Student loans •

June 20, 2022

What is the HEROES Act, and how does it impact student loans?

The government passed several aid bills during the pandemic. Learn more about the HEROES Act and other forms of government student loan assistance.

College students and recent grads were hit hard by the financial effects of the pandemic and lockdowns in early 2020.

The government went to work, pausing student loans and drawing up all sorts of legislation—most famously, the CARES Act.

But there was another bill that would’ve sent out even more money. That bill’s called the HEROES Act.

This article will discuss the HEROES Act and where it is as of now. But since it hasn’t passed quite yet, we’ll also show you several other ways to get the government to help with your student loans, whether you have already graduated with loans or are looking for ways to mitigate your loans while still in school.

What is the HEROES Act?

The Health and Economic Recovery Omnibus Emergency Solutions Act, cleverly called the HEROES Act, is a broad pandemic relief bill. It originally included a $3 trillion stimulus package to address many different areas, including student loans, but that has since been revised down to $900 billion.

For education in particular, the original act provided about $191 billion for student loan relief and higher education funding.

HEROES Act vs. CARES Act

The Coronavirus Aid, Relief, and Economic Security Act, or the CARES Act, was the first stimulus bill to help keep the economy afloat when everything shut down.

It was a large bill, but not as comprehensive because the pandemic was just beginning. The government had to get something out the door, so it was a bit smaller.

Once we had seen some of the CARES Act’s effects, it was easier for the government to create another aid bill that was more comprehensive and better addressed society’s needs.

That’s what the HEROES Act was for. It added more money and provisions to address where the CARES Act fell short. Since we had more knowledge of the pandemic’s effects as it played out, the government had a better idea of what to include.

What happened to the HEROES Act?

The HEROES Act was introduced in the House of Representatives on May 12, 2020—less than 2 months after the CARES Act passed—by Rep. Nita Lowey, Democratic Congresswoman from New York.

After going back and forth through typical legislative matters, like committees, rule changes, and debates, it passed the House 208 - 199 on the evening of May 15, 2020.

Next up was the Senate, where it arrived on May 20, 2020, and this is where the HEROES Act story comes to a close for now.

The bill was read twice. First, on May 21, then on June 1, before being placed on the legislative calendar to be worked on later.

It made its way into the Senate Committee on Small Business and Entrepreneurship for some hearings on July 23, 2020… then never got anywhere after that, according to Congress’s website.

As of now, it's still in limbo in the Senate. An updated version passed the House in October 2020, but the act itself still isn’t law.

Ultimately, the Senate negotiated a new bill, the Consolidated Appropriations Act of 2021, which became the second form of aid in December 2020.

Now that we’re emerging from the pandemic, the odds of the HEROES Act passing grow slimmer, but we can never know for sure if Congress won’t pick it back up later.

Other ways to get help from the government with paying your student loans

The government offers numerous ways to help you reduce your student debt burden, such as non-loan aid, adjusting your repayment plan to be more affordable, and even erasing your loans (in certain cases).

Here are some of the numerous ways the government may help reduce your student loan burden or allow you to pay them back more easily:

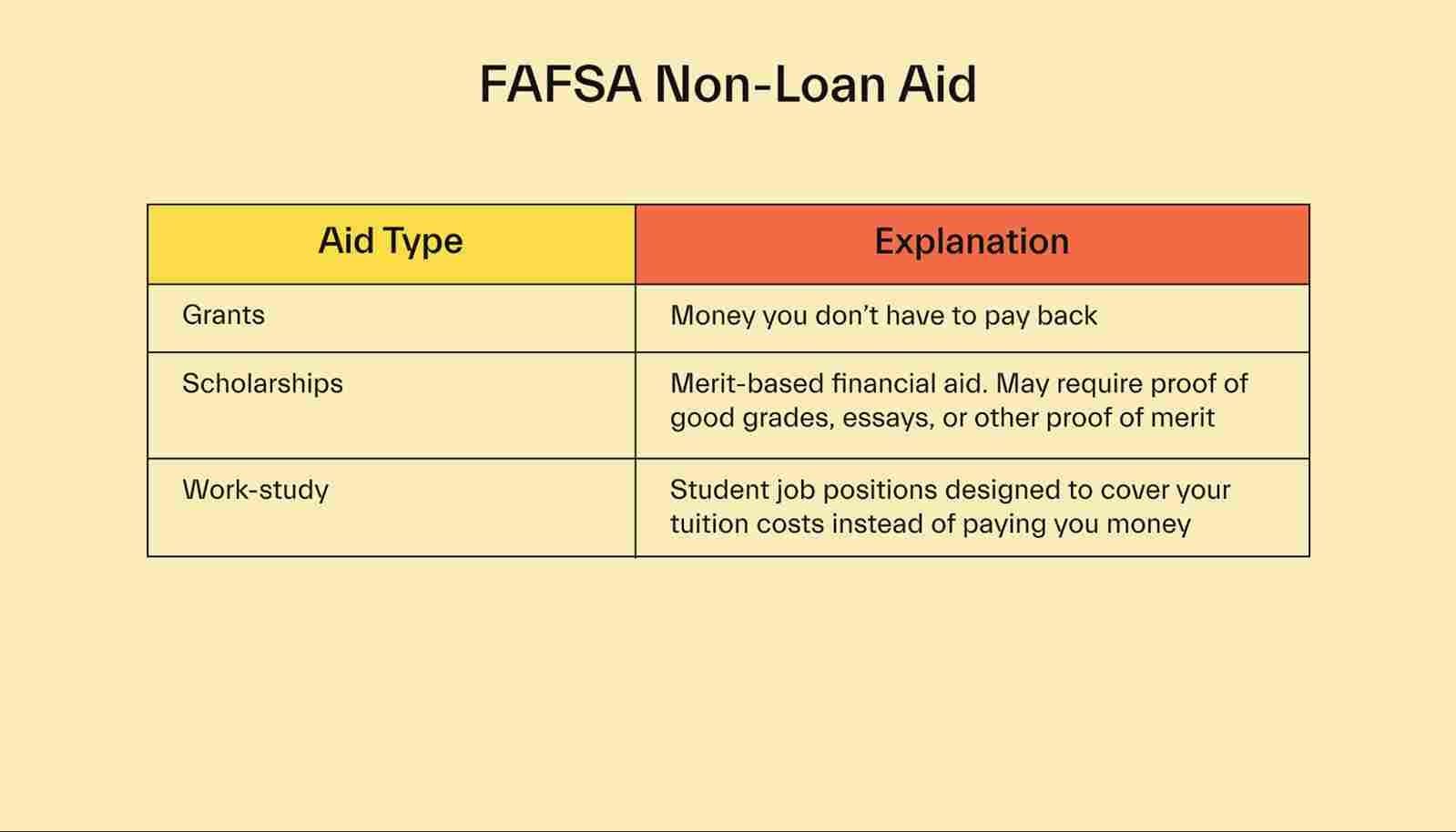

FAFSA non-loan aid

The FAFSA is the key to unlocking your financial aid because it shows your eligibility for all federal aid programs, not just federal student loans.

For instance, it shows your eligibility for federal grants like the Pell Grant. You don’t have to pay grants back, so this is free money.

Work-study is another form of federal aid you qualify for through the FAFSA. These are jobs that the university arranges for you, up to 20 hours a week, but you get paid a paycheck directly that you can use as you please, unlike other forms of aid. They’re often on campus but can also be at non-profits, public agencies, and small businesses off-campus.

Many scholarships aren’t available on FAFSA, but some, like the College Bound Scholarship, require some FAFSA information to qualify.

Some state-specific programs, like the NYS TAP grant program, are also attached to the FAFSA application and make you fill it out.

Non-FAFSA, non-loan aid

Outside of the FAFSA are still more forms of government aid at the state and local levels. These can be grant or scholarship programs offered through state and local governments.

Plus, businesses, non-profits, and other organizations offer grants and scholarships by the 1000s.

You can look for these online or get matched to the best ones for you automatically through a service like Mos.

Loan forbearance and deferment

Loan forbearance and deferment are programs where the government pauses your loan payments temporarily if you’re in a tight spot financially.

Deferment is the better of them because interest doesn’t accrue in deferment. Interest does accrue in forbearance, but at least you don’t have to make payments for the time being.

The exception was the pandemic loan forbearance, which set interest rates on federal student loans at 0% to ensure interest would not accrue and capitalize onto your loan balance.

Note that private lenders may not offer forbearance, deferment, and similar programs. And if they do, they may not be as flexible.

Loan Forgiveness

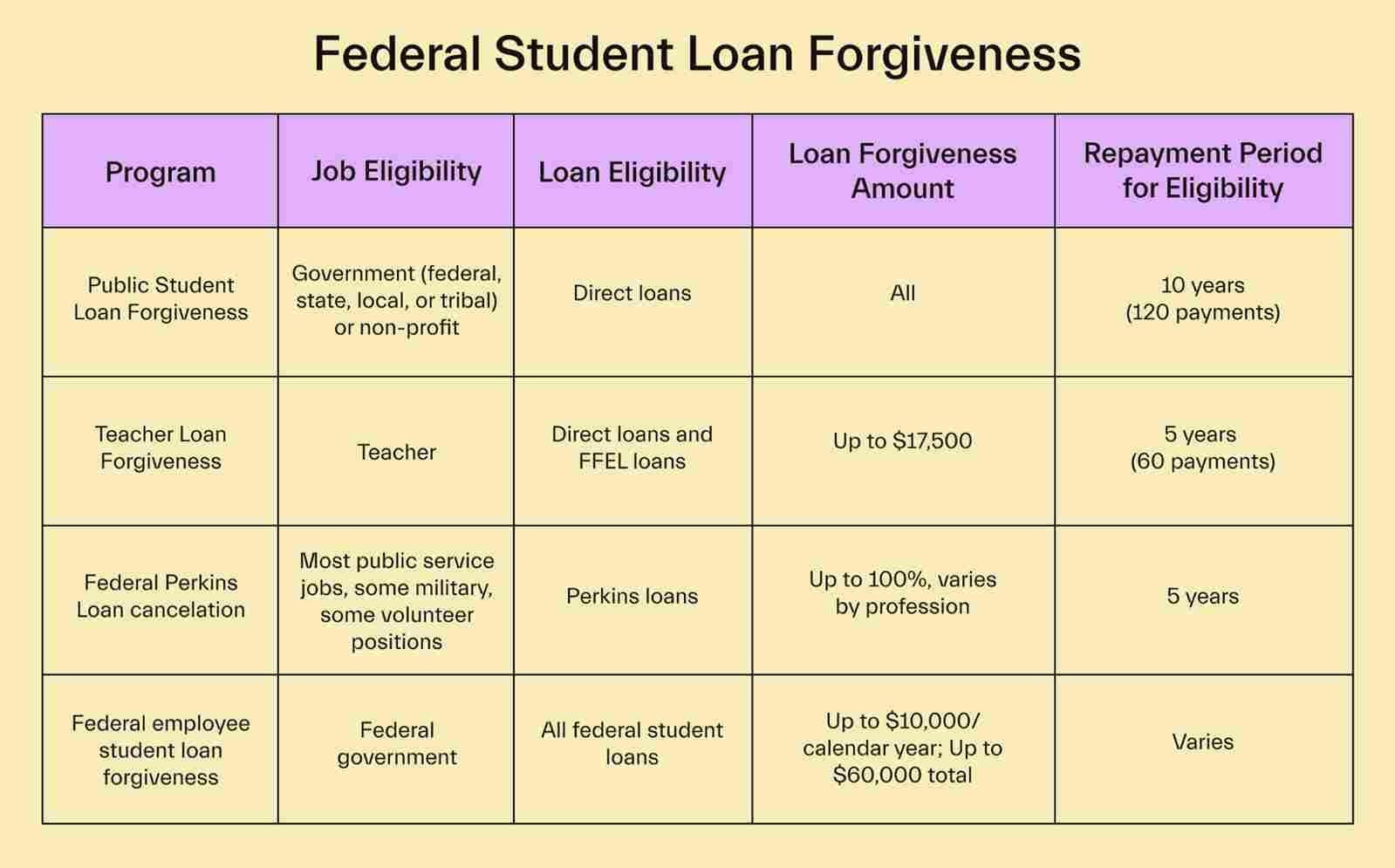

Loan forgiveness and cancelation is what it sounds like—several government programs will erase all eligible loans for students who meet a program’s criteria.

Public Student Loan Forgiveness (PSLF) is one that most people have heard of. Anyone employed by any government in the US—federal, state, local, or tribal—as well as non-profits can have their loans forgiven after making 10 years of payments, or 120 payments, on an income-driven repayment plan for a certain number of years while working in that sector.

PSLF may include teachers, but the Teacher Loan Forgiveness Program is another loan forgiveness program designed solely for teachers. This one could cancel up to $17,500 of Direct or FFEL (Federal Family Education Loan) loans.

There’s also student loan discharge, which is a bit different. It eliminates loans for events out of your control, such as your school closing, becoming disabled with outstanding loans, or you getting scammed by a for-profit school. These are obviously not ideal situations, but it is nice to know you could have your loans erased if you find yourself in one of them.

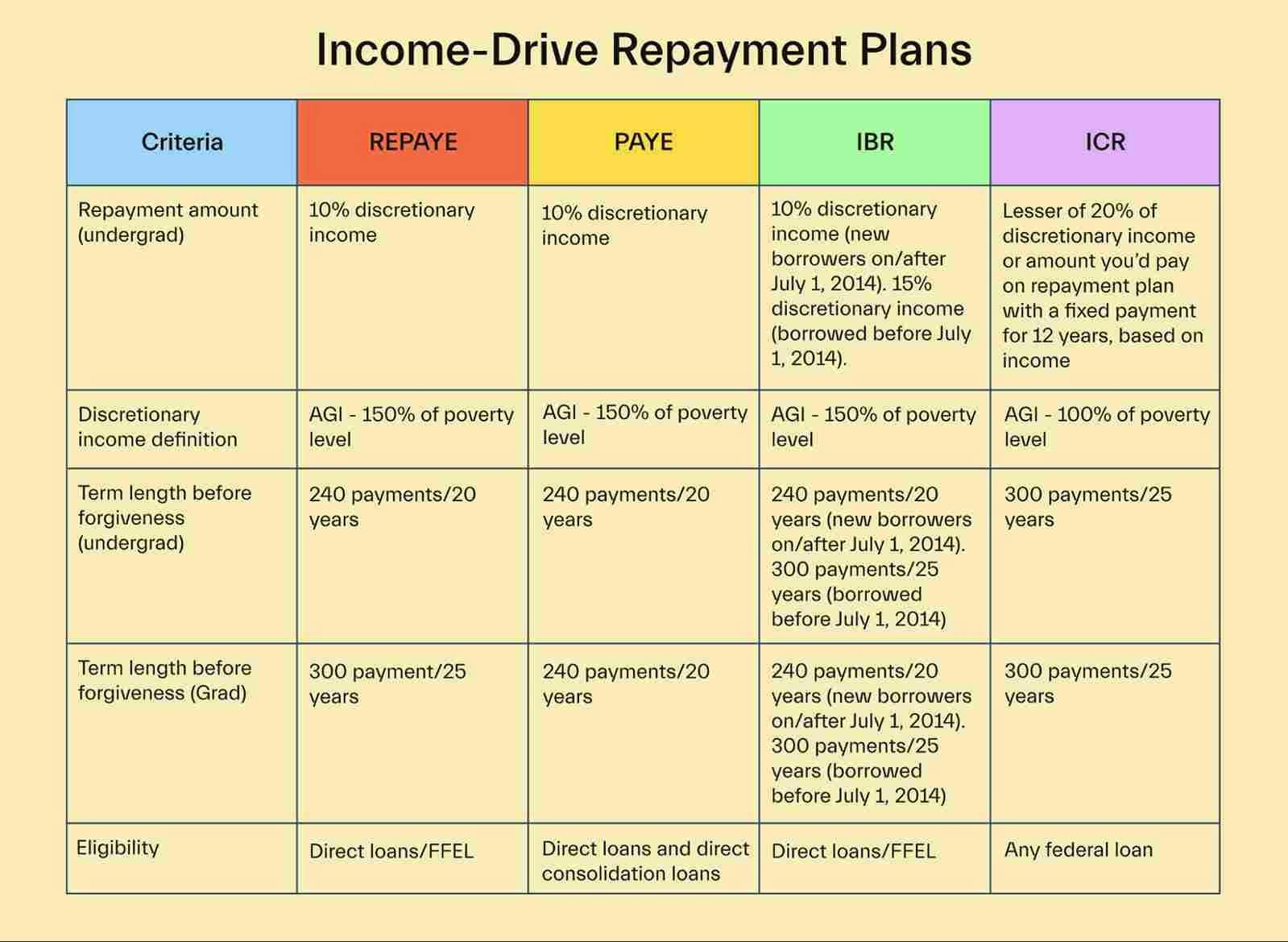

Income-driven repayment plans

If you’re struggling to make your payments, the government offers income-driven repayment plans that adjust your payment based on your current income and family size.

These programs may also offer forgiveness after enough time making on-time payments, since your payments under these plans wouldn’t be enough to pay off your loans within a regular timeframe.

There are 4 plans available:

Revised Pay-As-You-Earn: Payment is 10% of your discretionary income. Forgiveness comes after 20 years of payments for undergrads and 25 years for grad students. It subsidizes 100% of accrued, unpaid interest for the first 3 years, and 50% every year thereafter. The catch is if you’re married, your discretionary income is calculated including your spouse’s income, even if you file taxes separately.

Pay-As-You-Earn: Payment is 10% of your discretionary income. Forgiveness comes after 20 years for grad students and undergrads. It subsidizes 100% of accrued unpaid interest for the first 3 years, but nothing after that. Discretionary income is based on your income alone, even if you’re married, as long as you file taxes separately.

Income-Based Repayment: Payment is 10% or 15% of your discretionary income, depending on if any of your loans were taken out before or after July 1, 2014. Forgiveness after 20 or 25 years of payments for both undergraduate and grad students based on the same factor (date loans started).

Income-Contingent Repayment: Payment is the lesser of 20% of discretionary income or the amount you’d pay on a repayment plan with a fixed payment for 12 years, based on your income. Forgiveness comes after 25 years for grad students and undergrads.

Federal employee student loan assistance

To help recruit more talent, federal agencies are allowed to offer employees loan repayment assistance.

Federal agencies can help each employee repay up to $10,000 per calendar year, with a lifetime maximum of $60,000 per employee.

That said, federal agencies differ in how much they’ll repay. Ask your boss or HR department for more information about assistance amounts.

Military service

Most people have heard of the GI Bill. This covers all tuition and fees for students attending in-state public schools. It can cover out-of-state and private costs as well, but may not go as far.

The GI Bill may also provide allowances for housing, books, supplies, and some other costs.

Beyond the GI Bill, active duty military and veterans have plenty of ways to get government assistance with their loans:

Servicemembers Civil Relief Act (SCRA) Rate Cap: Any loans acquired before military service have rates capped at 6% while on active duty

Military Service Deferment: During certain periods of active duty and immediately after, you can defer loans.

0% Interest: If serving in a hostile area that qualifies for special pay, you don’t have to pay interest for up to 60 months.

Department of Defense Loan Repayment: The DoD may repay some or all of certain military members’ loans under specific circumstances.

Veterans Total and Permanent Disability Discharge: Veterans with service-related disabilities can have all of their federal and some private student loans discharged.

Active duty and veterans may also qualify for PSLF.

Education tax deductions and credits

The IRS knows education costs money, so students and families have plenty of tax breaks at their disposal.

One of the easiest is the student loan interest deduction. If you paid interest on student loans you took out for yourself, your spouse, or a dependent, you can deduct up to $2,500 of that interest per year from your gross income.

Education tax credits like the American Opportunity Credit and Lifetime Learning Credit can take your savings further. These are dollar-for-dollar payments that can reduce your tax owed if you spend money on qualifying education expenses during the year.

Finally, tax-advantaged education savings accounts like 529 plans let you invest money for college and let it grow tax-deferred.

These types of accounts generally let you spend the money tax-free if used on qualifying education expenses, like tuition and fees.

Government agency volunteer programs

Certain government agency volunteer programs may help you with your loans if you volunteer.

For instance, Americorps volunteers can earn a Segal AmeriCorps Education Award after completing service with AmeriCorps VISTA, AmeriCorps NCCC, or AmeriCorps State and National. The award amount is always equal to the max Pell Grant award amount for that year. In 2022, that’s $6,435.

Other government volunteer programs like the Peace Corp may qualify you for loan forgiveness programs we talked about earlier.

Refinance and consolidate

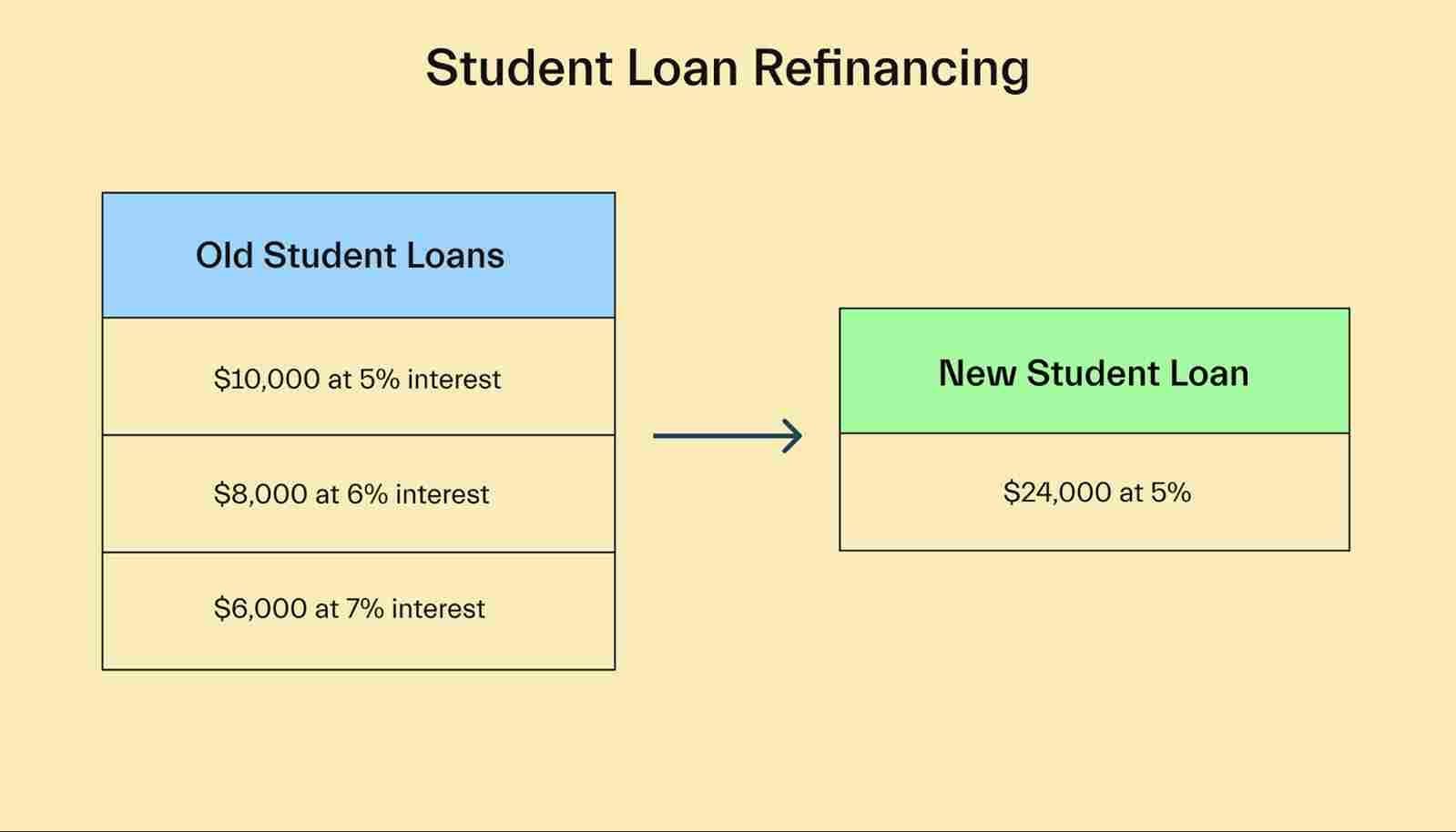

Refinancing student loans means getting a new loan at a lower rate to pay off those old loans. You essentially swap your current rate for a better rate to reduce your monthly payment and save on interest.

Many who refinance also consolidate their loans, meaning they pay off existing loans with one large loan, combining several loans into one.

This streamlines your loan payment. It’s easier to track your progress on loans, and you’re less likely to forget to make payments.

The federal government offers Direct Consolidation Loans that let you consolidate all your eligible loans into one at no cost.

As for refinancing, you can only refinance federal or private loans with a private lender. Check that the rate you get is lower than the weighted average of the old loans, and make sure you’re fine with losing eligibility for income-driven repayment and other federal loan benefits. Also, read the fine print in the contract carefully to see if the promised low interest rate won’t grow higher over the years.

No HEROES Act For Now…

The HEROES Act is still sitting in the halls of the federal government. We can’t know for sure when it’ll go through or if it’ll even survive the rest of the lawmaking process.

For now, the best you can do is look for ways to ease your student loan debt through the government and private sources.

Mos can help you get as much free money for college as possible by helping you apply for financial aid, grants, and scholarships—all in one place. Plus handpicked gigs for students to help you earn even more once you start classes.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you