Student loans •

June 20, 2022

What is a Master Promissory Note?

Check out this guide from Mos to find out everything you need to know about an MPN.

We all know that college isn’t cheap.

The average cost of public in-state college tuition in the US is more than $10,000 per year, rising to over $38,000 for a private out-of-state college. Plus, there are living expenses, books, and supplies to consider. Because most families don’t have that much cash sitting around, a majority of them are reliant on student loans to pay for college.

When you accept a student loan from a lender like the US Government, you’re effectively entering into a legal contract to repay that money—and the contract you’re signing is called a Master Promissory Note (MPN). But before you complete, sign, and submit your MPN, you must know what you’re getting into.

This guide explains what a Master Promissory Note is, what an MPN includes, how to complete an MPN, how long it takes for an MPN to process, and more.

What is a Master Promissory Note?

A Master Promissory Note (MPN) is a legal document in which a borrower promises to pay back a loan with any accrued interest. An MPN also explains all of the terms and conditions of the loan in question.

MPNs are incredibly relevant where Federal Student Aid is concerned. If you take out a Direct Subsidized Loan, Direct Unsubsidized Loan, or a DirectPLUS loan, you’ll receive and be expected to sign a Master Promissory Note before your loan money can be paid.

Where the US Department of Education is concerned, there are 2 types of MPNs you might encounter. This depends on the type of loan you take out from the federal government.

The first MPN type applies to both Subsidized and Unsubsidized Federal Direct Stafford Loans. This is for undergraduate and graduate students—although it’s important to note that graduate students and professional degree students aren’t eligible to receive subsidized Stafford Loans.

If you’re offered a Federal PLUS Loan, you’ll need to complete a slightly different MPN. PLUS Loans are designed for the parents of undergraduate students (or the students themselves) working toward a graduate school degree or another type of professional degree.

The key difference between these 2 MPNs is primarily the terms and conditions element because the terms of these loan types vary in nature.

Why is an MPN so important?

Above all else, it’s important because the MPN is a legally-binding document. Unlike borrowing money from a friend, borrowing money from the US government requires a formal process. By signing an MPN, you’re making a legal agreement to repay that loan in full—including interest.

What details are in a Master Promissory Note?

The two most important details that are included in your MPN are the interest rate on your student loan and how that interest is charged.

These two details are important because they directly affect the total cost of your student loan. When your loan has a lower interest rate, your monthly repayments are going to be lower—and you’ll be repaying less over the total life of your loan.

Your MPN also has details about your annual borrowing limits. You must understand your borrowing limits. That’s because if your loans aren’t going to cover the full cost of your education, you’re going to have to find more funding to make up the difference. This could include grants, scholarships, income from a part-time job, or anything in between.

But your Master Promissory Note doesn’t just spell out the loan amount you’ve borrowed, your loan limits, and the interest that will accrue.

An MPN for a federal student loan also includes details about what you can use the funds from your student loan for. For example, your MPN will state whether your loan can be applied to pay for tuition fees, room and board, or additional administrative fees. Likewise, your MPN also includes details about future repayment options after you graduate.

As a result of all these details, your MPN should be your first port of call if you have any questions about your federal student loan or how to repay it. If you have any additional questions about the information that’s in your Master Promissory Note, you’ll need to ask the finance office at your school. They’ll be able to fill in any blanks and explain the details of your MPN to you.

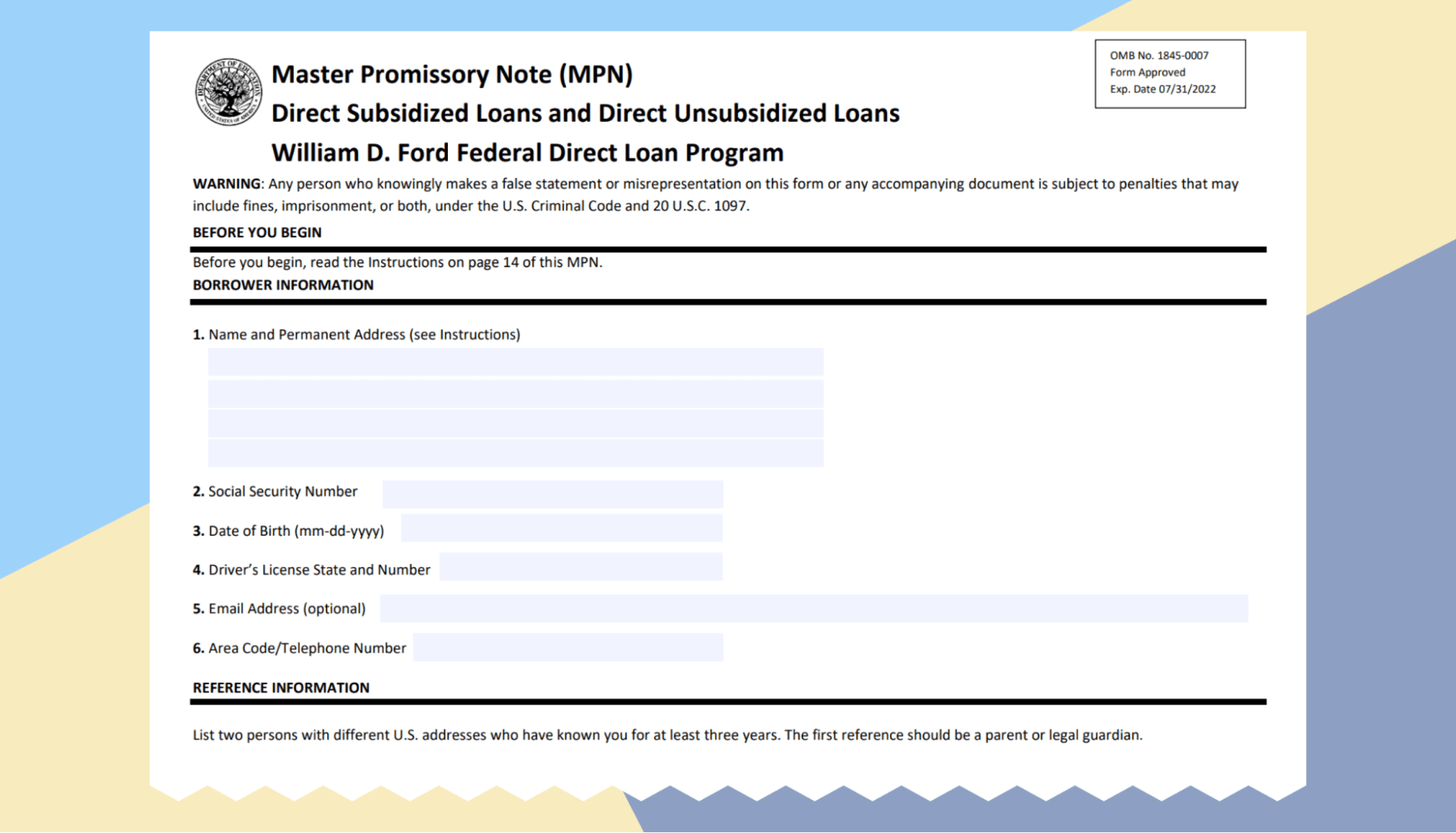

How do you complete a Master Promissory Note?

If you receive an offer for a Direct Subsidized Loan or a Direct Unsubsidized Loan as an undergraduate student, you’re going to have to complete an MPN.

Master Promissory Notes are usually quite simple, and as the borrower, you can complete your part of the MPN in under 30 minutes! But it’s important to note that you’ll need to complete your MPN in a single online session. If you fail to complete your MPN in one session, you’ll have to start again.

The process is completed entirely online. Your Federal Student Aid (FSA) ID functions as your electronic signature, so once you’ve read the information and completed all the necessary fields, you can sign your MPN with your FSA ID and submit it.

To complete the necessary fields, you’ll need the following information handy:

A verified username and password (FSA ID)

The name of your school

Your mailing address

Your contact information

Your reference information

If you want to make sure there are no delays in getting your funds disbursed, you must complete your MPN correctly and submit it as quickly as you can.

Do you need to include references on your Master Promissory Note?

We’ve already briefly mentioned that you need to have information about references on-hand to complete your MPN. But what are your MPN references?

When you submit a Master Promissory Note, you’re going to be asked to include the names and contact information of two people. These people will act as your references, and they can be just about anyone. One of the only rules about the eligibility of your references is that they’ve known you for at least three years.

Your references don’t have a huge amount of responsibility. But if you ever move without telling your lender (in this case, the US Department of Education), your references will be contacted to help locate you. This is part of the “skip-tracing” process, which is just a fancy term the government uses to describe the process of tracking you down.

In the context of a student loan MPN, that’s about all your references are ever going to have to do. That’s why it’s important when selecting your references to reassure them that they aren’t cosigning your loan. They’re not even going to be a character witness—which is a type of reference some lenders require for other loan products to check out your trustworthiness.

Again, you can pick whoever you want to be your two MPN references.

But generally speaking, the first person that most people list as a reference on their MPN is one of their parents or a guardian. The second reference is normally a person you have a close relationship with and you plan on keeping in touch within the years to come.

It’s not always possible to include both of your parents as MPN references because one of the eligibility rules is that your two references aren’t allowed to live at the same address.

How long does it take for an MPN to process?

After you submit your MPN to the US Department of Education, the government will then get in touch with your school’s financial aid office to let them know that it’s been completed. This process normally takes between 3 and 5 working days.

After your school’s finance office has received your MPN, you’ll have to complete entrance counseling before the school agrees to disperse your funds. The counseling process is mandatory if you’re a first-time borrower for a federal student loan—although the requirement also falls upon grad school students and professional students taking out a Direct PLUS Loan for the first time.

That being said, the requirement for entrance counseling doesn’t apply to parents who’re taking out a Direct PLUS Loan to help their children pay for college.

So, what is entrance counseling?

Entrance counseling is the process in which you sit down with a member of your school’s financial aid office and get to ask any questions about the loan process. They’ll explain how the loan works, as well as the responsibilities you’re assuming by accepting that loan.

An entrance counseling session normally takes about 30 minutes to complete. Like completing your MPN, entrance counseling must be completed in a single session.

After your session has been completed, your college will be able to disburse your loan funds. This is typically done in one installment, although there are exceptions. The way your loan is provided at your school should be covered as part of your counseling session.

When you’ve received your loan, you’ll have to notify your school’s financial aid office if anything about your enrollment at the school or your personal details change. This could mean you’ve moved apartments, changed your name, stopped attending school, or transferred to another college.

Does a Master Promissory Note need to be notarized?

If you’re taking out a loan from the US Department of Education, then your MPN doesn’t need to be notarized. Some lenders will require an MPN to get notarized depending on the product type, and who it is that’s offering the loan.

By contrast, an MPN is considered legally enforceable after it’s been signed by the individuals or parties involved. That means by signing your MPN, you’re entering into a legally binding contract to repay your loan and accrued interest as specified within your loan terms and conditions.

How do I get a copy of my Master Promissory Note?

If you ever need to access your MPN, it’s readily available online.

To get a copy of your MPN, all you’ve got to do is log into “studentaid.gov.” To log into the site, enter your FSA ID. Once you’re in, you can then choose the menu bar entitled “My Loan Documents.” From there, simply click on “Completed Master Promissory Notes.”

You should then be able to access and view all of your MPNs and download a digital copy if required.

How often do you have to complete a Master Promissory Note?

In most cases, you’ve only got to submit an MPN once after it’s been accepted. You’re then able to borrow additional Federal Direct Loans if required on a single MPN for up to 10 years.

That being said, there are a couple of exceptions to the rule.

Some schools do require you to sign a new MPN every academic year. This won’t be applicable for students at most colleges, though.

You may also be asked to sign an additional MPN if you completed one more than a year ago but no loan was disbursed.

Finally, if the Office for Federal Student Aid determines that you’ve got an adverse credit history and you obtain an endorser to borrow a Direct PLUS Loan, you might need to sign and submit a separate MPN for each loan you take out.

Conclusion

At the end of the day, your MPN is pretty important.

Your Master Promissory Note clearly outlines all the details on the amount of money that you owe, how your loan interest is calculated and when that interest is charged. It also includes information about any available repayment plans, product late fees, collection charges, deferment options, and cancellation options.

Bearing in mind all the important information that’s included in your MPN, you must understand the process in which an MPN is approved and passed on to your college so that you know when to expect your student aid to be disbursed.

Want to learn more about the student loan process? Join Mos now to find out about financial aid and to get matched with loads of scholarships and other financial aid opportunities to help you make the most of your time in college.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you