FAFSA •

February 28, 2023

How to make corrections to your FAFSA application

Have you ever sent in the FAFSA but then realized you made a mistake on it? Keep reading to learn how to make corrections to your FAFSA application.

A college degree isn’t cheap. And if you’re like most students, you’ll need financial aid to help cover those costs.

You should start the Free Application for Federal Student Aid (FAFSA)—a form that lets you access several financial aid options with just 1 application.

We know that this form can be brutal to navigate, and mistakes happen.

If you’ve submitted your FAFSA and realize something was wrong or has recently changed, it’s not too late.

You can make corrections to your FAFSA to ensure you get the most assistance possible.

Below, we’ll look at how to tackle common FAFSA corrections, along with other information you should know to make sure you get the support you need.

What is the FAFSA?

Every year, around 18 million students seek federal financial aid by filling out the Free Application for Federal Student Aid. However, The FAFSA can be intimidating for new and returning applicants alike.

The FAFSA is a form you can fill out to determine your federal financial aid eligibility. It asks for a variety of information, mostly about your and your family’s finances and the college you’re attending.

After completing the FAFSA, you’ll receive a Student Aid Report (SAR) that shows your answers to the FAFSA questions and explains your eligibility for financial aid.

It can be hard to understand how to answer every question the first time.

Additionally, financial and general life circumstances change.

Because of this, plenty of students need to make changes to their FAFSA each year.

What kind of aid can I get based on the FAFSA?

Both the federal government and universities base your financial aid on the information you include in your FAFSA.

The government will use the information in your application and the cost of attendance for your school to calculate your family’s expected family contribution (EFC) and compare it to the cost of your college education. The higher your EFC, the more aid you’ll need.

Overall, about 84% of students receive some type of financial aid, with the average borrower receiving $8,285 in federal loans each year. The average grant recipient receives $5,179 per year.

How to make changes to your FAFSA

Errors on the FAFSA can delay your FAFSA processing and may cause you to lose out on financial aid.

If you need to fix errors or make changes, you should do so as soon as possible.

There are 3 adjustments you can make to your FAFSA after submitting it:

Changes: Generally, the only change you can make is adding or removing schools.

Corrections: You may need to correct simple mistakes on your FAFSA, such as a misspelling, incorrect Social Security number, or typo in your financial information.

Updates: If you go through any relevant changes to your life or financial situation—like a change in dependency status or address—you should make the appropriate updates on the FAFSA. Doing so helps you get the correct amount of aid.

With these in mind, here are some of the most common reasons students adjust their FAFSA information. We’ll also tell you how to make those adjustments.

Adding or changing schools

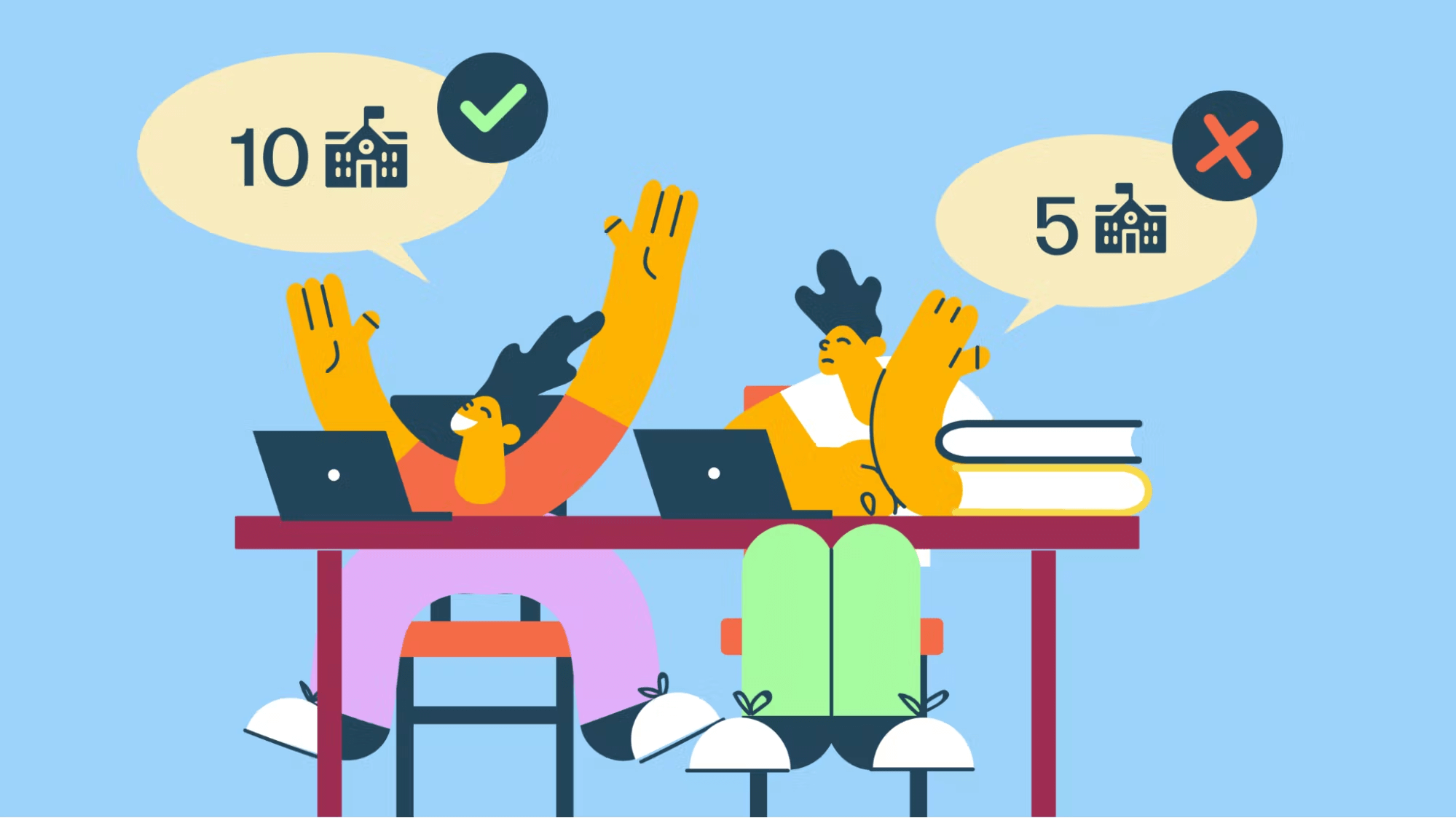

It’s recommended to submit your FAFSA before you finish all your college applications, and you can list up to 10 schools on the application.

However, you may need to make changes to the schools listed on your FAFSA after submitting it initially.

Fortunately, you don’t have to fill out a new form—just log into your Federal Student Aid account at fafsa.gov and add additional schools or remove school codes as needed. If you already have 10 listed, adding new codes will remove the ones included in your original application.

Triple-check that everything looks right to ensure your updated list of schools is on your most recent version of your FAFSA.

Given that the number of schools you add to your FAFSA doesn’t impact your aid eligibility, it’s usually a good idea to add as many as you intend to apply for. However, keep in mind that some states base their aid on the order in which you list prospective schools on your FAFSA, so consider listing the schools based on your ranking of preference.

Changing the year

Selecting the correct year on the FAFSA can be confusing since the academic year (August-July) doesn’t align with the calendar year (January-December). There’s an overlap, so it’s possible to submit your FAFSA for 2 different academic years. This can lead to accidentally selecting the wrong year.

For example, you might accidentally submit the FAFSA for 2023-2024 when you intended to submit it for 2022-2023.

Unfortunately, the FAFSA doesn’t let you change the year within the same form. You must fill out a completely new FAFSA for the correct year.

Fixing an incorrect Social Security number

You can’t do Social Security fixes through your Federal Student Aid account, but you have a few other options.

For one, you can fill out a brand new FAFSA. This will change the date your application is processed—make sure they’ll process your FAFSA in time to meet your desired schools’ financial aid deadlines.

This isn't a good option if you want priority aid consideration, and the deadline has passed.

If you don’t want to fill out a new FAFSA or a deadline has passed, you should contact the financial aid office of each school on your SAR and tell them to update your Social Security number. That way, your original FAFSA date stays the same.

Lastly, you can edit your paper copy of your SAR and mail it to the address listed on the form.

Updating your name

Whether you misspelled your name on your initial application or your name has since changed, there are ways to correct or update that information.

If you misspelled your name, you have 2 options: contact the financial aid office at each school you listed on your FAFSA and ask them to correct the error, or make the edit on your SAR paper copy and mail it.

If your last name has changed:

Update your name with the Social Security Administration

Update your FSA ID

Update your name on the FAFSA

Updating your household size

If your FAFSA is flagged for verification, you are required to update your household size.

You can’t update your household size after submitting the FAFSA unless it’s been flagged for verification.

Being selected for verification simply means that the government wants further information to prove your financial situation to make sure you get the right amount.

Updating your household size includes adjusting 2 things:

The total number of people in your or your parents’ household

The number of household members attending college

For marital status changes that affect household size, how and when you can make that change differs on a school-by-school basis, according to studentaid.gov.

If your household size changed due to a change in marital status, you should contact each of your chosen schools’ financial aid offices to see if the change requires an update to household size.

For most other household size change cases, you can make the changes online at fafsa.gov.

Updating dependency information

Dependency status plays a significant role in determining financial aid eligibility.

Dependent students must use their parents’ financial information, but independent students can use their own. Independent students usually get more financial aid since they typically make less than their parents.

Everyday situations that lead to dependency changes include getting pregnant, becoming an emancipated minor, or no longer relying on your parents to pay for school.

Keep in mind that you can’t just declare yourself an independent student—you need to meet certain requirements. For example, you may qualify if you’re married, a veteran or member of the armed forces, a ward of the court, at risk of being without housing, or at least 24 years old. If you don’t meet one of these requirements, you may not qualify—even if your parents aren’t providing you with any support.

For dependency status changes, you should contact the financial aid offices of each school you listed on your FAFSA to see if your dependency needs to be updated.

Updating other tax information

You may also need to update your tax information.

Log in to your Federal Student Aid account and navigate to the “Financial Information” section and change your status from “will file” to “already completed.”

If you’re eligible to use the IRS Data Retrieval Tool, which pulls the info from your tax return straight from the IRS, you can click the ‘Link to IRS’ button and follow the steps to pull in your tax data. Otherwise, you can enter the appropriate information manually.

When is the FAFSA corrections deadline?

Generally, the FAFSA corrections deadline is always about 3 months after the initial FAFSA deadline.

3 months sounds like plenty of time, but don’t wait—the sooner you get your FAFSA changes in, the faster you’ll receive an accurate reflection of your financial aid eligibility.

Also, some states and schools may have earlier corrections deadlines—check with your state and desired schools to be sure.

What happens if I miss the FAFSA corrections deadline?

If you miss the FAFSA corrections deadline, you may not receive as much financial aid as you qualify for.

In that case, you should call the financial aid office of your desired school and see if they can offer additional aid.

On top of that, look into other scholarships and grants.

Private student loans are also an option, but you have to pay them back, and they tend to have higher interest rates than federal loans—you should use them only after exhausting all other routes.

How long does it take for FAFSA to process my corrections?

Initial FAFSA processing time depends on how you submitted it. Here are some general time ranges to expect:

Online: 3-5 days

Mail: 7-10 days

Here’s what you can expect for correction processing times:

Online: 3-5 days

Mail: 2-3 weeks

By school: Varies by school

You’ll get an updated SAR once your new FAFSA has been processed.

Where do I make changes to my FAFSA?

There are several ways to make FAFSA corrections. Keep in mind that some methods might not work depending on the adjustment you need to make.

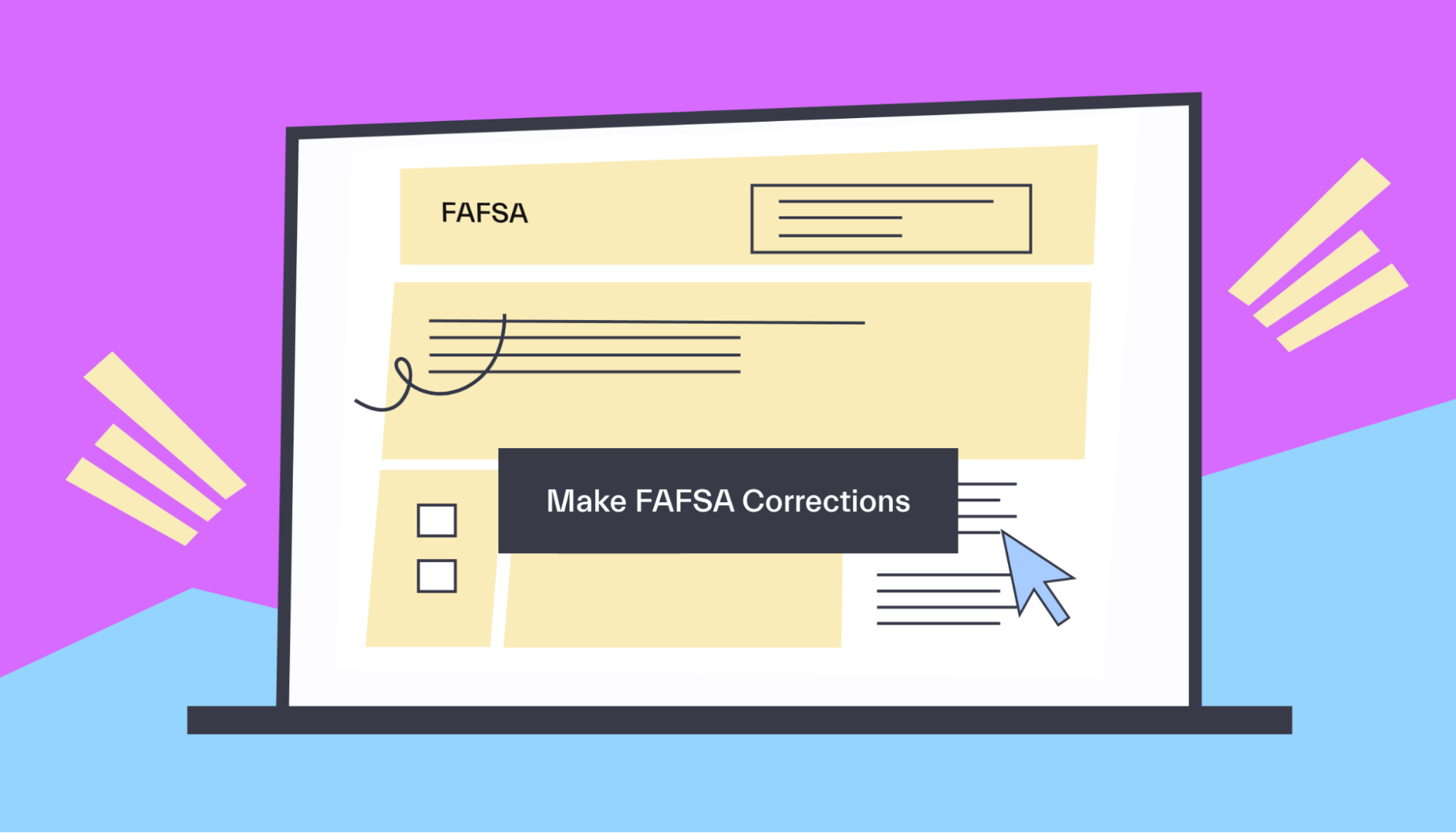

Online

If you can do your corrections online, it’s the simplest option.

Here’s how you do so:

Log in to fafsa.gov with your FSA ID

Head to the ‘My FAFSA’ page and choose ‘Make FAFSA Corrections’

Make a new save key

Adjust your information

Submit your correction

Phone

Find your Data Release Number in your FAFSA confirmation email or on your SAR.

Call 1-800-4FED-AID (1-800-433-3243) to reach the Federal Student Aid Information Center and have your DRN ready.

You might have to use the mail to make some corrections.

Here’s how:

Request a paper copy of your SAR by doing 1 of 2 things:

Online: Log into your Federal Student Aid account with your FSA ID, navigate to the ‘My FAFSA’ page, and click ‘View or Print your Student Aid Report (SAR)

By phone: Call 1-800-4FED-AID (1-800-433-3243) to reach the Federal Student Aid Information Center

Use your SAR to fill in your corrections and sign it

Mail the paper SAR to the address listed on it

Financial aid offices

You can also reach out to each of the financial aid offices of the schools listed on your FAFSA application to make the necessary changes.

They’ll also be able to answer any questions you have.

If you already accepted an admissions offer or are a student, reach out to that school’s financial aid office.

What’s the difference between correcting my FAFSA and sending a financial aid appeal letter?

The FAFSA is the form you use to apply for financial aid from the government and your school of choice. If you submit the form but haven’t yet received awards from either source, you still have time to correct the FAFSA using the above process, if needed.

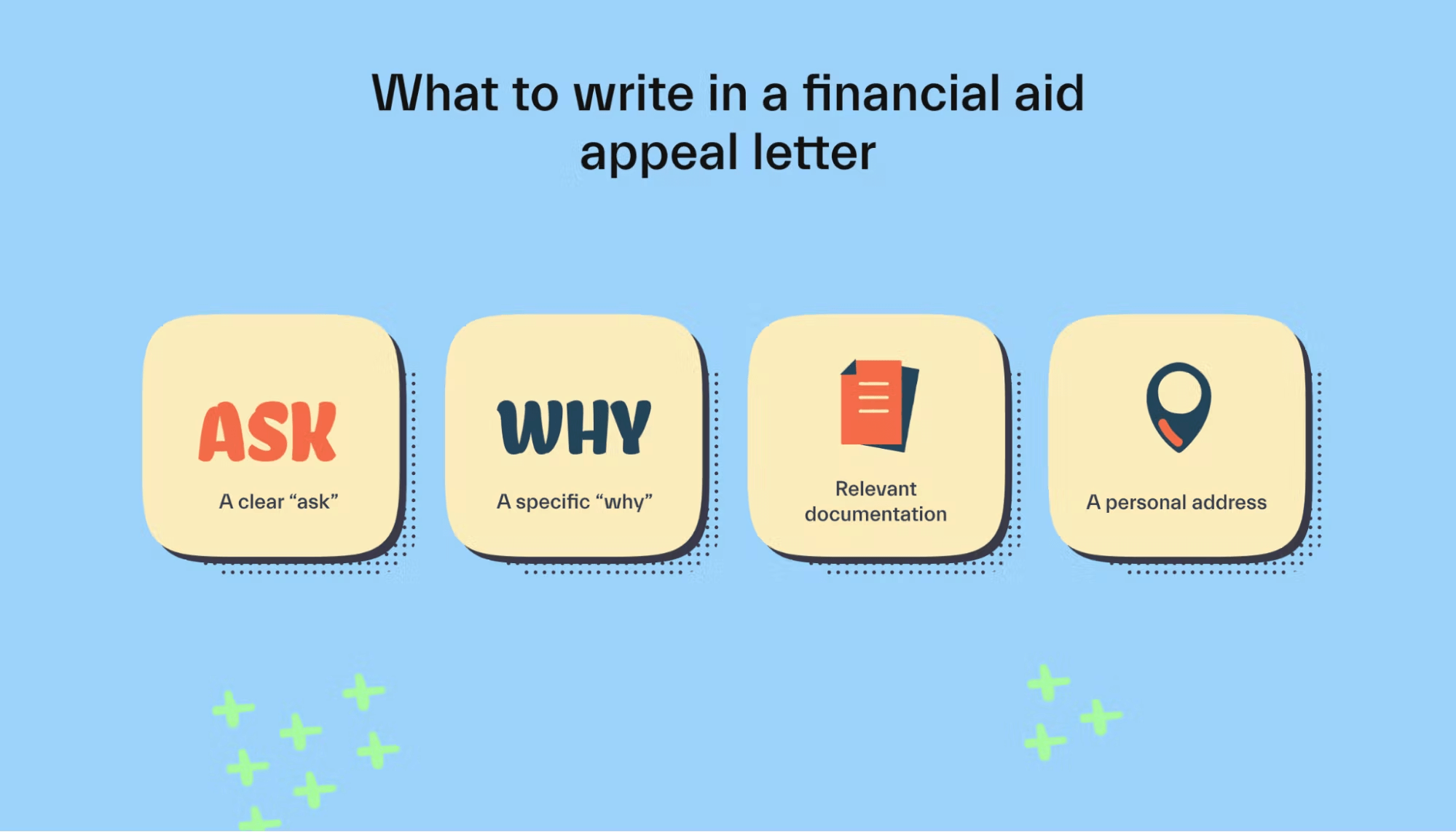

And if you receive financial aid but need more assistance, you can request it by submitting a financial aid appeal letter. This letter should clearly state what you’re asking for and why you’re asking for it. It should also include any relevant documents supporting your case.

However, you usually won’t get money for free just by asking. You need to have a good reason.

For example, if your family’s household size changes, you might include that info in a financial aid appeal letter to ask your school for additional money. In that case, you’d want to provide copies of the adoption papers or birth certificate for the new addition to the household.

Tip: Getting additional aid from your school can be difficult, so have a backup plan.

Get the aid you qualify for

The FAFSA can be challenging to figure out, leaving many students to go back and make some changes.

Making these adjustments can be tedious, but it’s worth it if you want to maximize your financial aid eligibility and attend your top-choice college!

Need a hand navigating the student aid process? Explore Mos memberships today.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you