Student loans •

June 20, 2022

Goodwill letter for student loans: what it is and a template to get started

Made a late student loan payment? Check out this guide from Mos to find out how you can send a goodwill letter.

Student loans can turn out to be a big debt liability for a lot of graduates, and making payments can be a real struggle for some people. Unfortunately, you can’t afford to miss any student loan payments, or your credit score will get absolutely hammered.

That being said, there’s one way you might be able to prevent further damage to your credit score if you’ve missed student loan payments—and that’s to submit a goodwill letter.

It’s important to bear in mind that a goodwill letter isn’t a guarantee you’ll get what you want. But if your request is approved, your lender could end up asking credit bureaus to take late payments off your credit history.

This guide explains what a goodwill letter for student loans is, whether they work, and how to write a goodwill letter for student loans.

What is a goodwill letter for student loans?

Simply put, a goodwill letter is a written request you can send to a lender asking them to remove an overdue loan payment from your credit report.

When you fail to make a payment on a loan, your lender will typically report that overdue payment to the 3 big credit bureaus: Equifax, Experian, and TransUnion.

This matters because other lenders and service providers pull credit reports from these bureaus to decide whether to extend you credit or a particular service. We’re talking about anything from buying a car or getting a mortgage to utilities service plans—and if those companies don’t like what they see on your credit report, you may get denied service (or get a worse deal).

That’s why you want to do your best to avoid any black marks on your credit report. But if you miss a student loan payment, those marks will usually start to appear. Writing a goodwill letter is essentially a roll of the dice to try and minimize the damage.

You can submit a goodwill letter to your lender for any number of loan products—including a student loan, mortgage, car loan, or anything in between. When you send your letter, it’s important to bear in mind that there’s no guarantee of success.

If your lender acknowledges your letter and agrees to remove the overdue payment on your credit report, it’s essentially an act of their own goodwill. They aren’t legally obligated to do anything.

But if your lender decides to strike a late payment off your credit report, your credit should rebound almost instantly. On paper, it’ll look like your payment was never missed at all.

Do goodwill letters work for student loans?

Unfortunately, there’s no guarantee that a student loan goodwill letter will actually work.

When you send a goodwill letter for a student loan, the decision on whether to accept your request will be completely up to your lender. It’s possible they’ll be totally unsympathetic to the circumstances which caused your late payment.

That being said, you could end up finding a sympathetic reader at the other end of your letter. This is much more likely if your late student loan payment was caused by unexpected circumstances. For example, maybe you lost your job, got sick, or had a bereavement.

If you’re able to honestly and politely explain what happened and why, you may be surprised to find your lender will be receptive to making a goodwill adjustment.

There aren’t really any concrete numbers that illustrate the success rate of goodwill letters—because they’re all decided upon behind closed doors on a case-by-case basis. There might be some student loan providers who are more receptive to goodwill letters than other providers.

But at the end of the day, those who don’t ask don’t get. Translation: there’s no harm in trying, right?

To maximize your chances of success, it’s important that you own up to any mistakes you’ve made which led to the late payment. Where an extraneous circumstance caused the late payment, provide assurances to your lender that missing a payment is a rare occurrence for you—and demonstrate a payment record to back that claim.

It’s also important that you get in touch with your student loan provider as soon as you see your credit score has been affected or you’ve received a late payment charge on your loan account. In many cases, your lender is likely to be more understanding if you reach out to them quickly to try and address the problem.

You should also bear in mind that borrowers aren’t the only ones who make mistakes. It’s also possible that a late payment was reported to a credit bureau as an error on the part of your loan provider. If this happens, you can dispute that report directly with the 3 big credit agencies over the phone or via email.

How to write a goodwill letter for student loans

Let’s say you’ve noticed a negative mark on your credit report. The first thing you need to do is get in touch with your lender as soon as possible to find out what’s happened.

If you think the black mark is an error, let them know. But if they’re able to explain to you that the report was genuine, it’ll then fall upon you to make the next move.

On the one hand, you could just choose to take the hit and try to rebuild your credit. On the other hand, you might go for one last roll of the dice by submitting a goodwill letter to your lender.

As we’ve already mentioned, the success of your student loans goodwill letter is pretty difficult to predict. But a number of factors are going to dictate whether or not your request gets approved. These include who’s reading your letter, your payment history, the rules set by your lender, and the content you include in your letter.

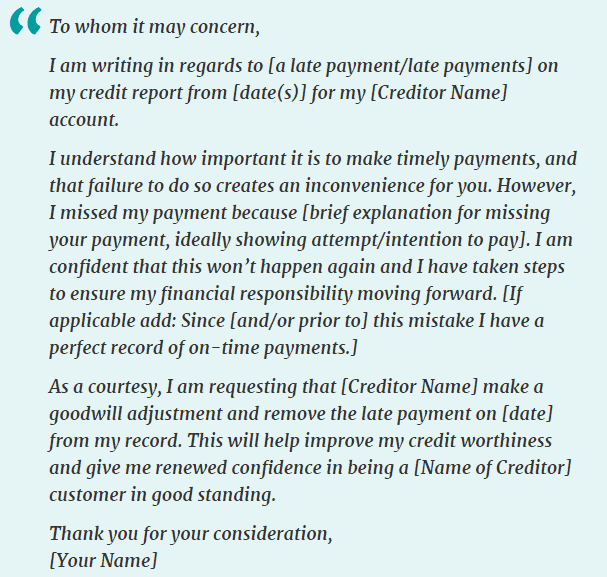

To help you get started, we’ll run you through all the basic information your letter needs.

What information do you include in a goodwill letter for student loans?

The first thing you have got to include in your goodwill letter is personal information. This will ensure that your lender can understand who you are and quickly access your account to understand your particular situation.

To do that, they’ll need your full name, account number, and other identifying information that might be relevant to that particular lender. For example, your student loan provider might also need your phone number, address, or account type.

Speaking of addresses, it should go without saying that you’ll need to include the address where your goodwill letter must be sent. If you’ve phoned your lender to ask about your credit ping, you should ask them for their representative’s name and address so you know where to send your letter and to whom you should address it.

When it comes to goodwill letters, personalization can go a long way.

Next, you need to include details about the late payment. Outline the date on which the late payment occurred. If possible, include any documentation that proves the late payment went through when you say that it went through.

You must then list the reason (or reasons) for that late payment. The more specific, the better. For example, did you miss a student loan payment because you got laid off at work? Did you miss a payment because you got sick and ended up in the hospital? Did you have a family emergency and need to travel overseas?

No matter what your situation was, your goodwill letter is where you need to spell out that situation explicitly.

Your goodwill letter then needs to include a clear and concise request for removal. A goodwill letter is no place to be coy or nonspecific. Tell your lender exactly what you’re asking them to do. It may help your chances to outline to your lender why you want to keep your credit score high and how the ding impacted your credit score.

For example, maybe you want to apply for a mortgage, and you’re relying on a good credit score to keep your interest rate as low as possible.

Finally, your goodwill letter has to show proof that you’ve made payments. Put simply; you need to show you’re good for the favor.

By reminding your lender that you have a history of making on-time payments, you’re demonstrating that you have the ability to pay back your loans. By showing how responsible you normally are with your credit, you’re going to maximize your chances of getting your request approved.

What supporting documentation should you include with your goodwill letter?

Depending on who your lender is, you might need to give them some form of proof of your claim before your request can be accepted.

For example, let’s say you ended up in the hospital and missed a payment because of it. In addition to explaining all of this in your goodwill letter, it’s normally worth including some documentary proof alongside your letter. This could be a hospital admission letter, an itemized bill, or even a note from your health insurance provider.

Likewise, if you were in a car wreck, you might consider including a copy of a police report or documentation from your car insurer.

This isn’t always required by student loan providers. But after considering your letter, lenders will often get in touch to ask for proof of your claim before approving the removal of your missed or late payment.

By including these documents from the get-go, you’ll cut out a step of the process—and hopefully get a positive result quicker.

How long does it take to get a response to a goodwill letter?

Remember how we’ve already said that you should be sure to send your goodwill letter as soon as you realize there’s a problem? Well, the reason you have to get your letter in quickly is that there’s no telling how long it’ll take to get a result.

In some cases, it can take a lender weeks to submit a response to your request. If it’s been a while and you haven’t heard back about your goodwill letter yet, it never hurts to follow up.

Give your contact a call and politely remind them you’ve submitted a goodwill letter and are awaiting a response. This should allow you to either get an update or give them a helpful reminder that it’s sitting on somebody’s desk.

It’s also important to remember that there’s a chance your lender won’t approve your request. They should still get in touch to let you know your request has been rejected.

If your request is approved, it may take a while for your lender to action the goodwill request. But once the request has been actioned, your credit score blip should disappear almost instantly.

If your request is rejected, you’ll need to move forward and try to find a way to rebuild your credit. Your first step will be to ensure you’re making on-time payments moving forward. It also helps if you avoid maxing out your credit cards.

Whether your goodwill request has been approved or not, it’s critical you get in touch with your lender if you’re struggling to make loan payments. Your lender might be able to offer a solution, such as adjusting your monthly payments. You may also be eligible for loan forbearance or deferment.

By striking an agreement, you may be able to prevent any more damage to your personal credit.

Conclusion

Your creditworthiness is pretty important—it dictates the rates you’re able to get for a mortgage, a car loan, a loan for new tech, or anything in between. If your credit’s no good, you might not even qualify in the first place.

That’s why it’s critical you do everything you can to keep your credit report looking squeaky clean. But making a late payment on your student loan is going to ruin that squeaky clean record.

Sending your lender a goodwill letter isn’t a sure thing. But if it’s successful, you can get any negative blips removed from your report and move forward. Just make sure to include all the essentials in your letter, including any supporting documentation. Remember to be direct but polite.

Do you want to learn more about financial aid and keeping on top of your finances? Check out Mos.com now.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you