FAFSA •

June 20, 2022

Does FAFSA cover graduate school?

Need funding for grad school? Check out this Mos guide to find out how you can use the FAFSA to get aid.

Completing an undergraduate degree is a great way to kickstart a new career and get the ball rolling toward chasing your dreams. But if you really want to shift into high gear and give your career potential a boost, going to grad school can be a pretty smart move.

College is expensive—but fortunately, there are plenty of generous opportunities out there that grad school students can use to fund a master’s degree. The tricky part is finding them all—which is where the government’s Free Application for Federal Student Aid (FAFSA) comes in handy.

If you’ve completed an undergraduate degree, chances are you’re already well-acquainted with the FAFSA. But not all undergraduate students know that you can also use the FAFSA to apply for graduate school funding.

This guide explains what the FAFSA is, how the FAFSA can be used to cover graduate school funding, the difference between using a FAFSA to cover graduate school vs. an undergraduate degree, and more.

What is the FAFSA?

Before we speed right into the FAFSA and how it can be used to support postgraduate funding, let’s pump the brakes and talk about what people mean when they’re talking about the FAFSA.

FAFSA stands for the “Free Application for Federal Student Aid.” It’s the universal application form used by the US Department of Education’s Office of Federal Student Aid to determine a student’s eligibility to receive financial aid to pay for college or other types of higher education.

But it’s not just the US government that looks at your FAFSA to figure out how much federal aid you’re entitled to. Your state government will also use the information you provide on your FAFSA to assess your eligibility for state aid. Plus, your school will use the FAFSA to decide how much institutional aid you’re able to secure.

Exactly how universal is the FAFSA?

Every year, more than 17 million students file the FAFSA. Those students are then given over $112 billion in low-interest loans, grants, and work-study opportunities from the US Department of Education.

Bearing that in mind, it’s fair to say a large proportion of the student population relies on the FAFSA. Fortunately, completing the FAFSA is fast and simple.

The form itself asks for basic information about you or your family’s finances. This includes information about your income and any relevant tax returns.

FAFSA applications open on October 1 every year, and they’re due by June 30 of the year when you actually attend school. But it’s important to bear in mind that you’ve got to complete and submit a FAFSA for each year you need funding.

Want help navigating the financial aid process and getting as much money for school as possible? Connect with a Mos financial aid expert today.

Does the FAFSA cover graduate school?

Simply put, yes: the FAFSA can cover financial aid for graduate school as well as for undergraduate study.

Earning a master’s degree or another postgraduate distinction is a great way to boost your career—but the cost can be a major barrier. Fortunately, you probably won't have to cover that full cost on your own. There are many financial aid opportunities available. But to access them, you’ll have to fill out the FAFSA just like undergraduate students do.

Translation: not only does the FAFSA cover graduate school funding, but it can help connect you with some pretty generous financial aid packages that could mean the difference between completing your master’s or not.

Fortunately, completing and submitting the FAFSA as a graduate student is pretty similar to completing it as an undergraduate student. You’re required to include the same sort of information about tax returns, your bank accounts, and details on any investments. There are a few differences, but we’ll get to that in just a minute.

It normally takes about 30 minutes to complete the FAFSA, and you can choose as many as 10 schools to send your FAFSA to.

How is the FAFSA different for graduate school than for undergraduate financial aid?

If you applied for FAFSA as an undergraduate student, the process is pretty similar to what you’ll be doing when you apply as a grad student. Because the application form is universal, the fields and pages you’ll be navigating are the exact same whether you’re applying for a bachelor’s degree or a postgraduate degree.

Both undergraduates and postgraduates can fill out the FAFSA in-browser on the Federal Student Aid website. They can also download the myStudentAid app from the iOS App Store or for Android via Google Play.

That being said, there are some important differences you should be aware of.

To help you get started, we’ll quickly walk you through the key distinctions between completing the FAFSA for graduate school and completing it as an undergrad student.

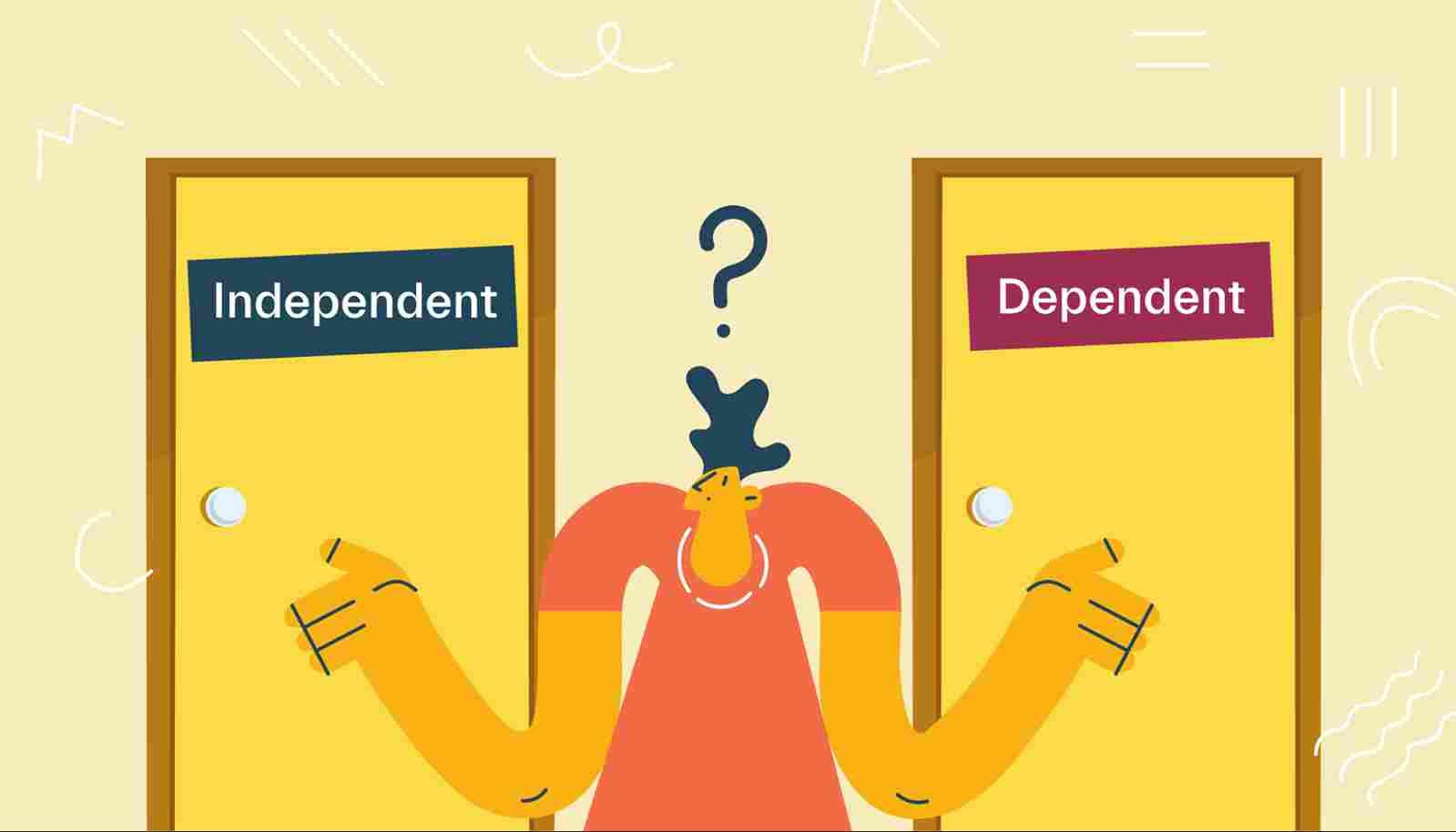

Your dependency status

The biggest difference between completing the FAFSA to cover graduate school and completing it for undergraduate degrees is that postgraduates are considered independents.

What is an independent?

When most undergraduates complete the FAFSA, they’re normally considered a dependent of their parents for the purposes of federal student aid. To qualify as a dependent, you’ve got to fulfill some eligibility requirements. These include the requirement to be under 24 years old, unmarried, and working to achieve an undergraduate degree.

But if you're going to be working toward a degree that's considered a graduate-level or professional-level degree, you'll automatically be considered an independent for financial aid purposes. This applies no matter how old you are or whether you're living with your parents.

This means you’re going to have to fill out your FAFSA with your own financial information rather than the financial information of your parents. That being said, there’s an exception to the rule here.

Some law schools and medical schools require you to include information about your parents, even if you’re considered an independent student from a financial aid point of view.

Subsidized loans

Another important difference for graduate school students applying for the FAFSA is that they aren't going to be eligible for subsidized loans.

Subsidized loans are an attractive student loan product for many individuals because they don’t start building up interest charges until you’ve graduated. That can save you a decent amount of money in the long run.

Unfortunately, these products don’t apply to postgrads. The loans you’ll take out as a grad student will generally be unsubsidized. This means your federal loan will begin building up interest charges immediately—whether you’re a full-time student or not.

Why is this important? Above all else, it’s important because the interest your loan accumulates will cause the balance of your loan to be a few thousand dollars more by the time you’ve graduated (even if you’re only in a two-year program).

Federal loan borrowing limits

As a postgraduate student, you’re going to benefit from a lack of borrowing limits where federal student loans are concerned.

Federal student loans for undergraduate students have both annual borrowing limits as well as aggregate borrowing limits. Graduate unsubsidized loans have borrowing caps, too.

But Federal Student Aid’s Grad PLUS Loans don’t have any borrower maximum. You’re allowed to borrow any amount up to the total cost of attendance (as certified by your school).

Can graduate students get Pell Grants?

The short answer is no: graduate students aren't eligible for Pell Grants.

A Pell Grant is a form of federal student gift aid provided to undergraduates who are able to demonstrate a significant level of financial need. Postgraduates aren’t normally eligible to receive a Pell Grant. But, as always, there’s an exception to the rule.

If you’re working toward your post-baccalaureate teacher certification, you may be able to qualify for a federal Pell Grant.

That being said, it’s worth noting that grad school students tend to qualify for a number of other federal grants. These include the Teacher Education Assistance for College and Higher Education (TEACH) Grant, the Fulbright Grant, and the Iraq and Afghanistan Service Grant.

You may also qualify for postgraduate-specific grants on offer from your state government or available internally at your chosen grad school.

Likewise, grad school students will normally be eligible to apply for the federal work-study program. Work-study is a funding program that offers students part-time work in exchange for funds that can be applied toward academic expenses.

How to complete the FAFSA for graduate school

Completing the FAFSA for grad school is pretty similar to the FAFSA for undergraduate students. Just like undergraduate students, postgraduate students will need to include the following information in their FAFSA:

Your Federal Student Aid (FSA) ID

Your Social Security number (SSN) or Alien Registration Number (or “A-number”)

Your account balances on any checking or savings accounts

Information about any investment accounts you may have

Your federal income tax returns

Any records relating to your untaxed income

Grad school students are encouraged to submit their FAFSA as soon as possible. Applications open on October 1 every year. But you should also bear in mind that your chosen grad school may require you to complete additional forms unique to that individual school.

Generally speaking, most schools will require your FAFSA form to be in by early February, even though the federal deadline isn’t until June of the year you actually attend school—but every university has its own deadline. Be sure to check with your school so that you can get your application in on time.

After submitting your FAFSA, you can normally expect to receive a Student Aid Report (SAR) within a few weeks.

Your SAR is the document that lists out all the answers and information you included on your FAFSA form. It also provides some basic information about financial aid eligibility. That means you’ve got to review it carefully and let your school know immediately if anything is wrong.

Your graduate school’s finance office will then send you a financial aid offer detailing what’s available to you. From there, you’ll be able to accept your aid and get the ball rolling by working directly with your school’s finance team.

If you’re offered and accept a federal student loan as part of your graduate funding, you’ll need to complete a Master Promissory Note (MPN).

An MPN is a legal document in which you promise to pay back your loans with any interest accrued. You’ll need to sign that form in order to get your funds.

Your MPN also details all the terms of your loan. This includes the interest rate, as well as the date or condition in which you’ll have to start repaying your loan.

You can expect to get a separate MPN for each kind of student loan you take out. That means students with both a Stafford Loan and a PLUS loan will get 2 different MPNs.

Want 1-on-1 help with the FAFSA and the entire financial aid process? Join Mos today to find out how students are maximizing their financial aid dollars.

Conclusion

As a grad school student, the FAFSA is absolutely critical. It covers financial aid for graduate school just like it covers aid for undergraduates.

But while you may have completed the FAFSA a fair few times already to get undergraduate funding, there are a few key differences you should be aware of when using the FAFSA to cover graduate school funding.

That’s why it’s essential you familiarize yourself with all of the basic rules on eligibility, deadlines, and completion.

The basics of the FAFSA are simple enough. But to maximize the financial aid, it pays to have a helping hand. That’s where Mos comes in. Mos financial aid advisors work with students 1-on-1 to help them get the most bang for their financial aid buck. Find the best plan for you to start your journey!

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you