FAFSA •

June 20, 2022

What's my FAFSA dependency and why does it matter?

Check out this guide from Mos to find out what your FAFSA dependency status is and how it affects financial aid.

If you’re trying to pay for college, chances are you’ll need some federal student aid. More than 2/3 of all college students apply for financial support from the government and their colleges using the US Department of Education’s universal application form.

The Free Application for Federal Student Aid (FAFSA) streamlines the financial application process—enabling the federal government, your state government, and your school to access your information in one place and quickly and efficiently decide how much financial aid you need to pay for school.

But one key factor that’s going to determine how much financial aid you’re able to access is whether you’re a dependent or independent student.

This guide explains the difference between a dependent and independent student, the information dependent and independent students must include in their FAFSA forms, and how to declare yourself as an independent student.

Dependent vs. independent student: what’s the difference?

Before we break down how you complete a FAFSA as an independent student, it’s important we talk about the distinction between dependent students and independent students.

In terms of federal student aid, your dependency status essentially indicates whether you’re in some way financially dependent upon your parents or guardians. This status gets determined based on the information you include in your Free Application for Federal Student Aid (FAFSA) form—and then dictates your eligibility for certain financial aid opportunities.

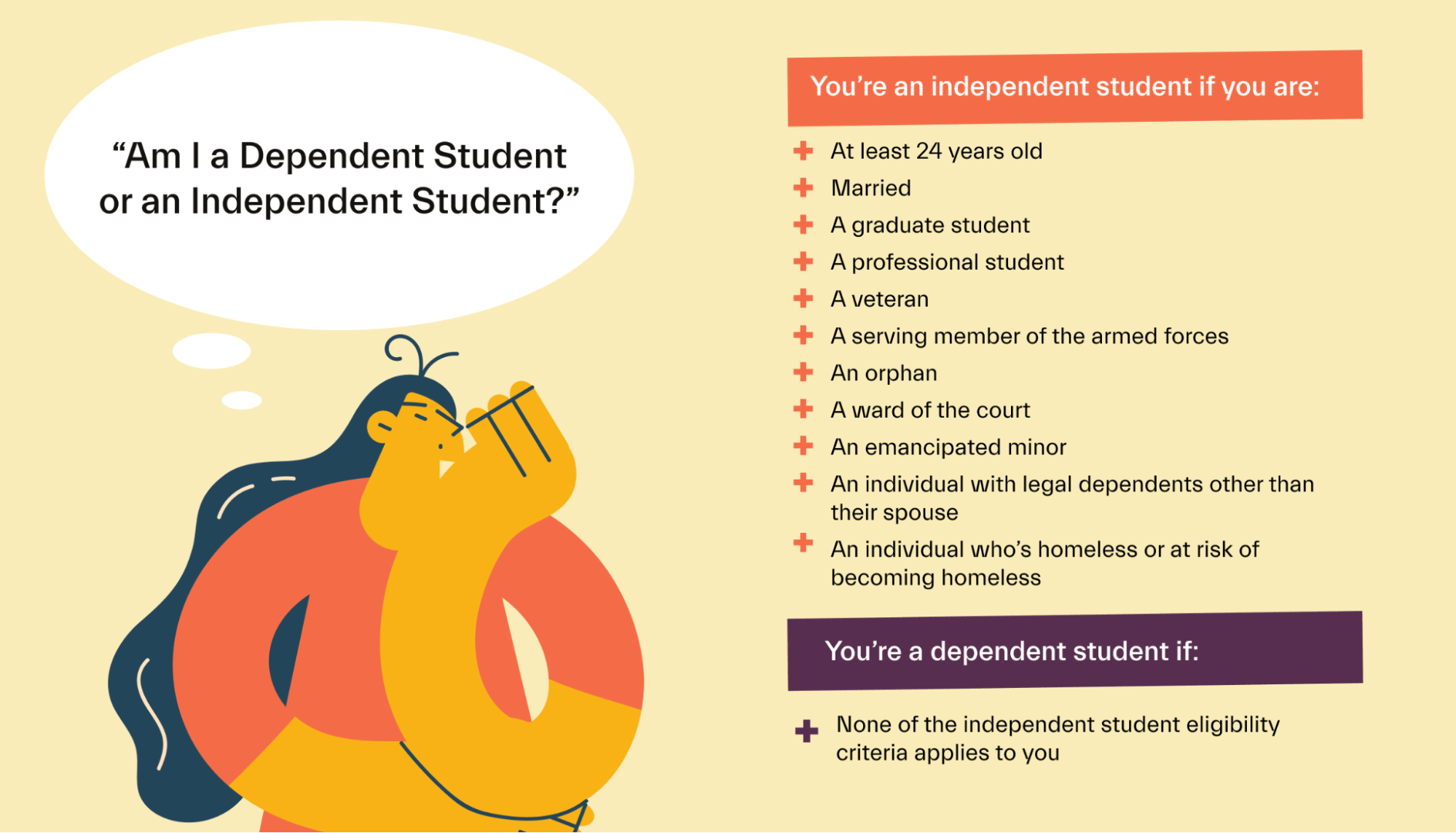

An independent student is anyone who’s considered financially independent from their parent or guardian. But the eligibility criteria to be considered an independent student for the purposes of federal student aid goes a little bit further.

The US Department of Education defines anyone as an independent student who is:

At least 24 years old

Married

A graduate student

A professional student

A veteran

A serving member of the armed forces

An orphan

A ward of the court

An emancipated minor

An individual with legal dependents other than their spouse

An individual who’s homeless or at risk of becoming homeless

As a financial aid applicant, you’ve got to fulfill at least one of these specific requirements in order to get classified as an independent student rather than a dependent student—and it’s important to note that not living with your parents or not being claimed by them on tax forms doesn’t make you an independent student for the purposes of applying for federal student aid.

Generally speaking, most students who complete the FAFSA aren’t FAFSA independent students. This is because they still receive some form of financial support from their parents and are under 24—but that doesn’t mean there aren’t quite a lot of independent FAFSA students around.

During the 2019–20 academic cycle, more than 9 million independent students applied for federal student aid using the FAFSA.

Because your dependency status is dictated by the information you include in your FAFSA, you have to carefully and honestly consider every single question on the application form.

These questions are basically the same every year, although the wording changes a little bit on an annual basis. For example, the 2022–23 FAFSA asks students whether they were born before January 1, 1999. Meanwhile, the 2023–24 FAFSA form will instead ask students whether they were born before January 1, 2000.

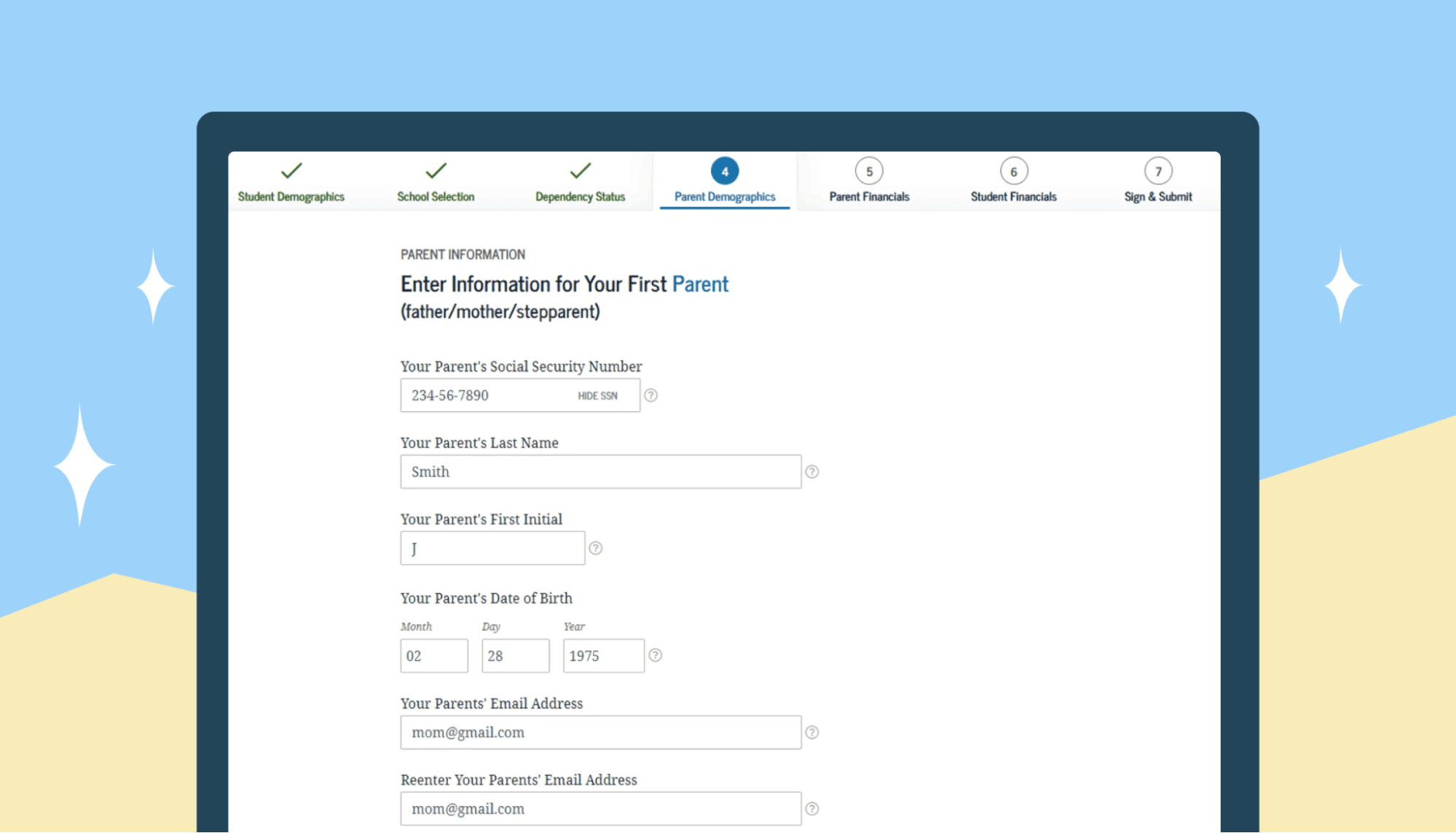

Do you have to provide your parents’ information on the FAFSA form?

You may be required to include information about your parents on your FAFSA form, but it’ll depend on your dependency status.

All of the college-funding programs offered by the US Department of Education are based on the idea that it’s primarily the responsibility of you and your family to pay for your college education. This is particularly important to bear in mind if you’re a dependent student.

That’s because federal student aid operates on the assumption that a dependent has the financial support of their parents or guardians. As a result, you’ll need to include information about your parents or guardians if you’re a dependent student.

The information about your parents will then be assessed alongside your information so that the federal government, state government, and your school can get a complete picture of your family’s ability to pay for school.

It’s important to note that your parents won’t necessarily need to pay anything for your college education just because you’re a dependent student. You’ve just got to make sure you include all of the relevant details about your parents and their financials so that the Department of Education can assess everyone in the same way.

In terms of the parent details you have to include as a dependent student, you should expect to have to report all the basics of your family’s income and the assets they own.

By contrast, independent students don't need to include their parents’ information on the FAFSA form. Instead, independent students only need to include information about their own income and assets. The only exception to this rule is if you’re married. Independent married students need to include information about their spouse’s income and assets on the FAFSA too.

So, why does your parents’ information matter so much?

In most situations, your parents will have a higher income and more financial resources than you will—especially when you’re a teenager or in your 20s. Parents and guardians also generally have higher levels of financial resources than independent students who are trying to pay for their education without parental support.

As a result, a dependent student who has parents with resources will normally receive less aid because those parental resources are factored into the student’s ability to pay for school. Some independent students may even have child dependents, which further slashes their ability to pay for school.

Because of this, the expected family contribution (EFC) of an independent student, excluding parent information, will generally be lower than the EFC of a dependent student.

Despite all of this, there’s an exception to this rule when it comes to including your parents’ details.

If you’re enrolling in a law school or getting a degree in an allied health profession, you may need to include your parents’ information on your FAFSA form—even if you’re classed as an independent student.

When it comes to federal funding, parent information is often used to help determine your financial eligibility for various types of sector-specific funding like a Health Professions Student Loan available from the US Department of Health and Human Services.

Do independent students get more financial aid?

Simply put: yes. Independent students will often get more financial aid than dependent students. But this isn’t a golden rule. In some cases, an independent student may not be offered any more than a dependent student working toward the same degree.

A student who qualifies as independent from a FAFSA point of view doesn’t need to file their parents’ financial information as part of their application. Independent students only file information about their own income and assets—and this often works in their favor.

As we’ve already touched upon, that’s because an independent student normally has a greater financial need. That also normally means they have better eligibility for various financial aid opportunities.

But a student’s dependency status doesn’t necessarily lead to more money.

Some financial aid programs don’t give your dependency status weighted value—meaning that you’d be offered the same amount whether you were financially independent or not.

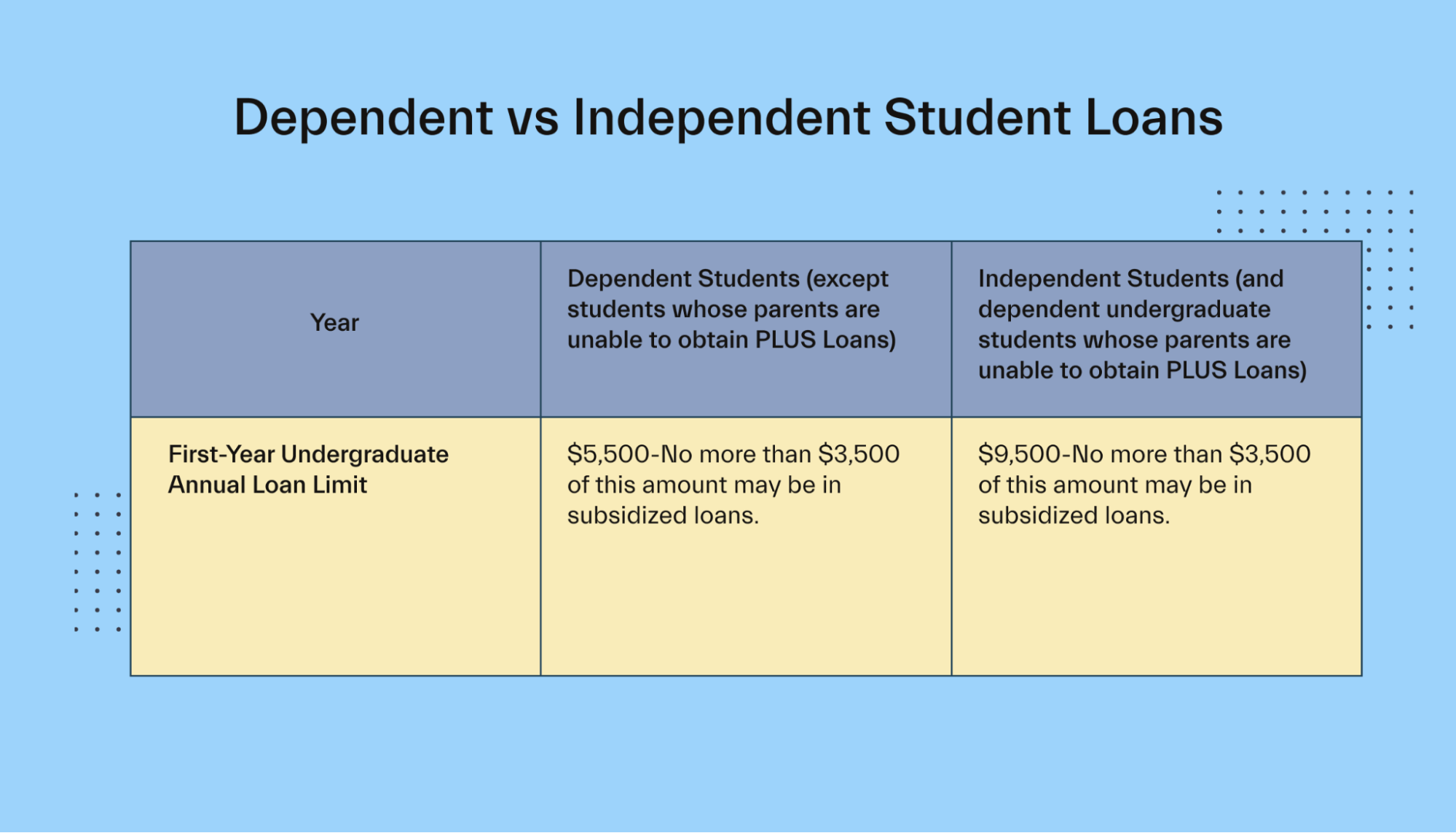

But the key program that does consider dependency status is the federal student loan program. With federal student loans, your dependency status has a direct impact on the maximum amount of federal student loans you’ll be eligible to receive.

For example, let’s take a quick look at Direct PLUS Loans.

Under the Direct PLUS Loan program, a dependent student can currently borrow up to $5,500 to help pay for tuition during their first year at college. On top of that, their parents can also borrow more through a Parent PLUS Loan.

But independent students aren’t in a position to get additional help paying for school via a Parent PLUS Loan because their parents aren’t eligible. Fortunately, the Department of Education understands that—which is exactly why the borrowing cap on Direct PLUS loans is higher for independent students.

At present, a financially independent freshman entering college or a university can borrow up to $9,500 per year. That’s nearly double the amount of a dependent student.

That being said, it’s also worth noting this higher cap can often be accessed by dependent students, too.

If you’re a dependent student and your parents or guardians aren’t eligible to apply for a Parent PLUS Loan, the government will often allow you to borrow up to the independent student cap even though you’re classed as a dependent student.

Why wouldn’t a parent or guardian qualify for a Parent PLUS Loan?

If your parents have an adverse credit history, they may not qualify for a federal student loan. Citizenship status can also come into play when applying for a Parent PLUS Loan. But the biggest eligibility requirement is that you’re the child’s biological or adopted parent.

Grandparents and legal guardians aren’t generally eligible to receive Parent PLUS Loans—even if they’re the primary caregiver responsible for raising that student.

Bearing all of that in mind, it’s likely independent students can generally expect to receive a higher financial aid package than dependent students.

But because parents are allowed to borrow any amount up to the full cost of attendance (after subtracting other forms of financial aid), an independent student without parental support might still end up with less financial aid regardless of the higher federal student loan limit.

As a result, independent students are typically advised to focus more on financial aid awards that are on offer from the school they’re attending. Work-related income is also going to be essential in paying for education-related expenses.

How can you become an independent FAFSA student?

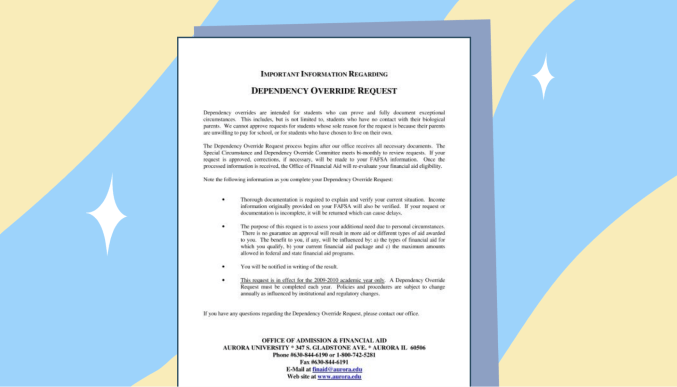

If you’re reading all of this thinking that you’d be better off financially if you were classed as an independent student, it is possible to change your status despite not meeting the typical eligibility requirements of financial independence.

In certain situations, the US Department of Education has the power to grant you a dependency override regardless of your ability to meet independent student requirements from a FAFSA point of view.

A dependency override is when your college changes your dependency status from dependent to independent.

This isn’t a common avenue students go down. According to Finaid, only about 2% of undergraduate students gain an independent status through a dependency override—and that’s mostly because the circumstances in which a dependency override is permitted are pretty specific.

These might include an abusive family environment, parental incarceration, or if parents are judged to lack the physical or mental capacity to raise a child.

It’s important to note that the following reasons are not judged sufficient to enable a dependency status change:

Your parents or guardians are refusing to contribute financially to your education.

Your parents or guardians aren’t willing to provide the necessary information for your FAFSA form or as part of the verification process.

Your parents don’t claim you as a dependent for income tax purposes.

You can demonstrate total financial self-sufficiency.

To apply for a dependency override, you’d need to request this in writing directly to the finance office at your school. The financial aid administrator at your college can help you request an override or learn more about the funding available to you despite any lack of parental support.

Conclusion

At the end of the day, it’s absolutely critical that you fully understand your FAFSA student status prior to sitting down and completing your FAFSA.

After all, if you want to make sure you get the correct amount of financial aid without any delays, you need to understand all of your responsibilities and eligibility requirements in terms of the pieces of information you must include on your FAFSA form.

Theoretically, independent students are able to get more financial aid than dependent students. But it’s important to remember that a higher loan cap doesn’t mean independent students always get more financial aid than dependent students. That’s why it’s important that you understand all of the financial aid opportunities available to you—which is where Mos comes in.

We can help you apply for hundreds of scholarships and grants and negotiate for more financial aid. Check out Mos to learn more.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you