Student loans •

Private student loan forgiveness: a walkthrough and leading alternatives

Learn about alternatives to private student loan forgiveness and how Mos can help you avoid private loans entirely.

We're not going to sugarcoat this. Getting private student loan forgiveness is extremely difficult. But if you're struggling to repay your loans and hoping to find some relief, we've got you covered.

In this article, we'll explore a few popular alternatives to student loan forgiveness. Now, these solutions won't wipe out your debt with the wave of a hand—they’re not magic. But they can give you some much-needed support in your quest to conquer your private loans and defeat student debt for good.

Federal student loans vs. private student loans

First, let’s look at how federal and private student loans differ when it comes to loan forgiveness as, sadly, they don’t play by the same rules.

As you may know, the US Department of Education administers federal student loans. And private student loans are issued by private financial institutions, including banks, credit unions, or agencies specializing in lending private student loans, such as Sallie Mae, Ascent, or SoFi.

Because federal student loans are government-issued, they're eligible for tons of different repayment assistance and student loan forgiveness programs, like:

Public Service Loan Forgiveness: a federal program that forgives federal student loans for borrowers who work full-time in public service for 10 years.

Teacher Loan Forgiveness: a federal program that forgives up to $17,500 of federal student loans for teachers who work in low-income elementary and secondary schools for 5 years or more.

Closed School Discharge: if your school closes while you're enrolled or soon after you graduate, the remaining balance on your federal loan may be forgiven.

On the other hand, private student loans don't offer the same protections and forgiveness programs because private lenders issue these loans. So, private loan forgiveness doesn't really exist—at least, not like it does for federal student loan debts.

Why is private student loan forgiveness almost impossible to get?

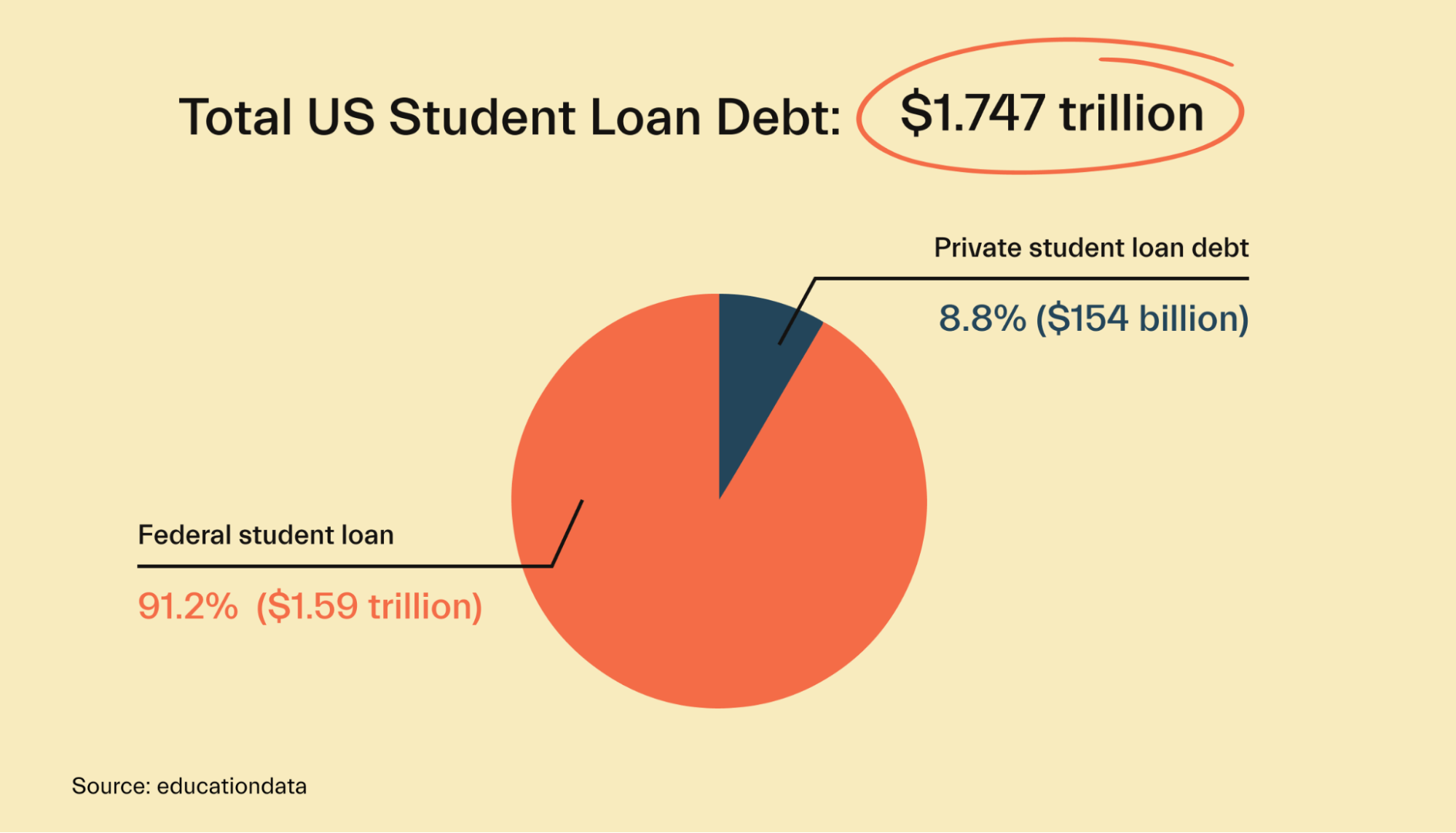

As of early 2022, US student loan debt tipped the scales at $1.747 trillion. Of that, 8.8% is private student loan debt, totaling $146 billion. But despite billions owed, why is it so hard to get private lenders to give borrowers a break and cancel student loan debt?

The answer, quite simply, is because there's no incentive. Remember, private lenders are in the business of making money. So, forgiving loans would require these lenders to take a significant loss on their investment.

Alternatively, the government has something to gain by forgiving federal loans. Sure, they want their money back. But by offering repayment assistance and forgiveness programs, the government attracts qualified job-seekers toward public sector employment, helping solve critical labor shortages. State governments may also offer loan relief programs for certain professions, like doctors and nurses, incentivizing them to work in underserved communities within the state.

Private lenders, however, don't care about your profession. They just want their money back at a very unforgiving interest rate.

The bottom line is that by forgiving student loans, the government can help address public issues—like labor shortages—and keep their voters happy. But because private lenders are for-profit businesses, they have nothing to gain and everything to lose by offering loan forgiveness.

Can private student loans be forgiven? What are the exceptions?

Technically, private student loans can be forgiven.

But before you get your hopes up, you ought to know that these exceptions are extreme and, depending on your lender's policy, aren't 100% guaranteed.

Death

Your student loan debt may be forgiven if you die. But unlike a federal loan, private lenders have no legal obligation to "discharge due to death."

Read your loan agreement carefully, or ask your loan agent about what happens to your loan when you die. If your lender doesn't discharge or cancel your loans when you die, your debt passes to your estate.

Thankfully, your family isn't directly responsible for paying your debts when you die. If there isn't enough money in your estate to settle your debts, the debt goes unpaid.

However, there are exceptions to this rule:

If your loan has a co-signer, they may be on the hook for your balance.

If you live in a community property state, your spouse may be responsible for your loans after you die.

Remember, just because you die doesn't mean your family won't be liable for repaying your debt.

Disability

Your private student loans may also be forgiven if you develop a permanent disability.

However, unlike federal student loans, a total and permanent disability discharge isn’t automatic if you become disabled. A few larger private lenders, like Sallie Mae, waive your balance if you become disabled, but other lenders may not. Always err on the side of caution and check the terms of your loan before signing.

Some lenders may assess disability on a case-by-case basis. So, if you develop a permanent disability that prevents you from working, have a doctor verify the extent of your condition and contact your lender.

Be warned, even if your lender offers disability discharge, they may fight you at every step. So be prepared to cross swords.

6 Alternatives to private student loan forgiveness

Just because it's next to impossible to have student loans forgiven doesn't mean you're out of options if you need debt relief.

Let's dive into 6 smart ways you can nip student loans in the bud without having to put yourself in the grave—literally!

1. Refinancing

Refinancing your student loans is an entirely doable way to help manage student debt.

When you refinance a loan, your lender pays off your old loan and issues you a new one based on your negotiated terms.

As long as you have good enough credit and a reliable income, getting your loans refinanced is an absolute breeze.

When you refinance your loans, your goal is to get a better interest rate than what you currently pay. A better interest rate means, usually, a lower monthly payment and less money paid in interest over the lifetime of your loan.

If you can't get a lower interest rate and struggle with your monthly payment, consider lengthening the term of your refinanced loan. You'll pay more in interest over time, but you'll have a more manageable monthly payment.

Loan refinancing isn't just an option for private student loans. If you also have federal loans and think you qualify for a better interest rate from a private lender, consider consolidating your federal and private loans. Not only could it save you a ton of money, but consolidating your loans into one payment makes juggling your finances a lot easier.

2. Bankruptcy

It's not glamorous nor easy, but declaring bankruptcy may release you from your student loans.

But filing for bankruptcy doesn't automatically wipe your student loans. Instead, you have to prove to the courts that your payments are causing you "undue hardship" by passing something called the Brunner test.

The Brunner test looks at three conditions when determining if student loan payments are causing you undue hardship:

Repaying student loans means you can't maintain a minimal standard of living.

Your financial situation isn't likely to change during the bulk of your repayment period.

You've made reasonable efforts to repay your student loans.

If each condition is true—and you can prove it—a judge can grant you a discharge from your student loans after filing for bankruptcy.

Bankruptcy isn’t a “get out of jail free card” for your student loan—it’s more of a last resort. But if student debt is robbing your means to achieve a minimum quality of life, seek help from a student loan lawyer and ask about the pros and cons of bankruptcy.

3. Forbearance

Forbearance is just a fancy term for when your lender lets you stop paying your student loans temporarily.

Many private student loan lenders offer forbearance, usually up to 12 months, but terms and conditions vary lender-to-lender.

To qualify, most lenders ask that you prove you're experiencing unexpected financial struggles, such as:

A job loss

An expensive medical emergency

Other reasonable financial challenges

Although forbearance is only temporary, it's a great option if you're facing a temporary setback and need some wiggle room to get back on your feet. Plus, it prevents you from falling behind on your payments and defaulting on your loans.

Keep in mind that while forbearance postpones your monthly payments, your student loan still collects interest. Despite this, forbearance is still a handy option if you’ve hit a financial snag and need short-term relief from your private student loan payments.

4. Deferment

Like forbearance, a deferment is when your lender lets you temporarily suspend your loan payments.

Private lenders aren’t required to offer deferments, but some do under special circumstances, like if a borrower is:

Experiencing financial or medical hardships.

Returning to school or attending an internship.

Deployed for active military duty.

Unlike federal student loan deferment programs, private loans may still accrue interest. But don’t let that be a deal-breaker. If you’re having trouble paying your loans and need a little breathing room, it’s better to defer your loans than default on them.

5. Repayment programs

Most states offer student loan repayment assistance programs (LRAPs). However, many of these programs are reserved for high-demand professionals like doctors, nurses, mental health professionals, legal aid lawyers, and teachers. For example:

California State Loan Repayment Program: available to certain healthcare professionals, like doctors, nurses, pharmacists, dentists, social workers, and therapists. Applicants must meet eligibility requirements and work in federally designated Health Care Professional Shortage Areas. Award amounts start at $50,000 for a 2-year commitment and reach a maximum of $110,000 if participants extend their contracts for another 4 years.

New York State Teacher Loan Forgiveness Program: up to $20,000 (paid over 4 years) of loan repayment aid is available for qualified New York teachers who work in hard-to-staff districts or teach in-demand subjects.

Florida Bar Foundation Loan Repayment Assistance Program: the Florida Bar Foundation will award $5,000 per year in student loan repayment assistance to qualified civil legal aid attorneys. Attorneys must be full-time or part-time (at least 50% FTE) employees with a legal aid organization that receives grants from the Florida Bar to be eligible for the program.

These programs are just a snapshot of what’s available. And if you want the most up-to-date info on LRAPs in your state, contact your state's department of education, consult with your professional organization (if you belong to one), or ask your employer if they know about assistance programs—they may even offer their own!

6. Use Mos and avoid private student loans entirely

Of course, one of the best alternatives to private student loan forgiveness is to avoid private loans entirely. And this is where Mos can help.

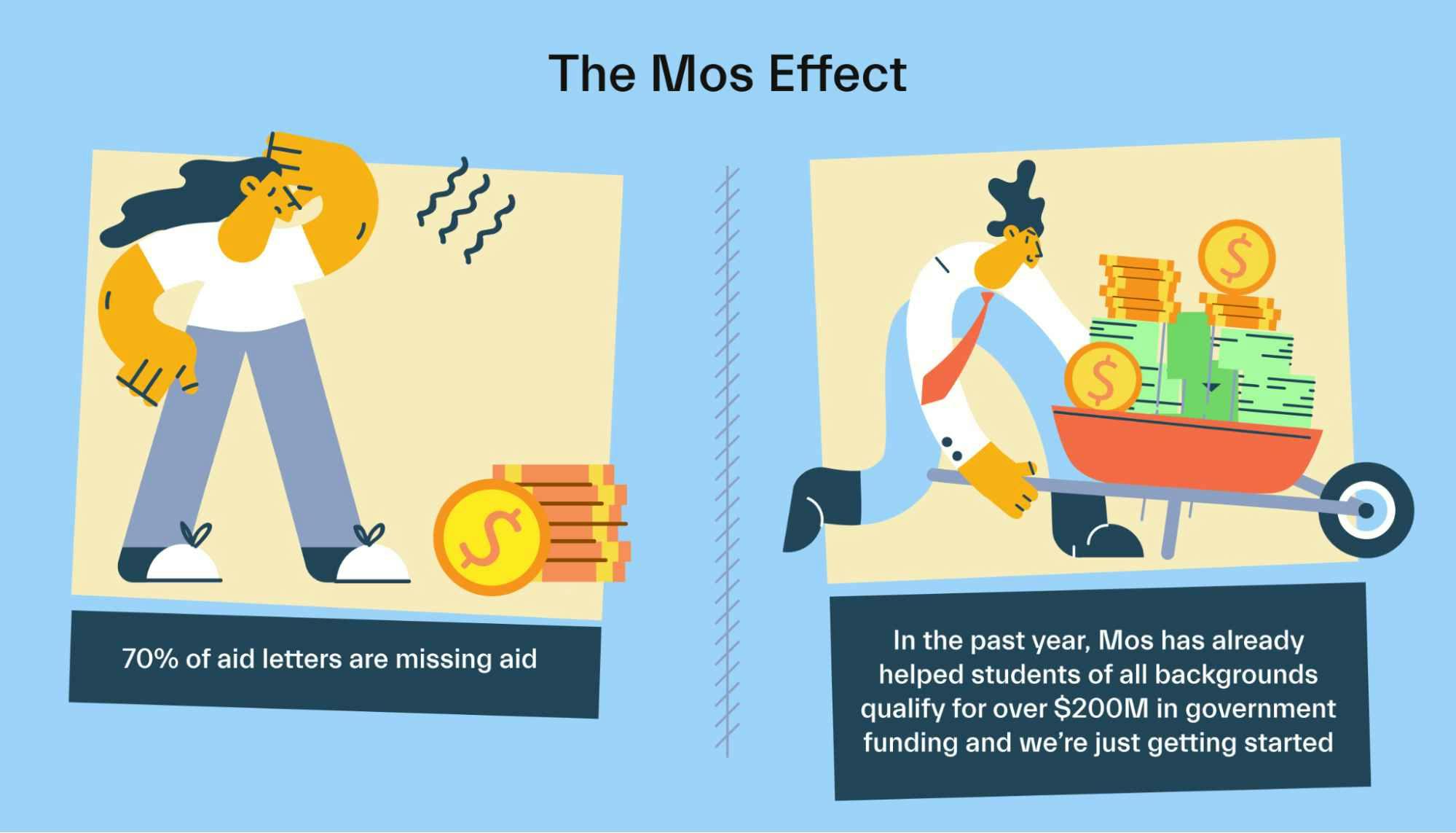

Fun fact: Billions in federal aid go unclaimed every year. For example, in 2021, $3.75 billion in Pell Grants went unawarded.

Over 70% of financial aid letters are missing aid. And let’s be honest, part of the reason this money didn’t go to the students who needed it is that applying for financial aid is a mind-boggling ordeal. But what if it wasn’t?

With Mos, we help you navigate the financial aid process and make sure that you get all the money you deserve.

Not to toot our own horn here, but our financial advisors can help you maximize the amount of federal aid, grants, and scholarships you receive so you never have to take out a private student loan.

Come hang out with us for a while and see what Mos is all about.

Frequently asked questions

Do private student loans go away after 7 years?

No, your private student loans don’t magically disappear after 7 years. But, usually, they’re removed from your credit report 7½ years after you’ve defaulted.

Can I change my private student loans to federal?

No, the government won't take on your private loan debt. Unfortunately, that's not how student loans work. And while you can refinance your federal loans with a private lender, it doesn’t work the other way around.

At what age do student loans get wiped?

Simply put, they don’t. Unless you live long enough to see the fall of capitalism, your student loans are with you forever.

Conclusion

Getting out of private student loan debt is a mountain to climb, especially when loan forgiveness isn't an option. But there are plenty of other smart alternatives, like refinancing or deferment programs that can help take the sting out of repayment.

And if you’re heading to college and want to avoid private loans completely, let Mos help you manage the cost of your education.

No matter what route you choose, taking action is the first step toward clobbering or curbing private student debt.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you