Financial aid •

July 18, 2022

Do you have to pay back a Pell Grant?

Wondering whether you'll need to repay your Pell Grant award? Check out this guide from Mos to find out.

Let's face it: college doesn't come cheap. The vast majority of students don't have the financial means to pay for college tuition without some form of financial aid—and while student loans can help you pay for your education, they also have to be repaid someday.

That’s why you should always try to prioritize gift aid like grants or scholarships if you can. Gift aid is financial aid from the government that you don’t normally have to pay back. When it comes to gift aid, one of your first ports of call should be the Federal Pell Grant.

The US Department of Education’s Pell Grant is a generous and pretty inclusive source of gift aid for loads of college students. Generally speaking, you don’t have to repay any Pell Grant award you receive, either.

But it’s important to note that there are a few conditions under which you may be asked to repay your Pell Grant.

This guide explains what the Pell Grant is, whether you need to repay the Pell Grant, and how to pay the Pell Grant back if you’re required.

What is a Pell Grant?

The Federal Pell Grant (or “Pell Grant”) is a financial aid program administered by the US Department of Education’s Federal Student Aid office.

The Pell Grant is designed specifically to support undergraduate students who haven’t yet earned a degree. Unlike some other financial aid programs, the Pell Grant is a need-based form of gift aid. That means your eligibility will depend on your financial need.

But we’ll get to that in a minute.

It’s also important to note that the amount of money you can receive through a Pell Grant varies based on a number of factors. These include your financial need, how expensive the tuition fees are at the specific school you’ve chosen, and whether you’re studying full-time or part-time.

No matter how much cash you’re awarded, there’s a total annual cap you’ll be limited to. The maximum grant award you can receive through the Pell Grant changes every year, but the cap was placed at $6,495 for the 2021-22 academic year.

How do you apply for the Pell Grant?

To apply for the Pell Grant, you have to complete and submit a Free Application for Federal Student Aid (FAFSA) form. The FAFSA is the US Department of Education’s universal financial aid form, and it’s used by the federal government, state governments, and most colleges to determine how much financial aid you are eligible to receive.

What are the Pell Grant eligibility requirements?

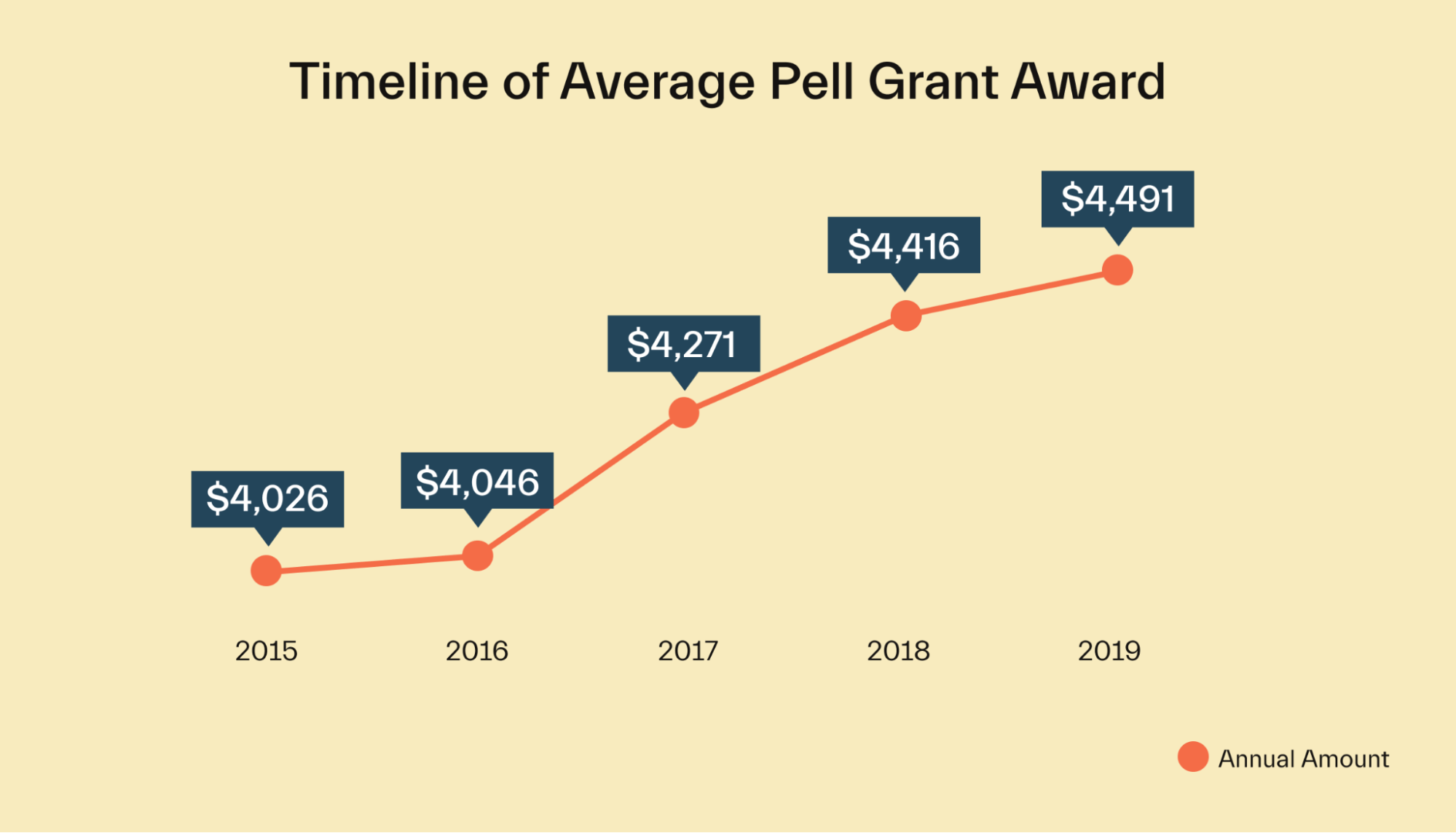

The Pell Grant includes a pretty broad and inclusive set of eligibility requirements. In the US, around 34% of undergraduates receive a Pell grant every year—and the average Pell Grant award is $4,491.

But because it’s a need-based grant program, it’s worth bearing in mind that not all students are going to be offered a Pell Grant. 51% of Pell Grant funds end up going to students whose families earn $20,000 or less annually.

To qualify for a Pell Grant, you must:

Be a US citizen (or eligible non-citizen)

Be a current or incoming undergraduate student

Not currently hold a bachelor’s degree

Have an Expected Family Contribution (EFC) of $6,000 or less

Be enrolled either part-time or full-time in an accredited college or career school

While both part-time and full-time students are eligible to receive a Pell Grant, you should note that part-time students generally won’t receive as much funding as full-time students. That being said, your school isn’t allowed to refuse your Pell Grant funds just because you’re enrolled half-time or less.

There’s also one exception to the Department of Education’s rule on only being eligible to receive the Pell Grant as an undergraduate. You’re also likely to be eligible to get a Pell Grant if you’re enrolled in a post-baccalaureate teaching certification program.

It’s also worth diving a bit deeper into the Pell Grant’s rules on your Expected Family Contribution (EFC). Your EFC is the number that the US Government determines your family can responsibly contribute on an annual basis toward your college tuition.

That means they aren’t going to look at your parents’ combined annual salary and use that entire number as the amount they should be expected to pay for your tuition. Instead, they look closely at the financial information you include in your FAFSA to figure out an amount they think your family can realistically afford to contribute without putting them in a tough spot.

To qualify for a Pell Grant, your EFC needs to be less than $6,000.

One final point you should consider is that you may be eligible for the Pell Grant even if you or your parents aren't US citizens. There are exceptions made for some non-citizens—and even if you’re undocumented or are a Deferred Action for Childhood Arrivals (DACA) student, you may still be eligible to apply for state government grants or college-specific grants from your school instead.

Pell Grant disbursement

After you’ve submitted your FAFSA, you’ll get a financial aid offer letter from the university (or universities) that you’ve applied to. That offer will include a list of any scholarships, grants, and loans available to you—and once you’ve accepted that award, it’ll set the cogs in motion to receive your grant money.

The process in which the cash from your Pell Grant award is distributed is called “disbursement.”

Normally, the US Department of Education will directly give the funds from your Pell Grant award to your college. Your college will then apply the grant money toward your tuition fees, administrative fees, and room and board (if you’re living in university-managed accommodation).

If any grant money is left over after it’s been applied to your institutional fees, it’ll be paid directly over to you so that you can spend it on other educational costs.

Do you have to pay back a Pell Grant?

Okay: so we’ve covered what a Pell Grant is and how you can qualify. Now, let’s talk about repayment.

Generally speaking, the answer is: no. You don’t need to repay a Pell Grant. That’s why grants are such a great way to fund your studies—they’re a non-repayable form of gift aid.

But before you start jumping for joy, it’s important that you understand there’s a bit of fine print here.

Translation: there are a few situations where you’ll need to pay back part or all of a federal grant. Don’t panic because these scenarios aren’t going to apply to most students. Let’s quickly break them all down.

Do you have to pay back grants if you drop out?

If you withdraw early from the course that you’ve received a grant to pursue, then you may be asked to repay some or all of your Pell Grant.

Normally, repayment is based on a pro-rata model—and so if you attended a college for 3½ out of 4 years, you’ll likely only be asked to repay your final semester’s worth of unused grant funding.

Long story short: if you want to hold on to your Pell Grant money, don’t drop out of school.

Do you have to pay back grants if your enrollment status changes?

If your enrollment status changes, it’ll likely reduce your Pell Grant eligibility. That means if you’re awarded a Pell Grant as a full-time student but you switch to studying part-time, your award amount will likely get reduced.

While you won’t be expected to repay your entire grant as a result of that eligibility shift, you’ll probably get asked to repay a relative proportion of the original award.

The silver lining here is that if you reduce your attendance from full-time to part-time, your tuition fees will probably get reduced as well. That means even after repaying part of your grant, you shouldn’t be any worse off financially.

How do you pay back a Pell Grant?

Let’s say that you decide to drop out of school or drastically reduce the number of hours you’re at school. You’ll now likely find yourself being asked to repay some (or all) of your Pell Grant award.

Fortunately, you don’t have to do a whole lot of work as part of the repayment process.

If your grant eligibility is lost or reduced, the finance office at your college will get alerted automatically. Your finance office will then get in touch with you to let you know that you’ll need to make a repayment. This letter should spell out exactly how much of your grant must be repaid and how that amount was calculated.

From the point at which you’ve been notified about your repayment due date, you’ll have 45 days in order to take action.

That action must take 1 of 2 forms. You must either repay the money owed in full, or you must enter into an approved repayment plan with your school’s finance office.

If you go for the second option and end up striking a repayment agreement with your college, your debt may get assigned to the US Department of Education for collection. That means your payments will go straight back to the federal government. Alternatively, the government might let your college keep the debt so that you’re making payments directly back to your school.

It doesn’t really matter from the student’s point of view. Either way, you’ll be expected to keep up with monthly payments as outlined in your repayment plan. Each plan is unique to the student, so the amount owed and repayment length will depend on your grant, how it’s been reduced, and your financial means.

What happens if you don’t pay back a Pell Grant?

If you do end up in a situation in which you’ve got to repay part of your Pell Grant, it’s essential that you meet the terms of your repayment agreement.

By failing to make your payments on time, your college’s finance office will typically pass your debt over to the US Department of Education (DOE). The DOE can then take action against you in a number of ways.

These include garnishing the wages you receive from your employer or withholding any outstanding or future income tax refunds and other federal payments owed to you.

The damage is a bit deeper than that, though.

If you fail to pay back part of a Pell Grant that you’ve been asked to repay, that activity will then ultimately get reported to the 3 big credit rating agencies: Experian, Equifax, and TransUnion. This can be pretty bad news for you in the long run.

That’s because these big credit bureaus catalog all of your reported credit history into a credit score which has a major impact on your life.

With a low credit score, you’ll find it extremely difficult to get a new credit card, qualify for a car loan, or get a mortgage. But even if you do qualify for credit with a bad credit score, the rates you’re offered will probably not be the best. That means shorter repayment timelines, worse interest rates, and fewer perks.

Some utility companies even look at your credit score before deciding whether to extend service—and with a bad credit score, you might get asked to pay huge deposits.

Long story short: if you get asked to repay all or part of your Pell Grant, do it. If you fail, you’ll regret it for a long time.

Conclusion

A Pell Grant is essentially free money to pay for college. If you qualify for one, that means it’s going to make paying for college that much easier.

Fortunately, you don’t normally need to pay back a Pell Grant. It’s considered gift aid, which means the money you receive is a one-off cash award. That being said, it’s important to note there are a few circumstances in which you'll be required to repay it—and if you fail to meet the terms of that repayment plan, your credit score is going to take a beating.

So, do you want to learn more about college grants? Join Mos now to learn about financial aid and get matched with loads of scholarships and other financial aid opportunities to help you make the most of your time in college.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you