Financial aid •

June 20, 2022

How to pay for college without loans

Want to pay for college without student loans? Check out this Mos guide to find out how.

It doesn’t matter where you choose to go to school or how much money your family has in the bank: college is expensive. That’s why so many students and their families turn to loans.

Today, around 65% of students graduate from college with student loan debt. A lot of that debt stems from federal student loans—which tend to include some great consumer protections like fixed interest rates, income-based repayment plans, and even the potential for loan forgiveness.

But even with a federal student loan, you could be signing on for up to three decades’ worth of monthly payments that aren’t going to make your adult life any easier. That’s why a lot of students are tempted to pay for college without loans—and, fortunately, there are plenty of options out there that can help you achieve that.

This guide explains why student loans aren’t ideal for all students, how grants and scholarships work, and everything you need to know about the federal work-study program.

Are student loans a good idea for everyone?

For a lot of students, the cost of college is just plain unattainable without loan assistance. But in exchange for accepting that generous financial aid, you’re then obligated to take on overwhelming long-term debt that’ll follow you around for years.

Let’s crunch the numbers here.

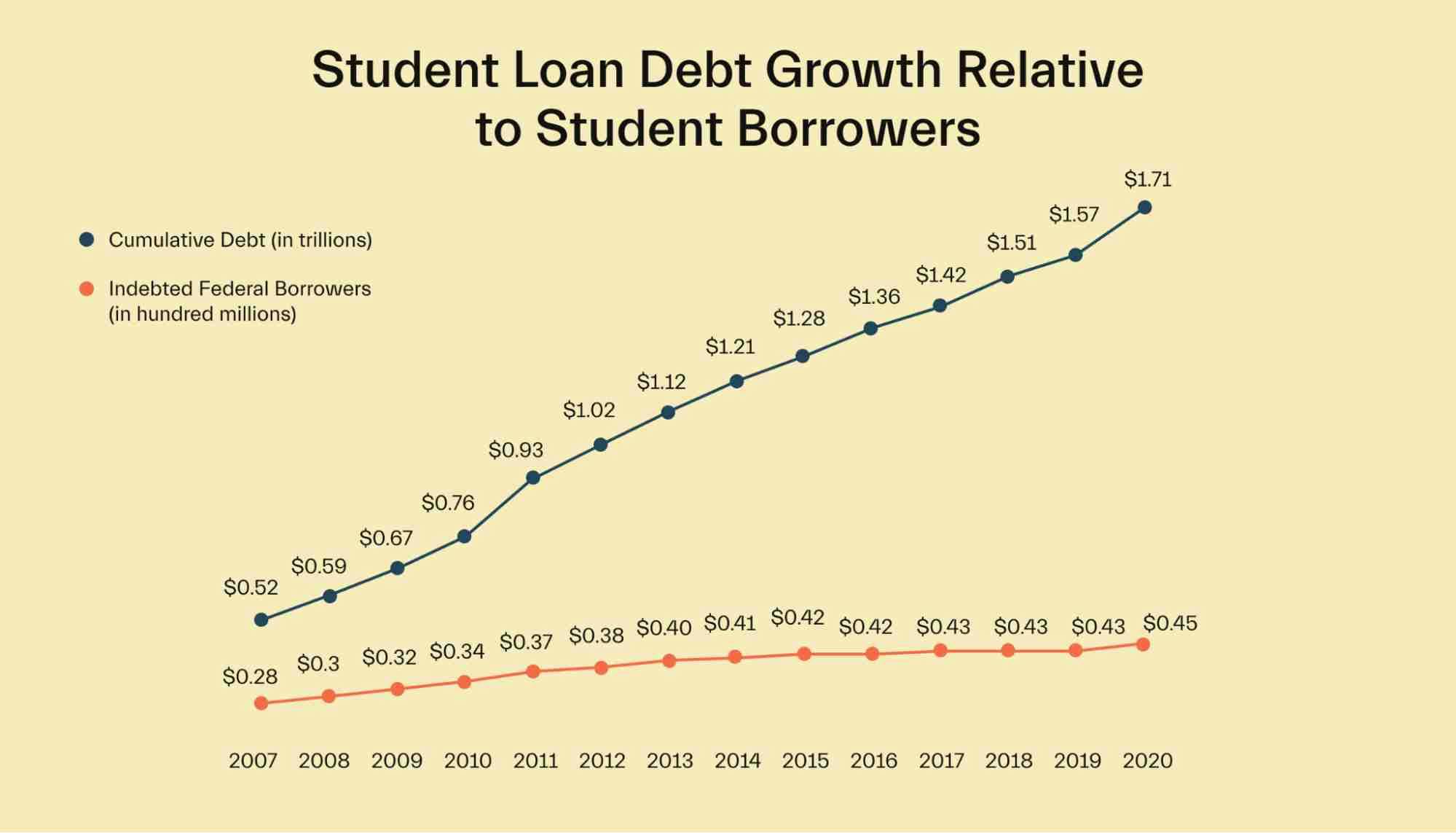

Right now, student loan debt in the US is sitting pretty at around $1.762 trillion—and the vast majority of that money is owed to the US Department of Education. The US Government’s Federal Loan Portfolio alone is currently more than $1.606 trillion.

In terms of how this loan burden affects each student borrower, there are 43.4 million borrowers in the US who’ve got federal student loan debt. The average balance owed by each student is $37,113. When you factor in private student loans, researchers say the average student loan debt is probably as high as $40,904 per person.

That’s nothing to scoff at—and depending on the loan amount you’ve borrowed and the repayment plan you’re on, this balance could be with you for quite a while. Federal student loans can take anywhere between 10 years and 30 years to pay back.

Simply put, a lot of families (or independent students) understandably don’t want that sort of debt hanging over their heads for decades. But unless you’re fortunate enough to have tens of thousands of dollars sitting in the bank, you’re going to need to focus on different forms of financial aid to pay for college.

Fortunately, there are alternative sources of funding available that don’t need repaying—and we’re happy to walk you through them.

How to pay for college using grants

If you’re keen to pay for college without loans, grants are a fantastic place to start. It’s not always possible to pay for the entire cost of college with grants alone, but if you combine multiple grants and scholarships, you might be able to cover college costs like the cost of tuition and your living expenses.

Let’s explore the ins and outs of college grants.

What are grants?

Before we get into how to pay for college using grants, let’s take a step back and talk about what we actually mean when we’re talking about grants.

A college grant is a form of financial aid called “gift aid.” Gift aid is funding support that’s gifted to the student, AKA, you don’t need to repay it. Grants are typically available from your state government, the federal government, your college, university, community college, or trade school.

Most academic grants are offered to students based on their financial need. These are called needs-based grants, and the popular Federal Pell Grant program falls into this category. To be eligible for a needs-based grant, you’ll need to provide proof that your income (or your family’s income) falls below a certain threshold.

That being said, not all college grants are awarded based on your financial needs. Colleges and trade schools often award grants that are based on your background, the community you come from, the subject you major in, and a wide range of other factors.

So, what are your chances of getting a grant to pay for college? To be honest, your chances are pretty good.

The federal government has an annual student grant budget of around $32 billion. Approximately 41% of all undergraduate students receive a federal grant—and those awards average $5,179 per student per year.

How to apply for grants

If you want to apply for a college grant, you’ll normally need to complete and submit the Free Application for Federal Student Aid (FAFSA).

The FAFSA is the universal application form the US Department of Education’s Federal Student Aid office uses to figure out the amount of financial aid you’ll be entitled to for a given school year.

Students can complete the FAFSA online or through Federal Student Aid’s mobile app. It doesn’t take very long to complete—but you’ve got to make sure you have any relevant documents handy when completing your FAFSA. This includes information about you and your family’s income, any large outstanding debts that’d affect your ability to pay for college, and recent IRS tax returns.

After you complete and submit your FAFSA, this information will be passed on to your state government and your college. You should then get a financial aid offer from your school’s financial aid office outlining which federal grants, state grants, or school-specific grants will be available for you.

That said, some state grants or school grants may require additional information or documentation—so just be aware that extra steps could be involved for particular grants after completing your FAFSA.

Plus, there may be state-based or school-specific grants that don’t use the FAFSA to determine eligibility. That means you should still look around and do some research after receiving your financial aid offer to see if there are additional private grants available for you.

Remember: Even if you know you won’t qualify for a federal student grant, you might still be in a position to qualify for a state-based grant. That’s why you must complete the FAFSA every year you plan on going to college. After all, you miss 100% of the shots you don’t take.

Translation: If you don’t apply for any grants, you won’t get any.

How to pay for college using scholarships

There’s a misconception out there that only certified geniuses or basketball stars get scholarships. But the truth is, there are literally over a million scholarships out there—which means there are scholarships for almost everybody.

You’ve just got to understand what scholarships are, how they work, where to find them, and how to apply.

What is a scholarship?

A scholarship is another form of gift aid. It’s a cash award for educational purposes that you aren’t required to pay back. So a scholarship is basically free money to pay for school—which makes it a great way to afford college without taking out massive student loans.

In 2020, around 58% of US students and their families received one or more scholarships to pay for school. This isn’t surprising, given how many scholarships there are out there.

In 2022, there are currently about 1.7 million scholarships available from colleges, employers, charities, companies, community groups, religious groups, trade schools, and loads of other organizations.

Some of these scholarships are need-based, like grants. But others are awarded based on your academic results, your background, or your interests. You’ll get both broad scholarship programs designed for inclusivity as well as niche scholarships with really specific eligibility requirements.

That means no matter where you’re coming from or what you’re into, chances are there’s a scholarship out there for you.

How to apply for scholarships

Each scholarship tends to have its own set of eligibility requirements and will be administered by a different group or organization. As a result, each scholarship usually has its own application process and requirements.

That means it’s up to you to do your homework, figure out when and how to apply and get everything in on time to make sure your application is considered.

The first step is tracking down a scholarship you’d like to apply for. After finding a scholarship that looks suitable, you should check out the scholarship’s website to find out how to apply.

Make sure you take your time reading all of the scholarship materials and understand the application process and what’s expected of you as an applicant. If you end up forgetting a step, you could be kissing a big scholarship goodbye.

One way to avoid costly mistakes like this is to get professional help. That’s where Mos comes to the rescue.

When you set up an account with Mos, you get access to the largest scholarship pool in America. You can also get help from dedicated advisors to connect you with scholarships you’re eligible to apply for. After getting matched with scholarships, you’ve just got to follow a few easy instructions on how to apply for each scholarship program.

How to pay for college using work-study

Another way to pay for college without loans is to use the federal work-study program. Work-study isn’t quite as well known as some of the other forms of federal student aid—but for those keen on getting work experience while earning money to pay for school, it’s a pretty smart option.

Here’s a quick rundown on how the work-study program functions and how to apply.

What is work-study?

Work-study is a type of federal financial aid you can use to pay for college. Students who’re able to qualify for the work-study program can get a part-time job of up to 20 hours per week while working towards a college degree.

Most of the work-study jobs you’ll find are on-campus jobs in which you’re able to work directly for your school. That being said, other work-study jobs can be based off-campus and are with local businesses, non-profits, or public agencies affiliated with the school.

There are around 3,400 schools in the US that offer work-study programs—and around 16% of all college students utilized the federal work-study program in 2021.

If you’re awarded work-study aid in your financial award letter, that means you’ve qualified. But responsibility then rests with you to go out and find a work-study job. This job can then help you to earn money to pay for school or other expenses.

How to apply for work-study

If you want to apply for work-study, there are two applications you’ll need to complete: the FAFSA as well as an application for each particular job.

As we’ve already touched upon, the FAFSA is the US Department of Education’s universal financial aid application. If you want to take part in work-study, you’ll need to indicate this on your FAFSA form.

But even if you’re invited to take on a work-study job as part of your financial aid package, it doesn’t guarantee you’ll get a job. You’ve then got to fill out individual applications for each opportunity.

That said, getting approved for work-study by the federal government will make it a lot easier for you to find a part-time job. Most schools that offer on-campus jobs are keen to hire students who have been designated as work-study students by the Federal Student Aid office.

It’s also important to note that you need to renew your work-study eligibility on an annual basis. That means you’ve got to submit a FAFSA for each academic year you want to maintain eligibility.

Conclusion

At the end of the day, loans are an easy way to pay for college because they’re so accessible. But most students and families would understandably prefer not to rely solely on loans. After all, a student loan burden can hang over your shoulder for decades—and so choosing to pay for college without loans will empower you with more financial freedom after graduating.

Fortunately, there are plenty of financial aid options available that can help you pay for college without taking on debt—and the most popular options are grants, scholarships, and work-study.

Want to learn more about how to pay for college without loans? Join Mos now to find out about financial aid and to get matched with loads of scholarships and other financial aid opportunities to help you make the most of your time in college.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you