Financial aid •

Grand Valley State University financial aid: a complete guide

Read all about financial aid at Grand Valley State University, including scholarships, loans, and grants.

Located in Allendale, Michigan, Grand Valley State University is a public research university with more than 22,000 enrolled students. The school boasts small class sizes and offers financial aid to more than 95% of its students, helping to keep educational costs as low as possible.

If you’re in high school and think that you want to go to Grand Valley State but don’t know how you’ll afford the cost, we’re here to help out. We’ll break down what you need to know.

A snapshot look at Grand Valley State University

Grand Valley State University was established about 12 miles west of Grand Rapids, Michigan, in 1960. The school is one of the 100 largest universities in the US and serves students from Michigan and around the world.

Students at GVSU can enjoy a small average class size of 26 and get involved in faculty research. A full quarter of GVSU students participate in research while studying at the school. GVSU has something for everyone, as students who want to learn more about other cultures and parts of the globe can join one of the school’s more than 4,000 study abroad programs.

Outside of academic programs, students can join or watch the school’s 21 NCAA Division II sports teams or participate in one of its 42 different club sports. Students who aren’t interested in sports can join one of the school’s more than 400 student organizations, such as the American Society of Mechanical Engineers, the Anchored in Poetry slam team, the Archaeological Society, or the Baseball Analytics club.

Ranking: 263rd in National Universities

Demographics: 41% male, 59% female

Acceptance rate: 92%

Average GPA of accepted student: 3.52

Key dates and deadlines (2022)

Application: May 1

Financial aid deadlines: March 1 priority deadline

A look at scholarships offered by Grand Valley State University

Paying for college is hard. On top of tuition, which can run tens of thousands of dollars per year, you need to pay for housing, food, books, and other personal expenses while you’re living at school. In many cases, families save for years and still don’t have enough cash to cover the cost of an education.

That’s why the best thing you can do to earn more money for college is to win scholarships.

Scholarships are like free money that you can use to pay for tuition and other college expenses. They’re not like loans, which you have to pay back. There are many sources of scholarship funding, including schools, businesses, and community organizations.

There are 2 main types of scholarships: merit-based and need-based.

You earn merit-based scholarships through achievements, such as getting good grades in high school or being a good athlete. Need-based scholarships are awarded to students based on their financial situation and how much help they’ll need when it comes to paying for college.

GVSU is very generous when it comes to awarding financial aid. It claims that more than 95% of its students receive some form of financial aid to attend the school. Its financial aid office maintains a list of institutional grants and scholarships that you can apply for. This database includes both internal and external opportunities.

External opportunities come from local companies and organizations that offer scholarship programs. You can also search for scholarships on your own. With some careful searching, you can find a scholarship for almost anything you can think of.

Scholarships are one of the best ways to pay for college, so check out our financial aid tips and tricks page for more info on earning scholarships and other college funds.

Student loans

While scholarships are the best way to pay for college, relatively few students wind up earning a full ride. If your scholarships and savings aren’t enough to cover the cost of your degree, the next step is to borrow money.

The drawback of borrowing money through student loans is that you have to pay them back eventually, plus interest. However, if you consider the loan an investment in yourself, you can see how getting one might be worth it.

GVSU’s financial aid office also has a webpage that breaks down student loan options.

In general, the best student loan program is the Federal Direct Loan Program. Like the name implies, these loans go to students directly from the federal government. There are 2 types of loans in this program: subsidized and unsubsidized loans.

Subsidized loans are the better of the 2. With these, the government pays the interest for you while you’re still in school. With unsubsidized loans, however, interest starts to build up as soon as you get the loan, which makes them more expensive.

These loans also have other benefits. For example, you can sign up for income-driven repayment plans that limit your maximum monthly payment to a percentage of your income. You might also be able to qualify for loan forgiveness.

In some cases, the government doesn’t lend enough to pay for the full cost of college. If that happens, you can also consider private student loans. However, these should be a last resort.

Private student loans tend to be more expensive than federal loans because they carry higher fees and interest rates. Private lenders also don’t offer loan forgiveness or income-driven repayment plans. Most students should max out their federal borrowing before applying for private loans.

Read our article on student loans before you get a student loan. We break it all down (and in plain English) to make sure you understand how loans work.

FAFSA

If you need help paying for college, filling out the Free Application for Federal Student Aid (FAFSA) is the most important thing that you can do.

The FAFSA is a universal student aid application that the government and most universities use to make decisions about financial aid. The information included in your FAFSA can make you eligible for federal grants, scholarships, and loans.

When you fill out the FAFSA, you’ll need to sit down with your family and provide a lot of financial information. That information includes details about your family’s income and how much you’ve saved up for college. The information you provide goes through a complicated formula to produce your Expected Family Contribution (EFC) to the cost of your education.

Subtract your EFC from the cost of attendance at the college of your choice, and you’ll find your total financial need. Your financial need is usually used when determining eligibility for need-based aid, like grants and subsidized loans.

Keep in mind that most colleges don’t commit to meeting 100% of their students’ financial needs. You’ll have to come up with the rest of the money some other way, such as through loans or merit-based scholarships.

You can start filling out the FAFSA as soon as October 1 for aid awarded in the next academic year. That means October 1, 2022 is the start date for aid awarded for the 2023-2024 year.

The application deadline is June, but it’s usually a good idea to submit the form as soon as you can. Many programs offer aid on a first-come, first-served basis, so faster applicants can get more aid. Michigan specifically has a May 1 deadline, so be sure to file by then to qualify for aid from the state.

The FAFSA is a long and complicated document. If you need a hand with it, check out our article on how long it takes to complete the FAFSA.

Grand Valley State University financial aid FAQs

We’ll answer a few more questions you may have about getting financial aid at Grand Valley State University.

What is Grand Valley State University’s cost of attendance?

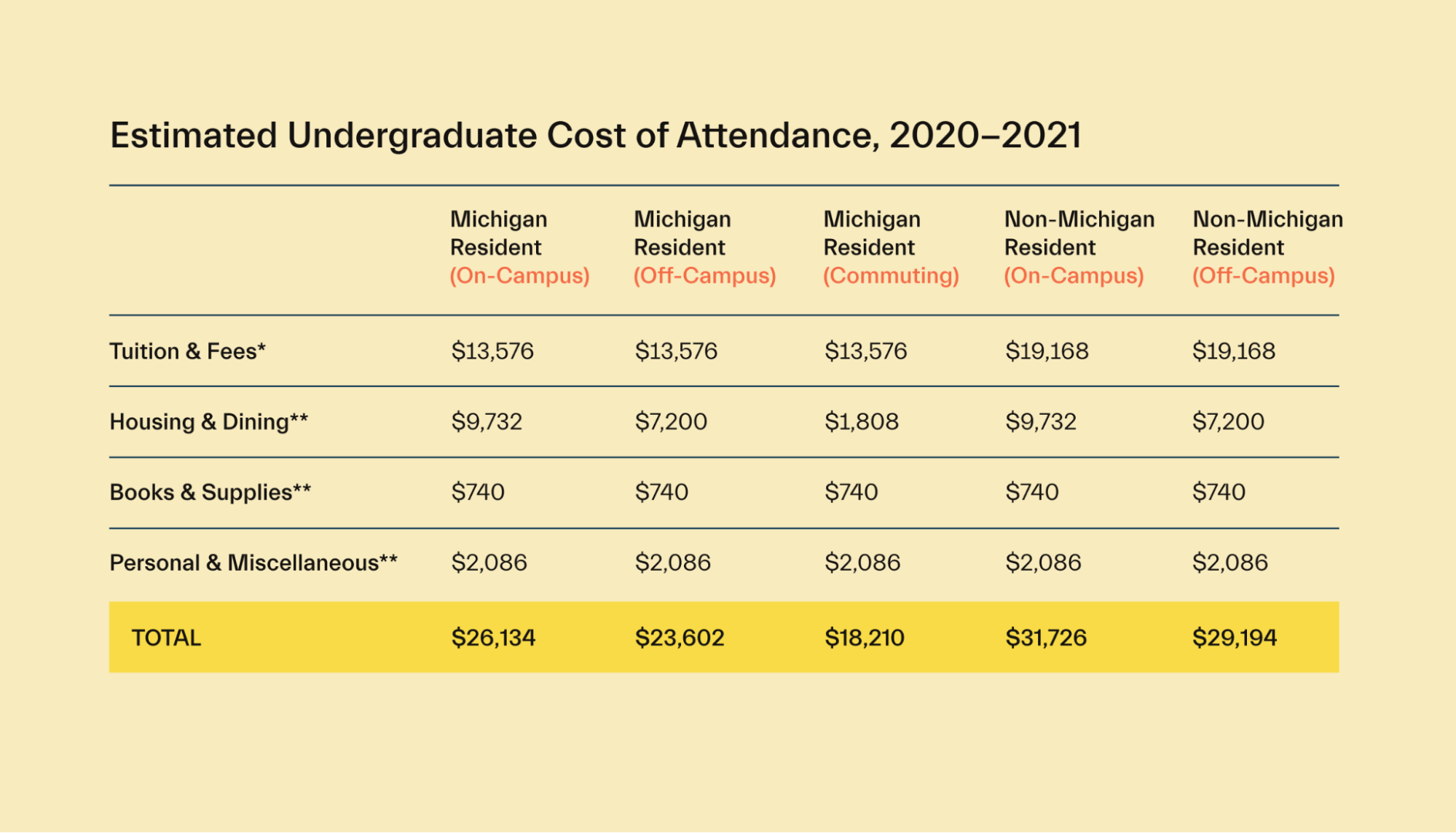

The cost of attendance at GVSU ranges from $18,210 to $29,194, depending on the student’s situation. Michigan residents pay a reduced tuition rate of $13,576, while out-of-state students pay $19,168.

One unique thing about GVSU is that tuition changes based on the number of credits you’ve earned. Prior to earning 55 credits, in-state and out-of-state students will pay $13,953 and $19,856, respectively, for tuition in 2022. Once they’ve earned 55 credits, their tuition will increase to $14,652 and $20,540, respectively.

How many students get a full ride?

GVSU doesn’t publish information about how many students get a full ride, but it is generous with the financial aid it awards.

More than 95% of students receive some form of aid. 53% of students get need-based aid, with the average need-based aid totaling $8,865.

When will I know my financial aid awards?

Incoming students who submit their FAFSA will receive financial aid award notifications in January. You may receive additional aid after this date because some scholarship applications are due in March.

What types of aid can I get from Grand Valley State?

GVSU offers both need-based and merit-based financial aid to students in the form of scholarships and grants. You can apply for merit-based scholarships through March 1 of the year prior to the award date.

Can I receive a federal grant at Grand Valley State University?

Yes, students at GVSU can receive federal grant aid to help cover the cost of their education.

Are there any ways to reduce student costs?

GVSU keeps tuition low for in-state students, but it offers other advice to students who wish to reduce the cost of their education. For example, it estimates that commuting students will spend as much as $8,000 less than those who live on campus.

Students who find their own off-campus apartment with roommates can also save over on-campus students.

Can out-of-state students receive financial aid?

Yes, financial aid eligibility, such as federal aid and scholarships from the school, includes students from outside of Michigan.

Universities like Grand Valley State University that you might be interested in

Michigan State University

Michigan State University is another well-known public university located in Michigan. It boasts top rankings nationally, earning the 32nd spot for public universities in the United States and a top 100 spot globally.

One exciting program at Michigan State is its nuclear science program for grad students, which is known as one of the top programs in the field. Even if you don’t continue to graduate school, roughly 95% of recent grads find employment shortly after school, beating the national average and making Michigan State a great place for career-minded students.

Ferris State University

Ferris State University is another Michigan-based public university. The school was founded as the Big Rapid Industrial School before becoming the Ferris Industrial School and later Ferris State University.

Students at Ferris State can study different topics, even those outside of industry. IT offers 7 colleges, including the College of Arts, Science, and Education, the College of Business, and the Michigan College of Optometry, meaning every student can find a course of study that appeals to them.

University of Michigan

The University of Michigan, located in Ann Arbor, is perhaps Michigan’s best-known public university.

As the #3 undergraduate university in the US, the school has a competitive admissions process, with an average SAT score of 1400-1540 and an average GPA for admitted students of 3.9.

If you’re looking for a well-priced but high-quality education, the University of Michigan is a great choice.

Conclusion

GVSU is an exciting option for students who want to attend a big school at a low cost. It keeps tuition affordable for both in-state and out-of-state students and gives almost every single student some form of financial aid. Those factors combine to make a degree from GVSU a great value.

From FAFSA to filing appeals, you can do the financial aid stuff on your own. Want an expert to take over? That's cool too--and where Mos financial aid advisors come in. Work 1-on-1 with an advisor who’ll review your annual aid offer, draft custom tuition negotiation letters, and more. Explore Mos memberships to get started.

To get started, check out Mos to learn more.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you