University •

February 28, 2023

University of Texas at Dallas financial aid: a complete guide

Read all about financial aid at the University of Texas at Dallas, including scholarships, loans, and grants.

The University of Texas at Dallas (UTD) is a public university in Dallas, Texas. The university comprises 7 schools offering more than 140 undergraduate and graduate degree programs to students from across the country and beyond.

UTD’s location in one of the fastest-growing metro areas in the United States makes it an appealing choice, especially for Texans looking to pay the relatively low in-state tuition rates.

If you're interested in applying to UTD but wondering how you'll pay for it, we've got you covered.

Let's break it all down.

A snapshot look at UTD

The University of Texas at Dallas is a public university that is part of the UT system. Rated as one of the top-value public universities in the country, UTD is home to more than 31,000 students and has graduated more than 132,000 students over its history.

The school began in the 1960s by 3 founders of Texas Instruments. It has many traditions that date back to its early days, including International Week, which celebrates the school’s diversity, an annual Juneteenth celebration, and Oozeball, an annual mud volleyball tournament.

Of course, college can’t be all fun and games. UT Dallas has a wide variety of degree and certificate programs for its students. With 7 schools offering programs like Accounting, Actuarial Science, Art History, Economics, Education, Energy Management, Information Technology, and Sociology, students are sure to find a course of study that interests them.

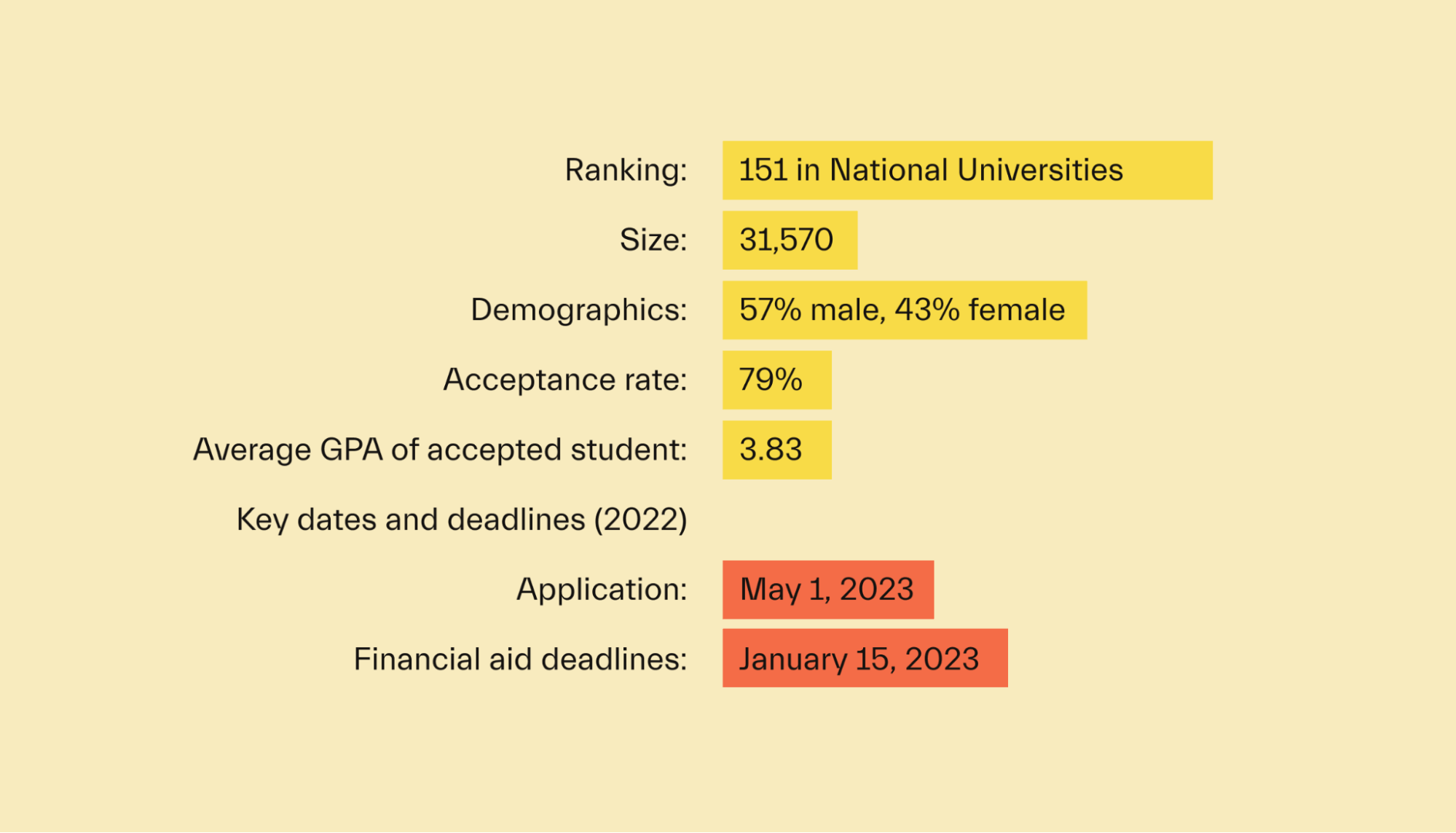

Ranking: 151 in National Universities

Size: 31,570

Demographics: 57% male, 43% female

Tuition: $14,564 for in-state students, $39,776 for out-of-state

Acceptance rate: 79%

Average GPA of accepted student: 3.83

Key dates and deadlines (Fall 2023):

Application: May 1st, 2023

Financial aid deadlines: January 15th, 2023

A look at scholarships offered by UTD

UT Dallas is a public university that charges reasonable tuition for in-state students.

Still, that doesn’t mean college is cheap. Everyone knows that paying for college is hard. Many families save for years and still don’t have enough to pay for a full degree.

That’s where scholarships come in. Scholarships are the best way to pay for school because they’re essentially free money that you can put toward tuition and other costs. And unlike student loans, you don’t have to pay them back once you finish your degree.

There are all sorts of scholarship programs out there. Many come from your school, while others can be from outside sources. You can earn awards based on academic achievements, athletic skills, or other merits. There are also need-based and niche scholarships for everything from being tall to having red hair.

UTD’s financial aid office has a list of its available scholarship programs. One exciting opportunity for prospective first-year students is the Academic Excellence Scholarship (AES). This award goes to students based on their academic accomplishments, leadership, and community involvement.

One unique benefit of this award is that out-of-state recipients will become eligible to pay the discounted in-state tuition if they receive this award.

Another opportunity for incoming first-year students is the National Merit Scholarship Package. Eligibility requirements include becoming a National Merit Finalist and naming UT Dallas your first-choice school.

The National Merit Scholarship Package award covers full tuition and offers a $4,000 cash stipend to pay for books, supplies, and other expenses, a $1,500 per semester on-campus housing stipend, and a one-time stipend of $6,000 for studying abroad.

Scholarships are the best way to pay for college. That makes it essential to earn every scholarship dollar you can. Mos’s financial aid tips and tricks page has resources on how to maximize your scholarship aid.

Student loans

Scholarships are the best way to pay for school, but the reality is that not everyone will earn one. Even most of those that do typically don’t get the elusive full-ride scholarship. That means you’ll need to have a plan to cover the rest of your college costs.

If your savings come up short, student loans are the next best option. These loans let you borrow money to invest in yourself by paying for an education. Just keep in mind that you’ll have to pay them back—plus interest—after you leave school.

UTD’s financial aid office has a page detailing the different loan programs available.

For most students, the best way to borrow money for college is through the Federal Direct Loan Program. A federal loan can be subsidized or unsubsidized.

Subsidized loans are the better of the 2, and you usually become eligible based on your financial need. With these loans, interest only builds up once you leave school. With unsubsidized loans, interest accrues right away.

Texans can also get the College Access Loan. These loans come from the state and can cover up to the total cost of attendance at your school minus any other aid you’ve received.

If government loans aren’t enough to cover the full cost of education, you’ll have to look elsewhere. Private companies offer private student loans with higher fees and rates than government loans. They also don’t have benefits such as income-based repayment or loan forgiveness.

In general, you should max out your government loans before you get private ones.

Student loans mean taking on debt you ultimately have to pay back, but they’re an effective way to invest in yourself. You can read our article on student loans, where we break down their pros and cons and how to make sure they’re worth the cost.

FAFSA

The government and your school won’t know if you need help paying for college unless you tell them. That’s why you must fill out the Free Application for Federal Student Aid (FAFSA).

The FAFSA serves as a universal financial aid application. It gets used by the federal government, state governments, and most universities in the US to help determine your eligibility for college aid.

When you fill out the FAFSA, you and your family need to provide a litany of financial information, such as your savings and how much money you make. Then, based on the information you provide and the cost of attendance at your school of choice, the FAFSA will let the government calculate your expected family contribution (EFC) to the cost of your education.

The difference between UTD’s cost of attendance and your EFC is your total financial need. The greater your financial need, the larger your financial aid package will typically be.

Keep in mind that most schools will not meet your full financial need when they give you an aid package. That leaves you to make up the difference with additional savings, loans, or by getting a job.

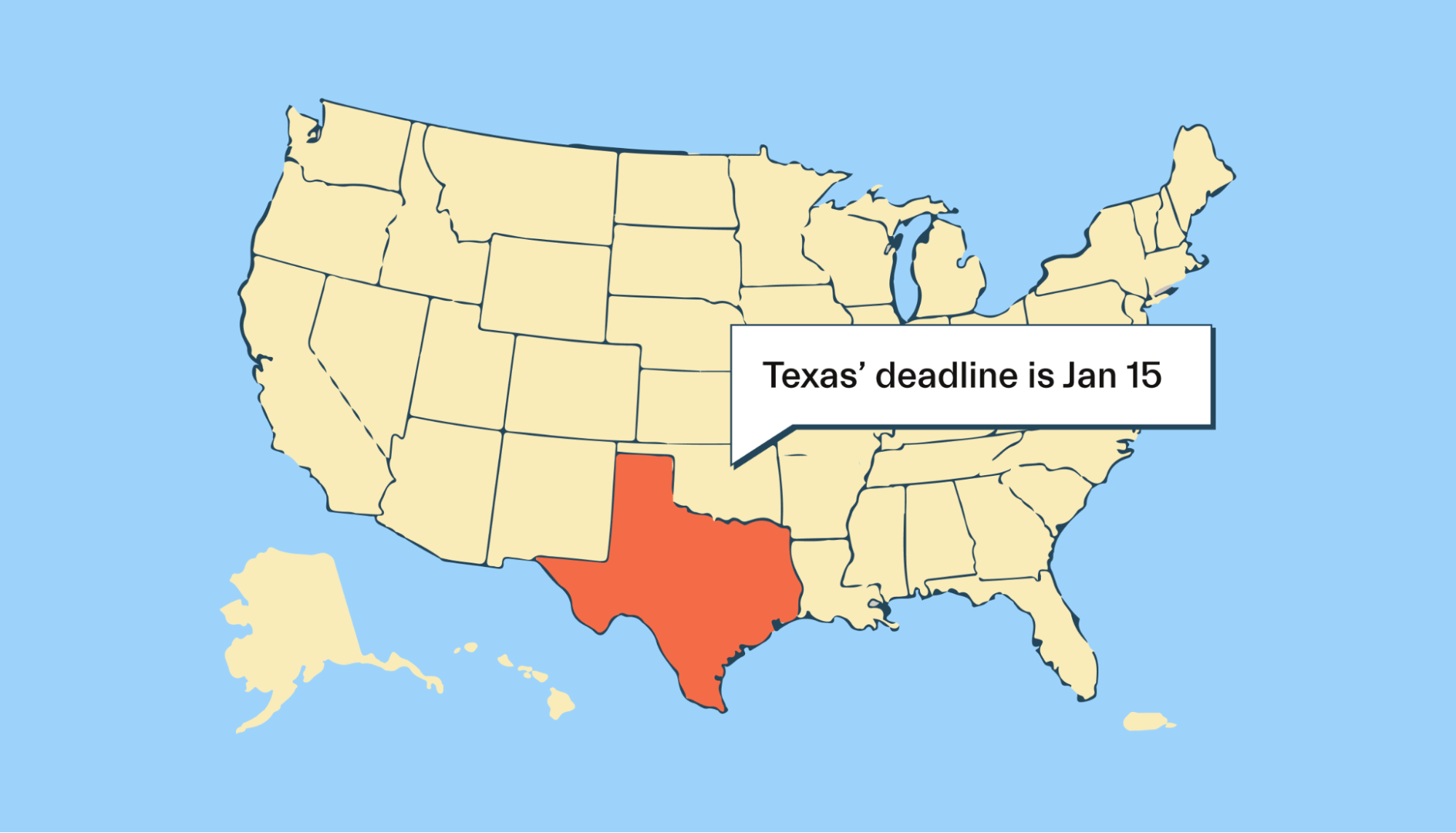

The FAFSA application opens on October 1st for aid awarded in the next academic year. The sooner you can fill out the application, the better.

The federal deadline is the end of June, but Texas has a state deadline of January 15th, so be sure to submit the form before that date.

The FAFSA is a long form, so you’ll need to set aside time to complete it correctly. For more info, visit our article on how long it takes to complete the FAFSA.

UTD financial aid FAQs

We’ll answer a few more questions about getting financial aid at UTD.

What is the University of Texas at Dallas's cost of attendance?

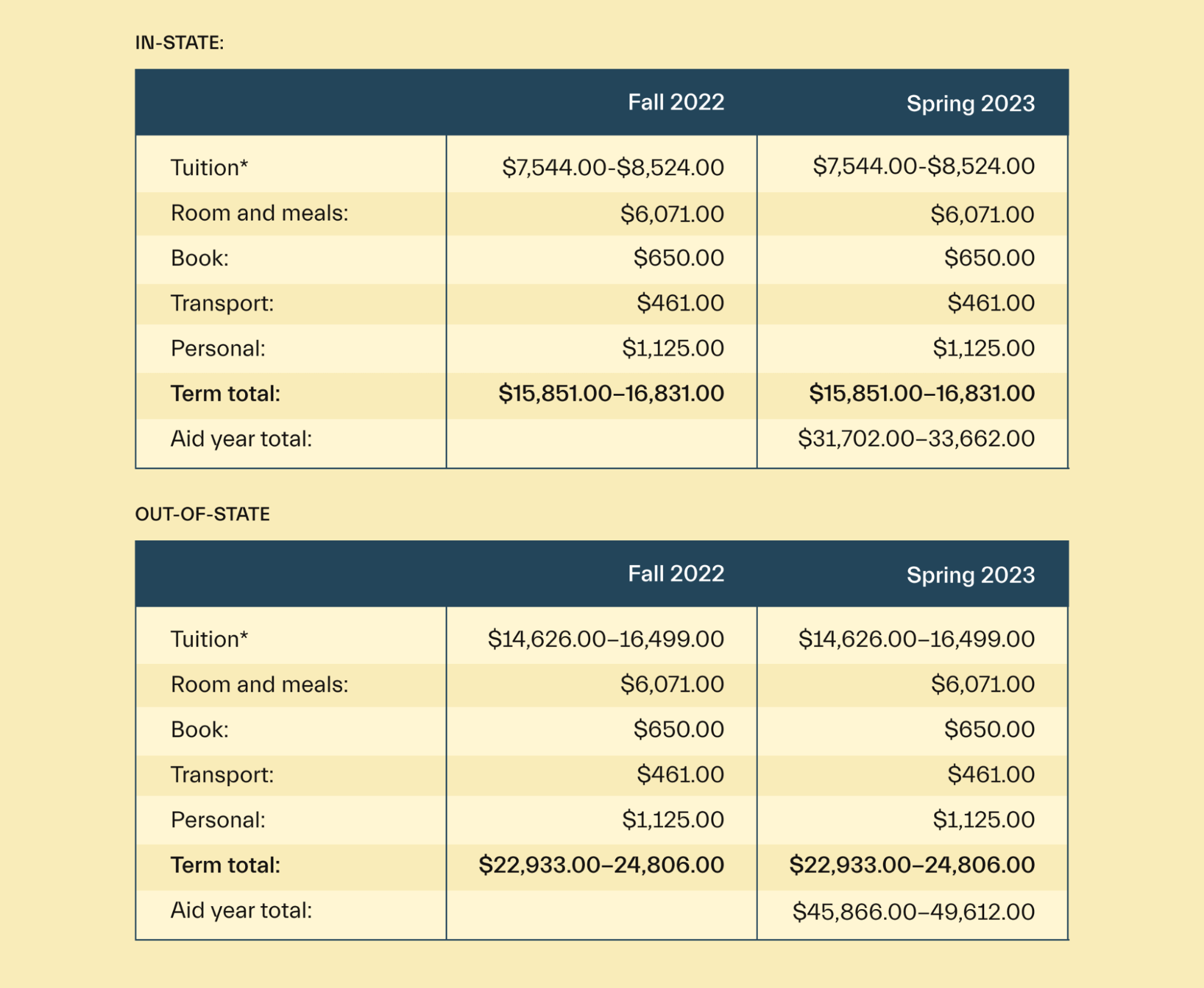

As a public university, UTD has different costs for Texas residents and non-residents. For in-state students, the total cost of attendance for a year is $31,702–$33,662, with tuition totaling $7,544–$8,524 of that amount.

Tuition is higher for out-of-state students at $14,626–$16,499, meaning the cost of attendance ranges from $45,866–$49,612.

Can out-of-state students receive financial aid?

Yes, out-of-state students at UTD are eligible to receive financial aid. Those who receive the Academic Excellence Scholarship even benefit from the reduced in-state tuition rate.

How many students get a full ride?

UTD doesn’t disclose how many students receive the coveted full-ride scholarship. However, 49% of students in 2020 received some need-based financial aid. Among eligible students, the average need-based award was $12,990.

Can international students receive financial aid?

Yes, international students at UTD are eligible for some forms of financial aid. However, they won’t qualify for government aid programs, such as federal or state loans.

What aid is available for undergraduate students?

Undergraduate students can receive a variety of financial aid, including scholarships and loans. The National Merit Scholarship Package is the most competitive and appealing, offering a full ride to any scholarship recipient in the program.

Is there aid available for graduate programs?

Yes, graduate students at UTD can receive financial aid from the school. Grad students can get paid for teaching and research assistantships and sign up for a guaranteed tuition plan that locks in their tuition rate.

Is there financial assistance specific to different academic programs?

Yes, your academic program may influence your eligibility for an academic scholarship or other forms of aid. Each school at UTD has its own list of scholarships. For example, the School of Arts, Humanities, and Technology has scholarships specifically for its students.

Are there resources that can help me find a campus job or part-time job?

Yes, UTD has a portal that can help students find part-time or on-campus jobs to help them pay for college. This program allows the school and off-campus employers to post jobs that students can apply to.

Universities like UTD that you might be interested in

If you’re considering UTD but aren’t sure if it’s right for you, consider these alternatives:

University of Texas at Austin

The University of Texas at Austin is another member of the University of Texas System member. Like UTD, it keeps tuition relatively low for in-state students, making it a great choice if you want to keep your college costs low.

UTA is located in Austin, which may appeal to students who want to be near Austin rather than Dallas. UTA also ranks higher than UTD, landing at #38 on the list of national universities. Therefore, UTA might be the right choice if you’re academically inclined and want to attend one of Texas’ top schools.

Texas State University

Located in San Marcos, Texas State University is another public university located in the state. It is the second-largest school in the Austin metro area and the fifth-largest in the state.

Texas State’s status as an emerging research university may make it an appealing choice if you're interested in research. Outside its academics, Texas State offers a strong athletics program, with teams in NCAA Division I.

Texas Tech University

Another public institution, Texas Tech University, is located in Lubbock. As its name implies, Texas Tech is dedicated to technology. It has Very High Research Activity status, one of only 94 public schools included in that list.

Texas Tech is also a designated Hispanic Serving Institution. More than 25% of its student population is Hispanic, which may make it appealing to students who want a school that offers comprehensive programs and initiatives targeted at Hispanic and other underrepresented students.

Conclusion

UT Dallas is a public university located in the heart of Texas. It offers a low-cost education to Texas residents while still appealing to out-of-state students with its location in one of the nation’s fastest-growing metro areas.

Combine that with its strong academic and extracurricular programs, and you have a university that can offer something to almost any student.

Paying for college is hard, so Mos is here to help maximize your financial aid. We can help you apply for both government financial aid and scholarships. Get started today.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you