Student loans •

June 20, 2022

Student loan rehabilitation: what it is and how it can work for you

Are you at risk of a student loan default? Read this guide from Mos explaining how student loan rehabilitation can save the day.

Student loans can be a huge debt obligation for a lot of us and can go on to haunt some students for years after they’ve graduated. Fortunately for those struggling to repay their federal student loans, the US Department of Education offers a couple of ways you can prevent a loan default—and the most popular solution by far is student loan rehabilitation.

Student loan rehabilitation allows you to dig your federal student loans out of default by making 9 monthly payments over 10 months. It can also help you improve your credit score. But it’s important to note that not everyone qualifies for loan rehabilitation, and there are some marks on your credit score that it can’t erase.

This guide explains what student loan rehabilitation is, how it works, what happens after student loan rehabilitation, and more.

What is student loan rehabilitation?

Student loan rehabilitation is a repayment strategy the US Government offers as a way to help college students avoid going into loan default.

If you miss federal student loan repayments for more than 270 days, your loan will generally automatically go into default. When a loan goes into default, it means that you’re going to lose access to any repayment benefits that your original loan agreement may have offered. You’ll also lose access to any future federal financial aid—which means you’re not going to be able to rely on the federal government for a grad school loan.

It’s critical to bear in mind that any late payments you’ve made to your loan servicer will ultimately hurt your credit score.

So, how does a loan default hurt your credit score?

Let’s say you end up missing a payment on your student loan. After a certain amount of time, your loan servicer will then report that missed payment to the 3 big credit agencies: TransUnion, Equifax, and Experian. They’ll then mark this blip on your credit report—which could end up causing trouble for you later.

For example, you might end up getting denied a good mortgage rate by the bank or a loan for a new car because you’ve got a black mark on your credit score for missing student loan payments. Translation: by defaulting on a loan, you might miss opportunities that can improve your life.

That’s why, if you’re struggling to repay your student loans, loan rehabilitation is worth considering. It can help you get your loans back into good standing. In return, you’ve got to make 9 on-time monthly payments that are equivalent to at least 15% of your discretionary income.

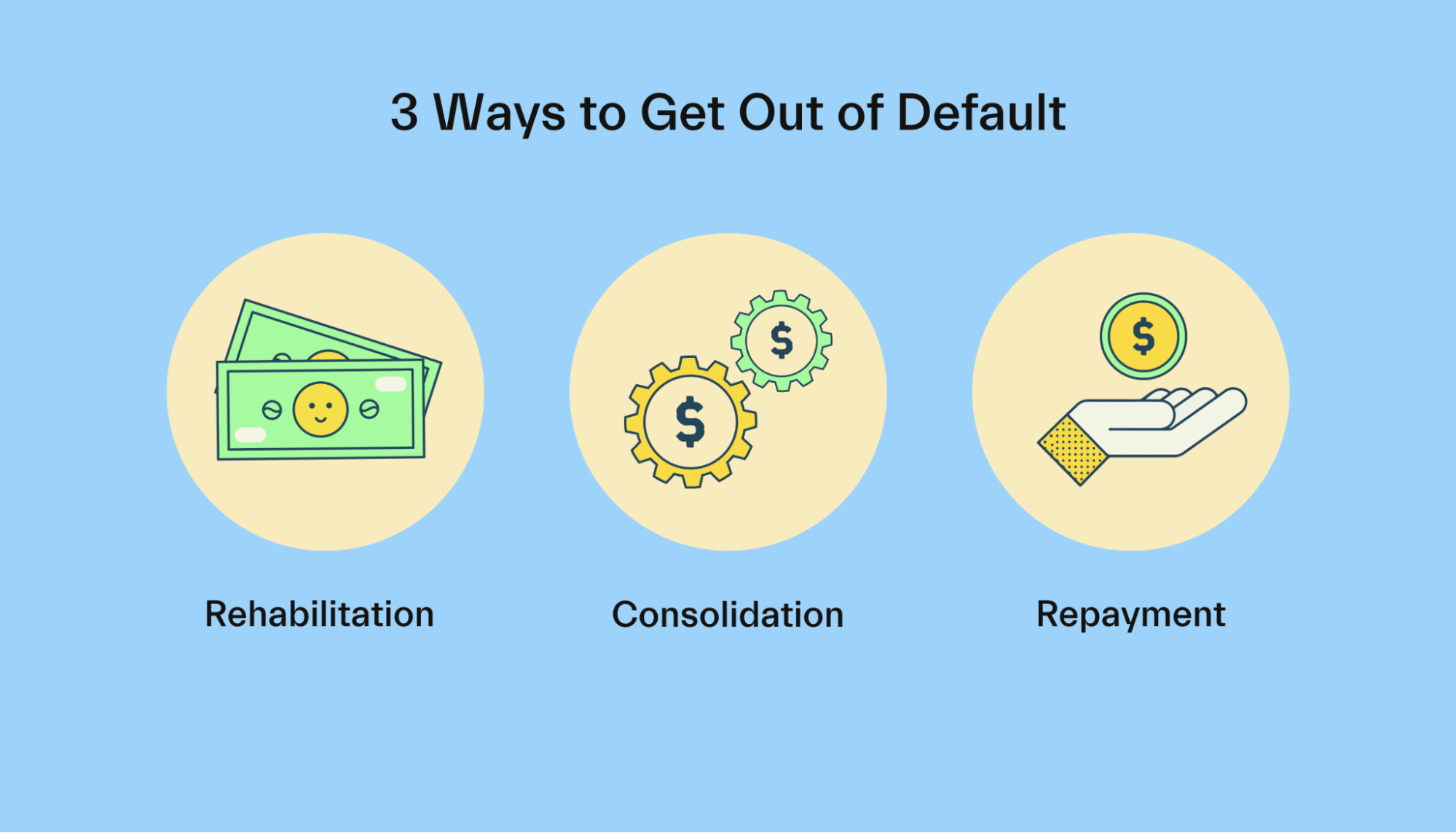

For reference, student loan rehabilitation isn’t the only solution the US Department of Education offers to help students avoid default. The other route is loan consolidation through the US Government’s Federal Student Aid (FSA) office.

The FSA offers a Direct Consolidation Loan, which allows you to combine (or “consolidate”) multiple federal student loans into just one loan. In doing so, you’ll benefit from a single monthly payment instead of loads of different payments coming out of your bank account. Loan consolidation also empowers you with the ability to access other types of loan repayment plans and loan forgiveness programs.

But loan consolidation can be a bit complicated, so let’s stick with loan rehabilitation for now.

How does student loan rehabilitation work?

Student loan rehabilitation is a lot more straightforward than people think, but there are pretty strict rules you’ll need to abide by to ensure that loan rehabilitation works.

After contacting your lender and letting them know you need support, you may be offered the chance to enter into a student loan rehabilitation agreement.

Once you’ve signed that agreement, your student loan servicer will give you a new monthly repayment amount that’s directly linked to your discretionary income. If you’re unfamiliar with the concept of “discretionary income,” don’t sweat it. It’s essentially just a fancy way of describing the amount of income you’ve got left after basic living costs, social security charges, and taxes have all been deducted.

To maintain your loan rehabilitation eligibility, you’ll then need to make 9 consecutive, on-time payments within 10 months. As a point of reference, the US Government defines “on time” as being within 20 days of the payment’s due date—so you’ve got plenty of time to get your payments in.

If you’re able to make those payments in line with your student loan rehabilitation agreement, that means your loan will no longer be in default.

Once this has happened, the ping on your credit report will be removed so that it looks like your loan never even went into default in the first place. Unfortunately, any late payments you made leading up to your default won’t be removed so easily. Late payments will stay on your credit report for 7 years before they disappear.

Student loan rehabilitation comes with a couple of extra benefits, too.

For example, if the US Government were trying to collect on your unpaid debts by garnishing your wages, those actions would end after your loan has been rehabilitated. Likewise, the government will no longer be able to withhold any outstanding tax refunds you’re owed.

By completing a loan rehabilitation program, you’ll also regain the ability to apply for additional federal student aid and leverage various repayment benefits. Finally, you’ll be delighted to know that you’ll no longer get any communications from collection agencies after your loan is rehabilitated. All of these actions stop after your agreement has been satisfied.

Although student loan rehabilitation offers a real lifeline for borrowers struggling to repay their debts, there are a couple of important rules you have to bear in mind.

First and foremost, you can only rehabilitate a defaulted student loan once. Translation: this is a single-use solution, so you can’t bet on loan rehab saving you more than once.

To help prevent future defaults, you’ll then need to make sure you work alongside your loan servicer to pick a repayment plan that you can afford.

After completing rehab, you’ll be able to choose one of the US Government’s 4 income-driven repayment plans. These plans work by calculating your monthly payments in relation to your discretionary income. You’ll then make more manageable payments for either 20 or 25 years (depending on the plan you’re offered).

If you end up selecting an income-driven repayment plan, you’ll benefit from loan forgiveness at the end of your repayment period. This means that any unpaid balance still existing on your account will be completely forgotten (although you might still need to pay income tax on that outstanding amount).

How do you enroll in student loan rehabilitation?

If you want to enroll in student loan rehabilitation, your first step is to get in touch with your loan servicer to figure out if you’re eligible to apply.

Assuming your loan provider gives you the go-ahead, you’ll have to send in a copy of your latest IRS income tax return or a tax transcript. Based on this information, your servicer will then determine the amount of money you can realistically afford to pay monthly without putting you into an even tougher financial position.

After working out a reasonable repayment amount, your loan servicer will then send you a written rehabilitation agreement. This should arrive within 15 days.

If you decide to accept your student loan rehabilitation agreement, you’ll need to sign and return that agreement to your loan servicer. Upon receipt of that signed contract, you’ll be enrolled in a unique rehabilitation program.

What happens after student loan rehabilitation?

After you’ve successfully met the conditions of your student loan rehabilitation, your loan will normally get sold or assigned to a new loan servicer.

As we’ve already touched upon, the government will stop garnishing your wages after you’ve made 5 rehabilitation payments. You’ll also regain access to other sources of federal student aid and various repayment options. These include forbearance, deferment, and the income-driven repayment plans we’ve covered.

Because you’re only able to rehab a student loan once, you must come up with a strategy to pay for any future payments you’ll have to make post-rehab.

For example, let’s say you fell behind on your loan repayments in the first place because your repayment amount was too expensive. If this is the case, asking your new servicer for an income-driven repayment plan is probably going to be your best bet.

That said, it’s also worth considering what might happen if your student loan rehabilitation doesn’t work. If your rehabilitation program fails or you end up defaulting again on your previously rehabilitated loan, your most viable option will be to consolidate your loan.

Just be aware that, like loan rehab, consolidation only works once. If you’ve consolidated student loans already, your only remaining options are to add that loan to your existing consolidation or simply pay the full balance of your outstanding loan.

If you end up running into this situation, you may find that your loan servicer is willing to settle for less than you owe. By getting in touch with them and explaining the situation, you may be offered a lower settlement figure to pay down your loan as an act of goodwill. It’s also possible to file for bankruptcy—but this route should be avoided at all costs, as it can have a horrible impact on your finances for years to come.

Doomsaying aside, student loan rehabilitation is a positive way to successfully repair your credit and get back on track with repaying your loan.

Will my credit score go up after loan rehabilitation?

Unfortunately, the answer to this one is a little bit complicated. Student loan rehab has a positive impact on your credit, but your credit score depends on a couple of other factors.

One of the key benefits of rehabilitating a student loan is that it removes the record of a default from your credit report. However, you’re not going to get that black mark removed from your credit report if you opt for loan consolidation—it’ll remain on your credit report for 7 years.

As a result, loan rehab is generally a smarter option than loan consolidation if you’re trying to build your credit.

While your credit score is going to see a boost from the elimination of that default notation on your credit report, it’s not a silver bullet to help you achieve a stellar credit score. Loan rehab won’t remove previous late payments you made from your credit score, which means your score could remain relatively static even after you’ve successfully rehabbed a loan.

Conclusion

Loan rehabilitation can be a real financial lifeline for those struggling to repay student loans. You don’t have to let the consequences of a loan default follow you around forever. Instead, you can get in touch with your loan servicer and enroll in loan rehab.

If you’re able to rehabilitate a loan successfully, that default note will be removed from your credit history. Remember that, even if you can rehab a loan, your credit report will still include any late payments reported to the 3 big credit agencies before your loan went into default.

The key here is to make sure you plan ahead, stay organized, and are aware of all the options available to you. That means doing your homework concerning student finance—but it also means asking for help from professionals when and where you need support.

So are you ready to learn more about student loans?

If you’re still in college, you should join Mos. We can walk you through various financial aid opportunities and match you with loads of scholarships and other financial aid options to help you make the most of your time at school.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you