Financial aid •

December 15, 2022

San Jose State University financial aid: a complete guide

Read all about financial aid at San Jose State University, including scholarships, loans, and grants.

San Jose State University is a public university located in San Jose, California. A large university, SJSU has a student body of roughly 36,000 and offers more than 250 degree programs, including bachelor’s, master’s, and doctoral degrees.

Its location near Silicon Valley makes it a great university for students interested in the world of technology and entrepreneurship.

If you’re a high school student and want to attend SJSU, we’ll break down everything you need to know about how to afford tuition.

A snapshot look at San Jose State University

San Jose State University is one of the top universities in California and has received some top ratings from national publications, including #1 most transformative university from Money magazine, #4 best undergraduate engineering programs from U.S. News and World Report, and #13 top colleges for diversity from Wall Street Journal.

Alongside its top-rated engineering program, SJSU offers a huge variety of degree programs, letting students study topics like biology, climate science, meteorology, geography, history, business, and more. Many of these programs include a specific focus on sustainability to help equip students to build a greener world.

Outside of class, students at SJSU can join a vibrant campus community that includes more than 450 student organizations and athletic teams. They can also work with the school’s office of sustainability, which aims to help the university reduce its ecological footprint.

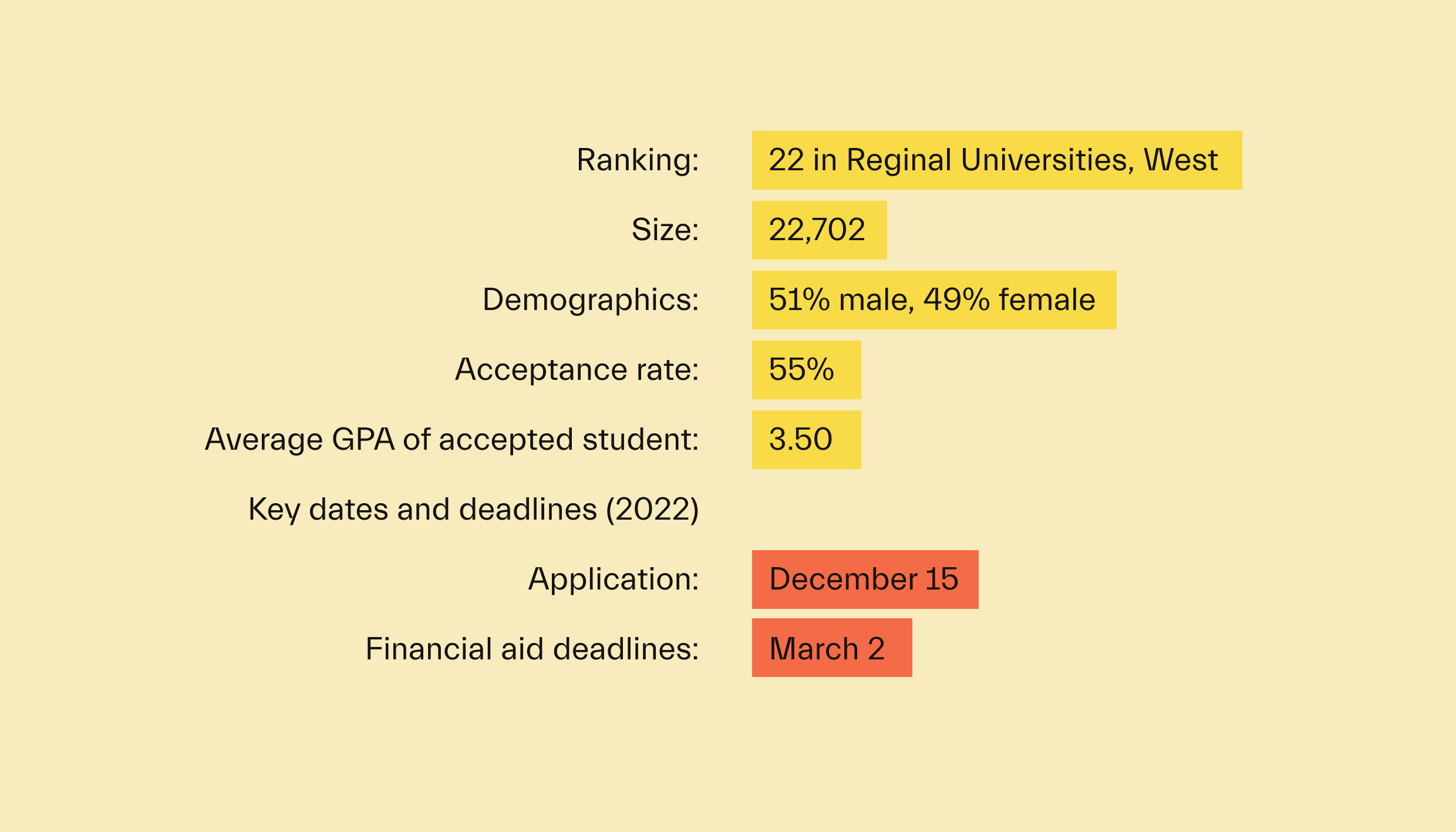

Ranking: 22 in Regional Universities, West

Size: 22,702

Demographics: 51% male, 49% female

Acceptance rate: 55%

Average GPA of accepted student: 3.50

Key dates and deadlines (2022):

Application: December 15

Financial aid deadlines: March 2

A look at scholarships offered by San Jose State University

Outside of buying a home, a college education is one of the most expensive things that most people will purchase in their lifetime. Paying for college is hard. Many families spend years saving for the bill only to find that they can barely afford a semester or 2 of tuition.

If you find that your family’s college fund isn’t enough to pay for your education, the best thing that you can do is try to earn a scholarship.

Scholarships are like free money that you can put toward the cost of a degree. You can put the money toward tuition and other fees. Best of all, you don’t have to worry about paying them back like you would a student loan.

There are many different scholarship opportunities out there, and you may also receive grants, which function much like scholarships. Some awards are based on athletic achievement, while others are awarded based on academic merits. You can also earn scholarships for things like artistic skills or writing.

SJSU’s financial aid office has a list of resources that you can use to help earn scholarships.

Because SJSU is a state school, one valuable resource for students from California is the Cal Grant. This program awards residents with funds they can put toward an education at state schools.

Outside of state and school-based awards, you can also look for scholarships offered by third parties. Many businesses and community organizations will have scholarship funds available to students who meet their requirements. With a bit of effort, you can find scholarships for almost anything.

The more scholarships you earn, the easier it will be to pay for college. You can check out our financial aid tips and tricks page for more resources on earning scholarships and other college funds.

Student loans

While scholarships are one of the best ways to pay for school, most students will find that they haven’t earned enough to cover the full cost of a degree. If you find yourself in that boat, the next best way to pay for college is through student loans.

Student loans give you the opportunity to invest in yourself by getting a college education. However, keep in mind that you’ll need to pay back the loan, plus interest, once you leave school.

Like scholarships, SJSU’s financial aid office has a webpage that breaks down the different types of student loans that are available.

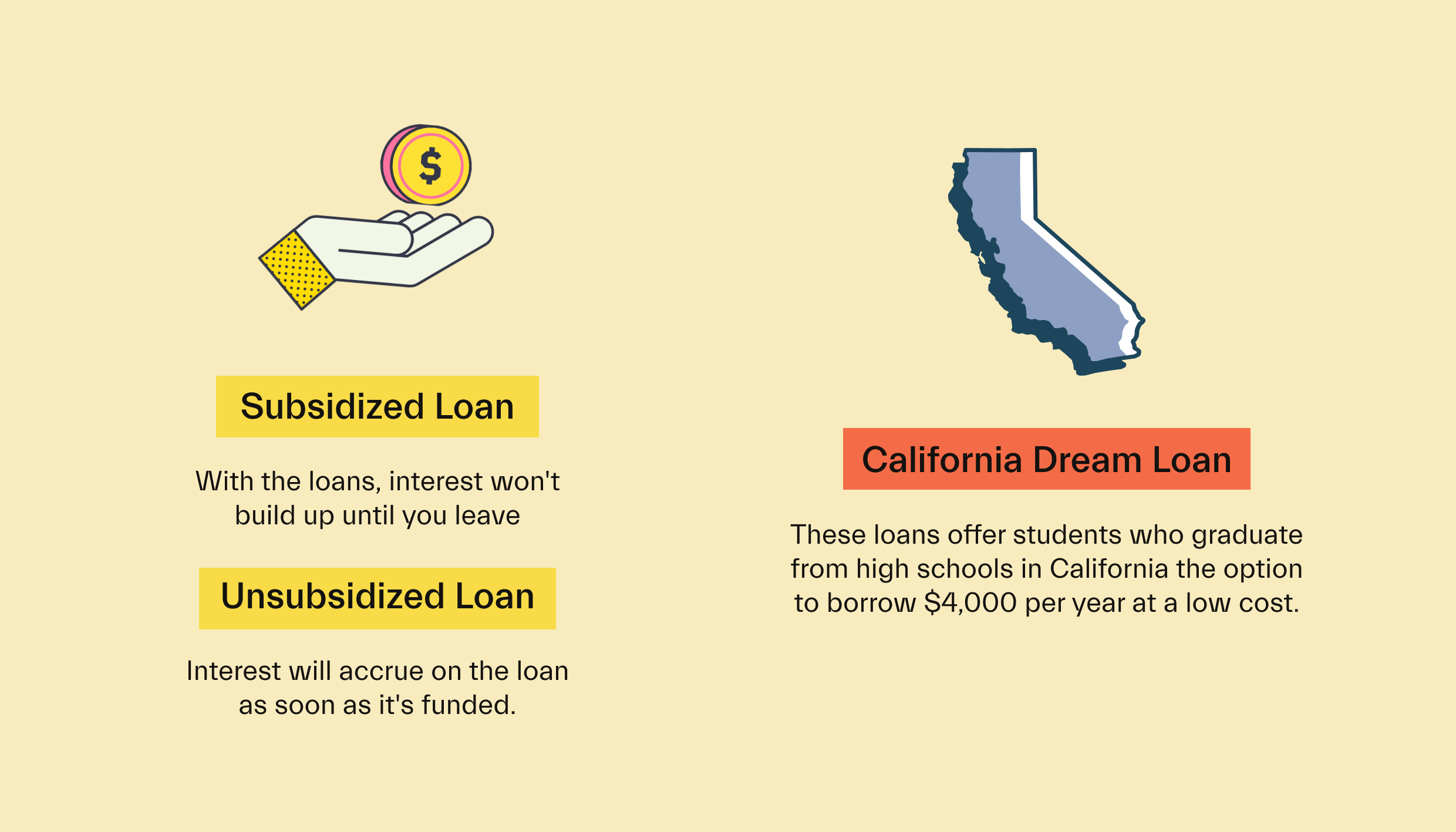

Most students will find that the best way to borrow money for college is through the Federal Direct Loan program. These loans come from the United States government in 2 forms: subsidized and unsubsidized.

Subsidized loans are the better of the 2. With the loans, interest won’t build up until you leave school. If you get an unsubsidized loan, interest will accrue on the loan as soon as it's funded.

Another good option for California residents is the California Dream Loan. These loans offer students who graduate from high schools in California the option to borrow $4,000 per year at a low cost.

If you’ve exhausted your government loans but still need more money to pay for college, you’re not out of luck. You can also consider working with a private student lender.

Private lenders include banks and other companies that offer student loans. These can be a good way to pay for school, but they typically have higher interest rates than government loans. They also lack consumer protections and perks like income-based repayment and loan forgiveness.

That means you should typically max out your government loans before turning to private loans.

Loans are an option for people who want to invest in a college education, but it’s important to understand the commitment you’re making when you borrow money. You can read our article on student loans, where we break it down.

FAFSA

When it comes to receiving financial aid for college, the best thing for every student is to complete the Free Application for Federal Student Aid (FAFSA).

The FAFSA is a student aid application that the federal government and most universities across the US use to help decide how much aid to award to students. That means that filling out the FAFSA is necessary to get many scholarships, grants, and loans.

To fill out the FAFSA, you’ll need to sit down with your family and answer a number of questions about your financial situation. This can include details like your family’s annual income and how much they’ve saved for your education.

Based on the answers you provide, the government will calculate your expected family contribution (EFC) to the cost of your education. You can determine your financial need by subtracting your EFC from the cost of attendance at your school.

The higher your financial need, the more need-based aid you’re likely to receive. That can include various need-based scholarships, grants, and loans. However, keep in mind that schools usually don’t promise to meet 100% of their students’ financial needs. That means you’ll need to find other sources of funding to pay for school.

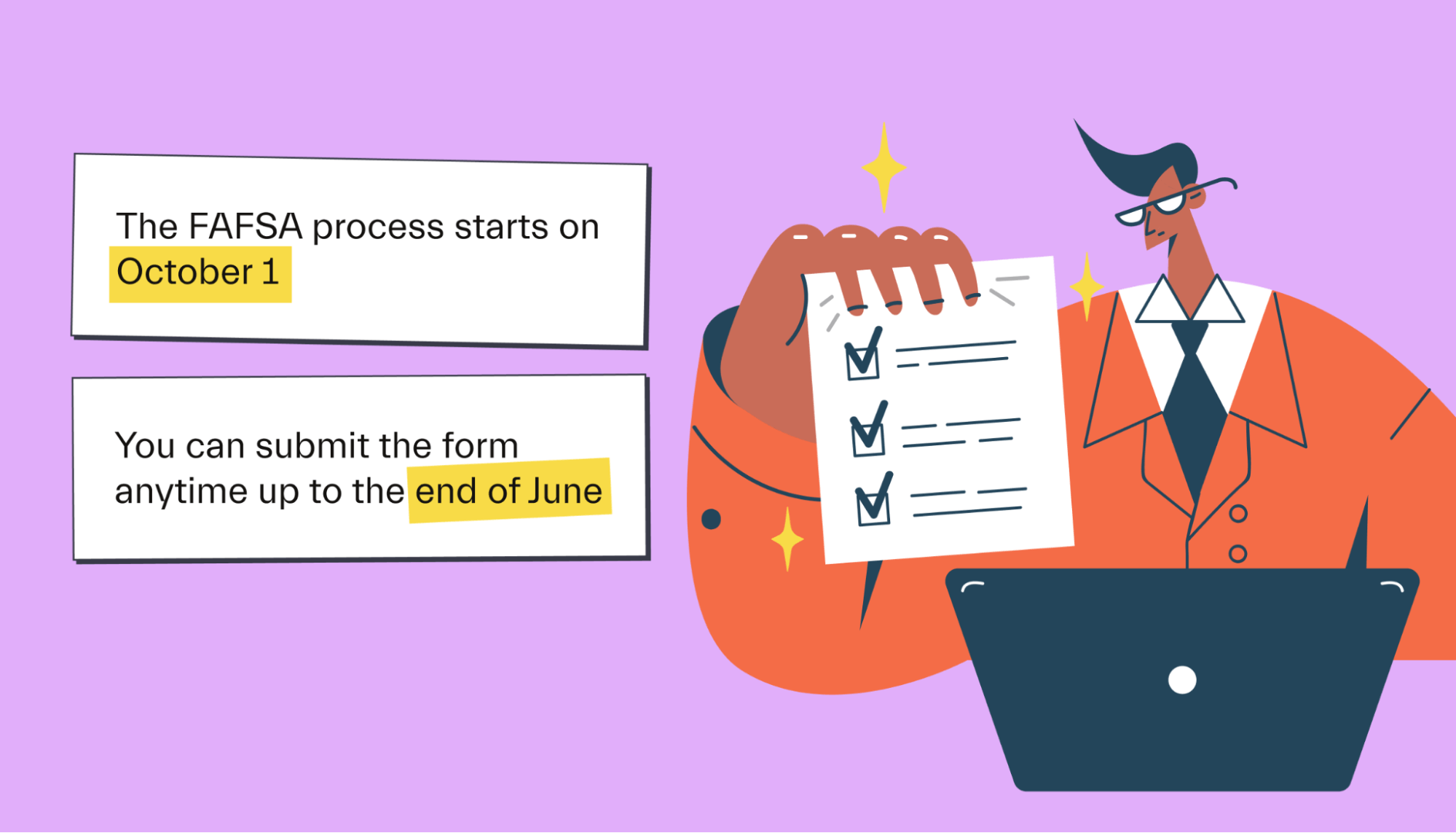

You can start filling out the FAFSA anytime on or after October 1st for aid awarded in the next financial year. That means you can fill out the form starting October 1st, 2022, for aid that will be awarded starting in September 2023.

The deadline for the FAFSA is the end of June, but California has a state deadline of March 2nd for many programs and awards aid on a first-come, first-served basis. That means you should submit the FAFSA as soon as you’re able to.

Filling out the FAFSA can take some time, so prepare yourself by learning more about how long it takes to complete the FAFSA.

San Jose State University financial aid FAQs

We’ll answer a few more questions you may have about getting financial aid at SJSU.

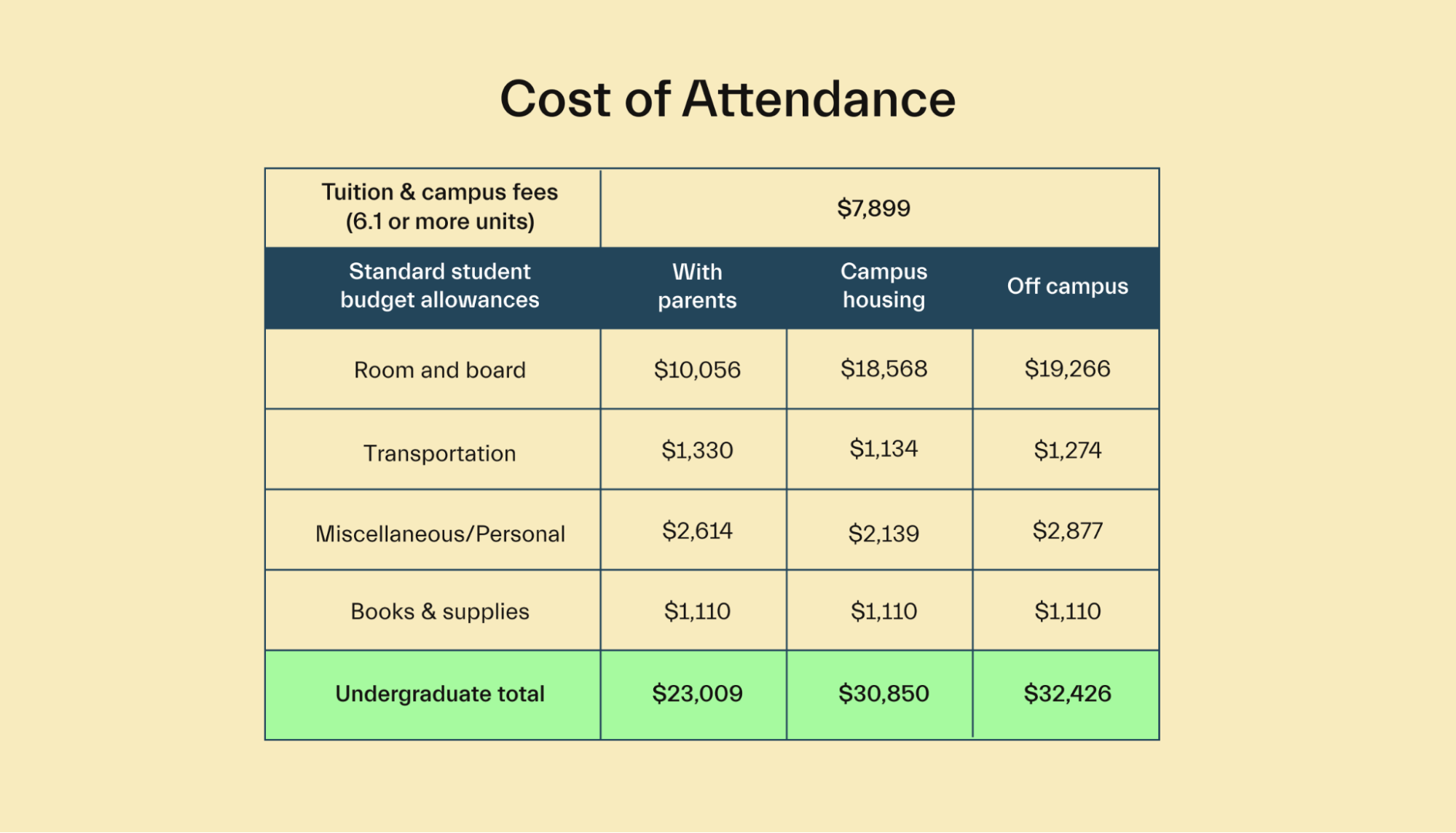

What is San Jose State University's cost of attendance?

The cost of attendance for in-state students at SJSU ranges from $23,009 to $32,426, depending on the student’s living situation. Of that amount, $7,899 is tuition.

Non-resident students pay an additional $396 per unit they take each semester. Most students take 15 units per semester, meaning non-residents pay an additional $5,940 per semester or $11,880 per year.

Can out-of-state students receive financial aid?

Yes, out-of-state students at SJSU can receive financial aid. However, they won’t be eligible for state programs such as California Dream Loans or Cal Grants.

How many students get a full ride?

SJSU doesn’t publish the number of students who receive a full ride. However, it does state that 63% of students received need-based aid in fall 2019 and that the average award was $7,146.

Can international students receive financial aid?

International students at SJSU cannot receive federal or state-based financial aid, but SJSU does offer merit-based scholarships to these students but does not offer need-based scholarships to students from outside the US.

Can undocumented students receive financial aid?

Yes, SJSU operates the UndocuSpartan Student Resource Center for undocumented students, helping them adjust to college life and maximize the financial aid they earn.

What is the financial aid process at SJSU?

The financial aid process at SJSU starts with filling out the FAFSA. Eligible students will receive their aid decision between 4 and 8 weeks after the deadline to submit documents. Aid is disbursed to student accounts during the first week of each semester.

What types of financial assistance does SJSU offer?

SJSU offers multiple types of aid. Students can receive financial aid and scholarship funds based on their financial need and academic merit.

Is there financial aid for graduate students?

Yes, both undergraduate students and graduate students at SJSU can receive financial aid in many forms. The financial aid office maintains a list of grants, loans, employment opportunities, and research funding opportunities that may be available to graduate students who need help paying for college.

Universities like San Jose State University that you might be interested in

If you’re considering SJSU but aren’t sure it’s right for you, consider these alternatives.

San Francisco State University

If you want to go to a college in the Bay Area but feel like SJSU isn’t the right fit, San Francisco State University may be a solid choice.

Like SJSU, SFSU is a public university, meaning it keeps costs low for California students. It has a commitment to keeping class sizes low and offers students access to an alumni network that includes leaders in fields like business, education, and other fields. It also serves as a top feeder school for companies like Apple, Google, Oracle, and Wells Fargo.

University of California

The University of California system is another option for people who want to attend a public school. Students can choose from more than 160 major and 800 degree programs across the 10 different UC campuses, including UCLA, UC Davis, UC Irvine, and UC San Diego.

The University of California is highly popular with students from the state. Roughly 83% of the students in the UC system are state residents.

Stanford University

For high-achievers who want to study in the Bay Area, Stanford University can be an appealing choice. One of the world’s top research universities, Stanford has a reputation for innovation and entrepreneurship. Many students who found startups at the university receive outside funding for their ventures.

The drawback of Stanford is that it is highly selective. It also isn’t a state school, which means tuition can be high. However, for students who want an opportunity to participate in cutting-edge research, the cost can be worth it.

Conclusion

SJSU is a public university located in the heart of Silicon Valley, making it a low-cost option for California residents who want to receive a strong education while living in one of the world’s tech hubs. Even for out-of-state students, the school’s location and a huge variety of degree programs can make it a highly appealing choice.

If you’re trying to figure out the best way to pay for college, Mos can help.

With Mos, you can get help earning more financial aid, applying for hundreds of scholarships and grants, and writing scholarship essays to help you earn extra funding to pay for tuition.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you