Budgeting •

June 2, 2022

2 college student budget templates to help you manage your money

Stressed about money in college? Learn how to make a basic college budget and use one of these templates to get started!

In college, you’re living on your own for the first time. But you probably don’t have the qualifications necessary to nab a full-time salary.

Hence, the “broke college student” trope.

But even if you don’t have much money to your name in college, you can still improve your financial situation with a solid student budget.

It’ll help you manage your money now, and teach you a crucial financial skill that’ll pay off throughout the rest of your life.

Below, we’ll show you why you need a college student budget, then walk you through creating your own and show you a budget template to get you started. Once you’re done, you’ll feel more confident managing your money.

What is a student budget?

A student budget is a tool for laying out your total monthly income and expenses.

Budgeting sounds like something you don’t have to worry about until you have a steady paycheck, but college students arguably need them more.

After all, students spend plenty on tuition, fees, and supplies—and many use student loans to do so.

But you also have daily living expenses to handle. You spend around $10,000 a year just for room and board. Then, you have groceries, transportation, dues for any clubs you’re in, and a little bit of fun money, too.

Without a budget, it’s pretty tough to juggle these all stress-free. You’ve already got enough to deal with—a student budget gives you a clear picture of your money to reduce your money stress and minimize debt.

Here’s why you need a student budget ASAP

A student budget is a map of where your money goes each month. It’s also a plan—it helps you decide where money should be going.

Here are a few reasons you should consider making a student budget as soon as possible:

Helps you find expenses to cut

It’s easy to spend a little bit of money here and there on things you don’t really need or value—especially if you’re putting it on a credit card. But then you look at that card statement or your bank account and realize those small-dollar purchases add up fast.

A budget lays out all your expenses in front of you. You can see exactly where every dollar is going. From there, you might discover at least a few expenses you can cut out right away.

For example, students spend an average of $547/month on food—yet it’s possible to cut that by a large amount without going hungry. For example, you could try and eat out less!

Or perhaps you have an unused Netflix subscription. That’s money down the drain every month.

Whittle away those expenses you don’t need, and you’ll have extra money to spend on things you truly want.

Helps you set aside money to save

The earlier you start saving, the faster you’ll reach financial goals, such as:

Emergency savings

Vacations

A car

A home

A family

Retirement—yes, even if it’s decades away

And even if you aren’t sure what some of those goals are, just setting money aside will put you ahead of the game when you do figure out what you want.

Of course, budgets help you save up money because you can see what you have left after expenses.

And speaking of expenses, you can cut those—as we mentioned earlier—and save even more money.

Keeps you from adopting bad habits

College is the first time in many peoples’ lives where they’re largely responsible for managing their own money. Without prior experience, it’s easy to develop bad habits.

As we talked about earlier, one of those is using credit cards the wrong way. It’s less painful to swipe a piece of plastic than it is to hand over cash.

A budget holds you accountable, reducing the chance of going on spending sprees you can’t afford.

Reduces your money stress

Money is a big stressor among college students—there’s no doubt about it—but getting things onto paper can make you feel a little more at ease because it eliminates uncertainty.

You can see how much money’s coming in and where it’s going instead of trying to juggle it in your head. Even if money’s tight, you have a clear picture of your money situation.

You now have the power to do something to improve it, whether that’s shifting your spending or finding a way to make more money.

Teaches you an important life skill

Part of the college experience is learning skills vital to succeeding in the “real world.”

Budgeting is one of those skills you’ll carry with you for the rest of your life. Learning how to do it now—when you’re just starting to handle your finances—will make the transition to “full-time paycheck” status much easier.

Plus, you’ll learn all the other life lessons that come with budgeting, such as living within your means and saving a portion of your income for the future.

How to make a student budget

Starting a budget from scratch can seem daunting if you’ve never made one before. And if you tend to spend a lot, writing out your budget might make you wince, too.

To make that a little easier, here’s a simple, 5-step process to creating your student budget:

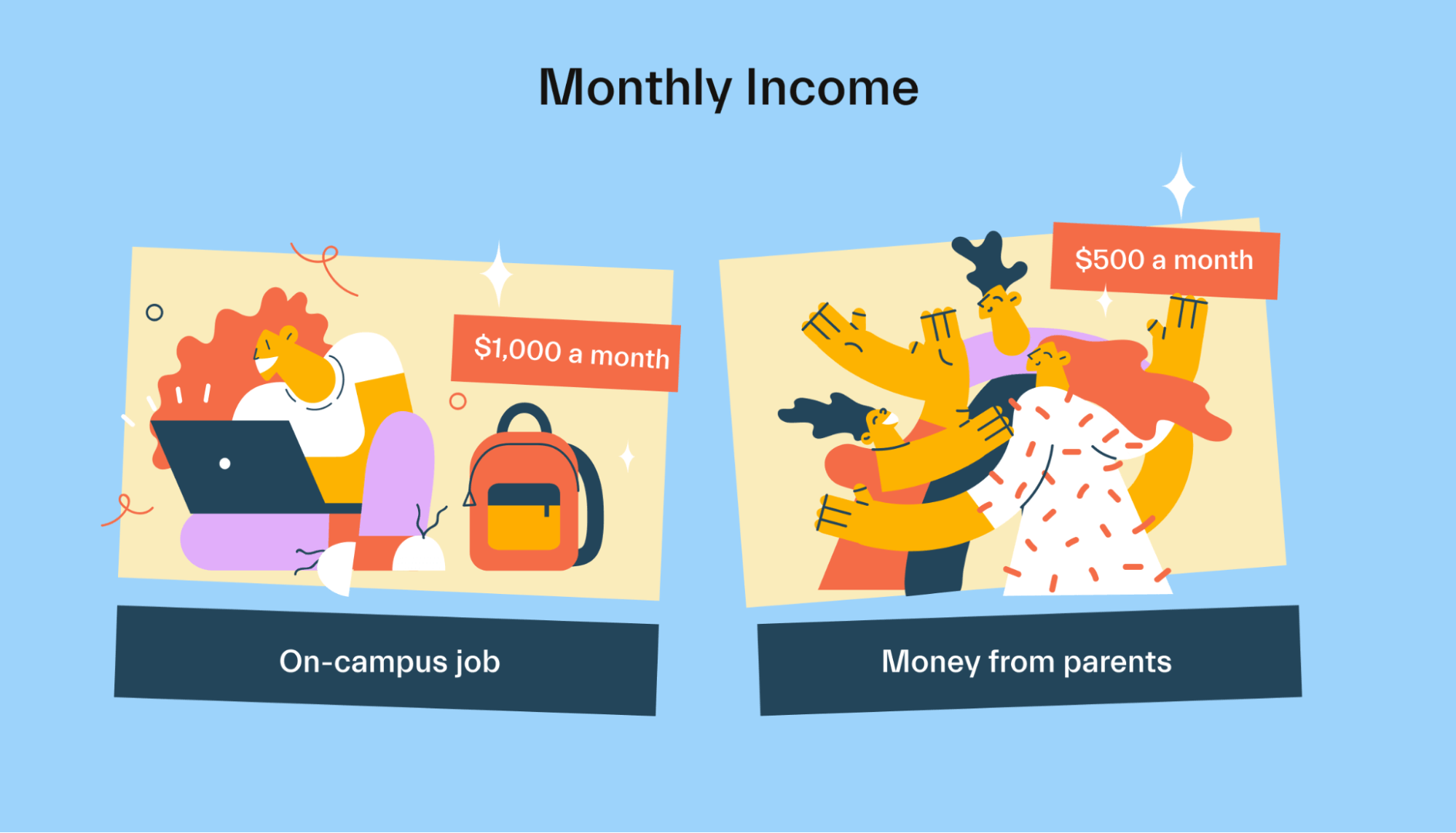

1. Record your income/available funds

First, you’ll need to gather all of your sources of income. Most students will have any combination of 4 main sources:

Job

Money from parents

Miscellaneous

Looking at your income is a good starting point for figuring out how much you have available in total. You should break your income down between each source.

For your job, look at one of your paychecks. If your wages change from month to month, try to look at several paychecks and average it out. You can also use your Form W2—the tax form used to report job earnings.

For parental aid, a quick glance at your bank account statements can give you an idea of how much money you get from them.

Same with financial aid. However, if any sources of financial aid are sent directly to your school, you’ll need to add those in as well.

Lastly, the miscellaneous section is for any random or one-off income. This could include a tax refund, birthday money, or even a $10 bill you find on the ground.

2. Write down your fixed expenses

Next is your fixed expenses. Basically, it’s any spending where the amount doesn’t change from month to month.

For instance, some of your fixed expenses as a college student might be:

Tuition and fees

Room and board/rent

Meal plan (if you have one)

Car payment

Streaming service subscriptions

As with your income, looking at your bank and credit card statements is a great way to uncover the exact costs.

3. Track your variable expenses

Your variable expenses include anything else you spend money on. These costs vary from month to month.

Your “fun money” usually makes up a good chunk of this category. That said, some other items in here might be car repairs, traveling home, new clothes, ridesharing services, and other miscellaneous things.

Some expenses may be variable or fixed, depending on your situation. For example, you may consider groceries a variable expense if the amount changes a lot each month.

Utilities are another example. If you live somewhere with mild weather all year, your electric bill might not change much each month. However, if your area has distinct seasons throughout the year, you might consider your electric bill a variable expense.

4. Consider your savings goals

If you’re actively saving for anything, such as an emergency fund, you’ll want a section for those goals.

Ideally, you’ll split your savings into each goal you’re saving for, then total that up.

5. Write it all out

Once you have all of your income, monthly expenses, and savings, you’ll need to write them all down and arrange them into a budget.

At the most basic level, a budget will have your income at the top. Below that are your fixed and variable expenses.

Finally, you subtract your expenses from your income to see if you have money left or not.

Congrats! That’s a basic budget right there.

Now, you might find out you’re spending more than you make. That’s fine—your budget helps you see where you can make changes to get in the green.

6. Make adjustments as time goes on

Few people, if any, nail their budget numbers the first time around. There’s a good chance you’re off for the first few months.

And that’s ok.

As you live with that budget, you can refine it so that it more accurately reflects your financial situation. After all, income and expenses can change.

Maybe you get a raise at your job, or your tax refund hits your bank account. Either way, you’ll have more income to work into your budget.

On the other hand, you might move into an off-campus apartment. Your housing costs will change, and you might now be responsible for utilities. That means making some changes to the expenses portion.

The important thing is to stick with your budget as best you can and make adjustments when your life changes.

Use these student budget templates for inspiration

Above, we covered the basics of creating a budget. But the truth is there are several types of budgeting models.

So to help you out, here are a couple of college budget templates to kickstart your own.

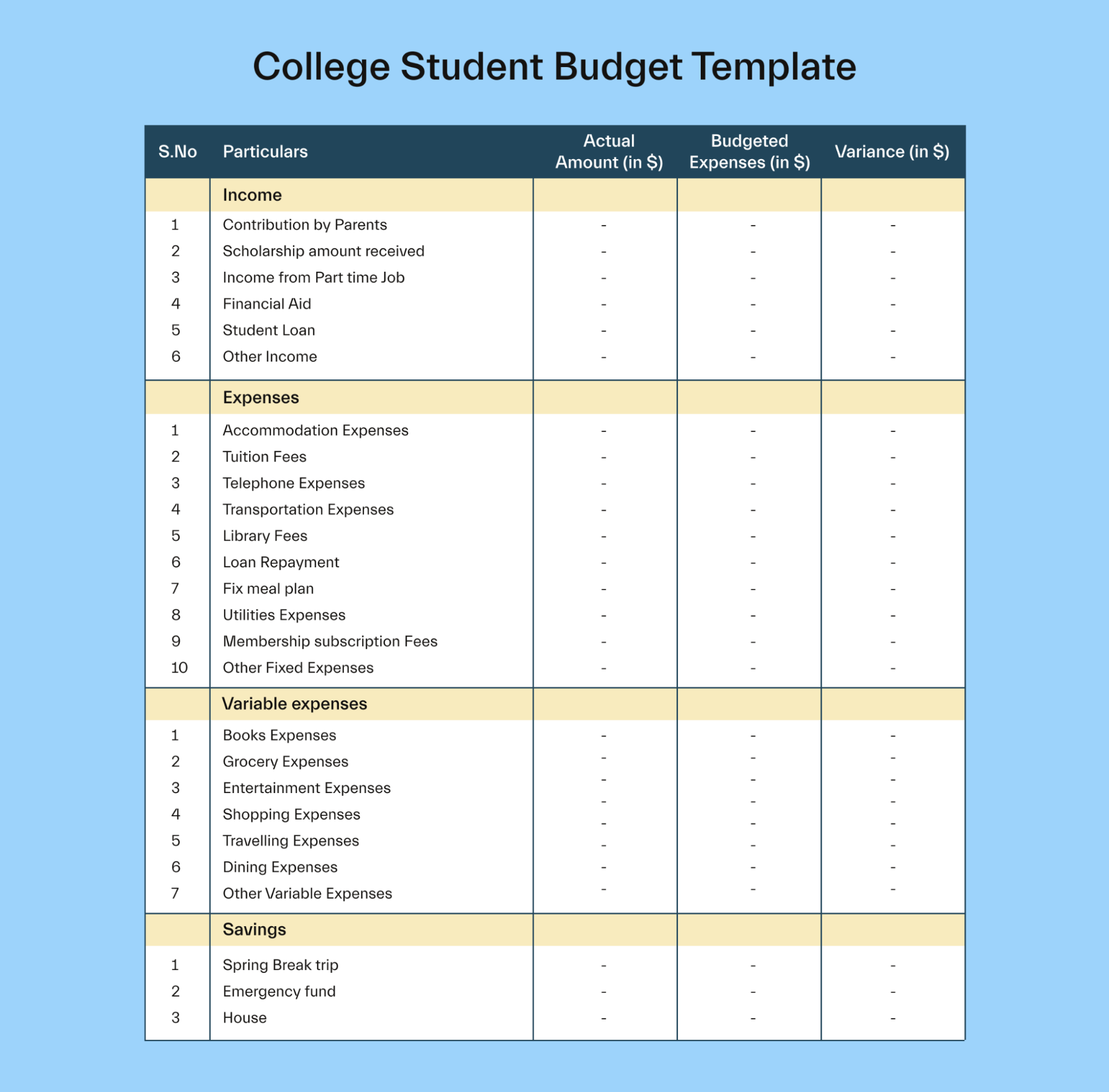

1. Traditional budget

Here’s a template of a traditional budget:

Income

At the top, you can see the income section. It’s split into job income, money from parents, and other income—such as financial aid, birthdays, and holidays. In the right column, you have the dollar amounts of each one.

All sources of income are added together to arrive at your total income for the month.

Expenses

Next, we have expenses. This section covers your fixed expenses, like tuition and rent. These numbers should generally stay the same from month to month. Variable expenses

Underneath your fixed expenses are your variable expenses, which will likely change quite a bit each month. These include things like groceries, traveling, and dining out.

Savings

We also have a nice and simple savings section with 3 savings goals you may be working toward as a student.

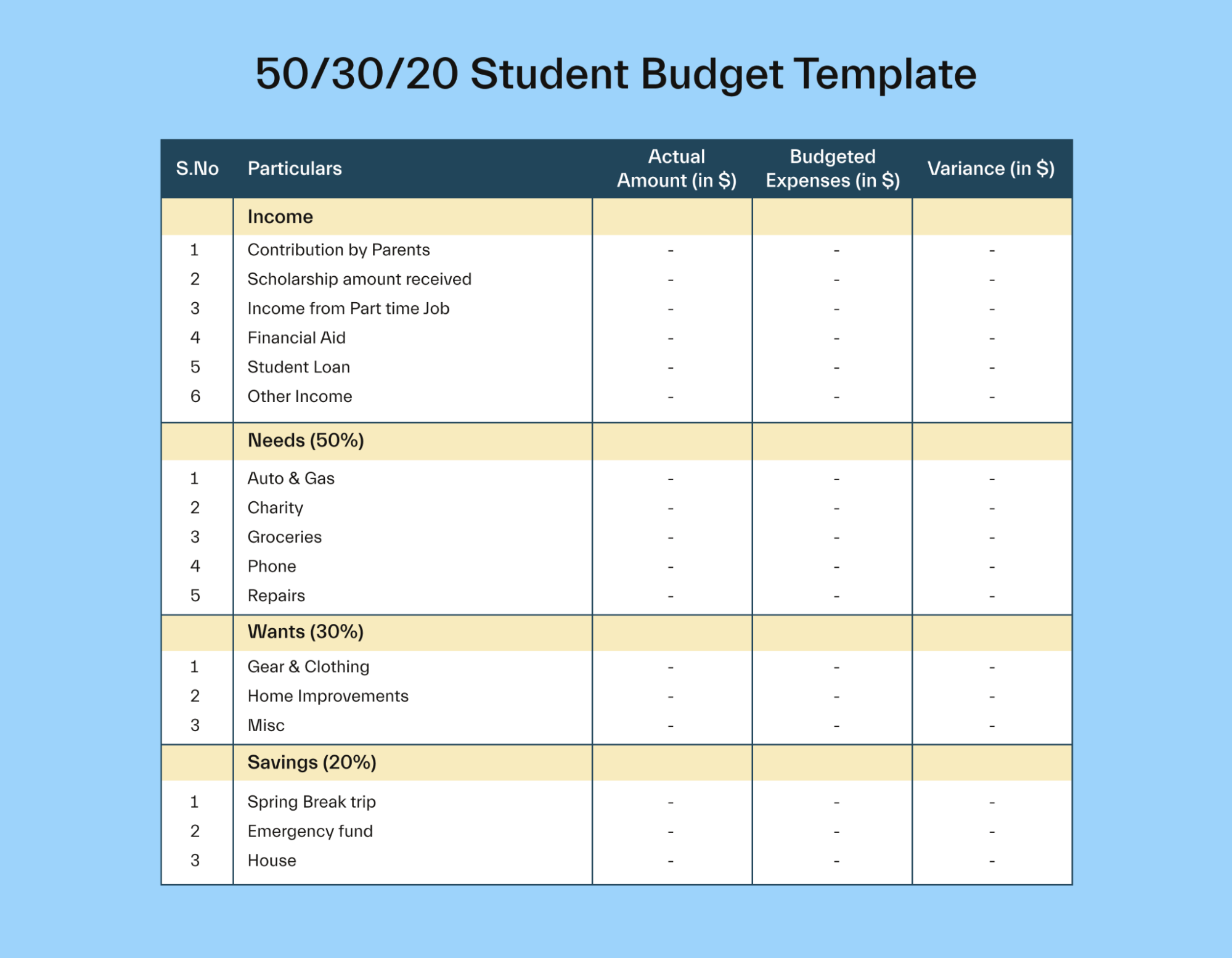

2. 50/30/20 budget

The 50/30/20 budget is a great template for anyone with a lower or moderate income, especially budgeting beginners.

It splits your budget into 3 main categories:

50% needs

30% wants

20% savings

Your needs include anything necessary for your day-to-day college life. This could include rent, utilities, groceries, your car payment, and school textbooks, to name a few.

Your wants are self-explanatory. Dining out, catching a movie, traveling, and hobby expenses all fall into here.

Your savings is the last 20% of your budget. This includes your emergency fund, debt payments, a retirement account if you have one, and investing.

As you can see, the 50/30/20 template can help you develop solid money habits and figure out what you value. It holds you accountable by making sure you’re saving enough and covering all your necessities without sacrificing the things you want.

Ways to make your student budget

There are 2 ways you can create your student budget:

Apps/digital tools

Pen and paper

Both have benefits and drawbacks. Let’s look at them below.

Apps/digital tools

Today, budgeting apps make it easy to create and monitor your budget online and via mobile apps. They let you set budget categories, link your financial accounts to monitor spending, and offer advice.

You can use spreadsheet software as well. Building a spreadsheet budget takes a little more legwork—including creating the layout and writing formulas—but can offer a little more flexibility than some budgeting apps.

And anyway, you can copy one of our budget templates above to kick things off.

Pen and paper

Using pen and paper involves more work than digital methods and can lead to clutter if you aren’t careful.

But on the plus side, there’s no technology learning curve with this approach. Some people prefer to start with pen and paper before moving to digital budgeting.

Also—many budgeting apps use strong security measures these days, but nothing is safer than old-fashioned pen and paper.

Make a student budget that works

Budgeting gives you a better picture of your spending, helping to cut back on things you don’t need and avoid bad financial habits. Meanwhile, it makes it easier for you to save for the future and reduce your financial stress.

So regardless of how much support you get from your parents or programs that don’t require you to pay the money back, learning to budget is an invaluable skill you’ll carry through college and into your adult life.

Once you have a solid college student budget, finding ways to make more money in college is a great idea. Check out our guide on how to make money in college to learn more.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you