to pay them back like you would with a student loan.

There are all sorts of scholarships out there. Some are based on academic merit or athletic skills, while others are based on financial need or simply getting lucky and winning a drawing.

CSUN’s financial aid office has information about both on-campus and off-campus scholarships that students can apply for, helping them find opportunities to get college funds.

One important program for California students to know about is the Cal Grant program. This program provides residents with grants to attend state schools like CSUN.

Beyond state grant programs and scholarship aid you receive from the university, you can also look for scholarship opportunities from outside CSUN. Many businesses, community organizations, and other groups offer scholarship programs. With some careful searching, you can find a scholarship for almost anything you can think of.

If you’re looking to maximize your financial aid, check out our financial aid tips and tricks page for more resources on earning scholarships and other college funds.

Student loans

Once you’ve earned as many scholarships as possible, the next best place to get money for college is student loans.

Student loans have a major drawback compared to scholarships—you have to pay them back eventually, plus interest. However, the cost of getting a loan can be worth it if you consider your education and investment in your future.

Like scholarships, CSUN’s financial aid office has a web page outlining the different student loan programs that are available to its students.

For most students, the Federal Direct Loan Program is the best loan option out there. As the name implies, this program gives students loans directly from the United States government that come in 2 forms: subsidized and unsubsidized.

Subsidized loans are preferable by far because the government pays the interest while you’re in school and during grace periods. Unsubsidized loans let interest start building up right away, making them more expensive.

California also has a state-based loan program called the California Dream Loan. This program provides students who graduate from California high schools with the option to borrow up to $4,000 per year.

If government loans don’t provide you with enough financial assistance to cover your college costs, you may want to consider private lenders (this should be a last resort for most people). Many banks and specialized lenders offer student loans. However, private loans tend to be more expensive than government loans. They also lack options like interest subsidization, income-based repayment, and loan forgiveness, meaning you should typically max out your government loans before getting private loans.

If you’re thinking about getting loans to pay for college, it’s important to understand how they work. You can read our article on student loans, where we break it all down (and in plain English, not banker or bureaucrat jargon).

FAFSA

If you need financial aid to help pay for college, filling out the Free Application for Federal Student Aid (FAFSA) is the first step you should take.

The FAFSA is a comprehensive financial aid application the federal government and most colleges and universities use to make decisions about the financial aid that you require (and ultimately receive). Based on the information you provide, you might receive student loans, grants, and scholarships.

The FAFSA involves sitting down with your family and providing some information about your finances, such as your annual income and how much money you have saved for college. A government body will calculate your expected family contribution (EFC) to the cost of your college education based on the information you provide.

The difference between your EFC and the cost of attendance at your school is your total financial need. Your financial need plays a role in determining what need-based financial assistance, such as subsidized loans and need-based grants or scholarships you receive.

Most schools don’t guarantee they’ll meet all their students’ financial needs, so you have to look out for yourself. You’ll have to come up with the remaining funds through loans or other methods.

FAFSA applications open up on October 1st for financial aid awarded in the next academic year. For example, you could apply on October 1st, 2022, for aid awarded in the 2023-2024 academic year. You can submit the application anytime through the end of June. However, California has a March 2nd deadline for many of its state programs, and some programs offer awards on a first-come, first-served basis. That means it’s in your best interest to submit the FAFSA as soon as you’re able to.

Filling out the FAFSA can take some time, so prepare yourself by learning more about how long it takes to complete the FAFSA.

California State University, Northridge financial aid FAQs

We’ll answer a few more questions you may have about getting financial aid at CSUN.

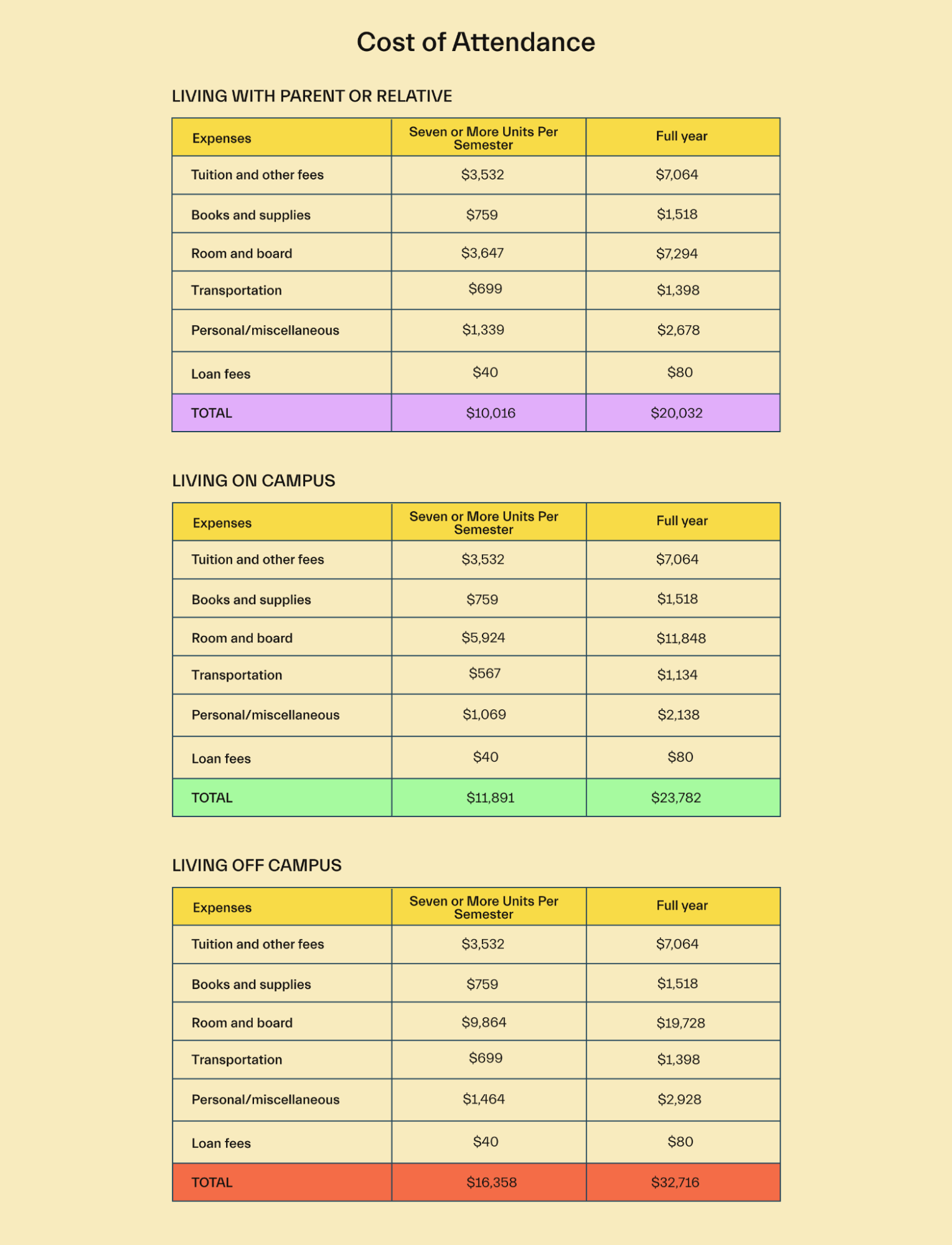

What is California State University, Northridge’s cost of attendance?

The cost of attendance for in-state undergraduate students living on campus at CSUN is $23,782. Of this amount, $7,064 covers tuition, and $11,848 goes toward room and board.

Out-of-state students pay an additional $396 per unit taken at CSUN, adding $11,880 to their costs, making the total cost of attendance for out-of-state students $44,596.

Can out-of-state students receive financial aid?

The short answer is yes; students from out of state are eligible to receive financial aid at CSUN. However, they will not be eligible for programs designed for California residents, such as the Cal Grant or CA DREAM Loan program.

How many students get a full ride?

CSUN does not publish numbers for how many students receive a full ride at the school. However, 82% of full-time undergraduate students receive some amount of need-based financial aid. The average student who gets a need-based award receives $17,240.

When will I know my financial aid awards?

CSUN’s financial aid office reviews financial aid documents in April and May before sending out financial aid awards. Continuing students will receive notification of their financial aid eligibility and the awards they receive in June. Funds are paid out 10 days before the beginning of the semester.

What types of aid can I get from CSUN?

CSUN offers many types of aid to its students. You can receive both need and merit-based scholarships as well as grants. You can also receive grants and loans from the federal and state governments.

Can I receive a federal grant at California State University, Northridge?

Yes, students at Cal State Northridge can receive federal grants as a portion of the financial aid funds that they receive. There are also many other financial aid programs available, including school-specific, state, and government programs.

Are there any ways to reduce student costs?

Students looking to reduce their cost of attendance may be able to do so by staying on-campus instead of in more expensive off-campus apartments or by living with their parents to reduce the cost of room and board.

Less-than-half-time students also pay reduced tuition, so you may save money by taking fewer classes.

Universities like California State University, Northridge that you might be interested in

California State University, Northridge, is just one option if you’re looking for an inexpensive school that provides a great education. If you’re thinking about applying to CSUN, consider these alternatives too:

University of California

The University of California system is another group of public universities in the state. The system offers 160 major and more than 800 degree programs across its 10 campuses, such as UC Davis, UC San Diego, UC Irvine, and UCLA.

As a public university system, the University of California keeps costs low for its students, 83% of whom come from California.

If you’re interested in a public university but don’t think CSUN is the right choice for you, the University of California is worth considering.

San Diego State University

San Diego State University (SDSU) is another public university located in California. Like CUSN, it keeps costs low for in-state students while offering a strong educational experience.

Located just 30 minutes north of the US-Mexico border, SDSU is well known for its diversity, equity, and inclusion practices. As a federally-designated Hispanic-service institution, more than half of the student population are students of color, and SDSU is a top-ranked college for LGBTQ+ students.

With more than 100 degree programs to choose from and an NCAA Division I sports program, SDSU offers a lot for students who want strong academics and a vibrant student life.

Stanford University

Stanford is one of the world’s top research universities. Located in the San Francisco Bay Area, the school gives its students easy access to one of the United States’ top tech hubs and has a reputation for entrepreneurship plansand innovation, with student startups frequently receiving funding.

Stanford isn’t a public university, which means it will be a bit more costly than a school like CSUN. However, it can be well worth the cost for enterprising students who want to be a part of cutting-edge research and who aim to make a difference in the world.

Conclusion

CSUN is a public university located on the edge of Los Angeles. As a public school, it offers students from California a quality education at a relatively low price.

If you’re looking for a vibrant campus in the city, CSUN might be the right school for you. If you’re looking for the best way to pay for higher education, Mos can help.

With Mos, you can get access to fee-free banking for students, a debit card with cashback and other rewards, along with personal assistance applying for financial aid, and a streamlined application to 100s of grants and scholarships with ease.

To get started, check out Mos today.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you