FAFSA •

Can international students apply for the FAFSA?

International students can fill out the FAFSA, but getting aid can be complicated. Learn how international students can pay for college in the US.

The US offers tons of great colleges and universities that attract students from over 200 countries around the world.

But if you’re one of those students, it can be tricky knowing where you can find enough funding to pay for school.

Most US students use the FAFSA to qualify for aid through the federal government—but things get more complicated for international students.

This article will explain the FAFSA, whether international students can use it, and other international student financial aid forms. Then, we’ll dive into other aid types international students can use to afford school in the US.

What is the FAFSA?

The Free Application for Federal Student Aid, or the FAFSA, is a student aid form that incoming and current undergraduate and graduate students can fill out to qualify for government financial aid and determine their aid eligibility.

The federal deadline for filing the FAFSA is June 30, at the end of the academic year you want aid for. So if you want aid for the 2023-2024 school year, you must file by June 30, 2024.

That said, states and colleges may have different deadlines for state-specific or school-specific sources of aid.

So… can international students get FAFSA aid?

International students may qualify if they are eligible noncitizens per the Office of Federal Student Aid’s criteria.

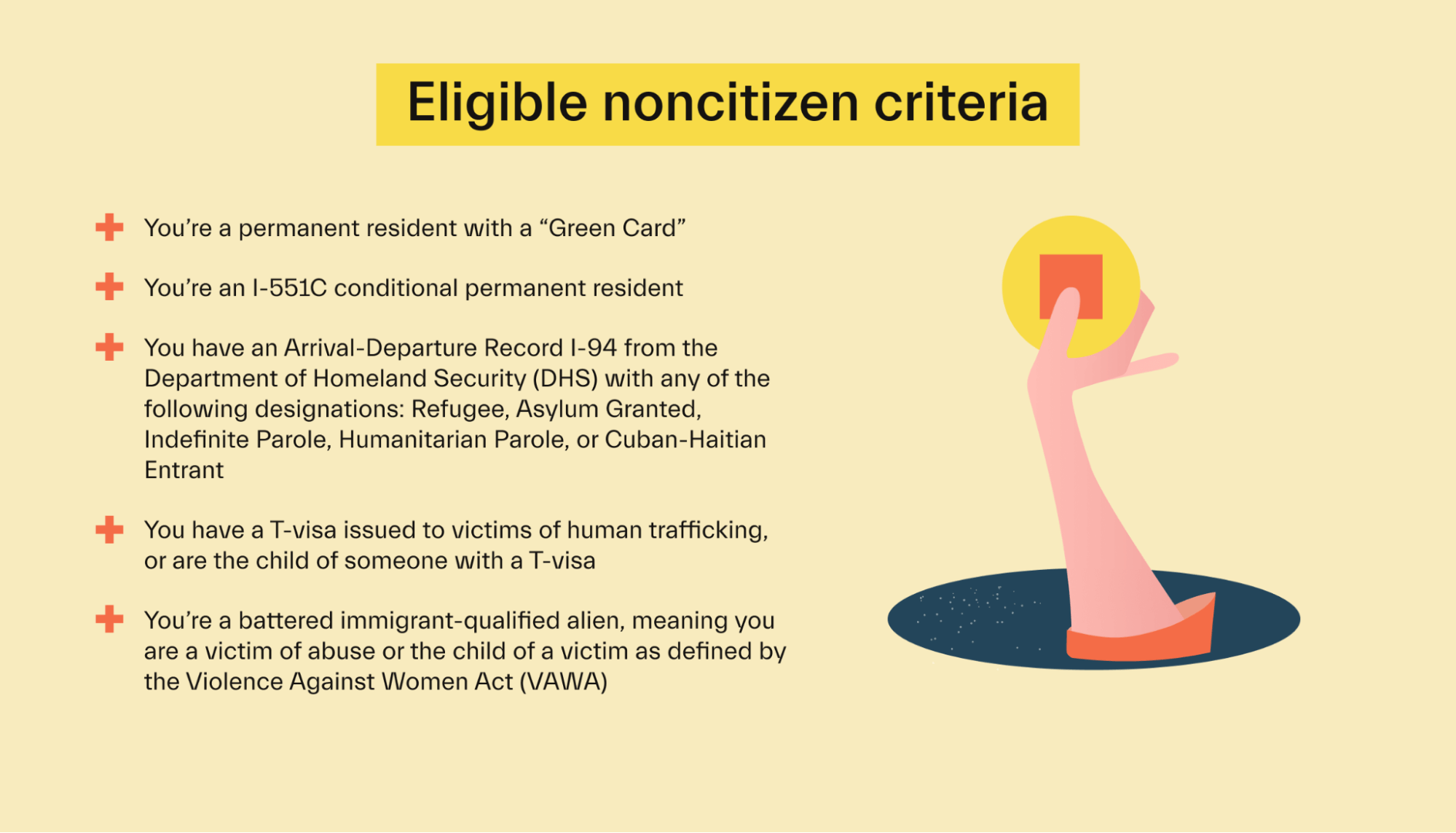

If at least one of the following describes you, you might be an eligible noncitizen:

You’re a permanent resident with a “Green Card”

You’re an I-551C conditional permanent resident

You have an Arrival-Departure Record I-94 from the Department of Homeland Security (DHS) with any of the following designations: Refugee, Asylum Granted, Indefinite Parole, Humanitarian Parole, or Cuban-Haitian Entrant

You have a T-visa issued to victims of human trafficking, or are the child of someone with a T-visa

You’re a battered immigrant-qualified alien, meaning you are a victim of abuse or the child of a victim as defined by the Violence Against Women Act (VAWA)

You can find more information on eligibility on the FSA website.

If you don’t fall under any of those categories, you will not be eligible to get financial aid through the federal government as an international student. That means federal student loans and grant programs are out of the question.

But that doesn’t mean states and schools will rule you out. You should still do the FAFSA because you might qualify for state-based aid, and your school might use the FAFSA for school-based aid determinations.

How the FAFSA works for international students

States and schools can still offer international students aid. But if you’re an international student, you’ll have a bit of extra work to do. For instance, some schools might make you fill out different application forms.

Before filing any aid application forms, research each school you’d like to apply to. See what kinds of aid options are available and which of the following forms they require.

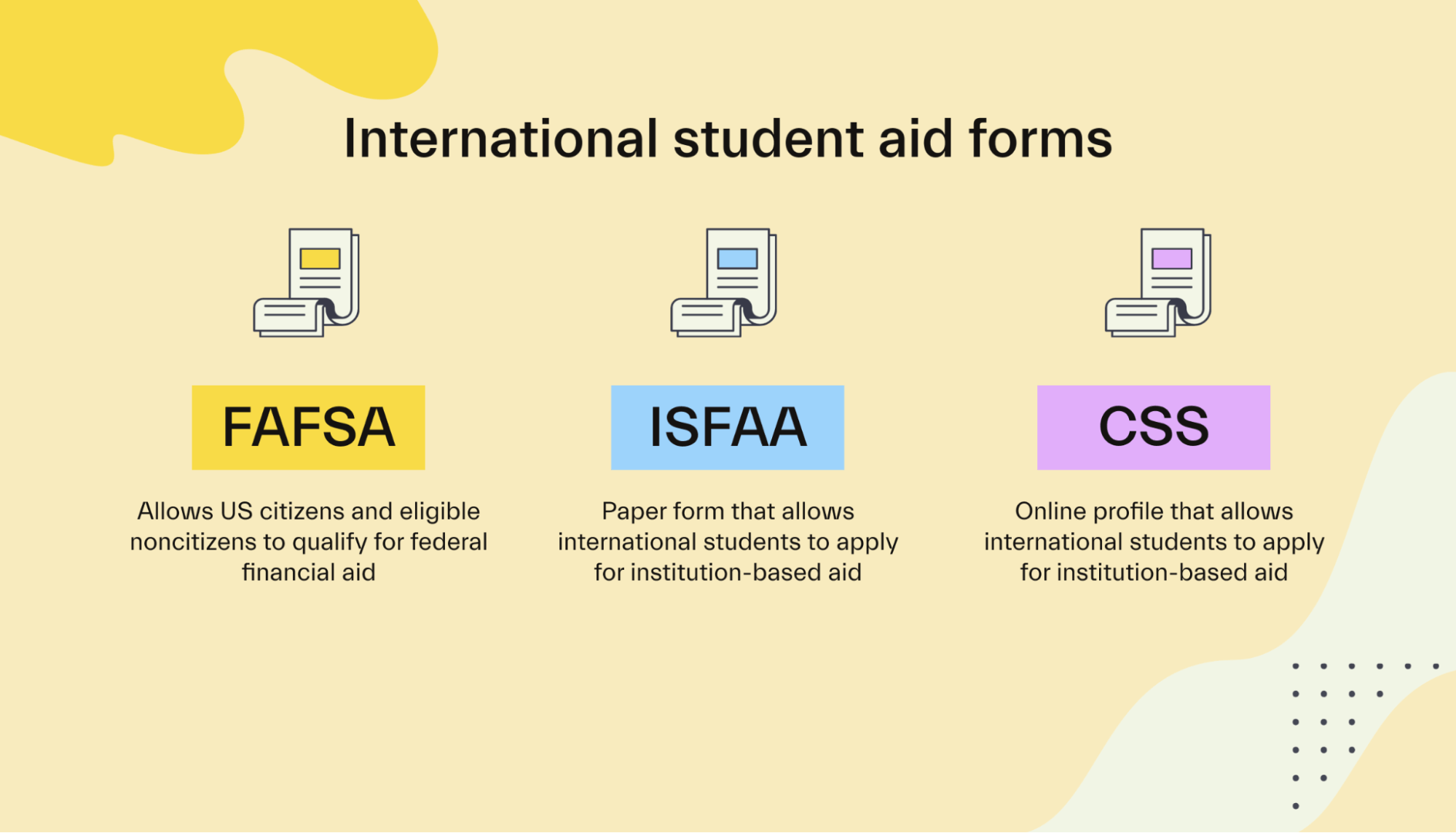

Regular FAFSA

You can’t apply for the FAFSA online without a Social Security number. Instead, you’ll need to print out the FAFSA and send it via mail.

Mailed FAFSA forms take 7-10 days to process—a bit longer than the online processing time of 3-5 days. So make sure you give yourself enough time to fill out the form and mail it in for processing.

Once the FAFSA has been processed, you’ll receive a Student Aid Report. This document summarizes the info you put on your FAFSA and your aid eligibility.

You won’t be eligible for federal aid, and the SAR may note that. But the SAR also helps states and schools determine how much aid to offer you.

Be sure to fill out any additional state-specific forms for state-based aid if needed. Same thing with school-specific forms.

As mentioned earlier, states and colleges might have different deadlines. Check with the state you’re attending school in and the school itself so that you don’t miss the deadline.

International Student Financial Aid Application (ISFAA)

The ISFAA is a form designed to help international students qualify for school-based aid. It is not electronic—you have to print it out from the College Board website, fill it out by hand, and send it to each college that asks for it.

The ISFAA asks for similar information as the FAFSA. You’ll need to provide some personal information first. Then, it asks for information about your parents’ finances, including their income, assets, expenses, and expected family contributions.

Like the FAFSA, the ISFAA is free to fill out.

College Scholarships Service (CSS) Profile

The CSS is an online financial aid application that helps US residents and international students alike qualify for some forms of need-based institutional aid. According to US News, about 300 colleges, universities, and scholarship organizations currently use the CSS.

The CSS asks for information similar to that asked on the FAFSA and ISFAA. Plus, you can detail any extenuating circumstances to justify your need for more aid than your profile might let on.

You’ll want to fill the CSS out each year to see what kind of aid you could get. However, be aware that you must pay a fee to send the CSS or seek out a fee waiver.

Unlike the FAFSA, you can select as many colleges as you want on the CSS.

Some schools will ask for the CSS alongside the ISFAA. Remember to double-check your school’s requirements and contact the financial aid office if you’re unsure.

That said, even if the CSS is not required, it may be worth filling out if the fee is not an issue or you can get a fee waiver.

Other ways international students can pay for college

Sure, federal aid might not be available through the FAFSA. But you shouldn’t feel limited by this just because you’re an international student.

Finding enough aid may involve a bit more leg work, but you have plenty of options. Here are some school funding sources to consider:

Your home country

Your home country’s government may offer you aid to study abroad. There could be loans, grants, scholarships, or all kinds of other stuff available.

Of course, eligibility and aid amounts vary widely depending on where you’re from.

Give yourself enough time to research aid options from your home country and whether you qualify.

Scholarships

Scholarships are free college money, meaning you don’t have to pay them back. There are tons available—in 2021, Sallie Mae estimated that 25% of all college students got scholarship aid in some form.

Most scholarships are merit-based, meaning you have to win a competition of some sort. However, need-based scholarships are out there as well.

Some merit-based scholarships, like the Courage to Grow Scholarship, are easy to apply for. These scholarships have far more competition, but you can knock out an application in a few minutes and apply multiple times.

Other scholarship contests require essays, videos, or other creative work. These take more time, but they narrow the competition—and this also means more potential winnings.

While some scholarships are broad, there are tons for many niches.

For example, the Create a Greeting Card Scholarship is great for those with graphic design talent.

To maximize your chances of winning free scholarship money, check out our guide on how to get a scholarship.

Grants

Grants, like scholarships, are free money—there is no need to repay them. But almost all grants are based on financial need instead of merit.

Unless you’re an eligible noncitizen per the criteria we laid out earlier, you can rule out federal grant programs like the Pell Grant.

However, like scholarships, private and nonprofit grants are everywhere. You can check with the state you’re attending school in, the school itself, nonprofits, and other private organizations.

Private student loans

Private student loans are available through banks, online lenders, and other private financial institutions.

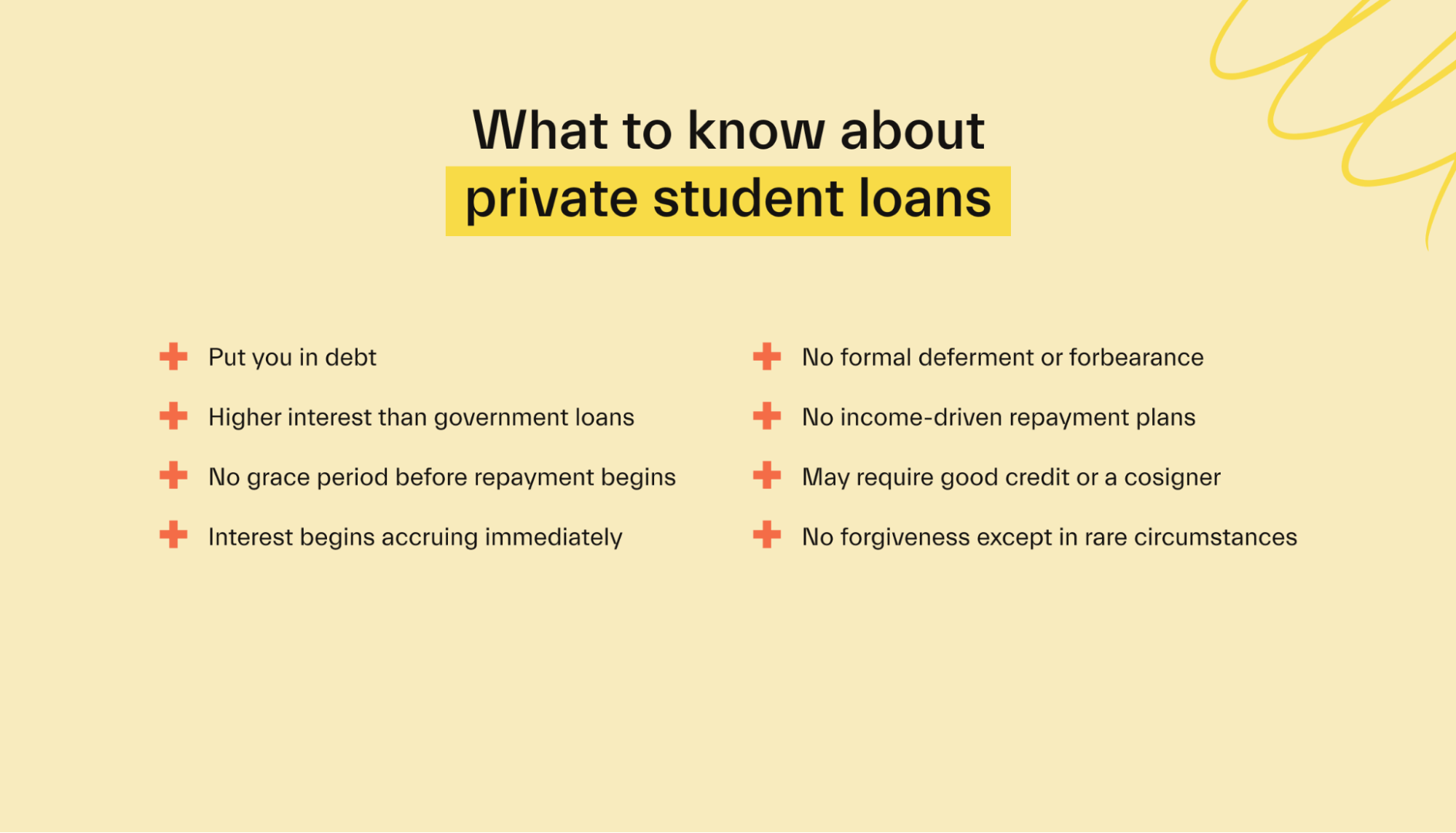

Although these can fill in gaps in the money you have to pay for school, they have several drawbacks.

Most obviously, they can put you into debt—and this debt can be worse than federal student loan debt because it often charges a higher interest rate.

Private student loans don’t have grace periods, either. Payments may be required while you’re still in school, and interest starts accruing right away.

Additionally, these loans don’t offer student loan forgiveness except in rare circumstances.

International students will need a US citizen or permanent resident cosigner to get one of these loans from most lenders. Some lenders don’t have this requirement, but you may still need a cosigner if you have no credit.

There is one big exception to this: eligible international students from Latin America and the Caribbean. Interest-free loans are available to these students through the Organization of American States.

One positive of private student loans is that they help you establish a credit score since you can’t get federal loans. You can refinance a student loan after graduation to reduce your interest rates and save on your monthly payments.

Graduate aid

International graduate students do have access to some forms of federal aid.

For example, the Fulbright program—known for helping fund US students studying abroad—also does things the other way around with the Fulbright Foreign Student Program.

Unlike the US version, Fulbright Foreign Student participants must have completed their undergrad and earned the equivalent of a bachelor’s degree. That means they must be either a grad student or returning to school for another undergrad degree.

Beyond that, requirements to apply to the program vary by your home country.

Aside from the Fulbright Foreign Student Program, you can look for private and nonprofit graduate school aid.

If you’re a woman, the American Association of University Women is one place you can look. Its International Fellowships are awarded to women pursuing full-time grad or postdoctoral education in the US who aren’t US citizens or permanent residents.

You could win the following amounts depending on what type of graduate education you’re going after:

$20,000 for master’s and professional degrees

$25,000 for doctoral degrees

$50,000 for postdoctoral education

Finally, grad students can land grad-specific jobs on campus, like assistantships. These offer a paycheck or a living stipend to cover living expenses and other college costs during your graduate studies.

On-campus jobs

Unless you’re an eligible noncitizen, federal work-study is out of the question. However, a regular on-campus job can help you earn a bit of cash for school or living expenses.

In the short term, campus jobs can mean discounts. For instance, if you work in the campus bookstore, you might get a discount on those pricey textbooks.

A campus job typically looks great on a resume. And if you stay in a position for a while, you could score some raises or promotions.

Keep in mind that eligibility for an on-campus job will depend on your immigration status.

Get financial aid as an international student

Undergraduate international students can’t qualify for federal financial aid. However, they can qualify for institution-based and state-based aid by filling out the FAFSA, ISFAA, or CSS, depending on the school.

Failing those, you can also look at scholarships, non-federal grants, private student loans, and government aid from your home country.

You may not be able to cover all your US college expenses, but with a little work, you can put a serious dent in your costs.

For more information on affording college in the US, check out Mos’s ultimate guide to financial aid for international students.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you