FAFSA •

How to fill out the FAFSA with divorced parents

The FAFSA is your ticket to financial aid. You’ll likely need to include your parents’ information, but what if your parents are divorced or separated?

The Free Application for Federal Student Aid (FAFSA) is your ticket to all forms of federal financial aid.

To get grants, work-study, and even student loans, you’ll first need to fill out the FAFSA.

Most students will be considered “dependent” students, which means they’ll need to include their parents’ or legal guardians’ information on the FAFSA.

But what happens if your parents are divorced or separated? How do you submit the FAFSA with divorced parents?

Do I need to report my parents’ information on the FAFSA?

Most students need to include their parents’ information, but this isn’t necessarily the case. Before we dive into the specifics for divorced parents, it’s important to understand whether you need parental information at all. It all depends on your FAFSA dependency status.

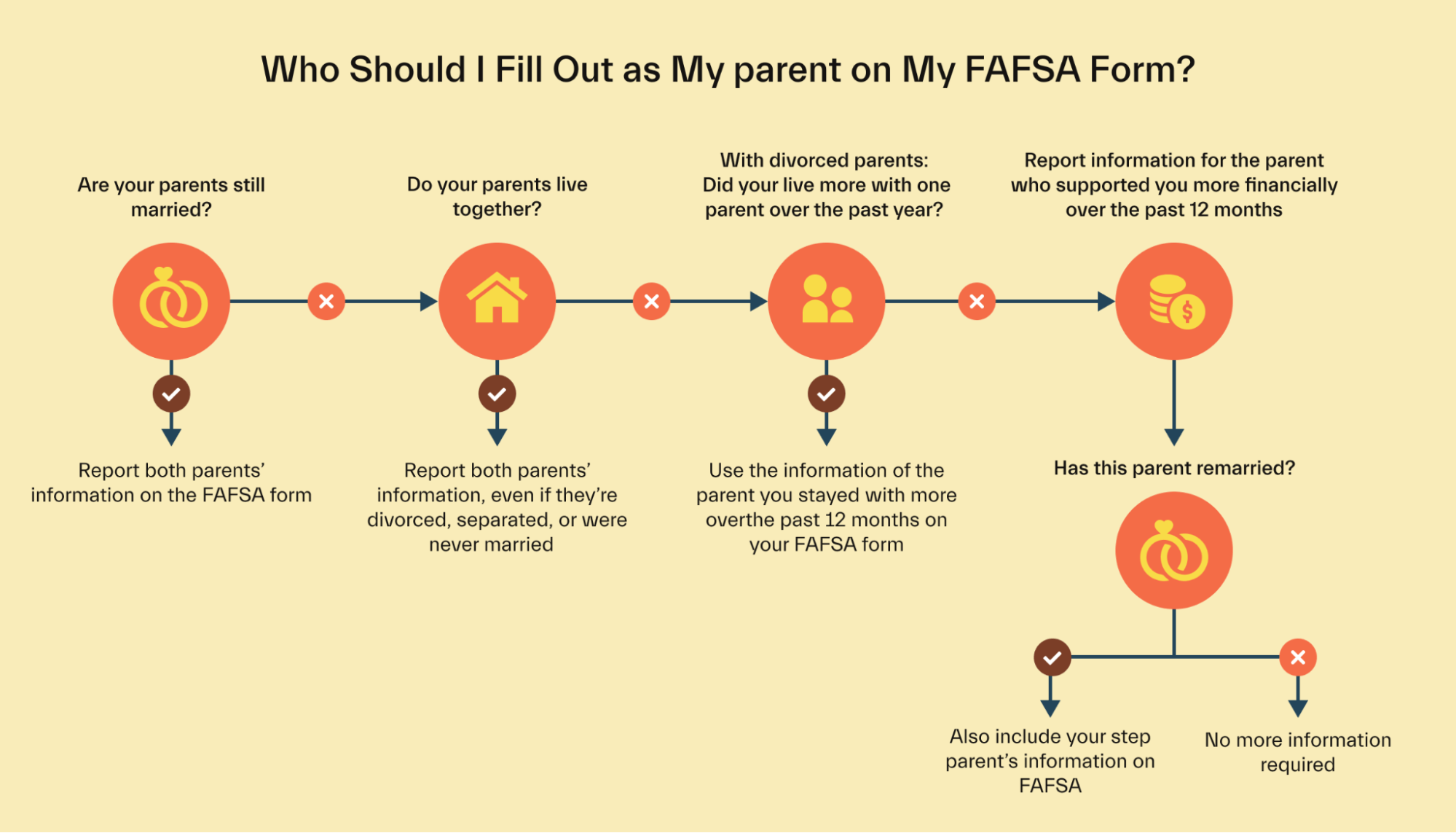

You need to include your parents’ information on your FAFSA if you’re considered a dependent student by the federal government. You can use this graphic to figure out who you should list as your parents on the form:

Dependent students are expected to receive financial support from their parents, and must therefore include parental information on their FAFSA.

Even if your parents won’t be helping you pay for school, you still need to include their information if you’re dependent.

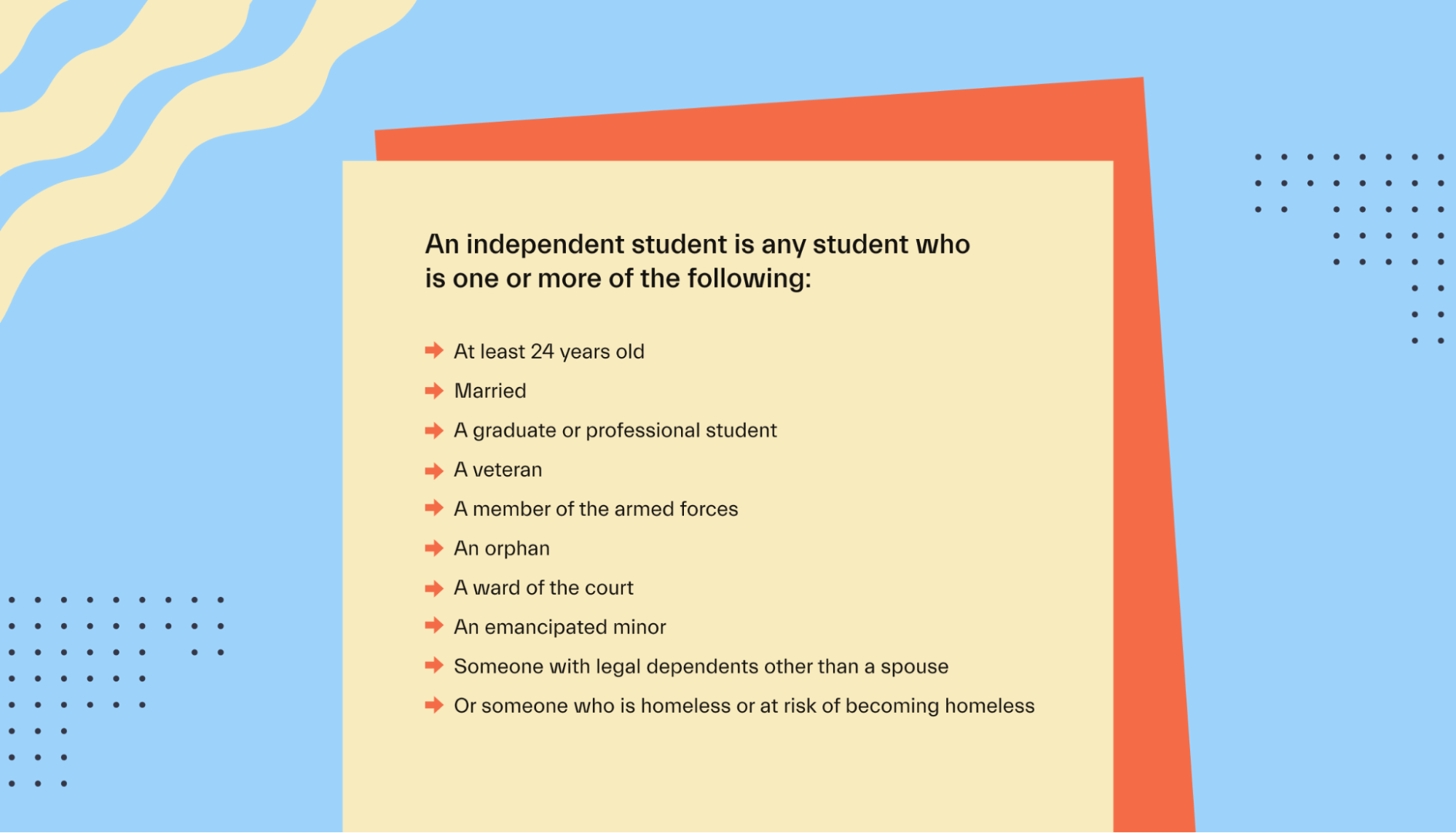

An independent student is any student who is one or more of the following:

At least 24 years old as of January 1 of the current calendar year

Married

A graduate or professional student

A veteran

A member of the armed forces

An orphan

A ward of the court

An emancipated minor

Someone with legal dependents other than a spouse

Someone who’s homeless or at risk of becoming homeless

You can use the full checklist here to determine dependency status

If you check any of the boxes above, you’re likely an independent student and can fill out the FAFSA without parental information.

If you don’t check any of the above boxes, you’re considered a dependent student. You’ll need to include your parents’ information on your FAFSA.

Who is considered a parent?

For FAFSA purposes, your parents are considered your biological parents or adoptive parents. It could also be your legal parent as determined by the state—for example, the individual listed as the parent on your birth certificate.

You should report information for both parents if:

Your parents are married

Your parents live together (married or not)

If your parents are divorced, the process is a bit different. Here’s what you need to know.

Why does it matter if my parents are married or separated?

The FAFSA is designed to determine how much federal financial aid you are eligible for.

To do this, it looks at your income, asset information, and the information of those in your household. Essentially, the FAFSA tries to estimate how much financial support your household might contribute to your college education.

Before it can do this, the FAFSA needs to first determine who it will consider your “parents.” That could be both your biological parents, your mother and a step-parent, or just your dad as your custodial parent. It all depends on the factors discussed in this article.

How does FAFSA define “divorced” or “separated?”

When it comes to filling out the FAFSA, parental marriage status is less important than whether or not they live together.

The FAFSA primarily asks about marriage status as it relates to parental living situations. The options are:

Unmarried and both legal parents living together (use this if your parents live together, and report information for both parents on your FAFSA)

Married or remarried (use this if your parents live together and are married, and report information for both parents on your FAFSA)

Divorced or separated (use this if your parents are separated and don’t live together, and report the information for the parent you’ve lived with the most in the past 12 months)

Full details can be found on the reporting parent information page of StudentAid.gov.

What about step-parents?

If a student has a step-parent that’s currently married to their legal parent, they must generally report information about that step-parent. This only applies if you’re reporting the information of that legal parent, however.

For example, if your parents are divorced and you live with your mom (who has remarried), you’d report your mom’s information and her partner’s information. If you don’t live with your dad, you wouldn’t report his information—nor his partners’ information.

If the step-parent is divorced from the legal parent, no reporting is required (but the student’s biological parents’ information may need to be reported).

What about same-sex marriages?

The same rules apply to same-sex couples as to opposite-sex couples.

The FAFSA uses gender-neutral questions relating to parents (“Parent 1” and “Parent 2”). It doesn’t matter which person completes which set of questions.

How to fill out the FAFSA with divorced parents

All students complete the same application for student aid. The application asks a series of questions to determine aid eligibility, many of which are based on household income.

In determining your eligibility for aid, the FAFSA uses the income and asset information of your parents. The specifics of whose information you report can vary, depending on your parents’ marital status and whether or not they live together.

For married couples, the FAFSA considers income from both parents.

For divorced parents, the FAFSA may consider income from both parents or from just one. The distinction depends on the parents’ living situation.

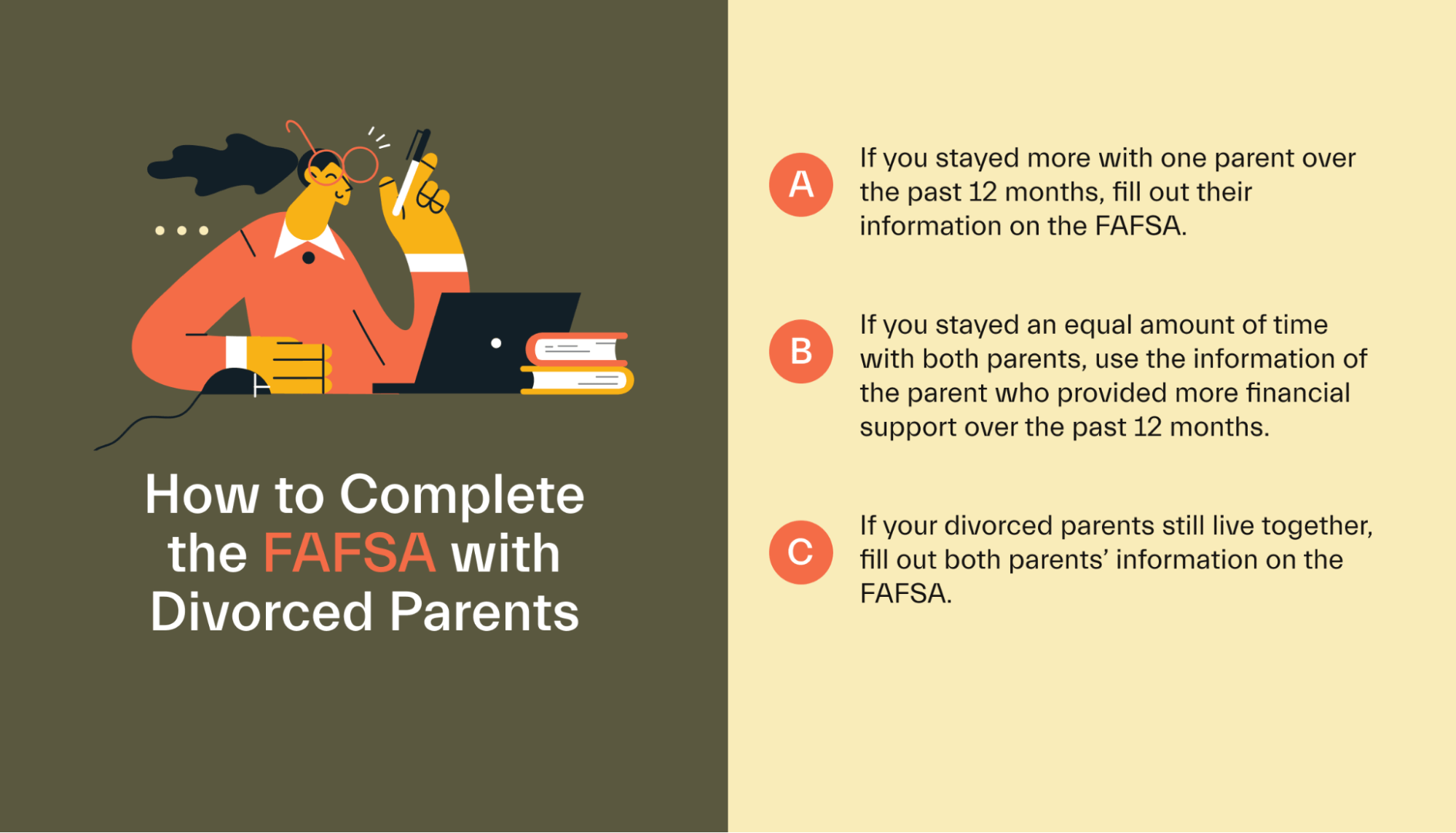

If your parents are separated/divorced but still live together, you’ll report information for both parents.

If your parents are separated/divorced and don’t live together, you’ll report information for only one parent. This parent should be the one you’ve lived with the most in the past 12 months or the one who provided the most financial support in the past 12 months.

We’ll break this down in more detail below.

Divorced/separated parents who live together

If your parents still live together, you need to report information for both of them—regardless of whether they are married or not.

In this case, select the option for “Unmarried and both legal parents living together” when asked about your parents’ marital status. Include all financial information for both parents.

Divorced/separated parents who don’t live together

If your parents don’t live together and are separated, you generally only need to include information for one of them.

In this case, you’ll answer FAFSA questions for the parent you’ve lived with most for the past 12 months.

If you’ve lived with both parents equally, report information for the parent who provided the most financial support in the past 12 months.

If you don’t live with your parents at all, report information about the parent who provided the most financial support in the past 12 months.

FAFSA eligibility always looks at the preceding 12 months. So, this information can change each year. Be sure to revisit these questions each year that you complete the FAFSA.

Unlike the FAFSA, the CSS profile has no standard ruleset for determining who is your custodial parent, as different colleges and states have varying requirements.

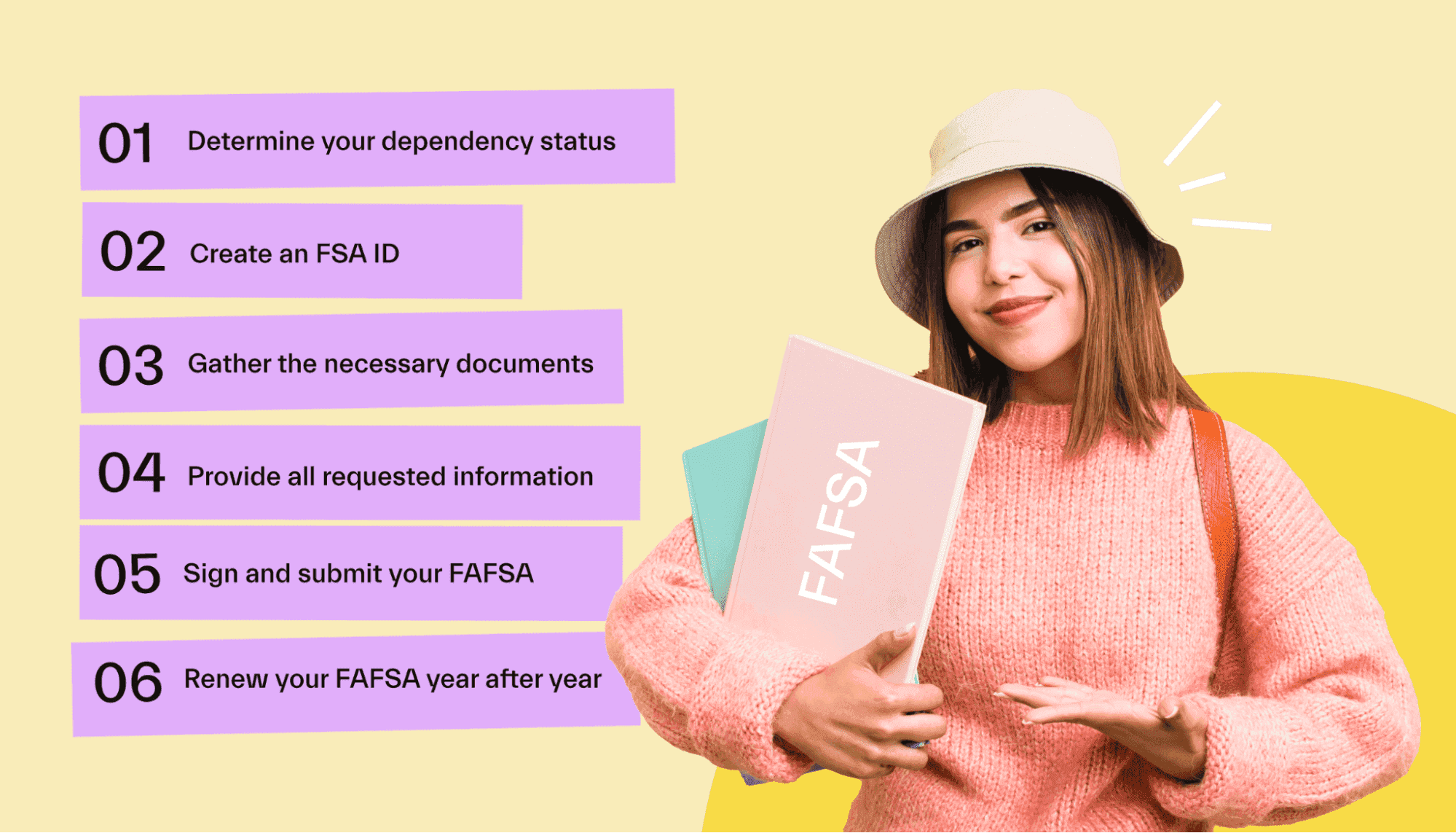

FAFSA step-by-step

The Free Application for Federal Student Aid (FAFSA) is important for all students to fill out. And you need to fill it out each year!

You can submit the FAFSA online or by mail. It’s faster to tackle it online. It should only take an hour or so to complete the application, as long as you have your information ready.

1. Determine dependency status

The first step is to determine your dependency status. That will tell you whether or not you need to include your parents’ information. Your parents are your legal parents, birth parents, or the parents listed on your birth certificate.

If you’re dependent, you’ll need your parental information. If you’re independent, you’ll only need your personal information.

The graphic below shows who qualifies as an independent student.

This status should be reviewed each year you submit the FAFSA. If your circumstances change (i.e., you get married or turn 24), you’ll no longer be dependent and will no longer need your parental information.

2. Create an FSA ID

The FSA ID is your login username and password for your Federal Student Aid account. You’ll use this to log in to the FSA website and also to digitally “sign” your FAFSA when you submit it.

You can create an FSA ID here (full instructions here). It takes just a few minutes.

For dependent students, your parents will also need to create their own FSA IDs. You can send them the links above and ask them to sign up.

3. Gather necessary information

Next up, gather all the information and documents that you’ll need to submit the FAFSA.

Your information

Your social security number (or registration number for non-citizens)

Your drivers’ license number

Your federal tax returns

Information about your assets—bank accounts, investments, cash, etc.

Records of any untaxed income

Your parents’ information

Social security numbers for both parents

Copies of their tax returns

Information about their assets

Records of their untaxed income

It’s helpful to have all this information ready before you get started. But if necessary, you can save your progress on the FAFSA to come back to it later.

If possible, it’s a good idea to sit down with your parents to complete the application together. That way, you can clarify any issues as they come up.

4. Provide all requested information

It’s time to actually start the FAFSA online!

The application is clear and simply asks you to answer a series of questions. As you answer questions, the system will automatically ask for the relevant information it needs.

The entire FAFSA should take approximately an hour to complete. Make sure to double-check your answers—mistakes on your FAFSA could delay your application or disqualify you from aid. Don’t worry too much—you can make FAFSA corrections later if need be!

5. Sign and submit the FAFSA

Complete all the required steps for the FAFSA, then digitally sign it with your FSA ID. Remember to turn it in before the FAFSA deadline (June 30 each academic year). But don’t procrastinate too long—even if it’s tempting. Since a lot of college financial aid programs are first come, first serve, try to get it in as early as possible!

If you need to gather more information, you can save your progress and come back to the application later.

6. Update every year

Don’t forget that you need to update your FAFSA each academic year. Be sure to double-check your dependency status each year if anything has changed in your life.

For instance, if you got married, joined the military, or turned 24, you’re now an independent student. If this is the case, you can remove your parental information from your FAFSA when you update it for the new academic year. This might also affect your aid eligibility.

7. Consider finding help!

The FAFSA can be a bit tricky. If you want help, consider connecting with a Mos financial aid advisor.

Students who join Mos can get 1-on-1 help with the FAFSA and navigating the financial aid process. Plus, they get access to scholarships, side hustles, and so much more. Get more money for college life through Mos today!

Conclusion

Submitting the FAFSA each year is the only way to qualify for federal financial aid. Fortunately, it doesn’t take long to file the FAFSA.

If you’re a dependent student, you’ll need to include your parents’ information on the FAFSA each year.

The specifics of how to submit the FAFSA with divorced parents depend on whether or not your parents live together, among other factors.

Submitting the FAFSA is vital—and you should also get your financial situation in order before heading off to college.

And if you need help, Mos is here to help. Mos is a money app for students that helps you save and earn in college—and members can get 1-on-1 help from an expert financial aid advisor! Explore Mos memberships today to take the first step toward a brighter financial future.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you