Financial aid •

November 11, 2022

Wayne State University financial aid: a complete guide

Learn about the financial aid at Wayne State University, including information about scholarships, loans, and grants.

Located in Detroit, Michigan, Wayne State University has a mission to “create and advance knowledge, prepare a diverse student body to thrive, and positively impact local and global communities.”

The school was founded in 1868 by 5 physicians who committed themselves to advancing healthcare education after witnessing the horrors of the Civil War and the crude medical techniques used on the battlefield and in field hospitals. Luckily, that’s not a mandatory class for new students nowadays.

Today, the school is home to almost 25,000 students from across the US and from 70 other countries, with a wide variety of majors available—from accounting to medicine, physics, and world history.

If you’re thinking about going to Wayne State, but need to figure out how you’ll pay for school, here’s everything you need to know.

A snapshot look at Wayne State University

Students at Wayne State can choose from one of the university’s 13 different schools. Given the school’s foundation as an institution focused on medicine, many opt for the School of Medicine and College of Nursing, but students can also study business, education, engineering, the arts, and more at Wayne State.

Located in Detroit, a highly diverse city, Wayne State has a commitment to diversity. It offers students an immersive educational experience that allows them to work with people from various educational, cultural, and socioeconomic backgrounds. The school even claims to be home to Michigan's most diverse student body.

Outside of class, students can explore the city of Detroit or take part in some of the many campus activities. Wayne State University has teams in sports like basketball, football, tennis, swimming, fencing, and golf.

Those who prefer other pursuits can join some of the school’s nearly 500 student clubs and organizations, including the Red Cross Club, Art in Medicine Club, Bird Watching Club, and more.

Ranking: 249th nationally

Size: 17,513

Demographics: 43% male, 57% female

Tuition: $14,464 for in-state students, $30,914 for out-of-state students

Acceptance rate: 68%

Average GPA of accepted student: 3.45

Key dates and deadlines (2022):

Application: August 1

Financial aid deadlines: March 1

A look at scholarships offered by Wayne State University

Scholarships are a great way to cover educational expenses and pay for college. You can earn scholarships based on many factors, including academic merit or athletic skill. What makes them the best way to pay for school is that, unlike loans, you don’t have to pay them back after you graduate.

Wayne State University makes it easy for students to apply for scholarships. The financial aid website includes a portal called AcademicWorks. Through AcademicWorks, you can view a list of scholarships available to WSU students. It includes the name of the program, a short description of it, how much can be awarded, and the deadline to apply. One thing of note is that Wayne State allows international students to apply for scholarships. International students can’t get federal aid, so this is a good opportunity for them to get help with college costs.

You can also fill out a basic application to get matched with scholarships that you qualify for. Then you can fill out any additional materials required and apply directly from the website, making it simple to apply for multiple scholarships.

Some of the scholarships available are merit-based, while others focus more on financial need. Many are restricted to students in a specific college or course of study.

One unique program that Wayne State offers is the Heart of Detroit Tuition Pledge. This pledge offers free tuition for 4 years to students who graduate from a high school in Detroit. To apply, eligible students need to complete the FAFSA, but you need not demonstrate financial need. Recipients must remain in good academic standing to keep the award.

Outside of the scholarships offered by Wayne State, students can apply for awards from other organizations. Many local businesses, non-profits, community groups, and others have scholarship programs.

These programs can offer awards large and small and offer awards based on a variety of factors. You can even find scholarship programs designed specifically for left-handed people or students who play specific instruments!

If you look carefully, you can find niche scholarships for just about anything.

Ready to apply for scholarships? Check out how we can help.

Student loans

Once you’ve received your scholarship aid, the next best way to pay for the cost of school is with student loans. When you take out a loan, you’re borrowing money and will have to pay it back eventually. However, it’s one way to invest in yourself by furthering your education—just be careful when exploring your options to avoid unnecessary debt!

Wayne State’s financial aid website has some resources discussing student loan options for attendees.

One of the best student loan programs that students can use is the Federal Direct Loan Program (which includes loans like the Stafford Loan). Loans that you earn through this program come directly from the US government. The loans come in 2 forms: subsidized and unsubsidized loans.

If you get a subsidized loan, you don’t have to worry about interest building up while you’re still in school. With an unsubsidized loan, interest starts to accrue on the loan right away. Either way, you don’t have to worry about making payments until you leave school.

One of the top benefits of federal loans is that they’re eligible for a variety of assistance programs, such as payment deferment and forbearance, as well as things like income-based repayment and loan forgiveness.

Once you’ve exhausted your federal student loans, you also have the option to get private student loans. There are many private banks and lenders that will lend money to students, but their loans tend to be worse than federal loans.

Private loans typically have higher interest rates and also lack the protections of federal student loans. So that means no interest subsidization, income-based repayment options, or ability to get your balance forgiven.

Basically, you should max out your federal loans before you even consider adding private student loans to the mix.

If you want more detailed info on student loans, check out our article on how student loans work.

FAFSA

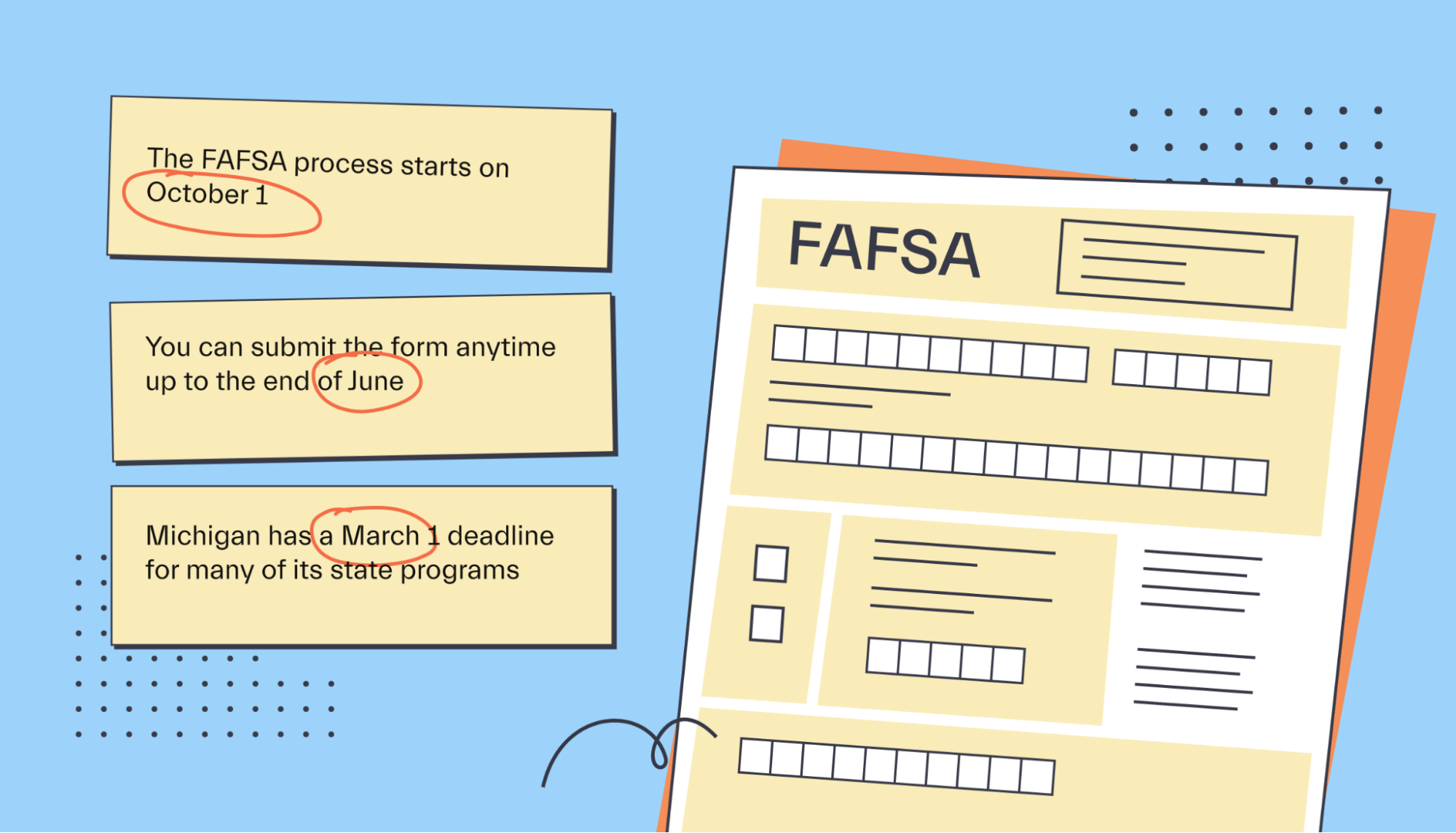

The most important thing that a student can do if they want help paying for college is complete the Free Application for Federal Student Aid (FAFSA).

The FAFSA is a universal student aid application. It’s used by the government as well as most colleges and universities in the United States. The information that you put on your FAFSA can help make you eligible for scholarships, federal grants, and other types of financial aid!

When you complete your FAFSA, you and your parents or guardians will need to provide some basic financial information about your family. This includes things like how much money you’ve saved for school and how much your family makes each year.

The government uses the information you’ve provided in a complicated formula to determine your Expected Family Contribution (EFC) to your education.

Your EFC plays a big role in how much financial aid you receive from schools like Wayne State and from the federal government. You can receive need-based scholarships and other aid such as Pell Grants based on your EFC. Your FAFSA also influences how much you can borrow from the federal government and how much of your loan balance will be subsidized.

Schools don’t guarantee that they’ll cover 100% of your financial need, but the lower your EFC, the more you can generally expect to receive in financial aid.

The FAFSA process begins each year on October 1 for aid awarded during the next academic year. The deadline to submit it is June 30 of the year you actually attend school. However, Michigan has a March 1 deadline, so you should submit the form as soon as you can!

To get more information about the FAFSA and when it’s due, check out our article that covers everything you need to know about the FAFSA.

Wayne State University financial aid FAQs

Let’s answer some common questions about financial aid at Wayne State.

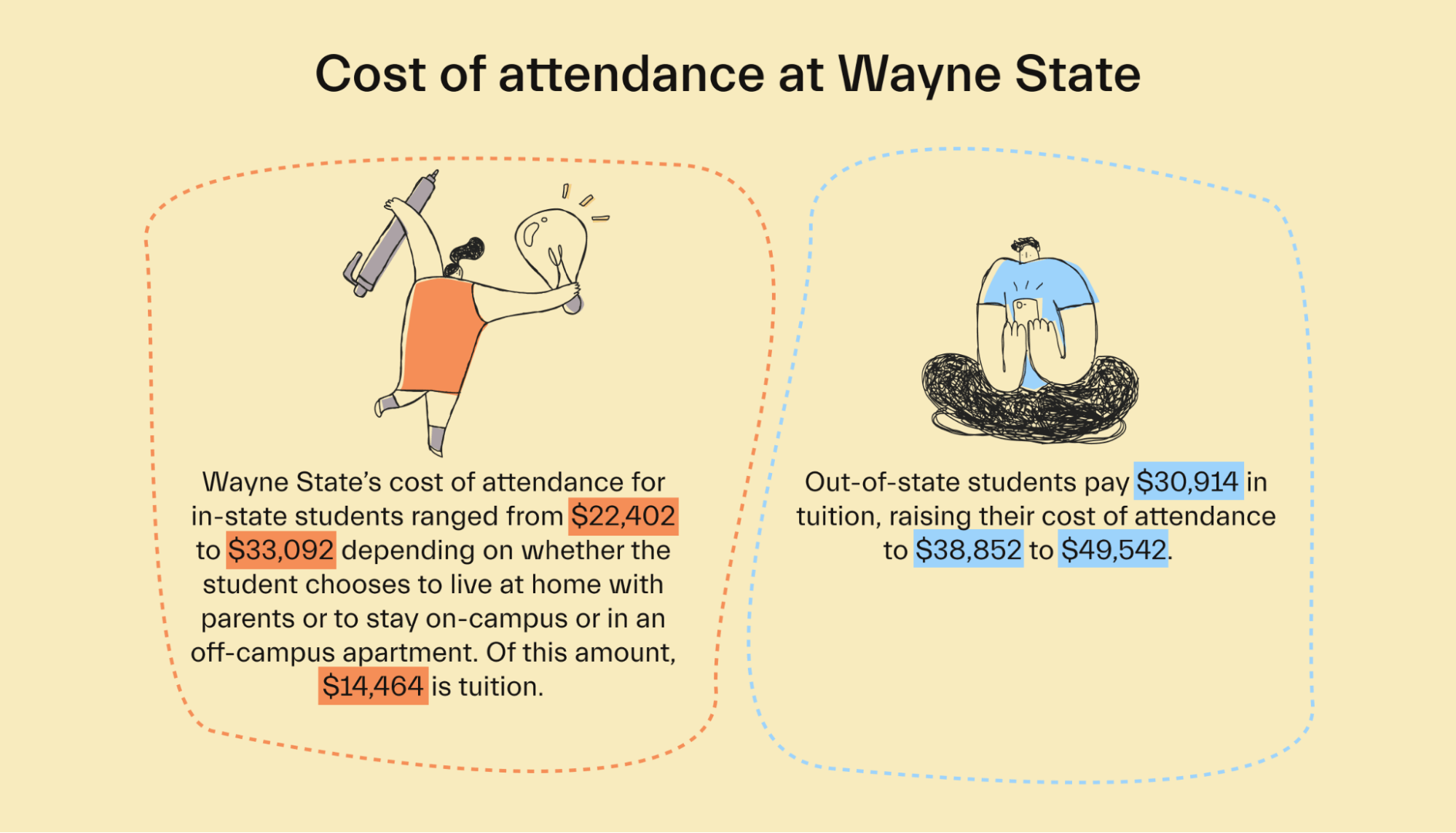

What is Wayne State University’s cost of attendance?

For in-state students, Wayne State is a very affordable college, but the costs jump considerably for out-of-state students.

Wayne State’s cost of attendance for in-state students ranged from $22,402 to $33,092 depending on whether the student chooses to live at home with parents or to stay on-campus or in an off-campus apartment. Of this amount, $14,464 is tuition.

Out-of-state students pay $30,914 in tuition, raising their cost of attendance to $38,852 to $49,542.

How many students pay no tuition at Wayne State?

Wayne State University does not publish numbers on how many students pay no tuition at the school. However, Detroit residents and those who graduate from Detroit high schools are eligible for a tuition-free education thanks to the Heart of Detroit Tuition Pledge.

For other students, Wayne State estimates that it meets 53% of its students’ financial need.

Can out-of-state students receive financial aid?

Yes, out-of-state students at Wayne State University are eligible for financial aid. Some programs, like the Heart of Detroit Tuition Pledge, are only available to students from specific regions.

Is there financial assistance available for graduate students?

Yes, graduate students can receive financial aid from Wayne State. Like undergrads, grad students should submit the FAFSA. Graduate students can receive departmental scholarships, federal loans, and other sources of funding, such as fellowships and graduate student assistantships.

When will I receive my financial aid award?

Wayne State’s office of student financial aid applies financial aid funds to student accounts after the first day of the semester, and a professor has confirmed your class participation.

Are there any eligibility requirements for financial aid?

Eligibility for financial aid is contingent on a few factors, including:

The student's academic status

The student’s academic program

The student’s state residency

Full-time or part-time enrollment status

Satisfactory academic progress

Can undergraduate students receive student employment?

Yes, work-study and non-work study jobs are available to undergraduate students at Wayne State.

Can I receive a private scholarship?

Yes, though Wayne State offers some scholarship aid to students, there is nothing stopping students from applying to private scholarships or other financial aid programs if they want more financial aid.

Can international students receive financial aid?

Wayne State does offer scholarships to international students through its Undergraduate Admissions Office. Graduate students from abroad can also receive financial aid. However, international students can’t submit the FAFSA or receive federal student aid.

What type of work-study opportunities are available?

Wayne State makes many work-study positions available through its career services office. Students can view available jobs in person or online using the school’s Handshake account portal.

Positions vary widely and can be posted by many different departments at the school, meaning you should have no trouble finding an opportunity that interests you.

Universities like Wayne State University that you might be interested in

If you’re considering Wayne State University but aren’t sure if it’s right for you, consider these alternatives.

University of Michigan

Located in Ann Arbor, Michigan, the University of Michigan is one of the state’s best-known public universities.

The school is highly-ranked, boasting the titles of #3 ranked undergraduate university in the nation and the top public university in the US, and it is located in the best small college town in America. The school is also competitive, with an average high school GPA of 3.9 and an average SAT range of 1400-1540.

If you want a highly-ranked school that charges a reasonable price for in-state students, the University of Michigan is a strong choice.

Michigan State University

Michigan State University is another well-known public school in the state. The university is located in East Lansing and, like the University of Michigan, boasts top rankings. It is ranked the 32nd public university in the US, has the top nuclear science graduate program in the nation, and is ranked in the top 100 universities globally.

If you’re concerned about finding employment after graduating, MSU has a 95% placement rate for recent grads, which is above the national average by about 12%. That makes the school a great choice for students who are trying to plan for their careers.

Eastern Michigan University

Eastern Michigan University is a highly-diverse school that has a strategic focus on equity and inclusion.

The second-oldest public university in the state, EMU offers its 15,000 students access to a strong education in subjects like business, education, engineering, technology, health, and the arts.

Like other public universities, EMU has a reasonable cost of attendance for in-state students, making it a good choice for students who want a good education at a good price.

Conclusion

Wayne State University is an exciting school located in Detroit. Students can enjoy the school’s large campus as well as the bustling city that surrounds the campus. As a public school, Wayne State’s tuition is quite reasonable, making it a strong choice for students from Michigan.

There’s no hiding that it’s hard to pay for college. That’s why Mos is here to help! We can help you get more financial aid, apply for scholarships and grants, and earn other extra funds. Get started today!

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you