Financial aid •

November 11, 2022

Ball State University financial aid: a complete guide

Read all about financial aid at Ball State University University, including scholarships, loans, and grants.

Ball State University, located in Muncie, Indiana, is a public research university that offers low tuition for Indiana residents. With more than 15,000 undergraduates enrolled, its students can enjoy a vibrant campus life and the opportunity to engage with the school’s variety of immersive learning projects.

If you’re in high school and think that you want to go to Ball State but don’t know how you’ll afford the cost, we’re here to help out. This article will break down what you need to know.

A snapshot look at Ball State University

Ball State’s mission is to “engage students in educational, research, and creative endeavors that empower our graduates to have fulfilling careers and meaningful lives enriched by lifelong learning and service.”

The school boasts a 94% placement rate for graduates and offers aid to more than 4 out of 5 students. That makes it a great choice for students looking to land a great career. The school offers hundreds of degree programs along with a unique “degree in 3” program that lets students finish their course of study a year early, enabling them to save money.

Outside of classes, students can enjoy the campus’s vibrant student life by joining one of the hundreds of student organizations, fraternities, or sororities, including the dance roller skating club, the improv comedy club, or the aquatics club.

Ranking: 212th among national universities

Demographics: 40% male, 60% female

Acceptance rate: 65%

Average GPA of accepted student: 3.4

Key dates and deadlines (2022)

Application: March 1

Financial aid deadlines: April 15

A look at scholarships offered by Ball State University

There’s no doubt about it—paying for college is hard. Tuition can be tens of thousands of dollars, and the full cost of a degree can easily reach 6 figures. Even if your family has saved to help you pay for your tuition, they might not have enough to pay the full amount.

If you want to earn more money to pay for college, the best thing that you can do is apply for scholarships.

Scholarships, unlike loans, don’t have to be paid back after school. This makes them one of the best ways to pay for college. They’re like free money you can put toward tuition, fees, housing, and other costs.

There are many different scholarship opportunities out there. Some are based on financial need, while others focus on your academic, athletic, or other achievements. Some scholarships are as simple as getting lucky and winning a draw.

Ball State’s financial aid office has a list of the different scholarships available, as well as a calculator and search tool to help you discover more aid opportunities. For example, the Ball State Scholars Award can provide up to $4,000 a year for in-state students and $14,000 for out-of-state students.

Many community organizations and businesses also offer scholarships. With some effort, you can find awards for almost anything, from being left-handed to being tall.

Scholarships are one of the best ways to pay for college, so check out our financial aid tips and tricks page for more info on earning scholarships and other college funds.

Student loans

Scholarships are the best way to pay for college, but unless you’re lucky enough to get the rare full ride, you’ll likely need another source of funds to pay for school. Your next best bet after scholarships is a student loan.

Student loans have the drawback of being loans. You have to pay them back, plus interest, once you leave school. However, you can think of them as an investment in yourself, helping you earn a degree that will improve your career prospects.

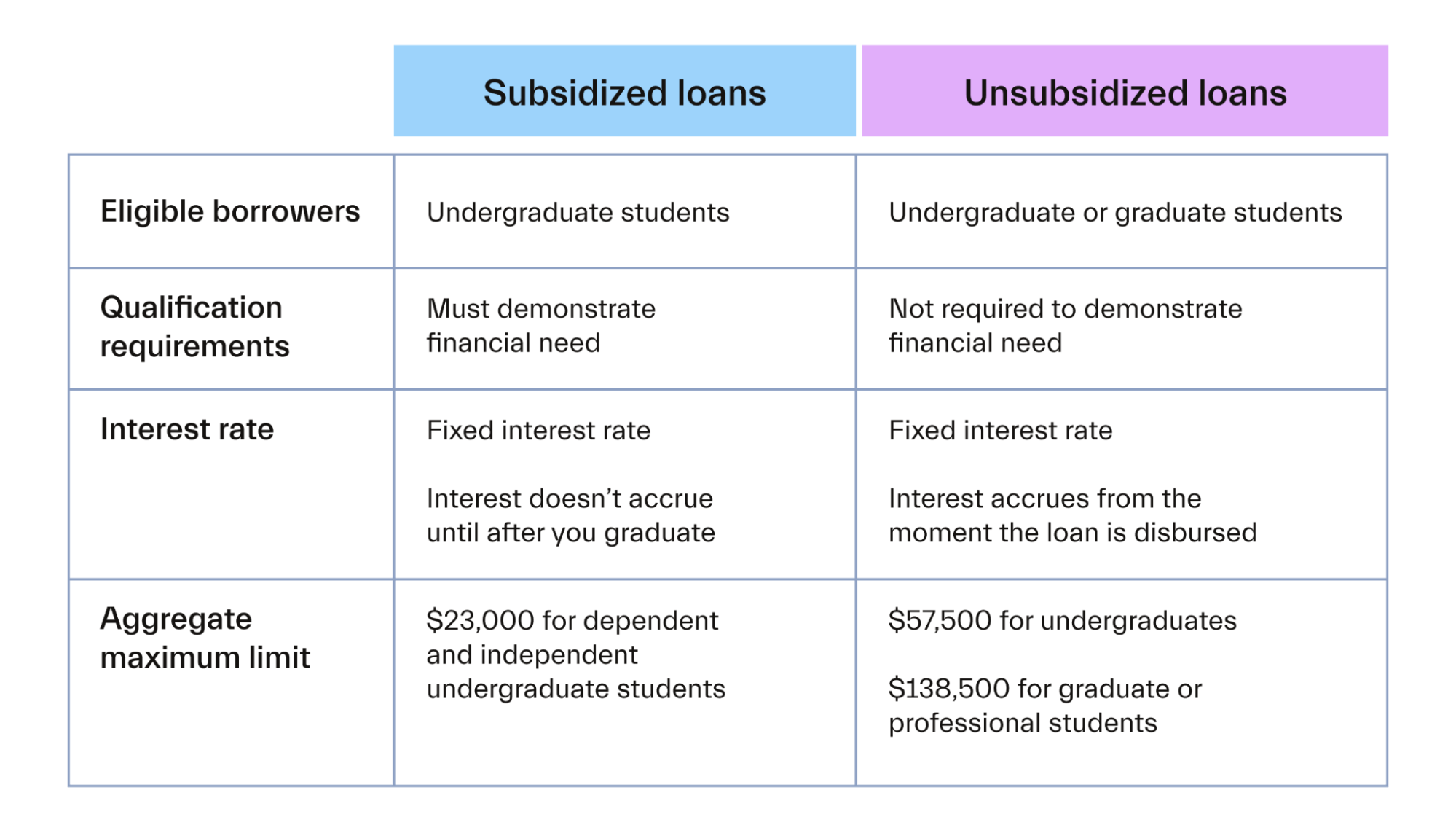

For the vast majority of students, the best loan program is the Federal Direct Loan Program. Like the name says, these loans come from the US federal government. There are 2 types of federal loans.

Subsidized loans are the better of the 2 types. With these loans, the government covers the interest until you leave school. With unsubsidized loans, interest starts to build up on them right away, meaning they’re more expensive.

Federal loans also come with borrower protections, including loan forgiveness and income-driven repayment options.

If your federal loans don’t cover the full cost of your education, you can also consider private student loans. However, these loans lack the protections of federal loans and usually have higher interest rates, so they shouldn’t be your first choice.

Borrowing money can be scary, but loans are a common way for people to pay for school. Still, it’s important to understand how they work. Our article on student loans breaks it all down—and in plain English, not banker or bureaucrat jargon.

FAFSA

When it comes to earning financial aid for college, the most important thing you can do is fill out the Free Application for Federal Student Aid (FAFSA).

The FAFSA is a universal aid application that the government and most colleges use to determine what scholarships and loans students will receive.

Filling out the FAFSA means sitting down with your family and providing financial information, such as how much you earn each year and how much you have saved for college. The information you provide goes through a complex formula to determine your expected family contribution (EFC) to the cost of your education.

You can determine your financial need by subtracting your EFC from the total cost of attendance at your school. Students with more need might qualify for more need-based aid, like federal grants and scholarships.

It’s important to note that few schools commit to meeting 100% of their students’ financial needs. This means you’ll have to find other sources of money to cover the difference, such as loans.

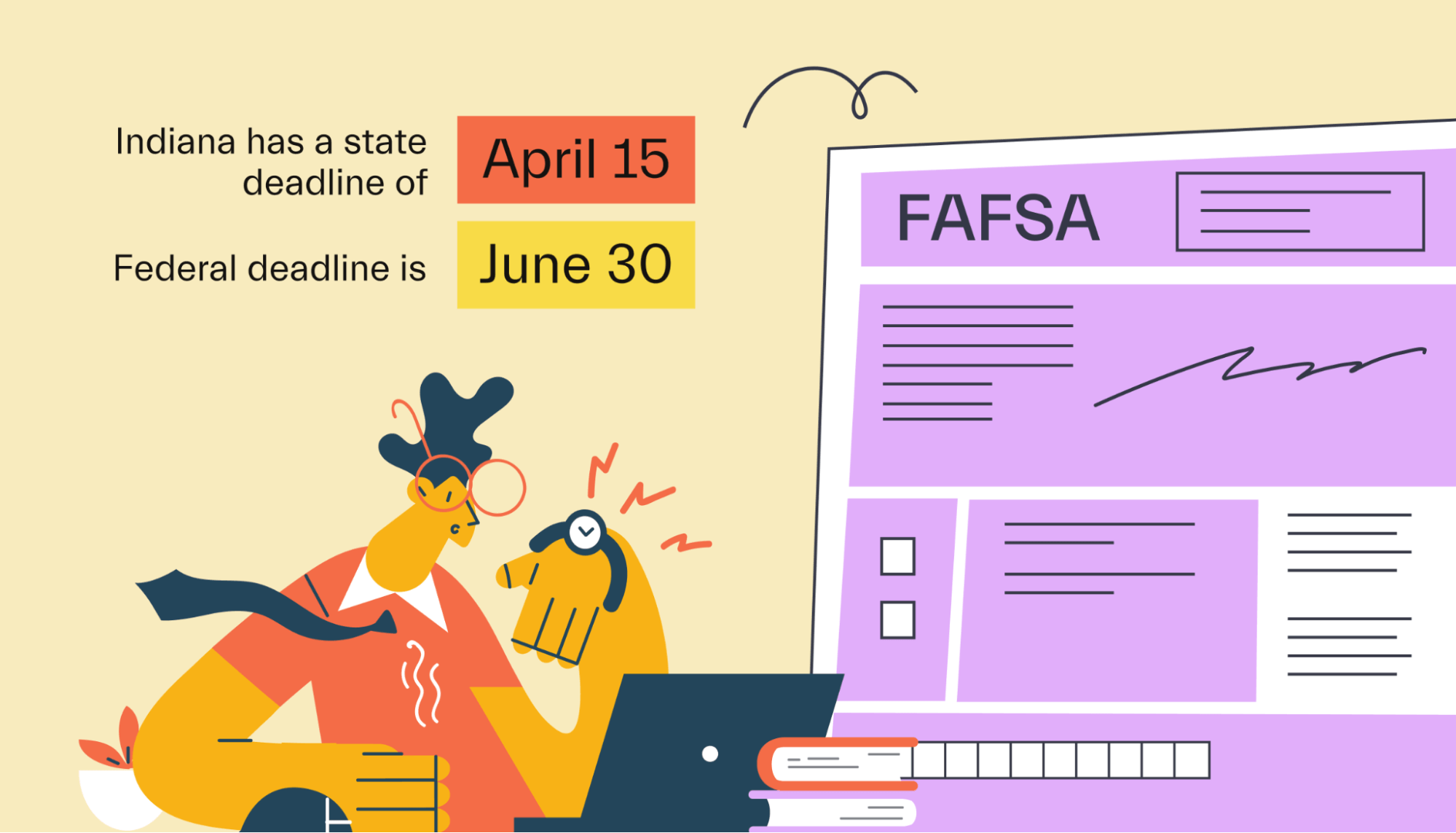

The FAFSA process starts on October 1 for aid awarded in the next academic year, and you have until the end of June to submit the application. However, Indiana has a state deadline of April 15, so try to get the application in before then to qualify for state aid.

Filling out the FAFSA can take some time, so prepare yourself by learning more about how long it takes to complete the FAFSA.

Ball State University financial aid FAQs

Here, we’ll answer a few more questions you may have about getting financial aid at Ball State.

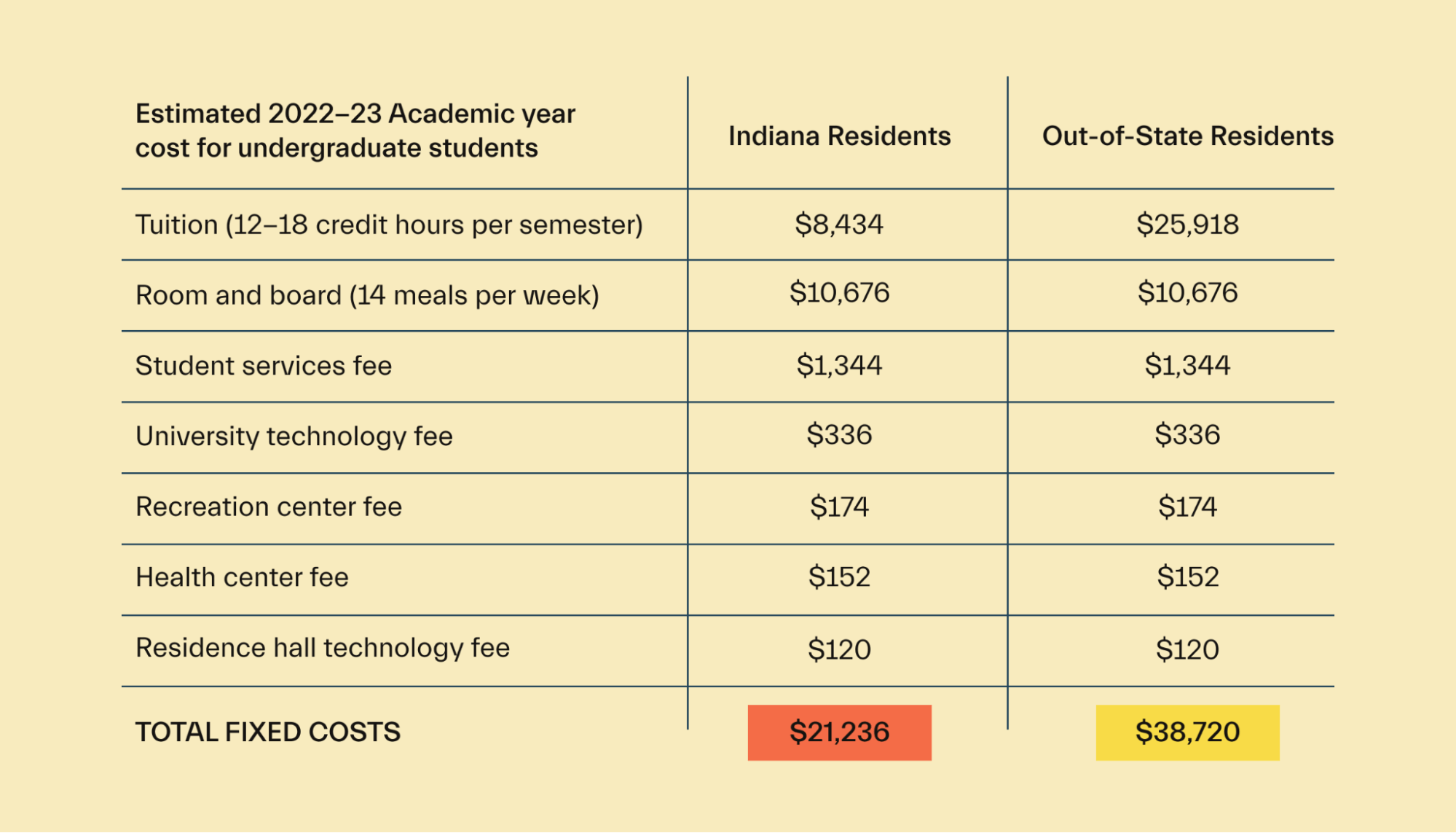

What is Ball State University’s cost of attendance?

As a public university, Ball State keeps costs low for in-state students. The cost of attendance is $21,236 for in-state students and $38,720 for out-of-state students. Of those amounts, in-state students pay $8,434 in tuition, while out-of-state students pay $25,918.

How many students get a full ride?

Ball State doesn’t publish information about how many students receive a full ride, but it does offer plenty of financial aid. 65% of students receive some amount of need-based aid, with an average award of $7,377.

What types of aid can I get from Ball State?

Ball State offers need- and merit-based scholarships, as well as grants, to students.

Can I receive a federal grant at Ball State University?

Yes, students at Ball State are eligible to receive federal grants and other forms of aid.

Are there any ways to reduce student costs?

In-state students pay a reduced tuition rate at Ball State. You might also be able to save on costs such as room and board by finding an inexpensive apartment off campus.

Universities like Ball State University that you might be interested in

If you’re thinking about Ball State but aren’t sure if it’s right for you, consider these other options:

Purdue University

Purdue is one of the best-known public universities in Indiana, offering a high-quality education at a low cost for in-state students. Undergraduates can choose from 11 colleges, including the Colleges of Agriculture, Education, Engineering, Health & Human Sciences, Liberal Arts, and Science.

Indiana State University

Indiana State University is another public university option for students who want to keep costs low. The school offers more than 100 undergraduate majors and has hybrid degree options for students who want to split their time between in-person and online classes.

University of Indianapolis

The University of Indianapolis was founded in 1902 and offers a service-based learning environment for students. With more than 100 academic programs and an average class size of 17, students can find a degree that interests them and benefit from a close-knit educational environment.

Conclusion

Ball State University offers Indiana residents the opportunity to study at a large research institution without breaking the bank. The school’s immersive education program contributes to its 94% career placement rate for graduates and makes it a great value.

Mos is a money app that helps students lower their tuition, match with top scholarships, and earn extra cash in college. Get started today.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you