Saving •

How much to save for college (and programs that can help)

Check out this guide from Mos to find out how much you need to save for college (and how you can do it).

For a lot of families, paying for college might feel like climbing Mount Everest. The cost of attendance includes a whole range of different expenses—and those expenses just seem to climb higher and higher every year.

That means you’ve got to start saving as soon as you can to fund your college education. Fortunately, there are plenty of tools to help you achieve that. Options include state-backed investment plans, federal grants, scholarships, personal savings strategies, and more.

We’re here to help you unpack all of these options.

This guide explains how much it costs to go to college, how much you’ll need to save for college, and a few of the top programs you can use to help.

How much does it cost to go to college?

You don’t need to have a degree in rocket science to know that college doesn’t come cheap. But how much do you (or your family) actually need to save for college?

The College Board says an in-state student at a 4-year public college should budget to spend around $25,707 per year—while an out-of-state public college student should have an average budget of $43,280. Private colleges come in slightly higher at $54,880 per year.

But the truth is that there are a couple of strands to this. Fortunately, we’re here to help. Let’s break them down.

Cost of attendance

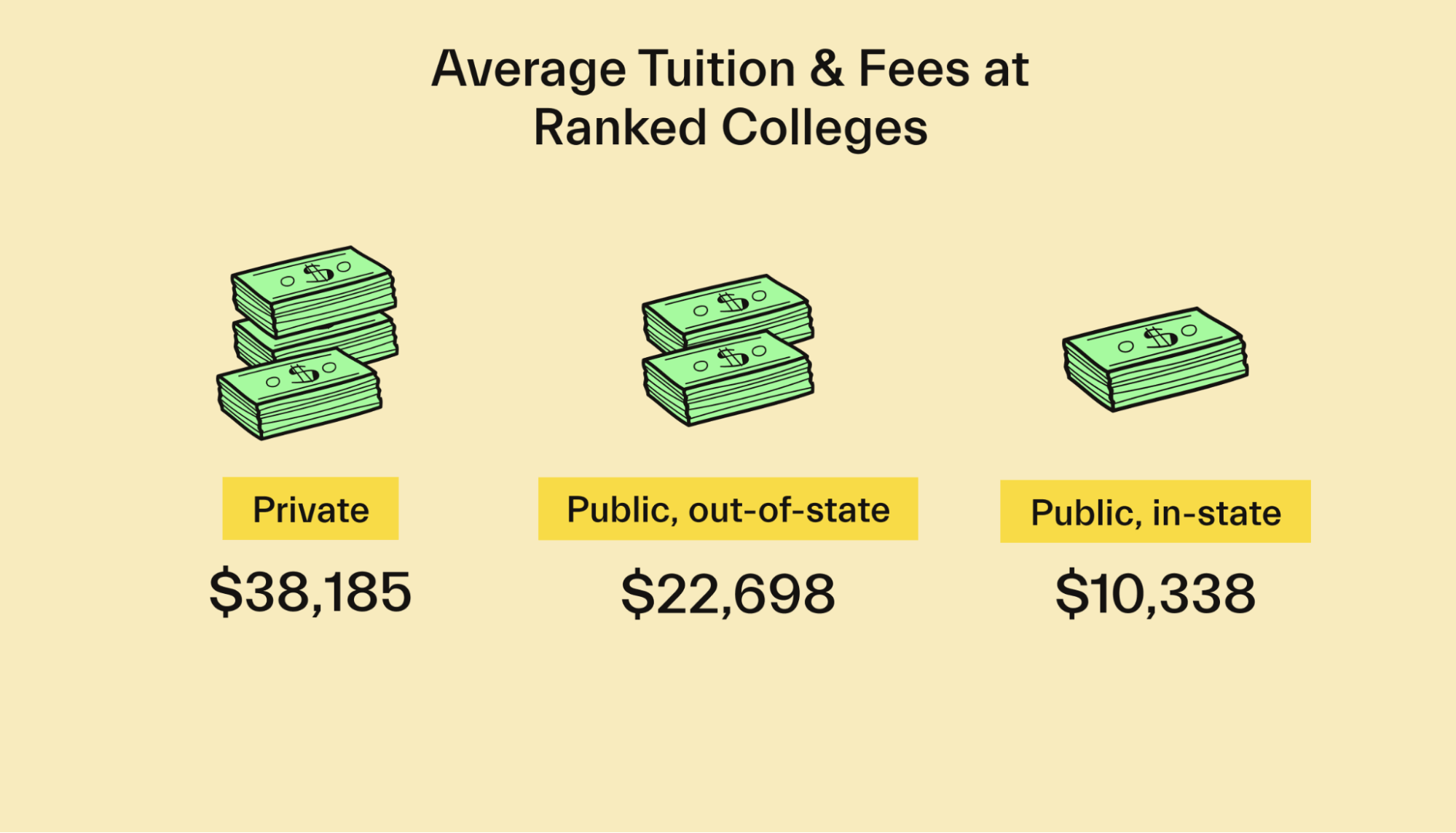

The biggest expense you have to save for is your college tuition fees.

For 2022-2023, private US colleges and universities averaged $39,723 per year for tuition and administrative fees alone. Public out-of-state colleges are a bit cheaper at $22,953 per year, while public in-state colleges come in at an average of $10,423 per year.

Multiply that number by 4 years, and we’re talking about big money no matter where you’re going to school. But it’s also important to remember that tuition fees go up every year. Last year, the cost of attendance shot up between 1% and 2%—which means if you’re going to graduate from high school in a few years, your savings target will need to be higher than the amounts we’re talking about.

Fortunately, you can normally cover a large proportion of this expense through financial aid like federal student loans, scholarships, or grants.

Room and board

Your second-biggest college expense is going to be accommodation. At your average 4-year college, annual room and board ranges from $10,429 to $12,857 per year.

This cost is going to vary quite a bit depending on whether you’re living on-campus or off-campus. But the way you pay that cost will vary, too. That’s because some financial aid can be used to cover university-managed accommodation—but if you’re renting privately, you’ll generally be paying out-of-pocket.

Textbooks

College textbooks can be pretty pricey, too. At a public 4-year college, students pay an average of $1,230 per year for their books and supplies.

Fortunately, it’s possible to shave a bit off some of these costs if you buy secondhand, rent your textbooks, or get them from the library.

Transport

You’ll also want to save for future transport costs. If you’re going to commute to campus or keep a car, you’ll need to think about car payments, car insurance, fuel, maintenance, and parking stickers.

If you don’t drive, you’ll be looking at a bus pass, train tickets, Uber fees, or maybe even a new bike. All these costs add up quickly—and you need to consider the cost of traveling home, too.

When you pool all these costs together, it’s estimated the average college student will have to spend between $1,070 and $1,870 on transportation per year.

Personal expenses

Like it or not, it costs money to live. Translation: you shouldn’t just be saving for your tuition and accommodation. You’ll also need clothing, food, toiletries, and money to fuel your social life in college.

This is the area that can spiral out of control the quickest, so you’ll need to be careful about how much you spend.

How much money should I have saved by the time I go to college?

You’re probably looking at these huge sums and panicking a little bit—but don’t. Although the cost of attending college is pretty astronomical, you’re able to fill in a lot of gaps with financial aid.

Translation: you don’t need to save up a whopping $200,000 before you graduate high school. We’ll explain why.

Saving for college using the ⅓ rule

Generally speaking, you should try to save around a third of your target amount. Scholarships, financial aid, student loans, or your current income can normally fill the remaining ⅔.

This is called the ⅓ rule—and it can make saving for your college education a lot less stressful.

For example, let’s say you’re 16, and you want to save to go to a public out-of-state university. As a middle-of-the-road estimate, you’d want to look at the average annual cost of $22,698 and multiply that by 4 years’ worth of tuition. That gives you an estimated cost of $90,792.

But take a breath. This isn’t your savings target.

Using the ⅓ rule, you’d want to save around $30,264 by the time you’re ready to go to college. When you reach the stage where you’re applying for schools, you’ll be able to get a more accurate estimate about the exact amount you’ll be paying off in tuition fees.

You’ll also be able to sit down and apply for scholarships, financial aid, and student loans to make up the difference. That way, a huge chunk of your college tuition is already taken care of before you even move into your dorm.

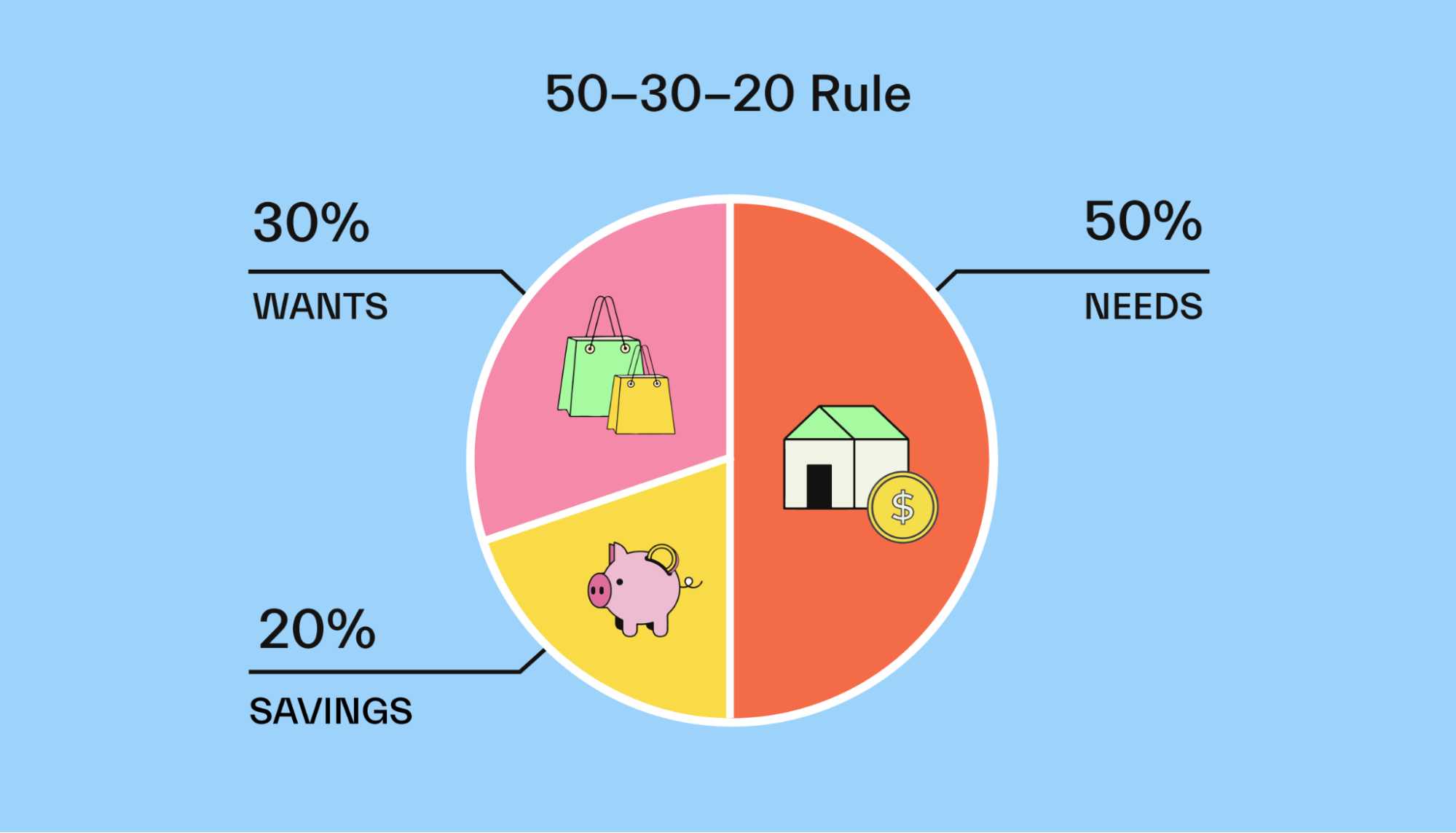

What's the 50/30/20 budget rule?

The 50/30/20 rule is a pretty straightforward budgeting method that can help you manage your money effectively. It’s a great way to save for your future education. But if you’re a current student, the 50/30/20 budget rule is also a great way to make sure you’re meeting your budget requirements.

The basic rule is that you need to divide your monthly income (after-tax) into 3 different spending categories: 50% for what you need, 30% for what you want, and 20% for saving or paying off any debts.

In this case, you’re looking at using the 20% you’re saving towards the ⅓ of your college expenses you’re pooling together.

That might mean that if your family makes a combined monthly income of $8,000, you should be aiming to put away around $1,600 per month toward future college expenses. This amount might need to be divided between multiple savings accounts (after all, your family should keep a rainy day fund and might have other stuff to be saving for, too—but you get the idea).

How to save for college

We’ve covered why you should save for college and the strategies you can use to do so. Now, let’s talk about the tools you may want to consider to make those savings go further.

529 college savings plan

A 529 plan is a special savings account that’s designed specifically to help you and your family cover higher education expenses—and it has good tax advantages.

529 plans are essentially investment accounts that let parents or guardians invest after-tax cash into low-cost and low-risk diversified security funds. They’re essentially education-specific brokerage accounts. But when you’re ready to withdraw cash to pay for college, you can take that money out tax-free (as long as it’s for a “qualified educational expense”).

This means you and your family will be able to save for college while slashing the amount of taxes you’ll have to hand over to the government.

Most 529 plans are state-specific, and there are 2 types available: prepaid tuition plans and education savings plans.

With prepaid tuition plans, family members prepay for your college by purchasing credits in advance. They can also pay future tuition costs at a particular school with a contract.

Education savings plans are the most popular option. Unlike prepaid tuition plans, education savings plans let you make withdrawals for more than just tuition fees. This enables you to use a 529 plan to pay for things like textbooks and accommodation.

Coverdell ESA

A Coverdell Education Savings Account (ESA) works a lot like a 529 plan. A Coverdell ESA lets you invest money into an education-specific account and then make withdrawals for qualified expenses in the future.

There are a couple of key differences, though.

Coverdell ESAs let you invest in a broader range of self-directed investments. That means you can choose from a wider range of securities and risk levels—and ESAs normally use a broader interpretation of “qualified expenses.” That means you’ll be able to use ESA funds on things other than tuition fees and university-managed accommodation.

The biggest catch is that a Coverdell ESA has a far lower contribution limit than a 529 plan. That means it’ll take longer to save a big nest egg.

Apply for grants and scholarships

Saving for college isn’t just about pooling as much cash together as you possibly can before graduating high school. You should also aim to get at least ⅓ of the cash you need to pay for school through grants and scholarships.

College grants are a form of financial aid called "gift aid." Gift aid is funding that you don't need to repay. You can get grants from your state government, your college, or the federal government.

Although federal grants are normally gifted based on your financial need, the US Department of Education uses a pretty inclusive set of eligibility requirements. That’s why around 34% of all undergraduate students receive a federal grant every year—and those awards average $4,491 per student per year.

Fortunately, applying for those grants is pretty simple. You’ll be able to apply for most federal and state grants using a single form: the Free Application for Federal Student Aid (FAFSA).

If you need more guidance on the FAFSA, don’t worry—we’ve got you covered.

Scholarships work differently.

Some scholarships are need-based, some are based on your academic results, and others might be more niche and based on your background or your interests. The good news is that there are a huge amount of scholarships that you can choose from.

This year, there are around 1.7 million scholarships from colleges, charities, companies, community groups, employers, trade schools, religious groups, and loads of other organizations.

Unfortunately, having such a huge number of scholarships to choose from can make finding the right scholarship feel like finding a needle in a haystack. But don’t panic because this is where Mos comes to the rescue.

By setting up a student account with Mos, you can get instantly matched with loads of scholarships that are absolutely perfect for you. All you need to do is to take a short quiz. You can even get one-on-one help applying for scholarships from our expert advisors.

Conclusion

Saving for college is incredibly important—and the earlier you start, the better. After all, college tuition only seems to get more expensive every year. Fortunately, you don’t have to worry about saving $200,000 for your college education. That’s where financial aid comes in.

Using the ⅓ rule, you should be aiming to save around ⅓ of the total amount you think you’ll need to pay for school. Financial aid like grants, scholarships, and federal student loans should be able to pick up the rest (alongside income from you or your family to pay for everyday personal expenses in the future).

Fortunately, there are plenty of great savings programs and investment tools that you can utilize in order to start saving for college now. But if you’re not sure where or how to get started, Mos is here to help you every step of the way.

Join Mos now to take control of your finances and get matched with loads of scholarships and other financial aid opportunities to help you make the most of your time in college.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you