Financial aid •

Can you get financial aid for grad school?

Going for that advanced or professional degree? Learn all the aid types available to help you pay for your graduate school coursework.

Graduate school deepens your education and opens up better job opportunities.

But advanced education often comes at a higher price tag than undergraduate programs. Grad school loans represent nearly half of all student debt despite a smaller student population than undergrad.

At the same time, less attention is paid to grad school costs than undergrad. Many students get confused about how to pay for grad school—especially if they already have debt from undergrad.

Fortunately, there are lots of financial aid options for grad students.

In this article, we’ll show you how to get financial aid for grad school, cover the aid types available, and explore other ways to pay.

How do I file for graduate school financial aid?

Applying for federal grad school financial aid is the same as applying for undergrad financial aid. You’ll have to fill out the FAFSA, which is entirely free. You can knock it out in less than an hour, too.

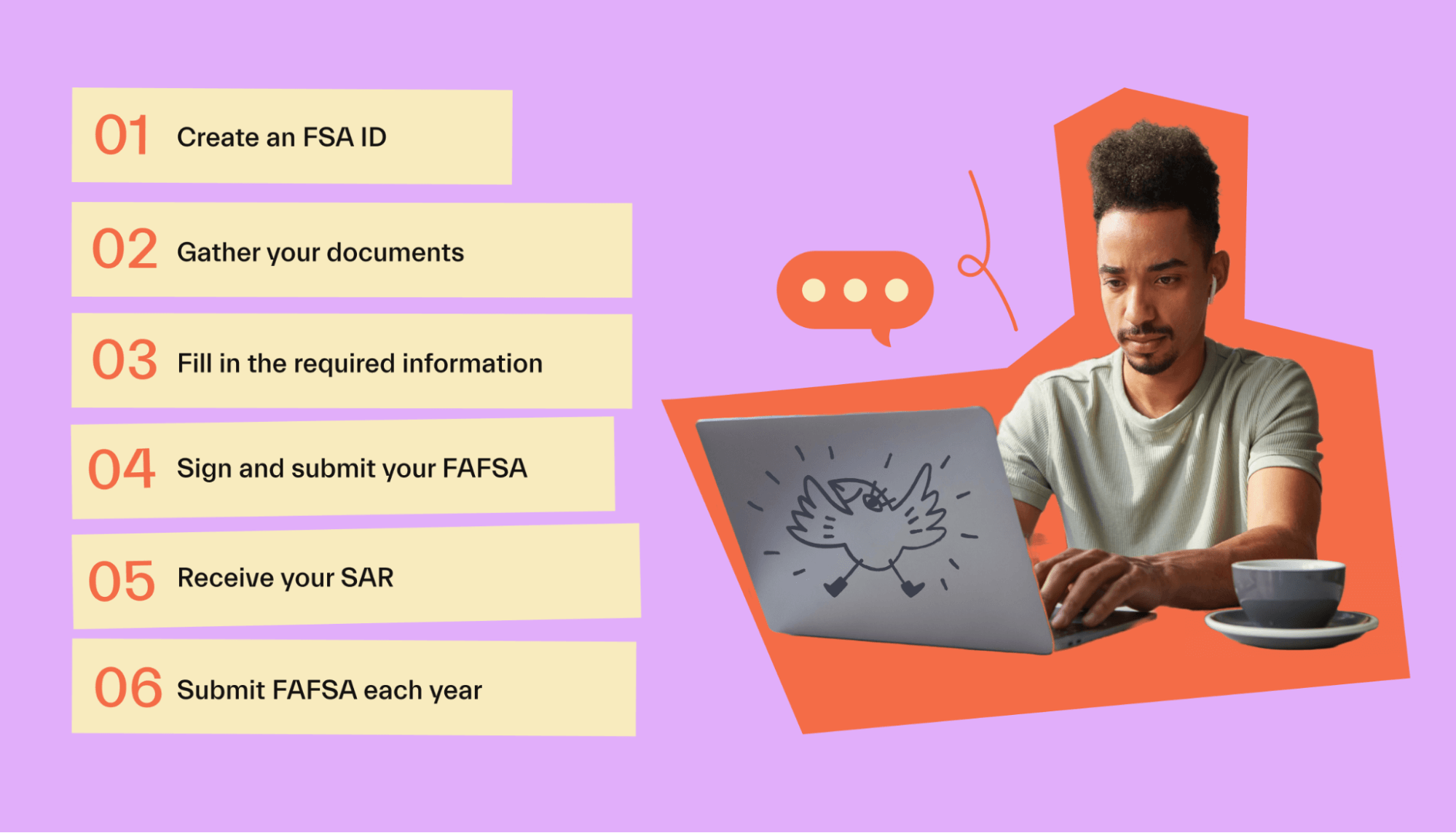

Here’s how to fill out the FAFSA to get aid for grad school:

Create an FSA ID

Your FSA ID is a username/password combo that lets you quickly sign into your FAFSA and sign and submit it. You use it every year for FAFSA filing and federal loan paperwork.

All grad students are independent on the FAFSA, so your parents won’t need to make their own.

Gather your documents

Next, you’ll need a few documents to get the information needed on the FAFSA. These include:

Your Social Security number (SSN) or your alien registration number if you’re not a US citizen

Driver’s license or state ID number

Federal tax returns and other income-related documents, such as your W-2

Records of untaxed income

Information about assets like cash, bank account balances, and investments

Fill in the required information

With documents in hand, it’s time to fill out the information. This shouldn’t take more than an hour when you have everything in front of you.

Sign and submit your FAFSA

Now that you filled out your FAFSA, double-check all your information and sign and submit the form.

You’ll need your FSA ID from step 1 to sign your form electronically. Your parents won’t need to sign since you’re independent as a grad student.

Receive your SAR

Once you sign and submit your FAFSA, you’ll get a student aid report (AKA: “SAR”) online or in the mail, depending on how you submitted it. Your schools will also receive one.

The SAR details your grad aid eligibility and options.

Submit FAFSA each year

You must resubmit your FAFSA each year you want aid for grad school.

Fortunately, you won’t have to start from scratch. You’ll just need to update any information that changed from the previous year.

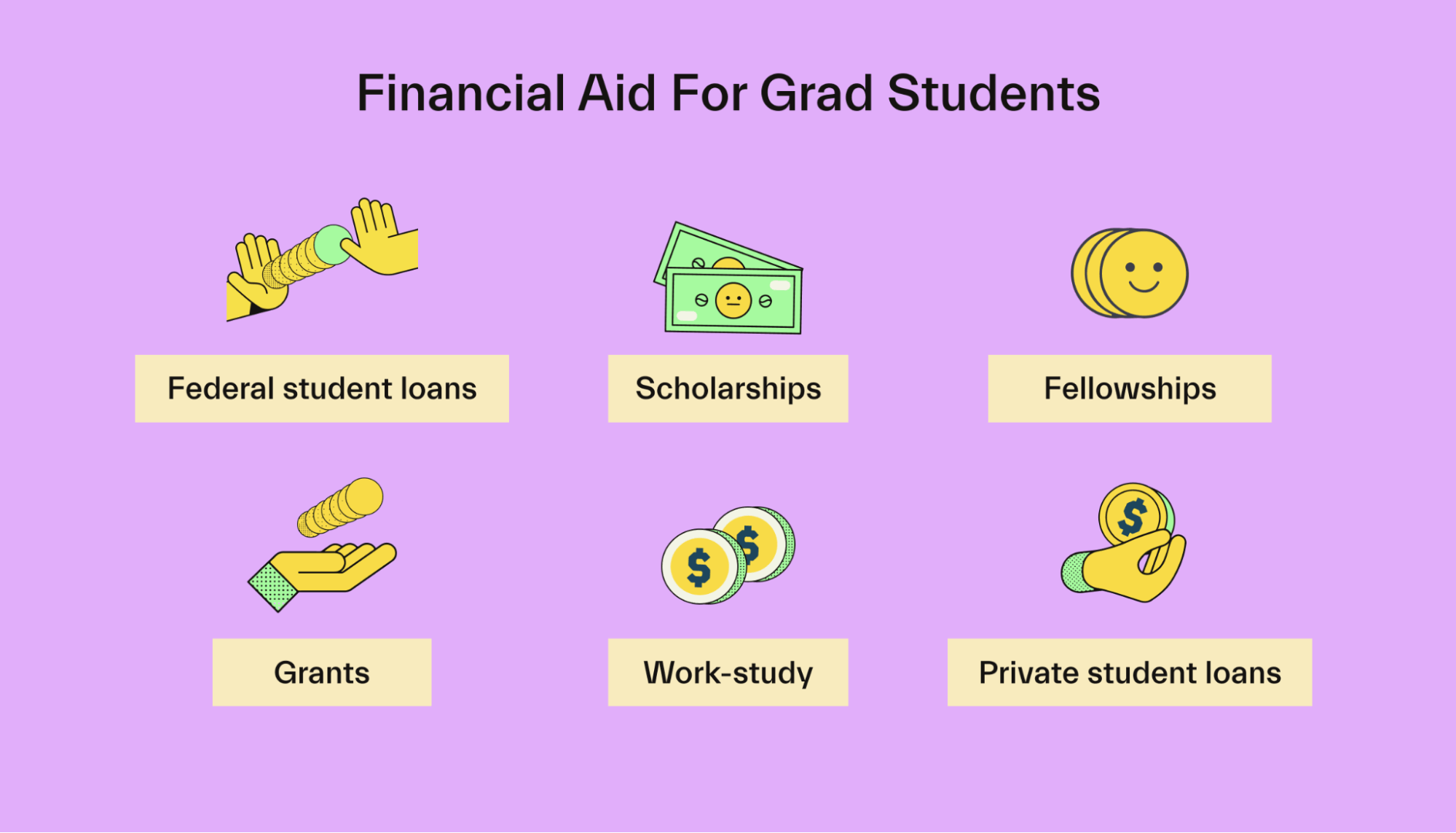

Types of financial aid for grad school

Grad school students can use many of the same forms of financial aid as undergrads.

However, there are some differences—some federal aid types aren’t available, but there are grad-specific aid types as well.

Let’s look at all the financial aid you can use to pay for grad school:

Federal student loans

Federal student loans are one of the most used forms of graduate financial aid. They let you borrow at lower rates than private student loans. Plus, they offer income-driven repayment plans, deferment, and forbearance.

Grad students can’t get direct subsidized loans, unfortunately. However, the following loan types are available:

Direct unsubsidized: Interest accrues immediately. However, payments aren’t required until six months after graduating or dropping below half-time enrollment, otherwise known as a grace period.

Direct Grad PLUS loans: You can borrow these up to your cost of attendance, so they can fill any gaps if needed. Interest rates are higher than unsubsidized loans. Interest begins accruing immediately on these. You’ll also go through a credit check, but your credit score won’t disqualify you.

Direct consolidation loans: These let you combine multiple student loans into one. This could save money on interest and simplify your loan payments.

Scholarships

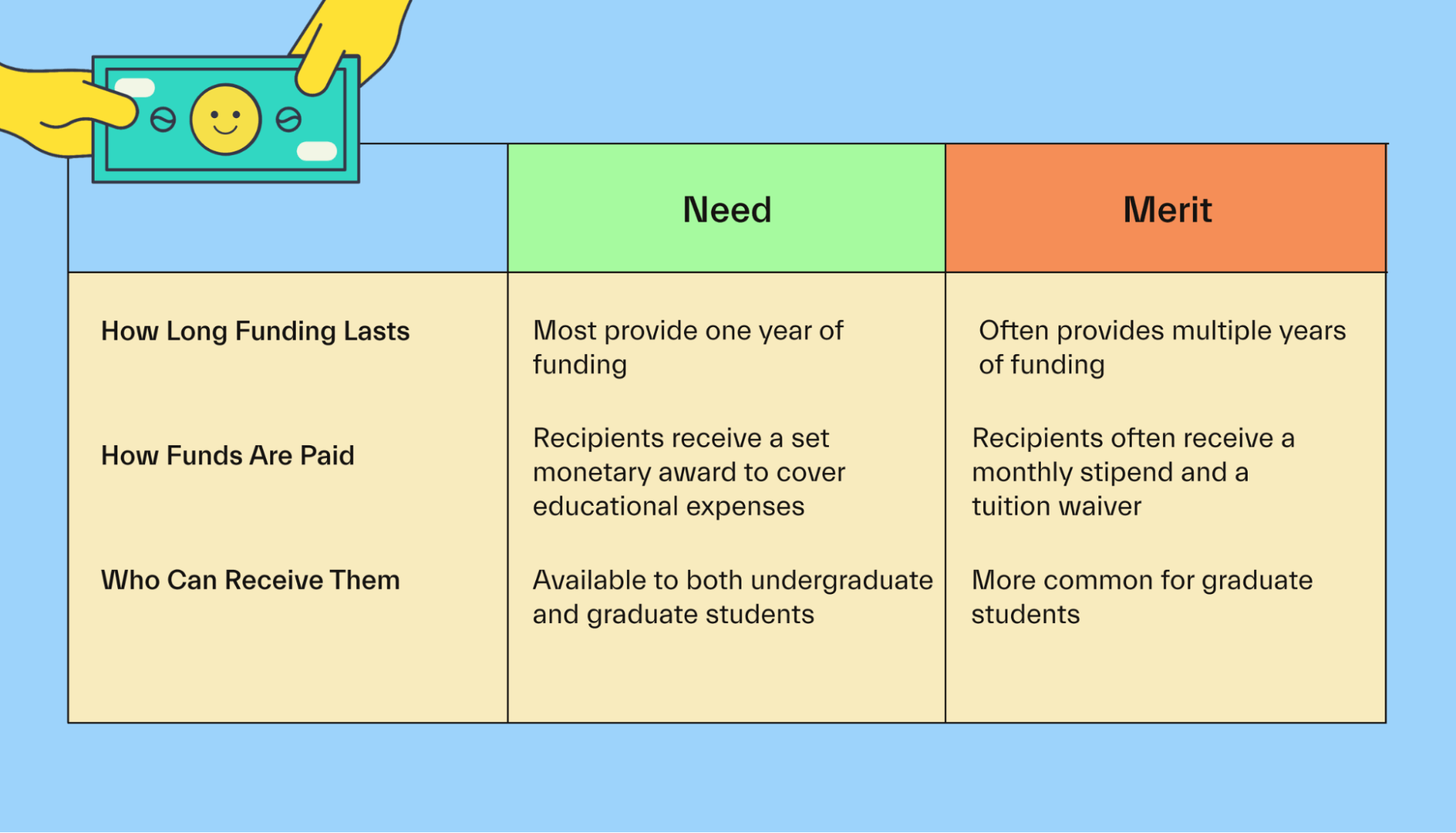

Scholarships are merit-based or need-based aid you don’t have to pay back.

For merit-based scholarships, you compete against others, but there is no cap on the aid you can win. Need-based scholarships are awarded based on the level of financial need identified.

Some scholarships are fairly easy, only asking for basic information and short answers to a few questions. These are simple to apply for, but that means more competition and lower rewards in most cases.

Others are more involved. They might ask for essays, videos, or similar projects. However, these scholarships offer higher rewards.

Many scholarships target certain niches, such as certain majors or minority groups. For example, the Graduate Scholarship Program offers graduate students studying mining-related fields up to $3,000.

Make sure to look for scholarships targeted toward grad students in your search. Some scholarships may only be for undergrad students.

Fellowships

Graduate students gain access to a new form of aid called a fellowship. These are awarded based on merit, like scholarships, but differ in a few ways.

For one, most fellowships provide aid for multiple years. That aid often takes the form of a stipend and tuition waiver instead of a fixed dollar amount.

Fellowships come mainly from government agencies and foundations, too.

For example, the Fulbright Scholarship is designed to fund students teaching or performing research abroad. It funds winners for multiple years instead of just one year.

Grants

Sure—grad students can’t qualify for the Pell Grant. But there are plenty of other grant types available. Some are even designed specifically for graduate study. For example, Federal TEACH Grants are available to eligible grad students.

Beyond that, grad students can look to their state and private organizations for more grant opportunities. Run a search online and check with your financial aid office if you need help finding more grant aid.

Work-study

Work-study awards you a part-time job that pays you money to use on grad school tuition and fees.

These jobs are often on campus and related to your field of study. For instance, if you’re pursuing a master’s in psychology, work-study may give you an administrative assistant role in the school’s psychology department.

Sometimes, they’re off-campus, but the role will still help further your civic education somehow.

Schools make sure your work-study job hours fit around your coursework so you can balance work and grades.

Private student loans

You can get private student loans from banks, credit unions, online lenders, and similar financial institutions.

These should be a last resort—even after federal loans. Private loans tend to have higher interest rates than federal loans and don’t come with the same income-driven repayment plans.

Private loans also require an established credit score and history. If you don’t have one, you may need a cosigner.

If you need private loans, shop around to get the best rates.

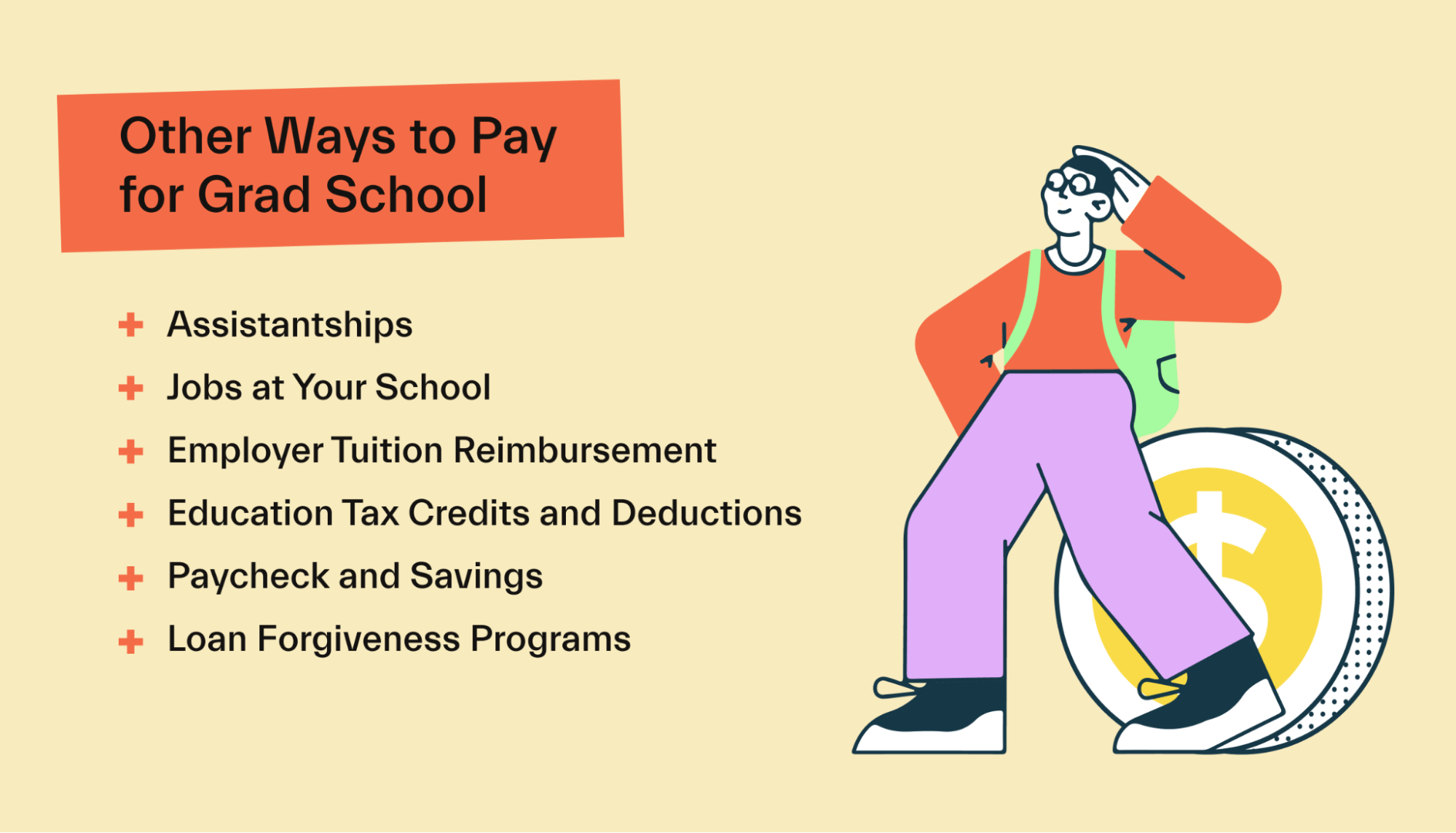

Other ways to pay for grad school

Grad students get some opportunities to earn money for school that most undergrads won’t have access to. This can vary by situation, though.

Here are some other grad-unique ways to cover the cost of grad school:

Assistantship opportunities

Assistantships let graduate students earn a paycheck, living stipend, or tuition discount while gaining field-related work experience.

There are a few types of assistantships:

Teaching assistantship: Teaching assistants help teach undergraduate college courses. In this role, you might grade papers and exams, meet with students individually, and even give some of the lecture or discussion sessions.

Lab assistantship: Lab assistantships are similar to teaching assistantships but in a laboratory setting.

Research assistantship: Research assistants help professors with their research, as the name implies. You’ll likely handle routine tasks like literature reviews, data collection, lab and office organization, and even writing reports.

Graduate assistantship: Graduate assistants help with basically any academic tasks the school or department needs. You might do any tasks the other three assistantships include, alongside other more general and administrative duties.

Regular jobs at the school

Working a professional job at your school could score you a big-time tuition discount. Depending on the institution, you may be able to take any professional position at the institution.

For example, maybe you land a marketing associate role in the university marketing office with your undergrad marketing degree. If your school offers tuition discounts in its benefits package, consider taking advantage of them.

Some schools offer discounts to family members or dependents of employees, too. If a parent or relative works for the school, see if they can knock down your grad tuition.

Employer reimbursement

Many grad students go to school on top of a full-time job they landed with their bachelor's degree.

If that’s you, see if your employer includes tuition reimbursement in your benefits package. Usually, an employer will pay you a good chunk of your tuition back if you pursue advanced education that teaches you skills beneficial to the company.

Your employer may also require you to maintain certain grades to get the full benefit. Some could use a sliding scale—100% of the benefits for As, 90% for Bs, and so on.

Talk with your employer to ensure you meet all their criteria and have enough time and drive to balance school and work.

Education tax breaks

College tax credits and deductions give you or your family tax breaks for education expenses.

Credits like The American Opportunity Credit and Lifetime Learning Credit directly reduce the taxes you owe or increase your refund if you qualify.

Deductions like the student loan interest deduction and tuition and fees deduction reduce the income the IRS looks at when calculating your taxes.

Grad students are considered independent for FAFSA purposes, but you may still be your parents’ dependent for tax purposes.

This can create complexities, so consult an accountant to ensure you claim the right amount of credits and deductions.

Your own paycheck and savings

After exhausting all other forms of aid, consider using some of your paycheck and savings to either pay for grad school or reduce your existing debt from undergrad.

You might have to do some math to balance your paycheck with student loans to minimize debt and continue to afford living expenses.

You could also get federal loan deferment to pause undergrad loan payments while you go back to grad school if you enroll at least half-time and meet other criteria.

However, if you have to go slower, fill that time with work to keep up on undergrad loan payments.

Loan forgiveness programs

After exhausting all options, you may still have to use loans for grad school. Loan forgiveness programs can potentially erase those loans down the line if you qualify.

The most well-known loan forgiveness program is Public Service Loan Forgiveness. This can erase your student loans if you work in a public service role, such as a teacher, police officer, or in certain nonprofit organizations.

Typically, you’ll need to make payments for a certain number of years before qualifying for debt cancelation under loan forgiveness programs.

Unfortunately, private student loan forgiveness is extremely rare. That said, lenders may work with you to ensure you can afford your loan payments. After all, if you can’t pay the loan back, they don’t get paid.

Get the money you need for grad school

Grad school isn’t cheap. But you’ve got so many financial aid types and other options for covering the costs.

Start by filing the FAFSA, even if you don’t think you’ll need loans. In the meantime, apply to every scholarship, fellowship, and grant you can find. Leverage your career, too—whether that’s an assistantship, a job at your school, or employer tuition reimbursement.

After exhausting these, find the right mix of your paycheck/savings and student loans to cover the rest. This will minimize your debt and financial strain in grad school so you can focus on getting good grades.

From FAFSA to filing appeals, you can do the financial aid stuff on your own. Want an expert to take over? That's cool too--and where Mos financial aid advisors come in. Work 1-on-1 with an advisor who’ll review your annual aid offer, draft custom tuition negotiation letters, and more. Explore Mos memberships to get started. Try it today.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you